MMS • RSS

Posted on mongodb google news. Visit mongodb google news

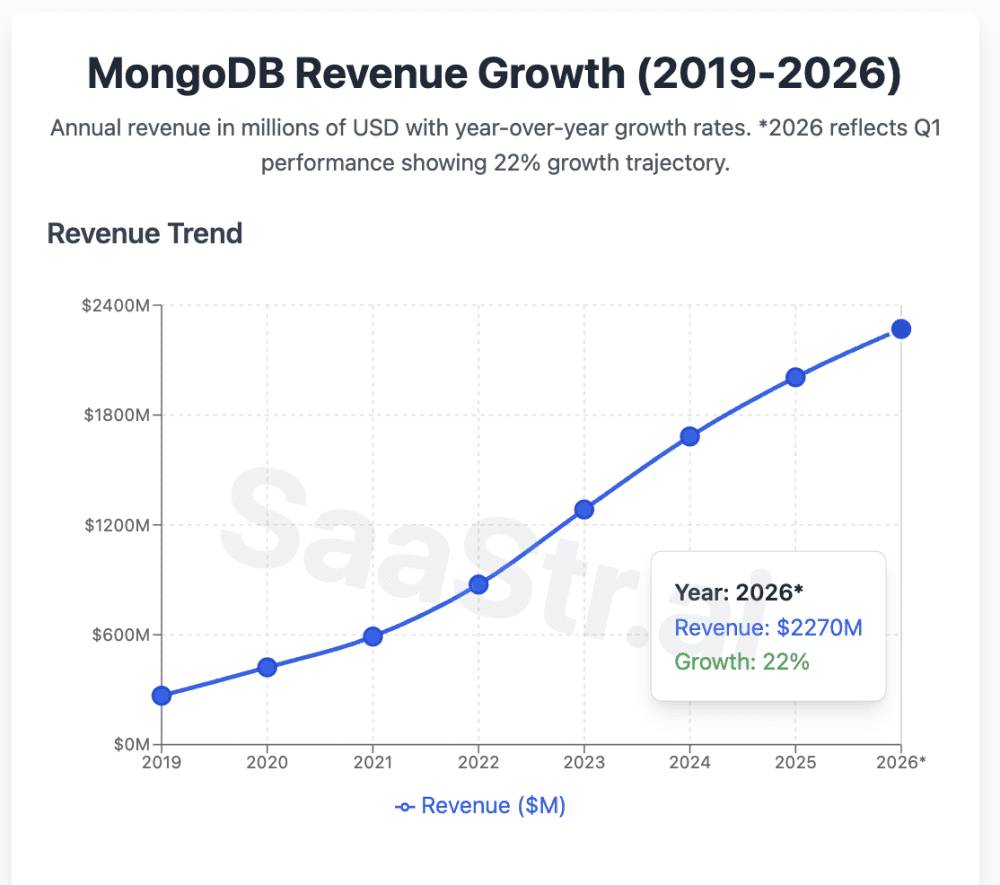

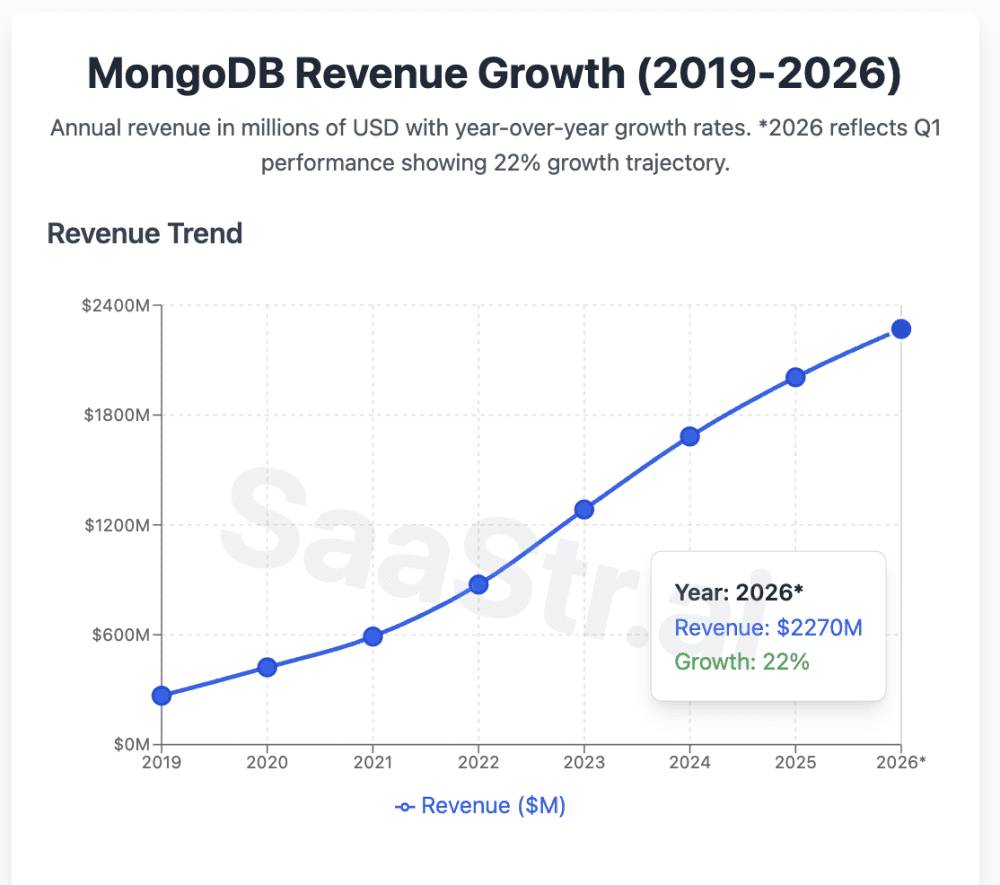

MongoDB recently dropped its Q1 2026 results, and well … Mongo is back.

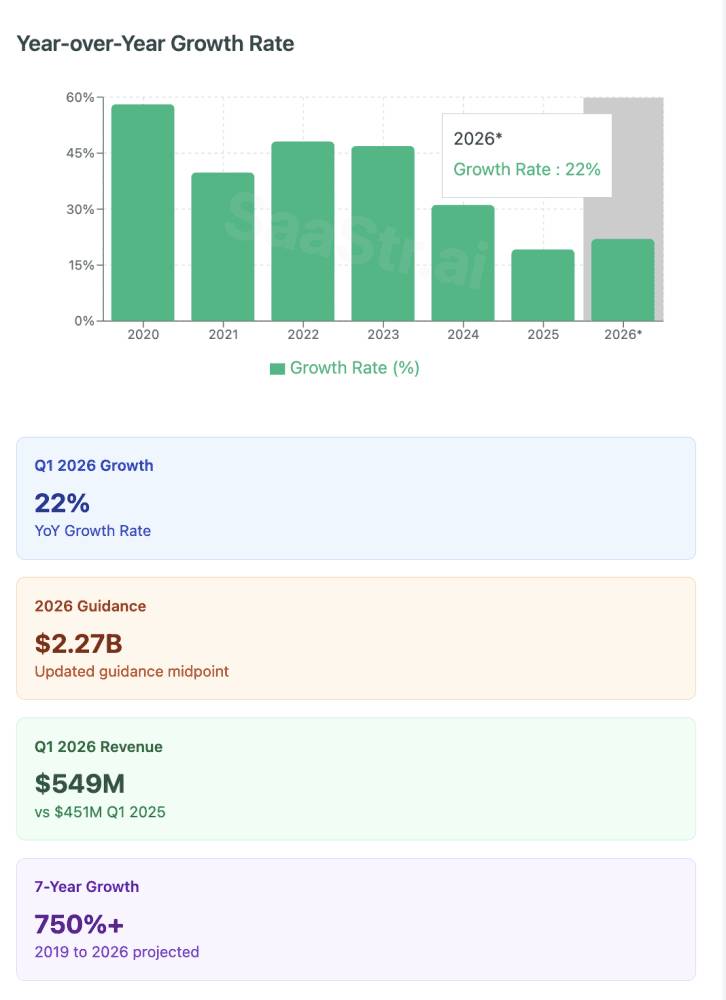

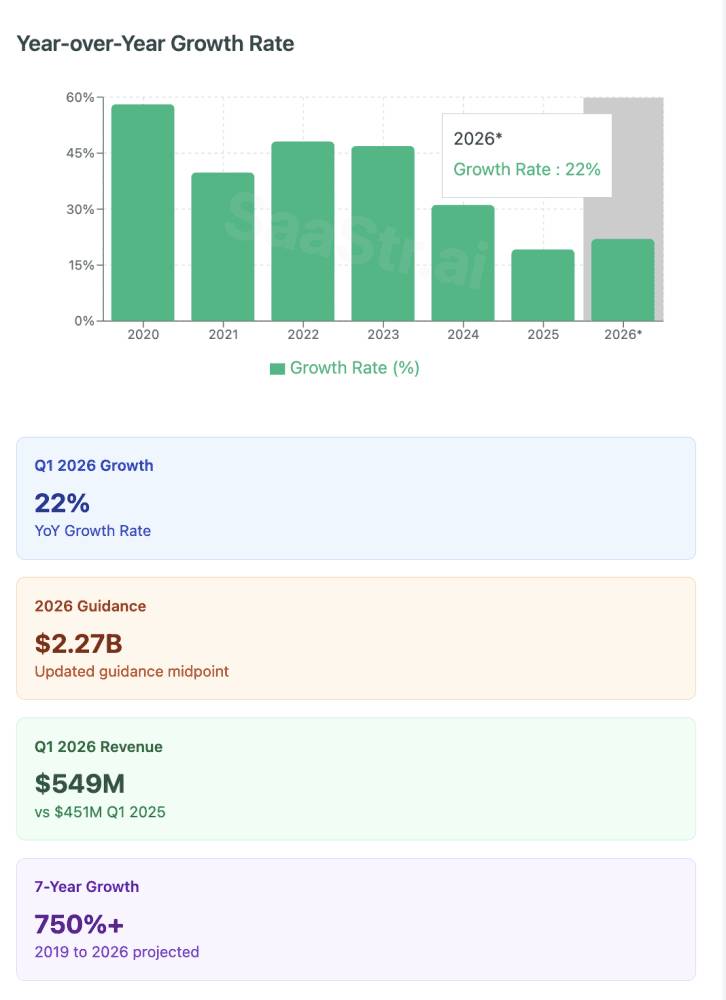

At $549M quarterly revenue (22% YoY growth), they’re proving something important: you CAN still grow 20%+ at massive scale.

Here are 5 top takeaways every B2B leader should internalize:

1. The “Growth Re-Acceleration” Playbook at $2B+ Scale

The Numbers: After moderating to 19% growth in FY2025, MongoDB bounced back to 22% in Q1 2026.

Why This Matters: Most companies see linear deceleration as they scale. MongoDB proved you can actually re-accelerate growth even at $2B+ ARR through:

- Product expansion (Atlas now 72% of revenue, up from 71% last quarter)

- Customer base expansion (2,600 net new customers – highest in 6 years!)

- Market category expansion (AI workloads driving new use cases)

The SaaStr Takeaway: Don’t accept linear growth deceleration as inevitable. Product innovation can reignite growth engines even at massive scale.

2. The Atlas Flywheel: How 72% Revenue Mix = Compound Advantages

The Numbers: Atlas (cloud) revenue grew 26% YoY and now represents 72% of total revenue.

The Flywheel Effect:

- Higher growth rates (26% vs 22% overall)

- Better unit economics (cloud margins typically superior)

- Customer stickiness (cloud platforms = higher switching costs)

- Expansion revenue (consumption-based model drives natural growth)

Why Most Companies Fail Here: They don’t get to 70%+ mix fast enough. MongoDB’s lesson: go ALL IN on your highest-growth, highest-margin product segment.

The SaaStr Takeaway: If you have a clear cloud/platform winner, accelerate the transition aggressively. 70%+ mix is where the magic happens.

3. The “Profitable Growth” Transition: From -40% to +16% Operating Margins

The Numbers: 16% non-GAAP operating margin in Q1 2026, up from negative margins just a few years ago.

How They Did It (The MongoDB Method):

- Disciplined hiring during the 2022-2023 downturn

- Revenue scale (easier to leverage fixed costs at $2B+ revenue)

- Product mix shift (Atlas has better unit economics)

- AI automation (reducing operational overhead)

The Critical Insight: MongoDB didn’t sacrifice growth for profitability. They achieved BOTH by:

- Maintaining 20%+ growth rates

- Improving operational efficiency

- Focusing on high-margin products

The SaaStr Takeaway: The best SaaS companies don’t choose between growth and profitability. They engineer business models that deliver both.

4. Customer Acquisition at Scale: 2,600 Net Adds = Highest in 6 Years

The Numbers: 2,600 net new customers in Q1 2026, bringing total to 57,100+.

What’s Remarkable: This is their HIGHEST net customer additions in 6 years, despite being at massive scale. Most companies see customer acquisition slow down dramatically as they get bigger.

MongoDB’s Customer Acquisition Secrets:

- Self-serve motion for mid-market (efficient acquisition)

- Enterprise sales for large deals (higher ACVs)

- Developer-first approach (product-led growth at its finest)

- AI use case expansion (new buying centers)

The Pattern: Great SaaS companies don’t just rely on expansion revenue. They keep growing their customer base aggressively.

The SaaStr Takeaway: If you’re seeing customer acquisition slow down, you’re either: (a) not expanding your TAM enough, or (b) not building efficient enough acquisition motions.

5. The $800M Share Buyback Signal: Ultimate Confidence Indicator

The Numbers: MongoDB announced an additional $800M share repurchase authorization, bringing total to $1B.

Why This Matters: Share buybacks at high-growth SaaS companies send a powerful signal:

- Cash generation confidence ($105.9M free cash flow in Q1)

- Limited M&A pipeline (organic growth is working)

- Stock undervaluation belief (management thinks shares are cheap)

- Capital allocation maturity (beyond just “growth at all costs”)

The Broader Trend: We’re seeing more SaaS companies return cash to shareholders as they mature. This isn’t a sign of slowing growth – it’s a sign of capital allocation sophistication.

The SaaStr Takeaway: When you’re generating serious cash flow, thoughtful capital allocation becomes a competitive advantage.

The Bottom Line: MongoDB’s Playbook for $2B+ SaaS Success

MongoDB is showing us what “mature SaaS excellence” looks like:

- Growth: Still growing 20%+ at $2B+ scale

- Profitability: 16% operating margins and improving

- Efficiency: Record customer acquisition with strong unit economics

- Cash Generation: $105.9M free cash flow in one quarter

- Capital Allocation: Returning cash while investing in growth

The Meta-Lesson: The best SaaS companies don’t “grow up” and become boring. They become MORE impressive as they scale.

5 More Quick-Hit Learnings:

- Self-Serve Channel Explosion: Record 2,600 net customer adds (highest in 6+ years) driven by self-serve acquiring mid-market efficiently – May Petri’s promotion to CMO reflects this success

- Voyage AI Integration Speed: Released Voyage 3.5 embeddings just 4 months post-acquisition, reducing storage costs 80%+ and outperforming competitors – fast M&A integration execution

- Enterprise Penetration Strategy: 75% of Fortune 100 and 50% of Fortune 500 already customers – focus shifting to “expand in those accounts” vs new logo acquisition at top end

- Competitive Moat Widening: Dev’s take on Snowflake/Databricks buying Postgres companies: “Why does the world need a 15th or 16th Postgres derivative?” – MongoDB = Postgres + Elastic + Pinecone + Cohere in one platform

- Developer Productivity Focus: Atlas instances 80% provisioned via code (matching Neon’s stat), plus new docs in Mandarin/Portuguese/Korean/Japanese – global developer experience investment paying off

Source: MongoDB Q1 2026 Financial Results

Article originally posted on mongodb google news. Visit mongodb google news