Month: June 2024

MMS • RSS

Rafferty Asset Management LLC acquired a new position in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm acquired 25,752 shares of the company’s stock, valued at approximately $10,529,000.

Several other hedge funds have also recently made changes to their positions in the business. Raymond James & Associates grew its stake in shares of MongoDB by 14.2% in the 4th quarter. Raymond James & Associates now owns 60,557 shares of the company’s stock valued at $24,759,000 after buying an additional 7,510 shares during the period. Nordea Investment Management AB grew its stake in shares of MongoDB by 298.2% in the 4th quarter. Nordea Investment Management AB now owns 18,657 shares of the company’s stock valued at $7,735,000 after buying an additional 13,972 shares during the period. Assenagon Asset Management S.A. grew its stake in shares of MongoDB by 1,196.1% in the 4th quarter. Assenagon Asset Management S.A. now owns 29,215 shares of the company’s stock valued at $11,945,000 after buying an additional 26,961 shares during the period. Atalanta Sosnoff Capital LLC grew its stake in shares of MongoDB by 24.7% in the 4th quarter. Atalanta Sosnoff Capital LLC now owns 54,311 shares of the company’s stock valued at $22,205,000 after buying an additional 10,753 shares during the period. Finally, Realta Investment Advisors acquired a new position in MongoDB during the 4th quarter valued at about $212,000. 89.29% of the stock is owned by institutional investors.

Insider Activity

In other news, Director Dwight A. Merriman sold 6,000 shares of the business’s stock in a transaction on Friday, May 3rd. The shares were sold at an average price of $374.95, for a total transaction of $2,249,700.00. Following the completion of the transaction, the director now directly owns 1,148,784 shares in the company, valued at approximately $430,736,560.80. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. In related news, Director Dwight A. Merriman sold 1,000 shares of the company’s stock in a transaction on Wednesday, May 1st. The shares were sold at an average price of $379.15, for a total value of $379,150.00. Following the completion of the transaction, the director now directly owns 522,896 shares in the company, valued at $198,256,018.40. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Dwight A. Merriman sold 6,000 shares of the company’s stock in a transaction on Friday, May 3rd. The stock was sold at an average price of $374.95, for a total transaction of $2,249,700.00. Following the completion of the transaction, the director now owns 1,148,784 shares of the company’s stock, valued at $430,736,560.80. The disclosure for this sale can be found here. Insiders sold 46,802 shares of company stock worth $16,514,071 in the last three months. Corporate insiders own 3.60% of the company’s stock.

Analyst Ratings Changes

A number of research firms have issued reports on MDB. Stifel Nicolaus cut their price target on MongoDB from $435.00 to $300.00 and set a “buy” rating for the company in a research note on Friday, May 31st. Guggenheim upgraded MongoDB from a “sell” rating to a “neutral” rating in a research note on Monday. Morgan Stanley cut their price target on MongoDB from $455.00 to $320.00 and set an “overweight” rating for the company in a research note on Friday, May 31st. Redburn Atlantic restated a “sell” rating and issued a $295.00 target price (down previously from $410.00) on shares of MongoDB in a research note on Tuesday, March 19th. Finally, Scotiabank cut their target price on MongoDB from $385.00 to $250.00 and set a “sector perform” rating on the stock in a research note on Monday. One research analyst has rated the stock with a sell rating, five have given a hold rating, nineteen have issued a buy rating and one has assigned a strong buy rating to the company’s stock. According to MarketBeat, the company has an average rating of “Moderate Buy” and an average price target of $364.11.

View Our Latest Research Report on MongoDB

MongoDB Stock Performance

MDB stock traded up $0.30 during midday trading on Wednesday, reaching $232.45. 658,194 shares of the company’s stock traded hands, compared to its average volume of 1,464,421. The company has a 50-day moving average price of $348.50 and a two-hundred day moving average price of $388.49. The company has a current ratio of 4.93, a quick ratio of 4.40 and a debt-to-equity ratio of 0.90. MongoDB, Inc. has a 52 week low of $225.25 and a 52 week high of $509.62.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its earnings results on Thursday, March 7th. The company reported ($1.03) earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of ($0.71) by ($0.32). MongoDB had a negative net margin of 11.50% and a negative return on equity of 14.88%. The business had revenue of $458.00 million for the quarter, compared to the consensus estimate of $431.99 million. Sell-side analysts forecast that MongoDB, Inc. will post -2.56 earnings per share for the current year.

MongoDB Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Do you expect the global demand for energy to shrink?! If not, it’s time to take a look at how energy stocks can play a part in your portfolio.

MMS • RSS

Nearly every software company is talking up the potential of artificial intelligence, but not every software company will benefit in a meaningful way. Database software provider MongoDB (NASDAQ: MDB) reported disappointing results and provided lackluster guidance last week, and the company’s optimistic talk about AI wasn’t enough to prevent the stock from tumbling.

The most important question to ask

MongoDB CEO Dev Ittycheria opened the company’s earnings report with a statement about the opportunity presented by AI. MongoDB sees AI spurring companies running legacy workloads to modernize those workloads, thus opening the door for MongoDB’s database to replace legacy alternatives. “We are confident MongoDB will be a substantial beneficiary of this next wave of application development,” Ittycheria said.

The big question to ask is this: Is MongoDB any better positioned than its myriad competitors to win market share as AI drives workload modernization? I think the answer is no. Developers are spoiled for choice in the database software market. Managed database products like MongoDB’s Atlas are everywhere.

Every major cloud computing platform offers multiple managed database products. Amazon Web Services, for example, has the MongoDB-compatible DocumentDB service in addition to relational database services. Microsoft Azure offers a similar lineup of database options, as does Alphabet‘s Google Cloud.

There’s also a slew of privately held technology companies that offer managed database services based on battle-tested open-source database software that run on one of the major cloud platforms. To name a few, there’s Aiven, Crunchy Data, PlanetScale, and EDB. Many of these providers are now pushing the AI angle just like MongoDB is doing.

MongoDB doesn’t appear to have any real edge in the age of AI.

Atlas weakness

Shares of MongoDB crumbled last week following the company’s first-quarter report. Revenue grew by 22% year over year, and revenue from Atlas rose 32%. However, Atlas consumption growth and new workload wins during the first quarter were weaker than expected. This weakness will hurt revenue and earnings during the rest of the fiscal year.

For fiscal 2025, MongoDB now expects to produce revenue between $1.88 billion and $1.90 billion, and adjusted earnings per share between $2.15 and $2.30. Revenue will be up just 12.5% at the midpoint of that range, and EPS will be down 33%. Ouch.

MongoDB’s confidence that AI will drive new workload wins is tough to square with its awful outlook for the year.

If you’re thinking about buying MongoDB stock on the dip, you should know that the stock’s valuation remains in the stratosphere. MongoDB isn’t profitable on a GAAP basis, and based on its outlook, the stock trades for over 100 times adjusted earnings. This is a stock that could fall much further before it bottoms out.

AI could drive some business MongoDB’s way, but the company and its technology don’t stand out as outsize beneficiaries. With growth slowing dramatically and competition intensifying, MongoDB is an AI stock to avoid.

Should you invest $1,000 in MongoDB right now?

Before you buy stock in MongoDB, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MongoDB wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Timothy Green has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and MongoDB. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Don’t Buy the AI Hype: Avoid This Crashing Software Stock was originally published by The Motley Fool

MMS • RSS

Not every company will benefit from AI.

Nearly every software company is talking up the potential of artificial intelligence, but not every software company will benefit in a meaningful way. Database software provider MongoDB (MDB -0.08%) reported disappointing results and provided lackluster guidance last week, and the company’s optimistic talk about AI wasn’t enough to prevent the stock from tumbling.

The most important question to ask

MongoDB CEO Dev Ittycheria opened the company’s earnings report with a statement about the opportunity presented by AI. MongoDB sees AI spurring companies running legacy workloads to modernize those workloads, thus opening the door for MongoDB’s database to replace legacy alternatives. “We are confident MongoDB will be a substantial beneficiary of this next wave of application development,” Ittycheria said.

The big question to ask is this: Is MongoDB any better positioned than its myriad competitors to win market share as AI drives workload modernization? I think the answer is no. Developers are spoiled for choice in the database software market. Managed database products like MongoDB’s Atlas are everywhere.

Every major cloud computing platform offers multiple managed database products. Amazon Web Services, for example, has the MongoDB-compatible DocumentDB service in addition to relational database services. Microsoft Azure offers a similar lineup of database options, as does Alphabet‘s Google Cloud.

There’s also a slew of privately held technology companies that offer managed database services based on battle-tested open-source database software that run on one of the major cloud platforms. To name a few, there’s Aiven, Crunchy Data, PlanetScale, and EDB. Many of these providers are now pushing the AI angle just like MongoDB is doing.

MongoDB doesn’t appear to have any real edge in the age of AI.

Atlas weakness

Shares of MongoDB crumbled last week following the company’s first-quarter report. Revenue grew by 22% year over year, and revenue from Atlas rose 32%. However, Atlas consumption growth and new workload wins during the first quarter were weaker than expected. This weakness will hurt revenue and earnings during the rest of the fiscal year.

For fiscal 2025, MongoDB now expects to produce revenue between $1.88 billion and $1.90 billion, and adjusted earnings per share between $2.15 and $2.30. Revenue will be up just 12.5% at the midpoint of that range, and EPS will be down 33%. Ouch.

MongoDB’s confidence that AI will drive new workload wins is tough to square with its awful outlook for the year.

If you’re thinking about buying MongoDB stock on the dip, you should know that the stock’s valuation remains in the stratosphere. MongoDB isn’t profitable on a GAAP basis, and based on its outlook, the stock trades for over 100 times adjusted earnings. This is a stock that could fall much further before it bottoms out.

AI could drive some business MongoDB’s way, but the company and its technology don’t stand out as outsize beneficiaries. With growth slowing dramatically and competition intensifying, MongoDB is an AI stock to avoid.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Timothy Green has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and MongoDB. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

MMS • RSS

MongoDB MDB released its first-quarter earnings report on May 20. Here’s Morningstar’s take on MongoDB’s earnings and stock.

Key Morningstar Metrics for MongoDB

What We Thought of MongoDB’s Q1 Earnings

- MongoDB’s revisions to its guidance were disappointing but not necessarily surprising, given the company’s exposure to volatile consumption-based revenue. A bright spot was its strength in enterprise revenues, which contributed to a revenue beat.

- Despite the macroeconomic slump, MongoDB operates in one of the fastest-increasing software markets. We believe it has a greater share potential than what the market is baking in, hence our above-consensus outlook even with its reduced fair value estimate.

- We are encouraged that the guidance adjustment is due to temporary headwinds rather than long-term vulnerabilities like customer churn to competition.

Fair Value Estimate for MongoDB

Our fair value estimate for MongoDB is $330 per share. Our valuation implies a forward fiscal-year enterprise value/sales of 14 times. The firm is in its infancy, but it has a massive market opportunity and a large runway for growth, in our view. We expect this substantial growth to be driven by continued shifts of workloads to a cloud environment, prompting the database market to grow as companies realize how much easier it is to scale data storage in the cloud. In turn, this implies substantial usage growth per customer for MongoDB.

Additionally, we think MongoDB’s database-as-a-service offering, Atlas, and data lake will bring significant new revenue streams to the company. Atlas revenue eclipsed on-premises sales in early fiscal 2022. We forecast that MongoDB’s gross margins will stay relatively the same, as the company’s increasing mix of Atlas revenue is somewhat margin-dilutive in the near term. We expect GAAP operating margins to increase from negative 14% in fiscal 2024 to 29% in fiscal 2034 because of operating leverage as revenue growth exceeds operating expenses.

Read more about MongoDB’s fair value estimate.

Economic Moat Rating

We do not assign MongoDB an economic moat. We think the company benefits from significant switching costs with the customers that it has captured thus far, but it is still in its customer acquisition phase, and it’s unclear whether this will lead to excess returns on invested capital over the next 10 years. MongoDB lacks profitability and continues to spend aggressively on sales and marketing.

Read more about MongoDB’s economic moat.

Financial Strength

We believe MongoDB is financially stable, and we are confident it will generate positive free cash flow in the long term. The firm had cash and cash equivalents of $2 billion at the end of fiscal 2024, with $1.14 billion in convertible debt on its balance sheet. We forecast that MongoDB will become free-cash-flow-positive in fiscal 2028, after which we believe it will continue to invest heavily in its business rather than distribute dividends or perform major stock repurchases.

Read more about MongoDB’s financial strength.

Risk and Uncertainty

We assign MongoDB a High Uncertainty Rating due to its place in a technological landscape that has the potential to shift rapidly. However, we do not foresee any material environmental, social, or governance issues.

The firm faces uncertainty based on future competition, with the risk of Amazon AMZN encroaching on its abilities. Currently, Amazon’s DocumentDB service claims it has MongoDB compatibility to help companies deploy MongoDB at scale in the cloud. At the moment, DocumentDB has significant limitations compared with MongoDB. In contrast with Atlas, it can’t support rich data types, is only interoperable with AWS, and has only 63% compatibility with MongoDB. While many open-source software companies have suffered from Amazon reselling their software for a profit (for example, Elastic was repackaged into Amazon Elasticsearch), MongoDB is protected against this risk, as its software license bans Amazon from reselling their software on AWS.

Read more about MongoDB’s risk and uncertainty,

MDB Bulls Say

- MDB’s document-based database is best-equipped to remove fear of vendor lock-in and is poised for a strong future.

- MongoDB’s new data lake could gain significant traction, making the firm even stickier, as we believe data lakes have even greater switching costs than databases. In turn, this could further boost returns on invested capital.

- MongoDB could eventually launch a data warehouse offering, increasing customer switching costs.

MDB Bulls Say

- Document-based databases could decrease in popularity if a new NoSQL variation arises that better meets developer needs.

- Cloud service providers like AWS could catch up to MongoDB’s rich features.

- MongoDB’s growth profile could be worse than expected. If the firm can’t reaccelerate growth in fiscal 2026 after a slower 2025, the current valuation would look too rich and there could be a significant downside

This article was compiled by Krutang Desai.

MMS • RSS

MongoDB’s MDB short percent of float has fallen 18.89% since its last report. The company recently reported that it has 4.24 million shares sold short, which is 5.97% of all regular shares that are available for trading. Based on its trading volume, it would take traders 4.58 days to cover their short positions on average.

Why Short Interest Matters

Short interest is the number of shares that have been sold short but have not yet been covered or closed out. Short selling is when a trader sells shares of a company they do not own, with the hope that the price will fall. Traders make money from short selling if the price of the stock falls and they lose if it rises.

Short interest is important to track because it can act as an indicator of market sentiment towards a particular stock. An increase in short interest can signal that investors have become more bearish, while a decrease in short interest can signal they have become more bullish.

See Also: List of the most shorted stocks

MongoDB Short Interest Graph (3 Months)

As you can see from the chart above the percentage of shares that are sold short for MongoDB has declined since its last report. This does not mean that the stock is going to rise in the near-term but traders should be aware that less shares are being shorted.

Comparing MongoDB’s Short Interest Against Its Peers

Peer comparison is a popular technique amongst analysts and investors for gauging how well a company is performing. A company’s peer is another company that has similar characteristics to it, such as industry, size, age, and financial structure. You can find a company’s peer group by reading its 10-K, proxy filing, or by doing your own similarity analysis.

According to Benzinga Pro, MongoDB’s peer group average for short interest as a percentage of float is 6.43%, which means the company has less short interest than most of its peers.

Did you know that increasing short interest can actually be bullish for a stock? This post by Benzinga Money explains how you can profit from it.

This article was generated by Benzinga’s automated content engine and was reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MMS • RSS

Q&A

Building Planet-Scale .NET Apps with Azure Cosmos DB

Azure Cosmos DB is a fully managed distributed database that can be transparently replicated across regions while remaining highly performant and seamlessly scaling according to needs, making it great for applications of any scale.

“Azure Cosmos DB simplifies and expedites your application development by being the single database for your operational data needs, from geo-replicated distributed caching to backup to vector indexing and search,” says Microsoft documentation. “It provides the data infrastructure for modern applications like AI, digital commerce, Internet of Things, and booking management. It can accommodate all your operational data models, including relational, document, vector, key-value, graph and table.”

To help you do all that, Justine Cocchi, a senior program manager on the Azure Cosmos DB team at Microsoft, will be presenting a session at the Visual Studio Live! developer conference in August titled “Building Planet Scale .NET Apps with Azure Cosmos DB.”

Taking place Aug. 7 at Microsoft Headquarters in Redmond, Wash., her introductory/intermediate-level 75-minute session will provide an overview of Azure Cosmos DB and best practices for .NET developers.

“We will cover some best practices as well as troubleshooting tips using OpenTelemetry and Application Insights,” she said, promising that in her session attendees will learn:

- How Azure Cosmos DB scales

- How to configure Azure Cosmos DB .NET applications for scale and performance

- How to troubleshoot and monitor Azure Cosmos DB .NET applications

In this Q&A, Cocchi provides a preview of her session, discussing the importance of database choice, the significance of Azure Cosmos DB’s global distribution features, and best practices for database modeling and query optimization. She also details the latest updates to the Azure Cosmos DB .NET SDK, and touches on the security measures that Azure Cosmos DB incorporates to ensure data integrity and security.

VisualStudioMagazine: What inspired you to present a session on this topic?

Cocchi: As a distributed database, scalability is at the heart of Azure Cosmos DB.

“It can be overwhelming to learn all of the concepts if you’re just getting started.”

Justine Cocchi, Senior Program Manager, Microsoft

However, it can be overwhelming to learn all of the concepts if you’re just getting started. Choices about partitioning your data and global distribution effect your application, and I wanted to provide an overview as well as give some best practices for .NET developers.

In the context of building planet-scale applications, how significant is the choice of database, and why is Azure Cosmos DB a preferred option?

Choosing a database that satisfies your needs is critical for any application. Whether you already have planet-scale or are just starting out, Azure Cosmos DB will grow with you as your application needs change. As a fully managed, distributed database with options for NoSQL, relational and vector data models, Azure Cosmos DB is a great choice for apps of any size.

Azure Cosmos DB’s global distribution features are a key aspect of its architecture. Can you discuss how data is replicated across regions and the benefits this brings to .NET applications?

Scaling your database across regions allows you to achieve low latency even when application users are in different geographies. Global distribution is also key to achieving high availability if one region becomes unreachable. Azure Cosmos DB allows you to add or remove regions with either read-only or read-write capabilities at any time without requiring application changes. Data will be transparently replicated to all configured regions for you automatically according to the consistency model you choose.

For developers new to Azure Cosmos DB, can you provide one or two best practices for database modeling and query optimization?

One of the first decisions you have to make when setting up a new container in Azure Cosmos DB is your partition key. The partition key is what determines how your container scales, and choosing a good partition key can have big implications for application performance. It’s ideal to choose a partition key that has a large number of values where the amount of data and number of requests are evenly distributed across values. Queries that contain the partition key are more efficient than queries without it, so you should pick a key that often occurs in your queries.

How do the latest updates to the Azure Cosmos DB .NET SDK enhance application development, particularly in terms of performance and usability?

We’re always adding new features to the Azure Cosmos DB .NET SDK. One feature to highlight is OpenTelemetry integration, which allows you to collect traces from your application requests without needing to write any custom code. OpenTelemetry is easy to configure in the SDK, and will allow you to analyze latency and performance as well as gather diagnostics for slow or failed requests with the exporter of your choice.

While data security won’t be featured in your talk, it’s a paramount concern for developers and businesses alike. What measures does Azure Cosmos DB incorporate to ensure data integrity and security?

There are many important security Azure Cosmos DB features from network security with IP firewalls, configuring access from virtual networks and private endpoints to encryption and customer-managed keys. Azure Cosmos DB also supports passwordless authentication with managed identities.

For attendees looking to further their knowledge beyond this session, what resources or learning paths do you recommend?

There are many great training modules with exercises for hands-on learning. Follow this learning path to connect to Azure Cosmos DB with the .NET SDK, Connect to Azure Cosmos DB for NoSQL with the SDK – Training | Microsoft Learn, or learn more about all Cosmos DB concepts in the documentation Azure Cosmos DB | Microsoft Learn.

Note: Those wishing to attend the conference can save hundreds of dollars by registering early, according to the event’s pricing page. “Register for VSLive! at Microsoft HQ by the Super Early Bird deadline of June 7 to save up to $400 and secure your seat for intensive developer training at Microsoft HQ in Redmond!” said the organizer of the developer conference, which is being presented by the parent company of Visual Studio Magazine.

About the Author

David Ramel is an editor and writer for Converge360.

MMS • Daniel Dominguez

Microsoft recently held its annual MSBuild developer conference, where it made several significant announcements, including updates to its AI capabilities, focusing on Copilot AI Agents, Phi-3, and GPT-4o now available on Azure AI.

New features for Microsoft Copilot were announced aimed at enhancing productivity and collaboration across organizations. The updates include Team Copilot, which expands Copilot’s role from a personal assistant to a team collaborator, facilitating meetings, managing tasks, and improving group communication in tools like Microsoft Teams and Microsoft Planner.

According to professor Ethan Mollick:

Agents represent the first break away from the chatbot and copilot models for interacting with AI.

Additionally, custom agents built with Microsoft Copilot Studio can now automate business processes, reason over user actions, and learn from feedback, aiming to boost efficiency and cost savings. New Copilot extensions and connectors allow developers to tailor and integrate Copilot with specific business systems, using Copilot Studio or Teams Toolkit for Visual Studio.

Microsoft also introduced Phi-3, a family of small open models developed by Microsoft. These models support developers in building cost-efficient and responsible multimodal generative AI applications. Phi-3-mini, Phi-3-small, Phi-3-medium, and Phi-3-vision are all super-sets of previous versions, offering a range of capabilities for various applications.

As mentioned by Machine Learning Researcher Awni Hannun on X:

You can run Phi3 Small (7B) in MLX LM.

The model has a few quirks: the block sparse attention, a new nonlinearity, and an unusual ways of splitting queries / keys / values.

Useful to have a flexible framework to implement it in. And still runs quite fast on an M2 Ultra

The previously available Phi-3-mini and Phi-3-medium models can now be accessed via Azure AI’s models as a service offering. Phi-3 models, optimized for various hardware and scenarios, offer cost-effective solutions for language, reasoning, and coding tasks. Notable use cases include ITC’s AI copilot for farmers, Khan Academy’s math tutoring, and Epic’s patient history summaries.

Finally, OpenAI’s GPT-4o, a new multimodal model, is now available in Azure AI Studio. This model, which is an extension of GPT-4, allows for a richer user experience by enabling inputs and outputs that span across text, images, and more. Azure OpenAI Service customers can explore GPT-4o’s capabilities in a preview playground in Azure OpenAI Studio, available in two US regions. GPT-4o is engineered for speed and efficiency, offering advanced handling of complex queries with minimal resources, translating to cost savings and improved performance.

MMS • RSS

Guggenheim upgraded shares of MongoDB (NASDAQ:MDB – Free Report) from a sell rating to a neutral rating in a research report report published on Monday, MarketBeat reports.

Guggenheim upgraded shares of MongoDB (NASDAQ:MDB – Free Report) from a sell rating to a neutral rating in a research report report published on Monday, MarketBeat reports.

MDB has been the subject of several other research reports. Robert W. Baird dropped their price objective on MongoDB from $450.00 to $305.00 and set an outperform rating for the company in a report on Friday. Oppenheimer dropped their price objective on MongoDB from $480.00 to $300.00 and set an outperform rating for the company in a report on Friday. Mizuho dropped their price objective on MongoDB from $380.00 to $250.00 and set a neutral rating for the company in a report on Friday. Canaccord Genuity Group lowered their target price on MongoDB from $435.00 to $325.00 and set a buy rating for the company in a research note on Friday. Finally, Piper Sandler lowered their target price on MongoDB from $480.00 to $350.00 and set an overweight rating for the company in a research note on Friday. One research analyst has rated the stock with a sell rating, five have issued a hold rating, nineteen have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, MongoDB has a consensus rating of Moderate Buy and a consensus price target of $364.11.

Read Our Latest Analysis on MDB

MongoDB Trading Down 0.6 %

Shares of MDB stock opened at $234.61 on Monday. MongoDB has a 1-year low of $225.25 and a 1-year high of $509.62. The company has a debt-to-equity ratio of 1.07, a current ratio of 4.40 and a quick ratio of 4.40. The business has a 50-day moving average of $350.94 and a 200 day moving average of $389.62. The stock has a market capitalization of $17.09 billion, a PE ratio of -83.49 and a beta of 1.13.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Thursday, March 7th. The company reported ($1.03) earnings per share for the quarter, missing the consensus estimate of ($0.71) by ($0.32). MongoDB had a negative return on equity of 16.00% and a negative net margin of 11.50%. The business had revenue of $458.00 million during the quarter, compared to analysts’ expectations of $431.99 million. As a group, sell-side analysts anticipate that MongoDB will post -2.53 earnings per share for the current year.

Insider Buying and Selling

In related news, CAO Thomas Bull sold 170 shares of MongoDB stock in a transaction on Tuesday, April 2nd. The stock was sold at an average price of $348.12, for a total value of $59,180.40. Following the completion of the sale, the chief accounting officer now owns 17,360 shares of the company’s stock, valued at $6,043,363.20. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, CFO Michael Lawrence Gordon sold 9,316 shares of MongoDB stock in a transaction on Tuesday, April 2nd. The stock was sold at an average price of $348.12, for a total transaction of $3,243,085.92. Following the transaction, the chief financial officer now directly owns 83,511 shares in the company, valued at $29,071,849.32. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CAO Thomas Bull sold 170 shares of MongoDB stock in a transaction on Tuesday, April 2nd. The shares were sold at an average price of $348.12, for a total value of $59,180.40. Following the transaction, the chief accounting officer now owns 17,360 shares in the company, valued at $6,043,363.20. The disclosure for this sale can be found here. Insiders sold 46,802 shares of company stock valued at $16,514,071 over the last 90 days. Company insiders own 3.60% of the company’s stock.

Hedge Funds Weigh In On MongoDB

Several large investors have recently made changes to their positions in MDB. Oppenheimer Asset Management Inc. lifted its position in shares of MongoDB by 52.9% in the third quarter. Oppenheimer Asset Management Inc. now owns 5,336 shares of the company’s stock valued at $1,846,000 after acquiring an additional 1,846 shares in the last quarter. Oppenheimer & Co. Inc. lifted its position in shares of MongoDB by 19.6% in the third quarter. Oppenheimer & Co. Inc. now owns 4,410 shares of the company’s stock valued at $1,525,000 after acquiring an additional 724 shares in the last quarter. Amalgamated Bank lifted its position in shares of MongoDB by 4.7% in the third quarter. Amalgamated Bank now owns 7,548 shares of the company’s stock valued at $2,611,000 after acquiring an additional 340 shares in the last quarter. Banque Cantonale Vaudoise lifted its position in shares of MongoDB by 10.4% in the third quarter. Banque Cantonale Vaudoise now owns 1,374 shares of the company’s stock valued at $476,000 after acquiring an additional 129 shares in the last quarter. Finally, Tanager Wealth Management LLP purchased a new position in shares of MongoDB in the third quarter valued at about $316,000. 89.29% of the stock is currently owned by hedge funds and other institutional investors.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

MongoDB (NASDAQ:MDB – Free Report) had its target price trimmed by Citigroup from $480.00 to $350.00 in a report published on Monday, Benzinga reports. The brokerage currently has a buy rating on the stock.

MongoDB (NASDAQ:MDB – Free Report) had its target price trimmed by Citigroup from $480.00 to $350.00 in a report published on Monday, Benzinga reports. The brokerage currently has a buy rating on the stock.

Other analysts have also recently issued reports about the stock. JMP Securities cut their price target on shares of MongoDB from $440.00 to $380.00 and set a market outperform rating on the stock in a report on Friday. Tigress Financial increased their target price on shares of MongoDB from $495.00 to $500.00 and gave the stock a buy rating in a report on Thursday, March 28th. Truist Financial dropped their target price on shares of MongoDB from $475.00 to $300.00 and set a buy rating on the stock in a report on Friday. KeyCorp dropped their target price on shares of MongoDB from $490.00 to $440.00 and set an overweight rating on the stock in a report on Thursday, April 18th. Finally, Oppenheimer dropped their target price on shares of MongoDB from $480.00 to $300.00 and set an outperform rating on the stock in a report on Friday. One analyst has rated the stock with a sell rating, five have assigned a hold rating, nineteen have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of Moderate Buy and a consensus target price of $364.11.

Check Out Our Latest Report on MongoDB

MongoDB Trading Down 0.6 %

MDB opened at $234.61 on Monday. The stock has a market capitalization of $17.09 billion, a PE ratio of -83.49 and a beta of 1.13. The firm’s fifty day moving average price is $350.94 and its 200 day moving average price is $389.62. The company has a debt-to-equity ratio of 1.07, a current ratio of 4.40 and a quick ratio of 4.40. MongoDB has a 12-month low of $225.25 and a 12-month high of $509.62.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings results on Thursday, March 7th. The company reported ($1.03) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.71) by ($0.32). The company had revenue of $458.00 million during the quarter, compared to analyst estimates of $431.99 million. MongoDB had a negative net margin of 11.50% and a negative return on equity of 16.00%. As a group, research analysts expect that MongoDB will post -2.53 EPS for the current fiscal year.

Insider Activity at MongoDB

In other news, Director Dwight A. Merriman sold 4,000 shares of the firm’s stock in a transaction dated Wednesday, April 3rd. The shares were sold at an average price of $341.12, for a total transaction of $1,364,480.00. Following the completion of the transaction, the director now owns 1,156,784 shares in the company, valued at approximately $394,602,158.08. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. In other news, Director Dwight A. Merriman sold 6,000 shares of the firm’s stock in a transaction dated Friday, May 3rd. The shares were sold at an average price of $374.95, for a total transaction of $2,249,700.00. Following the completion of the transaction, the director now owns 1,148,784 shares in the company, valued at approximately $430,736,560.80. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, Director Dwight A. Merriman sold 4,000 shares of the firm’s stock in a transaction dated Wednesday, April 3rd. The shares were sold at an average price of $341.12, for a total transaction of $1,364,480.00. Following the transaction, the director now owns 1,156,784 shares of the company’s stock, valued at approximately $394,602,158.08. The disclosure for this sale can be found here. Insiders sold 46,802 shares of company stock worth $16,514,071 in the last 90 days. Corporate insiders own 3.60% of the company’s stock.

Hedge Funds Weigh In On MongoDB

Several large investors have recently made changes to their positions in MDB. Cetera Advisors LLC lifted its stake in MongoDB by 106.9% during the first quarter. Cetera Advisors LLC now owns 1,558 shares of the company’s stock valued at $559,000 after buying an additional 805 shares in the last quarter. Cetera Investment Advisers lifted its stake in MongoDB by 327.6% during the first quarter. Cetera Investment Advisers now owns 10,873 shares of the company’s stock valued at $3,899,000 after buying an additional 8,330 shares in the last quarter. Atria Investments Inc lifted its stake in MongoDB by 1.2% during the first quarter. Atria Investments Inc now owns 3,259 shares of the company’s stock valued at $1,169,000 after buying an additional 39 shares in the last quarter. Swedbank AB purchased a new stake in MongoDB during the first quarter valued at about $91,915,000. Finally, LRI Investments LLC purchased a new stake in MongoDB during the first quarter valued at about $106,000. Institutional investors own 89.29% of the company’s stock.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

“In most cases [my customers] already have Veeam and really like it, but they value not having Windows more than Veeam” one MSP partner of the backup software specialist wrote drily on a support forum in 2020.

They were trying to persuade Veeam’s CPO Anton Gostev to make its Backup & Replication (VBR) suite available on Linux as well as Windows.

“This basically means re-writing the entire backup server, while the value of this massive undertaking is questionable for most of our customers,” Gostev grumbled in response, adding bluntly, “if this capability is critical to your clients, then indeed they should look for another solution.”

“We’re a small (only 6 staff) MSP and we’re exploring every option to rid ourselves of the cancer that is Windows but, asking Gostev to rewrite the whole software for Linux isn’t realistic,” another sympathetic user said.

The times, they are a’changing.

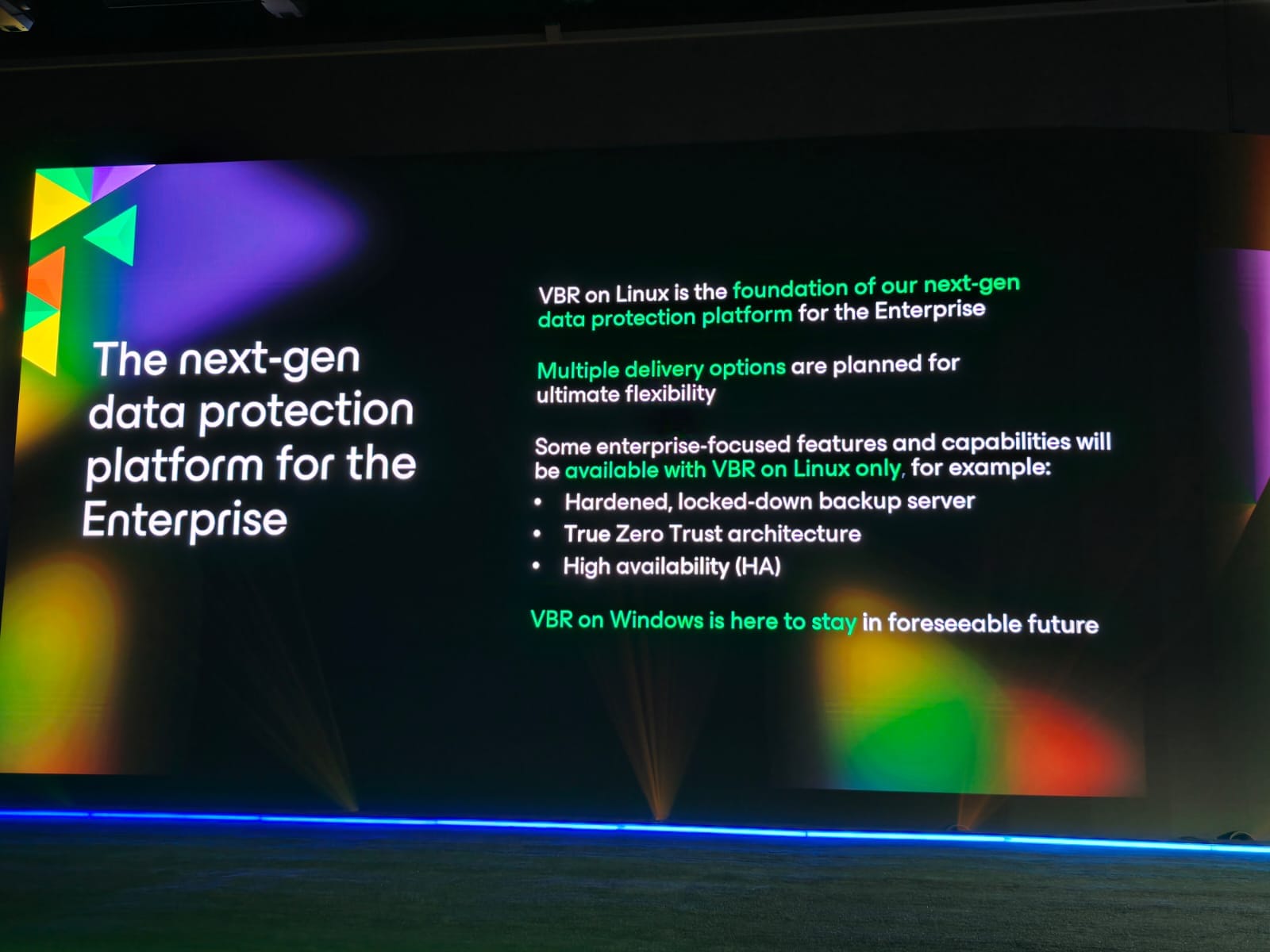

On stage at VeeamON, the privately held company’s tenth annual conference, held in Fort Lauderdale, Florida, the CPO said V13 of the widely adopted disaster recovery suite, coming later this calendar year, would be available on Linux as well as Windows, to some delight.

Indeed, “some enterprise-focused features and capabilities will be available with VBR for Linux only” executives said.

HOLY SMOKES ! 🚨🚨🚨#Veeam Backup & Replication for #Linux is coming. Seems like @RickVanover and @gostev fulfilled on of my biggest dreams / feature requests right here at #VeeamON !!! #VeeamVanguard @VeeamVanguard @Veeam @VeeamCommunity @anandeswaran pic.twitter.com/ope0tNvwvi

— Falko Banaszak (@Falko_Banaszak) June 4, 2024

As one Veeam user from Pure Storage put it to The Stack: “Customers heavily invest in other technologies utilizing SLES / RHEL and Linux for enterprise applications and building up skill. And as you may know windows boxes get targeted more than Linux boxes and if done right it makes things just more secure and more independent from a Microsoft perspective like EntraID or the whole ecosystem in general…”

That was one of a flurry of announcements out of the company including the promise of upcoming support for MongoDB and EntraID backups and the unveiling of a new “Veeam Data Cloud Vault” which sees it follow Rubrik in offering Azure-based immutable and encrypted storage.

“Veeam Vault pricing includes not just the storage component, but also the necessary API calls to write to that storage in an immutable format, as well as read and egress data in the event of a recovery – eliminating the bill shock encountered by organizations that don’t consider all required costs for cloud backup. Users can access the service through Veeam’s software interface” the company added in a press release.

Veeam Data Cloud Vault is available now via Azure Marketplace for a single fee per TB/month based on region, and includes storage, write/read APIs, and egress, the company said – saying that it sees simplicity of deployment as a key attraction (“Fully managed Azure storage with zero configuration, management or integration complexities.) Currently it is not available via channel partners.

We’ll be sharing more details and depth from the event in coming days. Veeam customer and have questions you’d like us to ask executives?