Month: July 2023

MMS • RSS

Amalgamated Bank raised its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.3% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 7,656 shares of the company’s stock after purchasing an additional 98 shares during the quarter. Amalgamated Bank’s holdings in MongoDB were worth $1,785,000 at the end of the most recent quarter.

Amalgamated Bank raised its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.3% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 7,656 shares of the company’s stock after purchasing an additional 98 shares during the quarter. Amalgamated Bank’s holdings in MongoDB were worth $1,785,000 at the end of the most recent quarter.

Other hedge funds have also recently bought and sold shares of the company. Vanguard Group Inc. increased its position in shares of MongoDB by 2.1% during the 1st quarter. Vanguard Group Inc. now owns 5,970,224 shares of the company’s stock valued at $2,648,332,000 after purchasing an additional 121,201 shares during the period. Franklin Resources Inc. increased its stake in MongoDB by 6.4% during the fourth quarter. Franklin Resources Inc. now owns 1,962,574 shares of the company’s stock valued at $386,313,000 after acquiring an additional 118,055 shares during the period. State Street Corp increased its stake in MongoDB by 1.8% during the third quarter. State Street Corp now owns 1,349,260 shares of the company’s stock valued at $267,909,000 after acquiring an additional 23,846 shares during the period. 1832 Asset Management L.P. grew its stake in shares of MongoDB by 3,283,771.0% in the 4th quarter. 1832 Asset Management L.P. now owns 1,018,000 shares of the company’s stock valued at $200,383,000 after purchasing an additional 1,017,969 shares during the period. Finally, Geode Capital Management LLC boosted its holdings in shares of MongoDB by 4.5% in the 4th quarter. Geode Capital Management LLC now owns 931,748 shares of the company’s stock worth $183,193,000 after acquiring an additional 39,741 shares in the last quarter. Institutional investors and hedge funds own 89.22% of the company’s stock.

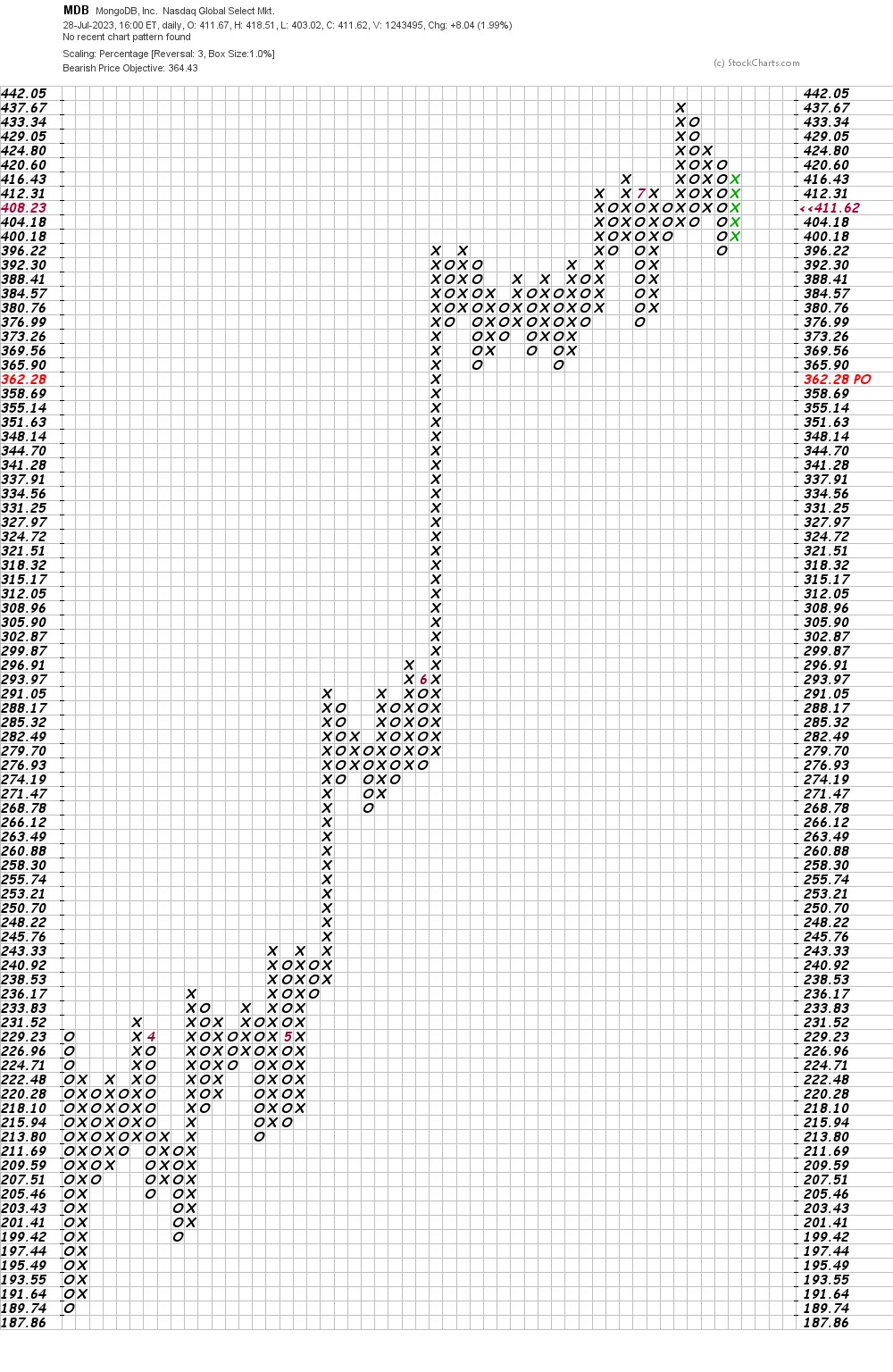

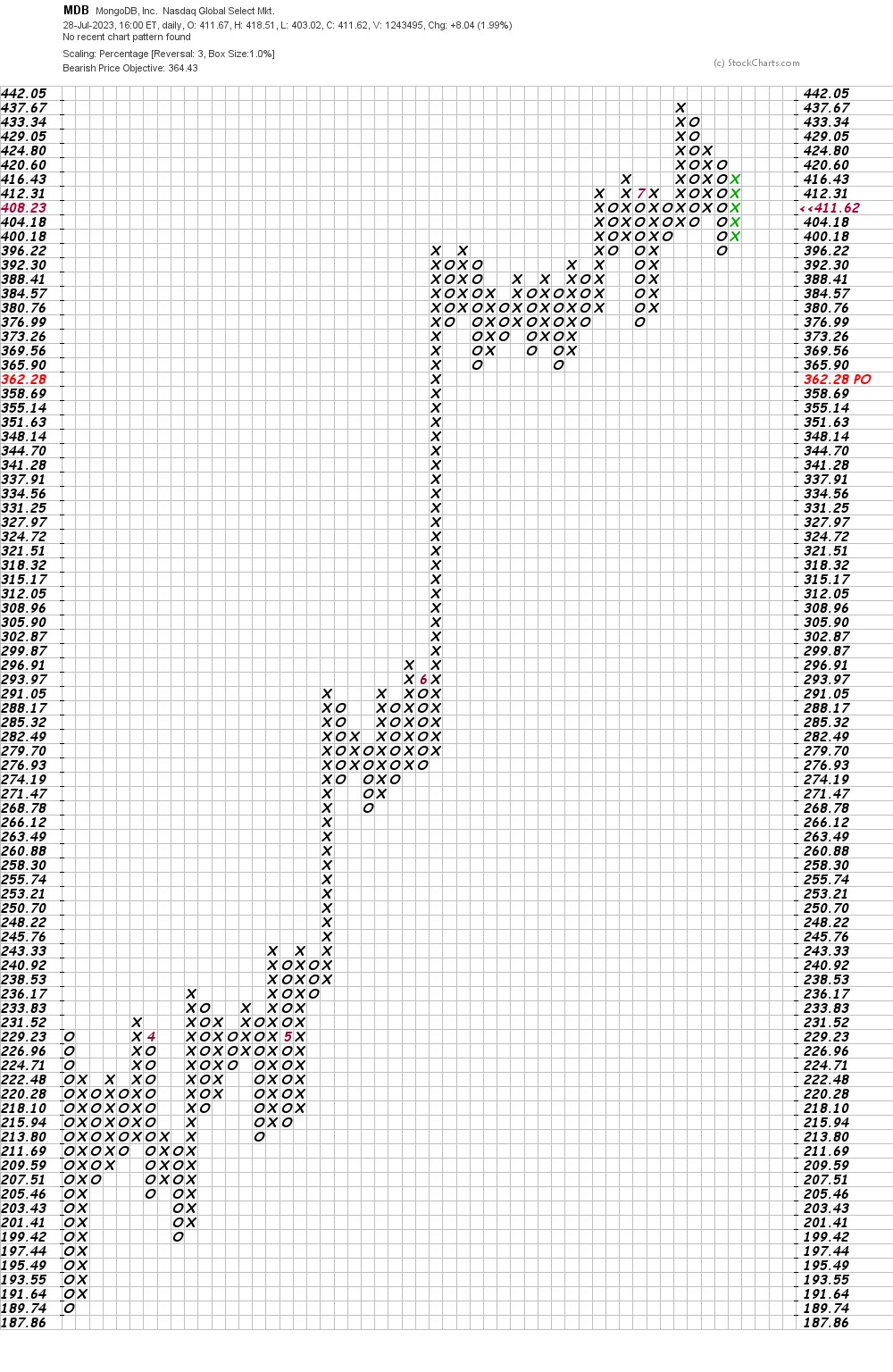

MongoDB Stock Performance

Shares of MDB opened at $411.62 on Monday. MongoDB, Inc. has a 1 year low of $135.15 and a 1 year high of $439.00. The company’s 50 day simple moving average is $375.55 and its 200 day simple moving average is $276.47. The company has a market capitalization of $29.05 billion, a price-to-earnings ratio of -88.14 and a beta of 1.13. The company has a debt-to-equity ratio of 1.44, a quick ratio of 4.19 and a current ratio of 4.19.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.18 by $0.38. The company had revenue of $368.28 million during the quarter, compared to analyst estimates of $347.77 million. MongoDB had a negative net margin of 23.58% and a negative return on equity of 43.25%. The business’s quarterly revenue was up 29.0% compared to the same quarter last year. During the same quarter in the prior year, the business earned ($1.15) earnings per share. On average, sell-side analysts predict that MongoDB, Inc. will post -2.8 EPS for the current year.

Insider Transactions at MongoDB

In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the firm’s stock in a transaction dated Tuesday, July 18th. The shares were sold at an average price of $420.00, for a total transaction of $420,000.00. Following the transaction, the director now owns 1,213,159 shares of the company’s stock, valued at approximately $509,526,780. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. In related news, CAO Thomas Bull sold 516 shares of the firm’s stock in a transaction that occurred on Monday, July 3rd. The shares were sold at an average price of $406.78, for a total transaction of $209,898.48. Following the completion of the sale, the chief accounting officer now directly owns 17,190 shares in the company, valued at $6,992,548.20. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Dwight A. Merriman sold 1,000 shares of MongoDB stock in a transaction that occurred on Tuesday, July 18th. The shares were sold at an average price of $420.00, for a total transaction of $420,000.00. Following the completion of the sale, the director now owns 1,213,159 shares of the company’s stock, valued at $509,526,780. The disclosure for this sale can be found here. In the last three months, insiders have sold 116,427 shares of company stock worth $41,304,961. 4.80% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

MDB has been the topic of a number of analyst reports. Citigroup increased their price target on MongoDB from $363.00 to $430.00 in a research note on Friday, June 2nd. The Goldman Sachs Group boosted their price objective on MongoDB from $420.00 to $440.00 in a report on Friday, June 23rd. Royal Bank of Canada boosted their price target on MongoDB from $400.00 to $445.00 in a research note on Friday, June 23rd. Morgan Stanley boosted their price objective on shares of MongoDB from $270.00 to $440.00 in a research report on Friday, June 23rd. Finally, Oppenheimer boosted their price objective on shares of MongoDB from $270.00 to $430.00 in a research report on Friday, June 2nd. One investment analyst has rated the stock with a sell rating, three have given a hold rating and twenty have given a buy rating to the company. According to MarketBeat, the stock has an average rating of “Moderate Buy” and an average target price of $378.09.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Amalgamated Bank raised its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.3% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 7,656 shares of the company’s stock after purchasing an additional 98 shares during the quarter. Amalgamated Bank’s holdings in MongoDB were worth $1,785,000 at the end of the most recent quarter.

Amalgamated Bank raised its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.3% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 7,656 shares of the company’s stock after purchasing an additional 98 shares during the quarter. Amalgamated Bank’s holdings in MongoDB were worth $1,785,000 at the end of the most recent quarter.

Other hedge funds have also recently bought and sold shares of the company. Vanguard Group Inc. increased its position in shares of MongoDB by 2.1% during the 1st quarter. Vanguard Group Inc. now owns 5,970,224 shares of the company’s stock valued at $2,648,332,000 after purchasing an additional 121,201 shares during the period. Franklin Resources Inc. increased its stake in MongoDB by 6.4% during the fourth quarter. Franklin Resources Inc. now owns 1,962,574 shares of the company’s stock valued at $386,313,000 after acquiring an additional 118,055 shares during the period. State Street Corp increased its stake in MongoDB by 1.8% during the third quarter. State Street Corp now owns 1,349,260 shares of the company’s stock valued at $267,909,000 after acquiring an additional 23,846 shares during the period. 1832 Asset Management L.P. grew its stake in shares of MongoDB by 3,283,771.0% in the 4th quarter. 1832 Asset Management L.P. now owns 1,018,000 shares of the company’s stock valued at $200,383,000 after purchasing an additional 1,017,969 shares during the period. Finally, Geode Capital Management LLC boosted its holdings in shares of MongoDB by 4.5% in the 4th quarter. Geode Capital Management LLC now owns 931,748 shares of the company’s stock worth $183,193,000 after acquiring an additional 39,741 shares in the last quarter. Institutional investors and hedge funds own 89.22% of the company’s stock.

MongoDB Stock Performance

Shares of MDB opened at $411.62 on Monday. MongoDB, Inc. has a 1 year low of $135.15 and a 1 year high of $439.00. The company’s 50 day simple moving average is $375.55 and its 200 day simple moving average is $276.47. The company has a market capitalization of $29.05 billion, a price-to-earnings ratio of -88.14 and a beta of 1.13. The company has a debt-to-equity ratio of 1.44, a quick ratio of 4.19 and a current ratio of 4.19.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.18 by $0.38. The company had revenue of $368.28 million during the quarter, compared to analyst estimates of $347.77 million. MongoDB had a negative net margin of 23.58% and a negative return on equity of 43.25%. The business’s quarterly revenue was up 29.0% compared to the same quarter last year. During the same quarter in the prior year, the business earned ($1.15) earnings per share. On average, sell-side analysts predict that MongoDB, Inc. will post -2.8 EPS for the current year.

Insider Transactions at MongoDB

In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the firm’s stock in a transaction dated Tuesday, July 18th. The shares were sold at an average price of $420.00, for a total transaction of $420,000.00. Following the transaction, the director now owns 1,213,159 shares of the company’s stock, valued at approximately $509,526,780. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. In related news, CAO Thomas Bull sold 516 shares of the firm’s stock in a transaction that occurred on Monday, July 3rd. The shares were sold at an average price of $406.78, for a total transaction of $209,898.48. Following the completion of the sale, the chief accounting officer now directly owns 17,190 shares in the company, valued at $6,992,548.20. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Dwight A. Merriman sold 1,000 shares of MongoDB stock in a transaction that occurred on Tuesday, July 18th. The shares were sold at an average price of $420.00, for a total transaction of $420,000.00. Following the completion of the sale, the director now owns 1,213,159 shares of the company’s stock, valued at $509,526,780. The disclosure for this sale can be found here. In the last three months, insiders have sold 116,427 shares of company stock worth $41,304,961. 4.80% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

MDB has been the topic of a number of analyst reports. Citigroup increased their price target on MongoDB from $363.00 to $430.00 in a research note on Friday, June 2nd. The Goldman Sachs Group boosted their price objective on MongoDB from $420.00 to $440.00 in a report on Friday, June 23rd. Royal Bank of Canada boosted their price target on MongoDB from $400.00 to $445.00 in a research note on Friday, June 23rd. Morgan Stanley boosted their price objective on shares of MongoDB from $270.00 to $440.00 in a research report on Friday, June 23rd. Finally, Oppenheimer boosted their price objective on shares of MongoDB from $270.00 to $430.00 in a research report on Friday, June 2nd. One investment analyst has rated the stock with a sell rating, three have given a hold rating and twenty have given a buy rating to the company. According to MarketBeat, the stock has an average rating of “Moderate Buy” and an average target price of $378.09.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

MongoDB Inc. (MDB) received a new outperform (buy) recommendation at a sell side firm here on Monday. Let’s review the charts and indicators of the database platform provider to see the best strategy for MongoDB’s stock from here.

MMS • RSS

MongoDB Inc. (MDB) received a new outperform (buy) recommendation at a sell side firm here on Monday. Let’s review the charts and indicators of the database platform provider to see the best strategy for MongoDB’s stock from here.

MMS • Arthur Casals

Earlier this month, Microsoft released the sixth preview of .NET 8. The new version of the framework, expected to be released later this year, will be a Long Term Support (LTS) release. This preview brings performance improvements and features such as a new WASM mode, more source generators, library updates, and NativeAOT support on iOS.

One of the most important features in this preview is related to the System.Text.Json source generator. Native AOT gets a significant boost, aiming to align it with the capabilities of reflection-based serializers. Among the improvements are the enhanced caching for the incremental generator, ensuring smoother IDE performance for large projects. The formatting of source-generated code was also refined, and new diagnostic warnings were added to the generator. Other improvements include fixing a number of bugs, including the ones related to supporting recursive collection types and nullable structs.

The introduction of JsonStringEnumConverter provides a complementary feature to the existing JsonStringEnumConverter class. Also, the new nullable property JsonConverter.Type allows developers to query for the type of a non-generic JsonConverter instance. This release also brings new overloads for ZipFile methods, emphasizing efficient disk usage.

There were also relevant enhancements in source generators and logging. The new options validation source generator is aimed at reducing startup overhead and improving the validation feature set. The LoggerMessageAttribute constructor also received new overloads for additional flexibility. The source generator to provide AOT configuration in ASP.NET Core, introduced in Preview 3, was also improved.

Other features in this release include more accurate metric and timestamp recordings in MetricCollector (formerly InstrumentRecorder), a new source generator for COM interoperability, support for the SHA-3 primitives, and changes to the generated image defaults for .NET 8 apps aimed at security and performance. The new HybridGlobalization mode on WASM allows globalization data to be partially pulled from ICU bundle and partially from calls into JS, leveraging the Web API and providing a lighter ICU bundle.

Finally, it is now possible to target iOS-like platforms with NativeAOT. Both .NET iOS and MAUI applications can now be built and run on ios, iossimulator, maccatalyst, tvos, and tvossimulator systems, opening up new opportunities for better performance and size savings. It is important to notice, however, that this feature is currently only available as an opt-in feature. Mono is still the default runtime choice for app development and deployment.

You can also find other improvements related to ASP.NET Core in this preview here. .NET 8 Preview 6 is available for Linux, macOS, and Windows.

MMS • Daniel Dominguez

Amazon announced the release of agents for Amazon Bedrock, a new feature that allows developers to quickly create fully managed agents. By performing API calls to enterprise systems, agents for Amazon Bedrock speed up the release of generative AI applications that can manage and carry out activities. Agents go beyond Foundation Models to comprehend user requests, decompose difficult activities into manageable steps, carry on a discussion to gather further details, and take appropriate actions to complete the request.

Agents for Amazon Bedrock streamline the prompt engineering and orchestration of user-requested tasks. Once set up, these agents autonomously construct prompts and enhance them securely with company-specific data, delivering natural language responses to users. These advanced agents possess the ability to deduce the necessary actions for processing user requests automatically. They break down tasks into multiple steps, orchestrate sequences of API calls and data lookups, and retain memory to effectively fulfill actions on behalf of the user.

In Amazon Bedrock, fully managed agents eliminate the requirement for infrastructure management or provisioning. Without writing any new code, users may easily take advantage of complete monitoring, encryption, user rights, and control of API invocation support. The Bedrock console or SDK makes it simple for developers to upload the API schema. The agent then successfully coordinates tasks with FMs and uses AWS Lambda functions to efficiently carry out API calls.

Generative AI has captured our imaginations for its ability to create images and videos and even generate code, and I believe it will transform every application, industry and business, said Swami Sivasubramanian, VP of databases, analytics and ML at AWS.

Amazon has developed the AI models powering agents internally, but they have also added models from third-party companies like Anthropic, Stability AI, and Cohere to the Bedrock library. Agents securely connect a foundation model to the right data source through a simple API. The agent can also be used to help automatically convert data into machine-readable format.

Several other tech companies are actively developing agents as well. Meta expressed the potential of bringing AI agents to billions of people. Additionally, OpenAI discussed the topic of AI agents and pondered the best approach to their creation.

MMS • Robert Krzaczynski

Auth0 Templates for .NET offers pre-built project templates with integrated Auth0 support for authentication and authorization. Current templates include ASP.NET Core MVC, ASP.NET Core Web API, Blazor Server, and Blazor WebAssembly (hosted on ASP.NET Core) applications for the .NET 7 platform. The development process is simplified, enabling the creation of Auth0-integrated .NET projects through familiar approaches from built-in templates. The project is open-source.

The Auth0 Templates for the .NET project guarantee seamless compatibility across different development environments and operating systems. It is possible to use these templates with the preferred development tools. To install the Auth0 Templates for the .NET NuGet package, it is necessary to run the following command in a terminal window:

dotnet new install Auth0.Templates::2.0.0

Before using the Auth0 templates, some preliminary steps are required. Firstly, it is necessary to register an application with Auth0 and have all the necessary configuration settings. To integrate your application, an Auth0 account is required, which can be obtained by creating a free account. After this, it is needed to register an application or API in the Auth0 dashboard, which will provide the necessary data used when configuring an application with templates. This data includes the Auth0 domain, customer ID, customer secret key, and API ID or recipients. After obtaining this data, an application can be created using the Auth0 templates.

The templates installed with the above command are available from IDE or .NET CLI. There is a possibility to get the list of available Auth0 templates using the command:

dotnet new list auth0

After executing this command, the following list will be displayed:

List of templates (Source: auth0 blog)

The community reacts positively to Auth0 Templates for .NET. Among others, one of the Reddit users wrote:

This is great, will try it out. I combined an Auth0 template with a VS one using the React template auth0-react-netcoreapi

This is the first release of the Auth0 Templates for .NET package, but there are plans to add new templates and improve the developer experience as well. The project is open-source and the contribution policy is available. There is an opportunity to apply for the development of the tool.

Quantinno Capital Management LP Reduces Holdings in MongoDB, Inc. Shares – Best Stocks

MMS • RSS

Quantinno Capital Management LP, a prominent institutional investor, has made significant reductions in its holdings of MongoDB, Inc. (NASDAQ:MDB) shares during the first quarter of this year. According to the company’s recent disclosure with the Securities and Exchange Commission (SEC), Quantinno Capital Management LP sold 3,156 shares of MongoDB, representing a decrease of 36.5% in their overall investment. As a result of these transactions, the institutional investor now possesses 5,491 shares of MongoDB stock worth $1,280,000 as at the end of the reporting period.

MongoDB, Inc. is a global provider of a versatile database platform. The company offers various products such as MongoDB Atlas – a multi-cloud database-as-a-service solution hosted by MongoDB; MongoDB Enterprise Advanced – a commercial database server designed for enterprise customers that can be deployed either on-premise or in hybrid cloud environments; and Community Server – an open-source version featuring essential functionalities aimed at assisting developers in starting projects on the MongoDB platform.

Several research firms have voiced their opinions on MDB stock. Notably, Robert W. Baird increased their target price from $390.00 to $430.00 per share in a research note issued on June 23rd. Tigress Financial also raised their target price from $365.00 to $490.00 per share in another research note dated June 28th. Capital One Financial initiated coverage on MongoDB with an “equal weight” rating and set a target price of $396.00 per share on June 26th. Oppenheimer raised their target price from $270.00 to $430.00 per share on June 2nd while Citigroup also increased theirs from $363.00 to $430.00 per share on the same day.

With regards to analysts’ ratings, one analyst has given MDB stock a sell rating, three analysts have assigned it a hold rating, and a substantial twenty analysts have assigned it a buy rating. According to data from Bloomberg.com, the stock currently holds an average rating of “Moderate Buy” with a consensus target price of $378.09.

These recent developments in Quantinno Capital Management LP’s holdings of MongoDB underscore the dynamic nature of institutional investing. Investors are perpetually making tactical decisions to adjust their portfolio composition based on various factors such as market conditions, company prospects, and industry trends. As these high-stakes decisions take place, it is essential for both institutional investors and individual shareholders alike to stay informed and vigilant to make well-informed investment choices.

Date: July 30, 2023.

Hedge Funds and Institutional Investors Show Confidence in MongoDB’s Growth Potential

July 30, 2023 – In a recent turn of events, several hedge funds and institutional investors have made significant changes to their positions in MongoDB, Inc. (NASDAQ:MDB). This comes as the company continues to dominate the market with its general-purpose database platform that offers cutting-edge solutions to businesses worldwide.

Among these notable investors is Bessemer Group Inc., who purchased a new position in MongoDB during the fourth quarter of 2022, amounting to approximately $29,000. Similarly, BI Asset Management Fondsmaeglerselskab A S acquired a new position worth about $30,000 during the same period. These strategic moves highlight the confidence that these financial powerhouses have in MongoDB’s potential for future growth and profitability.

Another significant player in this arena is Lindbrook Capital LLC, which recently increased its holdings in MongoDB by an impressive 350.0% during the fourth quarter. As a result, Lindbrook Capital now owns 171 shares of the company’s stock valued at $34,000 after purchasing an additional 133 shares. This move showcases Lindbrook Capital’s belief in MongoDB’s ability to generate substantial returns for its investors.

Y.D. More Investments Ltd also joined the ranks of investors purchasing a new position in MongoDB during the fourth quarter, with an investment totaling around $36,000. Additionally, CI Investments Inc., renowned for its astute investment strategies, boosted its holdings in MongoDB by 126.8% during the same period by acquiring an additional 104 shares worth $37,000. Collectively, these institutional investors held ownership of approximately 89.22% of MongoDB’s stock at that time.

In other news related to the company’s leadership team and insiders’ activities, CEO Dev Ittycheria recently sold 50,000 shares of MDB stock on Wednesday, July 5th. The transaction was carried out at an average price of $407.07 per share, amounting to a total value of $20,353,500.00. Following this sale, Ittycheria now possesses 218,085 shares of MongoDB’s stock valued at $88,775,860.95.

Similarly, Director Dwight A. Merriman sold 2,000 shares of MongoDB’s stock on Thursday, May 4th at an average price of $240.00 per share, totaling $480,000.00. Merriman’s current holdings include 1,223,954 shares valued at an impressive $293,748,960.

These recent insider transactions highlight the confidence that both Ittycheria and Merriman have in MongoDB’s long-term prospects and growth potential. Moreover, it demonstrates their commitment to maximizing shareholder value while maintaining transparency through proper legal filings with the U.S Securities and Exchange Commission (SEC).

Notably, a total of 116,427 shares were sold by insiders in the last ninety days alone. These transactions amounted to a staggering $41,304 ,961 worth of company stock changing hands among corporate insiders during that period.

Turning our attention to MongoDB’s market performance on July 28th; shares traded at NASDAQ:MDB witnessed an increase of $2.69 and closed at $406.27. The trading volume for the day stood at 481,319 shares compared to the company’s average daily volume of 1,744 ,642 shares.

It is crucial to note that over the past year MDB has showcased strong resilience and growth potential as its stock price reached new heights during this period. With a 52-week low of $135.15 and a 52-week high of $439.00 attained by the company’s share price recently; investors are keenly monitoring these developments as they weigh their investment decisions carefully.

At present,MongoDB has showcased impressive financial results with its latest quarterly earnings report issued on June 1st, 2023. The company reported earnings per share (EPS) of $0.56 for the quarter, surpassing analysts’ expectations by an impressive $0.38.

Furthermore, MongoDB’s revenue for the quarter amounted to a staggering $368.28 million compared to analysts’ estimates of $347.77 million, indicating a significant year-over-year increase of 29.0%. These results further substantiate MongoDB’s position as a leading provider of database solutions and reinforce investors’ confidence in the company’s future performance.

Looking ahead, industry experts anticipate that MongoDB will continue to showcase strong financial performance throughout the current fiscal year. Analysts project that it will post earnings per share (EPS) of -2.8 for this fiscal year, emphasizing the potential profitability and growth opportunities that lie ahead for both the company and its investors.

In conclusion, MongoDB continues to solidify its position as a prominent player in the database platform market globally. The recent investments made by various hedge funds and institutional investors attest to the company’s bright prospects and their belief in its ability to generate significant returns.

As MongoDB expands its product offerings with solutions like MongoDB Atlas and MongoDB Enterprise Advanced, it is well-positioned to cater to businesses’ evolving needs for reliable and innovative data management tools. With an

Top SaaStr Content for the Week with Creandum’s Partner, MongoDB, Founder’s Fund and lots more!

MMS • RSS

Each week, we round up our most popular content so you can catch up on anything you may have missed. Check out this week’s top blog posts, podcasts, and videos:

Top Blog Posts This Week:

Top Podcasts This Week:

1. SaaStr 678: Raising Capital in 2023: What You Really Need To Know with Creandum Partner Peter Specht

2. SaaStr 677: MongoDB at $1.5 BILLION in Revenue: An Epic Growth Story

3. SaaStr 676: CRO Confidential: How to Grow Revenue Faster in the Second Half of 2023. Hosted by Sam Blond, Partner at Founders Fund

4. SaaStr 675: Why You’re Unfundable in 2023: The Cold, Hard Truths About SaaS Part 2 with SaaStr CEO Jason Lemkin

5. SaaStr 674: The Cold, Hard Truths About SaaS In 2023: Part 1 AMA with SaaStr CEO and Founder, Jason Lemkin

Top Videos This Week:

1. From 2 Weeks of Runway to a $1.5B Valuation: The Founder Playbook with Loom’s CEO and Co-Founder

2. Why You’re Unfundable in 2023: The Cold, Hard Truths About SaaS Part 2 with SaaStr CEO Jason Lemkin

3. Raising Capital in 2023: What You Really Need To Know with Creandum Partner Peter Specht

4. Go to Market Strategies That Led To Divvy’s $2.5B Exit with Divvy’s Former CRO, Sterling Snow

5. Rippling CEO Parker Conrad’s Theory of the Compound Startup: Disrupting How We Think About Software

Microsoft Previews Azure Boost to Improve Remote Storage Throughput and IOPS Performance

MMS • Renato Losio

During the recent Inspire 2023 conference, Microsoft announced the preview of Azure Boost to improve remote storage throughput and IOPS performance. Separating the hypervisor and host OS functions from the host infrastructure, the new option allows up to 10 Gbps throughput and 400K IOPS.

The new system offloads virtualization processes traditionally performed by the hypervisor and host OS, such as networking, storage, and host management, onto purpose-built hardware and software. Azure Boost is designed to enable greater network and storage performance and to improve security. Max Uritsky, partner PM manager at Azure, explains:

By separating hypervisor and host OS functions from the host infrastructure, Azure Boost enables greater network and storage performance at scale, improves security by adding another layer of logical isolation, and reduces the maintenance impact for future Azure software and hardware upgrades.

The announcement highlights that customers can achieve remote storage throughput and IOPS performance of 10 Gbps and 400K IOPS relying on memory-optimized E112ibsv5 VM and using NVMe-enabled Premium SSD v2 or Ultra Disk options. Uritsky adds:

While we are announcing the preview of Azure Boost today, Azure Boost has been providing benefits to millions of existing Azure VMs in production today, such as enabling the exceptional remote storage performance of the Ebsv5 VM series and networking throughput and latency improvements for the entire Ev5 and Dv5 VM series.

According to the cloud provider, the Azure Boost system can expand network bandwidth to facilitate faster and more efficient data transfers and achieve higher network availability and stability. The improvement in network performance is achieved using the Microsoft Azure Network Adapter (MANA) and providing a set of stable forward-compatible device drivers for Linux and Windows operating systems. Glenn K. Lockwood, principal product manager at Microsoft, tweets:

This MANA NIC has a Linux driver which reveals a lot of the potential capabilities of the thing. For example,the RDMA support.

Azure Boost’s isolated architecture improves security with a system-on-chip (SoC) providing hardware-based secure boot and attestation. Additionally, the new option can help reduce maintenance downtime as Azure infrastructure updates can be deployed faster by loading directly onto the Azure Boost hardware. Ganesh Swaminathan, COO at Tesser Insights, comments:

A significant advancement in the IaC domain, Azure Boost showcases how we can push the boundaries of cloud infrastructure possibilities. As a technologist, I am extremely excited to see the ripple effect this will have in our industry.

Addressing some comments from the community, Uritsky acknowledges that Azure Boost supports an increased number of flows but does not disclose the expected limits. To take part in the preview, developers have to request access.