MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Just_Super

MongoDB’s (NASDAQ:MDB) stock is up roughly 100% from last year’s lows, despite an ongoing deterioration in growth. While MDB stock is not necessarily overvalued for investors with a long-term time frame, it is difficult to see mid-teen growth supporting the current valuation for any length of time. This leaves the stock vulnerable to a substantial pullback, particularly if the macro environment continues to deteriorate.

Market

MongoDB observed a slowdown in consumption during December and January and is expecting fairly soft growth in FY2024. While there have been consumption headwinds, MongoDB continues to attract new customers at a healthy clip. Management believes that this is because the platform is mission critical and has a strong ROI.

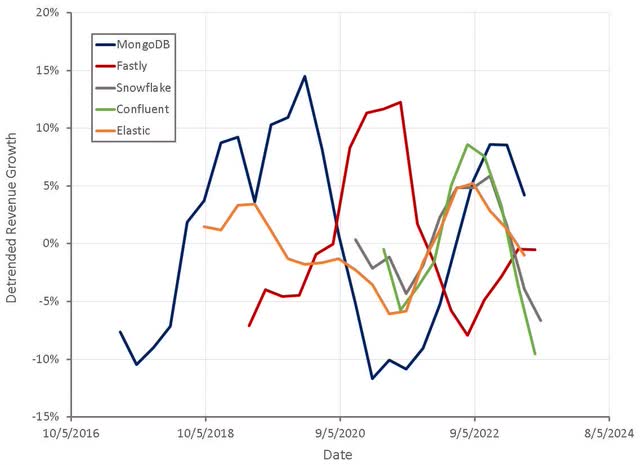

There is a tendency to lump SaaS companies together, but there are nuances to demand drivers, even for seemingly similar companies. Growth may be dependent on users, compute, storage, networking, etc. MongoDB is dependent on customer application usage for consumption growth, and this is something the company has no control over. Weak consumption growth is being driven by macro factors, with little to indicate there are company specific problems. Demand is softening for a range of companies and MongoDB is likely to follow.

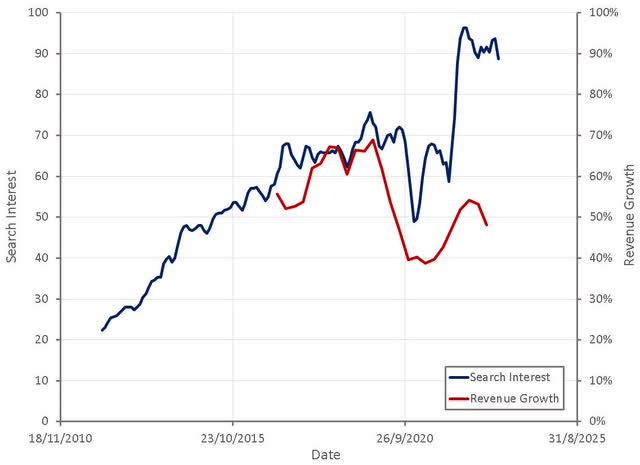

Figure 1: SaaS Company Detrended Revenue Growth (source: Created by author using data from company reports)

AI

As with many companies, there are questions around the impact of AI on MongoDB’s business. The general consensus appears to be that it is a large tailwind, although this is likely to be through secondary effects.

Generative AI could lead to a boom in new software applications by improving the productivity of developers. This would presumably lead to greater usage of MongoDB’s platform and accelerated revenue growth. Even if this is to occur, it is likely to take time to play out. Developers tools leveraging AI need to be improved, and gain widespread adoption, and applications built using these tools will need time to build usage.

MongoDB can also be used in machine learning workflows but it seems likely that this would only be a fairly modest source of growth. MongoDB’s flexible data model, distributed design, scalability, rich query capabilities and strong consistency are attractive features for machine learning. Applications built on top of MongoDB which gain widespread usage are likely to generate more transactions over time than training machine learning models.

MongoDB

MongoDB offers a developer data platform that is witnessing increasing adoption on the back of growing usage of non-relational databases and broader applicability. The broad applicability of MongoDB’s platform is also beneficial in an environment where customers are trying to consolidate vendors.

Given MongoDB’s growing success in its core market, expansion into adjacent use cases is likely to be important going forward. MongoDB is trying to encourage adoption of its platform for analytic use cases, with real-time analytics a natural fit due to the fact that data is generated on the platform.

Search is another expansion area where customer demand is high, as it saves customers having to manage a separate search engine and maintain connectivity between the OLTP database and search database. MongoDB is also reportedly seeing a lot of demand for time series use cases for similar reasons.

While MongoDB is expanding into new areas, vendors in adjacent verticals are also encroaching on MongoDB’s core territory. Snowflake (SNOW) is attempting to position itself as a developer platform, and not just an analytic database. This initiative is nascent though, and MongoDB believes that it is protected by its developer mindshare.

MongoDB’s management team appears increasingly confident in regards to its long-term opportunity, despite any near-term headwinds, and as a result they are continuing to invest in growth. The company’s principal focus is on acquiring new applications as its platform tends to be extremely sticky. This optimism may come from the fact that some of MongoDB’s largest and most sophisticated customers plan on meaningfully increasing their MongoDB deployments. This is suggestive of larger organizations beginning to standardize on MongoDB as a developer platform.

Financial Analysis

MongoDB observed some consumption weakness related to Atlas in the fourth quarter. The slowdown was broad based, but consumption growth in February was reportedly better than December and January, and more in line with average growth over the past 12 months. Atlas revenue still increased 50% YoY and now represents 65% of revenue.

Slowing consumption growth is not being attributed to optimization, as is the case for many companies. It is reportedly due to existing workloads growing slower than has generally been the case in the past, with customer acquisition and new applications both relatively strong.

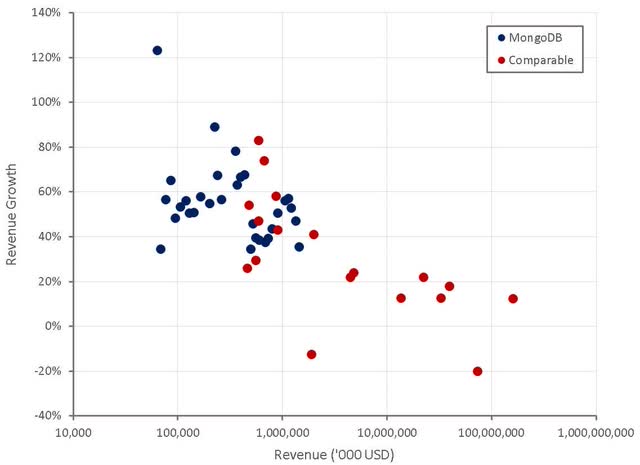

MongoDB expects roughly 21% revenue growth YoY in the first quarter and 16% revenue growth for FY2024. This would represent a significant deceleration of growth, which should not be surprising given MongoDB’s past growth volatility. This may be negatively received by the market in the near term, but provided MongoDB continues to gain customers and churn remains low, the long term implications are minimal.

Figure 2: MongoDB Revenue Growth (source: Created by author using data from company reports)

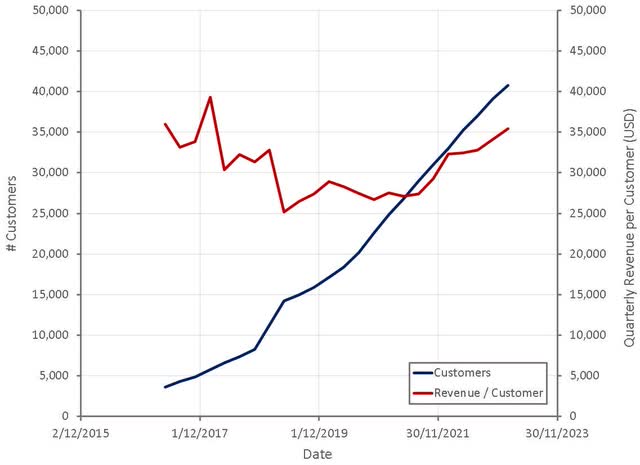

Unlike many software companies, MongoDB continues to win new customers in a difficult macro environment and retention rates also continue to be strong. MongoDB added roughly 500 net new direct sales customers in the fourth quarter. Over 6,400 of MongoDB’s customers are now direct sales customers, compared to over 4,400 in the year ago period. MongoDB also now has 1,651 customers with at least 100,000 USD in ARR and annualized MRR.

Figure 3: MongoDB Customers (source: Created by author using data from MongoDB)

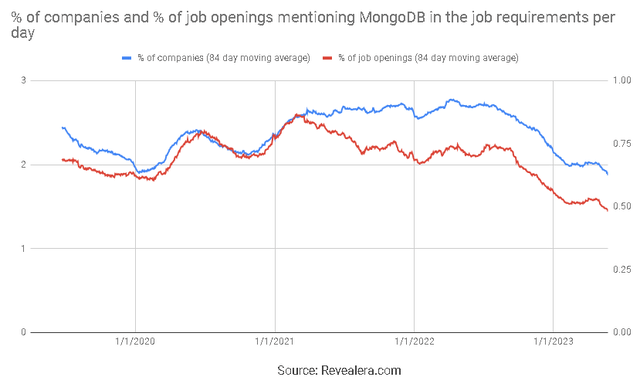

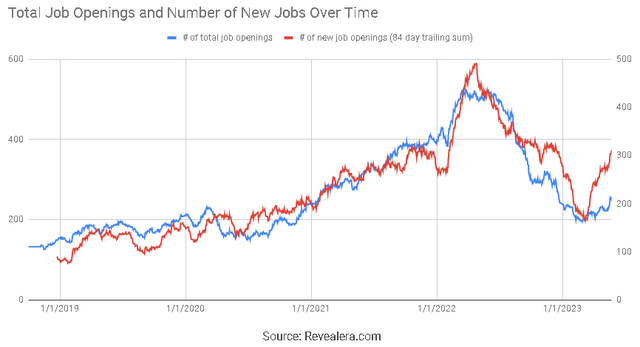

The number of job openings mentioning MongoDB in the job requirements has fallen significantly over the past 12 months. This trend isn’t supported by MongoDB’s customer count, but it obviously isn’t a positive.

Figure 4: Job Openings Mentioning MongoDB in the Job Requirements (source: Revealera.com)

After surging over the past 12 months, search interest for “MongoDB Pricing” has begun to fall. While this is a noisy signal and could be interpreted as indicative of pricing pressure or demand, it broadly aligns with MongoDB’s revenue growth and suggests an ongoing slowdown.

Figure 5: “MongoDB Pricing” Search Interest (source: Created by author using data from MongoDB and Google Trends)

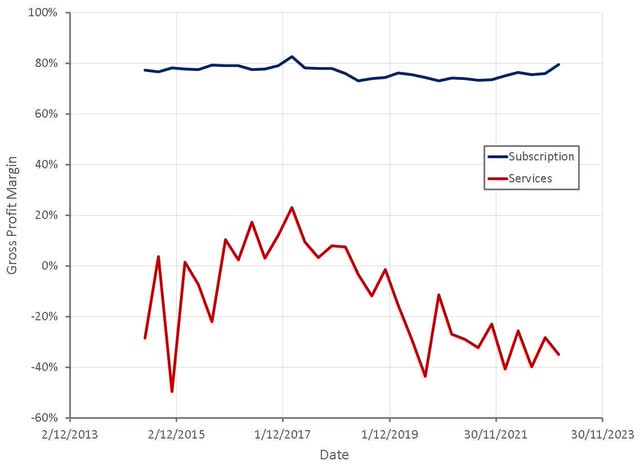

Figure 6: MongoDB Gross Profit Margins (source: Created by author using data from MongoDB)

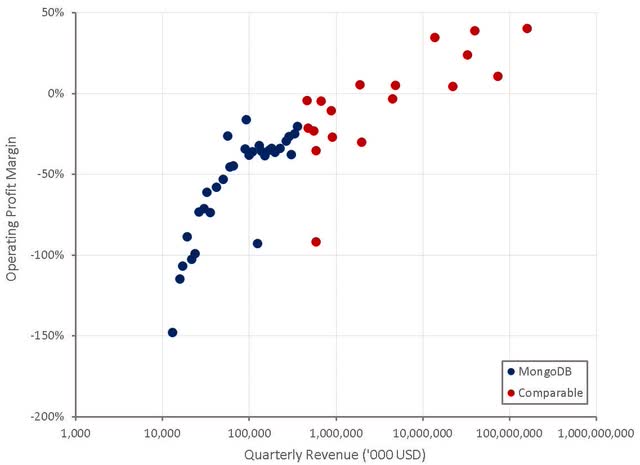

MongoDB’s increased focus on costs is translating into improving operating profit margins, which is more than can be said for many SaaS companies. MongoDB will obviously be highly profitably in time, but the company still has some ways to go.

Figure 7: MongoDB Operating Profit Margins (source: Created by author using data from company reports)

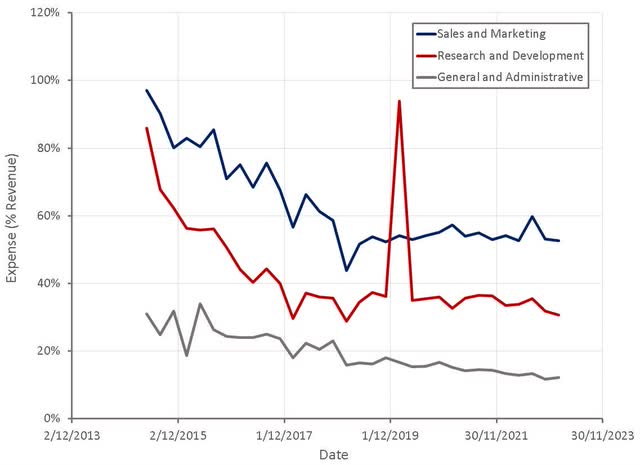

MongoDB has moved the bar for new investments higher in recent months in an effort to accelerate its path to profitability. The company plans on significantly reducing headcount growth in 2024, which should contribute to an improvement in margins. They will continue to increase the number of quota carrying reps though, prioritizing regions and channels with the most potential. Investments in some supporting areas will be reduced and MongoDB wants to improve efficiency within G&A. R&D efforts will be focused on enhancing the core product and adding to search and time series capabilities.

Figure 8: MongoDB Operating Expenses (source: Created by author using data from MongoDB)

Given the deceleration in growth and management’s stated desire of slowing headcount growth, it is somewhat surprising to see the number of job openings at MongoDB surge in recent months. This could indicate that business fundamentals are improving, but if this is not the case, it could pressure margins, which is unlikely to be well received by the market.

Figure 9: MongoDB Job Openings (source: Revealera.com)

Valuation

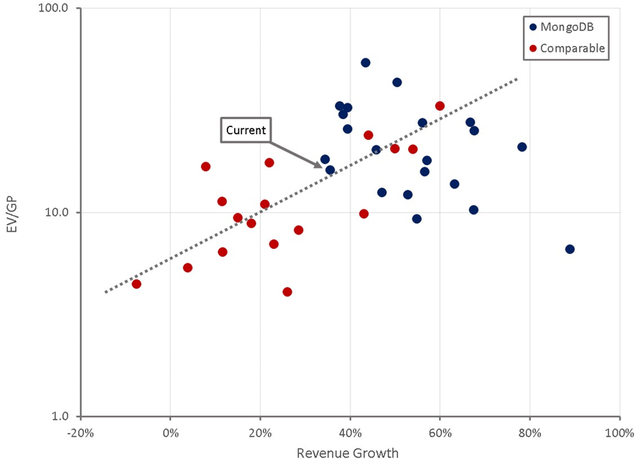

Given the expected growth deceleration in FY2024, MongoDB’s valuation is beginning to look stretched. The company is still some way off profitability, which leaves little downside support if sentiment towards the stock shifts. Customer metrics are healthy though and MongoDB appears to be well on its way to establishing itself as a long term winner. Investors must weigh MongoDB’s obvious long term potential against the near term risk presented by a deteriorating macro environment.

Figure 10: MongoDB Relative Valuation (source: Created by author using data from Seeking Alpha)

Article originally posted on mongodb google news. Visit mongodb google news