Month: September 2024

MMS • Steef-Jan Wiggers

Amazon Web Services (AWS) has announced the general availability of its new Parallel Computing Service (PCS), which aims to reduce the time required to process complex scientific computations significantly.

AWS has a history of innovation in supporting High-Performance Computing (HPC) workloads, with releases like AWS ParallelCluster, AWS Batch, Elastic Fabric Adapter, Amazon FSx for Lustre, and dedicated AMD, Intel, and Graviton-based HPC compute instances. Now, the company has released a fully-managed comprehensive HPC service with PCS to eliminate the heavy lifting of creating and managing HPC clusters.

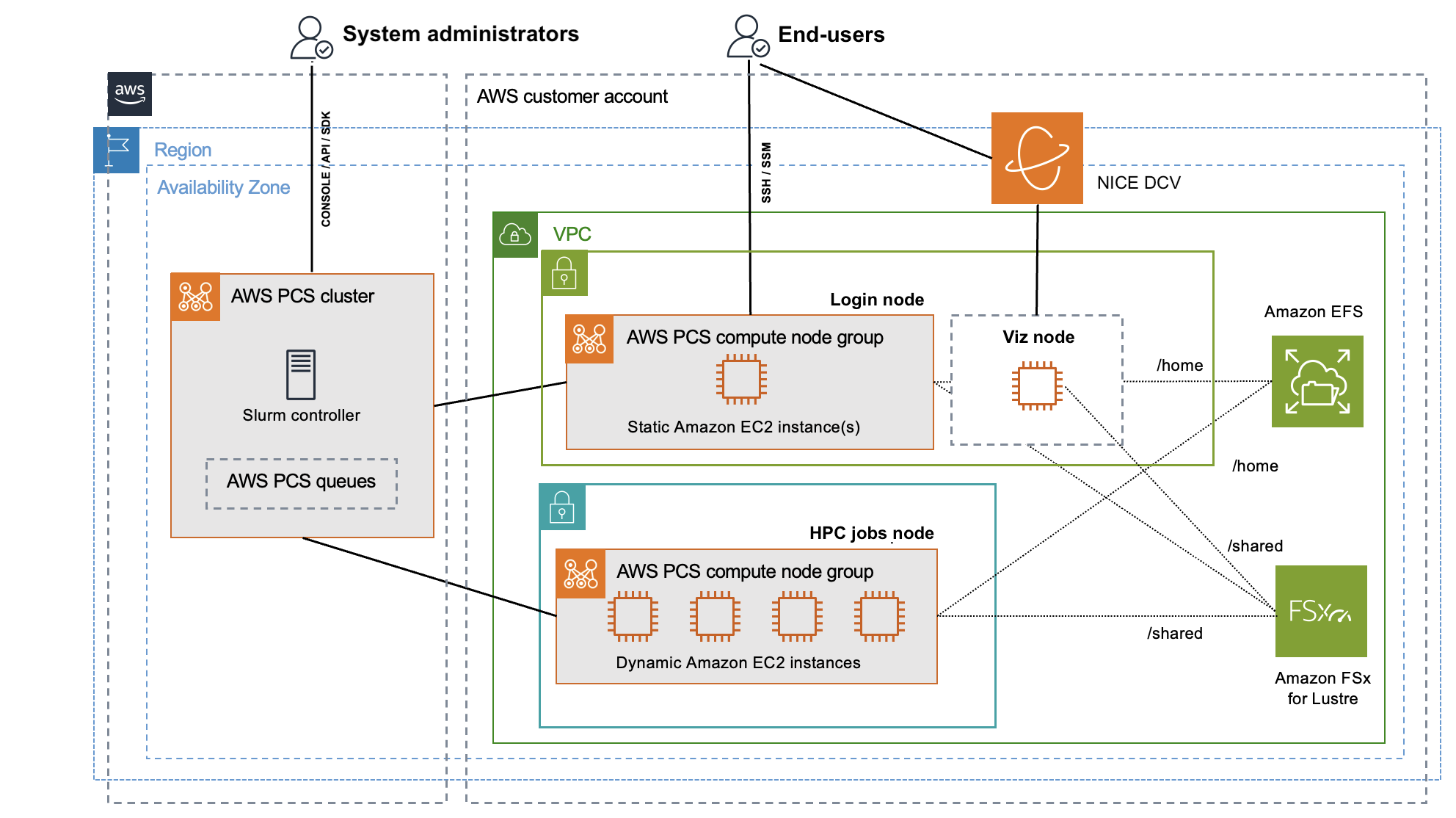

System administrators can create clusters using Amazon Elastic Compute Cloud (Amazon EC2) instances, low-latency networking, and storage optimized for High Performance Computing (HPC) workloads. Scientists and engineers can rapidly scale simulations to validate models and designs with these clusters. In addition, the system administrators and integrators can also build and manage HPC clusters on AWS using Slurm, a popular open-source HPC workload manager. Initially, the service supports Slurm 23.11 and offers mechanisms designed to enable customers to upgrade their Slurm major versions once new versions are added.

According to the company, AWS PCS simplifies high-performance computing (HPC) environments managed by AWS and is accessible through the AWS Management Console, AWS SDK, and AWS Command-Line Interface (AWS CLI). Channy Yun, a principal developer advocate for AWS, writes:

AWS PCS uses Slurm, a highly scalable, fault-tolerant job scheduler used by a wide range of HPC customers, to schedule and orchestrate simulations. End users such as scientists, researchers, and engineers can log in to AWS PCS clusters to run and manage HPC jobs, use interactive software on virtual desktops, and access data. You can quickly bring their workloads to AWS PCS without requiring significant effort to port code.

In addition, users can leverage fully-managed NICE DCV remote desktops for remote visualization and monitoring HPC workflows in one place.

(Source: AWS News blog post)

In an AWS press release, Ian Colle, director of advanced compute and simulation at AWS, said:

Managing HPC workloads is extraordinarily difficult, particularly the most complex and challenging extreme-scale workloads. Our aim is that every scientist and engineer using AWS Parallel Computing Service, regardless of organization size, is the most productive person in their field because they have the same top-tier HPC capabilities as large enterprises to solve the world’s toughest challenges any time they need to and at any scale.

The company states that AWS PCS is intended for various traditional and cutting-edge workloads in computational fluid dynamics, weather modeling, finite element analysis, electronic design automation, and reservoir simulations.

The service is currently available in the US East (N. Virginia), AWS US East (Ohio), US West (Oregon), Asia Pacific (Singapore), Asia Pacific (Sydney), Asia Pacific (Tokyo), Europe (Frankfurt), Europe (Ireland), and Europe (Stockholm) regions. The pricing is listed on the pricing page.

MMS • RSS

Quest Partners LLC purchased a new position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) during the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm purchased 640 shares of the company’s stock, valued at approximately $160,000.

Quest Partners LLC purchased a new position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) during the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm purchased 640 shares of the company’s stock, valued at approximately $160,000.

Several other institutional investors have also recently added to or reduced their stakes in MDB. Transcendent Capital Group LLC purchased a new position in shares of MongoDB in the 4th quarter valued at approximately $25,000. MFA Wealth Advisors LLC purchased a new position in MongoDB in the 2nd quarter valued at $25,000. YHB Investment Advisors Inc. acquired a new position in MongoDB in the 1st quarter valued at $41,000. Sunbelt Securities Inc. raised its position in MongoDB by 155.1% during the 1st quarter. Sunbelt Securities Inc. now owns 125 shares of the company’s stock worth $45,000 after buying an additional 76 shares during the last quarter. Finally, J.Safra Asset Management Corp lifted its stake in shares of MongoDB by 682.4% in the 2nd quarter. J.Safra Asset Management Corp now owns 133 shares of the company’s stock worth $33,000 after acquiring an additional 116 shares during the period. Institutional investors and hedge funds own 89.29% of the company’s stock.

Analysts Set New Price Targets

Several research analysts recently issued reports on MDB shares. Piper Sandler increased their price target on shares of MongoDB from $300.00 to $335.00 and gave the stock an “overweight” rating in a report on Friday, August 30th. Morgan Stanley raised their price target on MongoDB from $320.00 to $340.00 and gave the company an “overweight” rating in a report on Friday, August 30th. Scotiabank upped their price objective on MongoDB from $250.00 to $295.00 and gave the stock a “sector perform” rating in a report on Friday, August 30th. Stifel Nicolaus raised their target price on MongoDB from $300.00 to $325.00 and gave the company a “buy” rating in a report on Friday, August 30th. Finally, Bank of America upped their price target on shares of MongoDB from $300.00 to $350.00 and gave the stock a “buy” rating in a research note on Friday, August 30th. One analyst has rated the stock with a sell rating, five have issued a hold rating and twenty have assigned a buy rating to the company’s stock. Based on data from MarketBeat, MongoDB presently has a consensus rating of “Moderate Buy” and a consensus price target of $337.56.

Read Our Latest Research Report on MongoDB

Insider Buying and Selling at MongoDB

In other news, CAO Thomas Bull sold 138 shares of the business’s stock in a transaction dated Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total transaction of $36,610.02. Following the completion of the sale, the chief accounting officer now owns 17,222 shares in the company, valued at approximately $4,568,824.38. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. In related news, CAO Thomas Bull sold 138 shares of the company’s stock in a transaction on Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total transaction of $36,610.02. Following the completion of the sale, the chief accounting officer now directly owns 17,222 shares of the company’s stock, valued at approximately $4,568,824.38. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, Director Dwight A. Merriman sold 3,000 shares of the company’s stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $290.79, for a total value of $872,370.00. Following the completion of the sale, the director now directly owns 1,135,006 shares of the company’s stock, valued at approximately $330,048,394.74. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 32,005 shares of company stock valued at $8,082,746. Company insiders own 3.60% of the company’s stock.

MongoDB Trading Down 1.7 %

NASDAQ MDB opened at $290.09 on Monday. The company has a market cap of $21.28 billion, a P/E ratio of -103.23 and a beta of 1.15. MongoDB, Inc. has a 12 month low of $212.74 and a 12 month high of $509.62. The company has a debt-to-equity ratio of 0.84, a current ratio of 5.03 and a quick ratio of 5.03. The company has a 50-day moving average of $255.85 and a 200-day moving average of $302.21.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings results on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, topping analysts’ consensus estimates of $0.49 by $0.21. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The company had revenue of $478.11 million for the quarter, compared to the consensus estimate of $465.03 million. During the same quarter last year, the firm posted ($0.63) earnings per share. MongoDB’s revenue was up 12.8% on a year-over-year basis. As a group, equities analysts predict that MongoDB, Inc. will post -2.46 earnings per share for the current year.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Sierra Summit Advisors LLC purchased a new stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) during the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor purchased 24,050 shares of the company’s stock, valued at approximately $6,012,000. MongoDB comprises 1.5% of Sierra Summit Advisors LLC’s holdings, making the stock its 28th largest position.

A number of other institutional investors and hedge funds have also bought and sold shares of the stock. Transcendent Capital Group LLC acquired a new position in shares of MongoDB during the 4th quarter worth approximately $25,000. MFA Wealth Advisors LLC acquired a new position in shares of MongoDB during the 2nd quarter worth approximately $25,000. J.Safra Asset Management Corp grew its position in shares of MongoDB by 682.4% during the 2nd quarter. J.Safra Asset Management Corp now owns 133 shares of the company’s stock worth $33,000 after purchasing an additional 116 shares in the last quarter. Hantz Financial Services Inc. acquired a new position in shares of MongoDB during the 2nd quarter worth approximately $35,000. Finally, YHB Investment Advisors Inc. acquired a new position in shares of MongoDB during the 1st quarter worth approximately $41,000. Institutional investors and hedge funds own 89.29% of the company’s stock.

Insiders Place Their Bets

In other news, Director John Dennis Mcmahon sold 10,000 shares of the business’s stock in a transaction on Monday, June 24th. The shares were sold at an average price of $228.00, for a total transaction of $2,280,000.00. Following the transaction, the director now directly owns 20,020 shares of the company’s stock, valued at $4,564,560. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. In other news, Director John Dennis Mcmahon sold 10,000 shares of the company’s stock in a transaction dated Monday, June 24th. The shares were sold at an average price of $228.00, for a total transaction of $2,280,000.00. Following the completion of the transaction, the director now owns 20,020 shares in the company, valued at $4,564,560. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Dwight A. Merriman sold 1,000 shares of the company’s stock in a transaction dated Thursday, June 27th. The stock was sold at an average price of $245.00, for a total transaction of $245,000.00. Following the transaction, the director now owns 1,146,003 shares of the company’s stock, valued at approximately $280,770,735. The disclosure for this sale can be found here. Insiders sold a total of 32,005 shares of company stock worth $8,082,746 over the last ninety days. 3.60% of the stock is owned by company insiders.

MongoDB Stock Performance

Shares of NASDAQ:MDB traded up $0.85 during midday trading on Monday, hitting $290.94. The stock had a trading volume of 238,893 shares, compared to its average volume of 1,494,393. The company has a market capitalization of $21.34 billion, a PE ratio of -103.23 and a beta of 1.15. The stock has a 50 day moving average price of $255.85 and a two-hundred day moving average price of $302.21. The company has a current ratio of 5.03, a quick ratio of 5.03 and a debt-to-equity ratio of 0.84. MongoDB, Inc. has a 1 year low of $212.74 and a 1 year high of $509.62.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its earnings results on Thursday, August 29th. The company reported $0.70 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $0.49 by $0.21. The company had revenue of $478.11 million during the quarter, compared to analysts’ expectations of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The firm’s quarterly revenue was up 12.8% compared to the same quarter last year. During the same quarter in the previous year, the business posted ($0.63) earnings per share. As a group, equities analysts predict that MongoDB, Inc. will post -2.46 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of research analysts have issued reports on the stock. Canaccord Genuity Group decreased their target price on shares of MongoDB from $435.00 to $325.00 and set a “buy” rating on the stock in a research report on Friday, May 31st. Morgan Stanley upped their price target on shares of MongoDB from $320.00 to $340.00 and gave the stock an “overweight” rating in a report on Friday, August 30th. Wells Fargo & Company upped their price target on shares of MongoDB from $300.00 to $350.00 and gave the stock an “overweight” rating in a report on Friday, August 30th. Needham & Company LLC upped their price target on shares of MongoDB from $290.00 to $335.00 and gave the stock a “buy” rating in a report on Friday, August 30th. Finally, Mizuho upped their price target on shares of MongoDB from $250.00 to $275.00 and gave the stock a “neutral” rating in a report on Friday, August 30th. One investment analyst has rated the stock with a sell rating, five have issued a hold rating and twenty have issued a buy rating to the company’s stock. According to MarketBeat.com, the company currently has an average rating of “Moderate Buy” and an average price target of $337.56.

Read Our Latest Research Report on MDB

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat’s analysts have just released their top five short plays for September 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

MMS • RSS

Oracle (NYSE: ORCL) first introduced its relational database (the one that can be visualized in tables of rows and columns) in the late 1970s.

While the Oracle database served user needs for decades, the nature of data has changed as computing capabilities have increased. That need prompted MongoDB (NASDAQ: MDB) to introduce Atlas, a non-relational database that can store unstructured data types.

However, Oracle responded by introducing its own non-relational database. It has also pivoted into the fast-growing cloud infrastructure business. Does this response mean that Oracle is still a better software-as-a-service (SaaS) stock for investors, or should they buy MongoDB as it spearheads a major shift in the industry?

Source Fool.com

MMS • RSS

MongoDB has helped to fundamentally change databases, but will that unseat Oracle?

Oracle (ORCL 0.40%) first introduced its relational database (the one that can be visualized in tables of rows and columns) in the late 1970s.

While the Oracle database served user needs for decades, the nature of data has changed as computing capabilities have increased. That need prompted MongoDB (MDB -1.72%) to introduce Atlas, a non-relational database that can store unstructured data types.

However, Oracle responded by introducing its own non-relational database. It has also pivoted into the fast-growing cloud infrastructure business. Does this response mean that Oracle is still a better software-as-a-service (SaaS) stock for investors, or should they buy MongoDB as it spearheads a major shift in the industry?

The case for Oracle

Given Oracle’s longtime presence in the tech industry, it is the more stable stock of the two. As the world’s largest database management company, it has long served customers and shareholders with various IT services.

The company derives most of its revenue from its cloud services and license support segment. This includes its database services, applications such as its e-business suite and PeopleSoft enterprise, and its cloud infrastructure services.

While not among the largest cloud companies, it holds about 2% of the cloud market share, according to Statista. Since cloud computing plays a critical role in supporting artificial intelligence (AI), Oracle is unlikely to go into decline and could leverage AI to keep it relevant in the database market.

Image source: Statista.

In the first quarter of fiscal 2025 (ended Aug. 31), revenue of $13 billion rose 6% from year-ago levels. This matched the revenue growth rate for fiscal 2024, which was also 6%. Still, because it limited operating expense growth to under 2%, Oracle reported $2.9 billion in net income for fiscal Q1, rising 21% from the same quarter last year.

The company’s value proposition has likewise grown, taking its stock higher by approximately 25% over the last year.

However, the stock has become increasingly expensive, with a P/E ratio of 42 and a price-to-sales (P/S) ratio of 8. Even with earnings growth of over 20%, that could leave investors questioning its valuation with a recent history of single-digit revenue growth. But amid the continuing popularity of its database and software capabilities, the stock should hold its own.

Why investors might consider MongoDB

In contrast, MongoDB is comparatively new, existing only since 2007. As previously mentioned, it derives its revenue from its non-relational database, which could upend the database industry as Oracle’s traditional database model becomes outdated.

Non-relational databases stand out for their ability to store and manage data types that do not fit into an existing structure. Thus, users can store data types, such as videos or abstract text, that a more structured database would struggle to manage.

Its Atlas database has attracted more than 85 million downloads and Atlas clusters. Moreover, its community consists of over 1 million developers and many of the world’s most prominent corporations use its services.

Nonetheless, it has suffered a steep deceleration in its growth in recent quarters as fewer multiyear licensing deals, which recognize revenue up front, came due. In the second quarter of fiscal 2025 (ended July 31), revenue of $478 million rose 13% compared to the same period last year. That was below the 17% increase for fiscal 2025 and a 31% rise in the previous fiscal year.

Also, the $55 million loss in fiscal Q2 was up from the second quarter of fiscal 2024, when the company lost $38 million.

The slowing revenue growth appears to have taken its toll on the stock, down more than 20% over the last year.

As a money-losing company, it has no P/E ratio, and one has to wonder whether its P/S ratio of 12 will attract investors given its growth slowdown from last year. Considering this situation, investors may want to stay on the sidelines until they see signs of improvement.

Oracle or MongoDB?

When accounting for the state of both companies, investors should probably choose Oracle. Admittedly, MongoDB’s non-relational database could challenge Oracle’s long-standing database business over time.

However, Oracle continues to grow its software business, and its presence in the cloud should keep its AI capabilities competitive in the tech market. Additionally, Oracle turns a profit and offers a lower valuation to investors despite becoming an increasingly expensive stock.

Ultimately, unless MongoDB can address its decelerating growth, its stock is unlikely to gain traction at its current price.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Microsoft, MongoDB, Oracle, Salesforce, and Tencent. The Motley Fool recommends Alibaba Group and International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Private Advisor Group LLC Has $1.58 Million Stock Position in MongoDB, Inc. (NASDAQ:MDB)

MMS • RSS

Private Advisor Group LLC grew its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 167.4% during the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 6,324 shares of the company’s stock after purchasing an additional 3,959 shares during the period. Private Advisor Group LLC’s holdings in MongoDB were worth $1,581,000 at the end of the most recent quarter.

Private Advisor Group LLC grew its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 167.4% during the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 6,324 shares of the company’s stock after purchasing an additional 3,959 shares during the period. Private Advisor Group LLC’s holdings in MongoDB were worth $1,581,000 at the end of the most recent quarter.

A number of other institutional investors have also made changes to their positions in MDB. Vanguard Group Inc. boosted its position in MongoDB by 1.0% during the first quarter. Vanguard Group Inc. now owns 6,910,761 shares of the company’s stock valued at $2,478,475,000 after purchasing an additional 68,348 shares during the last quarter. Jennison Associates LLC boosted its holdings in shares of MongoDB by 14.3% in the 1st quarter. Jennison Associates LLC now owns 4,408,424 shares of the company’s stock valued at $1,581,037,000 after buying an additional 551,567 shares during the last quarter. Norges Bank bought a new position in shares of MongoDB in the fourth quarter valued at $326,237,000. Swedbank AB increased its holdings in MongoDB by 156.3% during the second quarter. Swedbank AB now owns 656,993 shares of the company’s stock worth $164,222,000 after buying an additional 400,705 shares during the last quarter. Finally, Champlain Investment Partners LLC raised its position in MongoDB by 22.4% during the first quarter. Champlain Investment Partners LLC now owns 550,684 shares of the company’s stock worth $197,497,000 after acquiring an additional 100,725 shares in the last quarter. Institutional investors own 89.29% of the company’s stock.

Analysts Set New Price Targets

Several research analysts have recently weighed in on MDB shares. Morgan Stanley boosted their price objective on shares of MongoDB from $320.00 to $340.00 and gave the stock an “overweight” rating in a research note on Friday, August 30th. Loop Capital dropped their price objective on MongoDB from $415.00 to $315.00 and set a “buy” rating on the stock in a research note on Friday, May 31st. Scotiabank raised their price objective on MongoDB from $250.00 to $295.00 and gave the company a “sector perform” rating in a research report on Friday, August 30th. Mizuho boosted their target price on MongoDB from $250.00 to $275.00 and gave the stock a “neutral” rating in a report on Friday, August 30th. Finally, JMP Securities reaffirmed a “market outperform” rating and set a $380.00 price target on shares of MongoDB in a report on Friday, August 30th. One research analyst has rated the stock with a sell rating, five have issued a hold rating and twenty have assigned a buy rating to the company’s stock. According to data from MarketBeat, the company presently has an average rating of “Moderate Buy” and a consensus target price of $337.56.

Get Our Latest Research Report on MongoDB

MongoDB Stock Down 1.7 %

MDB stock opened at $290.09 on Friday. MongoDB, Inc. has a 52 week low of $212.74 and a 52 week high of $509.62. The business has a 50-day simple moving average of $255.85 and a 200 day simple moving average of $303.20. The company has a quick ratio of 5.03, a current ratio of 5.03 and a debt-to-equity ratio of 0.84. The company has a market cap of $21.28 billion, a PE ratio of -103.23 and a beta of 1.15.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its earnings results on Thursday, August 29th. The company reported $0.70 EPS for the quarter, beating the consensus estimate of $0.49 by $0.21. The company had revenue of $478.11 million during the quarter, compared to analysts’ expectations of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The business’s revenue for the quarter was up 12.8% compared to the same quarter last year. During the same period in the previous year, the company earned ($0.63) EPS. Sell-side analysts anticipate that MongoDB, Inc. will post -2.46 EPS for the current fiscal year.

Insider Activity

In related news, Director Hope F. Cochran sold 1,174 shares of the firm’s stock in a transaction dated Monday, June 17th. The stock was sold at an average price of $224.38, for a total value of $263,422.12. Following the sale, the director now directly owns 13,011 shares of the company’s stock, valued at $2,919,408.18. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. In other MongoDB news, CRO Cedric Pech sold 273 shares of the business’s stock in a transaction that occurred on Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total transaction of $72,424.17. Following the sale, the executive now directly owns 35,719 shares of the company’s stock, valued at approximately $9,475,893.51. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Hope F. Cochran sold 1,174 shares of the firm’s stock in a transaction on Monday, June 17th. The shares were sold at an average price of $224.38, for a total transaction of $263,422.12. Following the transaction, the director now directly owns 13,011 shares of the company’s stock, valued at approximately $2,919,408.18. The disclosure for this sale can be found here. In the last quarter, insiders have sold 33,179 shares of company stock worth $8,346,169. Insiders own 3.60% of the company’s stock.

MongoDB Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Choreo LLC boosted its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 187.1% in the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 2,291 shares of the company’s stock after buying an additional 1,493 shares during the quarter. Choreo LLC’s holdings in MongoDB were worth $603,000 at the end of the most recent quarter.

Choreo LLC boosted its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 187.1% in the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 2,291 shares of the company’s stock after buying an additional 1,493 shares during the quarter. Choreo LLC’s holdings in MongoDB were worth $603,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the business. Transcendent Capital Group LLC bought a new position in shares of MongoDB during the 4th quarter valued at approximately $25,000. MFA Wealth Advisors LLC purchased a new stake in MongoDB in the second quarter worth $25,000. J.Safra Asset Management Corp lifted its position in shares of MongoDB by 682.4% during the second quarter. J.Safra Asset Management Corp now owns 133 shares of the company’s stock worth $33,000 after purchasing an additional 116 shares during the last quarter. Hantz Financial Services Inc. purchased a new stake in shares of MongoDB during the second quarter valued at $35,000. Finally, YHB Investment Advisors Inc. bought a new position in shares of MongoDB in the first quarter worth about $41,000. 89.29% of the stock is owned by hedge funds and other institutional investors.

Insider Activity at MongoDB

In other news, CAO Thomas Bull sold 138 shares of the stock in a transaction that occurred on Tuesday, July 2nd. The shares were sold at an average price of $265.29, for a total value of $36,610.02. Following the sale, the chief accounting officer now directly owns 17,222 shares in the company, valued at $4,568,824.38. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, CAO Thomas Bull sold 138 shares of the firm’s stock in a transaction dated Tuesday, July 2nd. The stock was sold at an average price of $265.29, for a total value of $36,610.02. Following the transaction, the chief accounting officer now directly owns 17,222 shares in the company, valued at approximately $4,568,824.38. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Director Dwight A. Merriman sold 3,000 shares of the stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $290.79, for a total transaction of $872,370.00. Following the sale, the director now directly owns 1,135,006 shares of the company’s stock, valued at approximately $330,048,394.74. The disclosure for this sale can be found here. In the last three months, insiders have sold 33,179 shares of company stock valued at $8,346,169. Insiders own 3.60% of the company’s stock.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on the stock. Loop Capital reduced their price target on shares of MongoDB from $415.00 to $315.00 and set a “buy” rating for the company in a report on Friday, May 31st. Tigress Financial cut their price target on MongoDB from $500.00 to $400.00 and set a “buy” rating on the stock in a report on Thursday, July 11th. Canaccord Genuity Group decreased their price objective on MongoDB from $435.00 to $325.00 and set a “buy” rating for the company in a research note on Friday, May 31st. Stifel Nicolaus lifted their target price on MongoDB from $300.00 to $325.00 and gave the company a “buy” rating in a research note on Friday, August 30th. Finally, UBS Group raised their price target on shares of MongoDB from $250.00 to $275.00 and gave the company a “neutral” rating in a report on Friday, August 30th. One analyst has rated the stock with a sell rating, five have issued a hold rating and twenty have issued a buy rating to the company. According to MarketBeat, the stock currently has an average rating of “Moderate Buy” and a consensus price target of $337.56.

Read Our Latest Stock Analysis on MongoDB

MongoDB Stock Down 1.7 %

MongoDB stock opened at $290.09 on Friday. MongoDB, Inc. has a twelve month low of $212.74 and a twelve month high of $509.62. The company has a current ratio of 5.03, a quick ratio of 5.03 and a debt-to-equity ratio of 0.84. The stock has a 50 day moving average of $255.85 and a two-hundred day moving average of $303.20. The stock has a market capitalization of $21.28 billion, a price-to-earnings ratio of -103.23 and a beta of 1.15.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings results on Thursday, August 29th. The company reported $0.70 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $0.49 by $0.21. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The business had revenue of $478.11 million for the quarter, compared to analyst estimates of $465.03 million. During the same period in the previous year, the business posted ($0.63) earnings per share. The business’s revenue was up 12.8% compared to the same quarter last year. As a group, research analysts expect that MongoDB, Inc. will post -2.46 earnings per share for the current year.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Oracle (NYSE: ORCL) first introduced its relational database (the one that can be visualized in tables of rows and columns) in the late 1970s.

While the Oracle database served user needs for decades, the nature of data has changed as computing capabilities have increased. That need prompted MongoDB (NASDAQ: MDB) to introduce Atlas, a non-relational database that can store unstructured data types.

However, Oracle responded by introducing its own non-relational database. It has also pivoted into the fast-growing cloud infrastructure business. Does this response mean that Oracle is still a better software-as-a-service (SaaS) stock for investors, or should they buy MongoDB as it spearheads a major shift in the industry?

The case for Oracle

Given Oracle’s longtime presence in the tech industry, it is the more stable stock of the two. As the world’s largest database management company, it has long served customers and shareholders with various IT services.

The company derives most of its revenue from its cloud services and license support segment. This includes its database services, applications such as its e-business suite and PeopleSoft enterprise, and its cloud infrastructure services.

While not among the largest cloud companies, it holds about 2% of the cloud market share, according to Statista. Since cloud computing plays a critical role in supporting artificial intelligence (AI), Oracle is unlikely to go into decline and could leverage AI to keep it relevant in the database market.

Image source: Statista.

In the first quarter of fiscal 2025 (ended Aug. 31), revenue of $13 billion rose 6% from year-ago levels. This matched the revenue growth rate for fiscal 2024, which was also 6%. Still, because it limited operating expense growth to under 2%, Oracle reported $2.9 billion in net income for fiscal Q1, rising 21% from the same quarter last year.

The company’s value proposition has likewise grown, taking its stock higher by approximately 25% over the last year.

However, the stock has become increasingly expensive, with a P/E ratio of 42 and a price-to-sales (P/S) ratio of 8. Even with earnings growth of over 20%, that could leave investors questioning its valuation with a recent history of single-digit revenue growth. But amid the continuing popularity of its database and software capabilities, the stock should hold its own.

Why investors might consider MongoDB

In contrast, MongoDB is comparatively new, existing only since 2007. As previously mentioned, it derives its revenue from its non-relational database, which could upend the database industry as Oracle’s traditional database model becomes outdated.

Non-relational databases stand out for their ability to store and manage data types that do not fit into an existing structure. Thus, users can store data types, such as videos or abstract text, that a more structured database would struggle to manage.

Its Atlas database has attracted more than 85 million downloads and Atlas clusters. Moreover, its community consists of over 1 million developers and many of the world’s most prominent corporations use its services.

Nonetheless, it has suffered a steep deceleration in its growth in recent quarters as fewer multiyear licensing deals, which recognize revenue up front, came due. In the second quarter of fiscal 2025 (ended July 31), revenue of $478 million rose 13% compared to the same period last year. That was below the 17% increase for fiscal 2025 and a 31% rise in the previous fiscal year.

Also, the $55 million loss in fiscal Q2 was up from the second quarter of fiscal 2024, when the company lost $38 million.

The slowing revenue growth appears to have taken its toll on the stock, down more than 20% over the last year.

As a money-losing company, it has no P/E ratio, and one has to wonder whether its P/S ratio of 12 will attract investors given its growth slowdown from last year. Considering this situation, investors may want to stay on the sidelines until they see signs of improvement.

Oracle or MongoDB?

When accounting for the state of both companies, investors should probably choose Oracle. Admittedly, MongoDB’s non-relational database could challenge Oracle’s long-standing database business over time.

However, Oracle continues to grow its software business, and its presence in the cloud should keep its AI capabilities competitive in the tech market. Additionally, Oracle turns a profit and offers a lower valuation to investors despite becoming an increasingly expensive stock.

Ultimately, unless MongoDB can address its decelerating growth, its stock is unlikely to gain traction at its current price.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Microsoft, MongoDB, Oracle, Salesforce, and Tencent. The Motley Fool recommends Alibaba Group and International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

MMS • RSS

Private Advisor Group LLC increased its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 167.4% in the second quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 6,324 shares of the company’s stock after purchasing an additional 3,959 shares during the quarter. Private Advisor Group LLC’s holdings in MongoDB were worth $1,581,000 as of its most recent filing with the Securities & Exchange Commission.

Several other hedge funds also recently made changes to their positions in MDB. Transcendent Capital Group LLC purchased a new position in shares of MongoDB during the fourth quarter valued at approximately $25,000. MFA Wealth Advisors LLC bought a new stake in MongoDB in the second quarter worth $25,000. J.Safra Asset Management Corp grew its stake in shares of MongoDB by 682.4% in the second quarter. J.Safra Asset Management Corp now owns 133 shares of the company’s stock worth $33,000 after acquiring an additional 116 shares during the last quarter. Hantz Financial Services Inc. bought a new position in shares of MongoDB during the second quarter valued at $35,000. Finally, YHB Investment Advisors Inc. purchased a new position in shares of MongoDB in the 1st quarter worth about $41,000. 89.29% of the stock is currently owned by institutional investors.

Insider Activity at MongoDB

In other news, Director Hope F. Cochran sold 1,174 shares of the company’s stock in a transaction that occurred on Monday, June 17th. The stock was sold at an average price of $224.38, for a total transaction of $263,422.12. Following the sale, the director now directly owns 13,011 shares of the company’s stock, valued at approximately $2,919,408.18. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other MongoDB news, Director Dwight A. Merriman sold 3,000 shares of the business’s stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $290.79, for a total transaction of $872,370.00. Following the sale, the director now directly owns 1,135,006 shares of the company’s stock, valued at $330,048,394.74. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Hope F. Cochran sold 1,174 shares of the firm’s stock in a transaction that occurred on Monday, June 17th. The shares were sold at an average price of $224.38, for a total value of $263,422.12. Following the completion of the sale, the director now directly owns 13,011 shares of the company’s stock, valued at $2,919,408.18. The disclosure for this sale can be found here. Over the last three months, insiders sold 33,179 shares of company stock valued at $8,346,169. Insiders own 3.60% of the company’s stock.

Wall Street Analysts Forecast Growth

A number of research analysts have recently issued reports on the company. Oppenheimer upped their price target on MongoDB from $300.00 to $350.00 and gave the company an “outperform” rating in a report on Friday, August 30th. Monness Crespi & Hardt raised shares of MongoDB to a “hold” rating in a report on Tuesday, May 28th. DA Davidson raised their target price on shares of MongoDB from $265.00 to $330.00 and gave the stock a “buy” rating in a report on Friday, August 30th. Sanford C. Bernstein boosted their target price on shares of MongoDB from $358.00 to $360.00 and gave the company an “outperform” rating in a research note on Friday, August 30th. Finally, Needham & Company LLC raised their price target on MongoDB from $290.00 to $335.00 and gave the stock a “buy” rating in a research note on Friday, August 30th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and twenty have assigned a buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of “Moderate Buy” and an average price target of $337.56.

Read Our Latest Report on MongoDB

MongoDB Price Performance

MDB traded down $5.09 on Friday, hitting $290.09. 1,154,127 shares of the company’s stock traded hands, compared to its average volume of 1,501,590. MongoDB, Inc. has a one year low of $212.74 and a one year high of $509.62. The company has a current ratio of 5.03, a quick ratio of 5.03 and a debt-to-equity ratio of 0.84. The firm has a market cap of $21.28 billion, a price-to-earnings ratio of -103.23 and a beta of 1.15. The company’s 50 day simple moving average is $255.85 and its 200-day simple moving average is $303.20.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its earnings results on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, topping analysts’ consensus estimates of $0.49 by $0.21. The firm had revenue of $478.11 million during the quarter, compared to analyst estimates of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. MongoDB’s revenue for the quarter was up 12.8% on a year-over-year basis. During the same quarter in the prior year, the business earned ($0.63) earnings per share. As a group, research analysts anticipate that MongoDB, Inc. will post -2.46 EPS for the current year.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

MMS • RSS

Daiwa Securities Group Inc. raised its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 6.5% in the second quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 9,191 shares of the company’s stock after purchasing an additional 563 shares during the quarter. Daiwa Securities Group Inc.’s holdings in MongoDB were worth $2,297,000 at the end of the most recent reporting period.

Daiwa Securities Group Inc. raised its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 6.5% in the second quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 9,191 shares of the company’s stock after purchasing an additional 563 shares during the quarter. Daiwa Securities Group Inc.’s holdings in MongoDB were worth $2,297,000 at the end of the most recent reporting period.

Other institutional investors have also recently made changes to their positions in the company. Transcendent Capital Group LLC bought a new position in shares of MongoDB in the fourth quarter valued at $25,000. MFA Wealth Advisors LLC acquired a new stake in MongoDB in the second quarter valued at $25,000. J.Safra Asset Management Corp grew its position in shares of MongoDB by 682.4% in the 2nd quarter. J.Safra Asset Management Corp now owns 133 shares of the company’s stock valued at $33,000 after acquiring an additional 116 shares during the period. Hantz Financial Services Inc. acquired a new position in shares of MongoDB during the 2nd quarter worth about $35,000. Finally, YHB Investment Advisors Inc. bought a new stake in shares of MongoDB in the 1st quarter valued at about $41,000. Institutional investors and hedge funds own 89.29% of the company’s stock.

MongoDB Stock Performance

Shares of NASDAQ:MDB opened at $290.09 on Friday. MongoDB, Inc. has a 1 year low of $212.74 and a 1 year high of $509.62. The stock has a market capitalization of $21.28 billion, a price-to-earnings ratio of -103.23 and a beta of 1.15. The company has a debt-to-equity ratio of 0.84, a current ratio of 5.03 and a quick ratio of 5.03. The company’s 50 day simple moving average is $255.85 and its 200 day simple moving average is $304.22.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its earnings results on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, beating analysts’ consensus estimates of $0.49 by $0.21. MongoDB had a negative return on equity of 15.06% and a negative net margin of 12.08%. The firm had revenue of $478.11 million for the quarter, compared to the consensus estimate of $465.03 million. During the same quarter last year, the business posted ($0.63) EPS. The company’s revenue was up 12.8% compared to the same quarter last year. As a group, research analysts predict that MongoDB, Inc. will post -2.46 EPS for the current fiscal year.

Insider Buying and Selling at MongoDB

In other news, Director Dwight A. Merriman sold 3,000 shares of the stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $290.79, for a total value of $872,370.00. Following the completion of the transaction, the director now owns 1,135,006 shares of the company’s stock, valued at $330,048,394.74. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other news, Director Dwight A. Merriman sold 3,000 shares of the stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $290.79, for a total value of $872,370.00. Following the completion of the transaction, the director now directly owns 1,135,006 shares in the company, valued at approximately $330,048,394.74. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CAO Thomas Bull sold 1,000 shares of the business’s stock in a transaction on Monday, September 9th. The stock was sold at an average price of $282.89, for a total value of $282,890.00. Following the sale, the chief accounting officer now owns 16,222 shares in the company, valued at approximately $4,589,041.58. The disclosure for this sale can be found here. Insiders have sold a total of 33,179 shares of company stock worth $8,346,169 over the last 90 days. Insiders own 3.60% of the company’s stock.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on MDB. Royal Bank of Canada reissued an “outperform” rating and set a $350.00 price target on shares of MongoDB in a research report on Friday, August 30th. Barclays dropped their price target on MongoDB from $458.00 to $290.00 and set an “overweight” rating on the stock in a research note on Friday, May 31st. Sanford C. Bernstein upped their price objective on shares of MongoDB from $358.00 to $360.00 and gave the company an “outperform” rating in a report on Friday, August 30th. Citigroup raised their target price on shares of MongoDB from $350.00 to $400.00 and gave the stock a “buy” rating in a research note on Tuesday, September 3rd. Finally, Guggenheim upgraded shares of MongoDB from a “sell” rating to a “neutral” rating in a research note on Monday, June 3rd. One investment analyst has rated the stock with a sell rating, five have assigned a hold rating and twenty have issued a buy rating to the company. Based on data from MarketBeat, the company has an average rating of “Moderate Buy” and an average target price of $337.56.

Get Our Latest Stock Analysis on MongoDB

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.