MMS • RSS

Article originally posted on Data Science Central. Visit Data Science Central

Prescriptive Analytics and B2B Pricing Science

Pricing science is the application of analytical techniques and methods to solve the problem of setting prices. This discipline had its origins in the development of yield management in the airline industry in the 1980s, and has since spread to many other sectors and pricing contexts, including media, retail, manufacturing, distribution, etc.

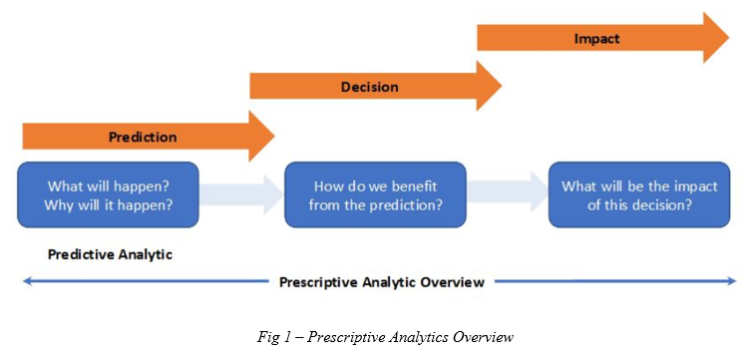

The goal of B2B pricing science is to optimize pricing strategies by using prescriptive analytics to model and modify historical behavior. Although pricing science does not solely predict historical pricing behavior, predictive analytics is the foundation of this process. The first step in creating a pricing strategy, developing a robust and reliable prediction model, is crucially important because failing to understand historical behavior and failing to capture market dynamics leads to irrelevant price recommendations.

In B2B companies, pricing behavior depends on many factors, such as product type, industry, location, annual customer spends, order size, seasonality, and many more. With so many factors at play, hundreds of millions of unique sales circumstances are possible, each of which is extremely relevant and important to a company. As a result, a predictive model should not only capture the effect of each factor from past data but also learn over time and adjust when encountering new circumstances.

Application Machine Learning in Pricing Science:

In the 1950s, Arthur Samuel, a pioneer of machine learning (ML), wrote the first game-playing program. The program played checkers against world champions to learn and eventually win the game. ML is built on the hypothesis that a machine can learn how the human brain processes information. Machine learning (ML) algorithms are categorized into three main groups based on their interactions with the environment: supervised learning, unsupervised learning and reinforcement learning. In this post we are going to review the application of first two categories for B2B pricing.

- Supervised learning:Supervised learning models require training datasets comprised of data and the correct labels. At the heart of supervised machine learning are three main algorithm categories:

-

- Regression-Based Models

- Decision Tree-Based Models

- Bayesian-Based Models

There two foremast application of supervised ML algorithms in pricing science:

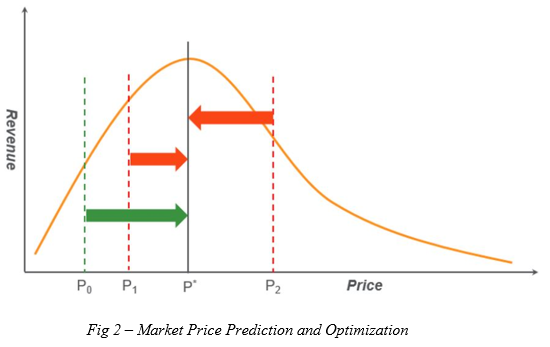

Market Price Prediction: Accurate market price prediction is extremely important in the price optimization process. In Figure 3, the actual market price is P0 and the optimum market price is P*. If the market price is incorrectly predicted as either P1 or P2, then it will incorrectly recommend a price change, either in direction or magnitude.

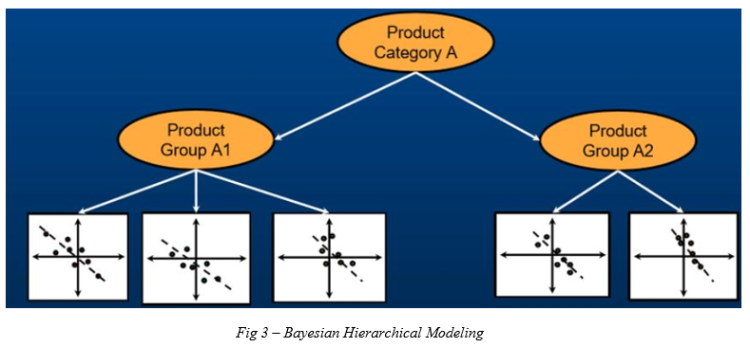

Price Sensitivity (Elasticity) Estimation: Price elasticity is the core of pricing science, as it provides direction on how to adjust and modify behavior to achieve P&L objectives. In general, B2B companies have fewer transactions than B2C companies, thus data sparsity is a real issue that can lead to over-fitted models when estimating price elasticity. Bayesian hierarchical model is a power ML technique because data can be analyzed across groups, thereby minimizing the effect of data sparsity. Higher level information can be shared effectively among the lower level groups, yet lower level estimation still follows its own data structure and pattern.

- Unsupervised learning:

Discovering hidden patterns and structures from data often leads to actionable insights that enable various trends to be predicted and helps businesses gain a competitive advantage. Unsupervised learning algorithms are the best tools for this purpose. In general terms, these algorithms seek to find the underlying structure or pattern of a data set without knowing the answer in advance.

Below we are describing two main applications for unsupervised algorithm in pricing.

Customer segmentation: For B2B companies, customers differ across multiple dimensions, such as demographics, competitiveness of location, annual spend, dominant industry, etc. Traditional marketing methods focus mostly on one or two dimensions to group similar customers together.

Complementary and substitute products: In the price optimization process, it is very important to understand the relationships between products based on customer behavior, whether those customers are retailers or suppliers. In general, if two products are related they can be either substitutes or complements. Extracting both complementary and substitute products provides valuable knowledge for market prediction. Mining complementary products reveals which products are frequently purchased together. Such information can be used to generate price recommendations, not only for individual products, but also for baskets of products that often are purchased together.

To read more on this topic: https://resources.zilliant.com/authors/amir-meimand