MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Market Highlights

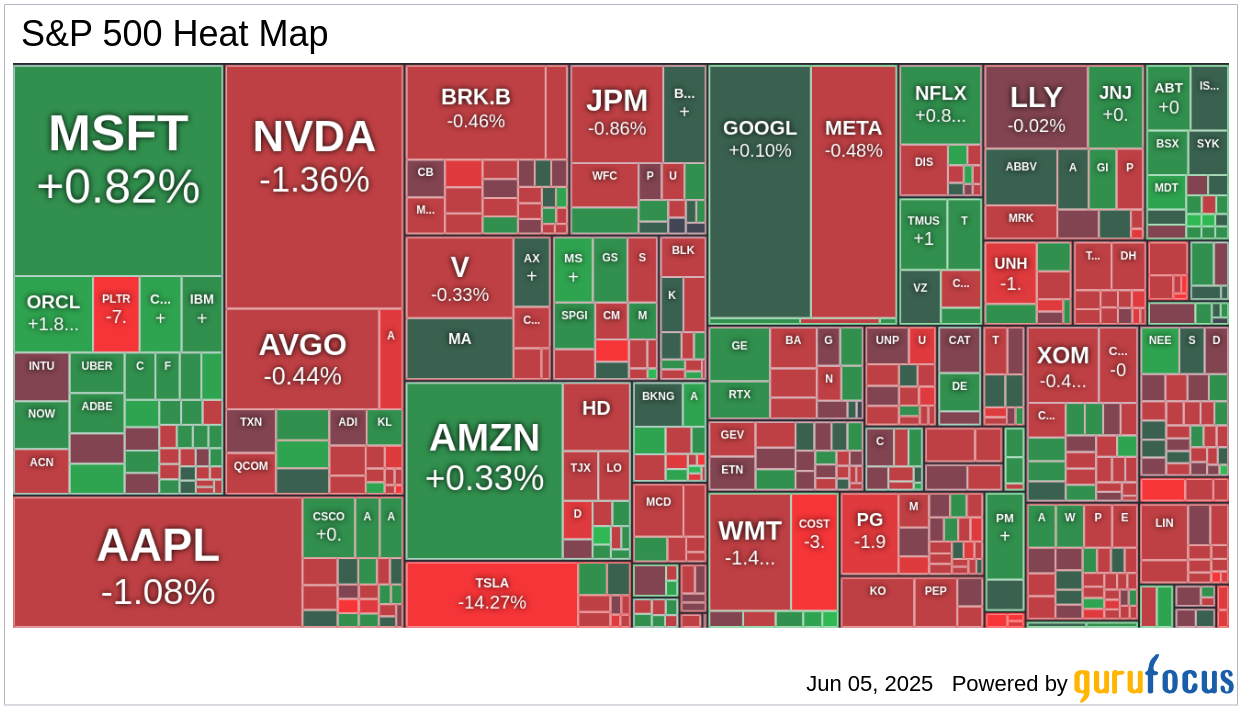

- The S&P 500 experienced high volatility, peaking at 5,999.70, but fell to 5,921.20 by the end, with Tesla (TSLA), Costco (COST), Brown-Forman (BF.B), and Palantir Technologies (PLTR) showing notable declines.

- President Trump and President Xi’s phone discussion hinted at future diplomatic meetings, perceived positively by investors.

- Elon Musk criticized a government bill, resulting in a social media exchange with President Trump, who suggested cutting Musk’s subsidies and contracts.

- The European Central Bank reduced interest rates by 25 basis points; the euro increased by 0.2% against the dollar.

- Q1 productivity dropped by 1.5%, and unit labor costs were revised up to 6.6%, raising concerns of stagflation.

- The trade deficit for April decreased significantly to $61.6 billion due to a notable reduction in imports from March.

- Circle Internet Group (CRCL) saw a strong market debut, closing at 83.23 after its IPO priced at $31.00.

Economic Indicators

- Initial jobless claims rose to 247,000, although the overall labor market outlook remains stable as the claims are below recession signals.

- Continuing jobless claims fell slightly to 1.904 million, with the four-week moving average reaching its highest since late 2021.

- The decline in the trade deficit is attributed to a sharp fall in imports, influenced by tariff-related activities.

Sector Performance

- The communication services sector was the only one with gains (+0.06%), while consumer discretionary (-2.5%) and staples (-1.2%) underperformed, impacted by Tesla and Costco’s declines.

- Overall, most sectors faced losses between 0.1% and 0.6%.

Indices Year-to-Date

- S&P 500: +1.0%

- Nasdaq: -0.1%

- DJIA: -0.5%

- S&P 400: -3.2%

- Russell 2000: -6.0%

TSLA,COST,BF.B,PLTR,CRCL

Guru Stock Picks

Jana Partners has made the following transactions:

Howard Marks has made the following transactions:

- Add in STR by 19.47%

Stock News

● MongoDB (MDB, Financial) shares soared 17% premarket following a robust Q1 fiscal 2026 performance that exceeded expectations. The company reported a 22% year-over-year revenue increase to $549 million, driven by a 26% rise in Atlas revenue. MongoDB also raised its full-year revenue guidance to $2.29 billion, reflecting strong customer growth and strategic acquisitions like Voyage AI.

● Suzuki Motor (OTCPK:SZKMY) halted production of its Swift model due to China’s rare earth export restrictions. The production stoppage, which began on May 26, is expected to last until June 6. Suzuki plans to resume full production by June 16 as parts supply prospects improve.

● Kimberly-Clark (KMB, Financial) is nearing a $3.5 billion sale of its international tissue business to Suzano (SUZ, Financial). This strategic move aims to focus on more profitable segments, leaving Kimberly-Clark with its North American and international personal care divisions.

● Citigroup (C, Financial) announced plans to cut 3,500 jobs at its technology centers in China as part of a global restructuring effort. The move is aimed at simplifying operations and reducing costs, aligning with Citigroup’s broader strategy to cut 20,000 jobs globally by 2026.

● DocuSign (DOCU, Financial) shares plummeted 14.5% after the company lowered its full-year billings guidance despite reporting better-than-expected Q1 results. The company now expects billings between $3.285 billion and $3.339 billion, slightly below previous estimates.

● PVH Corp. (PVH, Financial) shares dropped 8.2% after the company revised its full-year profit guidance downward, citing negative tariff impacts. The new EPS range of $10.75 to $11.00 fell short of the consensus estimate, reflecting ongoing macroeconomic challenges.

● Apple (AAPL, Financial) supplier Foxconn reported an 11.92% year-over-year revenue growth in May, despite a 3.99% month-over-month decline. The company anticipates continued growth in its Cloud and Networking Products segment in Q2.

● Wells Fargo (WFC, Financial) plans to expand its corporate and investment banking operations following the removal of a $1.95 trillion asset cap by the Federal Reserve. CEO Charlie Scharf aims to position the bank among the top five investment banks.

● Verint Systems (VRNT, Financial) shares surged 20% after the company reported strong Q1 earnings, driven by demand for its AI-powered solutions. The company maintained its annual guidance, targeting 8% ARR growth and double-digit free cash flow growth.

● Helius Medical Technologies (HSDT, Financial) announced a $9.1 million capital raise through a public offering, causing shares to fall 5.2% after-hours. The offering includes common shares and warrants, with proceeds expected to close on June 6.

● Tourmaline Oil (TSX:TOU:CA) increased its quarterly dividend by 43% to CAD 0.50 per share, reflecting a forward yield of 2.32%. The dividend is payable on June 30 to shareholders of record on June 16.

● Victoria’s Secret (VSCO, Financial) reported Q1 earnings that beat expectations, with non-GAAP EPS of $0.09 and revenue of $1.35 billion. The company continues to focus on strategic initiatives to enhance its market position.

● Winnebago Industries (WGO, Financial) shares fell 9.9% after preliminary FQ3 results missed estimates. The company cited macroeconomic uncertainty and cautious dealer networks as factors impacting its performance.

● Asana (ASAN, Financial) was downgraded by HSBC to Reduce from Hold, with a price target cut to $10. The company faces declining revenue growth and pricing pressures, leading to a 20% drop in shares on Wednesday.

● Qualcomm (QCOM, Financial) announced the acquisition of Autotalks, a semiconductor company specializing in vehicle-to-everything communication solutions. The terms of the transaction were not disclosed.

● LyondellBasell (LYB, Financial) entered exclusive talks with AEQUITA to sell four European assets as part of its strategic assessment. The transaction is expected to close in the first half of 2026.

● Alvotech (ALVO, Financial) and Dr. Reddy’s Laboratories (RDY, Financial) partnered to co-develop a biosimilar candidate for Keytruda, a cancer treatment. The collaboration aims to accelerate development and extend global reach.

● Cellebrite (CLBT, Financial) plans to acquire Corellium for $170 million in cash, with an additional $20 million converted to equity. The acquisition is expected to enhance Cellebrite’s digital investigation platform.

● TKO Group (TKO, Financial) disclosed that Vince McMahon sold 1.6 million shares for $250 million. The transaction was completed on June 4, with Endeavor Operating Company purchasing the shares.

GuruFocus Stock Analysis

Article originally posted on mongodb google news. Visit mongodb google news