On September 1, 2023, Karl Keirstead, an analyst at UBS, expressed his continued confidence in MongoDB (NASDAQ:MDB) by maintaining a Buy rating on the stock and increasing the price target to $465. This upward revision in price target is not a novel occurrence for UBS, as they had previously upgraded MongoDB from neutral to buy in March 2022, accompanied by a price target increase from $345 to $450.

Capital IQ’s survey of analysts reveals that MongoDB enjoys an average rating of outperform, with price targets spanning a wide range from $220 to $490. This signifies the varying opinions and expectations of industry experts regarding the future performance of the database program company.

MongoDB, Inc.

MDB

Buy

Updated on: 01/09/2023

Price Target

Current $394.30

Concensus $388.06

Low $180.00

Median $406.50

High $630.00

Show more

Social Sentiments

We did not find social sentiment data for this stock

Analyst Ratings

| Analyst / firm |

Rating |

Miller Jump

Truist Financial

|

Buy |

Mike Cikos

Needham

|

Buy |

Rishi Jaluria

RBC Capital

|

Sell |

Ittai Kidron

Oppenheimer

|

Sell |

Matthew Broome

Mizuho Securities

|

Sell |

Show more

MDB Stock Performance on September 1, 2023: Promising Signs for Investors

MDB, or MongoDB Inc., is a technology services company specializing in packaged software. On September 1, 2023, MDB’s stock performance showed promising signs for investors.

The previous close for MDB stock was $380.90. However, the stock opened higher at $395.45, indicating a positive start to the day. Throughout the trading session, the stock fluctuated within a range of $393.02 to $413.74.

The trading volume for MDB on September 1 was 320,884 shares. This figure is significantly lower than the average volume of the past three months, which stands at 1,732,652 shares.

MDB has a market capitalization of $25.6 billion.

In terms of earnings growth, MDB experienced a decline of 5.89% in the previous year. However, the company’s earnings growth for the current year is projected to be a remarkable 92.12%.

Looking ahead, MDB is expected to maintain a positive earnings growth rate of 8.00% over the next five years.

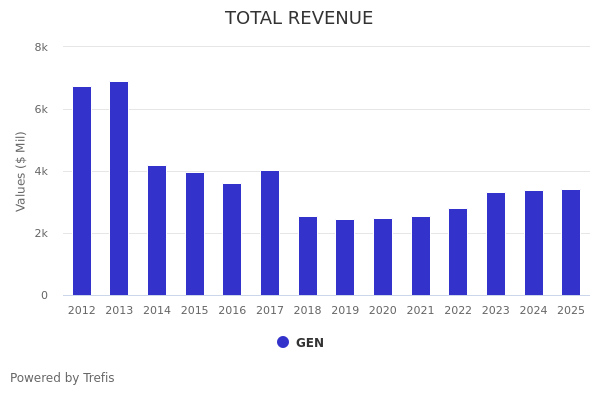

MDB’s revenue growth in the previous year was an impressive 46.95%.

When analyzing the stock’s valuation, the price-to-earnings (P/E) ratio is not available (NM). However, the price-to-sales ratio is 11.45, and the price-to-book ratio is 34.33.

In comparison to other companies in the technology services sector, MDB’s stock performance on September 1 stood out positively.

MDB is expected to report its next earnings on December 6, 2023. Analysts forecast an earnings per share (EPS) of $0.27 for the current quarter.

In terms of financials, MDB reported annual revenue of $1.3 billion in the previous year. However, the company incurred a net loss of -$345.4 million, resulting in a negative net profit margin of -26.90%.

MDB’s corporate headquarters is located in New York, New York. The company does not have any executives listed.

Overall, MDB’s stock performance on September 1, 2023, showed positive signs, with an opening price higher than the previous close and a range of trading activity. The company’s projected earnings growth, revenue growth, and market capitalization indicate a positive outlook for the future. However, it is important for investors to consider the company’s financials and industry trends before making any investment decisions.

MongoDB Inc Stock Analysis: Strong Performance, Positive Outlook, and Potential Growth

On September 1, 2023, MongoDB Inc (MDB) stock had a median target price of $440.00, according to 23 analysts offering 12-month price forecasts. The high estimate for the stock price was $480.00, while the low estimate was $250.00. This median estimate indicated a potential increase of 11.79% from the last recorded price of $393.59.

The consensus among 28 polled investment analysts on September 1, 2023, was to buy MongoDB Inc stock. This rating has remained unchanged since September, indicating a consistent positive sentiment towards the company’s performance.

In terms of financial performance, MongoDB Inc reported earnings per share of $0.27 for the current quarter. The company’s sales for the same period were $389.8 million. The reporting date for these figures was December 6.

These numbers suggest that MongoDB Inc has been performing well, with positive earnings per share and robust sales. The consensus among analysts to buy the stock further reinforces the positive outlook for the company.

Investors should consider the median target price of $440.00 as a potential benchmark for the stock’s performance in the next 12 months. However, it is important to note that this is only an estimate and actual stock performance may vary.

As always, investors should conduct thorough research and analysis before making any investment decisions. It is also advisable to keep track of the company’s financial reports and any updates from reliable sources to stay informed about any changes in the stock’s performance.

Private Advisor Group LLC purchased a new position in shares of MongoDB, Inc. (

Private Advisor Group LLC purchased a new position in shares of MongoDB, Inc. (