Author: RSS

MONGODB ALERT: Bragar Eagel & Squire, P.C. is Investigating MongoDB, Inc. on Behalf of

MMS • RSS

Bragar Eagel & Squire, P.C. Litigation Partner Brandon Walker Encourages Investors Who Suffered Losses In MongoDB (MDB) To Contact Him Directly To Discuss Their Options

If you are a long-term stockholder in MongoDB between August 31, 2023 and May 30, 2024 and would like to discuss your legal rights, call Bragar Eagel & Squire partner Brandon Walker or Marion Passmore directly at (212) 355-4648. MongoDB between August 31, 2023 and May 30, 2024 and would like to discuss your legal rights, call Bragar Eagel & Squire partner Brandon Walker or Marion Passmore directly at (212) 355-4648.

MMS • RSS

Numberly has been using both ScyllaDB and MongoDB in production for 5+ years. Learn which NoSQL database they rely on for different use cases and why.

Within the NoSQL domain, ScyllaDB and MongoDB are two totally different animals. MongoDB needs no introduction. Its simple adoption and extensive community/ecosystem have made it the de facto standard for getting started with NoSQL and powering countless web applications. ScyllaDB’s close-to-the-metal architecture enables predictable low latency at high throughput. This is driving a surge of adoption across teams such as Discord, TRACTIAN and many others who are scaling data-intensive applications and hitting the wall with their existing databases.

But database migrations are not the focus here. Instead, let’s look at how these two distinctly different databases might coexist within the same tech stack – how they’re fundamentally different, and the best use cases for each. Just like different shoes work better for running a marathon vs. scaling Mount Everest vs. attending your wedding, different databases work better for different use cases with different workloads and latency/throughput expectations.

So when should you use ScyllaDB vs. MongoDB and why? Rather than provide the vendor perspective, we’re going to share the insights from an open source enthusiast who has extensive experience using both ScyllaDB and MongoDB in production: Alexys Jacob, the CTO of Numberly. Alexys shared his perspective at ScyllaDB Summit 2019, and the video has been trending ever since.

Here are three key takeaways from his detailed tech talk:

Scaling Writes is More Complex on MongoDB

The base unit of a MongoDB topology is called a replica set, which is composed of one primary node and usually multiple secondary nodes (think of hot replicas). Only the primary node is allowed to write data. After you max out vertical write scaling on MongoDB, your only option to scale writes becomes what is called a sharded cluster. This requires adding new replica sets because you can’t have multiple primaries in a single replica set.

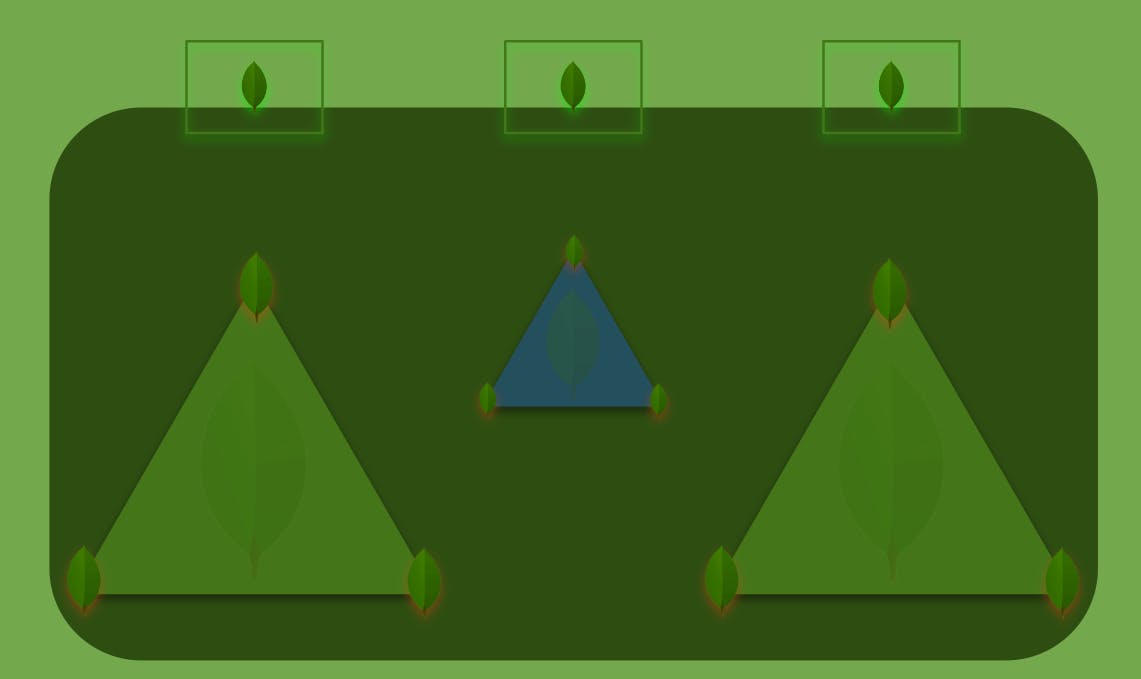

Sharding data across MongoDB’s replica sets requires using a special key to specify what data each replica set is responsible for, as well as creating a metadata replica set that tracks what slice of data lives on each replica (the blue triangle in the diagram below). Also, clients connecting to a MongoDB cluster need help determining what node to address. That’s why you also need to deploy and maintain MongoDB’s Smart Router instances (represented by the rectangles at the top of the diagram) connected to the replica sets.

The complexity of scaling writes in MongoDB

Having all these nodes leads to higher operational and maintenance costs as well as wasted resources since you can’t tap the replica nodes’ IO for writes, which make sharded MongoDB clusters the worst enemy of your total cost of ownership as Alexys noted.

For ScyllaDB, scaling writes is much simpler. He explained, “On the ScyllaDB side, if you want to add more throughput, you just add nodes. End of story.”

Alexys tied up this scaling thread:

“Avoid creating MongoDB clusters, please! I could write a book with war stories on this very topic. The main reason why is the fact that MongoDB does not bind the workload to CPUs. And the sharding, the distribution of data between replica sets in a cluster is done by a background job (the balancer). This balancer is always running, always looking at how sharding should be done, and always ensuring that data is spread and balanced over the cluster. It’s not natural because it isn’t based on consistent hashing. It’s something that must be calculated over and over again. It splits the data into chunks and then moves it around. This has a direct impact on the performance of your MongoDB cluster because there is no isolation of this workload versus your actual production workload.”

MongoDB Favors Flexibility Over Performance, While ScyllaDB Favors Consistent Performance Over Versatility

ScyllaDB and MongoDB have distinctly different priorities when it comes to flexibility and performance.

On the data modeling front, MongoDB natively supports geospatial queries, text search, aggregation pipelines, graph queries and change streams. Although ScyllaDB – a wide- column store (a.k.a. key-key-value) – supports user-defined types, counters and lightweight transactions, the data modeling options are more restricted than on MongoDB. Alexys noted, “From a development perspective, interacting with an JSON object just feels more natural than interacting with a row.” Moreover, while MongoDB offers the option of enforcing schema validation before data insertion, ScyllaDB requires that data adhere to the defined schema.

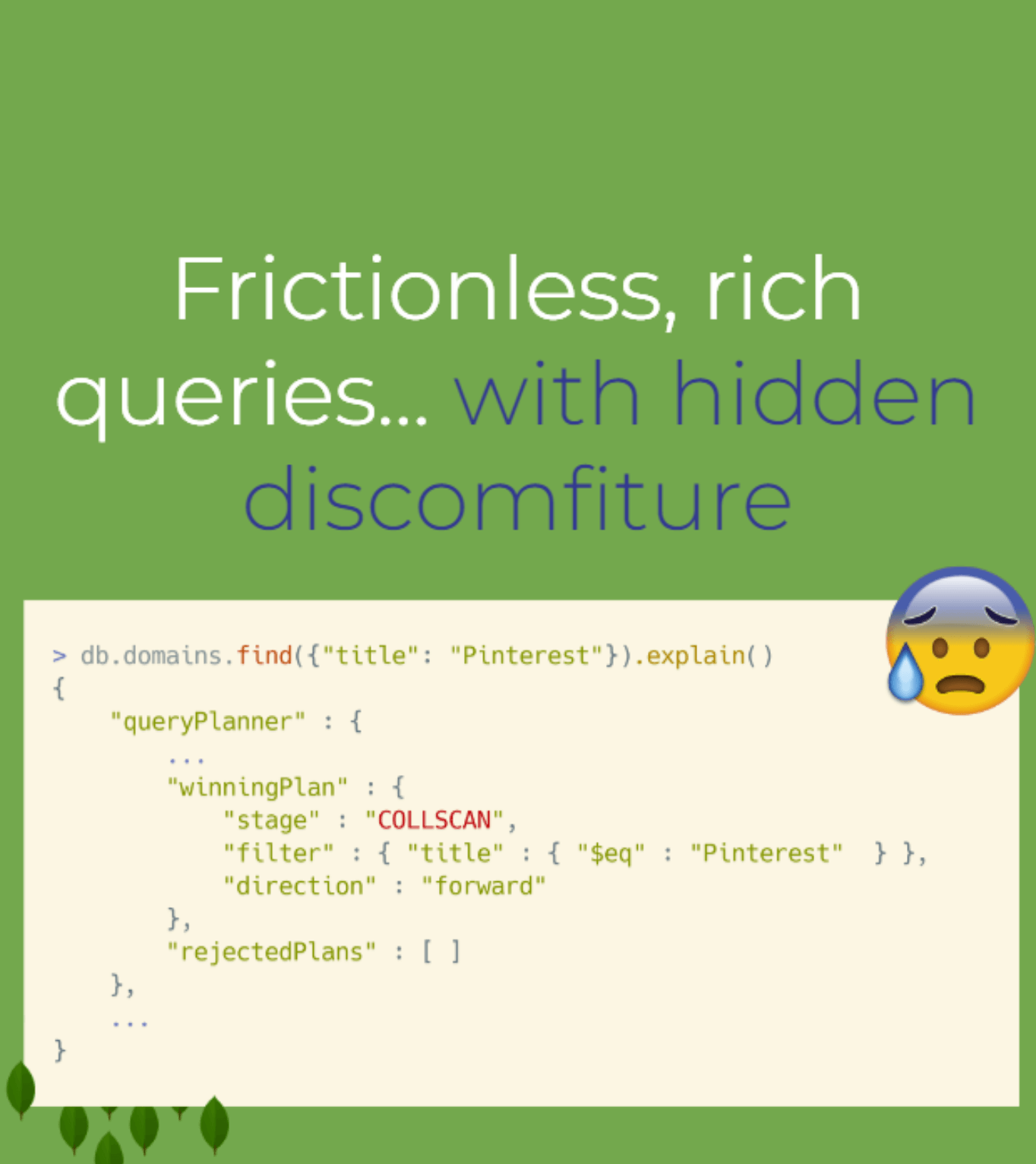

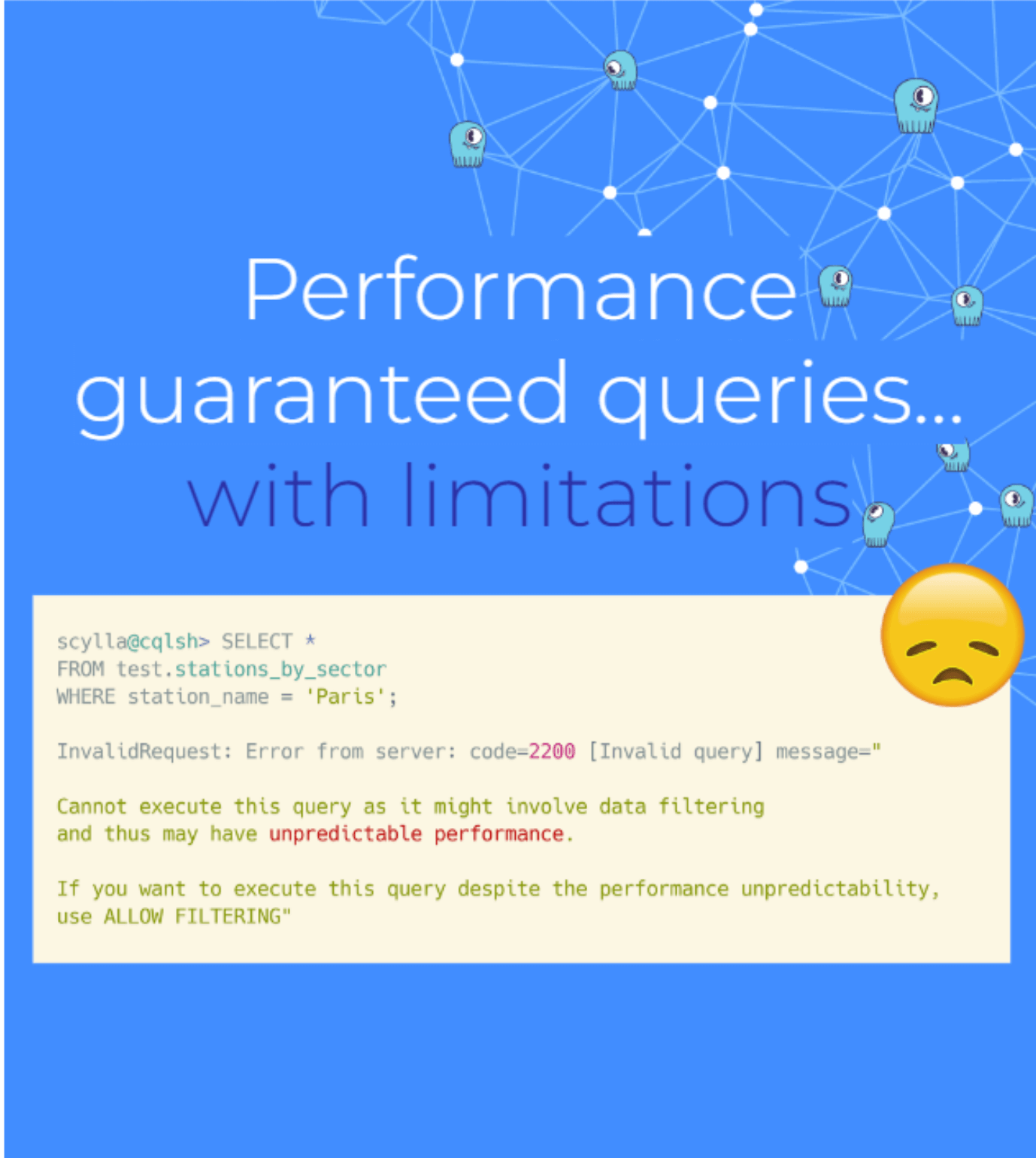

Querying is also simpler with MongoDB since you’re just filtering and interacting with JSON. It’s also more flexible, for better or for worse. MongoDB lets you issue any type of query, including queries that cause suboptimal performance with your production workload. ScyllaDB won’t allow that. If you try, ScyllaDB will warn you. If you decide to proceed at your own risk, you can enter a qualifier indicating that you really do understand what you’re getting yourself into.

Alexys summed up the key differences from a development perspective:

“MongoDB favors flexibility over performance. It’s easy to interact with and it will not get in your way. But it will have impacts on performance – impacts that are fine for some workloads, but unacceptable for others. On the other hand, ScyllaDB favors consistent performance over versatility. It looks a bit more fixed and a bit more rigid on the outside. But once again, that’s for your own good so you can have consistent performance, operate well and interact well with the system. In my opinion, this makes a real difference when you have workloads that are latency- and performance-sensitive.”

It’s important to note that even queries that follow performance best practices will behave differently on MongoDB than on ScyllaDB. No matter how careful you are, you won’t overcome the performance penalty that stems from fundamental architectural differences.

Together, ScyllaDB and MongoDB are a Great NoSQL Combo

“It’s not a death match; we are happy users of both MongoDB and ScyllaDB,” Alexys continued.

Numberly selects the best database for each use case’s technical requirements.

At Numberly, MongoDB is used for two types of use cases:

- Web backends with REST APIs and possibly flexible schemas.

- Real-time queries over unpredictable behavioral data.

For example, some of Numberly’s applications get flooded with web tracking data that their clients collect and send (each client with their own internally-developed applications). Numberly doesn’t have a way to impose a strict schema on that data, but it needs to be able to query and process it. In Alexys’ words, “MongoDB is fine here; its flexibility is advantageous because it allows us to just store the data somewhere and query it easily.”

ScyllaDB is used for three types of use cases at Numberly:

- Real-time latency-sensitive data pipelines. This involves a lot of data enrichment, where there are multiple sources of data that need to be correlated, in real time, on the data pipelines. According to Alexys, “That’s tricky to do…and you need strong latency guarantees to not break the SLAs [service-level agreements] of the applications and data processes which your clients rely on down the pipe.”

- Mixed batch and real-time workloads. Numberly also mixes a lot of batch and real-time workloads in ScyllaDB because it provides the best of both worlds (as Numberly shared previously). “We had Hive on one path and MongoDB on the other. We put everything on ScyllaDB and its sustaining Hadoop-like batch workloads and real time pipeline workloads.”

- Web backends using GraphQL, which imposes a strict schema. Some of Numberly’s web backends are implemented in GraphQL. When working with schema-based APIs, it makes perfect sense to have a schema-based database with low latency and high availability.

Alexys concluded: “A lot of our backend engineers, and frontend engineers as well, are adopting ScyllaDB. We see a trend of people adopting ScyllaDB, more and more tech people asking ‘I have this use case, would ScyllaDB be a good fit?’ Most of the time, the answer is ‘yes.’ So, ScyllaDB adoption is growing. MongoDB adoption is flat, but MongoDB is certainly here to stay because it has some really interesting features. Just don’t go as far as to create a MongoDB sharded cluster, please!”

Bonus: More Insights from Alexys Jacob

Alexys is an extremely generous contributor to open source communities, with respect to both code and conference talks. See more of his contributions at https://ultrabug.fr/

About Cynthia Dunlop

Cynthia is Senior Director of Content Strategy at ScyllaDB. She has been writing about software development and quality engineering for 20+ years.

MMS • RSS

IBM found that the global average cost of a data breach has fallen by 9% compared to 2024, driven by improved detection and containment

Read the original article:

MMS • RSS

SAP SE (SAP) stock rose in its recent intraday trading, following a rebound from the key support level at $285.50. This level represents the neckline of a potential bearish technical formation—a double top pattern developing in the short term. The stock’s rise attempts to recover part of prior losses and relieve its clearly oversold Stochastic conditions, especially as a bullish crossover begins to appear. However, the stock had previously broken a short-term ascending trendline and continues to face negative pressure from trading below the 50-day simple moving average, which increases the likelihood of further losses in the near term.

Therefore, we expect the stock to decline in upcoming sessions, especially if it breaks below the $285.50 support level, which would confirm the validity of the emerging pattern, targeting the initial support level at $269.90.

Today’s price forecast: Bearish.

MMS • RSS

Investment analysts at BMO Capital Markets began coverage on shares of MongoDB (NASDAQ:MDB – Get Free Report) in a research report issued to clients and investors on Monday, Marketbeat Ratings reports. The firm set an “outperform” rating and a $280.00 price target on the stock. BMO Capital Markets’ target price would suggest a potential upside of 16.24% from the stock’s current price.

Investment analysts at BMO Capital Markets began coverage on shares of MongoDB (NASDAQ:MDB – Get Free Report) in a research report issued to clients and investors on Monday, Marketbeat Ratings reports. The firm set an “outperform” rating and a $280.00 price target on the stock. BMO Capital Markets’ target price would suggest a potential upside of 16.24% from the stock’s current price.

MDB has been the topic of several other research reports. Monness Crespi & Hardt upgraded MongoDB from a “neutral” rating to a “buy” rating and set a $295.00 target price on the stock in a research note on Thursday, June 5th. Citigroup cut their price objective on shares of MongoDB from $430.00 to $330.00 and set a “buy” rating for the company in a research report on Tuesday, April 1st. Piper Sandler lifted their price objective on shares of MongoDB from $200.00 to $275.00 and gave the stock an “overweight” rating in a research note on Thursday, June 5th. Barclays upped their price objective on shares of MongoDB from $252.00 to $270.00 and gave the stock an “overweight” rating in a research report on Thursday, June 5th. Finally, Stephens began coverage on MongoDB in a report on Friday, July 18th. They set an “equal weight” rating and a $247.00 price target for the company. Nine investment analysts have rated the stock with a hold rating, twenty-seven have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company has a consensus rating of “Moderate Buy” and an average price target of $281.31.

Check Out Our Latest Stock Analysis on MongoDB

MongoDB Price Performance

MongoDB stock opened at $240.88 on Monday. MongoDB has a fifty-two week low of $140.78 and a fifty-two week high of $370.00. The firm has a market cap of $19.68 billion, a price-to-earnings ratio of -211.30 and a beta of 1.41. The firm has a fifty day moving average price of $208.62 and a two-hundred day moving average price of $212.38.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings results on Wednesday, June 4th. The company reported $1.00 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.65 by $0.35. MongoDB had a negative net margin of 4.09% and a negative return on equity of 3.16%. The business had revenue of $549.01 million for the quarter, compared to the consensus estimate of $527.49 million. During the same quarter in the prior year, the company earned $0.51 EPS. The firm’s quarterly revenue was up 21.8% on a year-over-year basis. As a group, sell-side analysts expect that MongoDB will post -1.78 earnings per share for the current year.

Insiders Place Their Bets

In other news, CEO Dev Ittycheria sold 25,005 shares of the firm’s stock in a transaction dated Thursday, June 5th. The stock was sold at an average price of $234.00, for a total transaction of $5,851,170.00. Following the completion of the sale, the chief executive officer directly owned 256,974 shares of the company’s stock, valued at $60,131,916. This trade represents a 8.87% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Dwight A. Merriman sold 2,000 shares of the stock in a transaction dated Thursday, June 5th. The shares were sold at an average price of $234.00, for a total value of $468,000.00. Following the transaction, the director directly owned 1,107,006 shares in the company, valued at approximately $259,039,404. This represents a 0.18% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 51,416 shares of company stock worth $11,936,656. 3.10% of the stock is owned by company insiders.

Hedge Funds Weigh In On MongoDB

Several large investors have recently made changes to their positions in MDB. Cloud Capital Management LLC acquired a new position in MongoDB in the first quarter valued at about $25,000. Hollencrest Capital Management acquired a new position in MongoDB in the 1st quarter worth $26,000. Cullen Frost Bankers Inc. boosted its holdings in MongoDB by 315.8% during the first quarter. Cullen Frost Bankers Inc. now owns 158 shares of the company’s stock worth $28,000 after purchasing an additional 120 shares during the last quarter. Strategic Investment Solutions Inc. IL acquired a new stake in shares of MongoDB in the 4th quarter valued at approximately $29,000. Finally, Coppell Advisory Solutions LLC boosted its stake in shares of MongoDB by 364.0% during the 4th quarter. Coppell Advisory Solutions LLC now owns 232 shares of the company’s stock worth $54,000 after acquiring an additional 182 shares during the period. Institutional investors and hedge funds own 89.29% of the company’s stock.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB – Get Free Report) CEO Dev Ittycheria sold 8,335 shares of the stock in a transaction dated Thursday, July 24th. The stock was sold at an average price of $231.99, for a total value of $1,933,636.65. Following the completion of the sale, the chief executive officer owned 244,892 shares of the company’s stock, valued at $56,812,495.08. This trade represents a 3.29% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website.

Dev Ittycheria also recently made the following trade(s):

- On Monday, July 28th, Dev Ittycheria sold 8,335 shares of MongoDB stock. The stock was sold at an average price of $243.89, for a total value of $2,032,823.15.

- On Wednesday, July 2nd, Dev Ittycheria sold 3,747 shares of MongoDB stock. The stock was sold at an average price of $206.05, for a total value of $772,069.35.

- On Thursday, June 5th, Dev Ittycheria sold 25,005 shares of MongoDB stock. The stock was sold at an average price of $234.00, for a total value of $5,851,170.00.

MongoDB Price Performance

MongoDB stock traded down $3.53 during mid-day trading on Tuesday, reaching $240.88. 1,773,883 shares of the company were exchanged, compared to its average volume of 2,297,158. The company has a fifty day simple moving average of $207.58 and a 200-day simple moving average of $212.18. MongoDB, Inc. has a 12 month low of $140.78 and a 12 month high of $370.00. The firm has a market cap of $19.68 billion, a PE ratio of -211.30 and a beta of 1.41.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings results on Wednesday, June 4th. The company reported $1.00 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.65 by $0.35. MongoDB had a negative return on equity of 3.16% and a negative net margin of 4.09%. The company had revenue of $549.01 million for the quarter, compared to analyst estimates of $527.49 million. During the same quarter last year, the company posted $0.51 EPS. The company’s revenue for the quarter was up 21.8% compared to the same quarter last year. Sell-side analysts anticipate that MongoDB, Inc. will post -1.78 earnings per share for the current year.

Hedge Funds Weigh In On MongoDB

Several hedge funds and other institutional investors have recently modified their holdings of MDB. Vanguard Group Inc. boosted its holdings in shares of MongoDB by 6.6% during the 1st quarter. Vanguard Group Inc. now owns 7,809,768 shares of the company’s stock valued at $1,369,833,000 after acquiring an additional 481,023 shares in the last quarter. Franklin Resources Inc. boosted its holdings in shares of MongoDB by 9.7% during the 4th quarter. Franklin Resources Inc. now owns 2,054,888 shares of the company’s stock valued at $478,398,000 after acquiring an additional 181,962 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC boosted its holdings in shares of MongoDB by 11.3% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,271,444 shares of the company’s stock valued at $223,011,000 after acquiring an additional 129,451 shares in the last quarter. Geode Capital Management LLC boosted its holdings in shares of MongoDB by 1.8% during the 4th quarter. Geode Capital Management LLC now owns 1,252,142 shares of the company’s stock valued at $290,987,000 after acquiring an additional 22,106 shares in the last quarter. Finally, Amundi boosted its holdings in shares of MongoDB by 53.0% during the 1st quarter. Amundi now owns 1,061,457 shares of the company’s stock valued at $173,378,000 after acquiring an additional 367,717 shares in the last quarter. Institutional investors own 89.29% of the company’s stock.

Analysts Set New Price Targets

Several brokerages recently commented on MDB. DA Davidson reissued a “buy” rating and set a $275.00 price target on shares of MongoDB in a research report on Thursday, June 5th. Redburn Atlantic raised MongoDB from a “sell” rating to a “neutral” rating and set a $170.00 price target for the company in a research report on Thursday, April 17th. Barclays raised their price objective on MongoDB from $252.00 to $270.00 and gave the company an “overweight” rating in a research report on Thursday, June 5th. Stifel Nicolaus cut their price objective on MongoDB from $340.00 to $275.00 and set a “buy” rating for the company in a research report on Friday, April 11th. Finally, Stephens assumed coverage on MongoDB in a research report on Friday, July 18th. They issued an “equal weight” rating and a $247.00 price objective for the company. Nine analysts have rated the stock with a hold rating, twenty-seven have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of “Moderate Buy” and a consensus price target of $281.31.

Check Out Our Latest Stock Analysis on MongoDB

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

Enter your email address and we’ll send you MarketBeat’s guide to investing in 5G and which 5G stocks show the most promise.

MMS • RSS

MongoDB (NASDAQ:MDB) just grabbed an Outperform from BMO Capital Markets with a $280 price target as it rides the wave of generative AI workloads.

BMO’s lead analyst Keith Bachman says MongoDB is poised to be a GenAI database winner as customers shift AI projects into production.

The database market tops $100 billion in annual spend per Gartner, and Bachman forecasts MDB can sustain low? to mid?20% revenue growth through fiscal 2026 and mid? to high?teens growth in fiscal 2027.

That outlook taps into surging demand for vector search and real?time analytics, areas where MongoDB is beefing up capabilities and exploring M&A.

Shares are up with a year?to?date gain of 4.5% versus 12.5% for the IGV software ETF. Analysts note MongoDB has beaten consensus revenue and EPS estimates every quarter since Q2 2021, setting a track record ahead of its Q2 fiscal 2026 report on August 28.

This article first appeared on GuruFocus.

MMS • RSS

MongoDB had its Relative Strength (RS) Rating upgraded from 68 to 71 Tuesday — a welcome improvement, but still shy of the 80 or better score you prefer to see.

When To Sell Stocks To Lock In Profits And Minimize Losses

IBD’s unique RS Rating tracks technical performance by showing how a stock’s price action over the last 52 weeks measures up against that of the other stocks in our database.

Decades of market research shows that the stocks that go on to make the biggest gains tend to have an RS Rating north of 80 in the early stages of their moves. See if MongoDB can continue to show renewed price strength and clear that threshold.

While MongoDB is not near a proper buying range right now, see if it manages to form and break out from a proper base.

MongoDB saw both earnings and sales growth rise last quarter. Earnings-per-share increased from 49% to 96%. Revenue rose from 20% to 22%. Keep an eye out for the company’s next round of numbers on or around Aug. 28.

The company earns the No. 2 rank among its peers in the Computer Software-Database industry group. Oracle is the No. 1-ranked stock within the group.

This article was created automatically with Stats Perform’s Wordsmith software using data and article templates supplied by Investor’s Business Daily. An IBD journalist may have edited the article.

RELATED:

Which Stocks Are Showing Rising Relative Strength?

Why Should You Use IBD’s Relative Strength Rating?

How Relative Strength Line Can Help You Judge A Stock

Ready To Grow Your Investing Skills? Join An IBD Meetup Group!

MMS • RSS

BMO Capital Markets initiated coverage on shares of MongoDB (NASDAQ:MDB – Free Report) in a research note released on Monday, Marketbeat Ratings reports. The brokerage issued an outperform rating and a $280.00 price target on the stock.

Other equities analysts also recently issued research reports about the company. Royal Bank Of Canada reiterated an “outperform” rating and issued a $320.00 price objective on shares of MongoDB in a research note on Thursday, June 5th. Stephens started coverage on shares of MongoDB in a report on Friday, July 18th. They set an “equal weight” rating and a $247.00 target price on the stock. DA Davidson reissued a “buy” rating and set a $275.00 target price on shares of MongoDB in a report on Thursday, June 5th. Rosenblatt Securities lowered their target price on shares of MongoDB from $305.00 to $290.00 and set a “buy” rating on the stock in a report on Thursday, June 5th. Finally, Needham & Company LLC reaffirmed a “buy” rating and issued a $270.00 price target on shares of MongoDB in a report on Thursday, June 5th. Nine analysts have rated the stock with a hold rating, twenty-seven have given a buy rating and one has assigned a strong buy rating to the company’s stock. According to data from MarketBeat, the stock currently has an average rating of “Moderate Buy” and an average price target of $281.31.

View Our Latest Stock Analysis on MongoDB

MongoDB Price Performance

Shares of MDB stock traded down $3.53 during trading hours on Monday, hitting $240.88. The stock had a trading volume of 1,793,244 shares, compared to its average volume of 2,009,958. The stock’s 50 day moving average is $208.62 and its 200 day moving average is $212.38. MongoDB has a twelve month low of $140.78 and a twelve month high of $370.00. The firm has a market capitalization of $19.68 billion, a PE ratio of -211.30 and a beta of 1.41.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings results on Wednesday, June 4th. The company reported $1.00 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.65 by $0.35. The business had revenue of $549.01 million for the quarter, compared to analyst estimates of $527.49 million. MongoDB had a negative return on equity of 3.16% and a negative net margin of 4.09%. The business’s revenue was up 21.8% compared to the same quarter last year. During the same period in the prior year, the company posted $0.51 EPS. As a group, equities analysts predict that MongoDB will post -1.78 earnings per share for the current year.

Insider Activity

In other MongoDB news, CEO Dev Ittycheria sold 8,335 shares of the company’s stock in a transaction that occurred on Monday, July 28th. The stock was sold at an average price of $243.89, for a total transaction of $2,032,823.15. Following the completion of the transaction, the chief executive officer owned 236,557 shares of the company’s stock, valued at $57,693,886.73. This represents a 3.40% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, Director Dwight A. Merriman sold 1,000 shares of the stock in a transaction that occurred on Friday, July 25th. The stock was sold at an average price of $245.00, for a total value of $245,000.00. Following the completion of the transaction, the director directly owned 1,104,316 shares of the company’s stock, valued at $270,557,420. This represents a 0.09% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 51,416 shares of company stock valued at $11,936,656. Insiders own 3.10% of the company’s stock.

Institutional Trading of MongoDB

Several hedge funds have recently bought and sold shares of the stock. Cloud Capital Management LLC bought a new position in MongoDB in the first quarter worth approximately $25,000. Hollencrest Capital Management bought a new position in MongoDB in the first quarter worth approximately $26,000. Cullen Frost Bankers Inc. grew its stake in MongoDB by 315.8% in the first quarter. Cullen Frost Bankers Inc. now owns 158 shares of the company’s stock worth $28,000 after purchasing an additional 120 shares in the last quarter. Strategic Investment Solutions Inc. IL bought a new position in MongoDB in the fourth quarter worth approximately $29,000. Finally, Coppell Advisory Solutions LLC lifted its holdings in MongoDB by 364.0% during the fourth quarter. Coppell Advisory Solutions LLC now owns 232 shares of the company’s stock worth $54,000 after buying an additional 182 shares during the period. Institutional investors own 89.29% of the company’s stock.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today’s markets.

MMS • RSS

Teams are increasingly abandoning Amazon Web Services’ DynamoDB in favor of alternative database solutions, according to an analysis published in the HackerNoon Newsletter [1]. The shift is driven by a combination of performance inefficiencies, cost concerns, and the demand for greater multi-cloud flexibility. The article, authored by ScyllaDB, highlights the company’s own platform as a preferred replacement, citing advantages such as lower latency, reduced operational costs, and enhanced scalability [1].

The newsletter notes that DynamoDB, while once a dominant force in the NoSQL market, has struggled to meet evolving enterprise needs. Teams are reportedly frustrated with DynamoDB’s fixed pricing model, which can become prohibitively expensive at scale, and its limited ability to adapt to hybrid or multi-cloud environments. ScyllaDB emphasizes that its solution addresses these pain points by offering open-source capabilities, cloud-agnostic deployment options, and a 95% reduction in tail latency compared to DynamoDB [1].

The migration trend reflects broader industry dynamics as organizations seek to optimize cloud expenditures and avoid vendor lock-in. The newsletter’s analysis suggests that DynamoDB’s dominance is waning among developers prioritizing cost efficiency and architectural flexibility. While AWS has not publicly responded to the claims, third-party experts have long debated the trade-offs between DynamoDB’s managed simplicity and its scalability limitations [1].

The decision to switch platforms is further supported by growing interest in alternative databases tailored to specific workloads. ScyllaDB’s emphasis on compatibility with Apache Cassandra, coupled with its Apache 2.0 licensing model, positions it as an attractive option for teams seeking to repurpose existing codebases without overhauling infrastructure. Additionally, the newsletter underscores the importance of performance metrics, noting that latency improvements can directly impact user experience in applications ranging from e-commerce to real-time analytics [1].

The analysis concludes that DynamoDB’s challenges are part of a larger conversation about the sustainability of monolithic cloud services in an era of modular, open-source solutions. As teams prioritize customization and cost control, platforms like ScyllaDB may continue to gain traction, signaling a potential realignment of the NoSQL market.

Source: [1] [title: The HackerNoon Newsletter: Why Teams Are Ditching DynamoDB (7/27/2025)] [url: https://hackernoon.com/7-27-2025-newsletter]