MMS • RSS

Posted on mongodb google news. Visit mongodb google news

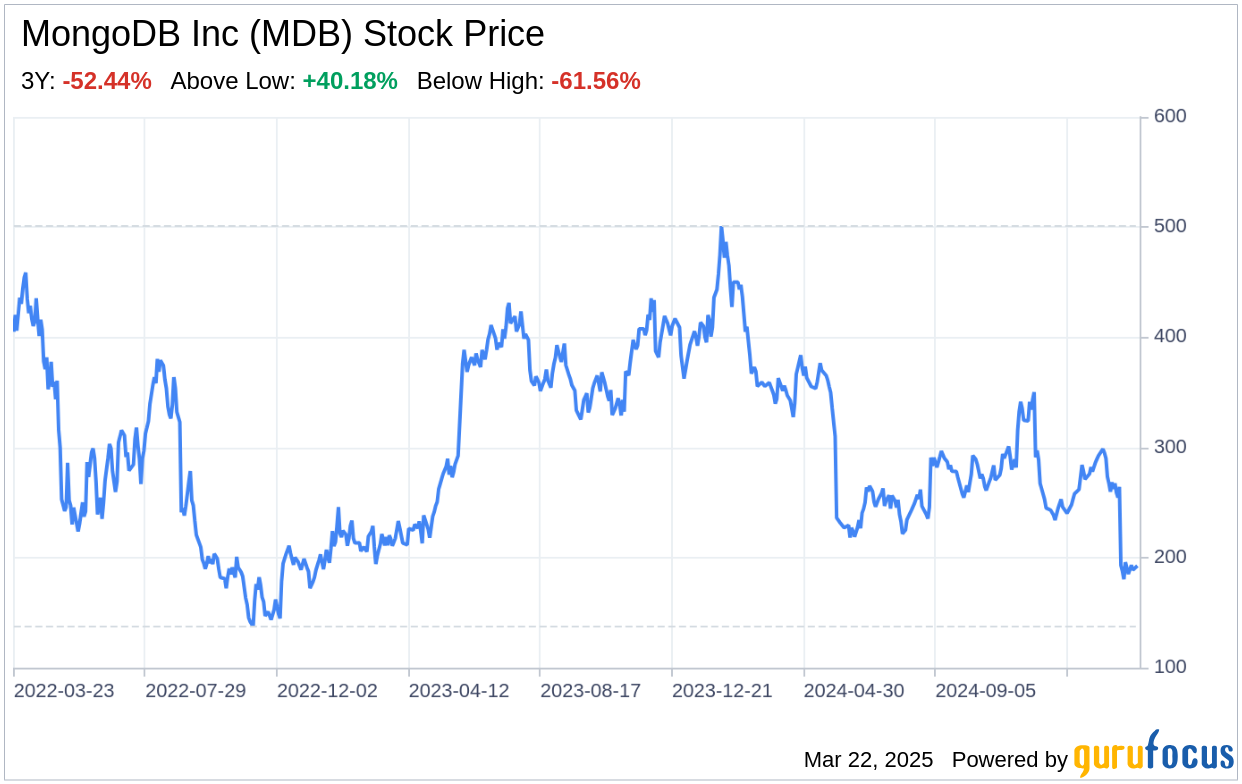

MongoDB Inc (MDB, Financial), a leader in document-oriented database solutions, filed its 10-K on March 21, 2025, offering a comprehensive view of its financial health and strategic positioning. The company has seen a notable increase in revenue, with subscription services accounting for 97% of the total revenue, climbing from $1.24 million in 2023 to $1.94 million in 2025. Despite this growth, MongoDB Inc (MDB) reported a net loss of $(129,072) in 2025, although this is an improvement from the $(345,398) loss in 2023. The company’s commitment to innovation is evident in its substantial research and development expenses, which reflect its strategy to maintain and extend product leadership. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as revealed by MongoDB Inc’s latest SEC filing.

Strengths

Brand Power and Market Position: MongoDB Inc (MDB, Financial) has established itself as a leading name in the database software market, known for its innovative document-oriented database platform. The company’s strong brand is built on a reputation for performance, scalability, flexibility, and reliability, which are critical factors in the database industry. MongoDB’s document-based architecture differentiates it from traditional relational databases, providing developers with a more natural and intuitive way to manage data. This strength has translated into significant revenue growth, particularly in subscription services, which have seen a year-over-year increase, demonstrating the company’s ability to attract and retain customers.

Research and Development Focus: MongoDB Inc (MDB, Financial) has consistently invested in research and development, which is a testament to its commitment to product innovation and leadership. In 2025, the company employed 1,327 individuals in its research and development team, underscoring its dedication to enhancing existing products and developing new offerings. This focus on R&D has led to the introduction of MongoDB version 8.0 and other features that keep the company at the forefront of database technology, catering to the evolving needs of developers and organizations.

Weaknesses

History of Net Losses: Despite its revenue growth, MongoDB Inc (MDB, Financial) has a history of net losses, which raises concerns about its long-term profitability. The company’s net loss decreased from $(345,398) in 2023 to $(129,072) in 2025, indicating an improvement in financial performance. However, the persistent losses highlight the challenges MongoDB faces in achieving profitability, particularly as it continues to prioritize growth and market expansion over immediate financial returns.

Intense Market Competition: MongoDB Inc (MDB, Financial) operates in a highly competitive database software market, where it faces stiff competition from legacy providers such as IBM, Microsoft, and Oracle, as well as cloud providers like AWS, GCP, and Microsoft Azure. These competitors have significant advantages, including established customer relationships, greater financial and technical resources, and broader product portfolios. MongoDB’s ability to compete effectively is crucial for its success, and the intense competition represents a significant weakness that the company must address.

Opportunities

International Expansion: MongoDB Inc (MDB, Financial) has identified significant opportunities to expand its platform’s use outside the United States. The company’s strategic focus on international growth can tap into new markets and diversify its revenue streams. By leveraging its strong product offerings and adapting to local market needs, MongoDB has the potential to increase its global footprint and capitalize on the growing demand for database solutions worldwide.

Strategic Partnerships and Developer Community: MongoDB Inc (MDB, Financial) has built a robust partner ecosystem and a large, engaged developer community, which presents opportunities for growth and innovation. The company’s partnerships with major cloud providers and expansion into new regions, such as China through collaborations with Alibaba Cloud and Tencent Cloud, can drive adoption and increase market presence. Additionally, fostering the MongoDB developer community can lead to increased brand awareness and advocacy, further propelling the company’s expansion.

Threats

Geopolitical Instability and Economic Conditions: MongoDB Inc (MDB, Financial) operates in a global market that is susceptible to geopolitical instability and economic fluctuations. Conflicts such as the Israel-Hamas conflict and Russia’s invasion of Ukraine, along with inflationary pressures and interest rate changes, can adversely affect the economy and MongoDB’s business. These external factors can disrupt global supply chains, increase costs, and impact customer spending, posing significant threats to the company’s financial stability and growth prospects.

Legal and Regulatory Challenges: MongoDB Inc (MDB, Financial) faces potential legal and regulatory challenges that could impact its operations and financial performance. The company is involved in ongoing litigation, such as the Baxter v. MongoDB securities action and shareholder derivative lawsuits, which could result in financial liabilities and damage its reputation. Additionally, MongoDB must navigate evolving regulatory landscapes, including privacy concerns and cybersecurity standards, which could impose additional compliance costs and operational constraints.

In conclusion, MongoDB Inc (MDB, Financial) demonstrates strong growth potential and market leadership, backed by its innovative technology and strategic investments in research and development. However, the company’s history of net losses and the intensely competitive landscape pose challenges that MongoDB must overcome. Opportunities for international expansion and strategic partnerships offer promising avenues for growth, while geopolitical and economic uncertainties, along with legal and regulatory issues, present threats that require careful management. Overall, MongoDB Inc (MDB) is well-positioned to leverage its strengths and opportunities to address its weaknesses and mitigate threats in the dynamic database market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Article originally posted on mongodb google news. Visit mongodb google news