Category: Uncategorized

MMS • RSS

Ensign Peak Advisors Inc trimmed its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 7.7% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 227,558 shares of the company’s stock after selling 18,995 shares during the quarter. Ensign Peak Advisors Inc owned about 0.31% of MongoDB worth $56,880,000 as of its most recent SEC filing.

Ensign Peak Advisors Inc trimmed its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 7.7% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 227,558 shares of the company’s stock after selling 18,995 shares during the quarter. Ensign Peak Advisors Inc owned about 0.31% of MongoDB worth $56,880,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also made changes to their positions in the stock. Transcendent Capital Group LLC acquired a new stake in MongoDB during the fourth quarter worth about $25,000. MFA Wealth Advisors LLC purchased a new stake in shares of MongoDB during the 2nd quarter valued at approximately $25,000. J.Safra Asset Management Corp lifted its holdings in MongoDB by 682.4% in the second quarter. J.Safra Asset Management Corp now owns 133 shares of the company’s stock valued at $33,000 after acquiring an additional 116 shares during the last quarter. Hantz Financial Services Inc. purchased a new position in shares of MongoDB during the 2nd quarter worth $35,000. Finally, YHB Investment Advisors Inc. purchased a new position in shares of MongoDB during the 1st quarter worth $41,000. 89.29% of the stock is currently owned by institutional investors and hedge funds.

MongoDB Price Performance

MDB stock opened at $278.45 on Friday. The stock has a market cap of $20.42 billion, a price-to-earnings ratio of -99.09 and a beta of 1.15. MongoDB, Inc. has a fifty-two week low of $212.74 and a fifty-two week high of $509.62. The company has a quick ratio of 5.03, a current ratio of 5.03 and a debt-to-equity ratio of 0.84. The business has a 50 day moving average price of $259.06 and a 200 day moving average price of $297.93.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its earnings results on Thursday, August 29th. The company reported $0.70 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.49 by $0.21. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The business had revenue of $478.11 million during the quarter, compared to analysts’ expectations of $465.03 million. During the same quarter in the prior year, the business posted ($0.63) EPS. The company’s revenue for the quarter was up 12.8% on a year-over-year basis. Equities research analysts anticipate that MongoDB, Inc. will post -2.46 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several research analysts have weighed in on the stock. Loop Capital lowered their target price on shares of MongoDB from $415.00 to $315.00 and set a “buy” rating for the company in a research note on Friday, May 31st. Scotiabank increased their price objective on shares of MongoDB from $250.00 to $295.00 and gave the stock a “sector perform” rating in a research report on Friday, August 30th. UBS Group boosted their target price on MongoDB from $250.00 to $275.00 and gave the company a “neutral” rating in a research report on Friday, August 30th. Robert W. Baird lowered their price target on MongoDB from $450.00 to $305.00 and set an “outperform” rating for the company in a research report on Friday, May 31st. Finally, JMP Securities reiterated a “market outperform” rating and issued a $380.00 price objective on shares of MongoDB in a report on Friday, August 30th. One investment analyst has rated the stock with a sell rating, five have assigned a hold rating and twenty have issued a buy rating to the company. According to data from MarketBeat, MongoDB has an average rating of “Moderate Buy” and a consensus price target of $337.56.

View Our Latest Stock Report on MongoDB

Insider Transactions at MongoDB

In related news, CAO Thomas Bull sold 1,000 shares of the company’s stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $282.89, for a total value of $282,890.00. Following the completion of the sale, the chief accounting officer now directly owns 16,222 shares of the company’s stock, valued at approximately $4,589,041.58. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other news, CAO Thomas Bull sold 1,000 shares of MongoDB stock in a transaction on Monday, September 9th. The shares were sold at an average price of $282.89, for a total value of $282,890.00. Following the transaction, the chief accounting officer now directly owns 16,222 shares of the company’s stock, valued at approximately $4,589,041.58. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Dwight A. Merriman sold 3,000 shares of the stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $290.79, for a total transaction of $872,370.00. Following the sale, the director now owns 1,135,006 shares of the company’s stock, valued at approximately $330,048,394.74. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 32,005 shares of company stock worth $8,082,746. Corporate insiders own 3.60% of the company’s stock.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Symmetry Investments LP acquired a new stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 1,000 shares of the company’s stock, valued at approximately $250,000.

Symmetry Investments LP acquired a new stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 1,000 shares of the company’s stock, valued at approximately $250,000.

Several other large investors have also bought and sold shares of MDB. Transcendent Capital Group LLC acquired a new stake in shares of MongoDB in the fourth quarter valued at about $25,000. MFA Wealth Advisors LLC acquired a new stake in MongoDB during the 2nd quarter valued at approximately $25,000. J.Safra Asset Management Corp raised its holdings in MongoDB by 682.4% during the 2nd quarter. J.Safra Asset Management Corp now owns 133 shares of the company’s stock worth $33,000 after purchasing an additional 116 shares during the last quarter. Hantz Financial Services Inc. acquired a new position in shares of MongoDB in the 2nd quarter worth approximately $35,000. Finally, YHB Investment Advisors Inc. acquired a new position in shares of MongoDB in the 1st quarter worth approximately $41,000. 89.29% of the stock is owned by institutional investors.

MongoDB Stock Performance

Shares of MongoDB stock opened at $278.45 on Friday. The company has a market cap of $20.42 billion, a PE ratio of -99.09 and a beta of 1.15. The company has a quick ratio of 5.03, a current ratio of 5.03 and a debt-to-equity ratio of 0.84. MongoDB, Inc. has a 52 week low of $212.74 and a 52 week high of $509.62. The business has a 50 day moving average price of $259.06 and a 200-day moving average price of $297.93.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings data on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, beating the consensus estimate of $0.49 by $0.21. MongoDB had a negative return on equity of 15.06% and a negative net margin of 12.08%. The business had revenue of $478.11 million for the quarter, compared to analysts’ expectations of $465.03 million. During the same period last year, the business earned ($0.63) EPS. The business’s revenue was up 12.8% on a year-over-year basis. Equities analysts anticipate that MongoDB, Inc. will post -2.46 earnings per share for the current fiscal year.

Insider Buying and Selling

In other MongoDB news, CAO Thomas Bull sold 1,000 shares of the stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $282.89, for a total value of $282,890.00. Following the completion of the sale, the chief accounting officer now owns 16,222 shares in the company, valued at approximately $4,589,041.58. The transaction was disclosed in a document filed with the SEC, which is available at this link. In related news, CEO Dev Ittycheria sold 3,025 shares of the stock in a transaction dated Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total transaction of $802,502.25. Following the completion of the transaction, the chief executive officer now owns 223,048 shares in the company, valued at $59,172,403.92. The transaction was disclosed in a document filed with the SEC, which is available through this link. Also, CAO Thomas Bull sold 1,000 shares of MongoDB stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $282.89, for a total transaction of $282,890.00. Following the completion of the sale, the chief accounting officer now directly owns 16,222 shares in the company, valued at approximately $4,589,041.58. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 32,005 shares of company stock worth $8,082,746. 3.60% of the stock is owned by insiders.

Analysts Set New Price Targets

Several research firms have recently weighed in on MDB. Loop Capital decreased their price objective on shares of MongoDB from $415.00 to $315.00 and set a “buy” rating for the company in a research report on Friday, May 31st. Barclays lowered their price objective on MongoDB from $458.00 to $290.00 and set an “overweight” rating for the company in a research report on Friday, May 31st. Monness Crespi & Hardt upgraded MongoDB to a “hold” rating in a research report on Tuesday, May 28th. Stifel Nicolaus lifted their target price on MongoDB from $300.00 to $325.00 and gave the stock a “buy” rating in a report on Friday, August 30th. Finally, Guggenheim upgraded MongoDB from a “sell” rating to a “neutral” rating in a report on Monday, June 3rd. One research analyst has rated the stock with a sell rating, five have assigned a hold rating and twenty have given a buy rating to the company. According to MarketBeat, MongoDB presently has an average rating of “Moderate Buy” and a consensus target price of $337.56.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Thrivent Financial for Lutherans increased its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1,098.1% in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 424,402 shares of the company’s stock after buying an additional 388,979 shares during the quarter. Thrivent Financial for Lutherans owned about 0.58% of MongoDB worth $106,084,000 as of its most recent SEC filing.

Thrivent Financial for Lutherans increased its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1,098.1% in the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 424,402 shares of the company’s stock after buying an additional 388,979 shares during the quarter. Thrivent Financial for Lutherans owned about 0.58% of MongoDB worth $106,084,000 as of its most recent SEC filing.

A number of other institutional investors also recently bought and sold shares of MDB. Jennison Associates LLC lifted its position in MongoDB by 14.3% in the first quarter. Jennison Associates LLC now owns 4,408,424 shares of the company’s stock worth $1,581,037,000 after buying an additional 551,567 shares during the last quarter. Swedbank AB increased its stake in MongoDB by 156.3% in the second quarter. Swedbank AB now owns 656,993 shares of the company’s stock worth $164,222,000 after purchasing an additional 400,705 shares during the period. Axiom Investors LLC DE purchased a new stake in MongoDB in the fourth quarter worth $153,990,000. Clearbridge Investments LLC increased its stake in MongoDB by 109.0% in the first quarter. Clearbridge Investments LLC now owns 445,084 shares of the company’s stock worth $159,625,000 after purchasing an additional 232,101 shares during the period. Finally, First Trust Advisors LP increased its stake in MongoDB by 59.3% in the fourth quarter. First Trust Advisors LP now owns 549,052 shares of the company’s stock worth $224,480,000 after purchasing an additional 204,284 shares during the period. 89.29% of the stock is currently owned by institutional investors.

MongoDB Price Performance

Shares of NASDAQ MDB opened at $278.45 on Friday. The company has a debt-to-equity ratio of 0.84, a quick ratio of 5.03 and a current ratio of 5.03. The company has a market cap of $20.42 billion, a PE ratio of -99.09 and a beta of 1.15. The business has a 50-day simple moving average of $259.06 and a two-hundred day simple moving average of $297.93. MongoDB, Inc. has a fifty-two week low of $212.74 and a fifty-two week high of $509.62.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings results on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, topping the consensus estimate of $0.49 by $0.21. The business had revenue of $478.11 million during the quarter, compared to the consensus estimate of $465.03 million. MongoDB had a negative return on equity of 15.06% and a negative net margin of 12.08%. The company’s quarterly revenue was up 12.8% on a year-over-year basis. During the same quarter last year, the company earned ($0.63) earnings per share. As a group, equities analysts expect that MongoDB, Inc. will post -2.46 EPS for the current fiscal year.

Insiders Place Their Bets

In other MongoDB news, CRO Cedric Pech sold 273 shares of the firm’s stock in a transaction dated Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $72,424.17. Following the completion of the sale, the executive now owns 35,719 shares of the company’s stock, valued at $9,475,893.51. The sale was disclosed in a filing with the SEC, which is available through this hyperlink. In related news, CRO Cedric Pech sold 273 shares of MongoDB stock in a transaction dated Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total transaction of $72,424.17. Following the completion of the sale, the executive now owns 35,719 shares of the company’s stock, valued at $9,475,893.51. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CAO Thomas Bull sold 138 shares of MongoDB stock in a transaction dated Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $36,610.02. Following the sale, the chief accounting officer now directly owns 17,222 shares of the company’s stock, valued at approximately $4,568,824.38. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 32,005 shares of company stock valued at $8,082,746. 3.60% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

A number of analysts have weighed in on MDB shares. Guggenheim upgraded MongoDB from a “sell” rating to a “neutral” rating in a research note on Monday, June 3rd. Tigress Financial reduced their target price on MongoDB from $500.00 to $400.00 and set a “buy” rating on the stock in a research note on Thursday, July 11th. Mizuho increased their target price on MongoDB from $250.00 to $275.00 and gave the stock a “neutral” rating in a research note on Friday, August 30th. Scotiabank increased their target price on MongoDB from $250.00 to $295.00 and gave the stock a “sector perform” rating in a research note on Friday, August 30th. Finally, Robert W. Baird cut their price target on MongoDB from $450.00 to $305.00 and set an “outperform” rating on the stock in a research note on Friday, May 31st. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating and twenty have assigned a buy rating to the stock. According to data from MarketBeat.com, MongoDB presently has a consensus rating of “Moderate Buy” and an average price target of $337.56.

View Our Latest Stock Report on MongoDB

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Itau Unibanco Holding S.A. bought a new position in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 6,382 shares of the company’s stock, valued at approximately $1,595,000.

Itau Unibanco Holding S.A. bought a new position in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 6,382 shares of the company’s stock, valued at approximately $1,595,000.

Several other hedge funds also recently modified their holdings of the business. Dimensional Fund Advisors LP boosted its holdings in MongoDB by 2.8% in the fourth quarter. Dimensional Fund Advisors LP now owns 91,696 shares of the company’s stock worth $37,495,000 after purchasing an additional 2,476 shares in the last quarter. Janney Montgomery Scott LLC boosted its stake in shares of MongoDB by 134.5% during the 4th quarter. Janney Montgomery Scott LLC now owns 3,905 shares of the company’s stock worth $1,597,000 after acquiring an additional 2,240 shares in the last quarter. Dynamic Technology Lab Private Ltd increased its holdings in shares of MongoDB by 36.8% during the 4th quarter. Dynamic Technology Lab Private Ltd now owns 1,183 shares of the company’s stock valued at $484,000 after acquiring an additional 318 shares during the last quarter. PNC Financial Services Group Inc. raised its stake in shares of MongoDB by 11.0% in the 4th quarter. PNC Financial Services Group Inc. now owns 2,746 shares of the company’s stock valued at $1,123,000 after acquiring an additional 272 shares in the last quarter. Finally, UBS Group AG lifted its holdings in MongoDB by 73.0% in the 4th quarter. UBS Group AG now owns 91,243 shares of the company’s stock worth $37,305,000 after purchasing an additional 38,509 shares during the last quarter. Institutional investors and hedge funds own 89.29% of the company’s stock.

Insider Buying and Selling at MongoDB

In other news, CAO Thomas Bull sold 138 shares of the company’s stock in a transaction dated Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total value of $36,610.02. Following the sale, the chief accounting officer now owns 17,222 shares of the company’s stock, valued at approximately $4,568,824.38. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other news, CAO Thomas Bull sold 138 shares of the business’s stock in a transaction that occurred on Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $36,610.02. Following the transaction, the chief accounting officer now directly owns 17,222 shares of the company’s stock, valued at approximately $4,568,824.38. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Michael Lawrence Gordon sold 1,569 shares of the firm’s stock in a transaction on Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total value of $416,240.01. Following the sale, the chief financial officer now directly owns 81,942 shares of the company’s stock, valued at $21,738,393.18. The disclosure for this sale can be found here. Over the last three months, insiders sold 32,005 shares of company stock valued at $8,082,746. 3.60% of the stock is currently owned by company insiders.

MongoDB Stock Performance

NASDAQ MDB opened at $278.45 on Friday. MongoDB, Inc. has a twelve month low of $212.74 and a twelve month high of $509.62. The company has a quick ratio of 5.03, a current ratio of 5.03 and a debt-to-equity ratio of 0.84. The stock has a market cap of $20.42 billion, a P/E ratio of -99.09 and a beta of 1.15. The company’s 50-day simple moving average is $259.06 and its 200 day simple moving average is $297.93.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, beating the consensus estimate of $0.49 by $0.21. The company had revenue of $478.11 million for the quarter, compared to analyst estimates of $465.03 million. MongoDB had a negative return on equity of 15.06% and a negative net margin of 12.08%. The company’s revenue was up 12.8% compared to the same quarter last year. During the same period in the prior year, the company posted ($0.63) EPS. As a group, research analysts forecast that MongoDB, Inc. will post -2.46 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

MDB has been the topic of several analyst reports. Mizuho increased their price target on MongoDB from $250.00 to $275.00 and gave the company a “neutral” rating in a report on Friday, August 30th. Scotiabank raised their target price on shares of MongoDB from $250.00 to $295.00 and gave the company a “sector perform” rating in a research note on Friday, August 30th. Morgan Stanley boosted their target price on shares of MongoDB from $320.00 to $340.00 and gave the stock an “overweight” rating in a research report on Friday, August 30th. JMP Securities reaffirmed a “market outperform” rating and issued a $380.00 price target on shares of MongoDB in a research report on Friday, August 30th. Finally, DA Davidson lifted their price objective on MongoDB from $265.00 to $330.00 and gave the stock a “buy” rating in a research note on Friday, August 30th. One analyst has rated the stock with a sell rating, five have given a hold rating and twenty have issued a buy rating to the company’s stock. Based on data from MarketBeat, MongoDB currently has an average rating of “Moderate Buy” and an average target price of $337.56.

Read Our Latest Report on MongoDB

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Swift Testing is a New Framework from Apple to Modernize Testing for Swift Across Platforms

MMS • Sergio De Simone

While XCTest remains the preferred way to create tests in Xcode, the new Swift Testing framework attempts to introduce an expressive and intuitive API for the definition of tests that applies to all platform where Swift is supported. The framework also enables parametrizing, parallelizing, categorizing, and associating tests with bugs.

Swift Testing makes extensive use of macros to provide an idiomatic way to declare complex behaviors. For example, this is how you declare a test with a name and a set of alternative inputs it should be run against:

import Testing

...

@Test("Sample test", arguments: [

"input string 1",

"input string 2",

"input string 3"

])

func sampleTest(sampleInput: String) {

...

}

The above test will be executed three times, with each call receiving one of the provided arguments through the sampleInput parameter. When parametrizing tests, you can also handle more than one input. In this case, you will provide a list of collections for @Test‘s arguments and the test function will take an argument from each collection for every possible combination of values from the two collections:

@Test("Multiple collections as test inputs", arguments: 0...100, ["a", ..., "z"])

func test(number: Int, letter: String) {

}

Under specific conditions for the arguments type, it is possible to run parametrized tests selectively, so you do not have to run tests for all possible combinations of input values when just a few of them fail.

Besides optionally specifying a name and a list of arguments, the @Test macro supports the possibility of associating traits to a test function. Existing traits make it possible to enable or disable tests based on a runtime condition, limit the running time of tests, run tests serially or in parallel, associate tests to bugs, and more. For example, this is how you can run a test only if a given app feature is enabled:

@Test(.enabled(if: App.ConditionToMatch))

func conditionalTest() {

...

}

Developers can also define their own traits by implementing types conforming to TestTrait.

Parametrizing tests has the additional advantage that the diagnostics produced in case of failure clearly indicates the input that failed.

Test functions can be organized into test suites. The traditional way of doing this is by placing them in the same test class. Swift Testing also provides a specific macro to that aim, @Suite. All test functions belonging to a test suite inherit the same traits from the suite, including tags(_:) or disabled(_:sourceLocation:).

To validate test results, Swift Testing provides two macros expect(_:_:sourceLocation:) and require(_:_:sourceLocation:). While require stops the test execution when its condition is not met by throwing an exception, expect prints detailed information.

One important caveat is test functions aren’t stripped from binaries when building for release. Due to this, Apple strongly advise to import the testing library into a test target not linked with your main executable.

Swift Testing is available on GitHub and on the Swift Package Index, and requires Swift 6. XCTest and Swift Testing can coexist in the same project, so you do not necessarily need to migrate your existing tests if you want to adopt the new framework.

MMS • RSS

Octahedron Capital Management L.P. acquired a new position in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the second quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 2,100 shares of the company’s stock, valued at approximately $525,000. MongoDB makes up about 0.5% of Octahedron Capital Management L.P.’s investment portfolio, making the stock its 16th largest holding.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Thrivent Financial for Lutherans increased its stake in shares of MongoDB by 1,098.1% during the 2nd quarter. Thrivent Financial for Lutherans now owns 424,402 shares of the company’s stock worth $106,084,000 after purchasing an additional 388,979 shares during the last quarter. Skandinaviska Enskilda Banken AB publ grew its stake in MongoDB by 39.3% in the 2nd quarter. Skandinaviska Enskilda Banken AB publ now owns 19,486 shares of the company’s stock valued at $4,865,000 after buying an additional 5,500 shares in the last quarter. AE Wealth Management LLC raised its holdings in MongoDB by 57.5% during the 2nd quarter. AE Wealth Management LLC now owns 5,523 shares of the company’s stock valued at $1,380,000 after acquiring an additional 2,017 shares during the period. Blair William & Co. IL lifted its position in shares of MongoDB by 16.4% during the second quarter. Blair William & Co. IL now owns 315,830 shares of the company’s stock worth $78,945,000 after acquiring an additional 44,608 shares in the last quarter. Finally, SYSTM Wealth Solutions LLC boosted its holdings in shares of MongoDB by 68.0% in the second quarter. SYSTM Wealth Solutions LLC now owns 11,338 shares of the company’s stock worth $2,834,000 after acquiring an additional 4,588 shares during the period. Hedge funds and other institutional investors own 89.29% of the company’s stock.

Analysts Set New Price Targets

A number of research firms have recently commented on MDB. Morgan Stanley raised their price objective on shares of MongoDB from $320.00 to $340.00 and gave the company an “overweight” rating in a research report on Friday, August 30th. Canaccord Genuity Group cut their target price on shares of MongoDB from $435.00 to $325.00 and set a “buy” rating on the stock in a research note on Friday, May 31st. Bank of America boosted their price target on MongoDB from $300.00 to $350.00 and gave the stock a “buy” rating in a research report on Friday, August 30th. Stifel Nicolaus increased their target price on MongoDB from $300.00 to $325.00 and gave the company a “buy” rating in a research note on Friday, August 30th. Finally, Oppenheimer lifted their target price on shares of MongoDB from $300.00 to $350.00 and gave the stock an “outperform” rating in a research report on Friday, August 30th. One investment analyst has rated the stock with a sell rating, five have given a hold rating and twenty have given a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of “Moderate Buy” and a consensus price target of $337.56.

Read Our Latest Research Report on MongoDB

MongoDB Trading Down 1.9 %

MongoDB stock traded down $5.41 during midday trading on Friday, reaching $278.45. The stock had a trading volume of 1,253,603 shares, compared to its average volume of 1,490,574. The company has a fifty day moving average of $259.06 and a 200 day moving average of $298.68. The firm has a market cap of $20.42 billion, a price-to-earnings ratio of -99.09 and a beta of 1.15. The company has a quick ratio of 5.03, a current ratio of 5.03 and a debt-to-equity ratio of 0.84. MongoDB, Inc. has a 52-week low of $212.74 and a 52-week high of $509.62.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings results on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, beating the consensus estimate of $0.49 by $0.21. The firm had revenue of $478.11 million during the quarter, compared to the consensus estimate of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The company’s revenue was up 12.8% on a year-over-year basis. During the same quarter in the previous year, the firm posted ($0.63) earnings per share. On average, analysts anticipate that MongoDB, Inc. will post -2.46 earnings per share for the current fiscal year.

Insider Buying and Selling at MongoDB

In other MongoDB news, Director John Dennis Mcmahon sold 10,000 shares of the firm’s stock in a transaction dated Monday, June 24th. The stock was sold at an average price of $228.00, for a total value of $2,280,000.00. Following the completion of the sale, the director now owns 20,020 shares of the company’s stock, valued at $4,564,560. The sale was disclosed in a filing with the SEC, which is available through this hyperlink. In related news, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction on Thursday, June 27th. The shares were sold at an average price of $245.00, for a total value of $245,000.00. Following the completion of the transaction, the director now directly owns 1,146,003 shares in the company, valued at approximately $280,770,735. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Director John Dennis Mcmahon sold 10,000 shares of the firm’s stock in a transaction on Monday, June 24th. The shares were sold at an average price of $228.00, for a total transaction of $2,280,000.00. Following the sale, the director now owns 20,020 shares in the company, valued at approximately $4,564,560. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 32,005 shares of company stock valued at $8,082,746. 3.60% of the stock is currently owned by corporate insiders.

MongoDB Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Growth stocks offer a lot of bang for your buck, and we’ve got the next upcoming superstars to strongly consider for your portfolio.

Capstone Triton Financial Group LLC Trims Stock Holdings in MongoDB, Inc. (NASDAQ:MDB)

MMS • RSS

Capstone Triton Financial Group LLC lessened its stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.3% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 9,272 shares of the company’s stock after selling 124 shares during the quarter. MongoDB accounts for about 1.6% of Capstone Triton Financial Group LLC’s holdings, making the stock its 18th biggest holding. Capstone Triton Financial Group LLC’s holdings in MongoDB were worth $2,318,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Capstone Triton Financial Group LLC lessened its stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.3% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 9,272 shares of the company’s stock after selling 124 shares during the quarter. MongoDB accounts for about 1.6% of Capstone Triton Financial Group LLC’s holdings, making the stock its 18th biggest holding. Capstone Triton Financial Group LLC’s holdings in MongoDB were worth $2,318,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors have also made changes to their positions in the company. Vanguard Group Inc. boosted its holdings in MongoDB by 1.0% during the 1st quarter. Vanguard Group Inc. now owns 6,910,761 shares of the company’s stock valued at $2,478,475,000 after acquiring an additional 68,348 shares during the period. Jennison Associates LLC boosted its stake in shares of MongoDB by 14.3% in the first quarter. Jennison Associates LLC now owns 4,408,424 shares of the company’s stock valued at $1,581,037,000 after purchasing an additional 551,567 shares during the period. Swedbank AB grew its holdings in shares of MongoDB by 156.3% in the second quarter. Swedbank AB now owns 656,993 shares of the company’s stock valued at $164,222,000 after purchasing an additional 400,705 shares in the last quarter. Champlain Investment Partners LLC increased its stake in MongoDB by 22.4% during the 1st quarter. Champlain Investment Partners LLC now owns 550,684 shares of the company’s stock worth $197,497,000 after buying an additional 100,725 shares during the period. Finally, First Trust Advisors LP lifted its holdings in MongoDB by 59.3% during the 4th quarter. First Trust Advisors LP now owns 549,052 shares of the company’s stock worth $224,480,000 after buying an additional 204,284 shares in the last quarter. 89.29% of the stock is currently owned by institutional investors and hedge funds.

MongoDB Stock Performance

Shares of MongoDB stock opened at $278.45 on Friday. The stock has a market capitalization of $20.42 billion, a price-to-earnings ratio of -99.09 and a beta of 1.15. The firm’s fifty day simple moving average is $259.06 and its 200-day simple moving average is $298.68. The company has a debt-to-equity ratio of 0.84, a current ratio of 5.03 and a quick ratio of 5.03. MongoDB, Inc. has a 12 month low of $212.74 and a 12 month high of $509.62.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its earnings results on Thursday, August 29th. The company reported $0.70 EPS for the quarter, beating analysts’ consensus estimates of $0.49 by $0.21. The business had revenue of $478.11 million during the quarter, compared to analysts’ expectations of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The business’s revenue was up 12.8% compared to the same quarter last year. During the same period in the prior year, the company earned ($0.63) earnings per share. As a group, equities analysts forecast that MongoDB, Inc. will post -2.46 earnings per share for the current year.

Analyst Ratings Changes

MDB has been the topic of a number of recent research reports. Barclays cut their price objective on MongoDB from $458.00 to $290.00 and set an “overweight” rating on the stock in a research report on Friday, May 31st. JMP Securities reaffirmed a “market outperform” rating and issued a $380.00 price target on shares of MongoDB in a research report on Friday, August 30th. Piper Sandler boosted their price objective on MongoDB from $300.00 to $335.00 and gave the stock an “overweight” rating in a research report on Friday, August 30th. Monness Crespi & Hardt raised shares of MongoDB to a “hold” rating in a report on Tuesday, May 28th. Finally, Guggenheim upgraded shares of MongoDB from a “sell” rating to a “neutral” rating in a report on Monday, June 3rd. One analyst has rated the stock with a sell rating, five have given a hold rating and twenty have issued a buy rating to the company’s stock. According to data from MarketBeat.com, the company currently has a consensus rating of “Moderate Buy” and an average target price of $337.56.

Check Out Our Latest Stock Report on MDB

Insider Activity

In related news, Director Dwight A. Merriman sold 3,000 shares of MongoDB stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $290.79, for a total value of $872,370.00. Following the transaction, the director now directly owns 1,135,006 shares in the company, valued at approximately $330,048,394.74. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. In other MongoDB news, Director Dwight A. Merriman sold 3,000 shares of the company’s stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $290.79, for a total transaction of $872,370.00. Following the completion of the transaction, the director now owns 1,135,006 shares in the company, valued at approximately $330,048,394.74. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CAO Thomas Bull sold 138 shares of MongoDB stock in a transaction dated Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total transaction of $36,610.02. Following the completion of the sale, the chief accounting officer now directly owns 17,222 shares in the company, valued at approximately $4,568,824.38. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 32,005 shares of company stock valued at $8,082,746. Company insiders own 3.60% of the company’s stock.

MongoDB Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • Sergio De Simone

Compose Material 3 Adaptive, a library meant to create adaptive UIs able to adapt themselves automatically according to the current window size or device orientation, has reached 1.0 and is ready to be used in production apps.

Leveraging Letpack Compose, the new library makes it easier for developers to create apps that run on a variety of form factors, including foldable phones and wall‑mounted TVs, and adapt to configuration changes like orientation changes and window resizing in split‑screen and free‑form windowing modes.

The idea behind adaptive UIs is simple: use different UI components depending on the window size to better use any available space. For example, panes naturally lend themselves to create adaptive list-detail layouts, where you navigate from the list to the detail view on smaller screens while larger devices show both the list and the detail view in the same layout. Alternatively, you can create supporting-pane layouts, where a larger portion of the screen is occupied by the primary content area and a supporting pane, which can be displayed or not, shows the secondary content area. Along the same lines, you can use a bottom navigation bar on compact displays and replace it with a vertical navigation rail on larger windows.

The library provides several components and APIs to make it easier to create adaptive experiences and allow developers to reuse proven solutions to common problems without having to reinvent the wheel. For example, developers can use NavigationSuiteScaffold to switch between navigation bar and navigation rail based on app window size class, ListDetailPaneScaffold to implement a list-detail layout self-adapting to the app window size, and SupportingPaneScaffold to implement the supporting pane canonical layout.

The components listed above transparently adapt the information they display based on window size according to a definition of what Google calls canonical layouts, which makes it possible to pack complex behavior into simple declarations. For example, this is all you need to create an adaptive navigable list-detail layout:

val navigator = rememberListDetailPaneScaffoldNavigator()

NavigableListDetailPaneScaffold(

navigator = navigator,

listPane = {

// List pane

},

detailPane = {

// Detail pane

},

)

In case you need to customize the canonical behavior in any ways, you can access the lower-level APIs provided by the library. For example, NavigableListDetailPaneScaffold is made of a BackHandler and a ListDetailPaneScaffold and you can directly tweak the latter to make it display two panes not only on larger displays but also at a smaller medium width, or change the policy it uses to adapt to different window sizes.

Another area where Compose Material 3 Adaptive helps developers is adding support for alternative input devices, like external keyboards, mice, and styluses. In particular, the library allows developers to seamlessly add support for using a stylus to write into any TextField component.

Networking Cost Estimations and Analysis with Open-Source AWS Networking Cost Calculator

MMS • Steef-Jan Wiggers

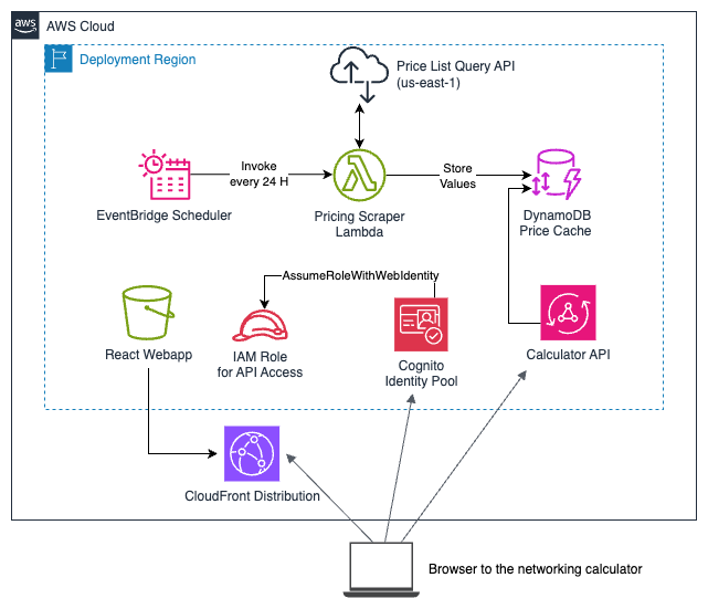

AWS recently released an open source project called AWS Networking Costs Calculator, which allows users to run an AWS networking-focused calculator to estimate and visualize the various charges for a given network architecture.

Users can use the calculator to select their AWS region and the networking services in their architecture, along with other relevant inputs such as the number of endpoints used and the amount of data transferred or processed. This will generate a sample diagram that helps visualize traffic’s connectivity and flow.

In a Networking and Content Delivery blog post, the company explains that the calculator has two main components:

- A serverless backend part that uses the AWS Price List Query APIs to get the updated prices for the different networking services. This process runs daily inside an AWS Lambda function, with prices cached in Amazon DynamoDB.

- A ReactJS front-end web application (hosted on Amazon Simple Storage Service (Amazon S3) and fronted with an Amazon CloudFront distribution), which is the calculator user interface.

AWS Networking Costs Calculator high-level architecture (Source: AWS Networking and Content Delivery blog post)

Before deploying the tool in an AWS account, users must ensure that they have a Linux-based OS, NodeJS (version 18 or later) and NPM, AWS Cloud Development Kit (AWS CDK), and an AWS account with AWS CLI (v2) installed and configured. After verifying the prerequisites, they can run the deployment script from the project’s root directory using the $ ./deploy.sh command. The deployment will take 5–10 minutes. Once completed, users will receive a CloudFront front-end URL to access the tool.

In a LinkedIn post, AWS principal solutions architect Hrushik Gangur writes:

No more guessing, using Excel sheets, or interpreting AWS documentation to figure out data transfer/processing costs, specifically when your workload uses multiple networking services. Install this tool locally on your laptop, drag and drop, and connect networking service, and get total end-to-end networking cost!

However, the company also states that the pricing users see in the tool for their network architecture is an estimate. The actual costs may vary depending on factors such as other AWS services or third-party products in use. In addition, not all AWS networking services are available for cost estimates in the tool.

Taranvir Singh, an IDC Analyst for Worldwide Cloud Networking Research, wrote in another LinkedIn post:

Unpredictable costs are a significant concern for clients using cloud services. While cloud pricing calculators are available, they primarily focus on compute and storage, leaving a gap in networking costs, which can significantly impact overall IT budgets. I’m not a fan of the self-hosted aspect and any cost that customers will incur for this tool, but I feel this is temporary, and the AWS team is working on it.

Lastly, other means of estimating and analyzing costs exist, such as the AWS Cost CLI, the AWS Pricing Calculator, and third-party products.

Grafana K6 Releases: Enhancements in Typescript, Ecmascript, Browser Testing, and More

MMS • Claudio Masolo

The Grafana k6 team releases a new version of its open-source load testing tool approximately every two months, bringing new features and improving user experience. Several recent updates have introduced key improvements, notably related to TypeScript support, ECMAScript compatibility, and enhancements to browser testing, gRPC, memory management, cryptography, and test result storage.

One of the major updates introduced in the k6 version 0.52 release is allowing native support for TypeScript. Previously, developers using TypeScript with k6 were required to bundle their scripts using tools like Webpack or Rollup before running them. With this update, TypeScript tests can now be run directly from the k6 command-line interface (CLI) by using a special compatibility mode option. This new feature significantly simplifies the testing process for developers who prefer TypeScript, making it easier to work with k6, especially when reusing existing TypeScript libraries.

In addition to TypeScript, the v0.52 release also introduced support for a range of ECMAScript 6 (ES6) and newer features that had previously been unavailable in k6. These include features like optional chaining, object spread, and private class fields. By incorporating these ECMAScript (ES+) features, k6 has become more compliant with the modern JavaScript ecosystem, allowing developers to utilize contemporary JavaScript syntax without the need for workarounds. As of the k6 v0.53 release, these ES6+ features are now available in the default compatibility mode, making it even easier for developers to use them without any special configuration.

Another area of focus in recent k6 updates has been the browser testing module. Initially introduced in 2021, the browser module did not support asynchronous operations or the JavaScript async and await keywords. This changed with the k6 v0.52 release, where browser APIs were made fully asynchronous, aligning with the broader JavaScript ecosystem and ensuring compatibility with tools like Playwright. This update has made the browser testing experience more user-friendly and intuitive, although it did introduce breaking changes to existing browser scripts. To help users adapt to these changes, the k6 team provided a migration guide detailing the affected APIs and how to modify existing scripts to ensure compatibility. The browser module has now officially graduated from experimental status to a core module, making it stable and available under k6/browser instead of k6/experimental/browser.

Alongside the browser module, the gRPC streaming functionality also underwent significant changes. In the k6 v0.51 release, the grpc. Stream feature, which supports bi-directional gRPC streaming, was fully integrated into the stable k6/net/grpc module. This graduation ensures that no further breaking changes will occur, allowing developers to confidently use the gRPC APIs in their tests and upgrade to future versions without concern. In addition, the gRPC module now supports non-blocking asynchronous operations with the client.asyncInvoke method, which returns a Promise and provides more efficient performance.

The k6 v0.51 release also addressed the challenge of running load tests with large files, which previously led to Out of Memory (OOM) errors. While the SharedArray object had provided some relief, it still loaded all file content into memory. To tackle this, the k6 team introduced the Stream module, which allows developers to read large files in small chunks, reducing memory consumption and significantly improving efficiency. The new Stream API enables k6 to handle large datasets by loading them piece by piece, preventing OOM issues during testing.

Additionally, the k6 v0.51 release made common JavaScript timer methods like setTimeout, clearTimeout, setInterval, and clearInterval globally available. Previously, these methods had to be imported from the k6/timers or k6/experimental/timers modules. By making these methods globally accessible, k6 now aligns more closely with the behaviour of other JavaScript environments and simplifies the process of managing asynchronous operations within tests.

Cryptographic operations have also seen improvements in recent k6 releases. The tool now supports additional Web Crypto methods, including new asymmetric cryptography algorithms such as ECDH and ECDSA, along with support for pkcs8 and spki formats. It also supports the import and export of keys in JSON Web Key (JWK) format, further enhancing k6’s ability to test secure applications that use cryptography. While the webcrypto module remains a work in progress, these updates are a step forward in making cryptographic testing more robust within k6.

Finally, the integration of OpenTelemetry (OTEL) into k6’s core functionality was another important update introduced in the k6 v0.53 release. OTEL has become a standard for telemetry and observability, and its inclusion in k6 allows users to send test results directly to OpenTelemetry backends. This addition enables k6 users to map k6 metrics and tags to OTEL equivalents and output test results to default OTEL exporters without needing additional configurations. This further expands k6’s flexibility in how test results are stored and analyzed, integrating it with industry-standard telemetry tools.

In addition to k6, other noteworthy load testing tools include Autocannon and Locust. Autocannon, written in Node.js, is a fast HTTP benchmarking tool designed for testing web server performance under heavy traffic. It provides key metrics like throughput and latency. Meanwhile, Locust is an open-source load testing tool that uses Python scripts to define custom user behaviour. It can simulate millions of concurrent users, making it ideal for large-scale performance testing.