MMS • RSS

Posted on mongodb google news. Visit mongodb google news

DKosig

MongoDB’s (NASDAQ:MDB) stock has performed well over the past 12 months, driven in large part by multiple expansion. If this is in expectation of an AI led surge in consumption, investors are likely to be left disappointed. MongoDB’s business is dependent on workloads, which probably won’t meaningfully benefit from AI anytime soon.

While MongoDB’s business performed reasonably well in 2023, this was in large part due to accounting requirements and sets the company up for difficult comparable periods in 2024. Investor response to continued growth deceleration in the second half of 2024 could be extremely negative given MongoDB’s valuation.

Market

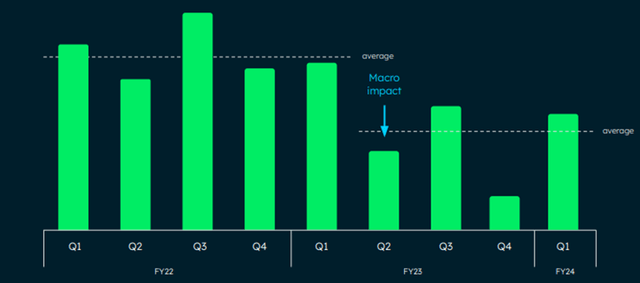

MongoDB observed a slowdown in consumption growth starting in early 2022. Consumption has since stabilized though, albeit at a lower level, and returned to growth. MongoDB is also seeing less consumption variability in FY2024 than previous years, which could lead to relative strength in the seasonally weak fourth quarter.

MongoDB continues to win new workloads from both new and existing customers. This suggests that the long-term outlook for the company remains healthy. The growth of existing workloads remains depressed though, which MongoDB has attributed to the macro environment.

Figure 1: Week-Over-Week Average Atlas Consumption Growth (source: MongoDB)

MongoDB

While MongoDB remains subject to the vicissitudes of the demand environment, the company continues to both expand the capabilities of its platform and make it easier for customers to adopt its products. This grows MongoDB’s addressable market and strengthens the company’s competitive position.

Relational Migrator was launched early this year and helps customers to migrate data from legacy relational databases. MongoDB also recently unveiled Query Converter, a tool that leverages generative AI to convert existing SQL queries into queries that work with MongoDB. Given skill shortages, solutions that reduce the time and effort required to adopt MongoDB are likely to be important growth drivers.

AI

MongoDB stands to benefit directly from AI workloads and indirectly from the productivity boost AI could provide to developers. The company announced that Vector Search was in preview in June, with Atlas Vector Search becoming generally available in early December.

Vector search enables use cases like semantic search and retrieval augmented generation. While it is early days, adoption is likely to increase in coming years. As an example, Walmart (WMT) is working with Microsoft (MSFT) to embed generative AI search capabilities into its website. This is designed to provide shoppers with a curated list of items based on their search query. Many organizations are likely to head down this path (both internal and customer facing applications) in coming years, and MongoDB is an obvious choice for existing customers.

MongoDB expects AI to provide a large tailwind, but this will take time to develop. While customers are already implementing AI, most of this is just proof-of-concept projects at the moment. Many customers are also realizing that their data infrastructure doesn’t lend itself to AI-enabled applications. This is creating pressure to modernize data infrastructure, which should benefit MongoDB.

Search

In addition to vector search, MongoDB also has a traditional search offering which is seeing increased adoption. MongoDB believes that it is able to offer customers a superior solution as its offering is integrated with the rest of its platform. MongoDB started out in niche use cases, but as its product has improved, the company is now trying to move upmarket. As part of this, MongoDB recently announced search nodes, which allow customers to scale search separately from operational transactions.

Stream processing

MongoDB believes that it is hard to process streaming data with existing solutions. Streaming data tends to come with rigid schemas and existing solutions create additional overhead. Atlas Stream Processing helps developers process complex streams of high velocity data, without having to learn new tools, languages and APIs.

These types of tools compete with best-in-class solutions from companies like Confluent (CFLT) and Elastic (ESTC), but MongoDB will likely still see significant adoption as it offers an integrated data platform, which potentially reduces complexity and resource requirements.

Financial Analysis

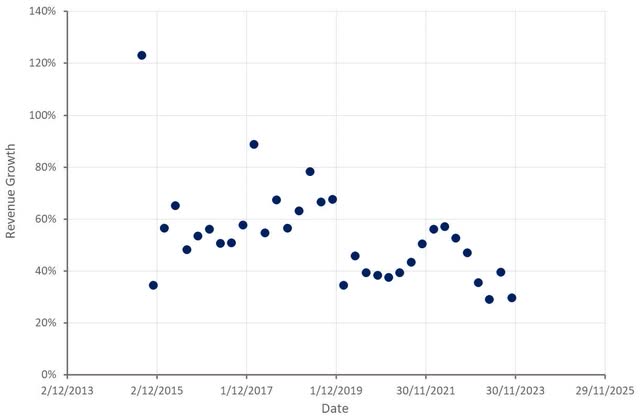

MongoDB’s revenue increased 30% YoY in the third quarter to 433 million USD. Atlas revenue grew 36%, representing 66% of total revenue. Enterprise Advance was again largely responsible for MongoDB’s outperformance in the quarter. EA is more heavily used by larger customers and often acts as an on-ramp to the cloud. As a result, EA strength may indicate adoption by more conservative or traditional customers.

EA also creates uncertainty regarding MongoDB’s forward performance though. EA revenue growth has been in large part due to more multi-year deals, which have a large amount of revenue recognized upfront. This will make Q2 and Q3 FY2024 tough comparable periods next year. As a result, there is a risk of growth dropping into the teens in the second half of 2024 if EA strength doesn’t persist.

MongoDB is guiding to 429-433 million USD revenue in the fourth quarter, which would represent roughly 19% growth at the midpoint. MongoDB has a history of conservative guidance though, and I would expect growth to come in closer to 26% YoY. There is a significant amount of uncertainty in this estimate though as a result of the importance of Enterprise Advanced to MongoDB’s business and the way it must be treated from an accounting perspective. Of note, unused commitments provided a several million dollar tailwind in Q4 FY2023, making for a difficult comparable period, as Q4 FY2024 unused commitments will be at a more normal level.

Figure 2: MongoDB Revenue Growth (source: Created by author using data from MongoDB)

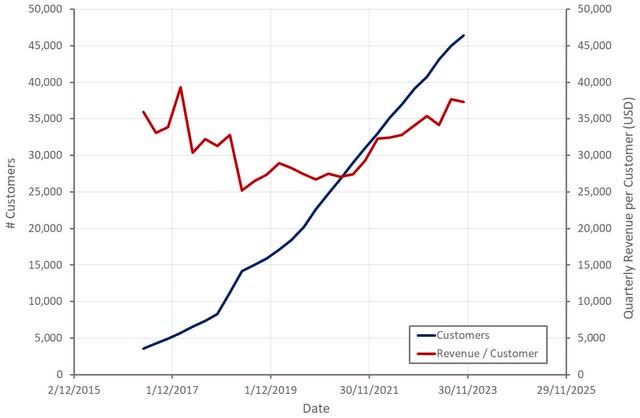

MongoDB’s customer count increased roughly 19% YoY in the third quarter, with the company’s direct sales customer count growing 12%. While customer additions appeared to soften in the third quarter, MongoDB removed roughly 350 self-serve accounts because they are better classified as subsidiaries of other customers or are now users of the free tier. Accounting for this, customer acquisition remains relatively healthy.

MongoDB’s net ARR expansion rate was above 120% in the third quarter. The company’s large customer count also increased roughly 28% YoY. There is still enormous room for expansion as well, as MongoDB currently only accounts for around 1.7% of Fortune 500 company database spend.

Figure 3: MongoDB Customers (source: Created by author using data from MongoDB)

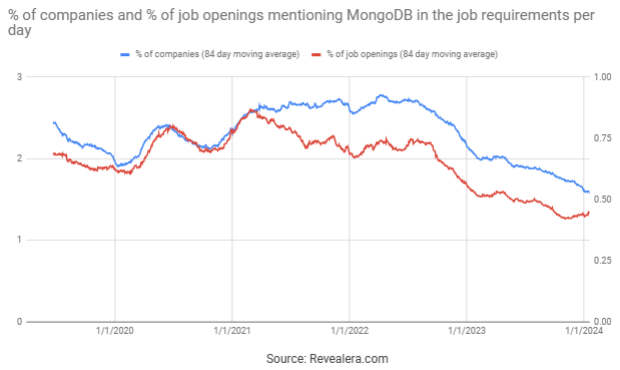

MongoDB’s recent growth has been fairly solid, but declining Atlas growth and the impact of multi-year licenses raise questions about the sustainability of this growth. Indicators like job openings and search interest point towards a tough demand environment.

Figure 4: Job Openings Mentioning MongoDB in the Job Requirements (source: Revealera.com)

Figure 5: “MongoDB Pricing” Search Interest (source: Created by author using data from Google Trends and MongoDB)

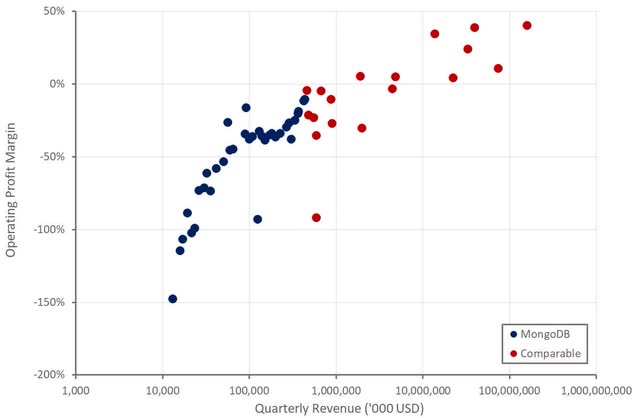

Recent margin improvement has been driven by efficiencies and revenue outperformance. As a result, there could be margin headwinds going forward if revenue growth softens or hiring picks up. MongoDB continues to drive efficient growth and has high retention rates though, which will lead to strong profitability in time. I still expect operating profit margins to end up north of 30%, which is well in excess of management’s 20% guidance.

Figure 6: MongoDB Operating Profit Margin (source: Created by author using data from MongoDB)

Conclusion

MongoDB’s recent performance has been in large part driven by the accounting treatment of multi-year licensing revenue, which sets the company up for relatively weak growth in FY2025. Given MongoDB’s valuation, it is not clear how this will be received by the market. Investors could lose patience with companies whose growth is still decelerating at this point in time.

Longer term, MongoDB’s data platform strategy is coming to fruition, which provides a long growth runway and a strong competitive position. I estimate that MongoDB’s intrinsic value is in excess of 500 USD per share, but the risk-reward tradeoff is unfavorable at the moment given MongoDB’s current revenue multiple and the potential for weaker growth in 2024.

Figure 7: MongoDB Relative Valuation (source: Created by author using data from Seeking Alpha)

Article originally posted on mongodb google news. Visit mongodb google news