Month: June 2024

MMS • RSS

-

Robust subscription revenue growth despite economic headwinds.

-

Consistent investment in sales and marketing to fuel expansion.

-

Challenges in maintaining service level commitments amidst rapid scaling.

-

International operations expose the company to geopolitical risks.

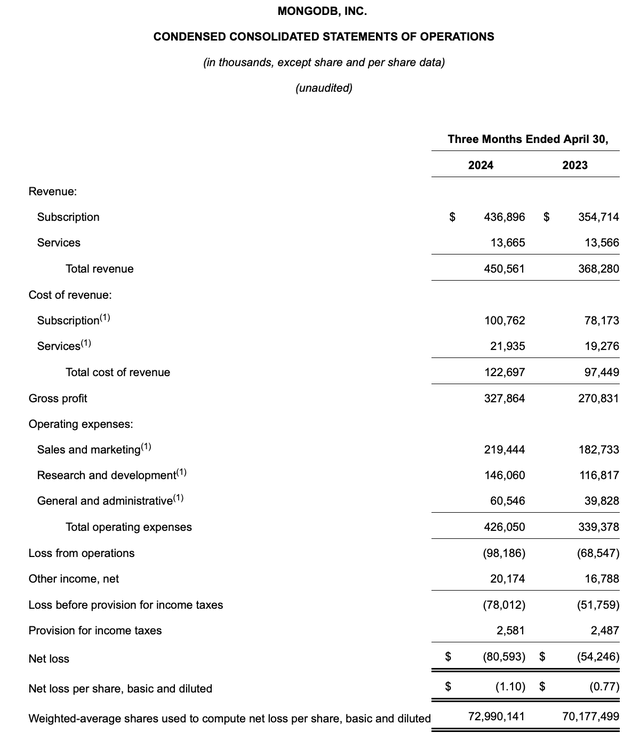

On May 31, 2024, MongoDB Inc (NASDAQ:MDB), a leader in document-oriented database solutions, filed its 10-Q report, revealing a detailed look into its financial performance and strategic positioning. Despite a challenging macroeconomic environment, MongoDB Inc has demonstrated resilience with a notable increase in subscription revenue from $354,714 in 2023 to $436,896 in 2024. The company’s commitment to investing in sales and marketing is evident, with a substantial portion of operating expenses allocated to these areas. However, the company’s rapid growth trajectory has put pressure on its ability to maintain service level commitments, a factor critical to customer satisfaction and retention. Furthermore, MongoDB Inc’s extensive international operations expose it to the risks associated with geopolitical tensions and economic instability, which could impact its global revenue streams.

Strengths

Robust Subscription Revenue Growth: MongoDB Inc’s strength lies in its impressive subscription revenue growth, which has surged from $354,714 in 2023 to $436,896 in 2024. This growth is indicative of the company’s successful land-and-expand strategy, where it focuses on not only acquiring new customers but also expanding its footprint within existing customer bases. The ability to consistently grow its annualized recurring revenue (ARR) and monthly recurring revenue (MRR) reflects the company’s strong market position and the high demand for its NoSQL database solutions.

Strategic Sales and Marketing Investments: MongoDB Inc has made significant investments in its sales and marketing efforts, which have been instrumental in driving customer acquisition and retention. With operating expenses in sales and marketing reaching $219,444 in 2024, the company has demonstrated a clear strategy to fuel growth through targeted outreach and customer engagement initiatives. These investments have not only helped in increasing the number of customers with $100,000 or greater in ARR and annualized MRR but also in maintaining a net ARR expansion rate consistently over 120%, showcasing the company’s ability to grow its customer base and deepen relationships with existing clients.

Weaknesses

Service Level Commitment Pressures: As MongoDB Inc scales rapidly, maintaining its service level commitments has become a challenge. The company’s MongoDB Enterprise Advanced customers expect guaranteed response times and comprehensive coverage, while MongoDB Atlas users demand high uptime. Any failure to meet these commitments could significantly affect customer satisfaction, potentially leading to customer attrition and negatively impacting the company’s reputation and financial health.

Dependence on MongoDB Atlas: With more than the majority of MongoDB Inc’s revenue derived from MongoDB Atlas, the company’s financial performance is heavily reliant on the success of this offering. While this dependence underscores the strength of MongoDB Atlas in the market, it also poses a risk. Any issues with customer satisfaction, competitive pressures, or technological shifts could disproportionately affect the company’s overall performance and growth prospects.

Opportunities

Expanding Cloud Infrastructure: The ongoing shift towards cloud computing presents MongoDB Inc with significant opportunities to expand its MongoDB Atlas services. Partnerships with cloud infrastructure providers, like the one with Tencent Cloud, enable MongoDB Inc to reach a broader global audience and capitalize on the growing demand for cloud-based database solutions. This expansion strategy can lead to increased market share and revenue in the rapidly growing cloud services sector.

International Market Penetration: MongoDB Inc’s international operations, which account for a substantial portion of its revenue, offer a pathway for growth outside the United States. By continuing to adapt and localize its offerings for specific countries and regions, MongoDB Inc can tap into new markets, diversify its revenue streams, and mitigate the risks associated with over-reliance on any single market.

Threats

Macroeconomic Instability: The company has acknowledged the negative impact of the macroeconomic environment on the growth of existing Atlas applications, which has affected revenue growth. With expectations that these conditions will persist, MongoDB Inc faces the threat of reduced technology spending by clients, potentially leading to slower revenue growth and challenges in customer acquisition and expansion.

Geopolitical Risks: MongoDB Inc’s international presence exposes it to geopolitical risks, including trade laws, political instability, and economic sanctions. These factors can lead to decreased use of MongoDB Inc’s offerings or limitations on its ability to export or sell its products, adversely affecting its operations and financial results. Additionally, the company must navigate the complexities of operating in multiple legal and regulatory environments, which can increase costs and operational challenges.

In conclusion, MongoDB Inc (NASDAQ:MDB) exhibits a strong financial foundation with robust subscription revenue growth and strategic investments in sales and marketing. However, the company must address the pressures of maintaining service level commitments and its heavy reliance on MongoDB Atlas. Opportunities in cloud infrastructure expansion and international markets are promising, but MongoDB Inc must carefully manage the threats posed by macroeconomic instability and geopolitical risks. By leveraging its strengths and addressing its weaknesses, MongoDB Inc can capitalize on the opportunities and mitigate the threats in its path, positioning itself for sustained growth and success in the competitive database market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

MMS • RSS

#inform-video-player-1 .inform-embed { margin-top: 10px; margin-bottom: 20px; }

#inform-video-player-2 .inform-embed { margin-top: 10px; margin-bottom: 20px; }

NEW YORK (AP) — Stocks that traded heavily or had substantial price changes on Friday:

Veeva Systems Inc., down $19.94 to $174.25.

The provider of cloud-based software services gave investors a revenue forecast that fell short of Wall Street expectations.

MongoDB Inc., down $73.94 to $236.06.

The database platform trimmed its earnings forecast for the year.

Zscaler Inc., up $13.31 to $169.96.

The cloud-based information security provider raised its earnings forecast for its fiscal year.

SentinelOne Inc., down $2.59 to $16.83.

The cybersecurity provider cut its revenue forecast for the year.

Ulta Beauty Inc., up $9.51 to $395.09.

The beauty products retailer beat Wall Street’s first-quarter earnings forecasts.

Gap Inc., up $6.44 to $28.96.

The clothing chain’s first-quarter profit beat analysts’ forecasts.

VF Corp., up 95 cents to $13.28.

The maker of North Face and Timberland products named Michelle Choe as president of its Vans brand.

NetApp Inc., up $3.93 to $120.43.

The data storage company beat analysts’ fiscal fourth-quarter financial forecasts.

#inform-video-player-3 .inform-embed { margin-top: 10px; margin-bottom: 20px; }

MMS • RSS

U.S. stocks traded mixed toward the end of trading, with the Dow Jones index gaining around 250 points on Friday.

The Dow traded up 0.66% to 38,361.37 while the NASDAQ dipped 1.30% to 16,519.04. The S&P 500 also fell, dropping, 0.36% to 5,216.72.

Check This Out: Cirrus Logic, Texas Roadhouse And 2 Other Stocks Insiders Are Selling

Leading and Lagging Sectors

Energy shares rose by 2% on Friday.

In trading on Friday, information technology shares fell by 1.5%.

Top Headline

The total number of active U.S. oil rigs slipped by 1 to 496 rigs this week, Baker Hughes Inc reported.

Equities Trading UP

- Novo Integrated Sciences, Inc. NVOS shares shot up 153% to $1.1359 after the company approved a $5 million stock repurchase. The company’s board is conducting a review to determine whether it is appropriate to increase the amount under the repurchase program.

- Shares of Ambarella, Inc. AMBA got a boost, surging 18% to $57.15 following strong first-quarter earnings and upbeat second-quarter guidance.

- The Gap, Inc. GPS shares were also up, gaining 28% to $28.83 after reporting strong quarterly results

Equities Trading DOWN

- MongoDB, Inc. MDB shares dropped 25% to $232.99 after the company issued weak FY25 guidance.

- Shares of Dell Technologies Inc. DELL were down 18% to $139.65. Dell reported upbeat earnings and sales results for the first quarter.

- Calidi Biotherapeutics, Inc CLDI was down, falling 30% to $0.21 after the company reported exercise of warrants for $2.1 million gross proceeds.

Also Check This Out: How To Earn $500 A Month From Pfizer Stock

Commodities

In commodity news, oil traded down 0.9% to $77.25 while gold traded down 0.8% at $2,346.70.

Silver traded down 3.4% to $30.475 on Friday, while copper fell 1% to $4.612.

Euro zone

European shares were mostly higher today. The eurozone’s STOXX 600 rose 0.32%, Germany’s DAX rose 0.01% and France’s CAC 40 gained 0.18%. Spain’s IBEX 35 Index slipped 0.14%, while London’s FTSE 100 gained 0.54%.

Annual inflation rate in the Eurozone increased to 2.6% in May compared to 2.4% in each of the prior two months. Producer prices in France fell 3.6% month-over-month for the month of April. The French economy grew by 0.2% quarter-over-quarter in the first quarter, while annual inflation rate in France came in steady at 2.2% in May.

Consumer credit in the UK increased by £73 million in April versus a revised £1.422 billion a month ago. Italy’s gross domestic product increased by 0.3% from the prior quarter during the three months ending March. Retail sales in Germany fell 1.2% month-over-month during April.

Asia Pacific Markets

Asian markets closed mixed on Friday, with Japan’s Nikkei gaining 1.14%, China’s Composite Index falling 0.16%, Hong Kong’s Hang Seng Index falling 0.83% and India’s S&P BSE Sensex gaining 0.01%.

Retail sales in Hong Kong fell 16.5% year-over-year in April compared to revised 8.7% decline in the earlier month. The NBS Composite PMI Output Index for China fell to 51.0 in May compared to April’s reading of 51.7.

Retail sales in Japan increased by 2.4% year-over-year in April, while industrial production fell 0.1% month-over-month in April. Japan’s housing starts climbed by 13.9% year-over-year in April versus a 12.8% decline in the prior month. Japan’s unemployment rated came in unchanged at 2.6% in April.

Economics

- The headline PCE inflation rate held steady at 2.7% year-on-year in April 2024, matching economist expectations, according to Econoday data.

- Personal income rose at a 0.3% monthly rate, slowing down from March’s 0.5% growth and matching expectations.

- Personal spending advanced at a 0.2% pace, decelerating from March’s 0.8% growth and missing expectations of 0.3%.

- The Chicago PMI fell to 35.4 in May from 37.9 in the previous month.

- The total number of active U.S. oil rigs slipped by 1 to 496 rigs this week, Baker Hughes Inc reported.

Now Read This: Top 5 Defensive Stocks That May Explode This Quarter

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MMS • RSS

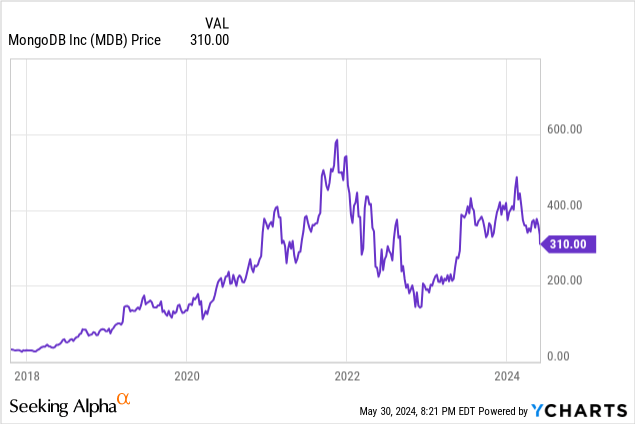

After issuing downbeat FY25 guidance last quarter, conditions worsened for MongoDB (MDB, Financial) in Q1, leading to a lowered outlook for the year. The unstructured database management software provider is grappling with a deteriorating macroeconomic situation, causing its stock to plummet to one-year lows—a more than 50% drop from mid-February 2024 highs.

Several factors are driving today’s negative reaction, but two key developments stand out:

- MongoDB now anticipates a slowdown in consumption growth for its cloud offering, Atlas, despite earlier predictions of stability.

- Its pipeline of multi-year deals within the legacy Enterprise Advanced (EA) offering is lower than expected, leading to a mid-single-digit percentage decline in non-Atlas revenues for FY25.

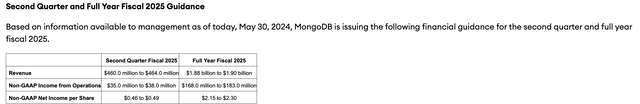

As a result, MongoDB has reduced its FY25 guidance, now expecting adjusted EPS of $2.15-2.30 and revenues of $1.88-1.90 billion, down from $2.27-2.49 and $1.90-1.93 billion, respectively.

What happened?

MongoDB’s quarterly numbers can fluctuate significantly due to its consumption-based pricing for Atlas. The company experienced broad-based weakness within a short period, affecting customers across various sectors and geographies, reflecting a challenging global economic environment. Additionally, MongoDB had a slow start in acquiring new business.

- Despite these challenges, MongoDB managed to deliver another quarter of top and bottom-line growth, with adjusted EPS of $0.51 and a 22.3% year-over-year revenue increase to $450.56 million. However, Q1 difficulties are expected to impact the rest of the year.

On a positive note, MongoDB’s win and retention rates remained strong in Q1, highlighting the mission-critical nature of its platform. Once customers adopt MongoDB’s software, switching to a competitor is costly. Additionally, the rise of AI is pushing businesses to modernize legacy applications, benefiting MongoDB in the long term.

MongoDB is optimistic about capitalizing on the acceleration in legacy app modernization using AI. Although migrating from a legacy platform is costly and challenging, management believes its offerings and investments will attract hesitant businesses.

- MongoDB signed Accenture (ACN, Financial) as its first global systems integrator for its MongoDB AI Application Program (MAAP), which integrates hyperscalers and Gen AI frameworks.

The rapidly changing economic backdrop has generated considerable selling pressure. While MongoDB’s software maintains a competitive edge in organizing unstructured data, the current cautious buying climate—similar to what Salesforce (CRM, Financial) and UiPath (PATH, Financial) have experienced—poses challenges that may impede a swift recovery.

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB – Get Free Report)’s share price reached a new 52-week low during trading on Friday after Barclays lowered their price target on the stock from $458.00 to $290.00. Barclays currently has an overweight rating on the stock. MongoDB traded as low as $225.25 and last traded at $228.57, with a volume of 2559554 shares. The stock had previously closed at $310.00.

MongoDB, Inc. (NASDAQ:MDB – Get Free Report)’s share price reached a new 52-week low during trading on Friday after Barclays lowered their price target on the stock from $458.00 to $290.00. Barclays currently has an overweight rating on the stock. MongoDB traded as low as $225.25 and last traded at $228.57, with a volume of 2559554 shares. The stock had previously closed at $310.00.

A number of other brokerages have also commented on MDB. Tigress Financial lifted their price target on shares of MongoDB from $495.00 to $500.00 and gave the stock a “buy” rating in a research note on Thursday, March 28th. Oppenheimer cut their target price on shares of MongoDB from $480.00 to $300.00 and set an “outperform” rating for the company in a research report on Friday. Bank of America lowered their price target on MongoDB from $500.00 to $470.00 and set a “buy” rating on the stock in a report on Friday, May 17th. Needham & Company LLC reduced their price objective on MongoDB from $465.00 to $290.00 and set a “buy” rating for the company in a research report on Friday. Finally, Morgan Stanley dropped their target price on MongoDB from $455.00 to $320.00 and set an “overweight” rating on the stock in a research report on Friday. Two equities research analysts have rated the stock with a sell rating, four have given a hold rating and twenty-one have assigned a buy rating to the company’s stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of “Moderate Buy” and a consensus target price of $374.29.

Read Our Latest Stock Analysis on MongoDB

Insiders Place Their Bets

In related news, CRO Cedric Pech sold 1,430 shares of the stock in a transaction that occurred on Tuesday, April 2nd. The stock was sold at an average price of $348.11, for a total transaction of $497,797.30. Following the completion of the transaction, the executive now directly owns 45,444 shares of the company’s stock, valued at $15,819,510.84. The sale was disclosed in a filing with the SEC, which is available through this link. In other MongoDB news, Director Dwight A. Merriman sold 4,000 shares of MongoDB stock in a transaction on Wednesday, April 3rd. The shares were sold at an average price of $341.12, for a total value of $1,364,480.00. Following the completion of the transaction, the director now directly owns 1,156,784 shares of the company’s stock, valued at approximately $394,602,158.08. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, CRO Cedric Pech sold 1,430 shares of the business’s stock in a transaction dated Tuesday, April 2nd. The stock was sold at an average price of $348.11, for a total transaction of $497,797.30. Following the completion of the sale, the executive now owns 45,444 shares in the company, valued at $15,819,510.84. The disclosure for this sale can be found here. Insiders have sold a total of 46,802 shares of company stock worth $16,514,071 in the last 90 days. 3.60% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Transcendent Capital Group LLC purchased a new position in MongoDB during the fourth quarter worth $25,000. Blue Trust Inc. grew its holdings in MongoDB by 937.5% during the 4th quarter. Blue Trust Inc. now owns 83 shares of the company’s stock valued at $34,000 after purchasing an additional 75 shares during the last quarter. Huntington National Bank raised its position in MongoDB by 279.3% in the 3rd quarter. Huntington National Bank now owns 110 shares of the company’s stock worth $38,000 after purchasing an additional 81 shares during the period. YHB Investment Advisors Inc. bought a new stake in MongoDB in the first quarter worth about $41,000. Finally, Parkside Financial Bank & Trust boosted its position in shares of MongoDB by 38.3% during the third quarter. Parkside Financial Bank & Trust now owns 130 shares of the company’s stock valued at $45,000 after buying an additional 36 shares during the period. Hedge funds and other institutional investors own 89.29% of the company’s stock.

MongoDB Stock Performance

The company has a quick ratio of 4.40, a current ratio of 4.40 and a debt-to-equity ratio of 1.07. The business has a 50 day moving average price of $353.32 and a 200 day moving average price of $390.77. The stock has a market cap of $17.19 billion, a P/E ratio of -95.19 and a beta of 1.19.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings data on Thursday, March 7th. The company reported ($1.03) EPS for the quarter, missing the consensus estimate of ($0.71) by ($0.32). MongoDB had a negative net margin of 10.49% and a negative return on equity of 16.22%. The business had revenue of $458.00 million during the quarter, compared to the consensus estimate of $431.99 million. As a group, sell-side analysts expect that MongoDB, Inc. will post -2.53 EPS for the current year.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

#inform-video-player-1 .inform-embed { margin-top: 10px; margin-bottom: 20px; }

#inform-video-player-2 .inform-embed { margin-top: 10px; margin-bottom: 20px; }

NEW YORK (AP) — Stocks that traded heavily or had substantial price changes on Friday:

Veeva Systems Inc., down $19.94 to $174.25.

The provider of cloud-based software services gave investors a revenue forecast that fell short of Wall Street expectations.

MongoDB Inc., down $73.94 to $236.06.

The database platform trimmed its earnings forecast for the year.

Zscaler Inc., up $13.31 to $169.96.

The cloud-based information security provider raised its earnings forecast for its fiscal year.

SentinelOne Inc., down $2.59 to $16.83.

The cybersecurity provider cut its revenue forecast for the year.

Ulta Beauty Inc., up $9.51 to $395.09.

The beauty products retailer beat Wall Street’s first-quarter earnings forecasts.

Gap Inc., up $6.44 to $28.96.

The clothing chain’s first-quarter profit beat analysts’ forecasts.

VF Corp., up 95 cents to $13.28.

The maker of North Face and Timberland products named Michelle Choe as president of its Vans brand.

NetApp Inc., up $3.93 to $120.43.

The data storage company beat analysts’ fiscal fourth-quarter financial forecasts.

#inform-video-player-3 .inform-embed { margin-top: 10px; margin-bottom: 20px; }

MMS • RSS

NEW YORK (AP) — Stocks that traded heavily or had substantial price changes on Friday:

Veeva Systems Inc., down $19.94 to $174.25.

The provider of cloud-based software services gave investors a revenue forecast that fell short of Wall Street expectations.

MongoDB Inc., down $73.94 to $236.06.

The database platform trimmed its earnings forecast for the year.

Zscaler Inc., up $13.31 to $169.96.

The cloud-based information security provider raised its earnings forecast for its fiscal year.

SentinelOne Inc., down $2.59 to $16.83.

The cybersecurity provider cut its revenue forecast for the year.

Ulta Beauty Inc., up $9.51 to $395.09.

The beauty products retailer beat Wall Street’s first-quarter earnings forecasts.

Gap Inc., up $6.44 to $28.96.

The clothing chain’s first-quarter profit beat analysts’ forecasts.

VF Corp., up 95 cents to $13.28.

The maker of North Face and Timberland products named Michelle Choe as president of its Vans brand.

NetApp Inc., up $3.93 to $120.43.

The data storage company beat analysts’ fiscal fourth-quarter financial forecasts.

Copyright 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.

, source Associated Press News

MMS • RSS

Michael Vi

A pessimistic earnings season for tech stocks continues in full force, and the latest victim is MongoDB (NASDAQ:MDB). The non-relational database software company suffered one of its largest one-day declines on record after releasing Q1 results and lowering its full-year outlook.

Blaming a soft macro environment for a slower-than-expected pace of new customer adds plus consumption rates, MongoDB showed a sharp deceleration in its growth rates – which isn’t a good look when the company has also invested heavily into opex to prepare for growth, cutting margins in the process. The stock fell more than 25% in after-hours trading to the ~$230 levels after reporting Q1 results, bringing year-to-date losses to nearly 40%.

With the post-earnings share decline, I see a mixed bull and bear case

I last wrote a bearish article on MongoDB in March, when the stock was trading closer to the ~$350 levels. At the time, I had cited both possible deceleration and margin compression as core downside drivers for MongoDB, plus an incredibly rich valuation that already priced in all of MongoDB’s strengths – and then some.

All of these downward drivers materialized in the company’s Q1 earnings, and yet I had also quoted a $262 year-end price target for the company. Given the stock’s post-earnings slide to below these levels (which I view to be a bit of an overreaction to a reasonably bad quarter), I’m upgrading my viewpoint on MongoDB to neutral.

At newer, post-earnings share prices, I’m more inclined to see a balanced bull and bear case for MongoDB. On the bright side for the company:

- Unstructured data is growing and benefits from AI tailwinds. More and more these days, companies and brand marketers want to capture consumer data coming from “unstructured” sources – Tweets, social media posts, and the like. Traditional databases which store data in a columnar format are not equipped to handle this. As companies look to leverage this data for AI large-language models, databases like MongoDB are essential to house this data.

- Large gross margin profile – MongoDB’s mid-70s gross margins create plenty of headroom to scale in the future, even though it’s not profitable currently.

At the same time, however, a number of risks still remain:

- Decelerating revenue growth, weaker usage trends – Once thought to be a company that could grow at a 40%+ clip indefinitely, MongoDB has surprisingly released a FY25 outlook that calls for a slippage to just low-teens growth rates. It has cited weaker customer consumption levels as one of the core drivers here, as IT departments tighten their belts in response to a softer macro picture.

- Competition – MongoDB may have called itself an “Oracle killer” at the time of its IPO, but Oracle (ORCL) is also making headway in autonomous and non-relational databases. Given Oracle’s much broader software platform and ease of cross-selling, this may eventually cut into MongoDB’s momentum.

Valuation update

Now, from a valuation standpoint – at current post-earnings share prices near $230, MongoDB trades at a market cap of $17.27 billion. After we net off the $2.07 billion of cash and $1.14 billion of debt on MongoDB’s most recent balance sheet, the company’s resulting enterprise value is $16.34 billion.

Meanwhile, for the current fiscal year, MongoDB’s latest outlook calls for $1.88-$1.90 billion in revenue, or 12-13% y/y growth.

MongoDB guidance (MongoDB Q1 earnings release)

This is a two-point growth cut relative to a prior outlook that called for 13-15% y/y growth. But again, we have to ask ourselves: does two points of growth merit a quarter of MongoDB’s market cap getting wiped off the map? Of course, the stock was overvalued to begin with, but I think there’s some room on the upside now.

Taking the midpoint of this guidance outlook at face value, MongoDB trades at 8.6x EV/FY25 revenue.

And if we look ahead to FY26 (the fiscal year for MongoDB ending in January 2026), Wall Street analysts are expecting MongoDB to generate $2.33 billion in revenue (+23% y/y) as the company laps a weaker consumption year and starts to pick up tailwinds from AI demand. Against FY26 estimates, MongoDB trades at 7.0x EV/FY26 revenue.

I’m resetting my price target slightly lower to reflect MongoDB’s lowered outlook. By year-end, I expect MongoDB to recover to $251, which is 9.5x FY25 revenue and ~9% upside from post-earnings share prices.

My strategy here: I view longer-term risks for MongoDB as it continues to digest weaker demand in the current year. However, I do think there’s an opportunity for investors to pick up the stock for short-term gains, as I believe MongoDB will continue to trade in volatile patterns over the next few weeks. Maintain caution here, but a lot of the downside for MongoDB has been removed with the post-earnings drop.

Q1 download

Let’s now go through MongoDB’s problematic Q1 results in greater detail. The Q1 earnings summary is shown below:

MongoDB Q1 results (MongoDB Q1 earnings release)

MongoDB’s revenue grew just 22% y/y to $450.6 million. Though this beat Wall Street’s expectations of $440.0 million (+19% y/y), growth decelerated five points relative to 27% y/y growth in Q4 – a surprise for a company that typically outperforms its outlook by a wide margin.

The company noted a “slower start to the year” for both new workload adds and consumption on MongoDB Atlas, which is a continuation of the trends that we saw in Q4.

It’s worth noting, however, potential upside from new products – especially having to do with AI. In Q1, the company launched the MongoDB AI Applications Program (which it’s abbreviating as MAAP): which gives customers pre-built reference architectures to quickly reference data residing in MongoDB to build AI-powered applications.

As this marks a foray for MongoDB outside of infrastructure and into the application layer, it’s worth noting that MongoDB will pit itself as a competitor versus the likes of C3.ai (AI) – which reported earnings the day before MongoDB and rose as sharply as MongoDB declined. C3.ai’s CEO, Thomas Siebel, noted on its Q1 earnings call that he believes more of the silicon and infrastructure layers of AI will eventually be commoditized, whereas software applications will dominate the long term of the industry. In other words, MongoDB’s expansion into the application layer gives it a differentiated growth vehicle for the future, even if it’s off to a slower start.

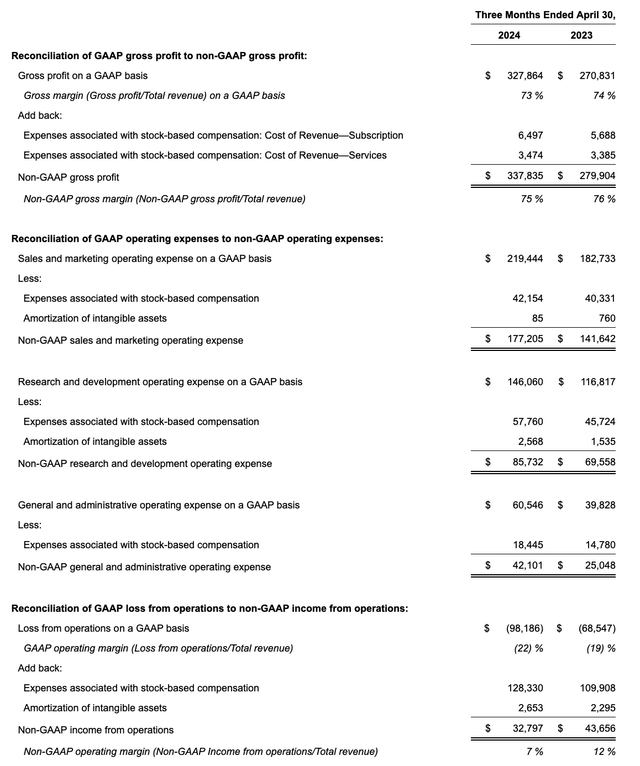

Unfortunately, the company also had disappointing news on profitability. Alongside a one-point slippage in pro forma gross margins to 75%, higher spending across all components of the company’s operating expenses (including and especially G&A, unfortunately), MongoDB’s pro forma operating margins dropped to 7%, a 5-point reduction from the year-ago quarter.

MongoDB operating margins (MongoDB Q1 earnings release)

Key takeaways

At the moment, MongoDB is a victim to ever-present short-termism on Wall Street, and in my view, is overreacting to a disappointing (but not disastrous) quarter. Because MongoDB is dependent on consumption, its quarterly trends will be lumpier than that of a subscription company, and thus it also has the capability to rebound more quickly.

Keep an eye on this stock and add opportunistically as it drops.

MMS • RSS

MongoDB, Inc. MDB shares are trading lower Friday after the company issued weak guidance for the upcoming quarter as well as fiscal-year 2025.

The Details: MongoDB reported financial earnings for the first quarter of fiscal-year 2025 after the market close on Thursday.

The company reported adjusted EPS of 51 cent beating analyst estimates of 40 cents. In addition, MongoDB announced revenue of $450.56 million which came in ahead of analyst estimates of 439.64 million.

The reported sales figure represents a 22.34% increase in sales compared to the same period last year.

MongoDB announced guidance for the second quarter and for the whole fiscal-year 2025.

For the second quarter, the company sees adjusted EPS between 46 cents and 49 cents versus analyst estimates of 58 cents. Also, the company estimates revenue between $460 million and $464 million versus analyst estimates of $470.43 million.

In terms of fiscal-year 2025 estimates, the company sees adjusted EPS between $2.15 and $2.30 versus analyst estimates of $2.50. Furthermore, the company estimates revenue between $1.88 billion and $1.90 billion versus analyst estimates of $1.93 billion.

Analyst Changes: Following the earnings announcement, several analysts released price target adjustments.

- Piper Sandler analyst Brent Bracelin maintains MongoDB with an Overweight and lowers the price target from $480 to $350.

- Needham analyst Mike Cikos maintains MongoDB with a Buy and lowers the price target from $465 to $290.

- Baird analyst William Power maintains MongoDB with a Outperform and lowers the price target from $450 to $305.

- Morgan Stanley analyst Sanjit Singh maintains MongoDB with an Overweight and lowers the price target from $455 to $320.

- Mizuho analyst Matthew Broome maintains MongoDB with a Neutral and lowers the price target from $380 to $250.

- Truist Securities analyst Miller Jump maintains MongoDB with a Buy and lowers the price target from $475 to $300.

- Stifel analyst Brad Reback maintains MongoDB with a Buy and lowers the price target from $435 to $300.

Related Link: Smart Money Is Betting Big In ORCL Options

MDB Price Action: At time of writing MongoDB shares were trading down 25.5% at $230.94, according to data from Benzinga Pro.

Image:Michael Vi/Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.