MMS • RSS

Posted on nosqlgooglealerts. Visit nosqlgooglealerts

KanawatTH

Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed Couchbase (NASDAQ:BASE) would continue growing by riding on the industry tailwind. The stock would react positively if BASE were to reach profitability as well. I am reiterating my buy rating for BASE as I see positive growth catalysts that will enable BASE to meet management guidance. As it does, valuation at the current 4.2x forward revenue should be sustainable.

Financials/Valuation

BASE reported strong 3Q24 results again, with ARR (annual recurring revenue) growing by 24% y/y to $189 million, beating the high-end of guidance. The business also reported revenue of $46 million, which beat consensus as well. The strong ARR and revenue performance were driven by strong demand consumption for Capella and strength in the enterprise business. As I expected, BASE continued to move towards profitability as well, with EBIT margins coming in at -11%, which was 1000bps ahead of consensus expectations.

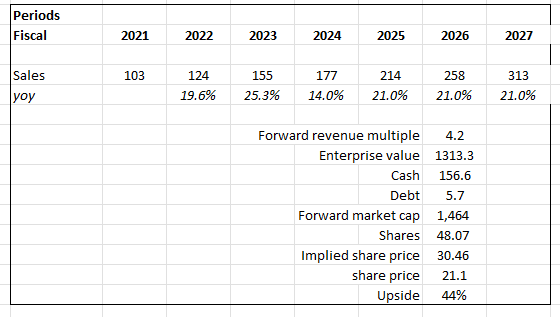

Based on author’s own math

While the stock has reached my previous price target of $22, I believe there is still attractive upside from here given the new growth drivers that I expect to help achieve management’s medium-term guidance. Relative to my previous assumptions, I am now expecting FY25-FY27 to grow at 21%, in line with the management growth guide of >20%. I would note here that 21% might be downplaying the potential growth, as BASE ARR is already growing at 24% in 3Q23. With a better growth profile, I believe the stock should be trading higher than it did previously (3x forward revenue), and it appears that the market has already reflected this as valuation went up to 4.2x forward revenue. I am assuming valuation will stay at this level, given that it is at the historical average. However, I would note that MongoDB is currently trading at 13.5x forward revenue, with a growth profile of >20%, and is still loss-making. The key difference between MongoDB and BASE is that MongoDB has a much larger revenue base ($1.6 billion vs. BASE’s $100+ million). I would expect BASE valuation to improve over time and close its gap with MongoDB as it scales, but I am not modeling this today for conservative sake.

Comments

BASE presented its Analyst Day just 2 weeks ago, and I have finally got time to review them (after all the celebrations during the festive season). At a high level, I really like the information that management presented, and I think the stock should continue to react favorably.

First of all, from a growth perspective, I don’t see any hurdles that are stopping BASE, as the company is seeing a relatively unchanged competitive environment. That is to say, BASE continues to see competition from legacy relational database vendors such as Oracle, purpose-built NoSQL vendors such as MongoDB, and hyperscalers like Amazon. If readers were to recall what I wrote last year in my initiation post, I discussed how BASE is well-positioned to capture share as its database is built with modern technology. Indeed, management mentioned in the presentation that customers are migrating to Capella. Interestingly, since customers usually do not evaluate the competition in full during a transition, management does not perceive much additional risk from competition.

In terms of competitive landscape, we can segment our competitors into three cohorts. The legacy RDBMS systems like Oracle and IBM. Listen, I’ve worked in some of these firms myself.

We don’t see the door getting open from a competitive point of view. I would say our customers enjoy what they get from enterprise today, and they’re looking to get the TCO that gets delivered with Capella. Analyst day

Next, I think a major focus of the presentation was on cloud transition, which I see as a strong catalyst for growth in the coming years. At Analyst Day, Capella, the company’s fully managed DBaaS product, accounted for more than 10% of ARR, indicating that the early-stage cloud transition was already under way. Results from 3Q24 show that this transition is gaining steam, with Capella’s NRR (net retention rate) of 167% exceeding the consolidated 115% LTM NRR by a significant margin. Sequential customer growth accelerated to 25%, a 500bps improvement from 2Q23, making the performance even more commendable. There are two main things that will drive growth acceleration in the future. As a first step, BASE will introduce an adoption model that is less complex in comparison to Couchbase Enterprise. Recall that for Enterprise, it requires multiple back-and-forth with the client (discussion on customization, billing details, consumption, etc.). This is a long and slow process before BASE can book the customer billings. With a simpler adoption process, I see this as a strong catalyst for new logo acquisition acceleration. In particular, this encompasses a developer community self-service model that can supplement BASE’s conventional go-to-market strategy and channel distribution by serving as a conversion funnel for Capella. Secondly, to make this new adoption process more smooth, BASE is going to roll out a feature that allows clients to start with a small initial workload and have the ability to subsequently expand. This is perfect, in my opinion, as it reduces the financial burden for new adoptees, and once they realize how useful it is, they have the flexibility to increase consumption. From a financial perspective, it meant that NRR could stay at an elevated level, relative to history, over the medium term as these “small initial workload” clients ramped up their consumption. Beyond Capella’s traditional focus on high-budget enterprise accounts, I think the developer-led, lower-friction movement could open up more opportunities in the downmarket.

With the points above, it led me to be very bullish on management’s new medium-term targets, presented at the analyst day. The guide points to >20% ARR, revenue growth, and positive EBIT in FY27. For reference, BASE is already growing ARR at 24% in 3Q24, and revenue grew 19%. With the current adoption model, I believe it should easily accelerate ARR and topline growth to meet the guidance. The important thing is that I think BASE has a long way to go in driving the on-premise to cloud conversions that will keep the mid-term guidance supported. As for positive EBIT in FY27, BASE has demonstrated its ability to drive significant EBIT margin as revenue grows (EBIT margin stepped up from -21.4% to -11% sequentially in 3Q24). If revenue grows as guided (20+% over 3 years), I believe reaching positive EBIT is not an issue.

Risk & Conclusion

Due to consumption ramping from a low base, initial revenue growth immediately after signing the Capella deal would lag behind ARR growth when a customer migrates from Enterprise to Capella. As a result, revenue growth will remain uneven, and large customer migrations may have a significant impact on growth in the short to medium term. The market might see this weak headline growth as a sign of weakness and sell off the stock.

In conclusion, I reiterate my buy rating for BASE. The upcoming growth drivers – Capella’s cloud transition and simplified adoption models – should help enable BASE to meet management’s medium-term targets of >20% ARR and revenue growth, positive EBIT in FY27. As it shows that these targets are achievable, I expect valuation to be well supported by the current 4.2x forward revenue.