Month: July 2024

Java News Roundup: WildFly 33, Spring Cloud Data Flow, Apache TomEE, LangChain4j, Micronaut

MMS • Michael Redlich

This week’s Java roundup for July 22nd, 2024 features news highlighting: the release of WildFly 33; Spring Cloud Data Flow 2.11.4; the second milestone release of Apache TomEE 10.0; LangChain4j 0.33; Micronaut 4.5.1; Eclipse Store 1.4; and an update on Jakarta EE 11.

JDK 23

Build 34 of the JDK 23 early-access builds was made available this past week featuring updates from Build 33 that include fixes for various issues. Further details on this release may be found in the release notes, and details on the new JDK 23 features may be found in this InfoQ news story.

JDK 24

Build 8 of the JDK 24 early-access builds was also made available this past week featuring updates from Build 7 that include fixes for various issues. More details on this release may be found in the release notes.

For JDK 23 and JDK 24, developers are encouraged to report bugs via the Java Bug Database.

Jakarta EE

In his weekly Hashtag Jakarta EE blog, Ivar Grimstad, Jakarta EE Developer Advocate at the Eclipse Foundation, provided an update on the upcoming release of Jakarta EE 11, writing:

The Jakarta EE Platform project continues the work toward finalizing Jakarta EE 11. The refactoring of the TCK shows promising results. Hopefully, we will be able to announce a release date shortly. Check in to the weekly Jakarta EE Platform call that happens every Tuesday at 11:00 AM Eastern (Daylight Savings) Time.

The road to Jakarta EE 11 included four milestone releases with the potential for release candidates as necessary before the GA release in 3Q2024.

BellSoft

BellSoft has released versions 24.0.2 for JDK 22, 23.1.4 for JDK 21 and 23.0.5 for JDK 17 of their Liberica Native Image Kit builds as part of the Oracle Critical Patch Update for July 2024 to address several CVEs and bugs.

Spring Framework

The release of Spring Cloud Data Flow 2.11.4 primarily addresses: CVE-2024-37084, Remote Code Execution in Spring Cloud Data Flow, a vulnerability where an attacker, who has access to the Skipper Server API, can use a crafted upload request to write an arbitrary file to any location on the file system which could lead to compromising the server; and PRISMA-2023-0067, where an attacker can send a specially-crafted request to take advantage of an improper input validation by the StreamReadContraints class causing a denial of service. Other improvements include: the ability for a user to specify the application version when creating a schedule; and a new endpoint, /tasks/thinexecutions, for more efficient retrieval of task executions pages without all the extra detail. Further details on this release may be found in the release notes.

Version 4.24.0 of Spring Tools 4.24.0 has been released with notable changes such as: support for Spring Expression Language (SpEL) syntax highlighting and validation inside Java and embedded Spring Data queries; syntax highlighting and validation for MySQL and PostgreSQL queries; and support for bean name code completion and navigation for name attribute of the Jakarta Annotations @Resource annotation. More details on this release may be found in the release notes.

WildFly

The release of WildFly 33 delivers bug fixes, component upgrades and new features such as: an enhanced overriding of base configuration settings using a YAML file by using the YAML file to add unmanaged deployments to the configuration; the core-management subsystem now allows developers to enable scanning of deployments for usage of classes/methods in the SmallRye and Hibernate ORM libraries annotated with @Experimental and @Incubating, respectively; and utilities to reload a server to a different stability level in the testsuite. Further details on this release may be found in the release notes. InfoQ will follow up with a more detailed news story.

Micronaut

The Micronaut Foundation has released version 4.5.1 of Micronaut Framework featuring Micronaut Core 4.5.4, bug fixes, improvements in documentation and updates to modules: Micronaut Micrometer, Micronaut OpenAPI, Micronaut Security, Micronaut SourceGen, Micronaut Data, Micronaut Reactor, Micronaut Test Resources, Micronaut Test, Micronaut gRPC, Micronaut Validation and Micronaut Views. More details on this release may be found in the release notes.

Eclipse Foundation

The release of Eclipse Store 1.4.0 provides bug fixes and new features: integration with Amazon S3 Express One Zone; enhancements to S3 cloud storage with the addition of a default folder for the S3 connector into configuration and support for directory buckets; and a new API to import and export the serializer type dictionary. Further details on this release may be found in the release notes.

The release of Eclipse Serializer 1.4.0 aligns with Eclipse Store 1.4.0 with no documented updates or release notes.

Apache Software Foundation

The second milestone release of Apache TomEE 10.0.0, aimed at JakartaEE 10, ships with bug fixes, dependency upgrades and notable changes such as: a minimal JDK 17 version; an implementation of the OIDC section of the Jakarta EE Security specification; and an initial integration of some MicroProfile updates. More details on this release may be found in the release notes.

JHipster

The release of JHipster Lite 1.14.0 ships with dependency upgrades and enhancements such as: the use of string templates instead of string concatenation; fields that are only assigned in the constructor should be redd only; and unchanged variables should be marked as const. Further details on this release may be found in the release notes.

LangChain4j

Version 0.33.0 of LangChain for Java (LangChain4j) features new integrations: Redis via the new RedisChatMemoryStore class; and embedding models from OVHcloud. Other notable changes include: support for audio, video and PDF inputs in Google Gemini; support for embedding removal in Chroma; and support for storing metadata and embedding removal in Pinecone. Developers should note that a breaking change was necessary to fix split package issues. More details on this release may be found in the release notes.

Arquillian

The release of Arquillian 1.9.1.Final provides dependency upgrades and notable changes such as: replace use of the Java ThreadLocal class with the Java Hashtable class due to a memory leak in Arquillian Warp; support for the @ArquillianResource annotation parameter injection on methods annotated with @Deployment; and a resolution to integration test build issue to ensure that versions get updated. Further details on this release may be found in the changelog.

Jox

As a follow-up from the release of Jox 0.3.0, as described in the July 15, 2024 Java news roundup, details related to their new structured concurrency module were made available by Adam Warski, Chief R&D Officer at SoftwareMill, who told InfoQ:

We’ve added a “programmer-friendly” API for structured concurrency. This blog describes it in detail, and contrasts it with what’s proposed by the structured concurrency JEP.

Introduced to the Java community in February 2024, Jox is a new virtual threads library that implements an efficient Channel data structure in Java designed to be used with virtual threads.

MMS • Steef-Jan Wiggers

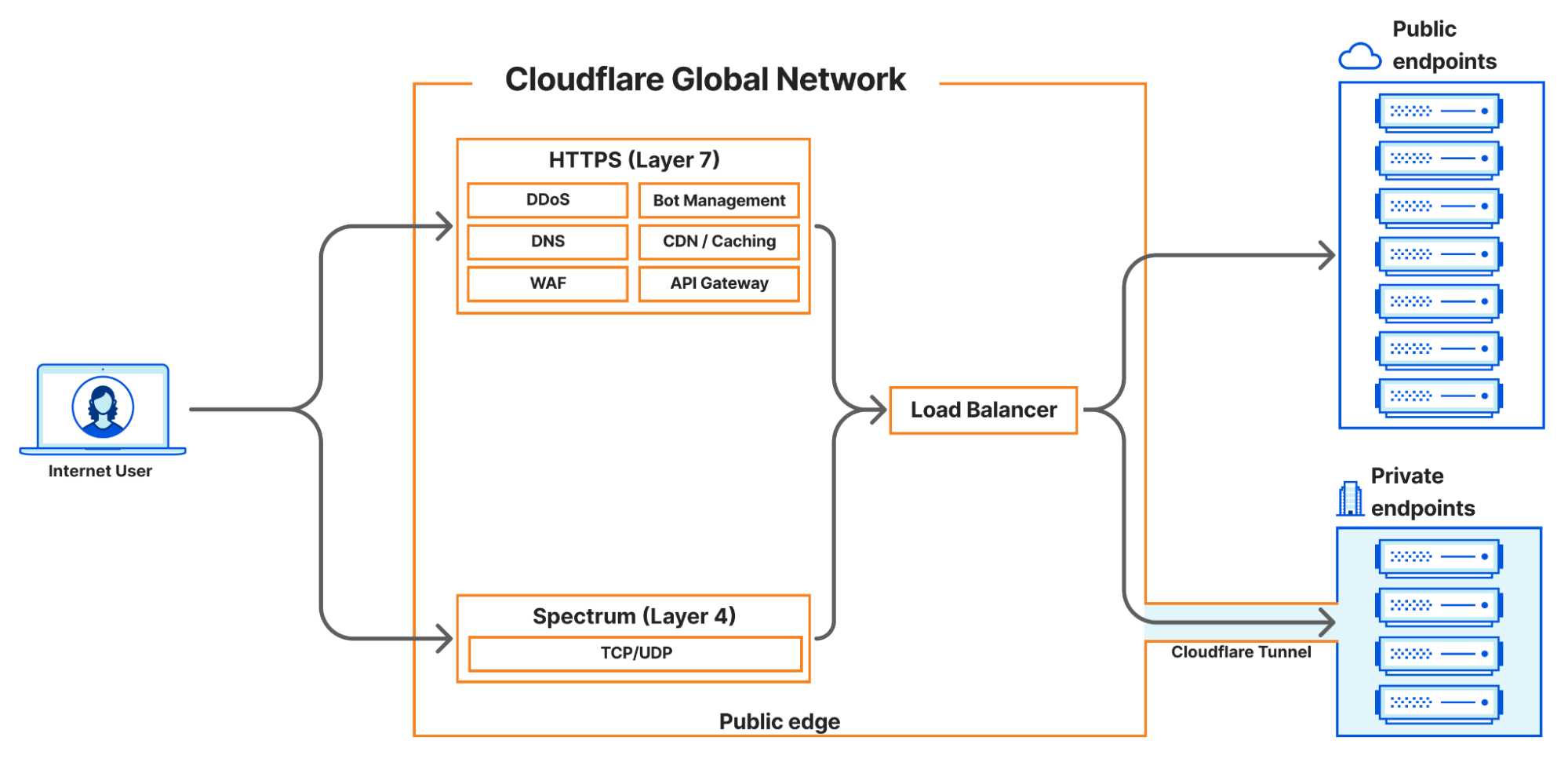

Cloudflare recently unveiled significant advancements in its load balancing capabilities, aiming to eliminate the need for hardware-based solutions. The company’s latest enhancements integrate seamlessly with Cloudflare One, providing end-to-end private traffic flow support and WARP authenticated device traffic. This development allows organizations to balance public and private traffic directed at privately hosted applications without needing dedicated hardware load balancers.

Cloudflare’s existing solution supports layer 4 load balancing for TCP and UDP traffic within private networks through Spectrum (a layer 4 reverse proxy that protects against DDoS attacks and conceals a customer’s private origin IP address, preventing direct attacks) and layer 7 load balancing via Cloudflare tunnels, which allows organizations to balance public HTTP(S) and private traffic, offering a load balancing solution for all network types.

(Source: Cloudflare blog post)

Earlier, Cloudflare’s layer 4 load balancers were connected to the public Internet. Although customers could secure that traffic with WAF rules and Zero Trust policies, some preferred to keep resources private. Isolation for layer 4 load balancers is now available for origin servers and endpoints.

Moreover, load balancers accessible at private IPs can now be utilized within a virtual network to segregate traffic to specific sets of Cloudflare tunnels. This allows customers to balance traffic within their private network without exposing their applications to the public internet.

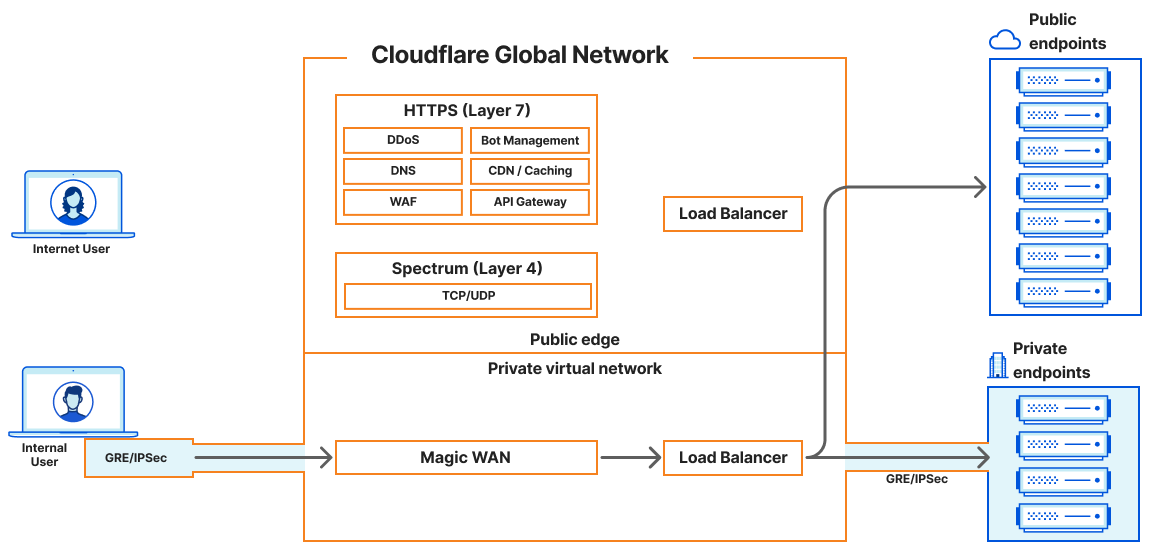

Also, Cloudflare Magic WAN can now be used as an on-ramp with Cloudflare load balancers accessed via a private IP address, providing a secure, high-performance connection to internal resources and ensuring private and optimized traffic across the global network. Customers can connect their corporate networks directly to Cloudflare’s network with GRE or IPSec tunnels, maintaining privacy and security.

(Source: Cloudflare blog post)

The enhancement enables various internal load balancing use cases, including managing traffic between data centers, routing traffic for internally hosted applications, optimizing resource allocation for critical applications, and ensuring high availability for internal services.

Noah Crouch, a product manager at Cloudflare, writes:

Organizations can now replace traditional hardware-based load balancers, reducing complexity and lowering costs associated with maintaining physical infrastructure. By leveraging Cloudflare load balancing and Magic WAN, companies can achieve greater flexibility and scalability, adapting quickly to changing network demands without the need for additional hardware investments.

Lastly, Cloudflare WARP can now reach Cloudflare load balancers with private IP addresses. The WARP client protects corporate devices by securely and privately sending traffic to Cloudflare’s global network. It also allows advanced web filtering through Cloudflare Gateway and enables advanced Zero Trust policies to check a device’s health before connecting to corporate applications.

With Cloudflare enhancing its load balancing product and eliminating hardware, other load balancing solutions are available to provide high availability, scalability, and performance without needing dedicated hardware. For instance, AWS offers Elastic Load Balancing, which automatically distributes incoming application traffic across multiple targets, such as Amazon EC2 instances, containers, IP addresses, and Lambda functions, or VMware NSX Advanced Load Balancer, which provides multi-cloud load balancing, web application firewall, application analytics, and container ingress services across on-premises data centers and any cloud. In addition, another example is F5 NGINX Plus, a software load balancer, web server, and content cache built on top of open-source NGINX – which adds several features to its open-source counterpart, including active health checks, session persistence, and more.

MMS • RSS

Duration: 3 months

Learning Format: Online

Skills Covered: Continuous Integration, Continuous Delivery, MongoDB, Agile, DevOps, Software Development, React (Web Framework), Front-End Development, Front-End Design, Web Development, JavaScript, Cascading Style Sheets (CSS), User Interface, WordPress, Front-End Web Development, UI/UX Design, No-Code, Website Wireframe, User Interface Design (UI Design), Progressive Web Development, Figma, User Experience (UX), Responsive, Bootstrap, Grid System, Web Development Framework, Software Engineering, Software Architecture, Python Programming, Agile and Scrum, Software Development Lifecycle (SDLC), Webpack, Search Engine Optimization (SEO), JavaScript Library, Debugging, Software Engineering, Coding Challenge, Full Stack Development, Distributed Version Control Systems (DVCS), Git, GitHub, Cloning and Forking

Fees: Not Available

Source:Coursera

This three-month professional certificate program covers front-end development. It includes training in React, MongoDB, and various front-end design and development tools.

MMS • RSS

Shares of MongoDB, Inc. (NASDAQ:MDB – Get Free Report) have been assigned a consensus recommendation of “Moderate Buy” from the twenty-six research firms that are currently covering the company, Marketbeat reports. One investment analyst has rated the stock with a sell recommendation, five have issued a hold recommendation, nineteen have issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average twelve-month target price among brokerages that have covered the stock in the last year is $355.74.

MDB has been the topic of several research reports. Oppenheimer decreased their target price on MongoDB from $480.00 to $300.00 and set an “outperform” rating on the stock in a research note on Friday, May 31st. Monness Crespi & Hardt upgraded shares of MongoDB to a “hold” rating in a report on Tuesday, May 28th. Truist Financial reduced their target price on shares of MongoDB from $475.00 to $300.00 and set a “buy” rating on the stock in a report on Friday, May 31st. Canaccord Genuity Group cut their price objective on MongoDB from $435.00 to $325.00 and set a “buy” rating on the stock in a research report on Friday, May 31st. Finally, Loop Capital decreased their target price on MongoDB from $415.00 to $315.00 and set a “buy” rating for the company in a report on Friday, May 31st.

Read Our Latest Stock Report on MDB

MongoDB Trading Down 0.2 %

MongoDB stock traded down $0.55 during mid-day trading on Monday, hitting $252.95. The company’s stock had a trading volume of 224,707 shares, compared to its average volume of 1,522,184. The firm has a market capitalization of $18.55 billion, a PE ratio of -90.21 and a beta of 1.13. MongoDB has a 1 year low of $214.74 and a 1 year high of $509.62. The stock’s fifty day moving average is $261.27 and its two-hundred day moving average is $345.66. The company has a current ratio of 4.93, a quick ratio of 4.93 and a debt-to-equity ratio of 0.90.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings data on Thursday, May 30th. The company reported ($0.80) earnings per share for the quarter, hitting analysts’ consensus estimates of ($0.80). The firm had revenue of $450.56 million during the quarter, compared to analysts’ expectations of $438.44 million. MongoDB had a negative net margin of 11.50% and a negative return on equity of 14.88%. On average, analysts anticipate that MongoDB will post -2.67 EPS for the current year.

Insider Buying and Selling

In other news, CAO Thomas Bull sold 138 shares of the stock in a transaction dated Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total value of $36,610.02. Following the completion of the transaction, the chief accounting officer now owns 17,222 shares in the company, valued at approximately $4,568,824.38. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In related news, Director Dwight A. Merriman sold 6,000 shares of the firm’s stock in a transaction that occurred on Friday, May 3rd. The stock was sold at an average price of $374.95, for a total value of $2,249,700.00. Following the completion of the transaction, the director now directly owns 1,148,784 shares of the company’s stock, valued at approximately $430,736,560.80. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CAO Thomas Bull sold 138 shares of MongoDB stock in a transaction on Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $36,610.02. Following the transaction, the chief accounting officer now directly owns 17,222 shares of the company’s stock, valued at approximately $4,568,824.38. The disclosure for this sale can be found here. Insiders have sold 35,179 shares of company stock valued at $9,535,839 over the last quarter. Company insiders own 3.60% of the company’s stock.

Institutional Investors Weigh In On MongoDB

A number of large investors have recently added to or reduced their stakes in MDB. Transcendent Capital Group LLC acquired a new stake in shares of MongoDB during the fourth quarter valued at $25,000. MFA Wealth Advisors LLC purchased a new position in MongoDB in the 2nd quarter valued at about $25,000. J.Safra Asset Management Corp boosted its stake in shares of MongoDB by 682.4% during the 2nd quarter. J.Safra Asset Management Corp now owns 133 shares of the company’s stock worth $33,000 after purchasing an additional 116 shares during the last quarter. Blue Trust Inc. grew its holdings in shares of MongoDB by 937.5% during the fourth quarter. Blue Trust Inc. now owns 83 shares of the company’s stock worth $34,000 after buying an additional 75 shares in the last quarter. Finally, YHB Investment Advisors Inc. acquired a new position in shares of MongoDB in the first quarter valued at approximately $41,000. 89.29% of the stock is owned by institutional investors and hedge funds.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB – Get Free Report) has been assigned a consensus rating of “Moderate Buy” from the twenty-six ratings firms that are currently covering the firm, MarketBeat reports. One analyst has rated the stock with a sell rating, five have given a hold rating, nineteen have issued a buy rating and one has issued a strong buy rating on the company. The average 12-month price target among brokerages that have covered the stock in the last year is $355.74.

MongoDB, Inc. (NASDAQ:MDB – Get Free Report) has been assigned a consensus rating of “Moderate Buy” from the twenty-six ratings firms that are currently covering the firm, MarketBeat reports. One analyst has rated the stock with a sell rating, five have given a hold rating, nineteen have issued a buy rating and one has issued a strong buy rating on the company. The average 12-month price target among brokerages that have covered the stock in the last year is $355.74.

MDB has been the topic of a number of recent analyst reports. Piper Sandler decreased their price target on MongoDB from $350.00 to $300.00 and set an “overweight” rating on the stock in a research report on Friday, July 12th. Canaccord Genuity Group reduced their price objective on MongoDB from $435.00 to $325.00 and set a “buy” rating on the stock in a research note on Friday, May 31st. Mizuho reduced their price objective on MongoDB from $380.00 to $250.00 and set a “neutral” rating on the stock in a research note on Friday, May 31st. Monness Crespi & Hardt raised MongoDB to a “hold” rating in a research note on Tuesday, May 28th. Finally, Robert W. Baird reduced their price objective on MongoDB from $450.00 to $305.00 and set an “outperform” rating on the stock in a research note on Friday, May 31st.

View Our Latest Stock Report on MongoDB

Insider Buying and Selling

In other MongoDB news, CRO Cedric Pech sold 273 shares of the business’s stock in a transaction on Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $72,424.17. Following the transaction, the executive now owns 35,719 shares of the company’s stock, valued at $9,475,893.51. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction on Wednesday, May 1st. The stock was sold at an average price of $379.15, for a total value of $379,150.00. Following the transaction, the director now owns 522,896 shares of the company’s stock, valued at $198,256,018.40. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, CRO Cedric Pech sold 273 shares of the business’s stock in a transaction on Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $72,424.17. Following the completion of the transaction, the executive now directly owns 35,719 shares in the company, valued at approximately $9,475,893.51. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 35,179 shares of company stock worth $9,535,839. 3.60% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in the company. Liontrust Investment Partners LLP raised its stake in shares of MongoDB by 76.7% during the 2nd quarter. Liontrust Investment Partners LLP now owns 53,000 shares of the company’s stock valued at $13,248,000 after purchasing an additional 23,000 shares during the period. Slow Capital Inc. raised its stake in shares of MongoDB by 3.7% during the 2nd quarter. Slow Capital Inc. now owns 15,902 shares of the company’s stock valued at $3,975,000 after purchasing an additional 573 shares during the period. Louisiana State Employees Retirement System raised its stake in shares of MongoDB by 1.8% during the 2nd quarter. Louisiana State Employees Retirement System now owns 5,800 shares of the company’s stock valued at $1,450,000 after purchasing an additional 100 shares during the period. MN Wealth Advisors LLC bought a new stake in shares of MongoDB during the 2nd quarter valued at $576,000. Finally, MFA Wealth Advisors LLC bought a new stake in shares of MongoDB during the 2nd quarter valued at $25,000. Hedge funds and other institutional investors own 89.29% of the company’s stock.

MongoDB Trading Down 1.1 %

Shares of MongoDB stock opened at $253.50 on Monday. The business has a fifty day simple moving average of $261.27 and a two-hundred day simple moving average of $345.66. MongoDB has a 1 year low of $214.74 and a 1 year high of $509.62. The company has a market capitalization of $18.59 billion, a price-to-earnings ratio of -90.21 and a beta of 1.13. The company has a debt-to-equity ratio of 0.90, a current ratio of 4.93 and a quick ratio of 4.93.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings data on Thursday, May 30th. The company reported ($0.80) earnings per share for the quarter, hitting the consensus estimate of ($0.80). The firm had revenue of $450.56 million for the quarter, compared to analysts’ expectations of $438.44 million. MongoDB had a negative return on equity of 14.88% and a negative net margin of 11.50%. Research analysts forecast that MongoDB will post -2.67 EPS for the current year.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

New York, New York–(Newsfile Corp. – July 28, 2024) – WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of MongoDB, Inc. (NASDAQ: MDB) between August 31, 2023 and May 30, 2024, both dates inclusive (the “Class Period”), of the important September 9, 2024 lead plaintiff deadline.

SO WHAT: If you purchased MongoDB securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the MongoDB class action, go to https://rosenlegal.com/submit-form/?case_id=27182 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than September 9, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, throughout the Class Period, defendants created the false impression that they possessed reliable information pertaining to the Company’s projected revenue outlook and anticipated growth while also minimizing risk from seasonality and macroeconomic fluctuations. In truth, MongoDB’s sales force restructure, which prioritized reducing friction in the enrollment process, had resulted in complete loss of upfront commitments; a significant reduction in the information gathered by their sales force as to the trajectory for the new MongoDB Atlas enrollments; and reduced pressure on new enrollments to grow. Defendants misled investors by providing the public with materially flawed statements of confidence and growth projections which did not account for these variables. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the MongoDB class action, go to https://rosenlegal.com/submit-form/?case_id=27182 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/217996

MMS • RSS

O Shaughnessy Asset Management LLC increased its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 21.8% in the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 2,150 shares of the company’s stock after purchasing an additional 385 shares during the quarter. O Shaughnessy Asset Management LLC’s holdings in MongoDB were worth $771,000 at the end of the most recent reporting period.

O Shaughnessy Asset Management LLC increased its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 21.8% in the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 2,150 shares of the company’s stock after purchasing an additional 385 shares during the quarter. O Shaughnessy Asset Management LLC’s holdings in MongoDB were worth $771,000 at the end of the most recent reporting period.

A number of other large investors have also recently added to or reduced their stakes in MDB. Transcendent Capital Group LLC acquired a new position in MongoDB in the 4th quarter valued at $25,000. Blue Trust Inc. lifted its position in shares of MongoDB by 937.5% during the 4th quarter. Blue Trust Inc. now owns 83 shares of the company’s stock worth $34,000 after purchasing an additional 75 shares during the last quarter. YHB Investment Advisors Inc. bought a new stake in MongoDB during the 1st quarter valued at approximately $41,000. Sunbelt Securities Inc. grew its holdings in MongoDB by 155.1% in the 1st quarter. Sunbelt Securities Inc. now owns 125 shares of the company’s stock valued at $45,000 after buying an additional 76 shares during the last quarter. Finally, GAMMA Investing LLC bought a new position in MongoDB in the 4th quarter worth approximately $50,000. Institutional investors own 89.29% of the company’s stock.

Insider Transactions at MongoDB

In related news, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction that occurred on Wednesday, May 1st. The shares were sold at an average price of $379.15, for a total transaction of $379,150.00. Following the completion of the transaction, the director now owns 522,896 shares in the company, valued at $198,256,018.40. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. In related news, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction that occurred on Wednesday, May 1st. The stock was sold at an average price of $379.15, for a total value of $379,150.00. Following the completion of the transaction, the director now directly owns 522,896 shares in the company, valued at approximately $198,256,018.40. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CRO Cedric Pech sold 273 shares of MongoDB stock in a transaction that occurred on Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total transaction of $72,424.17. Following the completion of the transaction, the executive now directly owns 35,719 shares in the company, valued at approximately $9,475,893.51. The disclosure for this sale can be found here. In the last ninety days, insiders sold 35,179 shares of company stock worth $9,535,839. 3.60% of the stock is currently owned by company insiders.

MongoDB Price Performance

Shares of NASDAQ:MDB opened at $253.50 on Friday. The company has a debt-to-equity ratio of 0.90, a current ratio of 4.93 and a quick ratio of 4.93. MongoDB, Inc. has a 1-year low of $214.74 and a 1-year high of $509.62. The business has a 50-day moving average price of $261.27 and a two-hundred day moving average price of $345.99.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its earnings results on Thursday, May 30th. The company reported ($0.80) EPS for the quarter, meeting the consensus estimate of ($0.80). MongoDB had a negative net margin of 11.50% and a negative return on equity of 14.88%. The company had revenue of $450.56 million during the quarter, compared to analysts’ expectations of $438.44 million. On average, equities research analysts expect that MongoDB, Inc. will post -2.67 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of equities analysts recently issued reports on the stock. Citigroup dropped their target price on shares of MongoDB from $480.00 to $350.00 and set a “buy” rating on the stock in a research report on Monday, June 3rd. Wells Fargo & Company decreased their target price on MongoDB from $450.00 to $300.00 and set an “overweight” rating on the stock in a research report on Friday, May 31st. Canaccord Genuity Group cut their price target on MongoDB from $435.00 to $325.00 and set a “buy” rating for the company in a report on Friday, May 31st. Loop Capital decreased their price objective on MongoDB from $415.00 to $315.00 and set a “buy” rating on the stock in a report on Friday, May 31st. Finally, Morgan Stanley cut their target price on MongoDB from $455.00 to $320.00 and set an “overweight” rating for the company in a research note on Friday, May 31st. One equities research analyst has rated the stock with a sell rating, five have given a hold rating, nineteen have issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of “Moderate Buy” and an average target price of $355.74.

Read Our Latest Report on MongoDB

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

NEW YORK, July 28, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, reminds investors that class actions have been commenced on behalf of stockholders of CAE Inc. (NYSE: CAE), Maxeon Solar Technologies, Ltd. (NASDAQ: MAXN), GameStop Corp. (NYSE: GME), and MongoDB, Inc. (NASDAQ: MDB). Stockholders have until the deadlines below to petition the court to serve as lead plaintiff. Additional information about each case can be found at the link provided.*CAE Inc. (NYSE: CAE**)*

Class Period: February 11, 2022 and May 21, 2024

Lead Plaintiff Deadline: September 16, 2024

The Complaint alleges that Defendants made false and/or misleading statements and/or failed to disclose that: (1) several of CAE’s pre-COVID fixed-price Defense contracts had incurred severe cost overruns due to supply chain and labor issues – as the segment was significantly impacted by the pandemic – which dented the segment’s profit and operating margin; and (2) CAE failed to successfully reduce hard costs and achieve a sufficient level of operational efficiency, particularly with respect to such contracts, necessitating a re-baselining of the Defense business and significant associated charges.

On August 10, 2022, the Company announced it had incurred “$28.9 million in unfavourable contract profit adjustments in Defense, involving two programs in the U.S.” As a result, the Company’s Defense segment reported an adjusted segment operating loss of $21.2 million, compared to an adjusted segment operating income of $23.7 million in the first quarter of the prior year, according to the complaint. On this news, the price of CAE stock fell more than 16%.

Then, on November 14, 2023, the Company announced that within the Defense segment, the Company planned to “retir[e] legacy contracts, which have been most affected by inflationary pressures.” CAE further stated that “[i]nflationary pressures on legacy contracts, while finite, remain the most significant factor contributing to the current suboptimal margin performance of the business” and that “[w]e are firmly focused on retiring legacy contracts as soon as possible and to mitigating the cost pressures associated with them.” On this news, the price of CAE stock fell nearly 4%.

Then, on February 14, 2024, the Company revealed that it “sought to further accelerate the retirement of outstanding program risks, mainly associated with certain legacy Defense contracts that we entered into pre-COVID and have been most impacted by economic headwinds.” The complaint further alleges that CAE also revealed that there were “eight distinct legacy contracts” and that “[a]lthough [the contracts] represent only a small fraction of the current business, these contracts have disproportionately impacted overall Defense profitability” and that “[f]or the third quarter of fiscal 2024, the ongoing execution of Legacy Contracts had a negative impact of approximately two percentage points on the Defense adjusted segment operating income margin.” On this news, the price of CAE stock fell nearly 10%.

Finally, on May 21, 2024, the Company announced a “re-baselining of its Defense business, Defense impairments, accelerated risk recognition on Legacy Contracts and appointment of Nick Leontidis as COO[.]” According to the Complaint, the Company revealed that “[i]n the fourth quarter of fiscal 2024, CAE has recorded a $568.0 million non-cash impairment of Defense goodwill and $90.3 million in unfavorable Defense contract profit adjustments as a result of accelerated risk recognition on the Legacy Contracts” and also “recorded a $35.7 million impairment of related technology and other non-financial assets which are principally related to the Legacy Contracts.” On this news, the price of CAE stock fell more than 5%.

For more information on the CAE class action go to: https://bespc.com/cases/CAE

*Maxeon Solar Technologies, Ltd. (NASDAQ: MAXN)*

Class Period: November 15, 2023 – May 29, 2024

Lead Plaintiff Deadline: August 26, 2024

On May 30, 2024, before the market opened, Maxeon announced financial results for first quarter 2024 in a press release, reporting a 41% year-over-year decline in revenue to $187.5 million. The Company disclosed that it was “facing a serious cash flow challenge” as the result of, in part, the termination of the SunPower supply agreement. The Company revealed that, as a result, it was forced to “negotiate[] commitments for significant liquidity support” which will result in “substantial dilution to existing public shareholders, with TZE [TCL Zhonghuan Renewable Energy Technology Co. Ltd.] ultimately becoming a controlling shareholder.”

On this news, the Company’s share price fell 34.7%, or $1.08, to close at $2.03 per share on May 30, 2024, on unusually heavy trading volume.

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors: (1) that Maxeon relied on the exclusive sales of certain products to SunPower; (2) that, following the termination of the Master Supply Agreement, the Company was unable to “aggressively ramp sales”; (3) that, as a result, revenue substantially declined; (4) that, as a result, the Company suffered a “serious cash flow” crisis; and (5) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

For more information on the Maxeon class action go to: https://bespc.com/cases/MAXN

*GameStop Corp. (NYSE: GME)*

Class Period: May 13, 2024 – June 13, 2024

Lead Plaintiff Deadline: August 27, 2024

GameStop is a specialty retailer that provides games and entertainment products through its stores and ecommerce platforms in the U.S., Canada, Australia, and Europe. GameStop’s principal executive offices are located at 625 Westport Parkway, Grapevine, Texas 76051. The Company’s Class A common stock trades in an efficient market on the New York Stock Exchange under the ticker symbol “GME.”

Defendant Keith Patrick Gill, known as “Roaring Kitty” on YouTube and the social media platform X (f/k/a Twitter), as well as “DeepF***ingValue” (“DFV”) on the social media platform Reddit, is an American financial analyst and investor, as well as former financial analyst for Massachusetts Mutual Life Insurance Company, also referred to as “MassMutual.” Defendant is also a former registered stockbroker who holds several securities-industry licenses, as well as one of GameStop’s largest shareholders. As of June 2024, Defendant had over 1.6 million followers on X, 982,000 subscribers on YouTube, 116,000 members on his personal subreddit “r/roaringkitty” (ranked “Top 2%” in size among top Reddit communities), and 200,000 members on his personal subreddit “r/DeepF***ingValue.”

Defendant was a key figure in the so-called “meme stock” movement, which saw shares of GameStop and a handful of other companies surge as much as twenty-one-fold over two weeks in January 2021 before crashing to pre-surge levels in the subsequent days. Meme stocks are stocks that gained viral popularity on discussion threads on social media platforms like Reddit and X, where online communities of retail investors dedicated their attention to particular stocks, sometimes for purposes of initiating a squeeze on short investors and hedge funds, and other times based on genuine beliefs about a company’s prospects.

Defendant’s ability to rally a massive following of retail investors to purchase and hold GameStop securities through his social media posts is well-documented. In 2021, after the meme stock movement sparked chaos in the financial markets as major hedge funds and others lost billions of dollars in short-squeeze events, Defendant testified before the U.S. House Committee on Financial Services about the meme stock movement as the perceived champion and face of that movement for GameStop investors. In fact, Defendant is largely credited as sparking the meme stock movement and, in 2023, a biographical film called Dumb Money was released chronicling these events and Defendant’s subsequent rise to celebrity status.

Defendant’s last post on Reddit in 2021 showed that his GameStop positions were worth approximately $30 million. Defendant made his fortune as an investor largely, if not entirely, as a result of his participation in the 2021 meme stock movement.

On May 12, 2024, for the first time in nearly three years, Defendant made a post on the social media platform X, which took the form of a meme showing a “gamer”—that is, an individual that plays video games—in a suit, leaning forward in his chair in seeming concentration and/or attention. As reported by multiple news outlets, this meme was widely understood by Defendant’s followers, analysts, and others to mean that Defendant was watching and/or following GameStop’s performance. Over the next few days, Defendant posted a series of subsequent memes on X—largely taking the form of video clips with a battle or fight theme from popular movies and television shows, overlaid with text or other graphics—that were similarly understood to generally reflect Defendant’s renewed interest in GameStop.

As the market reacted to Defendant’s posts, GameStop’s stock price surged, rising by $12.99 per share, or over 74%, to close at $30.45 per share on May 13, 2024—the first trading day following Defendant’s post on X. GameStop’s stock price continued to climb the following trading day, closing at $48.75 per share, an increase of over 179% from the stock’s closing price of $17.46 per share on May 10, 2024—the last trading day before Defendant’s post on X—only to normalize again and close as low as $18.32 per share by May 23, 2024.

The complaint alleges that on Sunday, June 2, 2024, to pump the prices of GameStop’s securities back up, Defendant revealed his large stake in the Company via a post on Reddit, causing GameStop shares to soar more than 70% in early premarket trading on June 3, 2024. In particular, Defendant posted a screenshot of his GameStop portfolio on Reddit through his DFV account, revealing that he owned 5 million shares of GameStop stock and 120,000 GameStop call options with a strike price of $20, which were set to expire on June 21, 2024. Significantly, this post did not reveal when Defendant had purchased these securities.

On June 3, 2024, GameStop’s stock price ultimately closed at $28.00 per share—21% higher than the prior trading day’s closing price of $23.14 per share on May 31, 2024.

On June 3, 2024, shortly before markets closed, the Wall Street Journal (“WSJ”) published an article revealing that Defendant had purchased “a large volume of GameStop options on E*Trade” shortly before his May 12, 2024 post on X that sent GameStop securities soaring. The WSJ reported that “E*Trade is considering telling Defendant that he can no longer use its platform after growing concerned about potential stock manipulation around his recent purchases of GameStop options, according to people familiar with the matter.” The article reported that “[s]hortly before [Defendant] reignited a meme-stock craze in May, he bought a large volume of GameStop options on E*Trade,” and that “[t]his week, Gill posted screenshots of an E*Trade account showing he owns GameStop shares now valued at $140 million and a new set of options that expire later this month. His total gains on the positions were at $85.5 million, he posted late [on June 3], showing his account remained in operation.” The WSJ article stated that “E*Trade and its owner Morgan Stanley” had “concerns [Defendant] can pump up a stock for his own benefit” and are “debat[ing] whether his actions amounted to manipulation[.]” Finally, the article reported that “the Massachusetts securities division is looking into [Defendant]’s activities” and that “[t]he [SEC] has also been reviewing trading in GameStop call options around the time of [Defendant]’s social media posts[.]”

On this news, GameStop’s stock price fell $1.50 per share, or 5.36%, to close at $26.50 per share on June 4, 2024.

Then, on June 13, 2024, during after-market hours, Defendant posted another screenshot of his GameStop portfolio on Reddit through his DFV account, showing that his portfolio no longer included the 120,000 GameStop call options set to expire on June 21, 2024, and that his position in GameStop stock had increased from 5 million shares to over 9 million shares, making him one of the Company’s largest shareholders. Defendant profited handsomely from these transactions. In particular, before his May 12, 2024 post on X that reignited the meme stock movement, GameStop call options were generally trading at less than $3.00 per option contract. After his May 12, 2024 post on X and during the Class Period, the value of these options rose dramatically to an average of $10.16 per option contract, peaking at a closing price of $31.00 per option contract on May 14, 2024 during the Class Period. These same options traded at around $5.00 per option contract as of their June 21, 2024 expiration date.

Following news that Defendant had sold and/or exercised these GameStop call options, GameStop’s stock price fell $4.42 per share, or 15.18%, over three consecutive trading sessions, to close at $24.70 per share on June 18, 2024.

The complaint alleges that Defendant engaged in a pump-and-dump scheme, whereby he: (i) shortly before his May 12, 2024 social media post on X, and unknown to investors, quietly purchased a large volume of GameStop call options on E*Trade at comparatively low prices; (ii) on May 12, 2024, reignited the meme stock movement and pumped the value of GameStop securities with his first social media post on X in nearly three years; (iii) after the prices of GameStop securities had abated, pumped the value of GameStop securities again via a June 2, 2024 post of his GameStop portfolio on Reddit, disclosing his large position in GameStop securities, including 120,000 GameStop call options and 5 million shares of GameStop stock; and (iv) by June 13, 2024, quietly sold and/or exercised (i.e., dumped) all 120,000 of his GameStop call options for a large profit, seemingly to increase his own stake in GameStop stock by over 4 million shares, belatedly revealing as much to investors on June 13, 2024, during after-market hours.

For more information on the GameStop class action go to: https://bespc.com/cases/GME

*MongoDB, Inc. (NASDAQ: MDB)*

Class Period: August 23, 2023, – May 30, 2024

Lead Plaintiff Deadline: September 9, 2024

According to the complaint, on March 7, 2024, MongoDB reported strong Q4 2024 results and then announced lower than expected full-year guidance for 2025. MongoDB attributed it to the Company’s change in its “sales incentive structure” which led to a decrease in revenue related to “unused commitments and multi-year licensing deals.”

Following this news, MongoDB’s stock price fell by $28.59 per share to close at $383.42 per share.

Later, on May 30, 2024, MongoDB further lowered its guidance for the full year 2025 attributing it to “macro impacting consumption growth.” Analysts commenting on the reduced guidance questioned if changes made to the Company’s marketing strategy “led to change in customer behavior and usage patterns.”

Following this news, MongoDB’s stock price fell by $73.94 per share to close at $236.06 per share.

For more information on the MongoDB class action go to: https://bespc.com/cases/MDB

*About Bragar Eagel & Squire, P.C.:*

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York, California, and South Carolina. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

*Contact Information:*

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

MMS • RSS

Price T Rowe Associates Inc. MD trimmed its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.2% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 3,130,068 shares of the company’s stock after selling 39,594 shares during the period. Price T Rowe Associates Inc. MD owned 4.30% of MongoDB worth $1,122,568,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in MDB. HB Wealth Management LLC increased its holdings in shares of MongoDB by 25.8% during the 4th quarter. HB Wealth Management LLC now owns 805 shares of the company’s stock worth $329,000 after buying an additional 165 shares during the last quarter. Raymond James & Associates increased its stake in MongoDB by 14.2% during the fourth quarter. Raymond James & Associates now owns 60,557 shares of the company’s stock worth $24,759,000 after acquiring an additional 7,510 shares during the last quarter. Raymond James Financial Services Advisors Inc. raised its holdings in shares of MongoDB by 64.6% in the 4th quarter. Raymond James Financial Services Advisors Inc. now owns 5,637 shares of the company’s stock worth $2,305,000 after purchasing an additional 2,213 shares during the period. Pacer Advisors Inc. lifted its stake in shares of MongoDB by 1,400.8% in the 4th quarter. Pacer Advisors Inc. now owns 3,632 shares of the company’s stock valued at $1,485,000 after purchasing an additional 3,390 shares in the last quarter. Finally, Assenagon Asset Management S.A. grew its holdings in shares of MongoDB by 1,196.1% during the 4th quarter. Assenagon Asset Management S.A. now owns 29,215 shares of the company’s stock worth $11,945,000 after purchasing an additional 26,961 shares during the period. Hedge funds and other institutional investors own 89.29% of the company’s stock.

MongoDB Stock Performance

Shares of NASDAQ MDB traded down $2.76 during midday trading on Friday, hitting $253.50. The company’s stock had a trading volume of 1,196,719 shares, compared to its average volume of 1,450,955. The firm has a market cap of $18.59 billion, a P/E ratio of -90.21 and a beta of 1.13. MongoDB, Inc. has a 1-year low of $214.74 and a 1-year high of $509.62. The firm’s fifty day moving average price is $261.27 and its 200-day moving average price is $345.66. The company has a debt-to-equity ratio of 0.90, a quick ratio of 4.93 and a current ratio of 4.93.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings results on Thursday, May 30th. The company reported ($0.80) EPS for the quarter, hitting the consensus estimate of ($0.80). The business had revenue of $450.56 million during the quarter, compared to analyst estimates of $438.44 million. MongoDB had a negative net margin of 11.50% and a negative return on equity of 14.88%. On average, sell-side analysts forecast that MongoDB, Inc. will post -2.67 EPS for the current fiscal year.

Insider Buying and Selling at MongoDB

In related news, Director Dwight A. Merriman sold 1,000 shares of MongoDB stock in a transaction dated Wednesday, May 1st. The stock was sold at an average price of $379.15, for a total transaction of $379,150.00. Following the transaction, the director now directly owns 522,896 shares of the company’s stock, valued at $198,256,018.40. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. In other MongoDB news, CFO Michael Lawrence Gordon sold 5,000 shares of MongoDB stock in a transaction that occurred on Tuesday, July 9th. The shares were sold at an average price of $252.23, for a total value of $1,261,150.00. Following the transaction, the chief financial officer now owns 81,942 shares in the company, valued at $20,668,230.66. The transaction was disclosed in a document filed with the SEC, which is available at this link. Also, Director Dwight A. Merriman sold 1,000 shares of the stock in a transaction on Wednesday, May 1st. The shares were sold at an average price of $379.15, for a total value of $379,150.00. Following the sale, the director now owns 522,896 shares of the company’s stock, valued at approximately $198,256,018.40. The disclosure for this sale can be found here. In the last ninety days, insiders sold 35,179 shares of company stock valued at $9,535,839. 3.60% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

Several research firms have issued reports on MDB. Citigroup decreased their price objective on shares of MongoDB from $480.00 to $350.00 and set a “buy” rating for the company in a research note on Monday, June 3rd. Canaccord Genuity Group reduced their price target on MongoDB from $435.00 to $325.00 and set a “buy” rating on the stock in a research report on Friday, May 31st. Loop Capital lowered their price objective on shares of MongoDB from $415.00 to $315.00 and set a “buy” rating for the company in a research report on Friday, May 31st. Barclays reduced their target price on shares of MongoDB from $458.00 to $290.00 and set an “overweight” rating on the stock in a research report on Friday, May 31st. Finally, Guggenheim upgraded shares of MongoDB from a “sell” rating to a “neutral” rating in a research note on Monday, June 3rd. One research analyst has rated the stock with a sell rating, five have given a hold rating, nineteen have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of “Moderate Buy” and a consensus price target of $355.74.

Get Our Latest Research Report on MDB

MongoDB Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

If a company’s CEO, COO, and CFO were all selling shares of their stock, would you want to know?

MongoDB, Inc. (Nasdaq:MDB) Shareholders are Alerted to an Imminent Deadline in … – Accesswire

MMS • RSS

NEW YORK, NY / ACCESSWIRE / July 28, 2024 / Leading securities law firm Bleichmar Fonti & Auld LLP announces a lawsuit has been filed against MongoDB, Inc. (Nasdaq:MDB) and certain of the Company’s senior executives.

If you suffered losses on your MongoDB investment, you are encouraged to submit your information at https://www.bfalaw.com/cases-investigations/mongodb-inc.

Investors have until September 9, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in MongoDB securities between August 31, 2023 and May 30, 2024, inclusive. The case is pending in the U.S. District Court for the Southern District of New York and is captioned John Baxter v. MongoDB, Inc., et al., No. 1:24-cv-05191.

What is the Lawsuit About?

The complaint alleges that the Company misrepresented the purported benefits stemming from the restructuring of its sales force. This includes how the restructuring helped reduce friction in acquiring new customers and increased new workload acquisition among existing customers.

These statements were allegedly materially false and misleading. In truth, MongoDB’s sales force restructuring resulted in a near total loss of upfront customer commitments, a significant reduction in actionable information gathered by the sales force, and hindered enrollment and revenue growth.

On March 7, 2024, the Company allegedly announced that due to the sales restructuring, it experienced an annual decrease of approximately $40 million in multiyear license revenue, anticipated near zero revenue from unused Atlas commitments (one of its core offerings) in fiscal year 2025, and provided a disappointing revenue growth forecast that trailed that of the prior year. This news caused the price of MongoDB stock to decline $28.59 per share, or about 7%, from $412.01 per share on March 7, 2024, to $383.42 per share on March 8, 2024.

Then, on May 30, 2024, the Company again announced significantly reduced growth expectations, this time cutting fiscal year 2025 growth projections further, again attributing the losses to the sales force restructuring. On this news, the price of MongoDB stock declined $73.94 per share, or nearly 24%, from $310.00 per share on May 30, 2024, to $236.06 per share on May 31, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/mongodb-inc.

What Can You Do?

If you invested in MongoDB, Inc. you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information:

https://www.bfalaw.com/cases-investigations/mongodb-inc

Or contact us at:

Ross Shikowitz

[email protected]

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/mongodb-inc

Attorney advertising. Past results do not guarantee future outcomes.

SOURCE: Bleichmar Fonti & Auld LLP