Month: November 2023

MMS • RSS

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the stocks they discuss. The information and content are subject to change without notice. *Real-time prices by Nasdaq Last Sale. Realtime quote and/or trade prices are not sourced from all markets.

© 2000- Investor’s Business Daily, LLC All rights reserved

How Australia’s Database Management Systems are Shaping the Future of Technology and …

MMS • RSS

How Australia’s Database Management Systems are Shaping the Future of Technology and Connectivity

In today’s digital age, database management systems (DBMS) play a crucial role in storing, organizing, and retrieving vast amounts of data. These systems are the backbone of modern technology and connectivity, enabling businesses and individuals to access and analyze information efficiently. Australia, known for its technological advancements, has been at the forefront of developing innovative DBMS solutions that are shaping the future of technology and connectivity.

One of the key players in Australia’s DBMS landscape is Oracle, a multinational technology corporation that provides a comprehensive range of database solutions. Oracle’s DBMS offerings are designed to handle massive amounts of data, ensuring scalability, reliability, and security. These systems are widely used across various industries, including finance, healthcare, and e-commerce, where data integrity and availability are paramount.

Another prominent player in Australia’s DBMS market is MongoDB, a leading NoSQL database provider. MongoDB’s DBMS solutions are designed to handle unstructured and semi-structured data, making them ideal for applications that require flexibility and agility. With its document-oriented architecture, MongoDB enables developers to build scalable and high-performance applications that can adapt to changing business requirements.

FAQ:

Q: What is a database management system (DBMS)?

A: A database management system is software that allows users to store, organize, and retrieve data efficiently. It provides a structured approach to managing data, ensuring data integrity, security, and accessibility.

Q: How do DBMS systems shape the future of technology and connectivity?

A: DBMS systems are essential for storing and managing vast amounts of data generated by various technological advancements. They enable businesses to analyze data, make informed decisions, and develop innovative solutions. Additionally, DBMS systems facilitate connectivity by providing a centralized platform for data sharing and collaboration.

Q: Why are Australian DBMS solutions significant?

A: Australia has a thriving technology sector and is known for its innovative solutions. Australian DBMS providers, such as Oracle and MongoDB, offer cutting-edge technologies that address the evolving needs of businesses. These solutions contribute to the advancement of technology and connectivity, driving economic growth and innovation.

In conclusion, Australia’s database management systems are playing a pivotal role in shaping the future of technology and connectivity. With their scalability, reliability, and security features, these systems enable businesses to harness the power of data and drive innovation. As technology continues to evolve, Australian DBMS providers will undoubtedly continue to lead the way in developing advanced solutions that meet the ever-growing demands of the digital era.

USD 86.3 Billion NoSQL Market Reach by 2032 | Top Players Such as – Riak, ScyllaDB and Apache

MMS • RSS

The NoSQL database industry is driven by an increase in demand for e-commerce and online applications, which adds to total market demand.

PORTLAND, PORTLAND, OR, UNITED STATE, November 20, 2023 /EINPresswire.com/ — Allied Market Research published a new report, titled, ” The USD 86.3 Billion NoSQL Market Reach by 2032 | Top Players Such as – Riak, ScyllaDB and Apache.” The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter’s Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and determine steps to be taken to gain competitive advantage.

The global NoSQL market was valued at USD 7.3 billion in 2022, and is projected to reach USD 86.3 billion by 2032, growing at a CAGR of 28.1% from 2023 to 2032.

Request Sample Report (Get Full Insights in PDF – 350 Pages) at: https://www.alliedmarketresearch.com/request-sample/640

The rise in demand for big data analytics, enterprise-wide need for scalable and flexible database solutions, and growth in adoption of cloud computing technology are expected to drive the global NoSQL market growth. However, the high complexities of administrating NoSQL databases and the potential threat of data-related inconsistencies are expected to hinder market growth. Furthermore, the rise in adoption of advanced technologies such as AI & ML offers lucrative market opportunities for the market players.

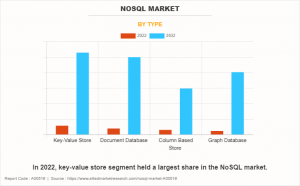

The NoSQL market is segmented on the basis of type, application, industry vertical, and region. On the basis of type, it is categorized into key-value store, document database, column-based store, and graph database. On the basis of application, it is divided into data storage, mobile apps, data analytics, web apps, and others. The data storage segment is further sub-segmented into distributed data depository, cache memory, and metadata store. On the basis of industry vertical, it is categorized into retail, gaming, IT, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

If you have any questions, Please feel free to contact our analyst at: https://www.alliedmarketresearch.com/connect-to-analyst/640

On the basis of type, the key-value store segment held the highest market share in 2022, accounting for less than two-fifths of the NoSQL market revenue, and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the high scalability and the ability to support multiple data models on a single database with faster access would continue driving its application. However, the document database segment is projected to manifest the highest CAGR of 29.0% from 2023 to 2032, as these database services help to reduce the time and costs associated with optimizing systems in the initial phase of deployment.

On the basis of application, the web apps segment accounted for the largest share in 2022, contributing to more than one-fourth of the NoSQL market revenue, owing to growth in the usage of website-based solutions in several industries. However, the mobile apps segment is expected to portray the largest CAGR of 31% from 2023 to 2032 and is projected to maintain its lead position during the forecast period. It provides several advantages such as reducing costs, supporting business, and effectively controlling the business environment in the organization.

On the basis of industry vertical, the IT segment accounted for the largest share in 2022, contributing to less than two-fifths of the NoSQL market revenue, owing to the development of digital technologies in IT sector. However, the gaming segment is projected to manifest the highest CAGR of 35.4% from 2023 to 2032. The surge in the implementation of automation trends and the increase in utilization of digital technology in this sector is expected to provide lucrative opportunities for the market.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/640

On the basis of region, the North America segment held the highest market share in terms of revenue in 2022, accounting for less than two-fifths of the NoSQL market revenue. The increase in the usage of NoSQL solutions in businesses to improve businesses and the customer experience is anticipated to propel the growth of the market in this region. However, the Asia-Pacific segment is projected to manifest the highest CAGR of 26.8% from 2023 to 2032. Countries such as China, India, and South Korea are at the forefront, embracing digital technologies to enhance their effectiveness and competitiveness, further expected to contribute to the growth of the market in this region.

The report analyzes the profiles of key players operating in the NoSQL market such as Aerospike Inc., Couchbase Inc., IBM Corporation, Neo4j, Inc., Objectivity, Inc, Oracle Corporation, Progress Software Corporation, Riak, ScyllaDB, Inc. and Apache Software Foundation. These players have adopted various strategies such as collaboration, acquisition, and product launch to increase their market penetration and strengthen their position in the NoSQL market.

Buy Now & Get Exclusive Discount on this Report (350 Pages PDF with Insights, Charts, Tables, and Figures) at: https://www.alliedmarketresearch.com/NoSQL-market/purchase-options

COVID-19 Scenario

● The NoSQL market witnessed stable growth during the COVID-19 pandemic, owing to the dramatically increased dependence on digital devices. The surge in online presence of people during the period of COVID-19 induced lockdowns and social distancing policies fueled the need for NoSQL solutions.

● In addition, with the majority of the population confined in homes during the early stages of the COVID-19 pandemic, businesses needed to optimize their business operations and offerings to maximize their revenue opportunities while optimizing their operations to support the rapidly evolving business environment, post the outbreak of the COVID-19 pandemic.

Thanks for reading this article, you can also get an individual chapter-wise section or region-wise report versions like North America, Europe, or Asia.

If you have any special requirements, please let us know and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

About Us:

Allied Market Research (AMR) is a market research and business-consulting firm of Allied Analytics LLP, based in Portland, Oregon. AMR offers market research reports, business solutions, consulting services, and insights on markets across 11 industry verticals. Adopting extensive research methodologies, AMR is instrumental in helping its clients to make strategic business decisions and achieve sustainable growth in their market domains. We are equipped with skilled analysts and experts and have a wide experience of working with many Fortune 500 companies and small & medium enterprises.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies. This helps us dig out market data that helps us generate accurate research data tables and confirm utmost accuracy in our market forecasting. Every data company in the domain is concerned. Our secondary data procurement methodology includes deep presented in the reports published by us is extracted through primary interviews with top officials from leading online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+ +1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

![]()

MMS • RSS

Shortly after version 16 of PostgreSQL was released,

CosmosDB follows suit adopting the new version applicable to production workloads.

Back in November last year and in Azure CosmosDB for PostgreSQL Reaches General Availability we watched the first steps of CosmosDB extending beyond NoSQL by adding support for PostgreSQL. That move rendered Azure the first cloud provider to offer its own single database service that supports both relational and NoSQL workloads.

Initially Cosmos supported MongoDB, Apache Gremlin and Apache Cassandra before adding support for PostgreSQL,

and you could choose the desired API when creating a cluster. So while Cosmos DB for NoSQL did not have relational constraints, when needing to work with relational workloads you could choose the Postgres backend, a fully managed distributed SQL offering built upon the core benefits of Postgres

like JSONB datatype extensions, PostGIS, rich indexing and so on.

Last November Cosmos was in tune with PostgreSQL version 15 but now also adds support for 16. What rendered the update easy, is the open source Citus extension which on top of that

enables Postgres to be fir for the distributed scale by using distributed tables across multiple nodes.

Needles to say, Cosmos also gets all the goodies coming with version 16 such as :

- query performance improvements with more parallelism

- developer experience enhancements;

- monitoring of I/O stats using pg_stat_io view; and

- enhanced security features

An added advantage of hosting Cosmos on Azure, is that creating a new database for PostgreSQL gives you many new capabilities. Example features include:

- High Availability across Availability Zones (AZ)

- Automatic backup/restore & ability to rewind to a particular point-in-time

- One-click upgrade to latest PostgreSQL & extension versions

- Scale up/down your CPU and storage resources

- Encryption at rest and private endpoints

- Compliance with global and local certifications across 30 Azure regions

- Global distribution across Azure regions to tolerate regional failures

It’s easy to get started with creating your first Cluster is good enough, and although the official documentation is good to start with, there’s also a free, self-paced course which gives you the chance to expand your knowledge of Azure Cosmos DB as well as earn a certification. Check Take the Azure Cosmos DB Cloud Skills Challenge for more details on that.

More Information

Postgres 16 available in Azure Cosmos DB for PostgreSQL, powered by Citus

Related Articles

Take the Azure Cosmos DB Cloud Skills Challenge

Azure CosmosDB for PostgreSQL Reaches General Availability

To be informed about new articles on I Programmer, sign up for our weekly newsletter, subscribe to the RSS feed and follow us on Twitter, Facebook or Linkedin.

Comments

or email your comment to: comments@i-programmer.info

MMS • RSS

kellyvandellen/iStock Editorial via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Never Revisit Past Glories?

If, like us, you are in the business of investment research, then you are going to get a lot wrong. Stands to reason. Core part of the job. All that. We never mind taking brickbats for being wrong, usually, we’re wrong less often than we’re right, and that’s pretty much where the bar is in our line of work. And we’re happy to say when we got it right, with the rider that what often comes after right is, wrong.

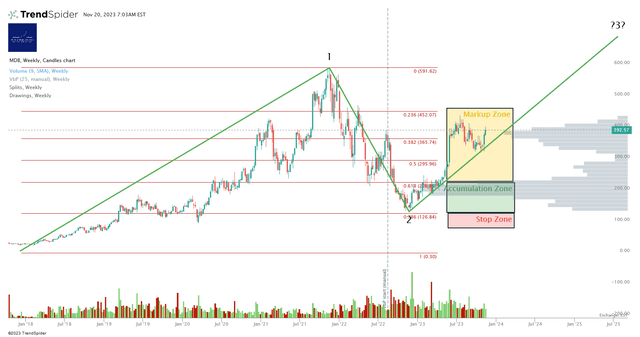

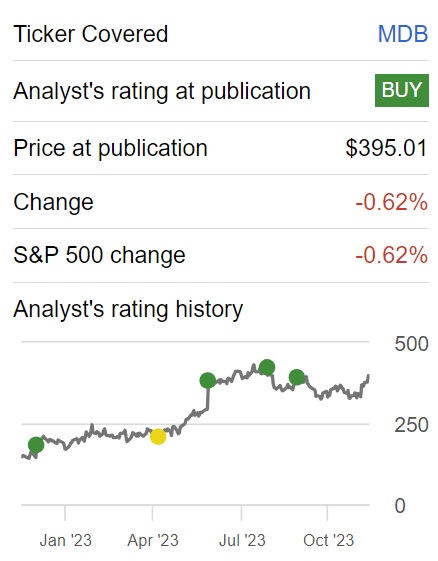

We made some righteous calls on MongoDB (NASDAQ:MDB) in the last year or so. A ‘Buy’ call in December 2022 and again in March 2023, and a ‘Sell’ call in June. Here’s how those ideas fared vs. the S&P 500.

Prior Cestrian Capital Research MDB Ratings

Our Luck Held! (Cestrian Capital Research, Seeking Alpha)

As is typical with highly-strung software names, the company put in a big correction from the market’s July high to the October lows – a drop from around $440 to $320; since which time the name is back up to $392. So the question is, did we hit peak tech stock excitement already, or is there more upside to come?

Let’s first take a look at the company fundamentals.

MongoDB’s Financial Analysis

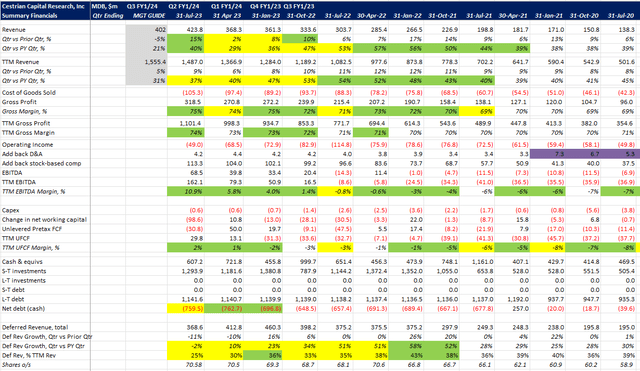

MongoDB Fundamental Analysis (Company SEC filings, YCharts.com, Cestrian Analysis)

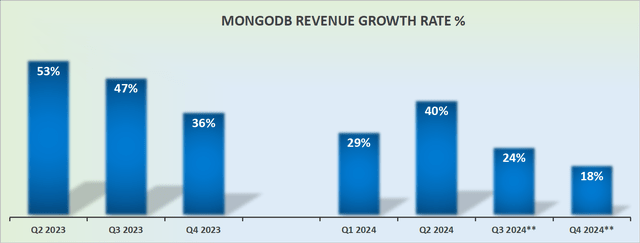

The company’s Q2 of FY1/24 was excellent. Revenue growth accelerated to +40% for the quarter vs. the same quarter last year. The company’s Q3 guide looks light, as it implies the fastest slowdown in growth (-5% vs. the prior quarter) that the company has experienced since at least 2018; we know of no particular macro nor company-specific reason why the quarter would be quite that brutal. We anticipate a beat, perhaps only a modest beat, but a beat nonetheless.

Gross margins once again hit record highs of 75% in the quarter and 74% on a TTM basis. TTM EBITDA margins are close to 11% now, and even allowing for the poor working capital management this company exhibits, cash flow is now positive on a TTM basis and has been so for two successive quarters. That may not sound like a big deal, but it is a big deal – the moment these types of software companies go from cash consumptive to cash generative is often an a-ha moment for latecomer investors in such names (and let’s not forget, it is late money that ultimately bids these stocks up so that smart-money early accumulators can then sell at large gains).

The balance sheet is strong enough with $760m of net cash. Fortress it isn’t, but it’s enough to keep the wolf from the door.

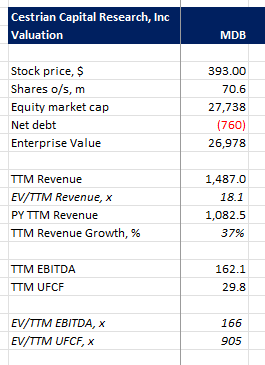

Valuation?

MongoDB’s Valuation Multiples

MongoDB Valuation Multiples (Company SEC filings, Ycharts.com, Cestrian Analysis)

Tough to look anyone in the eye and say, load up on this thing on the basis of fundamentals. 18x TTM revenue for a company that has TTM revenue growth of 37% but is telling the market that TTM growth will drop to 31% next quarter? Not so compelling as a buyer. The thing is, as all investors in high-growth software companies know, stocks like this are always “too expensive” and so very often the multiples have to get truly silly before one should dump the names and walk away, and this isn’t yet silly, it’s just expensive.

Perhaps the answer lies in the stock chart – certainly, the logic of our Buy and Sell calls above was technical rather than fundamental.

MongoDB’s Technical Analysis

You can open a full-page version of this chart, here.

MDB Stock Chart (Cestrian Capital Research, TrendSpider)

We chart this one using a slightly unusual method. We start the count at a notional 0 per share; clearly, the stock hasn’t ever traded there but for these huge corrections it happens more often than not that the stock finds support at the .786 Fibonacci retrace of the move from that notional zero to the all-time high – that’s the case with MDB stock as you can see. Projecting from the Wave 2 low we might expect a Wave 3 – that’s the current larger-degree move up currently underway – to terminate at somewhere between $592 (a whisker above the all-time high) to a too-difficult-to-contemplate-right-now $1093 (that’s the 1.618 extension of the prior Wave 1 which peaked in November 2021.

Wave Three targets always look silly when you draw them, because to happen the stock has to become the subject of overemotional buying – those late buyers again – which from the depths of Wave 2 misery is plainly impossible to imagine, and once the stocks start to reach the prior Wave 1 highs, one’s own emotions are saying, well, this thing is looking expensive now. This is why we have stock charts of course, to take the emotion out of it.

We believe the current bull market is set to continue. For how long? Well, our base case is that the Nasdaq peaks sometime mid/late next year in the range QQQ420-QQQ460/share. Our bull case? This is our bull case.

And our view on MDB stock hinges on this. If indeed we have a moonshot in the Nasdaq, which is certainly a possibility in our view, then can MDB reach $1000 before rolling over and selling off hard? Sure. Can you plan on that happening? Unwise in our view. If there is a solid if unspectacular up-market in 2024, can MDB reach all-time highs (it’s currently around 2/3 of that price, so a 50%-ish rise from here is needed to recapture the highs)? Probably, as long as it has time to get there and the company doesn’t in fact see growth fall off a cliff as they are guiding.

MongoDB’s Stock Rating

So how to rate this? Well, a label is one thing but we’ll explain how we think about it in staff personal accounts.

- Fundamentals are good, not great. There’s not much in the way of revenue visibility in the business model – deferred revenue is low at just 25% of TTM revenue, and that proportion is falling, i.e., the business model is becoming more contingent, not more certain. There’s no comfort in remaining performance obligation (the total order book, whether already invoiced or not) either, which sits at $482m as of 31 July this year – that’s less than a third of TTM recognized revenue. Cash flow margins are poor vs. other software companies in its class, and the balance sheet is good but unspectacular, meaning that if the company has to acquire its way out of trouble it will have to raise equity (or dilutive convertible debt) to do so.

- The valuation is punchy as noted above.

- The stock chart doesn’t scream buy as it did in Q4 2022/Q1 2023.

In staff personal accounts we took very handsome and quick gains, in the 50% range, earlier this year, and we have not looked back. We have no plans to buy back into the stock because whilst it’s true that the technical upside to $600, $1000, is truly possible, we can think of better uses for capital than this.

So, rating? Buy? No. Sell? No, because with appropriate risk management in place, it’s reasonable for current shareholders to want to ride this up the curve if they can. Hold? That will do it. (Or you could adopt the rating used in our staff personal accounts which is, Do Nothing!).

Any questions, comments, objections, whatever, hit us up in comments below. We read them all and endeavor to answer quickly.

Cestrian Capital Research, Inc – 20 November 2023.

Java News Roundup: Spring Framework 6.1, Spring Data 2023.1, Payara Platform, JEPs for JDK 22

MMS • Michael Redlich

This week’s Java roundup for November 13th, 2023 features news from OpenJDK, JDK 22, and monthly, milestone and point releases of: Spring Framework; Spring Data; Payara Platform; Open Liberty; Micronaut; Grails; Quarkus; Tomcat; Apache Camel; Vert.x; Mojarra; Micrometer Metrics and Tracing; Project Reactor; Piranha; JDKMon; JobRunr; JHipster Lite; Testcontainers for Java; Arquillian; and Gradle.

OpenJDK

After its review has concluded, JEP 459: String Templates (Second Preview), has been promoted from Proposed to Target to Targeted for JDK 22. This JEP provides a second preview from the first round of preview: JEP 430, String Templates (Preview), delivered in JDK 21. This feature enhances the Java programming language with string templates, string literals containing embedded expressions, that are interpreted at runtime where the embedded expressions are evaluated and verified. More details on JEP 430 may be found in this InfoQ news story.

JEP 463, Implicitly Declared Classes and Instance Main Methods (Second Preview), has been promoted from Candidate to Proposed to Target for JDK 22. Formerly known as Unnamed Classes and Instance Main Methods (Preview), Flexible Main Methods and Anonymous Main Classes (Preview) and Implicit Classes and Enhanced Main Methods (Preview), this JEP incorporates enhancements in response to feedback from the previous round of preview, namely JEP 445, Unnamed Classes and Instance Main Methods (Preview). This JEP proposes to “evolve the Java language so that students can write their first programs without needing to understand language features designed for large programs.” This JEP moves forward the September 2022 blog post, Paving the on-ramp, by Brian Goetz, Java language architect at Oracle. Gavin Bierman, consulting member of technical staff at Oracle, has published the first draft of the specification document for review by the Java community. More details on JEP 445 may be found in this InfoQ news story. The review is expected to conclude on November 28, 2023.

JEP 457, Class-File API (Preview), has been promoted from Candidate to Proposed to Target for JDK 22. This JEP proposes to provide an API for parsing, generating, and transforming Java class files. This will initially serve as an internal replacement for ASM, the Java bytecode manipulation and analysis framework, in the JDK with plans to have it opened as a public API. Brian Goetz, Java language architect at Oracle, characterized ASM as “an old codebase with plenty of legacy baggage” and provided background information on how this draft will evolve and ultimately replace ASM. The review is expected to conclude on November 28, 2023.

JEP 447, Statements before super(…) (Preview), has been promoted from Candidate to Proposed to Target for JDK 22. This JEP, under the auspices of Project Amber, proposes to: allow statements that do not reference an instance being created to appear before the this() or super() calls in a constructor; and preserve existing safety and initialization guarantees for constructors. Gavin Bierman, consulting member of technical staff at Oracle, has provided an initial specification of this JEP for the Java community to review and provide feedback. The review is expected to conclude on November 22, 2023.

JEP 423, Region Pinning for G1, has been promoted from Candidate to Proposed to Target for JDK 22. This JEP proposes to reduce GC latency by implementing region pinning to the G1 garbage collector. This will extend G1 so that arbitrary regions may be pinned during both major and minor collection operations so that disabling the garbage collection process may be avoided while implementing JNI critical regions. The review is expected to conclude on November 28, 2023.

JDK 22

Build 24 of the JDK 22 early-access builds was made available this past week featuring updates from Build 23 that include fixes to various issues. Further details on this build may be found in the release notes.

For JDK 22, developers are encouraged to report bugs via the Java Bug Database.

Spring Framework

The release of Spring Framework 6.1.0 delivers bug fixes, improvements in documentation, dependency upgrades and new features such as: introduce way to convert the response body to a desired type using message converters from the ClientHttpResponse interface; improved support for method validation for errors on elements within a container; and support for pattern matching on method names in ControlFlowPointcut class. More details on this release may be found in the release notes and What’s New page.

Similarly, versions 6.0.14 and 5.3.31 of Spring Framework have been released featuring bug fixes, improvements in documentation, dependency upgrades and new features such as: Log4jLog inner class, defined in LogAdapter class, needs to re-resolve the Log4j ExtendedLogger interface on deserialization for compatibility with Log4j 2.21; an optimization of the StandardTypeLocator class for hotspot when the same classes are resolved; and enhancements to setting properties in the ProblemDetail class. More details on these releases may be found in the release notes for version 6.0.14 and version 5.3.31.

The release of Spring Data 2023.1.0, codenamed Vaughn, ships with: compatibility with JDK 21; use of virtual threads through configuration of the Java Executor interface; support for Kotlin inline value classes; and exploration on optimizations for Checkpoint/Restore (CRaC); single query loading for Spring Data JDBC; and a migration of documentation to Antora. More details on this release may be found in the release notes.

Similarly, versions 2023.0.6, 2022.0.12 and 2021.2.18, all service releases of Spring Data, feature bug fixes and respective dependency upgrades to sub-projects such as: Spring Data Commons 3.1.6, 3.0.12 and 2.7.18; Spring Data MongoDB 4.1.6, 4.0.12 and 3.4.18; Spring Data Elasticsearch 5.1.6, 5.0.12 and 4.4.18; and Spring Data Neo4j 7.1.6, 7.0.12 and 6.3.18. These versions can be consumed by the upcoming releases of Spring Boot 3.1.6, 3.0.13 and 2.7.18, respectively.

Payara

Payara has released their November 2023 edition of the Payara Platform that includes Community Edition 6.2023.11, Enterprise Edition 6.8.0 and Enterprise Edition 5.57.0 featuring: bug fixes; a dependency upgrade to Maven Bundle Plugin 5.1.9; and a security fix for CVE-2023-41699, a URL Redirection to Untrusted Site vulnerability in Payara Platform Payara Server, Micro and Embedded that allows redirect access to libraries.

New features include: a new --warmup command line parameter, in conjunction with the asadmin command, start-domain, to stop the server after bootstrapping; and the addition of individual timeout options for all the Payara Server Management asadmin commands.

With these releases, Payara also introduced Payara Starter, a source code generator to create new Payara Server or Payara Micro projects.

More details on these versions may be found in the release notes for Community Edition 6.2023.11 and Enterprise Edition 6.8.0 and Enterprise Edition 5.57.0.

Open Liberty

IBM has released version 23.0.0.11 of Open Liberty featuring new vendor metrics for MicroProfile Metrics 5.0, 4.0 and 3.0 that can be directly added to dashboards of various monitoring tools without additional computation. These new metrics are: Process CPU Utilization Percent; Heap Utilization Percent; GC Time per Cycle; Connection Pool in Use Time per Used Connection; Connection Pool Wait Time per Queued Request; Servlet Elapsed Time per Request; and REST Elapsed Time per Request.

Other new features include: a resolution for CVE-2023-46158, a vulnerability in IBM WebSphere Application Server Liberty 23.0.0.9 through 23.0.0.10 that could provide weaker than expected security due to improper resource expiration handling; and the ability to include all server configuration files in server.xml using the include element that eliminates the previous requirement in which they needed to be individually specified.

Micronaut

The Micronaut Foundation has released version 4.2.0 of the Micronaut Framework featuring Micronaut Core 4.2.0 with enhancements to their Kotlin Symbol Processing and dependency upgrades to Kotlin 1.9.20 and Netty 4.1.101. JDK 21 has been added to the list of available JDK versions in Micronaut Launch and support for the Gradle Kotlin DSL. More details on this release may be found in the release notes.

Grails

The Grails Foundation has released version 6.1.0 of the Grails Framework featuring bug fixes, improvements in documentation, dependency upgrades and notable changes such as: an upgrade to SnakeYAML 2.2 to mitigate CVE-2022-1471, a vulnerability in which the deserialization of types using the SnakeYAML Constructor() class will allow an attacker to initiate a malicious remote code execution; and a decoupling of the Sitemesh Plugin for improved flexibility. More details on this release may be found in the release notes.

Quarkus

The release of Quarkus 3.5.2 ships with bug fixes, improvements in documentation and notable changes such as: a resolution to mitigate CVE-2023-21971, a vulnerability that allows an attacker, with network access via multiple protocols, to compromise MySQL Connectors that may result in unauthorized ability to cause a hang or frequently repeatable denial-of-service of MySQL Connectors as well as unauthorized update, insert or delete access to some of MySQL Connectors accessible data; disable the Http2RSTFloodProtectionTest and CustomManifestArgumentsTest classes on Windows OS due to instability from the tests creating many streams in a single connection; and avoid using the JUnit @TempDir annotation in the RestClientCDIDelegateBuilderTest class due to continuous integration issues in Windows OS. More details on this release may be found in the changelog.

Apache Software Foundation

Versions 11.0.0-M14, 10.1.16, 9.0.83 and 8.5.96 of Apache Tomcat all feature bug fixes and notable changes such as: ensure that an IOException during the reading of a request always triggers error handling, regardless of whether the application consumes the exception; a fix for a Tomcat Connector that refused new connections or caused the JVM to crash upon reloading the Transport Layer Security (TLS) configuration via the TLSCertificateReloadListener class; and the StatusManagerServlet class can now output statistics in JSON format.

For version 11.0.0-M14, integration with OpenSSL will use the Foreign Function & Memory API API rather than Tomcat Native. OpenSSL support may be enabled by adding the OpenSSLLifecycleListener class on the Server element when using Java 22 or later. More details on these releases may be found in the changelogs for version 11.0.0-M14, version 10.1.16, version 9.0.83 and version 8.5.96.

The release of Apache Camel 4.2.0 delivers bug fixes, dependency upgrades and new features/improvements such as: support for OAuth 2.0 (Camel HTTP component); support for Spring bean autowiring using the @Primary annotation (Camel Spring component); and the ability to use the old Micrometer meter names or follow the new Micrometer naming conventions (Camel Micrometer component). More details on this release may be found in the release notes.

Eclipse Foundation

The release of Eclipse Vert.x 4.5.0 provides new feature such as: support for JDK 21 and virtual threads; the creation of dynamic SQL connections; the ability to update TCP client/server SSL options at runtime for certificate rotation; and implementation of the Builder Pattern for connecting to HTTP clients and SQL connection pools. More details on this release may be found in the release notes and deprecations and breaking changes.

The release of Mojarra 4.0.5, the compatible implementation of the Jakarta Faces specification, ships with notable changes such as: Move reinitialization of Weld from ConfigureListener class back into it original FacesInitializer class due to exception issues; a fix for a mismatch between the specification and implementation on the use of the constant field, "jakarta.faces.WEBAPP_CONTRACTS_DIRECTORY" defined as WEBAPP_CONTRACTS_DIRECTORY_PARAM_NAME in the ResourceHandler class; and a new ExceptionHandler class added to the getExceptionHandler() method defined in the InitFacesContext class to resolve an UnsupportedOperationException. More details on this release may be found in the release notes.

Micrometer

Versions 1.12.0, 1.11.6, 1.10.13 and 1.9.17 of Micrometer Metrics all deliver bug fixes, improvements in documentation, dependency upgrades and new features in version 1.12.0 such as: support for Generational ZGC; support for Jetty 12 in the JettyConnectionMetrics class; and a new JmsInstrumentation class to add observability for the Jakarta Messaging specification; More details on these releases may be found in the release notes for version 1.12.0, version 1.11.6, version 1.10.13 and version 1.9.17.

Similarly, versions 1.2.0, 1.1.7 and 1.0.12 of Micrometer Tracing all deliver dependency upgrades and new features in version 1.2.0 such as: make the SpanTagAnnotationHandler class optional such that it will match with the TimedAspect class for frameworks to more easily configure it; a new getDuration() method defined in the FinishedSpan interface; and deprecate HTTP instrumentation abstractions for removal due to a decision to not provide abstractions over transports in all instrumentation projects. More details on these releases may be found in the release notes for version 1.2.0, version 1.1.7 and version 1.0.12.

Project Reactor

The release of Project Reactor 2023.0.0 provides dependency upgrades to reactor-core 3.6.0, reactor-netty 1.1.13, reactor-kafka 1.3.22, reactor-pool 1.0.3, reactor-addons 3.5.1 and reactor-kotlin-extensions 1.2.2. More details on this release may be found in the changelog.

Similarly, Project Reactor 2022.0.13, the thirteenth maintenance release, provides dependency upgrades to reactor-core 3.5.12, reactor-netty 1.1.13 and reactor-kafka 1.3.22. There was also a realignment to version 2022.0.13 with the reactor-pool 1.0.3, reactor-addons 3.5.1 and reactor-kotlin-extensions 1.2.2 artifacts that remain unchanged. More details on this release may be found in the changelog.

Piranha

The release of Piranha 23.11.0 delivers notable changes such as: support for JDK 21; support for Coordinated Restore at Checkpoint (CRaC) to the Piranha Core Profile; and a removal of the Maintainability, Lines of Code, Code Coverage and Code Smells badges. More details on this release may be found in their documentation and issue tracker.

JDKMon

Versions 17.0.85 and 17.0.83 of JDKMon, a tool that monitors and updates installed JDKs, has been made available this past week. Created by Gerrit Grunwald, principal engineer at Azul, these new versions provide new features: support for GraalVM for National Vulnerability Database (NVD) scans related to the JDK; a new search field for discovering OpenJDK JEPs, JSRs and Java projects; and support for Common Vulnerability Scoring System (CVSS) 4.0 and NVD API 2.0.

JobRunr

Version 6.3.3 of JobRunr, a library for background processing in Java that is distributed and backed by persistent storage, has been released featuring: a separate build time and runtime configuration for Quarkus; and a fix for JobRunr accepting the synthetic classes provided by the Quarkus ClientProxy interface instead of the original proxy name that result in beans that are not found. More details on this release may be found in the release notes.

JHipster Lite

Version 0.48.0 of JHipster Lite has been released featuring bug fixes, dependency upgrades and new features/enhancements such as: a minimal JDK 21 for the JHipster Lite engine; a new license module to build multiple instances of the JHipsterModule class; and the addition of name and description attributes to the @BusinessContext and @SharedKernel annotations for better documenting contexts and the ability to generate living documentation. More details on this release may be found in the release notes.

Testcontainers for Java

Testcontainers for Java 1.19.2 has been released with notable changes such as: enable HTTP and HTTPS on native for the HttpWaitStrategy class; a new shutdown hook to send a SIGTERM to Moby Ryuk to shutdown sooner than the current default of 10 seconds; and support for the Elasticsearch image from DockerHub.

Arquillian

The release of Arquillian 1.8.0.Final delivers notable changes such as: elimination of a file leak in the RemoteExtensionLoader class; a dependency upgrade to Jetty 9.4.51.v20230217 to resolve the Jetty 8.1.2.v20120308 bypass vulnerability; and a replacement of deprecated JUnit and Arquillian constructors and methods.

Gradle

The third release candidate and second release candidate of Gradle 8.5 deliver continuous improvements on new features such as: full support for compiling, testing and running on JDK 21; improvements in the Kotlin DSL that include faster first use and version catalog support in precompiled Kotlin script plugins; and improved reporting of errors and warnings. More details on these releases may be found in the release notes for version 8.5-RC3 and version 8.5-RC2.

MMS • RSS

Khanchit Khirisutchalual

Investment Thesis

MongoDB (NASDAQ:MDB) is a few weeks away from reporting its fiscal Q3 2024 results.

Here I make the case that a lot is riding on its fiscal Q3 2024 report. MongoDB needs to convincingly articulate that although it’s slowing down its growth the strategic optimization of its go-to-market approach, together with a focus on winning new workloads can allow MongoDB’s fiscal 2025 to return to 30% CAGR.

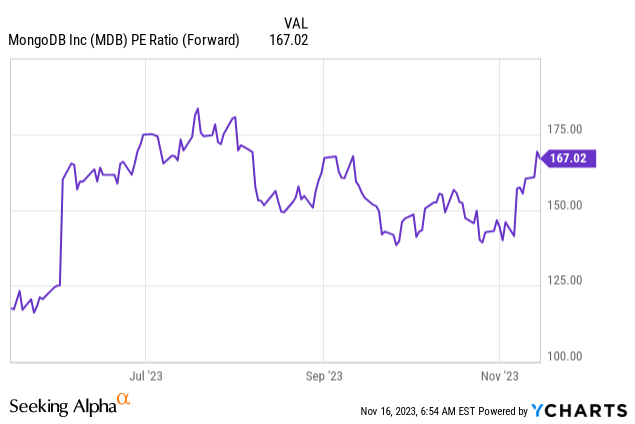

Because even though I’m bullish on this high-quality company, the fact remains that MongoDB’s stock is not cheap at more than 160x forward EPS.

Quick Recap

On the back of MongoDB’s Q2 results, I penned a bullish analysis where I said:

Despite MongoDB, Inc.’s impressive financial report, I must admit to feeling uncertain and doubtful about the future. While the company delivered exceptional results in Q2, questions linger in my mind.

MongoDB’s multiple doesn’t reflect a bargain, and the market had already set high expectations. The growth narrative focused on MongoDB’s cloud business, Atlas, but Q2’s success was driven more by the legacy business.

Since I put forth the assertion that this stock was fully valued, over the following 3 months, we can see how the stock has performed.

Author’s work on MDB

The stock has gone nowhere. This a reminder that investors want more than just an alluring narrative and that valuation still matters.

Recent Developments

A lot of companies in IT infrastructure have recently reported and the picture is mixed. This is what I find investors are rewarding, profitable growth.

Investors recognize that there’s a challenging macro environment marked by a slowdown in IT departments when it comes to software consumption. The way that CEOs have described this period is one of software digestion, where the bulk of companies that wanted to move to the cloud have already done so.

And although there’s likely to be a continued trend towards cloud migration, the pace of this cloud migration has moderated. I’ve discussed this at length here.

Indeed, recall, this line of reasoning aligns with what MongoDB has already reported in its cloud Atlas business last quarter. And I’m now starting to believe that that was not a one-off event, but instead the new normal for cloud companies.

For a long time, investors salivated on the back of cloud adoption narratives, not paying enough attention to the fact that this was simply companies cannibalizing their customer base.

Consequently, I believe that when MongoDB reports its fiscal Q3 2024 results in a few weeks were are likely to see MongoDB describing how customers are not proactively reducing their spend but rather experiencing a slower pace in underlying application growth.

MongoDB Needs to Convince Investors Of Fiscal 2025 Return to Growth

MDB revenue growth rates

Before we go further, note that MongoDB is about to report its fiscal Q3 20234 results, not to be confused with calendar 2023. Accordingly, I believe that investors have already come to terms with the fact that fiscal H2 2024 will be challenging for MongoDB.

But starting fiscal H1 2025, as its comparables ease up, I believe that MongoDB could once again return to growing at 30% CAGR.

And if that’s the case, this stock would continue to be perceived by investors as a high-growth story, deserving of a high-growth multiple.

MDB Stock Valuation – Very Expensive

MongoDB has nearly always traded at a very high multiple. But for a long time, it could be counted on for more than 30% CAGR, without any need for concern.

But now, the environment has changed. And there’s a likelihood that if MongoDB doesn’t meaningfully upgrade its fiscal Q4 2024 revenue guidance, investors will start to presume that this company is about to go ex-growth.

And if that happens, all of a sudden, investors will turn their focus to MongoDB’s bottom-line profitability and valuation. And I don’t know if investors will truly be eager to support paying more than 160x forward EPS for a company that could be growing at less than 30% CAGR.

The Bottom Line

MongoDB stands as a high-quality company with a compelling growth narrative, underscored by strategic optimizations in its go-to-market approach.

The upcoming fiscal Q3 2024 results are pivotal in communicating the company’s ability to navigate a shifting macro environment and return to a 30% CAGR in fiscal 2025.

However, despite my bullish stance on the company’s prospects, it’s crucial to acknowledge the hefty valuation, with the stock trading at more than 160x forward EPS. This valuation raises concerns, emphasizing the need for MongoDB to deliver robust performance and provide convincing guidance in order to sustain investor confidence amid potential challenges to its growth trajectory

MMS • RSS

InvestingPro subscribers always get first dibs on market-moving AI analsyt comments.

Unlock the potential of InvestingPro for up to 55% off this Black Friday and never miss out on a market winner again.

Microsoft Corporation (NASDAQ:MSFT) unveiled a series of new AI products at its Ignite conference. Among the notable announcements are AI Copilots for Azure and Service.

The Redmond-based tech titan is also working on internally designed semiconductors tailored for both AI and general-purpose workloads.

“Microsoft continues to be a first mover in bringing generative AI to customers, and the progress highlighted at Ignite today affirms our outlook that the company can continue to capitalize on the expanding opportunity it has in front of them,” Barclays analysts said.

NVIDIA Corporation (NASDAQ:NVDA) announced the new HGX H200 AI accelerator, which is an upgrade to the current H100.

Bank of America analysts reiterated a Top Pick designation on Nvidia stock following the announcement. They highlight that H200 is compatible with its predecessor H100 installations, enabling faster time to market.

“We view [this] as critical, as hyperscalers do not need to invest to reconfigure their existing hardware platform, incentivizing customers to remain key partners of NVDA,” analysts wrote.

Morgan Stanley analysts discussed potential GenAI winners in 2024 with Meta Platforms Inc (NASDAQ:META) seen as a strong mega-cap candidate.

“We continue to follow the multi-year phasing of investing in tech cycles (semi-conductors, infrastructure, then software) but in ’24 we look for more investor focus on material incremental ROIC of AI investments. META screens the most likely candidate among the mega caps.”

Elsewhere, the analysts also flagged several smaller stocks, including Snap (NYSE: SNAP), Pinterest (NYSE: NYSE:PINS), eBay (NASDAQ: NASDAQ:EBAY), Etsy (NASDAQ: NASDAQ:ETSY), Trade Desk (NASDAQ: NASDAQ:TTD), Take Two (NASDAQ: TTWO), and ridesharing-delivery businesses like Uber (NYSE: NYSE:UBER), DoorDash (NASDAQ: NASDAQ:DASH), and Lyft (NASDAQ: NASDAQ:LYFT).

MongoDB (NASDAQ:MDB) is the best way to play AI, according to Wells Fargo analysts.

The analysts initiated research coverage on MongoDB with an Overweight rating and a $500 per share price target.

“We see MongoDB as the best AI play in software infrastructure given its ever-expanding list of new workloads. The company is well-positioned for solid margin expansion, which in turn will drive strong Free Cash Flow growth,” analysts said in a note.

Wedbush tech analysts argue that a new tech bull market has started despite investor worries about stretched valuations. They see the set-up in the sector as strong amid a “tidal wave” of AI spending.

“Heading into 2024 we believe the tech sector is set up for an acceleration of spending around cloud and AI spending that we believe is being significantly underestimated by the Street,” analysts commented.

“While IT budgets are expected to be up modestly in 2024, we believe cloud and AI driven spending will be up 20%-25% over the next year with use cases now exploding across the enterprise and consumer landscape.”

MMS • Renato Losio

Timescale recently introduced Dynamic PostgreSQL, a new cloud-managed option to scale the database capacity within a predefined vCPU range. Promoted it as “buy the base and rent the peak”, the new option scales the capacity according to the load trying to address the unpredictability and variability of serverless options.

Based on TimescaleDB, the open-source time series database that extends PostgreSQL, Dynamic PostgreSQL wants to offer a third alternative to provisioned and serverless databases. Mike Freedman, CTO and co-founder at Timescale, and Grant Godeke, senior product manager at Timescale, explain:

It is backed by dynamic compute, a Timescale innovation that instantaneously scales your available compute within a predefined min/max range according to your load. Instead of provisioning for your peak (and paying for it at all times), you can now pick a compute range: your database will operate at base capacity and instantly access up to its peak only when needed. Buy the base, rent the peak.

As the customer chooses a range, the dynamic maximum is capped at twice the base capacity. Timescale argues that databases are very different from Lambda functions and serverless databases today are inefficient for most production workloads as they focus on the extremes for scaling up and down, and they introduce higher and hard-to-understand pricing to account for the resources reserved to serve changing demands. Jeremy Daly, CEO and Founder of Ampt, writes:

The difference here (I think) is that they are positioning this as “Buy the base, rent the peak.” I’ve been saying this for a very long time, but this is the missing piece of serverless that cloud providers need to embrace.

Tobias Petry, database consultant, comments:

It’s like burstable EC2 machines, which is a perfect solution: Cost-effective base pricing and you only pay more in the rare cases when needed. This effectively works against the oversized instances by default of teams.

One of the benefits of serverless databases is the ability to scale the capacity to zero, paying only for the compute time used. Freedman and Godeke argue:

There are some use cases where “scale to zero” makes sense. For example, proof-of-concept demos or more hobbyist applications (…) But for your production database and in more operational settings? You don’t want to scale to zero. Scaling to zero means a “cold boot” on restart: empty database shared buffers, empty OS cache, empty catalog caches.

Dynamic PostgreSQL targets mainly deployments running on AWS, claiming that customers will save 10-20 % when migrating from RDS for PostgreSQL and 50-70% when migrating from Aurora Serverless but no benchmarks have been published yet.

Dynamic PostgreSQL was not the only announcement during the Dynamic Infra Launch Week: the Terraform provider is generally available, hypertables are supported on Cloudflare Hyperdrive and Timescale cloud is now available on 7 AWS regions in Australia, Europe, the US, and Asia.

The monthly pricing starts at 87.60 USD for a 1-2 CPU range, with 0.12 USD changed hourly per CPU for usage above the committed base. Timescale offers a 30-day free trial for new accounts.

MMS • Sergio De Simone

Adding new features has often a hidden impact on app size, with several undesired effects, including user disengagement and unnecessary carbon emissions. To keep app size under control, Spotify engineers established pre-PR and post-PR processes to help prevent an estimated 10MB app size growth over six months.

While app size is not often at the core of developers’ interest, it is by any means an important factor to take into account, argue Spotify engineers Viktor Petrovski, Dmitry Povolotskyi, and Bruno Rocha.

App size affects users in two distinct dimensions, network bandwidth and storage. While those are not usually a concern for most people living in so-called developed countries, they usually are for 85% of the world population, due to factors like the prevalence of older devices with reduced storage or network bandwidth. According to an experiment led by Google, furthermore:

For every 6MB increase to an app’s size, the app’s installation-conversion rate decreased by 1%. The implications are profound, leading to a multitude of missed opportunities.

However, app size is bound to become a concern even in developed countries due to the effect that network traffic has on global warming. Spotify engineers provide data that show that only for updating their mobile app across its user base, a staggering 930+ petabytes of data traveled across the Internet. Using a popular model currently available, the one-byte model developed by the Shift Project, and EPA data for 2019, they estimated that network traffic to equate to around 65,000 tonnes of CO2, the equivalent of 65,000 individuals taking a round trip flight between London and New York.

To help keep app size under control, Spotify relies on strict pre-merge and post-merge processes. In the pre-merge process, each PR is analyzed using Emerge Tools to assess its impact on app size. If it is larger than 50KB, a dedicated team further analyzes it applying several criteria and approves or rejects it.

The post-merge process attempts to get a more global view of app size evolution from build to build. Indeed, even if each PR is smaller than 50KB, the overall app size growth from all PRs that go into a build can be significant. Again, Emerge Tools are key here. They provide a detailed breakdown of compilation units and how much each contributes to app size. This data is then used to pinpoint which teams have contributed most to app size growth and to build analytics to compare teams’ performance.

Establishing attribution and holding each team responsible for its impact allows us to effectively maintain a balance between rolling out new features and ensuring that our app size remains within reasonable limits.

Overall, this two-fold process allowed Spotify engineers to identify 100+ PRs that triggered warnings, of which 53 were revised to reduce their size. This made it possible to prevent app size increase by over 10MB as well as to establish a shared culture across engineers to strive for smaller PRs in the first place.