Month: September 2023

MMS • RSS

Argus Research has decided to maintain its Buy rating of MongoDB MDB and raise its price target from $435.00 to $484.00.

Shares of MongoDB are trading up 0.16% over the last 24 hours, at $393.51 per share.

A move to $484.00 would account for a 23.0% increase from the current share price.

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB’s database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

About Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish “analyst ratings” for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along with analyst success scores in Benzinga Pro.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

MMS • RSS

Dow Jones futures, S&P 500 futures, and Nasdaq futures were largely unchanged after hours on Tuesday. The stock market rally experienced a slight setback as Treasury yields rebounded. While major indexes such as the Dow Jones and the Russell 2000 fell below their 50-day lines, megacaps like Microsoft, Meta Platforms, and Tesla helped limit the overall losses.

Homebuilders and housing stocks, however, saw a significant sell-off due to the higher yields. Energy stocks, on the other hand, performed well as crude oil continued to climb.

Several stocks such as Microsoft, Meta, Tesla, General Electric, and MongoDB are currently trading close to their buy points.

After the market close, software makers Zscaler, Asana, and GitLab reported their earnings. Zscaler stock fell slightly despite better-than-expected earnings and a strong guidance. Asana stock declined modestly after beating estimates. GitLab stock rose solidly after reporting earnings and revenue above expectations.

In terms of ETFs, the Innovator IBD 50 ETF fell 0.5%, the iShares Expanded Tech-Software Sector ETF advanced 0.45%, and the VanEck Vectors Semiconductor ETF rose 0.2%.

The stock market rally felt the impact of rising Treasury yields, with the Dow Jones falling 0.6%, the S&P 500 retreating 0.4%, and the small-cap Russell 2000 tumbling 2.1%. Crude oil prices climbed 1.3% as Saudi Arabia and Russia announced production cuts. The 10-year Treasury yield also saw a significant increase.

Microsoft, Meta, and Tesla stocks are currently near their buy points, while General Electric and MongoDB stocks held their positions above their 50-day lines.

Although megacaps limited the losses on the major indexes, market breadth was weak. Losers outnumbered winners on both the Nasdaq and the NYSE, and the Russell 2000 fell below its 50-day line.

Source: [Article Source Name]

MMS • RSS

Principal Financial Group Inc. trimmed its stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 16.4% during the first quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 7,068 shares of the company’s stock after selling 1,384 shares during the quarter. Principal Financial Group Inc.’s holdings in MongoDB were worth $1,648,000 as of its most recent filing with the Securities and Exchange Commission.

Principal Financial Group Inc. trimmed its stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 16.4% during the first quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 7,068 shares of the company’s stock after selling 1,384 shares during the quarter. Principal Financial Group Inc.’s holdings in MongoDB were worth $1,648,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. Cherry Creek Investment Advisors Inc. raised its position in shares of MongoDB by 1.5% during the 4th quarter. Cherry Creek Investment Advisors Inc. now owns 3,283 shares of the company’s stock worth $646,000 after buying an additional 50 shares in the last quarter. CWM LLC raised its position in shares of MongoDB by 2.4% during the 1st quarter. CWM LLC now owns 2,235 shares of the company’s stock worth $521,000 after buying an additional 52 shares in the last quarter. Cetera Advisor Networks LLC raised its position in shares of MongoDB by 7.4% during the 2nd quarter. Cetera Advisor Networks LLC now owns 860 shares of the company’s stock worth $223,000 after buying an additional 59 shares in the last quarter. First Republic Investment Management Inc. raised its holdings in shares of MongoDB by 1.0% in the 4th quarter. First Republic Investment Management Inc. now owns 6,406 shares of the company’s stock worth $1,261,000 after purchasing an additional 61 shares in the last quarter. Finally, Janney Montgomery Scott LLC raised its holdings in shares of MongoDB by 4.5% in the 4th quarter. Janney Montgomery Scott LLC now owns 1,512 shares of the company’s stock worth $298,000 after purchasing an additional 65 shares in the last quarter. 88.89% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In related news, Director Hope F. Cochran sold 2,174 shares of the stock in a transaction that occurred on Thursday, June 15th. The stock was sold at an average price of $373.19, for a total value of $811,315.06. Following the transaction, the director now owns 8,200 shares in the company, valued at $3,060,158. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the stock in a transaction that occurred on Tuesday, July 18th. The stock was sold at an average price of $420.00, for a total transaction of $420,000.00. Following the transaction, the director now owns 1,213,159 shares in the company, valued at $509,526,780. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Hope F. Cochran sold 2,174 shares of the stock in a transaction that occurred on Thursday, June 15th. The shares were sold at an average price of $373.19, for a total value of $811,315.06. Following the transaction, the director now owns 8,200 shares in the company, valued at approximately $3,060,158. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 76,551 shares of company stock worth $31,143,942. Insiders own 4.80% of the company’s stock.

MongoDB Trading Up 3.0 %

NASDAQ:MDB opened at $392.88 on Tuesday. The stock’s 50 day moving average price is $390.24 and its 200 day moving average price is $306.34. MongoDB, Inc. has a 52 week low of $135.15 and a 52 week high of $439.00. The company has a market capitalization of $27.73 billion, a P/E ratio of -113.55 and a beta of 1.11. The company has a debt-to-equity ratio of 1.44, a quick ratio of 4.19 and a current ratio of 4.19.

Wall Street Analyst Weigh In

A number of analysts recently commented on the stock. KeyCorp boosted their target price on shares of MongoDB from $372.00 to $462.00 and gave the stock an “overweight” rating in a report on Friday, July 21st. Truist Financial boosted their target price on shares of MongoDB from $420.00 to $430.00 and gave the stock a “buy” rating in a report on Friday. Capital One Financial assumed coverage on shares of MongoDB in a report on Monday, June 26th. They issued an “equal weight” rating and a $396.00 target price on the stock. Stifel Nicolaus boosted their target price on shares of MongoDB from $420.00 to $450.00 and gave the stock a “buy” rating in a report on Friday. Finally, Barclays lifted their target price on shares of MongoDB from $421.00 to $450.00 and gave the stock an “overweight” rating in a research report on Friday. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and twenty have given a buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of “Moderate Buy” and an average price target of $407.39.

Check Out Our Latest Stock Analysis on MongoDB

MongoDB Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

On September 5, 2023, Joseph Bonner, an analyst at Argus Research, expressed his positive outlook on MongoDB (NASDAQ:MDB) by reiterating a Buy rating and revising the price target to $484, up from $435. This updated target indicates a potential increase of around 12% compared to the current stock price. Bonner’s decision to maintain the Buy rating and elevate the price target was influenced by various factors, including MongoDB’s impressive financial performance, promising growth prospects, and other pertinent considerations.

MDB Stock: Slight Decline in Performance on September 5, 2023 with Strong Growth Potential

On September 5, 2023, MDB stock experienced a slight decline in its performance. The stock opened at $389.55, lower than the previous closing price of $392.88. Throughout the day, the stock fluctuated within a range of $389.55 to $398.40. The trading volume reached 79,572 shares, which is significantly lower than the average volume of 1,767,765 shares over the past three months.

With a market capitalization of $28.0B, MDB is a significant player in the technology services sector, particularly in the packaged software industry. The company has shown impressive growth in recent years, with a revenue growth rate of 46.95% last year. Additionally, MDB has demonstrated strong earnings growth, with a growth rate of 92.12% this year and an estimated growth rate of 8.00% for the next five years.

However, it is important to note that MDB reported a negative earnings growth of -5.89% last year. Despite this setback, the company has managed to rebound and achieve substantial growth in the current year. The positive earnings growth reflects the company’s ability to adapt to market conditions and capitalize on opportunities.

When analyzing the valuation metrics, MDB has a price-to-sales ratio of 11.45 and a price-to-book ratio of 37.12. These ratios indicate that the stock may be relatively expensive compared to its peers in the industry. However, it is crucial to consider other factors such as the company’s growth potential and market position before making any investment decisions.

Looking at the stock’s performance on September 5, 2023, MDB experienced a decline of -1.54, equivalent to a -0.48% change. This decline may be attributed to various factors, including market volatility, investor sentiment, or company-specific news. It is essential for investors to conduct thorough research and analysis to understand the underlying reasons for the stock’s performance.

Among other technology services companies, ANSS (ANSYS Inc) and HUBS (HubSpot Inc) also experienced declines on September 5, 2023. ANSS declined by -1.21, representing a -0.22% change, while HUBS declined by -0.64, equivalent to a -0.45% change. These declines may indicate a broader trend in the technology services sector, or they could be influenced by company-specific factors.

Looking ahead, MDB’s next reporting date is scheduled for December 6, 2023. Analysts forecast an earnings per share (EPS) of $0.27 for the current quarter. The company’s annual revenue for the previous year stood at $1.3B, with an annual profit of -$345.4M. The net profit margin for MDB is -26.90%, indicating that the company has been operating with a negative profit margin.

In conclusion, MDB’s stock performance on September 5, 2023, experienced a slight decline. Despite this, the company has demonstrated strong growth in recent years, with impressive revenue and earnings growth rates. Investors should carefully consider the valuation metrics and conduct thorough research before making any investment decisions.

MongoDB Inc (MDB) Stock Analysis: Potential Growth and Promising Investment Opportunity

On September 5, 2023, MongoDB Inc (MDB) stock had a median target price of $450.00, according to 23 analysts offering 12-month price forecasts. The high estimate for the stock price was $500.00, while the low estimate was $250.00. This median estimate represented a 14.22% increase from the last recorded price of $393.99.

The consensus among 28 polled investment analysts was to buy stock in MongoDB Inc. This rating had remained unchanged since September, indicating a steady belief in the company’s potential for growth.

In terms of financial performance, MongoDB Inc reported earnings per share of $0.27 for the current quarter. This indicates the company’s profitability and ability to generate earnings for its shareholders. Additionally, the company reported sales of $389.8 million, demonstrating its strong revenue generation.

Investors and analysts will be eagerly awaiting the reporting date of December 6, which will provide more detailed insights into MongoDB Inc’s financial performance for the quarter.

Overall, the data suggests that MongoDB Inc is a promising investment opportunity. With a consensus buy rating and a median target price indicating potential growth, investors may consider adding MDB stock to their portfolios. However, it is essential to closely monitor the company’s financial performance and any updates from analysts to make informed investment decisions.

MMS • RSS

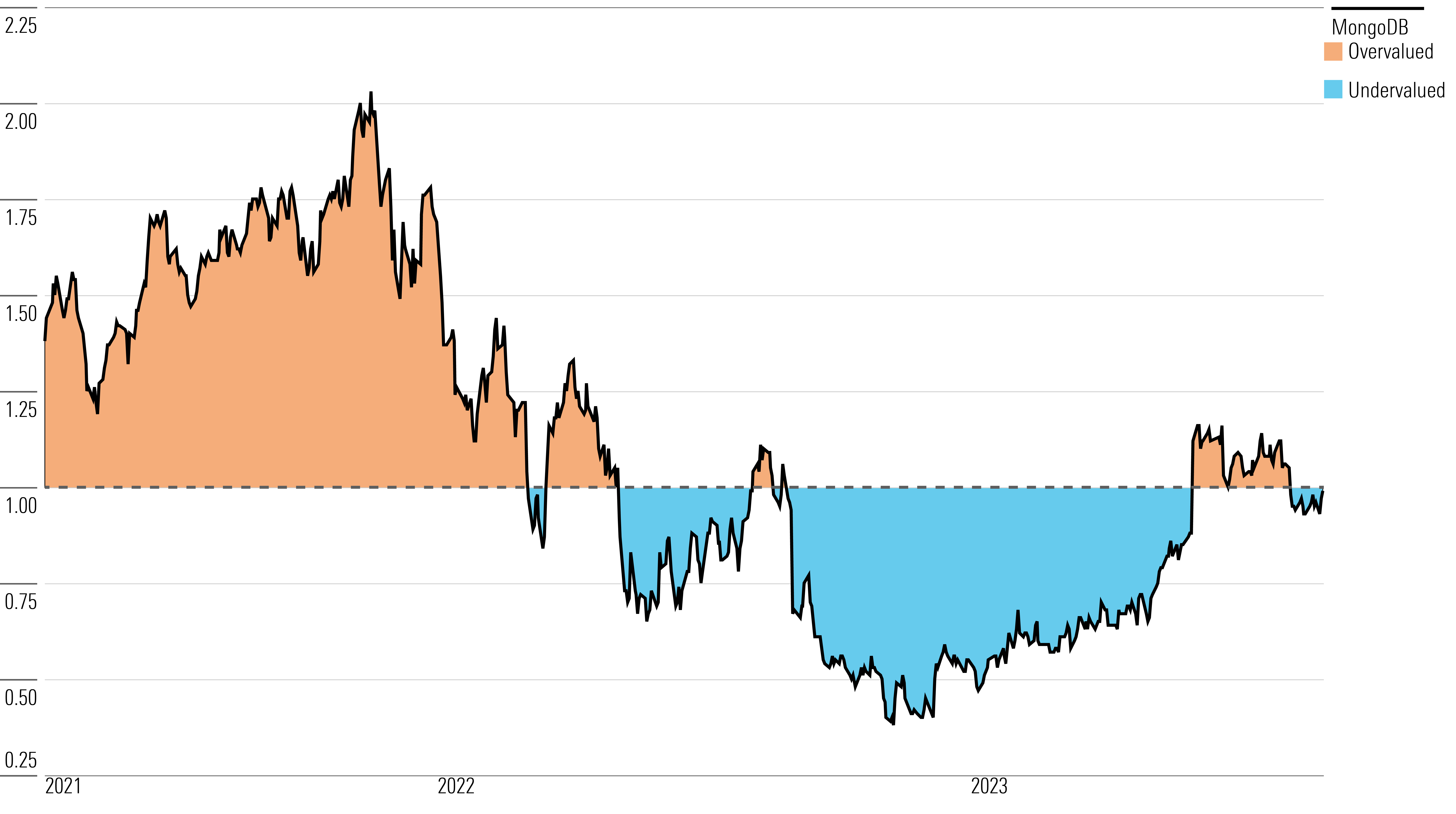

MongoDB MDB posted a solid quarter, exceeding our expectations all around as consumption of the firm’s cloud platform, Atlas, proved rosier even with it feeling the effects of the weak macroeconomic environment. With retention rates remaining high, we continue to believe MongoDB has all the right seeds of a switching cost moat that will pay off in the long run. We are maintaining our fair value estimate of $379 per share, as we remain confident in MongoDB’s positioning at the right place and the right time amid a mass data boom that will require the technical flexibility and ease of use MongoDB is known for. With afterhours shares trading near $398, up 4%, we view shares as fairly valued.

Second-quarter revenue increased 40% year over year, to $424 million. Atlas, MongoDB’s cloud offering, grew 38% year over year, now making up 63% of revenue. Atlas’ performance slightly surpassed management’s expectations in the quarter. We like that MongoDB has further lessened incentives to sign customer commitments upfront for Atlas, as we think this is showing flexibility in the current macroeconomic environment that can ensure MongoDB doesn’t miss out on acquiring sticky long-term customers who have tighter wallets in the near term. Enterprise Advanced and other licensing revenue exceeded management’s expectations on a meatier scale than the Atlas business as the firm signed more multiyear deals than they were baking in and signed renewals with large customers like Alibaba. Nonetheless, management doesn’t expect the back half of the year to mirror the first half in terms of the positive surprise in licensing revenue.

Second-quarter non-GAAP gross margins were 78%, up by 5 points from the prior-year period, thanks to the surprise outperformance by high-margin licensing and Enterprise Advanced revenue. But the firm warned that the profitability likely won’t be repeated since it was a result of anomalous strength. Non-GAAP earnings per share were $0.93.

The author or authors do not own shares in any securities mentioned in this article.

Find out about Morningstar’s editorial policies.

MMS • RSS

MongoDB MDB released its second-quarter earnings report on Aug. 31 after the close of trading. Here’s Morningstar’s take on what to think of MongoDB’s earnings and stock.

Key Morningstar Metrics for MDB

What We Thought of MongoDB’s Q2 Earnings

- Earnings Beat: MongoDB had a solid quarter, exceeding our expectations all around. We were pleased to see that consumption on the cloud Atlas platform was rosier than expected, as we think the firm is wisely focusing on customer acquisition over upfront billing.

- High Retention Rates: The latest results helped support our current thesis. Retention rates remain high, which indicates MongoDB continues to show all the right signs of benefiting from switching costs, even in this current macroeconomic environment.

Fair Value Estimate for MongoDB

With its 3-star rating, we believe MongoDB’s stock is fairly valued compared with our long-term fair value estimate.

Our fair value estimate for MongoDB is $379 per share. Our valuation implies forward fiscal-year enterprise value/sales of 17 times and a free cash flow yield of 0%. Our fair value estimate assumptions are based on our expectations for MongoDB achieving a compound annual growth rate over the next five years of 23%. MongoDB is in its infancy but has a massive market opportunity and a large runway for growth ahead of itself, in our view. We expect this substantial growth to be driven by continued shifts of workloads to a cloud environment, prompting the database market to grow robustly, especially NoSQL databases like document-based databases, as companies realize how much easier it is to scale data storage in the clouds. In turn, this implies substantial usage growth per customer for MongoDB. Additionally, we think MongoDB’s database-as-a-service offering, Atlas, and data lake will bring significant new revenue streams to the company—as Atlas revenue eclipsed on-premises sales in early fiscal 2022.

We forecast that MongoDB’s gross margins will stay relatively the same, as the company’s increasing mix of Atlas revenue is somewhat margin-dilutive in the near term. We expect GAAP operating margins to increase from negative 27% in fiscal 2023 to positive 27% in fiscal 2033, as a result of operating leverage as revenue growth exceeds operating expenses.

Read more about MongoDB’s fair value estimate.

Economic Moat Rating

We assign MongoDB a no-moat rating. We think the company benefits from significant switching costs with the customers that it has captured thus far. However, the company is still in its customer acquisition phase, and it is unclear that this moat source will lead to excess returns on invested capital over the next 10 years as MongoDB lacks profitability and continues to aggressively spend on sales and marketing.

MongoDB is a NoSQL database. This means that, instead of storing data in tables, like a relational, SQL database, MongoDB stores data in a different format. There are many nonrelational ways to store data, but MongoDB does so by storing data in collections that are known as documents. Document-based formats provide some appealing characteristics, which include the ability to store both structured and unstructured data and its ease of scalability.

While MongoDB is widely considered to be the best document-based database, many competitors exist, like Couchbase and AWS Document DB. The presence of these competitors (and particularly Amazon, which has nearly unlimited resources) restricts us from assigning MongoDB with an additional moat source based on intangible assets.

MongoDB has not yet reached enough size and scale to generate excess returns on capital, even when considering a good portion of its sales and marketing costs as an asset with future benefits, rather than a wasteful expense.

We think it will take a few more years for MongoDB to reach such excess returns, as the company will likely continue to generate operating losses as it continues to invest in customer acquisition. These subpar returns preclude us from assigning MongoDB with a narrow moat rating, but we’ll continue to monitor MongoDB’s ability to attract new business and profit from a potentially sticky customer base in the years ahead.

Read more about MongoDB’s moat rating.

Risk and Uncertainty

We assign MongoDB a High Morningstar Uncertainty Rating because of its place in a technological landscape that has the potential to shift rapidly. However, we do not foresee any material environmental, social, or governance issues on the horizon.

MongoDB faces uncertainty based on future competition. MongoDB runs the risk of Amazon encroaching on its abilities. Currently, Amazon’s DocumentDB service claims it has MongoDB compatibility, so that it can help companies deploy MongoDB at scale in the cloud, similar to MongoDB Atlas. At the moment, DocumentDB has significant limitations compared with MongoDB—with the inability to support rich data types, interoperability with AWS only, and only 63% compatibility with MongoDB—all in contrast to MongoDB Atlas. While many open-source software companies have suffered from Amazon reselling their software on their own platform for a profit (for example, Elastic was repackaged into Amazon Elasticsearch), MongoDB is protected against this risk, as its software license bans Amazon from reselling its software on AWS.

On the ESG front, MongoDB is at risk of compromising the data stored in its database through data breaches. For example, MongoDB offers a number of security features for protecting data, like authentication, access control, and encryption. However, if any of these features were to fail, MongoDB’s brand could suffer significantly and possibly lead to diminished future business.

Read more about MongoDB’s risk and uncertainty.

MDB Bulls Say

- MDB’s document-based database is best equipped to remove fear of vendor lock-in and is poised for a strong future.

- MongoDB’s new data lake could gain significant traction, making MongoDB even stickier, as we believe data lakes have even greater switching costs than databases. In turn, this could further boost returns on invested capital.

- MongoDB could eventually launch its own data warehouse offering, which would further increase customer switching costs.

MDB Bears Say

- Document-based databases could decrease in popularity, as a new NoSQL variation arises, better meeting developers’ needs.

- Cloud service providers, like AWS, could catch up to MongoDB in terms of its rich features.

- MongoDB’s profitability could see only gradual improvements, as the need or relevance in a fast-changing tech landscape could diminish major operating leverage.

This article was compiled by Saaketh Tirumala.

–>

MMS • RSS

The research study “NoSQL Databases Software Professional Market 2023 Trends” provides you with a detailed analysis of the state of the market today and the opportunities that lie ahead.

The NoSQL Databases Software Professional Market is a diverse and dynamic industry encompassing various products and categories. It carries great significance across diverse sectors, including technology, healthcare, consumer goods, and more. The market is distinguished by swift advancements, shifting consumer tastes, and dynamic regulatory environments.

Request a pdf sample report : https://www.orbisresearch.com/contacts/request-sample/6752231

COVID-19 Impact and Recovery

The NoSQL Databases Software Professional Market underwent significant changes as a result of the far-reaching effects of the COVID-19 pandemic. The initial phase of the pandemic led to disruptions in manufacturing, supply chains, and distribution channels. Consumer demand for certain products surged, while others experienced a decline. Disruptions in Manufacturing and Supply Chains Lockdowns and restrictions imposed by governments worldwide caused disruptions in manufacturing facilities and supply chains. The inability to access raw materials and transport finished goods led to production delays and shortages. Shift in Consumer Behavior and Demand The pandemic induced significant changes in consumer behavior and preferences. The demand for health and hygiene products, remote work solutions, and digital entertainment experienced a notable increase. On the other hand, non-essential products experienced a decline in demand.

Top Players in the NoSQL Databases Software Professional market report:

Azure Cosmos DB

MongoDB

SQL-RD

Amazon

Redis

RethinkDB

RavenDB

OrientDB

Couchbase

MarkLogic

CouchDB

ArangoDB

Recovery Strategies

To recover from the pandemic’s impact, companies in the NoSQL Databases Software Professional Market focused on implementing various strategies:

• Diversification: Companies explored new product categories to adapt to changing consumer demands.

• Digital Transformation: Emphasizing online sales channels and investing in e-commerce platforms. • Supply Chain Resilience: Businesses improved their supply chains to minimize potential disruptions in the future.

• Health and Safety Measures: Implementing health protocols to ensure the safety of employees and customers.

Buy the report at https://www.orbisresearch.com/contact/purchase-single-user/6752231

NoSQL Databases Software Professional Market Segmentation:

NoSQL Databases Software Professional Market by Types:

Cloud Based

Web BasedNoSQL Databases Software Professional Market by Applications:

Large Enterprises

SMEs

Product Outlook

The NoSQL Databases Software Professional Market comprises a wide range of products, including electronic gadgets, medical devices, consumer electronics, and more. The market remains stimulated by the increasing desire for cutting-edge and technologically sophisticated goods.

Category Outlook

The market is divided into various segments, classifying them according to the types of products, end-users, and applications they cater to.Each category experiences unique market dynamics and growth opportunities.

Do Inquiry before Accessing Report at: https://www.orbisresearch.com/contacts/enquiry-before-buying/6752231

Market Dynamics and Growth Opportunities:

Each category within the NoSQL Databases Software Professional Market experiences unique market dynamics and growth opportunities:

• Innovation and Technological Advancements: Rapid advancements in technology drive innovation and create opportunities for new product development and market expansion.

• Shift in Consumer Preferences: The market landscape is molded by shifting consumer preferences and demands, prompting companies to adjust their product offerings in response.

• Health and Environment Focus: The growing emphasis on well-being, ecological preservation, and health-consciousness fuels the need for eco-friendly and health-oriented goods.

• Emerging Markets: Developing countries offer unexplored potential for economic growth as a result of growing disposable incomes, urbanization, and heightened consumer consciousness.

• E-commerce Growth: The increasing prevalence of online marketplaces grants entry to a more extensive pool of customers and eases the process of venturing into global markets.

Regional Outlook

The NoSQL Databases Software Professional Market is widespread internationally, encompassing significant regions such as North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Each region has distinct market trends, consumer behavior, and regulatory environments.

Market Estimation

Estimating the size and potential of the NoSQL Databases Software Professional Market is a crucial aspect of this research. This involves analyzing historical data, market trends, and growth projections to forecast future market size and potential.

Regulatory Outlook

Regulatory frameworks and policies significantly impact the NoSQL Databases Software Professional Market. This section of the report will delve into the key regulations governing the industry, including product certifications, safety standards, and environmental regulations.

Conclusion

The NoSQL Databases Software Professional Market is a dynamic and diverse industry that continues to evolve amid the challenges posed by the COVID-19 pandemic. The market is projected to undergo a gradual revival as vaccination campaigns advance and restrictions are eased. Businesses are adjusting to shifting consumer preferences and implementing strategies for recovery in the aftermath of the pandemic.. It is essential for market players to stay abreast of regulatory developments to ensure compliance and sustain growth in the future.

About Us:

Orbis Research (orbisresearch.com) is a single point aid for all your market research requirements. We have a vast database of reports from leading publishers and authors across the globe. We specialize in delivering customized reports as per the requirements of our clients. We have complete information about our publishers and hence are sure about the accuracy of the industries and verticals of their specialization. This helps our clients to map their needs and we produce the perfect required market research study for our clients.

Contact Us:

Hector Costello

Senior Manager – Client Engagements

4144N Central Expressway,

Suite 600, Dallas,

Texas – 75204, U.S.A.

Phone No.: USA: +1 (972)-591-8191 | IND: +91 895 659 5155

Email ID: sales@orbisresearch.com

MMS • RSS

-

Lululemon Athletica Inc.’s (LULU) shares climbed 6% after reporting third-quarter fiscal 2023 adjusted earnings per share of $2.68, surpassing the Zacks Consensus Estimate of $2.53.

-

Dell Technologies Inc. (DELL) shares soared 21.3% after posting second-quarter fiscal 2024 adjusted earnings per share of $1.74, outpacing the Zacks Consensus Estimate of $1.13.

-

Shares of MongoDB Inc. (MDB) surged 3% after the company reported second-quarter fiscal 2024 adjusted earnings per share of $0.93, exceeding the Zacks Consensus Estimate of $0.45.

-

Shares of Nutanix Inc. (NTNX) jumped 12.2% after the company posted fourth quarter fiscal 2023 adjusted earnings per share of $0.24, beating the Zacks Consensus Estimate of $0.15.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Nutanix (NTNX) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

Intra-Account Collection Copy in Azure Cosmos DB for MongoDB in Public Preview – InfoQ

MMS • RSS

Microsoft recently introduced the public preview of Intra-Account Collection Copy for Azure Cosmos DB for MongoDB, allowing users to copy collections within the same account – offering enhanced data management and migration capabilities.

Azure Cosmos DB is a fully managed NoSQL database with various APIs targeted at NoSQL workloads such as MongoDB and Apache Cassandra, including native NoSQL and compatible APIs. In addition, the service supports relational workloads for PostgreSQL.

Last year the company first introduced the preview for Intra-account container copy jobs to allow users to create offline copies of containers for Azure Cosmos DB for both Core (SQL) API and Cassandra API using Azure CLI. Azure Cosmos DB now also has an Intra-Account Collection Copy feature for MongoDB that, according to the company, “enables users to copy collections within the same Azure Cosmos DB account in an offline manner.”

An account in Cosmos DB contains all the Azure Cosmos DB resources: databases, containers, and items. When creating an account, users can select the MongoDB API. Subsequently, they can add a database and collection (container). Within the account, users can create multiple collections.

The feature for copy collections with a MongoDB account can be helpful for data migrations, like when data has evolved and queries are no longer efficient with the existing shard key. Users can choose another shard key on a new collection and migrate the data using a collection copy. Another use case is updating the unique key index of a container by defining a new unique key index policy and migrating data to the new collection using a collection copy.

Users can register for the preview feature and install the Azure Cosmos DB preview extension through the CLI to migrate a collection or database. Next, choose the source and destination collection where they want to copy the data and start the collection copy operation from the Azure CLI. Lastly, users can monitor the progress.

A job to copy a container within an Azure Cosmos DB API for a MongoDB account:

az cosmosdb dts copy `

--resource-group $resourceGroup `

--account-name $accountName `

--job-name $jobName `

--source-mongo database=$sourceDatabase collection=$sourceCollection `

--dest-mongo database=$destinationDatabase collection=$destinationCollection

Several other cloud database services support MongoDB. One is MongoDB Atlas, MongoDB’s own fully managed cloud database service. This database service also supports data migration from one database to another, comparable to the Cosmos DB for MongoDB’s latest feature, Inter-Account Collection copy. With MongoDB Atlas users can bring data from existing MongoDB deployments, JSON, or CSV files into deployments in Atlas using either live migration, where Atlas assists them, or tools for a self-guided migration of data from their existing deployments into Atlas.

Lastly, the documentation provides a list of the Azure regions supporting the feature.

MMS • Daniel Dominguez

OpenAI is introducing ChatGPT Enterprise, which provides enterprise-grade protection and privacy, limitless higher-speed GPT-4 access, extended context windows for processing longer inputs, additional data analysis capabilities, customization possibilities, and much more.

According to OpenAI, artificial intelligence can improve every area of our professional lives and foster greater creativity and productivity among teams. This represents a significant advancement toward the creation of an AI assistant for the workplace that can assist with any activity, is tailored to business, and safeguards data.

ChatGPT Enterprise offers a brand-new admin portal with tools to control how employees use ChatGPT within a company, including domain verification integrations, single sign-on integrations, and a dashboard with usage statistics. Employees can utilize ChatGPT to construct internal workflows thanks to shareable discussion templates, and businesses can, if they so want, fully customize ChatGPT-powered solutions using credits to OpenAI’s API platform.

Moreover, includes unrestricted access to Advanced Data Analysis, a ChatGPT function that was originally known as Code Interpreter. With this feature, ChatGPT is able to analyze data, make charts, answer math problems, and more.

Both ChatGPT Plus and ChatGPT Enterprise are powered by GPT-4, the premier AI model from OpenAI. Customers of ChatGPT Enterprise, on the other hand, have priority access to GPT-4, which offers performance that is twice as quick as ordinary GPT-4 with an extended 32,000-token (about 25,000-word) context window.

The introduction of ChatGPT Enterprise comes amid intensifying competition in the chatbot industry, where companies like OpenAI, Microsoft, Google, and Anthropic are engaged in an AI arms race. These companies are racing not only to launch new chatbot applications but also to introduce innovative features to encourage wider adoption of generative AI in everyday use.

Google and Microsoft are continually updating their Bard and Bing chatbots, respectively, with new features such as visual search. Additionally, Anthropic, an AI startup founded by former OpenAI executives, entered the scene with its AI chatbot, Claude 2.