MMS • RSS

Article originally posted on Data Science Central. Visit Data Science Central

Document management is an inevitable part of every business industry. It is highly recommended to be efficient and neat when it comes to handling business documents. Every aspect of document management is important, whether you need to extract data from a document, to secure PDF files, to merge or split more documents, to cluster documents in different groups or to analyze them.

When your business documents are properly handled, it can only have a positive impact on your business and daily activities at work. Reorganizing data from different files, by doing document extraction or splitting, can help you with better data analysis and on the top of that, you will not lose time to make new versions of documents over and over again. Business documents can be reused and easily edited, even if they are in PDF form, thanks to the latest PDF technology that makes the whole process easier.

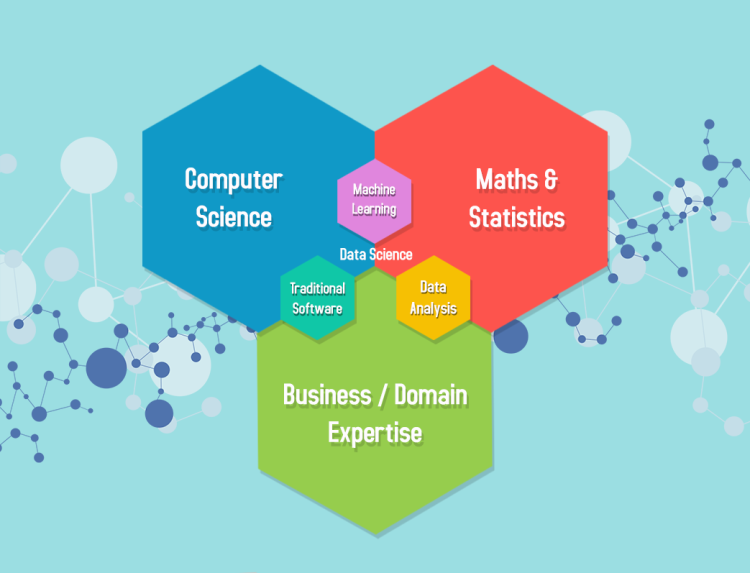

As document management is present in accounting, bookkeeping, finance, marketing, healthcare, agriculture, and many other industries, let’s see how data science transforms document management in some of these industries.

Use of data science in accounting

Accounting and data science are very connected in the same way document management with data science and accounting. There are many examples of the usage of data science in accounting. It all about tabular data. Document management helps accounting with managing PDF reports and other accounting documents, from the technical perspective. Data science helps with actual data handling and analysis. When you apply your data science skills in accounting data, it has a direct impact on document management too, as data is the part of a document.

Here are some examples of the data science usage in accounting:

- Use data analytics on expenses data of a company to cut expenses and make better spending plan.

- Data analysis models can be used to predict bad debts and to collect data of debt history to improve the strategy

- Thanks to data science you can use numerical models to track employees expenses and to further investigate budget spendings of high risk

- Data analytics can help in all aspects of risk management

- Data science helps auditors to get more precise results with less errors, especially when working with larger data sets.

- Investments can be better handled with data science and that’s why tax accountants use it to analyze complex tax data

- Data science gives companies an opportunity to respond faster to investment opportunities

- Big data can be used to make analytics models that will be used to find consumers’ behavioral standards.

Use of data science in finance

Thanks to data science algorights, many financial products and services have been made which resulted in easier finance management and better business solutions. Finance businesses can’t wait to embrace new technologies that rely on data science and machine learning.

Similar to accounting niche, finance companies rely on massive amount of financial data, transaction and market details. With the help of data science, finance companies can have better data and document handling. As mentioned above, documents and data are totally connected. With better data handling thanks to data science, managing financial documents is even easier.

Here’s how data science has a positive impact on finance:

- Risk management, identifying and monitoring as well as predictions on future risks can be better done with data mining and data analysis. Creditworthiness of bank customers is one of the most common examples of using data science for risk management.

- With statistical and predictive modelling, data can be personalized which is a key to successful product or service and customer retention.

- In finance business, it is very important to successfully manage customer data. Data and document management are very important to keep clients happy. With proper text analytics and data mining, customers data is converted into information which can be used to meet customers’ needs.

- Detecting financial fraud is an obligation of every finance company and users expect their financial data will be completely secured. With help of predictive systems developed by data scientists it is easier to detect fraud and prevent it. Data science algorithms can detect anomalies in processes or users’ behaviour and see possible finance manipulations.

- Real-time analysis is very crucial in finance industry, especially banking and it helps financial professionals to better understand their clients. Usually this data is huge and it wouldn’t be done without data scientists who can setup algorithms for customer sentiment analysis.

Data science models and techniques definitely shape the future of business and change the way you manage your documents. By creating data algorithms and structures, the only document management task left to do is technical nature (converting documents from one format to another, securing documents, merging files) and even that part is simplified enough thanks to new document management technologies.