MongoDB, Inc. (MDB) Reaches $55.83 After 9.00% Up Move; Textron (TXT) Has 0.83 Sentiment

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

July 12, 2018 – By Joshua Cleveland

The stock of MongoDB, Inc. (NASDAQ:MDB) is a huge mover today! The stock increased 4.86% or $2.59 during the last trading session, reaching $55.83. About 319,072 shares traded. MongoDB, Inc. (NASDAQ:MDB) has 0.00% since July 12, 2017 and is . It has underperformed by 12.57% the S&P500. Some Historical MDB News: 03/04/2018 – Investor Expectations to Drive Momentum within MongoDB, Johnson Outdoors, Bassett Furniture Industries, ESCO Technologies, Firs; 13/03/2018 – MONGODB INC – SEES 2019 REVENUE OF $211.0 MILLION TO $215.0 MILLION; 13/03/2018 – MongoDB Sees 1Q Adj Loss/Shr 44c-Adj Loss/Shr 43c; 13/03/2018 – MongoDB 4Q Rev $45M; 13/03/2018 – ObjectRocket® Delivers Fully Managed MongoDB-as-a-Service On Microsoft® Azure® For Access to Deeper Database Expertise and Better Performance; 29/05/2018 – WHALE ROCK CAPITAL MANAGEMENT LLC REPORTS 16.05 PCT PASSIVE STAKE IN MONGODB INC AS OF MAY 24 – SEC FILING; 27/04/2018 – WHALE ROCK CAPITAL MANAGEMENT LLC REPORTS A STAKE OF 16.25 PCT IN MONGODB INC AS OF APRIL 17, 2018 – SEC FILING; 22/04/2018 – DJ MongoDB Inc Class A, Inst Holders, 1Q 2018 (MDB); 13/03/2018 – MongoDB Sees FY19 Adj Loss/Shr $1.66-Adj Loss/Shr $1.62; 10/05/2018 – WHALE ROCK CAPITAL MANAGEMENT LLC REPORTS 28.74 PCT STAKE IN MONGODB INC AS OF MAY 8, 2018The move comes after 6 months positive chart setup for the $2.83B company. It was reported on Jul, 12 by Barchart.com. We have $60.85 PT which if reached, will make NASDAQ:MDB worth $254.43 million more.

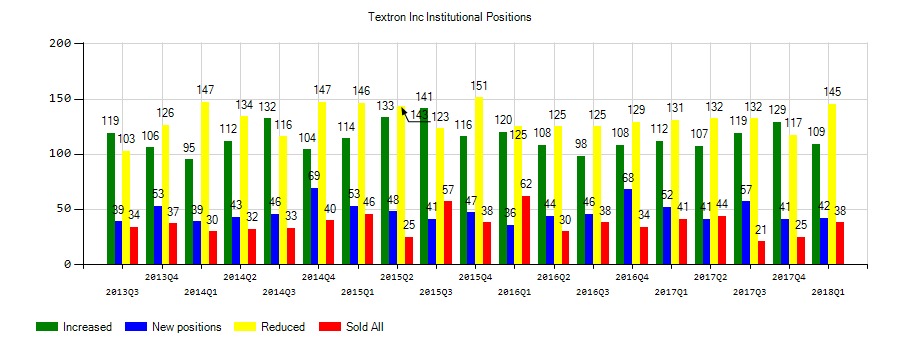

Textron Inc (TXT) investors sentiment decreased to 0.83 in Q1 2018. It’s down -0.37, from 1.2 in 2017Q4. The ratio turned negative, as 151 investment managers started new and increased stock positions, while 183 sold and trimmed positions in Textron Inc. The investment managers in our database now hold: 211.27 million shares, down from 215.83 million shares in 2017Q4. Also, the number of investment managers holding Textron Inc in top ten stock positions increased from 0 to 2 for an increase of 2. Sold All: 38 Reduced: 145 Increased: 109 New Position: 42.

More notable recent MongoDB, Inc. (NASDAQ:MDB) news were published by: Seekingalpha.com which released: “Billion-Dollar Unicorn: MongoDB, Post IPO Review” on July 07, 2018, also Nasdaq.com with their article: “Why MongoDB, Inc. Shares Jumped 67% Higher In the First Half of 2018” published on July 11, 2018, Prnewswire.com published: “MongoDB University Passes 1 Million Registrations” on July 12, 2018. More interesting news about MongoDB, Inc. (NASDAQ:MDB) were released by: Nasdaq.com and their article: “Salesforce.com Is Winning Big With Its Recent Investments” published on June 21, 2018 as well as Streetinsider.com‘s news article titled: “Rosenblatt Starts MongoDB (MDB) at Buy” with publication date: July 09, 2018.

Analysts await MongoDB, Inc. (NASDAQ:MDB) to report earnings on September, 5. After $-0.58 actual earnings per share reported by MongoDB, Inc. for the previous quarter, Wall Street now forecasts 0.00% EPS growth.

MongoDB, Inc. operates as a general purpose database platform worldwide. The company has market cap of $2.83 billion. It offers MongoDB Enterprise Advanced, a subscription package for enterprise clients to run in the cloud or in a hybrid environment; MongoDB Atlas, a cloud hosted database-as-a-service solution; Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB; and MongoDB Stitch, a backend-as-a-service designed to simplify application development. It currently has negative earnings. The firm also provides professional services, such as consulting and training.

Textron Inc. operates in the aircraft, defense, industrial, and finance businesses worldwide. The company has market cap of $17.09 billion. It operates through five divisions: Textron Aviation, Bell, Textron Systems, Industrial, and Finance. It has a 45.01 P/E ratio. The Textron Aviation segment makes and sells business jets, turboprop aircraft, piston engine aircraft, and military trainer and defense aircraft; and commercial parts, as well as provides maintenance, inspection, and repair services.

The stock increased 1.18% or $0.78 during the last trading session, reaching $66.75. About 268,828 shares traded. Textron Inc. (TXT) has risen 38.18% since July 12, 2017 and is uptrending. It has outperformed by 25.61% the S&P500. Some Historical TXT News: 27/04/2018 – U.S. STATE DEPARTMENT HAS APPROVED POSSIBLE $911 MLN SALE TO BAHRAIN OF ATTACK HELICOPTERS; BELL HELICOPTER AND GE ARE PRINCIPAL CONTRACTORS -PENTAGON; 18/04/2018 – Textron profit surges as corporate America buys more business jets; 18/04/2018 – TEXTRON INC – SEES 2018 CASH FLOW FROM CONTINUING OPERATIONS OF MANUFACTURING GROUP BEFORE PENSION CONTRIBUTIONS OF $700 TO $800 MLN; 18/04/2018 – TEXTRON’S BOARD ALSO AUTHORIZES BUYBACK OF UP TO 40M SHRS; 19/04/2018 – TRUMP ADMINISTRATION ANNOUNCES OVERHAUL OF U.S. ARMS EXPORT POLICY AIMED AT EXPANDING SALES TO U.S. ALLIES; 18/04/2018 – TEXTRON INC SAYS BUSINESS CONFIDENCE IS STRONG AND PEOPLE ARE LOOKING TO INVEST – CONF CALL; 18/04/2018 – TEXTRON – PROCEEDS FROM SALE OF TOOLS & TEST BUSINESS TO BE USED TO FUND ADDITIONAL SHARE REPURCHASES TO OFFSET EARNINGS IMPACT RELATED TO SALE; 18/04/2018 – TEXTRON 1Q DELIVERIES: 36 JETS VS 35 1Q17; 29 TURBOPROPS VS 20; 18/04/2018 – Textron 1Q Net $189M; 16/04/2018 – Textron Inc expected to post earnings of 48 cents a share – Earnings Preview

Another recent and important Textron Inc. (NYSE:TXT) news was published by Businesswire.com which published an article titled: “Textron Businesses Will Exhibit a Large Array of Products at the Farnborough International Airshow” on July 11, 2018.

Analysts await Textron Inc. (NYSE:TXT) to report earnings on July, 18 before the open. They expect $0.68 EPS, up 13.33% or $0.08 from last year’s $0.6 per share. TXT’s profit will be $174.11M for 24.54 P/E if the $0.68 EPS becomes a reality. After $0.72 actual EPS reported by Textron Inc. for the previous quarter, Wall Street now forecasts -5.56% negative EPS growth.

Receive News & Ratings Via Email – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with our FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news