Month: August 2024

MongoDB, Inc. (MDB) Investors: September 9, 2024 Filing Deadline in Securities Class Action

MMS • RSS

RADNOR, Pa., Aug. 13, 2024 (GLOBE NEWSWIRE) — The law firm of Kessler Topaz Meltzer & Check, LLP ( www.ktmc.com ) informs investors that a securities class action lawsuit has been filed in the United States District Court for the Southern District of New York against MongoDB, Inc. (“MongoDB”) ( NASDAQ:MDB ) on behalf of investors who purchased or acquired MongoDB securities between August 31, 2023 and May 30, 2024 (the “Class Period”). The case is assigned to the Honorable Gregory Howard Woods III. The lead plaintiff deadline is September 9, 2024.

MMS • RSS

Amazon DynamoDB continuously sends metrics about its behavior to Amazon CloudWatch. With CloudWatch, you can track metrics such as each table’s provisioned and consumed read and write capacity, counts for the number of read and write throttle events, as well as average latencies of each type of call. Something I’ve heard customers ask for is how to get a count of successful requests of each operation type (for example, how many GetItem or DeleteItem calls were made) in order to better understand usage and costs. In this post, I show you how to retrieve this metric.

Default CloudWatch metrics

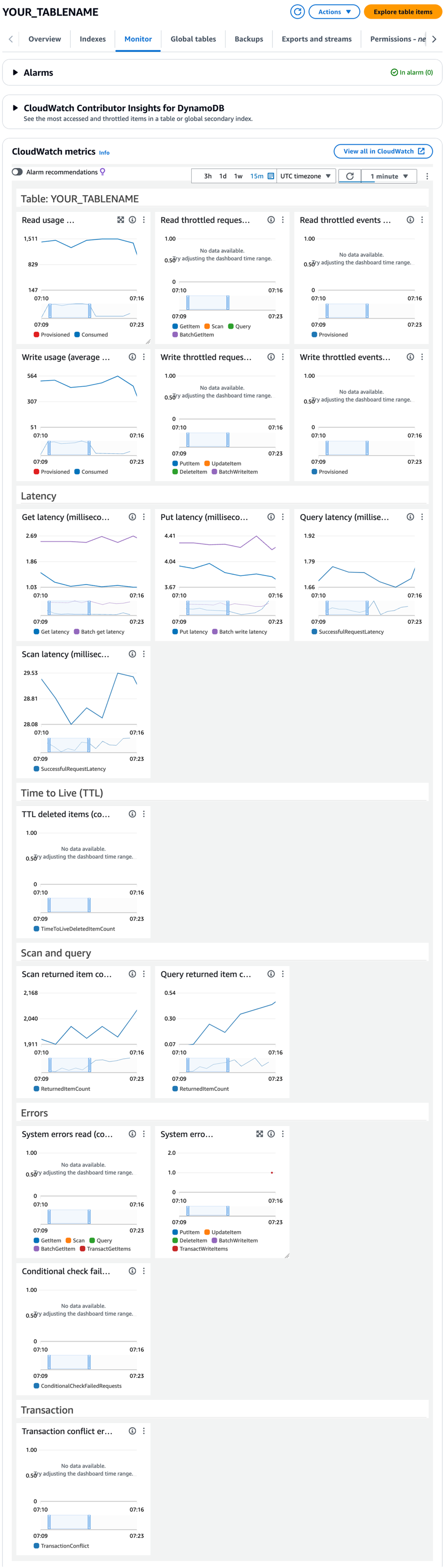

First, let’s look at what metrics are readily available. On the DynamoDB console, if you navigate to a particular table, the Monitor tab shows a long list of convenient metrics about that table pulled from CloudWatch. The following screenshot shows an example.

Retrieve a count metric

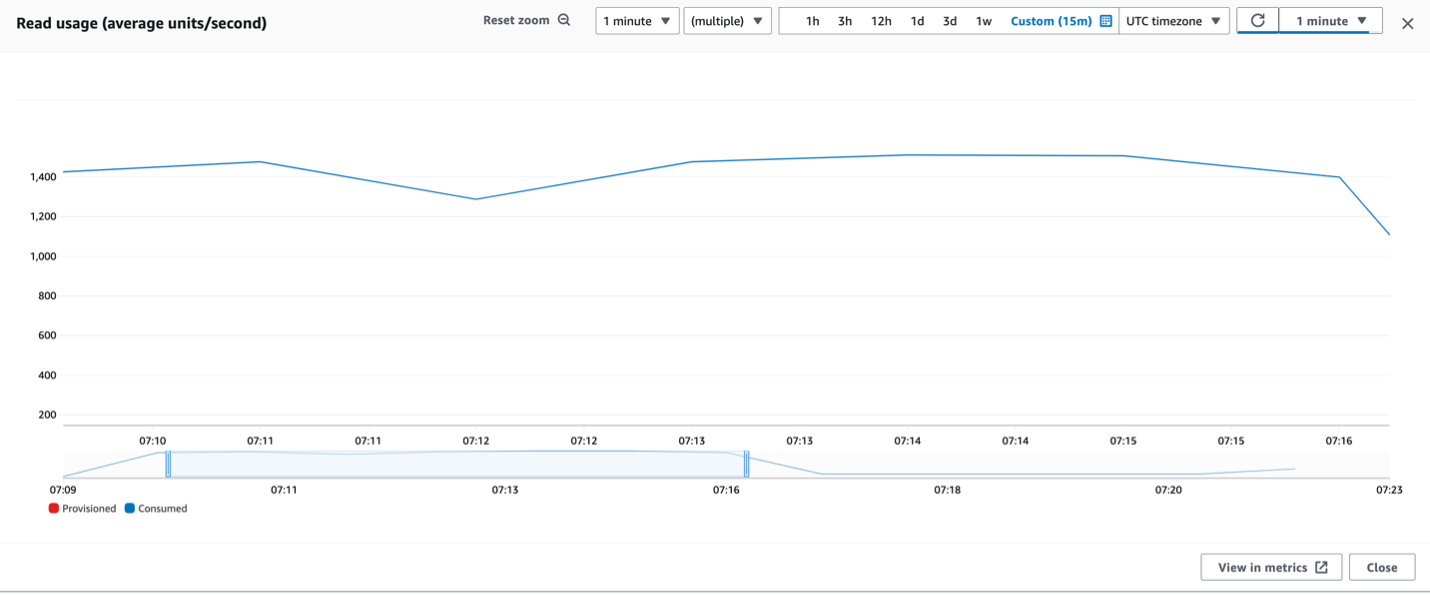

Imagine you find a period of elevated read consumption. You can expand the graph of read usage to show the Read Capacity Units (RCUs) consumed per second (displayed in the following screenshot on a per-minute period).

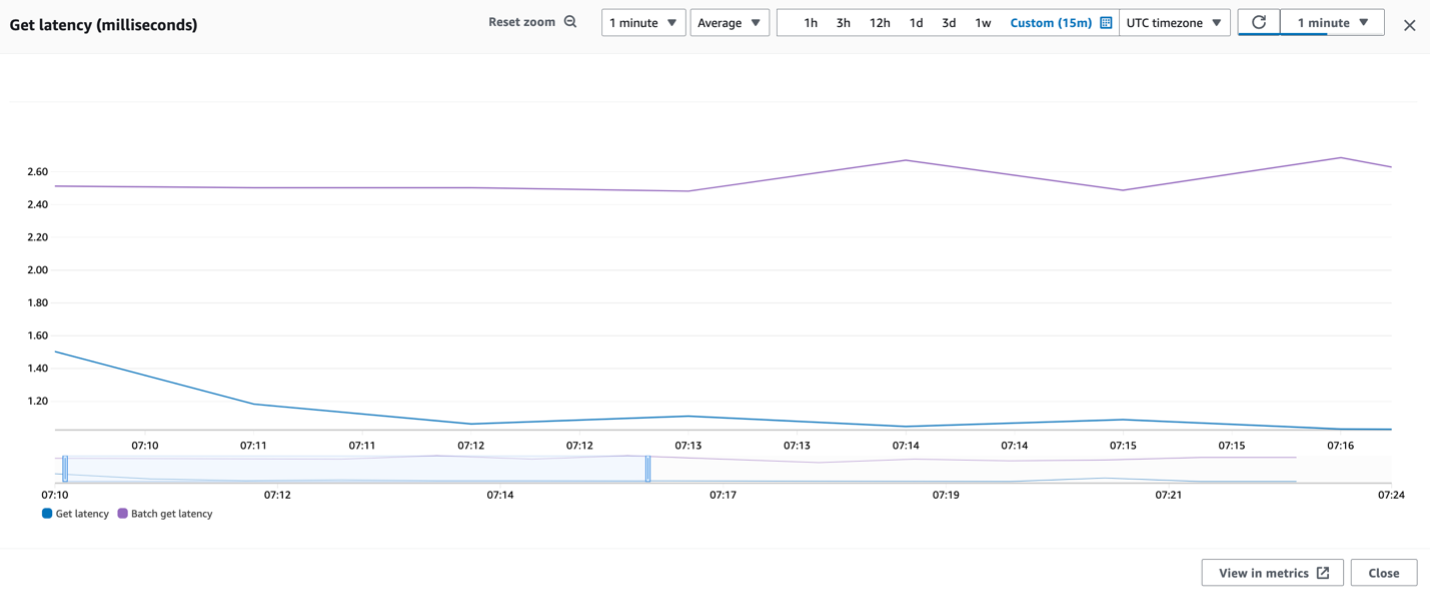

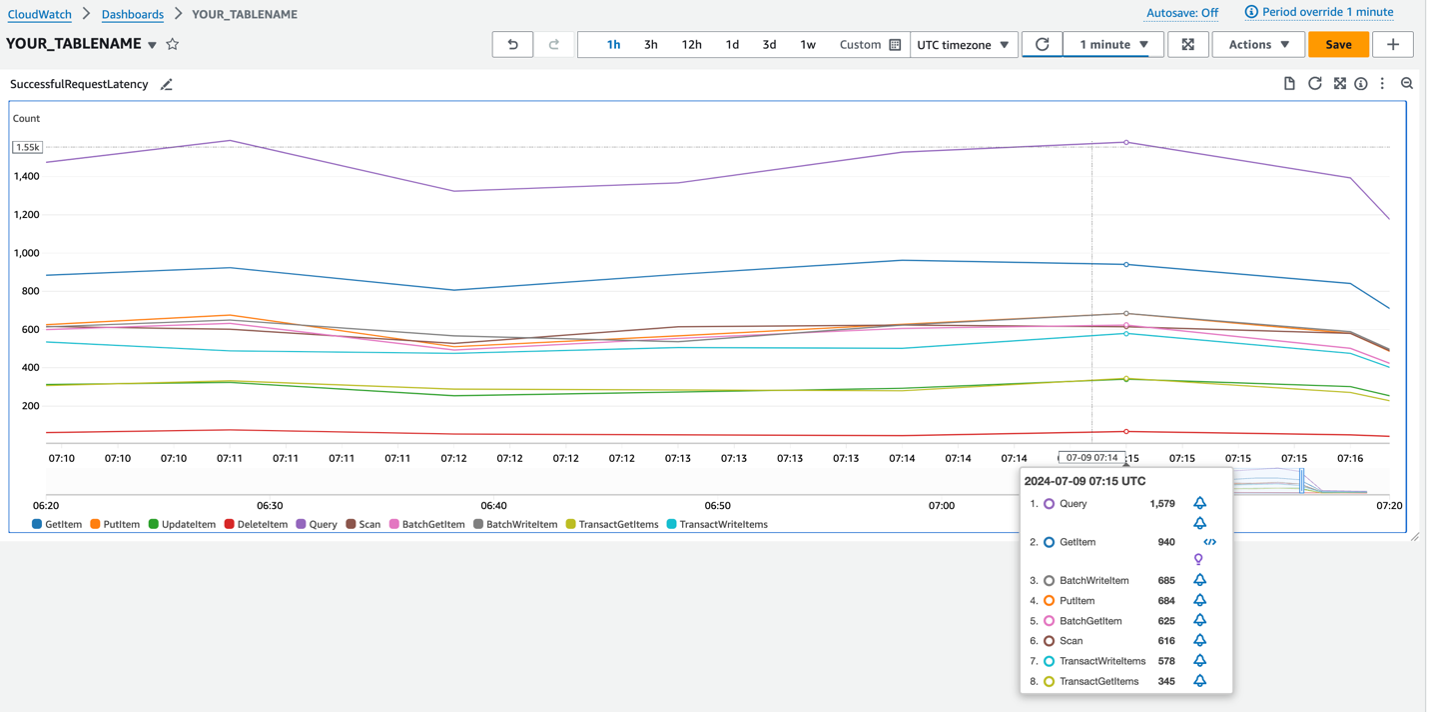

The Read usage graph shows the consumption rate that matters for pricing, but doesn’t show how many requests were being made during each period or what type they were. How many GetItem, BatchGetItem, Query, or Scan calls were happening? One graph that gets close is the average latencies for each operation type. The following screenshot shows the average Get latencies for GetItem and BatchGetItem calls during the period in question.

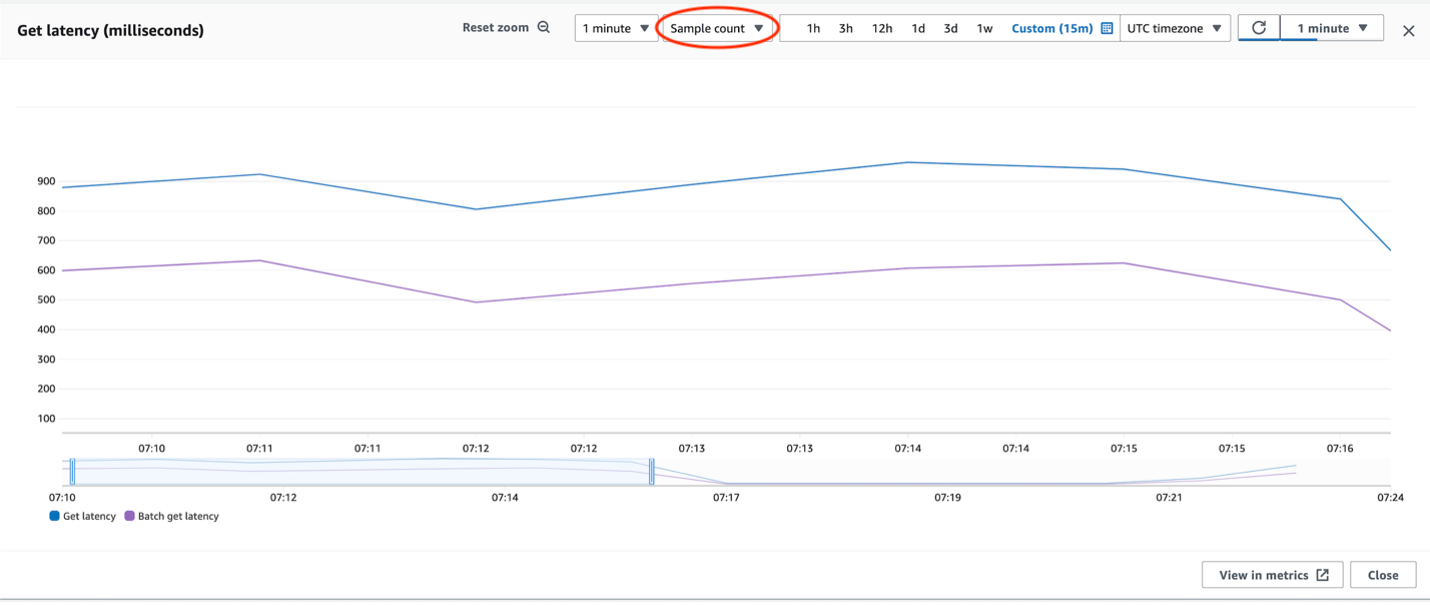

You can convert this average latency metric to a count metric by changing the statistic in the top center from Average to Sample count. This provides you with how many latency samples were gathered in each time period, which for our purposes is perfect because that matches how many successful GetItem and BatchGetItem calls were made. It’s now a successful request count graph. The following screenshot shows the adjusted graph. Ignore the top left still saying it’s in milliseconds, because by changing the statistic we’ve changed the units from “average milliseconds of latency” to “number of latency measurements”, which provides the number of requests.

This simple adjustment gives you a way to track the number of successful calls per operation type per time period.

A note about time periods: The most granular time period available for DynamoDB CloudWatch metrics is a one minute period. A metric that reports usage or requests “per second” is showing an inferred per second rate based on the larger time period. This means if you see 1,000 requests per second on a one minute period, what that technically means is there were 60,000 requests during the minute. More historic CloudWatch data tends to be aggregated into periods of 5 or 15 minutes.

CloudWatch dashboard

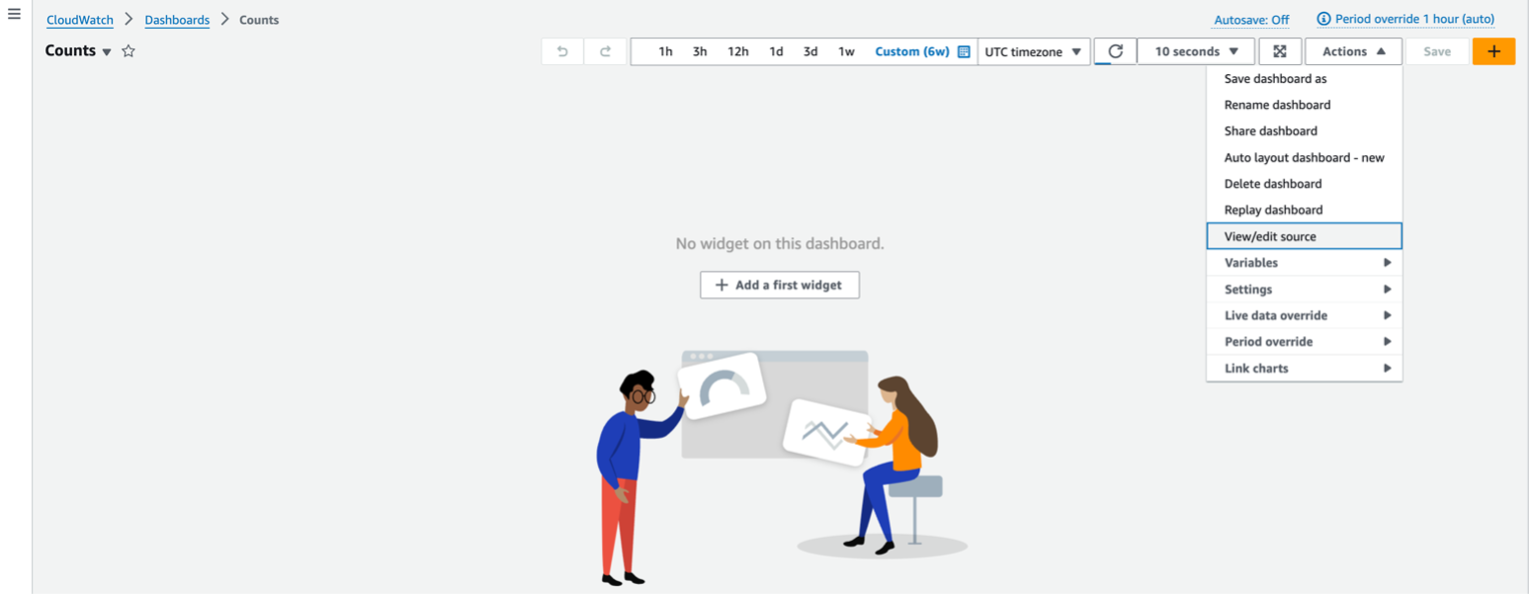

You can create a CloudWatch dashboard that shows the count of each operation type for a given table. A CloudWatch dashboard is a customizable page on the CloudWatch console that you can use to monitor your resources in a single view. The definition of a dashboard can be based on a JSON file, which is viewable and editable on the Actions menu, as shown in the following screenshot.

The following example JSON dashboard definition displays request counts for all standard operation types for a given table. To use it, adjust the code to provide your table name and AWS Region if not us-east-1. Then in CloudWatch Dashboards, you can create a new dashboard, provide a name, cancel out adding a widget, and on the Actions menu, choose View/edit source and provide your modified JSON as the source.

The resulting dashboard then looks like the following screenshot.

You can experiment with changing the Period (available under the Actions menu) to control the granularity. Remember, you can’t go finer grained than 1 minute and for historic data may need a 5 or 15 minute period.

You can add expressions to the Dashboard to show total reads, total writes, and total requests to the graph, as shown in the following expanded JSON.

Clean up

Custom dashboards incur a small cost per month, although the first few are free, so be sure to delete any custom dashboards you’re not using. You can delete a custom dashboard the same way you created it, via the Console or command line.

Conclusion

In this post we demonstrated how to track DynamoDB operation counts in CloudWatch using the latency metric and adjusting the statistic from Average to Sample count. We’ve provided steps to configure the metric and provided a CloudWatch dashboard source JSON file to track all operation counts in a given table. The following 2.5 minute video shows a screen recording walking you through the process.

Try it out with your own DynamoDB tables, and let us know your feedback in the comments section. You can find more DynamoDB posts and others posts written by Jason Hunter in the AWS Database Blog.

About the Author

Jason Hunter is a California-based Principal Solutions Architect specializing in Amazon DynamoDB. He’s been working with NoSQL databases since 2003. He’s known for his contributions to Java, open source, and XML.

Jason Hunter is a California-based Principal Solutions Architect specializing in Amazon DynamoDB. He’s been working with NoSQL databases since 2003. He’s known for his contributions to Java, open source, and XML.

MMS • RSS

NEW YORK, NY / ACCESSWIRE / August 13, 2024 / Pomerantz LLP announces that a class action lawsuit has been filed against MongoDB, Inc. (“MongoDB” or the “Company”) (NASDAQ:MDB). Such investors are advised to contact Danielle Peyton at [email protected] or 646-581-9980, (or 888.4-POMLAW), toll-free, Ext. 7980. Those who inquire by e-mail are encouraged to include their mailing address, telephone number, and the number of shares purchased.

The class action concerns whether MongoDB and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.

You have until September 9, 2024, to ask the Court to appoint you as Lead Plaintiff for the class if you are a shareholder who purchased or otherwise acquired MongoDB securities during the Class Period. A copy of the Complaint can be obtained at www.pomerantzlaw.com.

[Click here for information about joining the class action]

On March 7, 2024, MongoDB issued a press release announcing its fiscal year 2024 earnings and held a related earnings call that same day. Among other items, MongoDB announced an anticipated near-zero revenue from unused commitments for the Company’s MongoDB Atlas platform in fiscal year 2025, a decrease of approximately $40 million in revenue, attributed to the Company’s decision to change their sales incentive structure to reduce enrollment. Additionally, MongoDB projected only 14% growth for fiscal year 2025, compared to projected 16% growth for the previous year, which had resulted in an actualized 31% growth.

On this news, MongoDB’s stock price fell $28.59 per share, or 6.94%, to close at $383.42 per share on March 8, 2024.

Then, on May 30, 2024, MongoDB again announced significantly reduced growth projections for fiscal year 2025. The Company attributed the reduction to its decision to change its sales incentive structure to reduce enrollment frictions, as well as purportedly unanticipated macroeconomic headwinds.

On this news, Mongo’s stock price fell $73.94 per share, or 23.85%, to close at $236.06 per share on May 31, 2024.

Pomerantz LLP, with offices in New York, Chicago, Los Angeles, London, Paris, and Tel Aviv, is acknowledged as one of the premier firms in the areas of corporate, securities, and antitrust class litigation. Founded by the late Abraham L. Pomerantz, known as the dean of the class action bar, Pomerantz pioneered the field of securities class actions. Today, more than 85 years later, Pomerantz continues in the tradition he established, fighting for the rights of the victims of securities fraud, breaches of fiduciary duty, and corporate misconduct. The Firm has recovered billions of dollars in damages awards on behalf of class members. See www.pomlaw.com.

Attorney advertising. Prior results do not guarantee similar outcomes.

SOURCE: Pomerantz LLP

MongoDB, Inc. Investors are Notified to Contact BFA Law about the Securities Fraud Class …

MMS • RSS

NEW YORK, NY / ACCESSWIRE / August 13, 2024 / Leading securities law firm Bleichmar Fonti & Auld LLP announces a lawsuit has been filed against MongoDB, Inc. (Nasdaq:MDB) and certain of the Company’s senior executives.

If you suffered losses on your MongoDB investment, you are encouraged to submit your information at https://www.bfalaw.com/cases-investigations/mongodb-inc.

Investors have until September 9, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in MongoDB securities between August 31, 2023 and May 30, 2024, inclusive. The case is pending in the U.S. District Court for the Southern District of New York and is captioned John Baxter v. MongoDB, Inc., et al., No. 1:24-cv-05191.

What is the Lawsuit About?

The complaint alleges that the Company misrepresented the purported benefits stemming from the restructuring of its sales force. This includes how the restructuring helped reduce friction in acquiring new customers and increased new workload acquisition among existing customers.

These statements were allegedly materially false and misleading. In truth, MongoDB’s sales force restructuring resulted in a near total loss of upfront customer commitments, a significant reduction in actionable information gathered by the sales force, and hindered enrollment and revenue growth.

On March 7, 2024, the Company allegedly announced that due to the sales restructuring, it experienced an annual decrease of approximately $40 million in multiyear license revenue, anticipated near zero revenue from unused Atlas commitments (one of its core offerings) in fiscal year 2025, and provided a disappointing revenue growth forecast that trailed that of the prior year. This news caused the price of MongoDB stock to decline $28.59 per share, or about 7%, from $412.01 per share on March 7, 2024, to $383.42 per share on March 8, 2024.

Then, on May 30, 2024, the Company again announced significantly reduced growth expectations, this time cutting fiscal year 2025 growth projections further, again attributing the losses to the sales force restructuring. On this news, the price of MongoDB stock declined $73.94 per share, or nearly 24%, from $310.00 per share on May 30, 2024, to $236.06 per share on May 31, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/mongodb-inc.

What Can You Do?

If you invested in MongoDB, Inc. you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information:

https://www.bfalaw.com/cases-investigations/mongodb-inc

Or contact us at:

Ross Shikowitz

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/mongodb-inc

Attorney advertising. Past results do not guarantee future outcomes.

SOURCE: Bleichmar Fonti & Auld LLP

MMS • RSS

QRG Capital Management Inc. cut its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 55.9% during the 2nd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,794 shares of the company’s stock after selling 2,275 shares during the quarter. QRG Capital Management Inc.’s holdings in MongoDB were worth $448,000 as of its most recent SEC filing.

Other large investors also recently modified their holdings of the company. Transcendent Capital Group LLC acquired a new position in shares of MongoDB during the fourth quarter worth approximately $25,000. YHB Investment Advisors Inc. bought a new position in shares of MongoDB in the first quarter valued at $41,000. Sunbelt Securities Inc. grew its holdings in shares of MongoDB by 155.1% during the first quarter. Sunbelt Securities Inc. now owns 125 shares of the company’s stock valued at $45,000 after buying an additional 76 shares during the last quarter. GAMMA Investing LLC bought a new stake in shares of MongoDB during the fourth quarter worth about $50,000. Finally, DSM Capital Partners LLC bought a new position in MongoDB in the 4th quarter valued at about $61,000. Institutional investors and hedge funds own 89.29% of the company’s stock.

Insiders Place Their Bets

In other MongoDB news, CRO Cedric Pech sold 273 shares of the stock in a transaction that occurred on Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $72,424.17. Following the completion of the sale, the executive now owns 35,719 shares in the company, valued at approximately $9,475,893.51. The transaction was disclosed in a document filed with the SEC, which is available at this link. In other MongoDB news, CRO Cedric Pech sold 273 shares of the company’s stock in a transaction on Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total value of $72,424.17. Following the completion of the transaction, the executive now directly owns 35,719 shares in the company, valued at approximately $9,475,893.51. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Dwight A. Merriman sold 2,000 shares of MongoDB stock in a transaction dated Tuesday, June 4th. The shares were sold at an average price of $234.24, for a total transaction of $468,480.00. Following the sale, the director now directly owns 1,146,784 shares in the company, valued at approximately $268,622,684.16. The disclosure for this sale can be found here. Insiders sold a total of 30,179 shares of company stock valued at $7,368,989 over the last 90 days. Insiders own 3.60% of the company’s stock.

MongoDB Price Performance

Shares of MDB traded up $4.92 during mid-day trading on Tuesday, reaching $237.29. 153,619 shares of the stock traded hands, compared to its average volume of 1,504,054. The company has a current ratio of 4.93, a quick ratio of 4.93 and a debt-to-equity ratio of 0.90. MongoDB, Inc. has a 1 year low of $212.74 and a 1 year high of $509.62. The company has a market cap of $17.41 billion, a price-to-earnings ratio of -84.44 and a beta of 1.13. The firm has a fifty day moving average price of $241.13 and a 200 day moving average price of $332.87.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings results on Thursday, May 30th. The company reported ($0.80) EPS for the quarter, hitting analysts’ consensus estimates of ($0.80). MongoDB had a negative net margin of 11.50% and a negative return on equity of 14.88%. The firm had revenue of $450.56 million for the quarter, compared to analyst estimates of $438.44 million. As a group, equities research analysts predict that MongoDB, Inc. will post -2.67 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of equities research analysts recently commented on MDB shares. Scotiabank lowered their price target on MongoDB from $385.00 to $250.00 and set a “sector perform” rating for the company in a research report on Monday, June 3rd. Loop Capital lowered their target price on shares of MongoDB from $415.00 to $315.00 and set a “buy” rating for the company in a report on Friday, May 31st. Needham & Company LLC reaffirmed a “buy” rating and issued a $290.00 price objective on shares of MongoDB in a research report on Thursday, June 13th. Wells Fargo & Company reduced their target price on MongoDB from $450.00 to $300.00 and set an “overweight” rating for the company in a report on Friday, May 31st. Finally, DA Davidson raised MongoDB from a “hold” rating to a “strong-buy” rating in a research report on Friday, May 31st. One analyst has rated the stock with a sell rating, five have given a hold rating, nineteen have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, MongoDB currently has a consensus rating of “Moderate Buy” and a consensus price target of $355.74.

Get Our Latest Stock Analysis on MDB

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

MMS • RSS

Simplicity Wealth LLC decreased its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 21.8% in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 849 shares of the company’s stock after selling 237 shares during the quarter. Simplicity Wealth LLC’s holdings in MongoDB were worth $212,000 at the end of the most recent reporting period.

Simplicity Wealth LLC decreased its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 21.8% in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 849 shares of the company’s stock after selling 237 shares during the quarter. Simplicity Wealth LLC’s holdings in MongoDB were worth $212,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also recently made changes to their positions in the stock. Vanguard Group Inc. lifted its holdings in shares of MongoDB by 1.0% in the first quarter. Vanguard Group Inc. now owns 6,910,761 shares of the company’s stock worth $2,478,475,000 after acquiring an additional 68,348 shares during the last quarter. Jennison Associates LLC lifted its holdings in shares of MongoDB by 14.3% in the first quarter. Jennison Associates LLC now owns 4,408,424 shares of the company’s stock worth $1,581,037,000 after acquiring an additional 551,567 shares during the last quarter. Norges Bank bought a new position in shares of MongoDB in the fourth quarter worth about $326,237,000. Champlain Investment Partners LLC increased its stake in shares of MongoDB by 22.4% in the first quarter. Champlain Investment Partners LLC now owns 550,684 shares of the company’s stock valued at $197,497,000 after buying an additional 100,725 shares during the period. Finally, First Trust Advisors LP increased its stake in shares of MongoDB by 59.3% in the fourth quarter. First Trust Advisors LP now owns 549,052 shares of the company’s stock valued at $224,480,000 after buying an additional 204,284 shares during the period. Institutional investors own 89.29% of the company’s stock.

Wall Street Analysts Forecast Growth

MDB has been the subject of several recent research reports. Robert W. Baird lowered their price objective on MongoDB from $450.00 to $305.00 and set an “outperform” rating for the company in a research note on Friday, May 31st. Citigroup lowered their price objective on MongoDB from $480.00 to $350.00 and set a “buy” rating for the company in a research note on Monday, June 3rd. Wells Fargo & Company lowered their price objective on MongoDB from $450.00 to $300.00 and set an “overweight” rating for the company in a research note on Friday, May 31st. Barclays decreased their target price on shares of MongoDB from $458.00 to $290.00 and set an “overweight” rating for the company in a research report on Friday, May 31st. Finally, Scotiabank decreased their target price on shares of MongoDB from $385.00 to $250.00 and set a “sector perform” rating for the company in a research report on Monday, June 3rd. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating, nineteen have given a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of “Moderate Buy” and a consensus price target of $355.74.

View Our Latest Analysis on MDB

MongoDB Trading Down 1.1 %

Shares of MongoDB stock opened at $232.37 on Tuesday. MongoDB, Inc. has a 1 year low of $212.74 and a 1 year high of $509.62. The firm has a market cap of $17.04 billion, a PE ratio of -82.69 and a beta of 1.13. The stock has a fifty day moving average price of $241.17 and a 200-day moving average price of $334.05. The company has a debt-to-equity ratio of 0.90, a current ratio of 4.93 and a quick ratio of 4.93.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings data on Thursday, May 30th. The company reported ($0.80) earnings per share for the quarter, hitting the consensus estimate of ($0.80). MongoDB had a negative return on equity of 14.88% and a negative net margin of 11.50%. The company had revenue of $450.56 million during the quarter, compared to analyst estimates of $438.44 million. Equities research analysts anticipate that MongoDB, Inc. will post -2.67 EPS for the current year.

Insider Buying and Selling at MongoDB

In other MongoDB news, CRO Cedric Pech sold 273 shares of MongoDB stock in a transaction dated Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total transaction of $72,424.17. Following the completion of the transaction, the executive now owns 35,719 shares of the company’s stock, valued at approximately $9,475,893.51. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. In other news, Director Hope F. Cochran sold 1,174 shares of MongoDB stock in a transaction dated Monday, June 17th. The stock was sold at an average price of $224.38, for a total transaction of $263,422.12. Following the completion of the sale, the director now owns 13,011 shares in the company, valued at approximately $2,919,408.18. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, CRO Cedric Pech sold 273 shares of MongoDB stock in a transaction dated Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total value of $72,424.17. Following the sale, the executive now owns 35,719 shares of the company’s stock, valued at approximately $9,475,893.51. The disclosure for this sale can be found here. Insiders sold 30,179 shares of company stock valued at $7,368,989 in the last quarter. 3.60% of the stock is currently owned by corporate insiders.

MongoDB Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Levi & Korsinsky Reminds MongoDB Investors of the Pending Class Action Lawsuit with a …

MMS • RSS

NEW YORK, Aug. 13, 2024 /PRNewswire/ — Levi & Korsinsky, LLP notifies investors in MongoDB, Inc. (“MongoDB” or the “Company”) (NASDAQ: MDB) of a class action securities lawsuit.

CLASS DEFINITION: The lawsuit seeks to recover losses on behalf of MongoDB investors who were adversely affected by alleged securities fraud between August 31, 2023 and May 30, 2024. Follow the link below to get more information and be contacted by a member of our team:

https://zlk.com/pslra-1/mongodb-inc-lawsuit-submission-form?prid=95094&wire=4

MDB investors may also contact Joseph E. Levi, Esq. via email at jlevi@levikorsinsky.com or by telephone at (212) 363-7500.

CASE DETAILS: According to the complaint, on March 7, 2024, MongoDB reported strong Q4 2024 results and then announced lower than expected full-year guidance for 2025. MongoDB attributed it to the Company’s change in its “sales incentive structure” which led to a decrease in revenue related to “unused commitments and multi-year licensing deals.” Following this news, MongoDB’s stock price fell by $28.59 per share to close at $383.42 per share. Later, on May 30, 2024, MongoDB further lowered its guidance for the full year 2025 attributing it to “macro impacting consumption growth.” Analysts commenting on the reduced guidance questioned if changes made to the Company’s marketing strategy “led to change in customer behavior and usage patterns.” Following this news, MongoDB’s stock price fell by $73.94 per share to close at $236.06 per share.

WHAT’S NEXT? If you suffered a loss in MongoDB during the relevant time frame, you have until September 9, 2024 to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as a lead plaintiff.

NO COST TO YOU: If you are a class member, you may be entitled to compensation without payment of any out-of-pocket costs or fees. There is no cost or obligation to participate.

WHY LEVI & KORSINSKY: Over the past 20 years, the team at Levi & Korsinsky has secured hundreds of millions of dollars for aggrieved shareholders and built a track record of winning high-stakes cases. Our firm has extensive expertise representing investors in complex securities litigation and a team of over 70 employees to serve our clients. For seven years in a row, Levi & Korsinsky has ranked in ISS Securities Class Action Services’ Top 50 Report as one of the top securities litigation firms in the United States.

CONTACT:

Levi & Korsinsky, LLP

Joseph E. Levi, Esq.

Ed Korsinsky, Esq.

33 Whitehall Street, 17th Floor

New York, NY 10004

jlevi@levikorsinsky.com

Tel: (212) 363-7500

Fax: (212) 363-7171

www.zlk.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/levi–korsinsky-reminds-mongodb-investors-of-the-pending-class-action-lawsuit-with-a-lead-plaintiff-deadline-of-september-9-2024–mdb-302220424.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/levi–korsinsky-reminds-mongodb-investors-of-the-pending-class-action-lawsuit-with-a-lead-plaintiff-deadline-of-september-9-2024–mdb-302220424.html

SOURCE Levi & Korsinsky, LLP

MMS • RSS

QRG Capital Management Inc. decreased its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 55.9% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,794 shares of the company’s stock after selling 2,275 shares during the quarter. QRG Capital Management Inc.’s holdings in MongoDB were worth $448,000 at the end of the most recent quarter.

QRG Capital Management Inc. decreased its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 55.9% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,794 shares of the company’s stock after selling 2,275 shares during the quarter. QRG Capital Management Inc.’s holdings in MongoDB were worth $448,000 at the end of the most recent quarter.

Several other institutional investors also recently added to or reduced their stakes in MDB. Norges Bank bought a new position in shares of MongoDB during the 4th quarter worth about $326,237,000. Jennison Associates LLC increased its stake in MongoDB by 14.3% during the first quarter. Jennison Associates LLC now owns 4,408,424 shares of the company’s stock valued at $1,581,037,000 after acquiring an additional 551,567 shares during the period. Axiom Investors LLC DE bought a new position in MongoDB during the fourth quarter valued at about $153,990,000. Swedbank AB bought a new stake in shares of MongoDB in the 1st quarter worth approximately $91,915,000. Finally, Clearbridge Investments LLC lifted its position in shares of MongoDB by 109.0% in the 1st quarter. Clearbridge Investments LLC now owns 445,084 shares of the company’s stock worth $159,625,000 after acquiring an additional 232,101 shares during the period. 89.29% of the stock is owned by institutional investors.

MongoDB Stock Down 1.1 %

Shares of MongoDB stock opened at $232.37 on Tuesday. MongoDB, Inc. has a 12 month low of $212.74 and a 12 month high of $509.62. The business has a fifty day simple moving average of $241.17 and a 200 day simple moving average of $334.05. The company has a quick ratio of 4.93, a current ratio of 4.93 and a debt-to-equity ratio of 0.90. The stock has a market cap of $17.04 billion, a PE ratio of -82.69 and a beta of 1.13.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings data on Thursday, May 30th. The company reported ($0.80) earnings per share (EPS) for the quarter, meeting analysts’ consensus estimates of ($0.80). The firm had revenue of $450.56 million during the quarter, compared to analysts’ expectations of $438.44 million. MongoDB had a negative net margin of 11.50% and a negative return on equity of 14.88%. Research analysts predict that MongoDB, Inc. will post -2.67 EPS for the current year.

Analysts Set New Price Targets

A number of research analysts recently commented on the company. Robert W. Baird cut their target price on MongoDB from $450.00 to $305.00 and set an “outperform” rating for the company in a research note on Friday, May 31st. Tigress Financial cut their price target on shares of MongoDB from $500.00 to $400.00 and set a “buy” rating for the company in a research note on Thursday, July 11th. Needham & Company LLC reissued a “buy” rating and issued a $290.00 target price on shares of MongoDB in a report on Thursday, June 13th. Canaccord Genuity Group decreased their price target on MongoDB from $435.00 to $325.00 and set a “buy” rating on the stock in a research note on Friday, May 31st. Finally, Guggenheim upgraded MongoDB from a “sell” rating to a “neutral” rating in a research report on Monday, June 3rd. One analyst has rated the stock with a sell rating, five have issued a hold rating, nineteen have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of “Moderate Buy” and a consensus target price of $355.74.

View Our Latest Stock Report on MDB

Insider Buying and Selling

In other MongoDB news, CAO Thomas Bull sold 138 shares of the business’s stock in a transaction dated Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $36,610.02. Following the completion of the transaction, the chief accounting officer now directly owns 17,222 shares of the company’s stock, valued at $4,568,824.38. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In other news, Director Hope F. Cochran sold 1,174 shares of the stock in a transaction on Monday, June 17th. The shares were sold at an average price of $224.38, for a total transaction of $263,422.12. Following the completion of the sale, the director now owns 13,011 shares of the company’s stock, valued at $2,919,408.18. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CAO Thomas Bull sold 138 shares of MongoDB stock in a transaction dated Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total value of $36,610.02. Following the completion of the sale, the chief accounting officer now directly owns 17,222 shares in the company, valued at approximately $4,568,824.38. The disclosure for this sale can be found here. In the last quarter, insiders have sold 30,179 shares of company stock valued at $7,368,989. 3.60% of the stock is owned by company insiders.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • Jeremy Ruston

Transcript

Ruston: My name is Jeremy Ruston. You may know me for my work on an open source project called TiddlyWiki, which is 20 years old this year. I’m actually only going to talk about that tangentially, and leave this here to whet your appetite. I hope instead to take you on a journey back to the very early days of home computers in the UK, and use my experiences then to help us think about the landscape that we see around us today, and the challenges that we face for the future. We’ll talk about technology, but also culture and communities.

We’ll hear a little from the young man on the left. We’ll be seeing some extremely fruity, old 1980s computer animations. I should first apologize to people who might feel strongly about other home computers, and there were many other fine home computers in the ’80s. I’m not denigrating those at all. Perhaps a machine like the Spectrum might have had more influence on the games industry than the BBC Micro.

The BBC Micro was unique in its influence on the broader computer industry. Of course, I wasn’t one of the pioneers who built these machines, or built that generation of hardware and software. QCon has already been lucky enough to hear from some of those people such as Sophie Wilson, and I highly recommend those talks. I was just an enthusiast, a fan in the right place at the right time.

Computers, in the Culture of the 1980s

Let’s step into this handy TARDIS and go back to January 30, 1983.

Interviewer: In South East at 6 tonight, Mastering the Microchip, are two teenager’s expertise on computers is making them a fortune. You don’t need a computer to tell you that we’re now living in the age of the microchip. Our homes are randomly being invaded by mini computers, 17-year-old Jeremy Ruston, and Alex Gollner who’s 15, are two London school boys who stand to make about 16,000 pounds between them this year, cashing in on the computer craze.

Ruston: Strip away the prurient interest in money, and the focus on our ages. That little news slot actually quite neatly shows how computers sat in the culture of that time. There was excitement about them, and that was newsworthy, but really, I was there as a curiosity. Computers were new and exotic, vaguely threatening things that the vast majority of people at that time would never even have knowingly laid eyes on. In fact, at that time, my parents would bring their friends up to my bedroom, or hackerspaces, just to marvel at the sight of a computer, rather, as people in the 20s marveled at the sight of aeroplanes passing overhead. The thing I love is that now those people are all addicted to their iPad.

I think the interviewer talking about computers invading our homes is incredibly revealing. I didn’t have to be very astute at that age to realize that the problem was that he was scared of computers and the change that it represents. That’s my attempt to make a scary BBC Micro roaring. I found that really weird at the time. How could anyone be scared of computers? They were self-evidently wonderful, fulfilling things. Since then, I’ve worked for many organizations that face threatening existential change, and discovered that for many individuals within those organizations, the best strategy faced with a catastrophic change is just to ignore it, and pretend it’s not happening. For instance, at BT, I remember senior people who profess to believe that Voice over IP wouldn’t be a threat to BT’s core business, because customers, you, instinctively prefer the familiar reliable feel of a landline call. They believe that given a choice that’s what people would choose.

Let’s go back to 1983 and see how Jeremy responds to this impertinence.

Interviewer: Jeremy, first of all, how did you become hooked, and what’s the fascination?

Ruston: I started off being interested in electronics and building radios and so on. Then I started building small computers. From then, I just started buying ready-built ones instead.

Here indeed is that first computer. Its chief advantage was that it was 39 pounds 95 in kit form. Probably on this screen you can see my candid soldering. I don’t know what that is. I was 12. Of course, it says there, only had 256 bytes of RAM. I don’t think I ever filled that memory in my time with it. An astonishingly limited specification. As it says, no stack register.

It was like a RISC processor that had been cut in half, then cut in half again, and then cobbled together to work. Incredibly hard to convey how hard it was to use. It was about as much fun as programming a central heating controller. Our expectations of 256 bytes of RAM can be wrong. This is an image, it’s an entry in a demo scene competition. The conditions of this competition are to write a MS-DOS XE in 256 bytes. That image is a 20 kilobyte JPEG generated by 256 bytes. How can 256 bytes contain an image as rich and complex as that? An astonishing achievement, but an extraordinary commonplace achievement today. What if I told you that actually, if you run this code, let’s see what happens. This is actually animated. To me, it’s stunning that in the amount of space that I might allocate to a comment at the top of a file, somebody can build an entire immersive world. I think that is in the category of impossible things that we need to believe before breakfast.

The Role of Computer Magazines, in the ’80s

Going back to the ’80s, in the absence of the internet, the home computer community primarily manifested itself through computer magazines, and there were a lot of them, and they were a big business. A weird thing is, besides providing a substrate for the community, computer magazines were also a software distribution mechanism. They were stuffed full of listings of programs that people were expected to type in for themselves.

I soon started sending them in because they got published. It was, at the time, quite easy to figure out what people liked and send in this code. It was my first experience of what happens in a community, and today working in open source to see the same thing. It’s the cycle of copying from other people, modifying what they’ve done, sharing it within the community, typically within a platform. It’s weird to me that my first experience of that community was built on a substrate of old media, magazines, and books, and so on. It was still the same process that we see today.

That was the context for me when the BBC Micro appeared, fresh from using a machine with 256 bytes of RAM. The photo I showed at the beginning was the front of the machine, but in fact, the underneath and the back are far more relevant to our discussion. You can see a large array of ports on the back and the front, mysterious ports, but easier to see on the schematic. The BBC Micro arrived with a very detailed manual, this included circuit diagrams of the connectors, which makes me laugh to think of the iPhone coming with a circuit diagram.

You can see there’s a stunning array of ports, ones that you would expect, like a cassette interface. Also, a networking interface, in 1981 was for us, I know, one of the first networkable home computers. It had a video output that you could connect to your television. Indeed, the videos that you’re seeing today were recorded on VHS like that. It also had a digital RGB output. Underneath, you can see parallel interfaces for disk, printer, and unassigned user ports that could be used for a variety of things.

I jumped in and enjoyed all of that, and made my way from sending programs to magazines to writing books. Books at the time were also a software distribution mechanism. We tried to do the same things with software but we had to make do with the media at the time. I think these books today would just be a YouTube channel. Kids today do that kind of thing, or probably a Discord server. We didn’t have any choice. At the time, I was typing out these books on an electric typewriter with my mum proofreading them.

It’s also weird to think that home computers were so popular. The book, “The BBC Micro Revealed,” actually made it into the Sunday Times top 10 bestseller list for a couple weeks, which is extraordinary for an incredibly arcane, confusing, very technical book. I think what happened was that a lot of parents were buying the BBC Micro for their kids in the belief that it would help educate them for the coming invasion of computers. They also picked up a copy of my book to reassure themselves that their child was going to be learning to program and not just playing games. Less gloriously, the book, “The BBC Micro Compendium,” got me sued by Acorn. Several of the books were translated into other languages. It was actually really cool at the time to see the mechanism that the publishing industry, how quickly and efficiently they could do that.

The book you see in the middle is an American edition of one of my books. Even that needed translation. I’d use the word clever. In the English sense, that was a clever thing to do, but that has a completely different connotation in North America. The translators quite rightly had changed it to the word smart, which I would never use in that context. That experience underlined for me the way that unknowingly our own culture and geography can be a barrier to communication. We need to pay attention to that. I hopefully will try to show you why.

Collaboration in Open Source

We see this idea in open source projects like TiddlyWiki. It has, like many open source projects, a plugin mechanism. We have a common substrate, a universal core. Plugins are our mechanism for people to accommodate people’s sometimes conflicting requirements. We’ve architected it deliberately to be translatable. What you can see here is what happens as I work on TiddlyWiki. I’ll merge a PR, that might include a change to the English translation. Then, within an hour or two, BramChen will submit a PR with matching changes for the Chinese translation. It’s by far the highest quality translation we have and the most up to date.

Quite often, he’ll point out errors in what I’ve done or inconsistencies. As you can see, this has been going on for 10 years. I’ve had a 10-year relationship with Bram, but I’ve never met him. We can’t really communicate except in Google Translate mediated broken English, and of course through the code. The privilege for me is that I feel I have these talented people looking over my shoulder helping me with my work. I feel as though I, like a lot of us here, are participating in a completely new way of working, that we’re going to see more of in the future.

It simply couldn’t have happened just a few decades ago, the idea of collaborating so closely with somebody on the other side of the world. In fact, the Chinese community of TiddlyWiki is interesting in other ways too. The first thing is, it’s huge. It’s based on Chinese message boards, and an ecosystem of tools that I can’t really see. It’s like dark matter, this community that I can’t see directly, but I know about it from the members of that community who also participate in the English language community. Indeed, there is a small group of Chinese developers, who are incredibly prolific and valued contributors to the project. What it means to me is that I haven’t accidentally made a piece of software that represents me. I haven’t accidentally made a piece of software that embodies the thinking of a middle-aged white man. I have actually achieved the goal of making something that’s universal enough to be used by people of any culture. I think that is important for all of us in our work.

Understanding the Inside of a Machine (BBC Micro)

What were those books about? I think this is the first bit of code I’ve shown. When I got the BBC Micro, I dived into it, trying to understand every aspect of the machine, such thing that would be impossible now. Nobody could understand the inwardness of an iPhone, there’s just too much going on. It was possible for one brain to understand the entirety of the inside of the machine. I’m afraid a lot of that is gone now. At the time, I knew where every memory location, hardware register was for, and I knew how to blow up your monitor by freaking the video chip.

For me, I think the biggest impact of the BBC Micro was going from programming in machine code to an extremely at the time, advanced, sophisticated, elegant, basic language with a built-in assembler, so that I could still jump into the assembler when needed. I was fascinated by the way programs like BBC BASIC, were constructed by people with great skills, deep technical skills. They were using those skills to empower people with less deep technical skills to do the same thing. To me, that’s the kind of magic, to take your skills and empower people with less skills to pull them up behind you.

We live in a world today that’s riddled with software. Software is eating the world. Software is making the world. It’s riddled with it. Dig into the ground, anywhere, all you’ll find is software. Every type of business now has to be a software business. Software developers like us are in a unique position. We’re the people that can not only understand this world built of software, but also, we know how to change it. That was me disassembling BBC BASIC. I did a lot of that. In fact, that’s still going on today. You’ll find the BBC Micro community, those members who will publish a new disassembly of some popular game from the ’80s. It’s a big event.

TiddlyWiki in Use

Armed with what I’d learned by disassembling BBC BASIC, I went on to write many compilers and interpreters myself, and realized that’s what I cared about, creating a tool that I could then watch other people build something with. Empowering them to do something that they couldn’t do previously. I think you see a nice example here with TiddlyWiki. TiddlyWiki has wiki in the name, but it’s not at all interested in the idea of being a single page that lots of people can edit. Although it can do that, if you configure it that way.

What it’s really rooted in is a much more fundamental idea of wikis, which is that they elevate linking to be part of the punctuation of writing, as opposed to tools that require you to dive into a sub-dialog box, to set up a link. TiddlyWiki takes that further with a rich wikitext syntax, that can express complex interactive applications. The goal of that, the reason why we do it, creating yet another computer language, is to let domain experts create their own custom tools, rather than having to go through a cycle of trying to explain the unexplainable requirements to a developer, and then the feedback cycle that results.

Here, what we see is an example of TiddlyWiki being used by an American high school teacher to develop a custom application for teaching volleyball. I have no idea what it means. You click around and there’s masses of it. Little tables of instructions, ways of tracking the progress of the students. The thing that’s interesting to me about that is I don’t believe this world at the moment has a viable business model for custom software for volleyball teachers.

There’s no business there. How can we serve those people? We know that what we do is useful. We know that computers and software applied carefully can help jobs like that. We simply don’t have a business model. To me, the best that we can do is this, is empower the people who have the domain skills to build their own software. We have to step around capitalism and focus on people’s needs.

Another example is TiddlyWiki being used by the Anna Freud center. They’re a London based charity that do training and resources for working with young people with mental health problems and their families. They train all the social workers and similar people around the country. The challenge for them is that they’ve got a team in London, who are highly skilled, experienced, and they know, based on evidence, what practices work when you’re in that situation with troubled young people. Their approach is to build a manual telling people what to do.

The discovery very early on was they had a team in London put together a manual telling you what to do, and then you give it to the team in Dagenham. If the team in Dagenham see things in the manual that don’t apply to them, they’ll reject the whole thing, that it’s not for me. What we do with TiddlyWiki at Anna Freud is build what they call a fractal manual where there’s a central manual, where individual teams get their own version of the manual that adds and removes content to make it relevant for them.

Of course, that’s easy. It’s just a database query, put different stuff on a webpage. What’s hard here is to build a model for doing that kind of task that these domain experts can do. I’m not designing a system for you to use, I’m designing a system for social workers to use, for people whose skills are in another area.

Self-Education

Let’s, with that, step back to 1983, and have another patronizing question from our interviewer.

Interviewer: It must be pretty difficult writing all these bestselling books, and trying to struggle with your A levels?

Ruston: Yes, it is issue, very difficult. I failed my A levels in the summer because of it.

Interviewer: Has it been worthwhile?

Ruston: Yes, very much so.

Of course, I wouldn’t want to advertise the benefits of failing school. At the time, all I was interested in was computers. That was all I wanted to learn about. Back then, I didn’t have any chance of learning about that at school. Instead, I learned from the community and hanging around foils, reading all the important academic textbooks at the time. Now, of course, it’s never been easier for people to educate themselves. We saw earlier those ports on the BBC Micro, they gave rise to an ecosystem of hardware that was really fun. I think the barriers to entry for that market were quite small. We saw a lot of innovative strange hardware.

This is a very early graphics tablet, which I have put to good use, in some quite fun work again for the BBC. It was later in 1983, I think one of my favorite ever gigs, where I made a series of animations on the BBC Micro that we use with a voiceover to introduce Children’s BBC TV shows. That was a wonderful job. I would slouch into BBC TV center in the morning and have a meeting with the head of presentation, and we’d decide together that the next animation would be a tin of sardines with a wiggly tail. Then I’d go back home, stay up all night with a pint glass of coffee, putting these animations together. Then slightly bleary eyed, take them into the BBC the following day, and press the spacebar at the operative time for the animations to flow. I was involved for a few years in this but ultimately replaced by a broom cupboard, of all things.

Watching these back now I think, actually, the best thing about them is the sound effects. I hadn’t kept these obviously, and so I put out a Twitter alert and found that again, there’s a community that we didn’t know about of people who collect old British TV VHS tapes. I have managed to now scrape together about eight of them, but there were a lot more of them originally.

Latency in Computing

I also wanted to briefly mention the late Joe Armstrong. We’d been working together on a book about TiddlyWiki, just about a year before he died, almost exactly 5 years ago. Joe had first gotten in touch with me back in 2011, having somehow become obsessed with TiddlyWiki. We stayed in touch regularly and collaborated on a conference talk. Then the book, which was sadly curtailed when Joe passed. It was actually very difficult to get Joe to talk about his own work. I didn’t have at that time any experience of Erlang, but I was fascinated to learn more.

Every time I’d ask him a question, he would redirect it to some arcane intricacy of TiddlyWiki. You can still see his blog today, based on TiddlyWiki. Joe taught me the full implications of a really simple observation that I think really, we’re all grappling with: latency matters. If you care about latency, you need to move computation to where it is needed. If you have separate bits of computation, the laws of physics pretty much mean that you’re using the actor model. I think Joe’s formalization of the actor model into Erlang to me was a formalization of the laws of physics that I found incredibly inspiring.

BBC’s Doctor Who (Game)

We’ll go back to 1983.

Interviewer: Perhaps we could now take a look at your latest computer game which is called Doctor Who. How does this work? Is this sort of Pac-Man, isn’t it?

Ruston: Yes. It’s based on some of the ideas from Pac-Man, but it’s a very long program. It’s taken quite a long time to lay it off disk. Essentially, you’re that little dot in the corner, and you’re being chased by those worms who have now eaten me. That’s the game.

The game I showed was described as being called Doctor Who, but in fact, it was a bit more than that, it was the BBC’s first official computer game using their now cherished Doctor Who intellectual property. I don’t think it was quite so prized at the time. You might think it was an eccentric decision to entrust a franchise like that to the hands of a 16-year-old, however precocious. I know we’ve got people from the BBC here, and I’m about to talk about how the BBC worked in 1983. I’m pretty confident it doesn’t work like this anymore.

What actually happened is I’d co-written a book for BBC publications, first called, “The Book of Listings.” Again, reminding us that a book was considered an efficient mechanism of software distribution at the time. Getting a book published means having lots of meetings. That’s how the industry worked at the time. I remember being quite often in the BBC publications offices in Marylebone. Once I was there, anything could happen. The lesson I learned is that people are lazy. One day, I was in the office and somebody said, Jeremy, would you like to do some modeling?

I really thought they meant Plasticine or McCartney, but they actually meant this. I ended up on the box of the BBC’s robotic Turtle addon. In that context, when they started exploring making a Doctor Who game, obviously, I was the logical choice. I was a massive Doctor Who fan, of course, still a child at the time. I was thrilled. I wasn’t really a games player. My interest in games again was diving into the tour de force programming that I saw, and I wasn’t that interested in playing games. I never got to meet any of the actors, of course, but did get to collaborate with the Radiophonic Workshop on the music and sound effects, and did go to a props warehouse, where I saw an enormous pile of Cybermen body parts being prepared for an explosion.

It’s a coding conference, let’s look at the code. A couple of interesting details, I mentioned before how it mixes assembly language and BASIC together. You might notice we essentially minified our own code back in the day. The game was not an unqualified success. I think it suffered from being made by a committee, and a committee of people who are inexperienced, didn’t really know what they’re doing. That’s not the recipe for success. I hope I had an excuse being 17. Even though the game could have been so much better, it is actually still bringing great joy to people. There’s a steady stream of YouTubers reviewing it, and they revel in its hapless terribleness. I particularly recommend this to French people who watch it who have a species of hysterics that is quite infectious.

Jeremy’s JavaScript Linguistic Serendipity Generator

Let’s jump back to one last dip into that interview.

Interviewer: What are the practical applications really for home computers. What are the most useful things you can do with one in the home?

Ruston: I think the most useful thing really is word processing for writing letters and so on. Then, there are the less general applications like shopping lists. I use it for cataloging records and books.

I answer honestly that I use computers for cataloging books and records, and had in fact written more than one program for that task. Of course, I was far too distracted by the joys of programming to actually use it for its intended purpose. Instead, I’m going to talk about something that I think the interviewer would have firmly considered utterly impractical and stupid.

This gives me a chance to talk about AI and large language models which I know we’ll all be expecting. What I’m actually going to show you is the smallest feasible language model. It’s something that many of you will know. There’s a Markov chain generator. I didn’t know that at the time. It’s a program I originally wrote for the BBC Micro. What you see here is a more recent JavaScript version that’s on the web and you can play with. What it does, very familiar process. You give it a body of training data. It does some frequency calculations. Then it generates essentially random text that matches the same letter sequence distribution.

Let’s see if we can give it a try. I’ve primed it with a list of all the tube stations in London. This is what I remember doing with it in the ’80s. My friends and I found this hilarious. We’ve got a setting. We’ll start with two letters. It chooses the first two letters of the output text, and then chooses the next letter based on the frequency of all the different letters in the original text that follow those first two letters. Then it bumps along and does a bit more. There’s two letters here. As it says, we get near gibberish, but recognizably, English, and some of them if you weren’t from London, you might think could be a plausible tube station name.

If we crank it up to three letters, get slightly more plausible gibberish. I think South Greathrow is not bad. Hyde Parking Bridge. I’m not sure about Cockfoston, and so it goes. If we crank it up a little bit further, we get to confusingly readable where we’ll see frequently, Farring Broadway. We were 17. This stuff is funny, but we really found it hilarious. I think the reason why we found it so funny, is interesting and relevant to where we are now. I think it’s because our brains are desperate to find meaning. We’re sense making machines.

We bring in sensors to our brain, and then our brain makes a story to ourselves about what it’s seen. What this thing shows us is that our brains are so desperate to find meaning that we’re like somebody, a narc for a con artist. We’re perfectly primed to see intelligence and meaning where there is none. The fact that it’s so easy to see meaning in a simple statistical trick like this proves how our brains make us vulnerable.

The Purpose of Life

We are going to have one last dip into the 1980s. I worked with Richard Dawkins, who at the time was famous as the author of, “The Selfish Gene.” We worked together on the graphics for a couple of BBC Horizon documentaries. I worked with him on these illustrative animations. They also let me make the end credits, which again seems crazy.

Dawkins: There has to be an initial critical number, a critical mass of [inaudible 00:33:41] that have to get together before they can take off in the evolutionary sense. [inaudible 00:33:48] chance of cooperation.

Ruston: Once again, digging through this old stuff, something I find amazing is that that 8-bit pixelated aesthetic was so mainstream, and that plinky-plonky music, extraordinary. Working with Dawkins did have a huge impact on me. In the years before as a teenager, I’d become what I today you might call a techno-utopian optimist, which has negative connotations to me, priding myself on my rationality.

I was obsessively worried, wondering about the meaning of life. We all are at that age. By the time I met Dawkins, I’d pretty much convinced myself that he was right, that the purpose of life is to pass on your genes. Dawkins was very kind and generous with his time and I learned a lot from him. What I actually learned, what I actually became convinced of is, there’s a lot more to human life than passing on our genes. I learned a lesson that I find still guides me every day. It’s this, it’s surely that if life has a purpose, it is to love and be loved.

I think we need to ground ourselves on that perspective if we’re to realize the potential of global collaboration. The fact is we find ourselves working alongside people sometimes who take different sides in a bitterly contested argument. Only love, compassion, and understanding will get us through. We can think that we’re in the technology business, but actually, there’s the people business. People work together best through love.

See more presentations with transcripts

MMS • Edin Kapic

The long-term-support (LTS) version 6 of Microsoft .NET Framework is slated to go out of support on November 12, 2022. Microsoft recommends upgrading .NET 6 applications to .NET 8 to stay supported for the future.

Microsoft .NET Framework version 6, released in November 2021, is approaching the end of its support date. According to Rahul Bhandari, program manager at Microsoft .NET team, customers using version 6 should move to .NET 8 to still receive official support and security patches.

Mr. Bhandari explains that the .NET 6 applications will still run after the end of support date, but that customers can be exposed to potential security flaws that will be patched only for supported versions.

Version 6 is what Microsoft calls a long-term-support (LTS) release, having a support lifecycle of three years since the release date. Non-LTS (or “current”) releases, such as .NET 7, have a shorter support lifecycle of 18 months, as Microsoft will support them for six months after the release of the next LTS version. Microsoft schedules .NET versions to launch one major version of .NET a year, alternating between LTS and current versions.

The latest LTS version of .NET is 8, which Microsoft plans to support until November 2026. Microsoft expects to release .NET 9, a non-LTS version, in November 2024, meaning that the current .NET 6 customers can choose between upgrading to .NET 8 or 9 when version 6 support ends. .NET version 7 already went out of support in May 2024.

Upgrading to .NET 8 involves a change of one line in the project file to change the target framework version. However, there might be runtime or source-code incompatibilities between .NET 6 and .NET 8.

Microsoft recommends that developers check the official compatibility guide for any issues when upgrading their applications and provides an open-source upgrade tool called upgrade-assistant. The tool analyses the application code, updates the project files, checks for breaking changes, and does some automatic code fixes – but developers will still have to do some manual fixes.

The developer community’s reactions on social networks are mixed.In this Reddit thread some developers think that the speed of releases is too fast and that the “short overlap (of versions) is ridiculous”, while others argue that “taking a day to update to a new LTS every two years is hardly a scary prospect”.

Microsoft regularly publishes summarised telemetry information derived from the usage of .NET SDK. According to the data for May 2024, the most used version of .NET Framework for applications is precisely the .NET 6, accounting for 39% of the telemetry data, with .NET 8 being second with 26% of the installations.

gd2md-html: xyzzy Wed Aug 07 2024