When you’re selling assets to fund your retirement, you want the market to be as richly valued for as long as possible. Since bull markets don’t last forever, you should increasingly diversify your assets to protect that wealth as you age. If you’re a net buyer of stocks leading up to retirement, then you want them to trade as low as possible. So for most investors, bear markets are a blessing, not a curse.

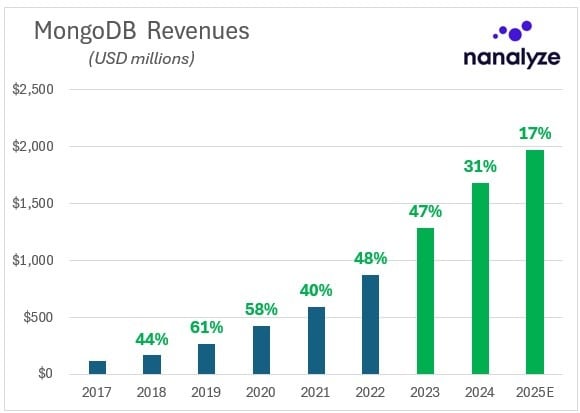

The same holds true for shares of quality companies that stagnate – like MongoDB (MDB). Since we last covered the company 28 months ago, their market cap is down 17% (from 22.6 billion to 18.8 billion) while revenue growth has continued unabated. The end result is a current simple valuation ratio (SVR) of 9, down from 20 the last time we looked. That’s what happens when revenues more than double, but the share price stays roughly the same.

Why We’ve Been Avoiding MongoDB Stock

Whether MongoDB stock outperformed or underperformed since we said we were avoiding it is irrelevant. This is a volatile stock, so the performance outcome will differ over time depending on when you take the measurements. As the dyed-in-the-wool types say, volatility equals risk, and MongoDB is quite a volatile stock.