MongoDB, Inc. (MDB) Reaches $55.83 After 5.00% Down Move; Tech Data (TECD) Had 4 Bulls

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

July 13, 2018 – By Richard Slagle

The stock of MongoDB, Inc. (NASDAQ:MDB) is a huge mover today! The stock decreased 3.54% or $2.05 during the last trading session, reaching $55.83. About 1.07M shares traded or 7.90% up from the average. MongoDB, Inc. (NASDAQ:MDB) has 0.00% since July 13, 2017 and is . It has underperformed by 12.57% the S&P500. Some Historical MDB News: 13/03/2018 – MongoDB 4Q Loss/Shr 52c; 22/04/2018 – DJ MongoDB Inc Class A, Inst Holders, 1Q 2018 (MDB); 10/05/2018 – WHALE ROCK CAPITAL MANAGEMENT LLC REPORTS 28.74 PCT STAKE IN MONGODB INC AS OF MAY 8, 2018; 13/03/2018 – MongoDB Sees FY19 Rev $211M-$215M; 29/05/2018 – WHALE ROCK CAPITAL MANAGEMENT LLC REPORTS 16.05 PCT PASSIVE STAKE IN MONGODB INC AS OF MAY 24 – SEC FILING; 13/03/2018 – MongoDB Sees 1Q Rev $45.5M-$46.5M; 13/03/2018 – MongoDB Sees FY19 Adj Loss/Shr $1.66-Adj Loss/Shr $1.62; 03/04/2018 – Investor Expectations to Drive Momentum within MongoDB, Johnson Outdoors, Bassett Furniture Industries, ESCO Technologies, Firs; 13/03/2018 – MONGODB INC – SEES 2019 REVENUE OF $211.0 MILLION TO $215.0 MILLION; 14/03/2018 – MONGODB INC MDB.O : BARCLAYS RAISES TARGET PRICE TO $45 FROM $38The move comes after 9 months negative chart setup for the $2.83 billion company. It was reported on Jul, 13 by Barchart.com. We have $53.04 PT which if reached, will make NASDAQ:MDB worth $141.35 million less.

Among 5 analysts covering Tech Data Corp (NASDAQ:TECD), 4 have Buy rating, 0 Sell and 1 Hold. Therefore 80% are positive. Tech Data Corp had 5 analyst reports since February 28, 2018 according to SRatingsIntel. Citigroup maintained the stock with “Neutral” rating in Friday, March 9 report. The firm has “Buy” rating given on Thursday, March 8 by Stifel Nicolaus. Bank of America maintained the shares of TECD in report on Friday, March 9 with “Buy” rating. The firm earned “Buy” rating on Thursday, May 31 by Pivotal Research. As per Wednesday, February 28, the company rating was maintained by Northcoast. See Tech Data Corporation (NASDAQ:TECD) latest ratings:

31/05/2018 Broker: Pivotal Research Rating: Buy New Target: $105.0000 Maintain

09/03/2018 Broker: Bank of America Old Rating: Buy New Rating: Buy Old Target: $115 New Target: $105 Maintain

09/03/2018 Broker: Citigroup Old Rating: Neutral New Rating: Neutral Old Target: $110 New Target: $95 Maintain

08/03/2018 Broker: Stifel Nicolaus Rating: Buy New Target: $110.0 Maintain

28/02/2018 Broker: Northcoast Rating: Buy New Target: $127.0 Maintain

More notable recent MongoDB, Inc. (NASDAQ:MDB) news were published by: Seekingalpha.com which released: “Billion-Dollar Unicorn: MongoDB, Post IPO Review” on July 07, 2018, also Fool.com with their article: “Why MongoDB, Inc. Shares Jumped 67% Higher In the First Half of 2018” published on July 11, 2018, Nasdaq.com published: “Salesforce.com Is Winning Big With Its Recent Investments” on June 21, 2018. More interesting news about MongoDB, Inc. (NASDAQ:MDB) were released by: Streetinsider.com and their article: “Rosenblatt Starts MongoDB (MDB) at Buy” published on July 09, 2018 as well as Digitaljournal.com‘s news article titled: “NASDAQ:MDB Investor Alert: Investigation over Potential Wrongdoing at MongoDB, Inc” with publication date: June 21, 2018.

MongoDB, Inc. operates as a general purpose database platform worldwide. The company has market cap of $2.83 billion. It offers MongoDB Enterprise Advanced, a subscription package for enterprise clients to run in the cloud or in a hybrid environment; MongoDB Atlas, a cloud hosted database-as-a-service solution; Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB; and MongoDB Stitch, a backend-as-a-service designed to simplify application development. It currently has negative earnings. The firm also provides professional services, such as consulting and training.

Analysts await MongoDB, Inc. (NASDAQ:MDB) to report earnings on September, 5. After $-0.58 actual EPS reported by MongoDB, Inc. for the previous quarter, Wall Street now forecasts 0.00% EPS growth.

The stock increased 0.27% or $0.23 during the last trading session, reaching $85.74. About 107,888 shares traded. Tech Data Corporation (NASDAQ:TECD) has declined 14.61% since July 13, 2017 and is downtrending. It has underperformed by 27.18% the S&P500. Some Historical TECD News: 24/05/2018 – Tech Data Appoints Raffaelo Piccolo to Lead Mexico Operations; 02/04/2018 – Tech Data Earns Five-Star Ratings in CRN’s 2018 Partner Program Guide; 19/04/2018 – TECH DATA CORP – COO RICH HUME TO SUCCEED BOB DUTKOWSKY AS CHIEF EXECUTIVE OFFICER IN JUNE 2018; 19/04/2018 – Tech Data Names Richard Hume CEO, Succeeding Dutkowsky; 23/05/2018 – Tech Data Recognized as 2018 Americas Distributor of the Year by Nutanix; 08/05/2018 – Tech Data Adds IBM MaaS360 with Watson to StreamOne Cloud Marketplace; 03/05/2018 – Tech Data Expands Cisco Partner Enablement Framework to Accelerate Profitable Growth for U.S. Partners; 08/03/2018 – Tech Data 4Q EPS 3c; 20/03/2018 – Tampa Bay Bus: Exclusive: Inside the Tech Data boardroom, three directors change the look of leadership; 07/05/2018 – Tech Data Recognized as Americas Distributor of the Year by Riverbed Technology

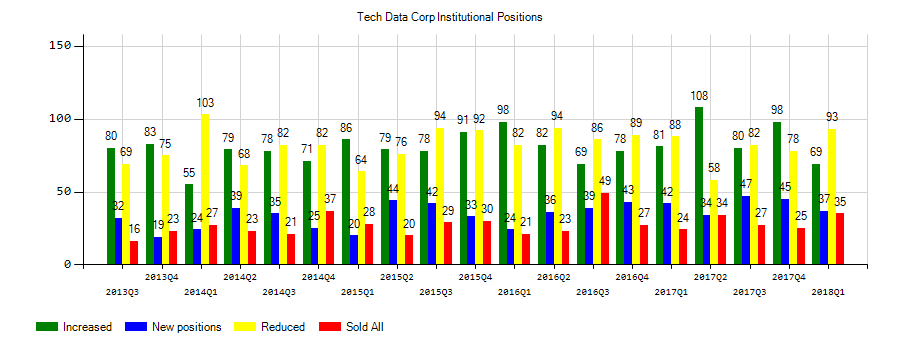

Investors sentiment decreased to 0.83 in 2018 Q1. Its down 0.56, from 1.39 in 2017Q4. It worsened, as 35 investors sold Tech Data Corporation shares while 93 reduced holdings. 37 funds opened positions while 69 raised stakes. 35.73 million shares or 1.77% more from 35.11 million shares in 2017Q4 were reported. Hancock Hldg stated it has 0.95% of its portfolio in Tech Data Corporation (NASDAQ:TECD). Ls Advsr Limited Company invested 0.01% of its portfolio in Tech Data Corporation (NASDAQ:TECD). Bragg Financial Advsr accumulated 45,122 shares. State Common Retirement Fund, New York-based fund reported 48,978 shares. Qs Ltd Liability Co holds 0.06% of its portfolio in Tech Data Corporation (NASDAQ:TECD) for 66,466 shares. Dimensional Fund Advsr Lp stated it has 0.11% of its portfolio in Tech Data Corporation (NASDAQ:TECD). Envestnet Asset Mgmt has invested 0% in Tech Data Corporation (NASDAQ:TECD). Massachusetts-based Congress Asset Mngmt Com Ma has invested 0.05% in Tech Data Corporation (NASDAQ:TECD). Macquarie reported 735,134 shares or 0.11% of all its holdings. Fmr Limited Liability Com holds 0.03% or 3.46 million shares in its portfolio. 4,170 were accumulated by Panagora Asset Mgmt Inc. Paloma Prtn reported 0.02% of its portfolio in Tech Data Corporation (NASDAQ:TECD). Texas-based Bridgeway Capital has invested 0.03% in Tech Data Corporation (NASDAQ:TECD). The Washington-based Cornerstone Advsr has invested 0% in Tech Data Corporation (NASDAQ:TECD). Clarivest Asset Mgmt Ltd Liability Co owns 0.04% invested in Tech Data Corporation (NASDAQ:TECD) for 30,400 shares.

Tech Data Corporation engages in the wholesale distribution of technology products. The company has market cap of $3.29 billion. It distributes and markets broadline products, such as notebooks, tablets, desktops, printers, printer supplies, and components; and data center products, including industry standard servers, proprietary servers, networking, and storage products. It has a 27.64 P/E ratio. The firm also offers software products, such as virtualization, cloud, security, desktop applications, operating systems, and utilities software; mobility products consisting of mobile phones and accessories; and consumer electronics comprising TV’s, digital displays, consumer audio-visual devices, and network-attached consumer devices.

Another recent and important Tech Data Corporation (NASDAQ:TECD) news was published by Globenewswire.com which published an article titled: “Detailed Research: Economic Perspectives on Tetraphase Pharmaceuticals, Tech Data, Southern National Bancorp of …” on June 21, 2018.

Receive News & Ratings Via Email – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with our FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news