MMS • RSS

Posted on mongodb google news. Visit mongodb google news

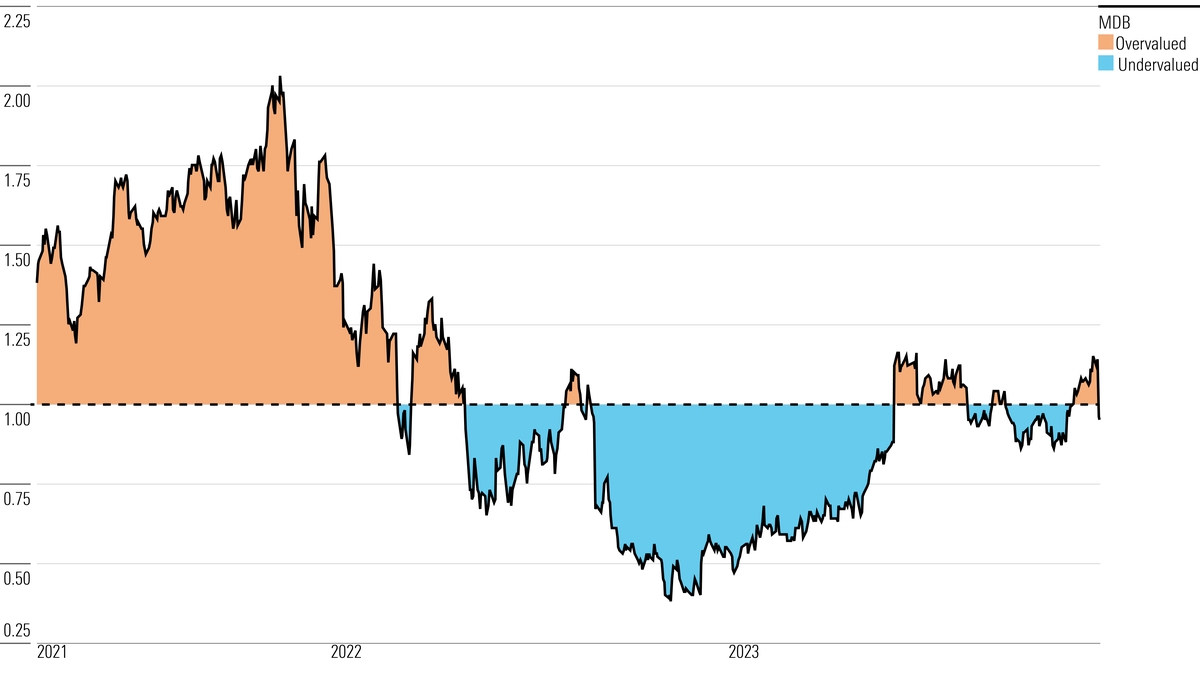

MongoDB: A Promising Stock Marred by High Valuation and Decelerating Growth

As we approach the Federal Reserve’s pivot in 2024, the stock market is riding a wave of unwavering optimism. Indices like the S&P 500 and Nasdaq are inching towards record-breaking highs. A prominent player in this upswing is the growth stock, MongoDB (MDB), which has demonstrated a significant recovery after a dramatic 70% fall due to inflation and interest rate hikes. Over the past year, MongoDB has seen its stock price double, signifying a remarkable turnaround.

From a Fall to a Rise

Once caught in the crosshairs of economic turbulence, MongoDB has carved out a space for itself in the realm of database services. Its success story has transformed it into a $28 billion company with projected FY2023 revenues touching the $1.65 billion mark. MongoDB’s recent quarterly results painted a promising picture with a 30% surge in revenue to $432 million and a 19% growth in its customer base. However, beneath this glittering veneer, analysts have detected signs of a slowing growth trajectory and have voiced concerns about MongoDB’s lofty valuation.

Profitability and Valuation: A Balancing Act

While MongoDB has recently begun to report positive free cash flow (FCF), its lack of GAAP profits complicates the valuation process. With a soaring Price to Sales ratio of 17.5x, the sustainability of MongoDB’s high valuation is under scrutiny. Despite showcasing potential for growth and profitability, its current valuation could be a potential minefield for investors.

Operational Efficiency vs. Shareholder Dilution

MongoDB’s story isn’t just about highs and lows; it’s also about its improved operational efficiency and its leverage from interest earned on investments. However, its use of Stock-Based Compensation (SBC) has resulted in shareholder dilution, casting a shadow over its potential. Consequently, MongoDB is seen as a company with potential but is deemed too risky of an investment at the current valuation. This narrative positions MongoDB as a more suitable candidate for a watchlist rather than an immediate addition to an investment portfolio.

Article originally posted on mongodb google news. Visit mongodb google news