Month: July 2024

MMS • RSS

NEW YORK, July 30, 2024 (GLOBE NEWSWIRE) — The Gross Law Firm issues the following notice to shareholders of MongoDB, Inc. (NASDAQ: MDB).

Shareholders who purchased shares of MDB during the class period listed are encouraged to contact the firm regarding possible lead plaintiff appointment. Appointment as lead plaintiff is not required to partake in any recovery.

CONTACT US HERE:

https://securitiesclasslaw.com/securities/mongodb-inc-loss-submission-form/?id=92729&from=3

CLASS PERIOD: August 31, 2023 to May 30, 2024

ALLEGATIONS: According to the complaint, on March 7, 2024, MongoDB reported strong Q4 2024 results and then announced lower than expected full-year guidance for 2025. MongoDB attributed it to the Company’s change in its “sales incentive structure” which led to a decrease in revenue related to “unused commitments and multi-year licensing deals.” Following this news, MongoDB’s stock price fell by $28.59 per share to close at $383.42 per share. Later, on May 30, 2024, MongoDB further lowered its guidance for the full year 2025 attributing it to “macro impacting consumption growth.” Analysts commenting on the reduced guidance questioned if changes made to the Company’s marketing strategy “led to change in customer behavior and usage patterns.” Following this news, MongoDB’s stock price fell by $73.94 per share to close at $236.06 per share.

DEADLINE: September 9, 2024 Shareholders should not delay in registering for this class action. Register your information here: https://securitiesclasslaw.com/securities/mongodb-inc-loss-submission-form/?id=92729&from=3

NEXT STEPS FOR SHAREHOLDERS: Once you register as a shareholder who purchased shares of MDB during the timeframe listed above, you will be enrolled in a portfolio monitoring software to provide you with status updates throughout the lifecycle of the case. The deadline to seek to be a lead plaintiff is September 9, 2024. There is no cost or obligation to you to participate in this case.

WHY GROSS LAW FIRM? The Gross Law Firm is a nationally recognized class action law firm, and our mission is to protect the rights of all investors who have suffered as a result of deceit, fraud, and illegal business practices. The Gross Law Firm is committed to ensuring that companies adhere to responsible business practices and engage in good corporate citizenship. The firm seeks recovery on behalf of investors who incurred losses when false and/or misleading statements or the omission of material information by a company lead to artificial inflation of the company’s stock. Attorney advertising. Prior results do not guarantee similar outcomes.

CONTACT:

The Gross Law Firm

15 West 38th Street, 12th floor

New York, NY, 10018

Email: dg@securitiesclasslaw.com

Phone: (646) 453-8903

Google’s JEST Algorithm Automates AI Training Dataset Curation and Reduces Training Compute

MMS • Anthony Alford

Google DeepMind recently published a new algorithm for curating AI training datasets: multimodal contrastive learning with joint example selection (JEST), which uses a pre-trained model to score the learnability of batches of data. Google’s experiments show that image-text models trained with JEST-curated data require 10x less computation than baseline methods.

JEST tries to solve the problem of curating training datasets; that is, filtering the dataset to choose the specific examples that will be most effective in training a model. However, because manually curating datasets is time-consuming, JEST automates the process by using a pre-trained reference model to select the best batches of samples based on their learnability score, which combines the loss from both the reference model and the learner model being trained. The goal is to find batches that have a high loss for the learner but a low one for the reference, which means that the data is both “unlearned and learnable.” According to Google,

[W]e find that central to the performance of our framework is the ability to steer the curation process towards the distribution of smaller, well-curated datasets…Crucially, we find this process [enables] strong data quality bootstrapping: a reference model trained on a small curated dataset can effectively guide the curation of a much larger dataset, allowing the training of a model which strongly surpasses the quality of the reference model on many downstream tasks.

JEST is applied during the training process. Given a large super-batch of training data, JEST selects chunks or sub-batches based iteratively by calculating their joint learnability conditioned on the sub-batches previously sampled. The research team found that this improves the quality of the batches, similar to the concept of hard negatives.

Because the learnability score is computed online during training, it imposes some additional compute cost. To address this, JEST uses model approximation for efficient scoring; for example, the vision component of the reference model can drop layers or image patches. The researchers also improved efficiency by training the learner at different image resolutions.

The DeepMind team ran several experiments to evaluate JEST. They first trained an image-text reference model on a curated dataset based on the Web Language Image (WebLI) dataset. They trained learner models using both JEST and compared to models trained using a baseline uniform batch selection. Models trained using JEST achieved the same benchmark performance as baseline models, while requiring 10x fewer training FLOPS.

In a discussion on Hacker News, several users praised DeepMind’s work. One wrote:

So the paper itself is pretty significant, I think, from looking at it. The general methodology seems to be: train small model as a discriminatory scoring model on very high quality data…This turns out to be significant FLOPs and quality win, even counting for the initial model training and scoring part of it…As always, appreciate the publishing from DeepMind – this looks like great work.

Another user pointed out that JEST was similar to another method called Cappy, which also uses a “pretrained small scorer.” Other related techniques include RHO-LOSS, which inspired JEST and is open-source. Google has not open-sourced JEST.

MMS • RSS

Acadian Asset Management LLC lowered its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 99.9% in the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 207 shares of the company’s stock after selling 139,071 shares during the quarter. Acadian Asset Management LLC’s holdings in MongoDB were worth $74,000 as of its most recent SEC filing.

Acadian Asset Management LLC lowered its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 99.9% in the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 207 shares of the company’s stock after selling 139,071 shares during the quarter. Acadian Asset Management LLC’s holdings in MongoDB were worth $74,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Norges Bank bought a new position in shares of MongoDB in the fourth quarter worth $326,237,000. Jennison Associates LLC boosted its stake in MongoDB by 14.3% in the 1st quarter. Jennison Associates LLC now owns 4,408,424 shares of the company’s stock worth $1,581,037,000 after purchasing an additional 551,567 shares during the period. Axiom Investors LLC DE purchased a new position in MongoDB during the 4th quarter valued at about $153,990,000. Clearbridge Investments LLC increased its position in shares of MongoDB by 10,827.8% during the fourth quarter. Clearbridge Investments LLC now owns 212,983 shares of the company’s stock valued at $87,078,000 after buying an additional 211,034 shares during the period. Finally, First Trust Advisors LP lifted its holdings in shares of MongoDB by 59.3% in the fourth quarter. First Trust Advisors LP now owns 549,052 shares of the company’s stock worth $224,480,000 after buying an additional 204,284 shares in the last quarter. 89.29% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other MongoDB news, CFO Michael Lawrence Gordon sold 5,000 shares of the company’s stock in a transaction that occurred on Tuesday, July 9th. The stock was sold at an average price of $252.23, for a total transaction of $1,261,150.00. Following the completion of the transaction, the chief financial officer now owns 81,942 shares of the company’s stock, valued at approximately $20,668,230.66. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In other MongoDB news, CFO Michael Lawrence Gordon sold 5,000 shares of the business’s stock in a transaction on Tuesday, July 9th. The shares were sold at an average price of $252.23, for a total transaction of $1,261,150.00. Following the transaction, the chief financial officer now directly owns 81,942 shares of the company’s stock, valued at approximately $20,668,230.66. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, CRO Cedric Pech sold 273 shares of the firm’s stock in a transaction dated Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total transaction of $72,424.17. Following the completion of the sale, the executive now directly owns 35,719 shares of the company’s stock, valued at $9,475,893.51. The disclosure for this sale can be found here. Insiders have sold 35,179 shares of company stock valued at $9,535,839 over the last ninety days. 3.60% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

MDB has been the topic of a number of analyst reports. Loop Capital decreased their target price on shares of MongoDB from $415.00 to $315.00 and set a “buy” rating on the stock in a report on Friday, May 31st. Robert W. Baird decreased their price target on shares of MongoDB from $450.00 to $305.00 and set an “outperform” rating on the stock in a report on Friday, May 31st. Oppenheimer dropped their price objective on MongoDB from $480.00 to $300.00 and set an “outperform” rating for the company in a research note on Friday, May 31st. Scotiabank decreased their target price on MongoDB from $385.00 to $250.00 and set a “sector perform” rating on the stock in a research note on Monday, June 3rd. Finally, Morgan Stanley lowered their price target on MongoDB from $455.00 to $320.00 and set an “overweight” rating on the stock in a report on Friday, May 31st. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating, nineteen have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of “Moderate Buy” and a consensus price target of $355.74.

Read Our Latest Stock Report on MDB

MongoDB Stock Performance

NASDAQ:MDB opened at $251.51 on Tuesday. The company has a debt-to-equity ratio of 0.90, a current ratio of 4.93 and a quick ratio of 4.93. MongoDB, Inc. has a fifty-two week low of $214.74 and a fifty-two week high of $509.62. The business has a 50 day moving average price of $258.94 and a 200-day moving average price of $344.67.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings results on Thursday, May 30th. The company reported ($0.80) EPS for the quarter, meeting analysts’ consensus estimates of ($0.80). The company had revenue of $450.56 million during the quarter, compared to analyst estimates of $438.44 million. MongoDB had a negative net margin of 11.50% and a negative return on equity of 14.88%. Equities analysts forecast that MongoDB, Inc. will post -2.67 earnings per share for the current year.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Bronstein, Gewirtz and Grossman, LLC Announces that MongoDB, Inc. Stockholders … – Accesswire

MMS • RSS

NEW YORK CITY, NY / ACCESSWIRE / July 30, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against MongoDB, Inc. (“MongoDB” or “the Company”) (NASDAQ:MDB) and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired MongoDB securities between August 23, 2023, and May 30, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/MDB.

Case Details

The complaint alleges that on March 7, 2024, MongoDB reported strong Q4 2024 results and then announced lower-than-expected full-year guidance for 2025. The Complaint adds that the Company attributed this to a change in its “sales incentive structure,” which led to a decrease in revenue related to “unused commitments and multi-year licensing deals.” Following this news, MongoDB’s stock dropped $28.59 per share to close at $383.42. Then, on May 30, 2024, MongoDB further lowered its guidance for the full year 2025, attributing it to “macro impacting consumption growth.” Analysts commenting on the reduced guidance questioned whether changes to the Company’s marketing strategy “led to change in customer behavior and usage patterns.” Following this news, MongoDB’s stock dropped $73.94 per share to close at $236.06.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/MDB or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in MongoDB you have until September 9, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | [email protected]

SOURCE: Bronstein, Gewirtz & Grossman, LLC

MMS • RSS

NEW YORK, NY / ACCESSWIRE / July 30, 2024 / Leading securities law firm Bleichmar Fonti & Auld LLP announces a lawsuit has been filed against MongoDB, Inc. (Nasdaq:MDB) and certain of the Company’s senior executives.

If you suffered losses on your MongoDB investment, you are encouraged to submit your information at https://www.bfalaw.com/cases-investigations/mongodb-inc.

Investors have until September 9, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in MongoDB securities between August 31, 2023 and May 30, 2024, inclusive. The case is pending in the U.S. District Court for the Southern District of New York and is captioned John Baxter v. MongoDB, Inc., et al., No. 1:24-cv-05191.

What is the Lawsuit About?

The complaint alleges that the Company misrepresented the purported benefits stemming from the restructuring of its sales force. This includes how the restructuring helped reduce friction in acquiring new customers and increased new workload acquisition among existing customers.

These statements were allegedly materially false and misleading. In truth, MongoDB’s sales force restructuring resulted in a near total loss of upfront customer commitments, a significant reduction in actionable information gathered by the sales force, and hindered enrollment and revenue growth.

On March 7, 2024, the Company allegedly announced that due to the sales restructuring, it experienced an annual decrease of approximately $40 million in multiyear license revenue, anticipated near zero revenue from unused Atlas commitments (one of its core offerings) in fiscal year 2025, and provided a disappointing revenue growth forecast that trailed that of the prior year. This news caused the price of MongoDB stock to decline $28.59 per share, or about 7%, from $412.01 per share on March 7, 2024, to $383.42 per share on March 8, 2024.

Then, on May 30, 2024, the Company again announced significantly reduced growth expectations, this time cutting fiscal year 2025 growth projections further, again attributing the losses to the sales force restructuring. On this news, the price of MongoDB stock declined $73.94 per share, or nearly 24%, from $310.00 per share on May 30, 2024, to $236.06 per share on May 31, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/mongodb-inc.

What Can You Do?

If you invested in MongoDB, Inc. you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information:

https://www.bfalaw.com/cases-investigations/mongodb-inc

Or contact us at:

Ross Shikowitz

[email protected]

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/mongodb-inc

Attorney advertising. Past results do not guarantee future outcomes.

SOURCE: Bleichmar Fonti & Auld LLP

MMS • RSS

NEW YORK, NY / ACCESSWIRE / July 30, 2024 / Leading securities law firm Bleichmar Fonti & Auld LLP announces a lawsuit has been filed against MongoDB, Inc. (Nasdaq:MDB) and certain of the Company’s senior executives.

If you suffered losses on your MongoDB investment, you are encouraged to submit your information at https://www.bfalaw.com/cases-investigations/mongodb-inc.

Investors have until September 9, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in MongoDB securities between August 31, 2023 and May 30, 2024, inclusive. The case is pending in the U.S. District Court for the Southern District of New York and is captioned John Baxter v. MongoDB, Inc., et al., No. 1:24-cv-05191.

What is the Lawsuit About?

The complaint alleges that the Company misrepresented the purported benefits stemming from the restructuring of its sales force. This includes how the restructuring helped reduce friction in acquiring new customers and increased new workload acquisition among existing customers.

These statements were allegedly materially false and misleading. In truth, MongoDB’s sales force restructuring resulted in a near total loss of upfront customer commitments, a significant reduction in actionable information gathered by the sales force, and hindered enrollment and revenue growth.

On March 7, 2024, the Company allegedly announced that due to the sales restructuring, it experienced an annual decrease of approximately $40 million in multiyear license revenue, anticipated near zero revenue from unused Atlas commitments (one of its core offerings) in fiscal year 2025, and provided a disappointing revenue growth forecast that trailed that of the prior year. This news caused the price of MongoDB stock to decline $28.59 per share, or about 7%, from $412.01 per share on March 7, 2024, to $383.42 per share on March 8, 2024.

Then, on May 30, 2024, the Company again announced significantly reduced growth expectations, this time cutting fiscal year 2025 growth projections further, again attributing the losses to the sales force restructuring. On this news, the price of MongoDB stock declined $73.94 per share, or nearly 24%, from $310.00 per share on May 30, 2024, to $236.06 per share on May 31, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/mongodb-inc.

What Can You Do?

If you invested in MongoDB, Inc. you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information:

https://www.bfalaw.com/cases-investigations/mongodb-inc

Or contact us at:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/mongodb-inc

Attorney advertising. Past results do not guarantee future outcomes.

SOURCE: Bleichmar Fonti & Auld LLP

View the original press release on accesswire.com

MMS • RSS

Acadian Asset Management LLC cut its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 99.9% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 207 shares of the company’s stock after selling 139,071 shares during the quarter. Acadian Asset Management LLC’s holdings in MongoDB were worth $74,000 as of its most recent SEC filing.

A number of other hedge funds have also modified their holdings of MDB. Vanguard Group Inc. boosted its position in MongoDB by 2.9% during the fourth quarter. Vanguard Group Inc. now owns 6,842,413 shares of the company’s stock valued at $2,797,521,000 after purchasing an additional 194,148 shares during the last quarter. Atalanta Sosnoff Capital LLC boosted its position in MongoDB by 24.7% during the fourth quarter. Atalanta Sosnoff Capital LLC now owns 54,311 shares of the company’s stock valued at $22,205,000 after purchasing an additional 10,753 shares during the last quarter. Realta Investment Advisors acquired a new position in MongoDB during the fourth quarter valued at approximately $212,000. Fiera Capital Corp boosted its position in MongoDB by 0.8% during the fourth quarter. Fiera Capital Corp now owns 224,293 shares of the company’s stock valued at $91,702,000 after purchasing an additional 1,695 shares during the last quarter. Finally, Artisan Partners Limited Partnership acquired a new position in MongoDB during the fourth quarter valued at approximately $10,545,000. 89.29% of the stock is currently owned by institutional investors.

MongoDB Price Performance

MongoDB stock opened at $251.51 on Tuesday. The stock’s fifty day moving average price is $258.94 and its two-hundred day moving average price is $344.67. MongoDB, Inc. has a one year low of $214.74 and a one year high of $509.62. The company has a debt-to-equity ratio of 0.90, a current ratio of 4.93 and a quick ratio of 4.93. The firm has a market cap of $18.45 billion, a PE ratio of -89.51 and a beta of 1.13.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings data on Thursday, May 30th. The company reported ($0.80) EPS for the quarter, hitting analysts’ consensus estimates of ($0.80). MongoDB had a negative return on equity of 14.88% and a negative net margin of 11.50%. The firm had revenue of $450.56 million for the quarter, compared to analyst estimates of $438.44 million. As a group, research analysts expect that MongoDB, Inc. will post -2.67 EPS for the current fiscal year.

Insider Activity

In other news, Director Dwight A. Merriman sold 1,000 shares of MongoDB stock in a transaction on Wednesday, May 1st. The stock was sold at an average price of $379.15, for a total value of $379,150.00. Following the transaction, the director now owns 522,896 shares in the company, valued at approximately $198,256,018.40. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In related news, CRO Cedric Pech sold 273 shares of the firm’s stock in a transaction on Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total transaction of $72,424.17. Following the sale, the executive now owns 35,719 shares of the company’s stock, valued at approximately $9,475,893.51. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Dwight A. Merriman sold 1,000 shares of the firm’s stock in a transaction on Wednesday, May 1st. The shares were sold at an average price of $379.15, for a total value of $379,150.00. Following the sale, the director now directly owns 522,896 shares in the company, valued at approximately $198,256,018.40. The disclosure for this sale can be found here. In the last quarter, insiders have sold 35,179 shares of company stock worth $9,535,839. Insiders own 3.60% of the company’s stock.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on the company. Loop Capital reduced their price target on MongoDB from $415.00 to $315.00 and set a “buy” rating for the company in a research report on Friday, May 31st. Citigroup cut their price objective on MongoDB from $480.00 to $350.00 and set a “buy” rating for the company in a research report on Monday, June 3rd. Stifel Nicolaus cut their price objective on MongoDB from $435.00 to $300.00 and set a “buy” rating for the company in a research report on Friday, May 31st. Piper Sandler cut their price objective on MongoDB from $350.00 to $300.00 and set an “overweight” rating for the company in a research report on Friday, July 12th. Finally, Canaccord Genuity Group cut their price objective on MongoDB from $435.00 to $325.00 and set a “buy” rating for the company in a research report on Friday, May 31st. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating, nineteen have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, MongoDB has a consensus rating of “Moderate Buy” and an average price target of $355.74.

Check Out Our Latest Stock Analysis on MongoDB

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

AWS Announces a Generative Artificial Intelligence-Powered Service AWS App Studio in Preview

MMS • Steef-Jan Wiggers

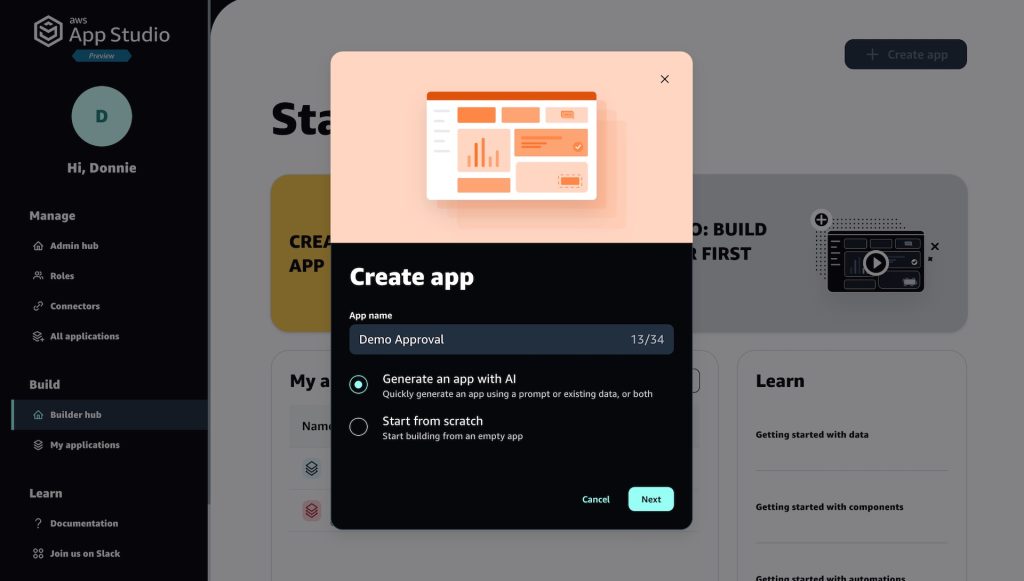

AWS App Studio, a new generative artificial intelligence (AI)-powered service designed to enable technical professionals without software development skills to create enterprise-grade applications using natural language, has been launched in preview by AWS in the US West (Oregon) AWS Region.

With App Studio, the company aims to revolutionize application development by empowering IT project managers, data engineers, and enterprise architects to build business applications quickly without needing operational expertise.

The service leverages generative AI to accelerate the application creation process. Users can describe the application they want. App Studio will generate an outline, build a multi-page UI, a data model, and business logic, and connect the application to various data sources using built-in connectors for AWS and Salesforce and API connectors for third-party services.

Create App with AWS App Studio (Source: AWS News Blog)

The company states that one critical feature of App Studio is that users do not need to concern themselves with the underlying code, as the service handles deployment, operations, and maintenance. Donnie Prakoso, a principal developer advocate at AWS, wrote:

I discovered that App Studio is useful for various technical professionals. IT project managers, data engineers, and enterprise architects can use it to create and manage secure business applications in minutes instead of day.

While a respondent on a Hacker News thread states:

This seems incredible for proof-of-concept prototyping to quickly validate ideas. If one of these is a good idea, using it as a reference while building the production-grade implementation shouldn’t be too expensive in terms of user hours.

For example, one of AWS’s competitors, Microsoft, has a low code offering with Power Automate with GenAI features. It has introduced AI Builder GPT Prompts, which allow users to add Generative AI capabilities to their apps and workflows. Users can leverage GPT Prompts for content processing, e-mail classification, summarization, data transformation, and more. Also, Power Automate has a connector that allows users to connect to various data sources using connectors for Azure and various other third-party services – yet it’s not intended for building apps.

In addition, Power Automate has introduced AI flows, a new way to automate processes using generative AI to analyze unstructured content and determine steps based on the user’s natural language instructions and parameters.

Corey Quinn wrote in a blog post called Amazon GenAI Services:

But as soon as you start moving up the stack into GenAI applications and GenAI assistants, Amazon’s leadership position evaporates as they begin trailing significantly behind their competition. It’s very hard to contend with a straight face that Amazon Q Developer can outcompete GitHub Copilot. While the just-launched low-code internal app builder App Studio seems promising, it remains to see if it can even outcompete the now-deprecated Amazon Honeycode, let alone something like my own beloved Retool for quickly throwing together inward-facing applications.

More details of AWS App Studio are available on the documentation pages.

Levi & Korsinsky Reminds Shareholders of a Lead Plaintiff Deadline of September 9, 2024 …

MMS • RSS

NEW YORK, July 30, 2024 /PRNewswire/ — Levi & Korsinsky, LLP notifies investors in MongoDB, Inc. (“MongoDB” or the “Company”) (NASDAQ: MDB) of a class action securities lawsuit.

CLASS DEFINITION: The lawsuit seeks to recover losses on behalf of MongoDB investors who were adversely affected by alleged securities fraud between August 31, 2023 and May 30, 2024. Follow the link below to get more information and be contacted by a member of our team:

https://zlk.com/pslra-1/mongodb-inc-lawsuit-submission-form?prid=92707&wire=4

MDB investors may also contact Joseph E. Levi, Esq. via email at jlevi@levikorsinsky.com or by telephone at (212) 363-7500.

CASE DETAILS: According to the complaint, on March 7, 2024, MongoDB reported strong Q4 2024 results and then announced lower than expected full-year guidance for 2025. MongoDB attributed it to the Company’s change in its “sales incentive structure” which led to a decrease in revenue related to “unused commitments and multi-year licensing deals.” Following this news, MongoDB’s stock price fell by $28.59 per share to close at $383.42 per share. Later, on May 30, 2024, MongoDB further lowered its guidance for the full year 2025 attributing it to “macro impacting consumption growth.” Analysts commenting on the reduced guidance questioned if changes made to the Company’s marketing strategy “led to change in customer behavior and usage patterns.” Following this news, MongoDB’s stock price fell by $73.94 per share to close at $236.06 per share.

WHAT’S NEXT? If you suffered a loss in MongoDB during the relevant time frame, you have until September 9, 2024 to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as a lead plaintiff.

NO COST TO YOU: If you are a class member, you may be entitled to compensation without payment of any out-of-pocket costs or fees. There is no cost or obligation to participate.

WHY LEVI & KORSINSKY: Over the past 20 years, the team at Levi & Korsinsky has secured hundreds of millions of dollars for aggrieved shareholders and built a track record of winning high-stakes cases. Our firm has extensive expertise representing investors in complex securities litigation and a team of over 70 employees to serve our clients. For seven years in a row, Levi & Korsinsky has ranked in ISS Securities Class Action Services’ Top 50 Report as one of the top securities litigation firms in the United States.

CONTACT:

Levi & Korsinsky, LLP

Joseph E. Levi, Esq.

Ed Korsinsky, Esq.

33 Whitehall Street, 17th Floor

New York, NY 10004

jlevi@levikorsinsky.com

Tel: (212) 363-7500

Fax: (212) 363-7171

www.zlk.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/levi–korsinsky-reminds-shareholders-of-a-lead-plaintiff-deadline-of-september-9-2024-in-mongodb-lawsuit–mdb-302209130.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/levi–korsinsky-reminds-shareholders-of-a-lead-plaintiff-deadline-of-september-9-2024-in-mongodb-lawsuit–mdb-302209130.html

SOURCE Levi & Korsinsky, LLP

MMS • Matt Saunders

Google has announced a free trial program for AlloyDB, its fully managed PostgreSQL-compatible database service. The trial allows users to test AlloyDB’s capabilities with their own workloads for up to 30 days.

AlloyDB is designed to provide high performance, particularly in HTAP scenarios, with scalability, and reliability while maintaining full compatibility with open-source PostgreSQL. Google claims AlloyDB offers up to 4x faster transactional performance than standard PostgreSQL, potentially allowing users to run workloads on smaller instances and reduce costs.

Key features of AlloyDB include:

- 99.99% availability SLA

- Minimal downtime for planned operations

- Columnar engine for analytics

- AI-assisted capabilities for management and security

- Vector search capabilities

- Integration with Google’s Vertex AI and Gemini

The free trial provides users with a cluster containing an 8 vCPU, 64 GB RAM primary instance and 1 TB of regional storage. This offering is said to be more generous in terms of storage than some competitors’ trial programs. Users can access their trial clusters through various methods, including AlloyDB Studio in the console, PostgreSQL clients via public IP or Auth Proxy, or private IP for applications running in the user’s VPC.

Google positions AlloyDB as suitable for a range of users, including application developers, database administrators, businesses migrating from on-premises databases, startups, and data scientists working on AI applications.

While Google promotes AlloyDB as “the future of PostgreSQL,” it’s worth noting that other cloud providers offer similar managed PostgreSQL services. Amazon Web Services provides Amazon Aurora PostgreSQL-Compatible and Amazon RDS for PostgreSQL, while Microsoft Azure offers Azure Database for PostgreSQL. User muhaym on Reddit is complimentary towards AlloyDB:

It’s insanely good for analaytical workload, specially the ones with multiple joins – but it works like magic, I don’t know how, but it gets better automatically over time. On top of it, now I’m stuck, I need to move to AWS for different reason, and there’s no compatible alternative, I don’t think Aurora is as good as alloydb is today

Furthermore, a presentation from 2022 from Taras Kloba suggests AlloyDB outperforms AWS Aurora and Azure Cosmos DB at similar price points.

User recurrence however is slightly less positive:

They pitched it as a massive performance boost but I did not see that in most of my tests. The 2X better perf on average did not materialize however for large tables the vector columns did have a massive improvement. However, it didn’t create vector columns for many of the places that I would have liked unfortunately.

Interested users can start their AlloyDB trial by visiting the Google Cloud console or signing up through the AlloyDB free trial link. Google has also released an e-book with more information about AlloyDB for those seeking additional details.

As with any database migration or new technology adoption, users are advised to thoroughly test their specific workloads and compare performance and costs with their current solutions and other available options in the market.