MMS • RSS

Scotiabank has adjusted its outlook for MongoDB (MDB, Financial), decreasing the price target from $240 to $160. Despite recognizing several strengths within MongoDB’s business model, analyst Patrick Colville maintains a Sector Perform rating for the company. This cautious stance suggests that the firm advises a prudent approach and does not recommend investors to quickly increase their positions in MongoDB at this time.

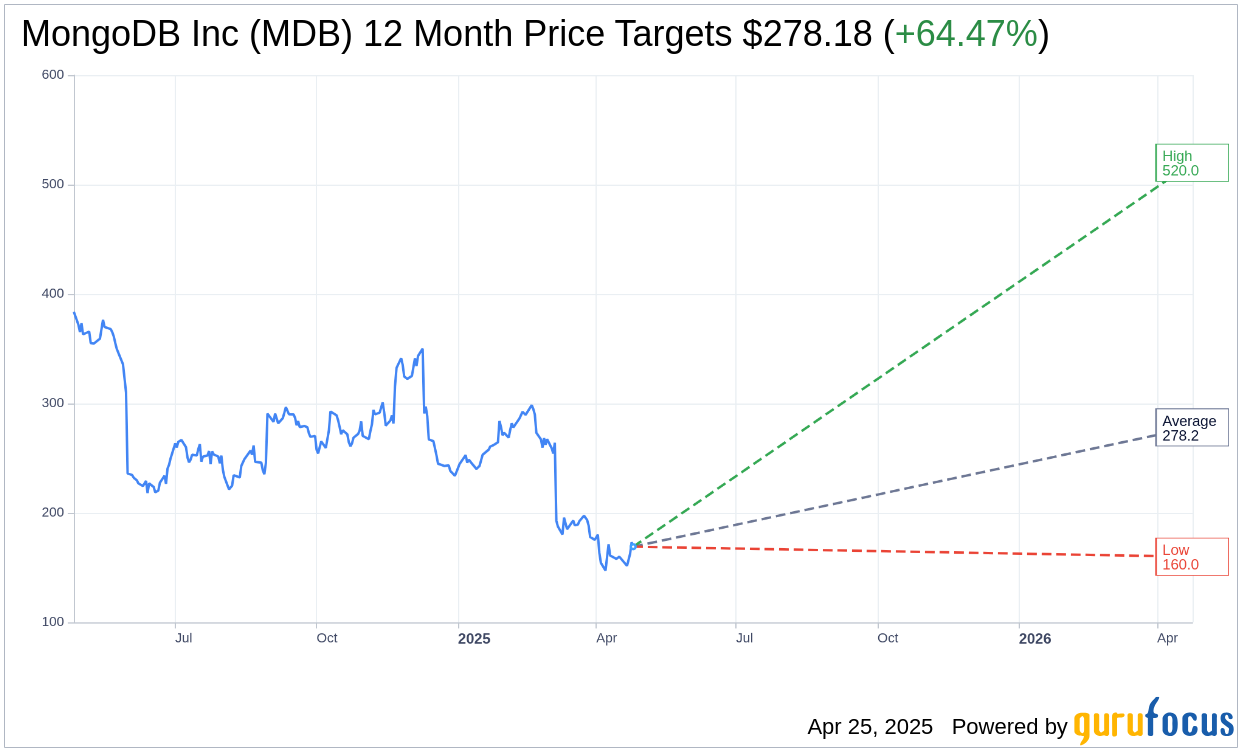

Wall Street Analysts Forecast

Based on the one-year price targets offered by 34 analysts, the average target price for MongoDB Inc (MDB, Financial) is $278.18 with a high estimate of $520.00 and a low estimate of $160.00. The average target implies an

upside of 64.47%

from the current price of $169.14. More detailed estimate data can be found on the MongoDB Inc (MDB) Forecast page.

Based on the consensus recommendation from 38 brokerage firms, MongoDB Inc’s (MDB, Financial) average brokerage recommendation is currently 2.0, indicating “Outperform” status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MongoDB Inc (MDB, Financial) in one year is $432.68, suggesting a

upside

of 155.81% from the current price of $169.14. GF Value is GuruFocus’ estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business’ performance. More detailed data can be found on the MongoDB Inc (MDB) Summary page.

MDB Key Business Developments

Release Date: March 05, 2025

- Total Revenue: $548.4 million, a 20% year-over-year increase.

- Atlas Revenue: Grew 24% year-over-year, representing 71% of total revenue.

- Non-GAAP Operating Income: $112.5 million, with a 21% operating margin.

- Net Income: $108.4 million or $1.28 per share.

- Customer Count: Over 54,500 customers, with over 7,500 direct sales customers.

- Gross Margin: 75%, down from 77% in the previous year.

- Free Cash Flow: $22.9 million for the quarter.

- Cash and Cash Equivalents: $2.3 billion, with a debt-free balance sheet.

- Fiscal Year 2026 Revenue Guidance: $2.24 billion to $2.28 billion.

- Fiscal Year 2026 Non-GAAP Operating Income Guidance: $210 million to $230 million.

- Fiscal Year 2026 Non-GAAP Net Income Per Share Guidance: $2.44 to $2.62.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- MongoDB Inc (MDB, Financial) reported a 20% year-over-year revenue increase, surpassing the high end of their guidance.

- Atlas revenue grew 24% year over year, now representing 71% of total revenue.

- The company achieved a non-GAAP operating income of $112.5 million, resulting in a 21% non-GAAP operating margin.

- MongoDB Inc (MDB) ended the quarter with over 54,500 customers, indicating strong customer growth.

- The company is optimistic about the long-term opportunity in AI, particularly with the acquisition of Voyage AI to enhance AI application trustworthiness.

Negative Points

- Non-Atlas business is expected to be a headwind in fiscal ’26 due to fewer multi-year deals and a shift of workloads to Atlas.

- Operating margin guidance for fiscal ’26 is lower at 10%, down from 15% in fiscal ’25, due to reduced multi-year license revenue and increased R&D investments.

- The company anticipates a high-single-digit decline in non-Atlas subscription revenue for the year.

- MongoDB Inc (MDB) expects only modest incremental revenue growth from AI in fiscal ’26 as enterprises are still developing AI skills.

- The company faces challenges in modernizing legacy applications, which is a complex and resource-intensive process.