Month: June 2023

MongoDB Atlas Enriched with New Capabilities to Build New Classes of Applications across …

MMS • RSS

MongoDB, Inc. is launching five new products and introducing new features to its developer data platform, MongoDB Atlas, making it faster and easier for customers to build modern applications, for any workload or use case.

The new products and features include generative AI capabilities with MongoDB Atlas Vector Search for highly relevant information retrieval and personalization; MongoDB Atlas Search Nodes for dedicated resources with search workloads at enterprise scale; MongoDB Atlas Stream Processing for high-velocity streams of complex data; significant scaling and efficiency improvements for MongoDB Time Series collections; and new capabilities using MongoDB Atlas Data Federation for querying data and isolating workloads on Microsoft Azure.

According to the company, these new features for MongoDB Atlas enable businesses to dramatically improve operational efficiency and speed up their pace of innovation by standardizing many types of workloads on a single developer data platform across the enterprise.

“The new MongoDB Atlas capabilities announced today are in response to the feedback we get from customers all around the world—they love that their teams are able to quickly build and innovate with MongoDB Atlas and want to be able to do even more with it across the enterprise,” said Dev Ittycheria, president and CEO at MongoDB. “With the new features we’re launching today, we’re further supporting not only customers who are just getting started, but also customers who have the most demanding requirements for functionality, performance, scale, and flexibility so they can unleash the power of software and data to build advanced applications to transform their businesses.”

MongoDB Atlas is a multi-cloud developer data platform that accelerates and simplifies building with data. MongoDB Atlas provides an integrated set of data and application services in a unified environment to enable developer teams to quickly build with the capabilities, performance, and scale modern applications require, according to the company.

Tens of thousands of customers and millions of developers rely on MongoDB Atlas every day so they can innovate more quickly, efficiently, and cost-effectively with modern applications for virtually every use case across an organization.

For more information about this news, visit www.mongodb.com.

MMS • RSS

MMS • Mostafa Radwan

KSOC labs recently announced the release of the first Kubernetes Bill of Materials(KBOMs). KBOM is an open source standard and command-line tool that helps security teams quickly analyze cluster configurations and respond to CVEs.

The project includes an initial specification and implementation that works across cloud providers, on-prem, and DIY environments.

The initial specification in JSON provides detailed information about the different components of a cluster in addition to instances, Kubernetes objects, and container images for both internal and hosted applications.

Such information can be helpful for security and compliance teams to look at a Kubernetes cluster as a single unit and quickly identify vulnerabilities and threats without necessarily having to look at the underlying components individually.

KBOM gives a quick rundown of a Kubernetes cluster such as:

- Cluster size in terms of the workload count

- Cost and type of nodes on a cloud provider

- Vulnerabilities for Kubernetes-related components and hosted application images

- Third-party customizations and plugs such as custom resources, authentication, and survive mesh

- Version details of the platform and its components

Earlier this year, KSOC labs surveyed a group of attendees at KubeCon+CloudNativeCon Europe 2023 by asking them if they had container security, cloud posture management, and runtime security solutions and whether having a dedicated security solution for Kubernetes is needed. 97% of participants said yes.

The team at KSOC realized that even though similar standards and tools exist today as Software Bill of Materials (SBOMs) and Infrastructure Bill of Materials (IBOMs) that can help in understanding the components that make up an application and its underlying infrastructure, they don’t necessarily enable security teams to be able to analyze their clusters and respond quickly to CVEs.

By releasing KBOM, the team at KSOC would like to bring Kubernetes into the conversation concerning security and compliance guidelines.

Using KBOM, security and compliance teams can get more visibility into their Kubernetes clusters, especially third party plugins. For example, KBOM can shed some light on the most recent Kubernetes CVEs that allow privilege escalation, a sophisticated technique by bad actors to escape from an application container to the underlying host and eventually take over an entire cluster.

Some of which are projects in the CNCF landscape. For example, CVE-2023-27483 affecting crossplane, a multi-cloud control plane that leverages the Kubernetes API to provision and manage cloud infrastructure, and CVE-2023-30622 affecting Clusternet, a solution to manage multiple Kubernetes clusters on public, private, hybrid, and edge environments.

Also, CVE-2023-30513 pertains to the Kubernetes plugin for Jenkins, a Jenkins plugin that takes care of all the communications from Jenkins to the cluster regarding CI/CD pipelines.

The specification provides a foundation for the community to build on and add more information to support different use cases in the future.

KBOM was tested on all the major cloud providers, including AWS, Azure, and Google Cloud. It works on all versions newer than Kubernetes v1.19. Instructions on how to get started using KBOM are available on the project’s GitHub repository.

MMS • RSS

The Nasdaq Composite Index is set to wrap up the best first half in 40 years, climbing 29%. The Nasdaq-100, which tracks the top 100 stocks traded on the Nasdaq Exchange, is also on track for its best first-half performance on record.

While most of the stocks in the index soared, we have highlighted five that have more than doubled this year and are expected to continue to outperform given their solid Zacks Rank #1 (Strong Buy) or #2 (Buy) and a solid estimated earnings growth rate for the current fiscal year. These include Nvidia NVDA, MicroStrategy Incorporated MSTR, Meta Platforms META, DraftKings Inc. DKNG and MongoDB Inc. MDB.

The outstanding performance can be attributed to several factors.

Strong Performance of Tech Stocks: Being tech-heavy, the index mostly benefited from the significant growth of major tech companies as investors rushed to these stocks in search for strong balance sheets, durable revenue streams and stable cash flows amid the banking crisis.

Excitement Around Artificial Intelligence (AI): The rise of AI technologies has created a wave of excitement among investors, which has propelled the Nasdaq index after a tough 2022.

Rate Hike Pause: Hopes that the Fed is nearing the end of its interest rate-hike cycle has provided a boost to the index. Powell, in the latest Fed meeting, kept interest rates steady in the range of 5% to 5.25%, marking a pause after 10 consecutive rate hikes. As the tech sector relies on borrowing for superior growth, it is cheaper to borrow more money for further initiatives when interest rates are low.

Positive Analyst Ratings and Outlooks: The potential for continued growth is supported by positive analyst ratings and price targets for several Nasdaq-listed companies.

Diversified Sectors and Industries: The Nasdaq’s strong performance is not solely dependent on tech stocks. There are signs that the rally has broadened, with previously unloved corners of the market, such as small-caps and cyclical names, starting to climb.

Best Stocks of Nasdaq

Nvidia is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. The stock has skyrocketed more than 179% this year so far, and its earnings are expected to grow 129.3% for the fiscal year ending January 2024.

Nvidia has a Zacks Rank #1 (Strong Buy) and a Momentum Score of B. You can see the complete list of today’s Zacks #1 Rank stocks here.

MicroStrategy is a leading worldwide provider of business intelligence software. The stock has soared more than 140% this year so far.

MicroStrategy has an estimated earnings growth rate of 124.9% for this year. It has a Zacks Rank #1 and a Growth Score of A.

Meta Platforms is the world’s largest social media platform. The company’s portfolio offering evolved from a single Facebook app to multiple apps like photo and video sharing apps, Instagram and WhatsApp owing to acquisitions. The stock has surged nearly 134% so far this year.

META has an expected earnings growth rate of 21.4% for this year and has a Zacks Rank #2. It carries a solid Growth Score of B.

DraftKings is a digital sports entertainment and gaming company created to fuel the competitive spirits of sports fans with products that range across daily fantasy, regulated gaming and digital media. The stock has climbed 130.6% this year so far.

DraftKings has an estimated earnings growth rate of 40.8% for this year. The stock carries a Zacks Rank #2 and has a Momentum Score of B.

MongoDB provides a general purpose database platform. Its products include MongoDB Enterprise Advanced, MongoDB Enterprise for OEM, MongoDB Professional, MongoDB Stitch, MongoDB Atlas, Development Support, Ops Manager, Cloud Manager, Compass, Connector for business intelligence and Connector for Spark. The stock has risen about 105% this year so far.

MongoDB is expected to see earnings growth of 86.4% for the fiscal year ending January 2024 and has a Zacks Rank #2. It has a solid Growth Score of A.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

MMS • RSS

Someone with a lot of money to spend has taken a bullish stance on MongoDB MDB.

And retail traders should know.

We noticed this today when the big position showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don’t know. But when something this big happens with MDB, it often means somebody knows something is about to happen.

So how do we know what this whale just did?

Today, Benzinga‘s options scanner spotted 20 uncommon options trades for MongoDB.

This isn’t normal.

The overall sentiment of these big-money traders is split between 55% bullish and 45%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $159,105, and 16 are calls, for a total amount of $986,561.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $500.0 for MongoDB over the last 3 months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for MongoDB options trades today is 395.88 with a total volume of 2,977.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for MongoDB’s big money trades within a strike price range of $70.0 to $500.0 over the last 30 days.

MongoDB Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| MDB | CALL | SWEEP | BULLISH | 07/21/23 | $420.00 | $124.0K | 241 | 0 |

| MDB | CALL | TRADE | BEARISH | 01/19/24 | $500.00 | $115.3K | 802 | 0 |

| MDB | CALL | TRADE | BEARISH | 06/30/23 | $300.00 | $110.9K | 33 | 0 |

| MDB | CALL | SWEEP | BULLISH | 06/30/23 | $400.00 | $82.6K | 544 | 174 |

| MDB | CALL | SWEEP | BEARISH | 07/07/23 | $415.00 | $76.5K | 135 | 187 |

Where Is MongoDB Standing Right Now?

- With a volume of 857,982, the price of MDB is up 2.75% at $414.07.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 61 days.

What The Experts Say On MongoDB:

- Goldman Sachs has decided to maintain their Buy rating on MongoDB, which currently sits at a price target of $420.

- Oppenheimer has decided to maintain their Outperform rating on MongoDB, which currently sits at a price target of $430.

- Canaccord Genuity has decided to maintain their Buy rating on MongoDB, which currently sits at a price target of $410.

- Wedbush downgraded its action to Outperform with a price target of $410

- Truist Securities has decided to maintain their Buy rating on MongoDB, which currently sits at a price target of $365.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for MongoDB, Benzinga Pro gives you real-time options trades alerts.

MMS • RSS

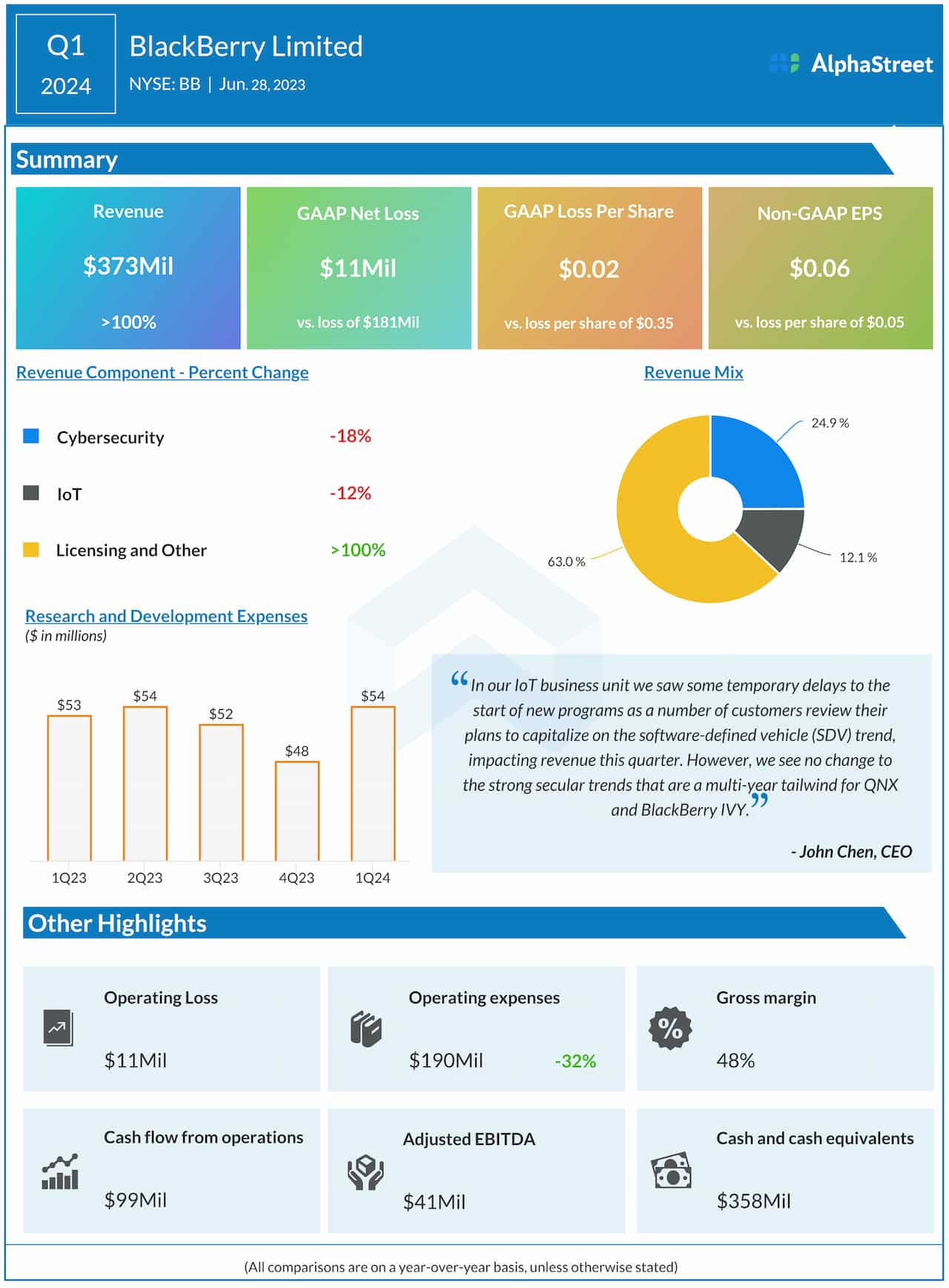

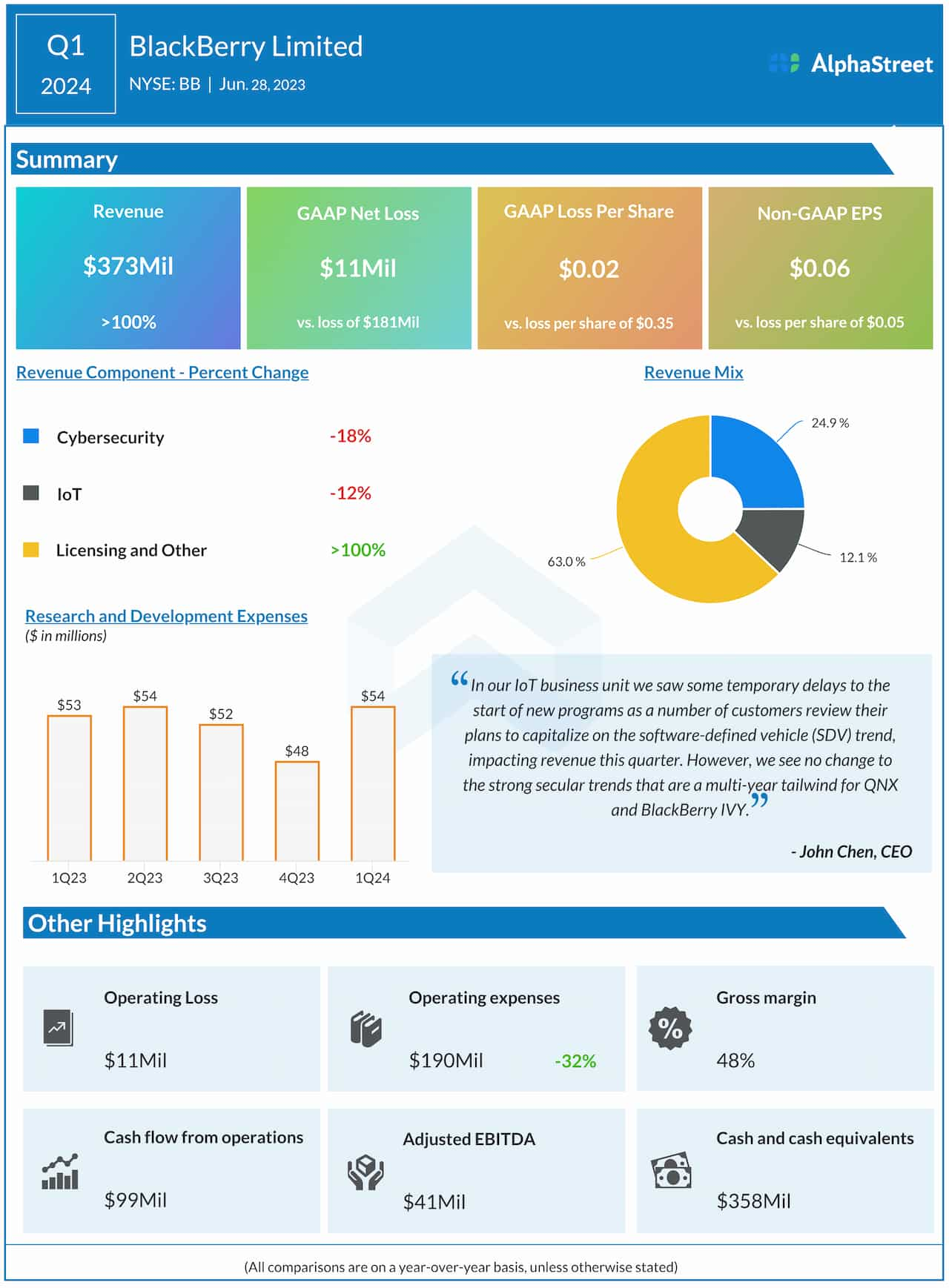

BlackBerry Limited (NYSE: BB) has reported a profit for the first quarter of 2024, on an adjusted basis, compared to a loss last year. The tech firm’s revenues more than doubled during the quarter.

Total revenues increased sharply to $373 million in the first quarter from $168 million in the corresponding period of 2023. A sharp increase in Licensing & Other revenue more than offset weakness in the other businesses.

The company reported adjusted earnings of $0.06 per share for the quarter, compared to an adjusted loss of $0.05 per share a year earlier. On an unadjusted basis, it was a net loss of $11 million or $0.02 per share, compared to a loss of $181 million or $0.35 per share in the first quarter of 2023.

“This quarter we delivered sequential revenue growth in our Cybersecurity business unit. Revenue growth was driven by a year-over-year increase in billings and pipeline, anchored on strength in our core verticals, particularly government,” said John Chen, CEO of BlackBerry.

Prior Performance

MMS • Ben Linders

The QCon New York 2023 track Staff+ Engineering: New Skills, New Challenges comprised four talks that went into decisions with buy-in, growing people, the art of staff+, and deciding between individual contributions and leading people.

John Riviello gave a talk about the decision buy-in algorithm.

Challenges of big decisions are how to decide and who will decide, Riviello said. Options are to ask the most senior engineer, do an equal democratic vote, or use the wisdom of the crowds. Research has shown that the merging of multiple independent judgments tends to lead to better decisions than individual experts, he said.

If there’s an opinion presented upfront, like an expert answer, people tend to anchor their decision toward that, Riviello said. When there’s a disagreement, people interpret it as assuming that their own estimate is right and the other must be wrong.

Riviello presented the Analytic Hierarchy Process (AHP) which consists of a goal, criteria, and alternatives. You do pairwise comparisons and scoring for each criteria between the alternatives, based on how important the criteria are. AHP uses a fundamental scale for the intensity of importance.

When making a decision on what JavaScript framework to use, they used weighted criteria like community, performance, Redux compatibility, and developer productivity. They were able to evaluate three alternatives and come to a decision on what framework to use.

They did the priority scoring by having people share their pairwise comparison scores in-person at the same time, not anonymously as AHP suggested. The discussions that followed when different scores were suggested turned out to be very valuable, Riviello mentioned.

AHP clearly helped to make decisions and get buy-in, Riviello said. Using AHP helped to capture the motivation behind why a decision was made. Also, people got to learn about each other in the process. AHP does not make hard decisions less painful, Riviello mentioned.

It is important to follow the concept of nemawashi to build consensus openly, and not force consensus, Riviello said. Don’t hide the data when sharing the final decision, he advised.

Audrey Troutt gave a talk about Growing Others to Grow Yourself.

Troutt started out as a software developer, and grew to take on tech lead, manager, director, and VP roles all the way up to recently becoming a CTO. Through her own growth and many years of coaching software engineers and leaders she has developed a generic framework for thinking about growth that translates across companies. She shared that framework, along with other coaching advice about the challenges and surprising inflection points awaiting engineers at each growth point.

Troutt mentioned that it is really hard to grow into a new role when you are still holding on to what you were really good at and really loved doing in your previous role. Holding on too close to that will only hold you back from growing into a new role, she said.

By holding on to your previous responsibilities and skills, you are also depriving the people around you of an opportunity to grow and learn to master those skills and take on those responsibilities too, Troutt said. You can also become a bottleneck for your team this way. Troutt mentioned that at many stages of her career, she helped her team build the skills and expertise needed to do the thing that she was previously single-handedly owning, and that led to growth for her and her team.

As a tech leader you can become a force multiplier by creating clarity and direction for your teammates and coaching and supporting them to be successful, Troutt said. Teams that approach growth this way are often the most healthy, effective, and resilient, which is great for you, great for your business, and great for our industry as a whole, Troutt concluded.

David Grizzanti gave a talk titled The Creative Act: How Staff+ Is More Art Than Science.

He started his talk by mentioning that he has never been in a role managing people. At all career decision points, he was able to stay in a technical Individual Contributor (IC) role.

Grizzanti presented an example of a parallel track for management and engineers as they grow through their careers. He also discussed the four staff+ archetypes from Will Larson’s Staff Engineer book: Tech Lead, Architect, Solver, and Right Hand. The audience mostly fell into the Tech Lead, Architect, and Solver types but a few folks in the audience signaled they identify with multiple types. He mentioned that in all roles, everyone is a creator, even if you’re writing software. People might not feel like an artist but they are doing creative work.

When moving into a staff+ role, Grizzanti discussed the struggles that Staff+ engineers often have and how these are similar to challenges faced by the more traditional artist. He suggested cultivating a beginner’s mindset to keep possibilities open. Ways to do this are asking questions, detaching from expert mode, or working with a beginner.

Grizzanti suggested frequently going for a walk, preferably without distractions like your phone. If he took his phone along, he would only use it to take notes about things that came up during the walk.

One of the big staff+ challenges is to lead without authority and get people to work with you. Co-elevation is key, Grizzanti said. Being friendly and approachable helps to build relationships. He suggested being an active listener and asking questions.

Grizzanti suggested doing peer mentoring by teaming up with colleagues who are in a similar position but with a different background or experience. It can complement your skillset and give you someone you can rubber duck with.

Michael Winslow presented Making the Decision to Be an Individual Contributor or a People Leader.

Winslow started as an individual contributor in 1998 with Basc and .Net, 10 years later he also started leading people. For him, that was “learning, and making mistakes, in management”.

When agile was introduced at the company without Scrum masters assigned, Winslow thought about how to organize the individual contributors in sprints to produce the software are a team.

When replacing his boss when he was on leave, Winslow got feedback that he was good at leading people. So he asked if he could get more management responsibility, although he felt he wasn’t ready yet to be a manager. Being personable doesn’t make you management material, Winslow said.

When Winslow became an organizational leader, his agenda filled up with meetings which left ample time for coding. As a leader, you can keep coding but leave the production code up to your teams. You can still create your own tools, status reports, bots, etc, Winslow said.

It’s ok to stay technical, but differently, once you start leading people, Winslow concluded. Every company is a tech company; try to find your passion in tech, he suggested.

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB) experienced a surge in unusual options trading activity on Wednesday, catching the attention of stock traders. A total of 23,831 put options were purchased, representing an increase of approximately 2,157% compared to the average daily volume of 1,056 put options.

This sudden surge in put options has piqued the curiosity of market observers. Put options are typically used by investors who believe that the stock price will decline. With such a significant increase in put option buying, it suggests that there may be some concerns or uncertainties surrounding MongoDB’s future performance.

Looking at recent activities from institutional investors and hedge funds may provide some insight into this unusual trading behavior. Skandinaviska Enskilda Banken AB publ and Lindbrook Capital LLC both increased their stakes in MongoDB during the fourth quarter of last year. This indicates confidence in the company’s prospects and may explain why institutional investors are not concerned about the surge in put option buying.

Principal Financial Group Inc., DekaBank Deutsche Girozentrale, and Los Angeles Capital Management LLC also increased their stakes in MongoDB during the same period. These moves suggest that these institutional investors have a positive outlook on the company’s future performance.

In terms of insider transactions, CAO Thomas Bull sold 605 shares of MongoDB stock on April 3rd for an average price of $228.34 per share. Director Hope F. Cochran also sold 1,175 shares on the same day for an average price of $228.33 per share. Insiders collectively sold 108,856 shares worth $27,327,511 in the last quarter alone.

Analysts have been closely following MongoDB’s stock performance as well. Guggenheim downgraded their rating from “neutral” to “sell,” citing valuation concerns and raising their target price to $210 per share. Credit Suisse Group dropped their price target from $305 to $250 but maintained an “outperform” rating. Meanwhile, KeyCorp increased their price target from $229 to $264 and gave the stock an “overweight” rating. Robert W. Baird raised their price target from $390 to $430, and William Blair reiterated their “outperform” rating.

Overall, despite the surge in put option buying and the mixed opinions from analysts, MongoDB remains a favorite among institutional investors who continue to increase their stakes in the company. It will be interesting to see how these various factors play out in the months ahead and whether investor sentiment towards MongoDB changes.

MongoDB (MDB): Unraveling the Complexity of Stock Movement and Financial Performance

In the world of finance, every twist and turn in the stock market can leave investors both perplexed and intrigued. Such complexity is evident in the case of MongoDB (NASDAQ:MDB), a technology company that has seen its shares make significant movements in recent times. On Thursday, MDB shares opened at an impressive $398.02, surprising many industry experts.

What makes this opening even more intriguing is when we delve into the company’s moving averages. It seems that MongoDB has been on an upward climb over the past few months, with a fifty-day moving average of $305.26 and a 200-day moving average of $243.01. These figures reflect a steady rise in the company’s stock price, indicating positive trends in investor sentiment.

However, it’s equally important to consider MDB’s 52-week low and high points, which provide a broader perspective on its stock performance. The fact that the company reached a low of $135.15 shows its resilience to bounce back from challenging periods, representing a testament to its stability. On the other hand, attaining a 52-week high of $414.48 demonstrates MDB’s potential for growth and profitability.

While these figures may seem perplexing to some, they offer deep insights into MongoDB’s financial standing. For instance, assessing its debt-to-equity ratio can shed light on how responsibly the company manages its finances. With a ratio of 1.44, it shows that MongoDB has established a healthy balance between debt and equity financing.

Moreover, analyzing quick ratios and current ratios allows us to evaluate MDB’s short-term liquidity position effectively. Both ratios stand at an identical 4.19 which signifies that not only does MongoDB possess adequate liquid assets but also maintains them at par with its current liabilities.

To gain further insight into MDB’s overall financial health, we turn our attention to its quarterly earnings results released on June 1st this year – an announcement eagerly anticipated by investors. The results revealed a noteworthy earnings per share (EPS) of $0.56, surpassing analysts’ estimates by a staggering $0.38. This outcome provides concrete evidence of MongoDB’s exceptional financial performance and its ability to outperform expectations.

Furthermore, the negative return on equity of 43.25% and negative net margin of 23.58% for this quarter may initially raise an eyebrow among shareholders. However, it is important to place these figures into context, considering the company’s aggressive growth strategy and its focus on expanding market share in the highly competitive technology sector.

The quarterly revenue figures add yet another layer to MDB’s perplexing nature. Generating $368.28 million during the period exceeded the consensus estimate of $347.77 million, illustrating consistent revenue growth for the company. In fact, comparing these results year-over-year shows a substantial 29% increase in MongoDB’s revenue – a remarkable accomplishment for any business.

As analysts continue to analyze MDB’s financial data holistically, projections are being made for future periods. Research analysts predict that MongoDB will post a rather unusual EPS of -2.85 for the current fiscal year. While these forecasts may seem counterintuitive at first glance, they reflect an informed anticipation of growing investments in research and development activities by the company.

In conclusion, MongoDB’s recent stock movement and quarterly earnings results have brought about both perplexity and excitement in the financial markets. As we piece together various financial metrics and market indicators, we gain a better understanding of MDB’s robustness as a business entity operating within today’s intricate technology landscape. Investors are left pondering whether this enigmatic stock might hold even more surprises in store as it continues on its upward trajectory towards success.

Source: [Reference Date]

Global Database As A Service Providers Market Size and Forecast | IBM, Beats, AWS, Ninox …

MMS • RSS

New Jersey, United States – The market research report offers an elaborate study of the Global Database As A Service Providers Market to help players prepare themselves well to tackle future growth challenges and ensure continued business expansion. With flawless analysis, in-depth research, and accurate forecasts, it provides easy-to-understand and reliable studies on the Global Database As A Service Providers market backed by statistics and calculations that have been finalized using a rigorous validation procedure. The report comes out as a comprehensive, all-embracing, and meticulously prepared resource that provides unique and deep information and data on the Global Database As A Service Providers market. The authors of the report have shed light on unexplored and significant market dynamics, including growth factors, restraints, trends, and opportunities.

The vendor landscape and competitive scenarios of the Global Database As A Service Providers market are broadly analyzed to help market players gain competitive advantage over their competitors. Readers are provided with detailed analysis of important competitive trends of the Global Database As A Service Providers market. Market players can use the analysis to prepare themselves for any future challenges well in advance. They will also be able to identify opportunities to attain a position of strength in the Global Database As A Service Providers market. Furthermore, the analysis will help them to effectively channelize their strategies, strengths, and resources to gain maximum advantage in the Global Database As A Service Providers market.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.verifiedmarketresearch.com/download-sample/?rid=160513

Key Players Mentioned in the Global Database As A Service Providers Market Research Report:

IBM, Beats, AWS, Ninox, Aiven, MongoDB Atlas, Zoho Creator, Azure, Kintone, Oracle, Google Cloud Bigtable

Global Database As A Service Providers Market Segmentation:

Database As A Service Providers Market, By Verticles

• Banking, Financial, Services, and Insurance (BFSI)

• Government and Defense

• Healthcare and Pharmaceuticals

• IT and Enterprises

• Telecommunication

• Retail

• Others (Incl. Energy, manufacturing, gaming and gambling, media and education)

Database As A Service Providers Market, By Database Type

• Structured Query Language (SQL)

• Not only Structured Query Language (NoSQL)

The report comes out as an accurate and highly detailed resource for gaining significant insights into the growth of different product and application segments of the Global Database As A Service Providers market. Each segment covered in the report is exhaustively researched about on the basis of market share, growth potential, drivers, and other crucial factors. The segmental analysis provided in the report will help market players to know when and where to invest in the Global Database As A Service Providers market. Moreover, it will help them to identify key growth pockets of the Global Database As A Service Providers market.

The geographical analysis of the Global Database As A Service Providers market provided in the report is just the right tool that competitors can use to discover untapped sales and business expansion opportunities in different regions and countries. Each regional and country-wise Global Database As A Service Providers market considered for research and analysis has been thoroughly studied based on market share, future growth potential, CAGR, market size, and other important parameters. Every regional market has a different trend or not all regional markets are impacted by the same trend. Taking this into consideration, the analysts authoring the report have provided an exhaustive analysis of specific trends of each regional Global Database As A Service Providers market.

Inquire for a Discount on this Premium Report @ https://www.verifiedmarketresearch.com/ask-for-discount/?rid=160513

What to Expect in Our Report?

(1) A complete section of the Global Database As A Service Providers market report is dedicated for market dynamics, which include influence factors, market drivers, challenges, opportunities, and trends.

(2) Another broad section of the research study is reserved for regional analysis of the Global Database As A Service Providers market where important regions and countries are assessed for their growth potential, consumption, market share, and other vital factors indicating their market growth.

(3) Players can use the competitive analysis provided in the report to build new strategies or fine-tune their existing ones to rise above market challenges and increase their share of the Global Database As A Service Providers market.

(4) The report also discusses competitive situation and trends and sheds light on company expansions and merger and acquisition taking place in the Global Database As A Service Providers market. Moreover, it brings to light the market concentration rate and market shares of top three and five players.

(5) Readers are provided with findings and conclusion of the research study provided in the Global Database As A Service Providers Market report.

Key Questions Answered in the Report:

(1) What are the growth opportunities for the new entrants in the Global Database As A Service Providers industry?

(2) Who are the leading players functioning in the Global Database As A Service Providers marketplace?

(3) What are the key strategies participants are likely to adopt to increase their share in the Global Database As A Service Providers industry?

(4) What is the competitive situation in the Global Database As A Service Providers market?

(5) What are the emerging trends that may influence the Global Database As A Service Providers market growth?

(6) Which product type segment will exhibit high CAGR in future?

(7) Which application segment will grab a handsome share in the Global Database As A Service Providers industry?

(8) Which region is lucrative for the manufacturers?

For More Information or Query or Customization Before Buying, Visit @ https://www.verifiedmarketresearch.com/product/database-as-a-service-providers-market/

About Us: Verified Market Research®

Verified Market Research® is a leading Global Research and Consulting firm that has been providing advanced analytical research solutions, custom consulting and in-depth data analysis for 10+ years to individuals and companies alike that are looking for accurate, reliable and up to date research data and technical consulting. We offer insights into strategic and growth analyses, Data necessary to achieve corporate goals and help make critical revenue decisions.

Our research studies help our clients make superior data-driven decisions, understand market forecast, capitalize on future opportunities and optimize efficiency by working as their partner to deliver accurate and valuable information. The industries we cover span over a large spectrum including Technology, Chemicals, Manufacturing, Energy, Food and Beverages, Automotive, Robotics, Packaging, Construction, Mining & Gas. Etc.

We, at Verified Market Research, assist in understanding holistic market indicating factors and most current and future market trends. Our analysts, with their high expertise in data gathering and governance, utilize industry techniques to collate and examine data at all stages. They are trained to combine modern data collection techniques, superior research methodology, subject expertise and years of collective experience to produce informative and accurate research.

Having serviced over 5000+ clients, we have provided reliable market research services to more than 100 Global Fortune 500 companies such as Amazon, Dell, IBM, Shell, Exxon Mobil, General Electric, Siemens, Microsoft, Sony and Hitachi. We have co-consulted with some of the world’s leading consulting firms like McKinsey & Company, Boston Consulting Group, Bain and Company for custom research and consulting projects for businesses worldwide.

Contact us:

Mr. Edwyne Fernandes

Verified Market Research®

US: +1 (650)-781-4080

UK: +44 (753)-715-0008

APAC: +61 (488)-85-9400

US Toll-Free: +1 (800)-782-1768

Email: sales@verifiedmarketresearch.com

Website:- https://www.verifiedmarketresearch.com/

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB – Free Report) shares reached a new 52-week high during trading on Wednesday after Tigress Financial raised their price target on the stock from $365.00 to $490.00. The stock traded as high as $413.63 and last traded at $405.50, with a volume of 682943 shares. The stock had previously closed at $388.34.

MongoDB, Inc. (NASDAQ:MDB – Free Report) shares reached a new 52-week high during trading on Wednesday after Tigress Financial raised their price target on the stock from $365.00 to $490.00. The stock traded as high as $413.63 and last traded at $405.50, with a volume of 682943 shares. The stock had previously closed at $388.34.

Several other research analysts also recently commented on MDB. Capital One Financial assumed coverage on shares of MongoDB in a report on Monday. They issued an “equal weight” rating and a $396.00 price objective for the company. Citigroup lifted their price objective on shares of MongoDB from $363.00 to $430.00 in a report on Friday, June 2nd. William Blair reaffirmed an “outperform” rating on shares of MongoDB in a report on Friday, June 2nd. Royal Bank of Canada lifted their price objective on shares of MongoDB from $400.00 to $445.00 in a report on Friday, June 23rd. Finally, Barclays lifted their price objective on shares of MongoDB from $374.00 to $421.00 in a report on Monday. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating and twenty-one have given a buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of “Moderate Buy” and a consensus price target of $366.30.

Insider Buying and Selling at MongoDB

In other news, Director Hope F. Cochran sold 1,175 shares of MongoDB stock in a transaction dated Monday, April 3rd. The shares were sold at an average price of $228.33, for a total transaction of $268,287.75. Following the sale, the director now owns 9,437 shares of the company’s stock, valued at approximately $2,154,750.21. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, CAO Thomas Bull sold 605 shares of MongoDB stock in a transaction dated Monday, April 3rd. The shares were sold at an average price of $228.34, for a total transaction of $138,145.70. Following the sale, the chief accounting officer now owns 17,706 shares of the company’s stock, valued at approximately $4,042,988.04. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Hope F. Cochran sold 1,175 shares of MongoDB stock in a transaction dated Monday, April 3rd. The shares were sold at an average price of $228.33, for a total transaction of $268,287.75. Following the sale, the director now directly owns 9,437 shares in the company, valued at approximately $2,154,750.21. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 108,856 shares of company stock worth $27,327,511. 4.80% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On MongoDB

Several hedge funds have recently bought and sold shares of the business. Empower Advisory Group LLC bought a new stake in MongoDB during the first quarter worth about $7,302,000. Toroso Investments LLC boosted its stake in MongoDB by 5.4% during the first quarter. Toroso Investments LLC now owns 2,827 shares of the company’s stock worth $659,000 after acquiring an additional 144 shares in the last quarter. B. Riley Wealth Advisors Inc. boosted its stake in MongoDB by 16.0% during the first quarter. B. Riley Wealth Advisors Inc. now owns 1,457 shares of the company’s stock worth $340,000 after acquiring an additional 201 shares in the last quarter. AM Squared Ltd boosted its stake in MongoDB by 33.3% during the first quarter. AM Squared Ltd now owns 1,200 shares of the company’s stock worth $280,000 after acquiring an additional 300 shares in the last quarter. Finally, Kayne Anderson Rudnick Investment Management LLC boosted its stake in MongoDB by 31.5% during the first quarter. Kayne Anderson Rudnick Investment Management LLC now owns 208,455 shares of the company’s stock worth $48,595,000 after acquiring an additional 49,900 shares in the last quarter. Institutional investors own 89.22% of the company’s stock.

MongoDB Price Performance

The company has a debt-to-equity ratio of 1.44, a current ratio of 4.19 and a quick ratio of 4.19. The firm’s 50 day moving average is $308.79 and its 200 day moving average is $244.13. The firm has a market cap of $28.22 billion, a P/E ratio of -86.29 and a beta of 1.04.

MongoDB (NASDAQ:MDB – Free Report) last issued its earnings results on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.18 by $0.38. The firm had revenue of $368.28 million for the quarter, compared to the consensus estimate of $347.77 million. MongoDB had a negative net margin of 23.58% and a negative return on equity of 43.25%. The business’s revenue was up 29.0% on a year-over-year basis. During the same quarter in the prior year, the firm posted ($1.15) earnings per share. As a group, analysts anticipate that MongoDB, Inc. will post -2.85 earnings per share for the current year.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.