Month: March 2025

MMS • RSS

Tesla’s stock price (TSLA) fell in latest intraday trading while attempting to retest the main upward trend line that was breached previously, as the price also tests the resistance of $271.00, amid negative pressure due to trading below the 50-day SMA, coupled with negative signals from the Stochastic after reaching overbought levels compared to the price’s movements, hinting at a negative divergence, which would heap more negative pressures on the stock.

Therefore we expect more losses for the stock, targeting the support of $217.00, provided the resistance of $271.00 holds on.

Today’s price forecast: Bearish

Presentation: Data, Drugs, and Disruption: Leading High-performance Company in Drug Development

MMS • Olga Kubassova

Transcript

Kubassova: This is not an engineering talk, it’s about leadership and how you can make business out of your engineering background. Normally I speak to doctors about tech, and now I’m going to speak about business to tech people, so it’s quite intimidating. I’m going to ask you, have you ever thought of starting a business, ever? Have you started a business? Have you ever tried to start a business? Are you still in that business? Anybody running a business? We have a few examples.

I’ll start from a very long journey from being an entrepreneur, and explain how you can get from being an engineer, a mathematician, whatever technical discipline you have in mind, doesn’t even have to be technical, to be an entrepreneur. Then how to take an idea into something tangible, like a business. This is my personal perspective. My only job over all these years was a CEO. I started as a CEO. I run the company as a CEO. I just hired a CEO for the company, so now I’m president. I don’t have a formal business training. I don’t have a formal CEO training. Everything I say is a mixture of what I have experienced in the Harvard Business Review, which is my Bible. Then I’ll tell you a little bit about what inspires, and challenges, and a little bit of my personal perspective on leadership. Again, if it’s not conventional, just take it as it is. This is how I run a business. If you run your business, you’re probably going to have something of your own.

From Engineer to Entrepreneur

I’ll start with where I come from, because I think the foundation of who you are will stay with you for a very long time. I was born in the Soviet Union, you could see by the red scarf. I did not get to the red scarf stage. That’s given to you when you’re slightly older. I think what’s important here is, a huge area of the Soviet Union was united by a few principles. I think those are very powerful principles, and they go across the business, the leadership, the technical, the non-technical, and they are equality. It didn’t really matter if you were a woman, or a man, young, old, you were expected to just do and deliver as much as everybody else.

If there is a big hole, you take a shovel, and you continue digging, it doesn’t matter who you are. The second principle was fearless. There were really no fears, there were a lot of challenges. People were united. People were doing something without really questioning, is it the right thing, is it the wrong thing? Maybe it’s not always good, but that was the principle, which was ingrained in our mentality. The last one was focus. From a very early age, you are told that you are the engineer, or a doctor, or a lawyer, or whatever it was. As a principle of that, you would go deeper into that discipline. Even the educational system is set up in such a way that it doesn’t give you a broad standard, but gives you a very focused, very determined way to think about the problem. I was a mathematician from the age of 7, which continued with me throughout.

From my Kazakhstan place of birth, I went to St. Petersburg, to State University of Physics and Mathematics. This is one of the extracts they give you after you finish, I think it’s like 5,000, 6,000 hours of pure mathematics. That’s what I’m talking about, focus. You didn’t have much of a philosophy, which probably is not a good thing, because once you get yourself focused on engineering, you lose that aspect of everything else. In the previous talk, it was a little bit about engineering versus the world. In some way, any discipline versus everything else is not really a positive quality. You really want to be multidimensional and multifaceted in your approach, because you, as a leader, will end up dealing with people who are not like you. In fact, if you are surrounded by people who are like you, that’s probably not a good thing. Maybe you picked the wrong team and nobody is challenging your ideas. Once you recognize it, you can actually amend for it and you can think about other ways of dealing with the situation.

However, I think recognizing it is very important. To my second slide, I think some of the leadership lessons, having really hard work. You can’t survive it on your own. You have to survive it in small groups. As you could imagine, doing something very specific, very focused for 5,000 hours, you have to find friends. You have to find your teams. You have to split yourself in small groups and tackle big challenges one by one in small teams, and get together, collate your effort, present it to the lecturer.

An interesting story about St. Petersburg State University is they accept everybody to the first level. There are six years of mathematics. The first level, everybody is accepted. 250 people got in. They allow you to take exams as many times as you like. Every six months, there is an exam. You can take them, four times officially, but as many as your lecturer would tolerate to take it. Only 5% of those people graduate. What does it tell us? It’s stamina. It’s very difficult to pass all these exams, and they question and you fail, and everything. I remember that once, when you’re going through that journey, again, that little team, that leadership within the teams, doing something together, that was something which makes you stay strong. You’re not alone. You’re not doing it by yourself. After the first year in mathematics, your hands are shaking. It’s nothing like you can experience.

Then, once you start collaborating, you really start collaborating. What happened on my journey was very interesting. As I was doing my mathematics, now four years into six years, the Soviet Union just collapsed and there were no jobs for mathematicians or engineers for that sake. Your choices were, you go to McDonald’s or you go to call center, no other jobs. Somehow by some miracle, we identified that there was an IT program in Finland, which is across the road from St. Petersburg. This is an extract from my passport. We actually asked the customs people to put our stamps very close together because it was so many trips backwards and forwards. That small group of mine, we decided to go to Finland.

We decided to do parallel degrees, one in Finland, one in St. Petersburg: one in English, in IT, another one in Russian in mathematics. I remember giving a call to my mother and saying, I really don’t speak English and I really don’t know what IT is about, but there is a scholarship, which is €500 a month versus average salary in Russia at the time being $100 a month. The best advice I’ve got, you go there and you will figure that out once you get there. I know that speaks sometimes to you as leaders. You go there, you just get there through your fears, through your insecurities. Once you arrive, actually, you are surrounded by exactly the same people with their own fears and insecurities. Together, you’re probably going to figure that out. That’s exactly what happened on my journey.

Through the two years and two parallel master degrees, we all traveled six hours one way, six hours the other way. We managed to pass exams in both universities. You saw those 5,000 hours, those were for real. Once we pass it, we’re about 20 of us out of those 250 who started at the university. We all ended up with actually quite applicable degrees, yet not very applicable passports. Mine was Kazakhstan. Many other people had also not the great ones. What I did is I emailed from my Yahoo account to every university I could find on the web to say, I have two master degrees, I have eight publications, I’d like to do a PhD. I don’t mind what country or what subject. Two replied, and I’m surprised two replied. One was from Denmark and one was from Leeds. Denmark probably was by mistake. They never followed up with that reply. Leeds said, “You can come over as long as you pass some exams, get a scholarship”. I think this slide is actually quite interesting for me because all you have is a 20-kilo bag, when you land. What does it mean?

It means freedom. You really have nothing and nothing to lose and nowhere to go back. What does freedom mean? Does it mean really freedom? I took notes for myself just to make sure I don’t forget to tell you, because freedom is not always the easiest of statuses because you’re free when you start your job. What do you immediately need to do? You need to define responsibilities, what are you going to do versus everybody else? What impact you’re going to make versus everybody else. You will have to choose how to set your goals.

For me, the most challenging aspect was, and you remember I arrived there, not really speaking English, understanding the culture where you actually landed. You know the 5 p.m. pub in England? I had no idea that you’re supposed to go there because that’s how you build friendships. Then, Tanja was one of my friends. We were all foreigners. It’s quite difficult. I think for me, if you arrive into a new organization and you’re starting from scratch, set your goals. Understand your culture. Understand what is you versus somebody else or maybe many people. Understand your allies. I think some of the previous talks were extremely insightful on how to build your own path.

For me, it was quite interesting because me being an engineer, obviously I came and said, I’m going to come. I’m going to do a PhD in three years. I have a scholarship for three years. The first thing I’ve done, I arrived with my 20-kilo bag, came to my supervisor, said, what do I do to finish in three years? The first thing he told me, nobody finishes in three years. You do your PhD in three, you write during the fourth year, then you’re finished. Said, “I can’t do that. I have a three-year scholarship. I have to finish in three years”. We were not friends after that. I don’t know if you want to be friends with somebody. It would have helped, I have to say. We were not friends. I got out of him that I have to publish two papers, produce a book with everything I’m going to invent, not yet invented.

Then with that book, I’m going to go to my viva and that the viva will be conducted, and then I will get my PhD. I was given very clear objectives. You clearly remember, I forgot the cultural aspect of it. I forgot that the pub was important, the whatever else was important, the humor was important. All of that was secondary. Then, I think we as engineers sometimes forget that we have very strict goals. I know the deadline, I’m going there. Sometimes we forget that there are other people around who are sometimes not engineers, which always comes as a surprise to me even until this day. Think about it next time you think that you’re free to invent because you’re not in isolation. For me, that’s one of the leadership lessons that you have to just step in, set your goals, set your own understanding of the culture, and then decide what’s important for you at the end of it.

I think for me, halfway through my PhD, I decided what I’m doing is very important. Yet again, not making any friends here. I came to the vice chancellor now and said, I’d like to set up a company. He said, nobody does company. 2007 in England was not a done deal. There was I think an IP office, but not much. The IP office was somewhere downstairs. It was not very popular. In the U.S., it was on trend. England, not quite much. I started the company towards the end of my PhD. University, again, probably could have been a better friend, but all I got is a letter to say, you can do whatever you want with your IP as long as you’re not mentioning the university name. I took the path, and I published my PhD. That’s another story, a very long one.

Making a decision, and I think here is the point of this slide, is really making a decision. What does it mean? Because you’re making a dramatic decision probably daily. You were in one position, you need to go into another position. How do you jump? How do you make that step change? Because going from a crowded lab with all the engineers, programming, doing some software development, into your bedroom to start the company is a very different setup. Right now, I think if you’re starting a business, you really want to define, how do you see yourself tomorrow? Today you start the business, everybody cheering, maybe you’re going to the pub. Tomorrow, you’re on your own with that business. It took me forever. It took me about six months going backwards and forwards thinking, am I wasting my time? Should I close this business down without telling anybody?

Then, Yorkshire Forward, which was a local newspaper, they gave me an award, Entrepreneur of the Year. I said, “I can’t close my business now. I have to receive the award, take the photographs, be in the newspaper, then I close it”. It was really an interesting moment, somebody recognizing you. You don’t even know about these people, but they’re giving you awards. I have seven. Some of them from Yorkshire Forward, which is a really amazing organization. I’m not sure if they’re still around. Somebody, which could be you, recognizing somebody in your team who might be on the verge of maybe yes, no, maybe yes, no.

Then, it puts them on the pedestal for just a second, maybe insignificant, but still, it gives you a chance to be a leader, to think about somebody who is not, and actually making that time of their impact, their little change in the organization, really shine. That does prevent them from giving up. At least that’s in my case. For me, it was very interesting to see how the relationship with me and the business got developed. I’m sure for you, as you’re running your teams, it’s the relationship between you and your team. Can you connect to your team? Can you see every single person for a person, for who they are, for what they do, or is it just like a gray mass of engineers? Sometimes it’s important just to lead everybody forward. Sometimes it’s important to pick particular people forward. In my case, it was very interesting to see those awards.

I have to say, you cannot do things on your own. You have to be the team. I was extremely lucky. During my PhD, I met a number of radiologists, one of them, Professor Mikael Boesen. At the time, he was a PhD researcher. He became the first believer who actually took my algorithm, which was developed in PhD, and used it to diagnose a patient. That’s a breakthrough moment in my head, my head nearly exploded. Could you imagine somebody doing a diagnosis using your technology? I’m sure you can, because if you develop Spotify, or you develop anything magnificent, it’s all out there. It was a breakthrough moment. You get the first investor, that’s another one, the first. Sometimes they just believe in you, and sometimes it’s your friends and family. I suggest you really get a proper investor if you’re starting a business. Then you get your first team. As I said, my business started somewhere in a dark bedroom, there was nothing there. When you move to your office, in your team, it doesn’t matter how shabby this office looks, and it was very shabby for many years, it’s still your office, it’s your team, it’s your armor. Now you’re surrounded.

Building From Scratch – Learning to Fly While Flying at Full Speed

I’ll tell you a little bit more what the business is about, because I told you a story, and this is what we are. In 2007, when I started it, it was a data science company, the company which would take imaging data, radiology scans, run them through the algorithms, and produce data. We were very lucky that when Yorkshire Forward gave me that award, in six months, our first client was Abbott, the largest drug development company of all times, the most successful one. The reason for it, because we could speed up, accelerate the recognition of a change in a hand, this is a hand, MRI scan, the hands of a rheumatoid arthritis patient. You could see that bright change a little bit faster, fast enough for them to claim that their drug works better than somebody else’s drug.

We moved from being a qualitative descriptor of the image, to quantitative analysis of the image. You could see here, that same hand, you can analyze it in two ways. You could look at it, you could scale, on a scale from 0 to 3, I think this joint, called metacarpophalangeal joint, is 3, really bad, really white. You fill the form, as a radiologist, and then you sum up all the numbers, and that’s your score. Alternatively, you can look at it via a methodology, which came out of my PhD. The book on Amazon is still available. You got a quantitative analysis of the pixels, incorporate into the radiology image. You can actually count the number of pixels automatically, obviously, you’re not sitting with a clicker. It allowed Abbott to see changes in four weeks, versus six months. Now you could see how this became valuable.

All of these big drugs, if you ever had autoimmune conditions, which is rheumatoid arthritis, psoriatic arthritis, multiple sclerosis, and it’s an inflammatory in your body, they all will be treated with one of those drugs, and new drugs as well. We were very lucky to be in the right place in the right time. We carried on.

We started with hands. It was a single indication, single focus, single image, enough companies, luckily, to start the business. We started analyzing those images and producing the results. Obviously, you have a paradigm change. You really need to think how to present it. Now you are, and I am, in engineering, a technology, a software engineer, trying to sell something to a doctor. They’re talking to me about, no, IL-6 is working better than IL-1 in this particular category of rheumatoid arthritis patients. It did not compute. It’s layers and years of medical degree, which I don’t have. You have to get your engineering mindset down to the point where you can actually show people what you understand, and then wave your hand and say, I don’t understand every single word you just said to me, but I think that’s going to help. Here comes a lot of noes. We tried. I emailed people.

By that time, I had about maybe 10, 15 engineers in my company. I had a few salespeople. I considered myself a salesperson because somebody had to be emailing those people to say, we have this methodology, we have this algorithm, we’re going to do this and this. Luckily, there were enough yeses. The business grew 100% year-on-year and continues to grow. We expanded, obviously, from rheumatoid arthritis into multiple indications. We’re very lucky to have extremely big names behind the publications that use our methodologies, and very interesting customers.

I think then the next steps come in. We develop engineering. We’re successful at understanding data. Often, in our teams, we stay in that track. I can do this, I’ve got a nail and a hammer, and I can hammer it like that, and I’m really good at it. Actually, the customers potentially want something bigger, because the business never stays still. The business of engineering also never stays still. This is probably subject to many conversations. Our customers told us that you take your algorithm, you put it on a cloud-based platform. They did not express it in those exact words, because it was before cloud. We were the first company to actually have a cloud-based platform. I had to explain to people how cloud is better than sending CDs to each other. That’s another set of emails that went out. We have a cloud-based platform called DYNAMIKA, and we put a number of different methodologies for medical image processing onto this platform.

We then realized that actually medical imaging and radiology as a niche market stays very different to a medical degree and to people who design clinical trials. We created a consulting division to design a trial which would incorporate medical imaging. Then we surrounded all of that with a global project management organization. Now you think, where is the tech? Where is the software? How is this all connected? Many businesses in my world, in drug development, drug discovery, they are normally started either by scientists who understand the cell-to-cell interaction and all of that good stuff, or project managers. It’s very different when actually a software engineer would start a business in this world. Software is a piece which is really universal. It’s not only connecting your own data, but also connects your customers to your data. It connects multiple third-party providers of similar algorithms to one platform. This is how we’re surviving. We’re innovating daily. We’re constantly developing new indications, new pieces of software. We’re thinking about new algorithms within indications. It’s an endless business. There is no end to it. What we have today is we have a platform which has a cloud-based infrastructure.

Then, connectivity of that infrastructure expands way beyond radiology teams. When you run a clinical trial, you really think about your other customers. You think about your hospitals who will upload the data. By now, everybody knows what clinical trial is because we’ve all been through COVID. You have a number of hospitals who will upload the results. They will be analyzed centrally, and decisions would be made based on analytics. Sometimes the analytics are survival or non-survival of the patient. Sometimes analytics are more about pain or function or improvement of health. You’re getting into the business which now connects teams way beyond engineering. Engineering still sits on top.

Obviously, we started with the technology, people who build the software. The product team became very important. That product team, which is the connector between the project managers, sometimes customers, sometimes third parties, and real tech, which are developers and IT specialists, became a critical and fundamental piece to the business. That team is now driving the tech.

Obviously, it’s a highly regulated environment and there is a regulatory piece to the product design and development and running of it, but just to simplify it. What it means in the real world, and I think I want it to be as visual as possible: this is an image of a tumor. Here, you could see a tumor in a nasal cavity. What happens to this tumor? Here is before treatment, here is the after treatment tumor. You see how the size of the tumor didn’t really change? What happened is something happened inside the tumor, some necrotic area got developed. Meaning the treatment worked somehow, but it didn’t change the size. Regulatory interaction with this image is the following. The treatment did not work. The size did not change. What we’re doing on the backend, we’re looking at the algorithms which actually can help us to recognize a change.

Obviously, all of you looking at this are visually thinking, you just take volume and volume would be easy, and you could just understand the areas which changed, which didn’t change. Now what you’re doing in your head is you’re layering software development, radiology, medical, regulatory. It’s an incredible sandwich, because when we’re sitting in a software development team, it’s really obvious for us. By the time you get to regulatory, it’s not obvious to them because the question is, your tumor changed, did the patient die sooner or not? If the patient was not affected, I don’t care about your tumor and your image and your software development. Your end customer and your end decision maker actually is somebody who is sitting in the FDA or EMA. Thinking about the product and the layers of scrutiny this product needs to go to allow someone to make that final decision is tremendous.

We have quite a few interesting examples, and I only have two for you. You can go on our website and have a look at every therapeutic area. It’s fascinating for me still to really think about it. It’s a glioblastoma head of a patient, a slice through the head, and there is a tumor which is in red. Blue is not a tumor, it’s just a necrotic core, so there’s nothing in there. Green is inflammation around the tumor. If you’re using what’s called the standard criteria, you actually see through the follow-ups of the image, so you have a baseline, first follow-up, second follow-up, you could see how this tumor is actually increasing in size. If you take a standard measure, you could see that at some point it reaches a really high size, then it drops, then it reaches it again.

At this point, when tumor increases, patient gets taken off the trial. This is really bad for the patient because the benefit of this therapy, which is called immuno-oncology therapy, only happens afterwards, so that increase is actually positive. As your product goes through the scrutiny of regulatory approval, you nearly need to have to think about, does this matter or is it ok for the patient to be dropped off the trial? You could see here that you’ve got a volume decrease on where it says volume. This volume is actually fundamental for this patient to stay in the trial. You could see that the very last follow-up, May 2007, the tumor reduces further. Your tech product is impacting somebody’s life. I think it can’t get sharper or clearer than that when you are responsible for that line of code.

That line of code is going to get into the hands of a radiologist, and that decision is going to be made on a patient level. Then, that decision is going to be made on a thousandth patient level, and this drug is going to get approved or not. The importance of a line of code gets up as far as I can see. You start understanding how anything you’re developing and your team is developing is becoming critically important for the patients and how the pharmaceutical companies could use it, and so on.

Building a team for the business is definitely not the same as building algorithms. Algorithms are very focused, very no left, no right. You just know your deadline. You know what you want to achieve. You know how precise you want to be. Building a team is incorporating everybody’s objectives, incorporating everybody’s culture, understanding who is your ultimate decision maker. Of course, when you’re thinking about the company, your people are not even your team: it’s your clients, it’s your investors, it’s your network. Each of those teams has completely different objectives. Even if you are within engineering, deep down, taking this out and really understanding how this product is going to impact a broader audience, first of all, makes your life much more interesting, but secondly, you could see the impact of everything you do.

Setting up strategy and vision, I think is one of those critical elements which you only realize when you, in passing, make a decision, and then somehow it gets implemented. All you meant is just to share your thoughts, what’s taken as a vision and a strategy. You need to be very careful how you communicate your ideas and your strategy around your team, clients, investors, and the entire network. I think controls and processes here are very important, but also looking at your own style of communication. Because I like writing emails on a plane. I’m on a seven-hour flight from here to New York, I write about 50 emails, they all come out as soon as I land. My team just gets shaken up in the morning, and they did ask me not to write those emails.

Now I do write the emails, I don’t send them straight away, I page them. It’s a very different objective when you have a team, you have a company, you have a network of people, and you’re trying to place your product in the right position. As a leader, it’s your job and it’s your responsibility. Of course, a company is not just people, strategy, and vision, it’s really luck: being in the right place at the right time, with the right approach, right product, that you can’t predict.

I finish the company story just to show you a few things, how diverse you could be with just one product. I consider that we only have one product, it’s a platform with multiple lines of applicability. We work in glioblastoma. We work in gastroenterology. We work in rare diseases. We work in some of the sophisticated oncology drug development. Building those partnerships, and again, partnerships are very important here because in our world, data is everything, so you cannot innovate one way. You can’t develop a product, place it on the market, hope for the best. This would be a very short span of what you’re doing. If you want to really innovate, you need to set up collaborations with your clients which would in return allow you to reuse this data for your AI algorithms, for training or for testing or for anything else, for development of something new. You share insights back, and that’s how you sustain yourself as a company. Now 15 years later as a company, we truly appreciate the power of the collaborations.

Challenges, Wins, Aspirations, Ambitions, and Principles

Now I’ll tell you a little bit more about the challenges and how I was building the business. Again, as I said, it’s from my perspective. Do you have the right team? How often do you need to ask this question? When you build a business, you never build a business of 50 people. You build a business of one, two, three, then you hire the next one and you think about it. Normally when you start, you can do everything. I can do software development. I can do some cleaning. If the customer comes along, I can make coffee. You have people just like you around because you can’t survive otherwise. You have to have that mentality that everybody has to do everything. As the business grows, first of all, if everybody does everything, it’s very little progress because everybody does everything and nobody focuses.

Then you have to introduce a concept that actually you’re only going to do that, and can you please chop this off and this too? We can hire a cleaner, I no longer need to clean. That focuses your time, it focuses your objectives, it pushes you up. For your team, that could be a challenge, because if you’re starting something from scratch, you are looking for the mindset that they can do everything, and then you’re telling them that you don’t want them to do everything. I can tell you, I changed my team many times. How often do you need to ask this question? I think that I leave to you, because as a leader, you really need to think really hard, do I have the right team? Am I asking this question in the right time because you’re in the middle of a crisis, you think your team just sucks. They don’t suck, it’s just a crisis. It’s not the time to change the team.

As you’re going into the next level of growth, as you’re thinking about your product becoming more established, how do you enable and empower your team to change with you or not? Because many people don’t like to change, and it’s a very difficult ask. You just hired somebody for them being everything, and now you’re asking them to be just half of that. You can give them double amount of work, but if the person is diverse in their talents and they want to be out there, they’re not going to be following you. It’s very painful because your best people are your best people.

What is your goal, when you start in a team, when you’re working within the team? Is it that you want to progress in your career? Because if you honestly look at yourself and say, do I want to progress in my career? Do I have the right team for that? Great. Increase in knowledge. It’s another objective. Again, day to day, month to month, quarter to quarter, you can ask this question. Do you want to be a leader? What type of team do you need to be a better leader? Or you’re striving for building something. Because as a leader, I think our objective is, create other leaders. Also, we want to make an impact, because you don’t empower more people around you and you don’t hire more people if you’re not making an impact, if you’re not feeling it. For me, it was always a step change.

Obviously, I could increase my technical knowledge any day and become a better leader. When you’re building a business, you really need to be quite objective in the assessment of what’s happening today and what you want tomorrow. You probably saw these books, there is a valley of death and chasm of rather something. As an entrepreneur, you constantly feel that you’re either in this valley of death or in that other hole. Any other things don’t exist. I didn’t even bother making them clear because I don’t know what they look like. You’re constantly feeling you’re failing because somebody is doing better, somebody is doing something different. You’re thinking, maybe I should do something else. When you’re building something new, it doesn’t matter where you are on a scale.

For me, what matters is to do a step change. I think an earlier speaker spoke about small incremental change to inspire the team. I don’t deny it. It’s very important to inspire people. If on the 1st of January, you say, when I sit here 12 months later, what do I want? What is my next step? You really can’t write more than three or four very clear objectives. Then you can deploy all sorts of techniques to make people follow your path, to follow your step change. The step change is very painful. It does live in that high impact, half pain rectangle of a graph. To grow your revenue as a business, year-on-year, take step change. It’s very difficult to do small incremental steps and then get everybody on that path. This is where the questions around the team really come from, is it the right team? What is my objective? For me, this is an annual step. An annual step change for the teams.

I also find it’s extremely difficult finding a focus, because as a CEO or as a leader, you will be pulled in so many different ways. You have to stop and you have to say, what is my focus, and what is everybody else’s focus? The clearer you can be, the more precise you can be where to focus. Please don’t take that as a micromanagement tip. That’s not it. Focus is that step change with a goal at the end. If you can write one line for your next level manager to say, I want you to focus here. Don’t tell them how. Just tell them what’s the focus. It helps tremendously. Also remember that mixed messaging, if you have this focus, you really need to be absolutely sure that this is the focus, because people will spend time and effort and mental effort to think how to deploy your vision and how to make it really work. If you set their own focus, do not blame them because you just told them that this is the focus. Within an organization, once you’re beyond five people, it becomes difficult. Focus for yourself, for me, is the most difficult thing.

If you find your own focus, you can then tell other people what it is, and somehow, they may be figuring out what it is for them. At some point, my friend, also a serial entrepreneur, told me, if you can’t find focus, which is, you’re finding yourself with doing too many things, too many lists, sometimes you tick them off, sometimes you don’t tick them off, try to find five aspects of your life. They cannot all be about engineering. Don’t do that, because then you will end up with five engineering objectives. One has to be about you. Another one has to be about your work. Another one has to be about your friends and family. Another one about extra knowledge. Maybe the last one is the material about the next level of money you want to earn, whatever that is. Make them diverse. Write the five statements of what that is going to be in three months. Three months horizon, there’s something magical about it. You could just see it. Not quite, but you could just see it. Great exercise. It’s actually much more difficult to do than it looks.

If I would write, by the end of Q2, I want my business to have revenue X. One more tip, the way you write is like it’s already happened. The business has revenue of X by, and you put date, month, and year. Very difficult. Think about five aspects, five objectives. Then, the most difficult thing, you have to look at your five cards every day in the morning. Visualize it, whatever else you do in your meditations. Visualize. For me, the most difficult one was to actually read the five cards every day. You read five statements you wrote, like they should be, every single day. That brings your focus back, back on the five statements. The reason I’m saying three months, it’s very difficult to plan actually beyond three months. You definitely have your annual step change.

Then you have this help on a three-month basis to support your step change in 12 months. You can write today that by the end of this year, or by the end of Q1 2025, I am a billionaire. I’m going to read this card every day. It’s going to happen: maybe not, maybe. If you write three months, clear statements, clear objectives. Many people talk how to best make it happen. It’s a meditation or visualization techniques, and you can read about them in all sorts of books. If you want it to happen, it will definitely happen. I think that gives you focus back from all those lists and all those diverse objectives. The reason you write five different statements is because you don’t want the five things to be in one area, because you will be very successful in those five, and highly unsuccessful everywhere else. You’re going to be the best technology leader and engineer in three months, but your wife divorced you, maybe it doesn’t matter. Make sure you write diverse things.

The last one, and I think it’s an interesting one, because I call it the box. Again, probably somebody calls it the same thing. What is the box? Are you comfortable with what you’re doing today? Are you confident in your outcomes? Are you in your comfort zone? Probably if I say that, we’re probably all going to raise our hands. Majority. Is this good? Is that good, that you’re comfortable, that you’re confident? Are you stretched? Am I growing in my role? Is this all I can achieve? What is my next challenge?

You define in your box. You might not be thinking about it right now, but after I told you, you will be. You’re comfortable. You know how to write sprints. You know how the AI works. You read that book. You know your team, everybody is productive. That’s your box. What if tomorrow I said, and tomorrow, I’d like you to do some sales? Talk to the customers, do demos, that will be the list of your problems. You actually need to write contracts, and sign those contracts. These contracts might not be ideal. This is a challenge. This is a challenge because you took yourself out of the comfort box, and you now became something else. Is it good or bad? That’s for you to decide.

The challenge. We need to understand ourselves. Understand our guiding principles. As I said, for me the foundation was in equality, focus, hard work, collaboration, all of the good stuff. My best people came out of being introverts. Way much better leaders than I am, because that focus, hard work, do not allow you to be the most amazing leader, you just don’t have the time. You have different people. You have different buildup of those people, and every leader is very different.

To me, I think the most important thing you can do as a leader is set yourself for growth. How do you set yourself for growth? You could really think about ability to self-doubt, ability to get out of the box. Because there’s nothing wrong with questioning, are you doing the right thing, are you in the right place? Then also being comfortable with being uncomfortable. There’s nothing wrong with that, because that’s how you grow. If it’s scary, potentially that’s the next path for growth. Of course, it gets scary when you go there, but then once you’re in, once one step in, once you get there, you’ll probably figure that out. The last slide is your ability to change. You could listen to all these talks, and change any day and any time.

See more presentations with transcripts

MMS • Craig Risi

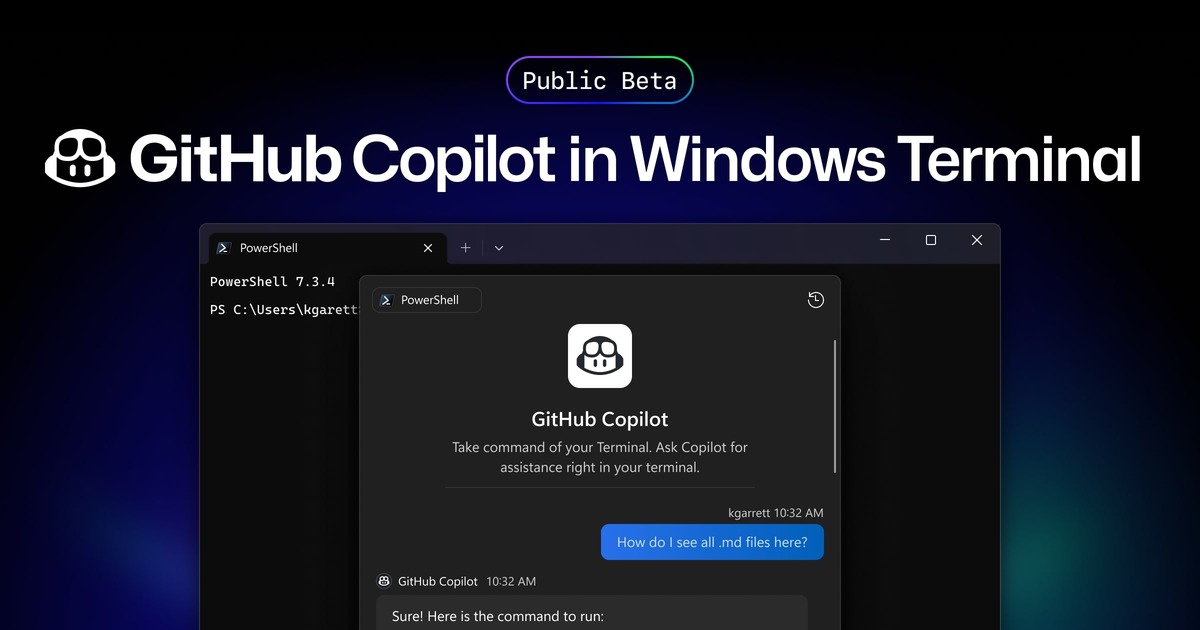

GitHub Copilot’s integration into Windows Terminal Canary introduces an AI-driven feature called Terminal Chat, enabling users to receive command suggestions and explanations directly within the terminal environment. This integration is accessible to all GitHub Copilot subscribers, including Individual, Business, and Enterprise users.

Terminal Chat allows users to interact with an AI service to obtain intelligent suggestions relevant to their terminal context. This feature does not include its own large-language model but can be managed through Group Policy settings. To utilize this feature, users need a subscription to GitHub Copilot and the latest build of Windows Terminal Canary. After authenticating their GitHub account within the Terminal Chat settings, users can engage with GitHub Copilot directly in the terminal.

The integration of GitHub Copilot into Windows Terminal is important because it brings AI-powered assistance directly into a traditionally manual environment, enabling developers to receive real-time command suggestions and explanations without leaving the terminal. This reduces context-switching, accelerates learning, and helps prevent errors, particularly for users working with complex or unfamiliar command-line tasks. By leveraging the user’s current context, the feature provides tailored guidance that supports more efficient workflows in areas like development, system administration, and DevOps.

Moreover, the feature demonstrates how AI services can be contextually aware within specialized environments. Unlike general-purpose AI tools, Terminal Chat leverages the user’s current working context to provide tailored suggestions, aligning with the specific tasks or challenges at hand. It also highlights the trend of integrating AI capabilities not as standalone tools, but as embedded components within existing developer workflows.

Christopher Nguyen, product manager II for Windows Terminal, noted in the article that, “GitHub Copilot users can now use the power of GitHub Copilot to get command suggestions and explanations without leaving the terminal with Terminal Chat in Windows Terminal Canary.” This underscores the focus on reducing friction in development environments, making support tools more accessible exactly where they are needed.

In a broader context, this feature illustrates how developer tools are evolving to incorporate intelligent systems that adapt to user needs. It aligns with ongoing efforts to make software development more efficient and less error-prone, especially as the complexity of systems and the speed of delivery continue to increase.

By incorporating AI assistance directly into the terminal, developers can streamline their workflows, reduce context-switching, and focus more on problem-solving and collaboration. This integration exemplifies the evolving landscape of development environments, where AI tools are becoming integral components in enhancing coding efficiency and developer experience.

MMS • Ben Linders

Age-related discrimination assumes older programmers are less capable or unwilling to learn. Kate Gregory stresses that inclusive, age-friendly workplaces benefit all employees. She advises staying open to new experiences, learning, and building connections to maintain a fulfilling career and well-being as we age.

Kate Gregory gave a talk about continuing to program as people age at NDC Tech Town.

Trouble seeing, pain, and stiffness are some of the things that can make it harder to program as you age. But they aren’t inevitable, and some solutions can help, as Gregory explained in the InfoQ article What Developers Can Do to Continue to Program as They Age. She gave examples of solutions, like changing fonts, using glasses, and rearranging the office layout.

Gregory did a survey to explore ageing for programmers as part of preparing her talk, and hundreds of developers, of all ages, responded.

Gregory mentioned that older people sometimes face age discrimination. She gave an example where people assume an older person “wouldn’t want to learn that”, or “doesn’t know how to use these new cool things”, or say that someone won’t be a culture fit. Without checking, they exclude the person based on assumptions, she said.

When people meet an older programmer they sometimes think (or even say!) things like, “I guess you weren’t good enough to get promoted to management yet”, Gregory said. The good news is it doesn’t happen everywhere, so if this happens to you, you should find an environment where you’re valued, she argued:

Some places have learned that offering a welcoming workplace gets them some amazing talent.

Most people who replied to her survey said they did occasionally assume older people couldn’t do something or wouldn’t want to, despite trying to remember we all age differently, as Gregory explained:

It’s actually in your own interests to educate yourself about the positive realities of aging, because studies show that people with negative attitudes towards old age and old people are more likely to be hospitalized or have a heart attack or stroke.

Improving the working conditions for programmers is not just about age, Gregory said. When employers stop assuming that everyone is the same, and build a more inclusive environment, that helps everyone, she mentioned. It could be having adjustable lighting, or flexible work hours, or not having a rigid dress code — all of these can make a big difference to some people as they age, or to younger people who have physical needs that are not the same as everyone else’s, she added.

Most of us don’t actually struggle with being able to keep up with new stuff as we are getting older. After several decades you know how to learn, you’ve seen ten different source control systems, or job tracking systems, or whatever, and you can pick up another one easily enough, Gregory said.

Gregory advised to make friends, and don’t stop making new friends all of your life. Try new things too – as life goes on there will be losses, and the only cure for loss is gain, so you have to give new hobbies, new foods, and new entertainment a chance. Some of them will work out wonderfully, she said.

No matter how young you are, it’s never too soon to start working towards the kind of old age you want. And the good news is, it’s also never too late, Gregory concluded.

InfoQ interviewed Kate Gregory about continuing to program as people age.

InfoQ: What’s your suggestion for keeping up with new stuff when we’re getting older?

Kate Gregory: It’s mostly a matter of wanting to keep up. Sometimes we’re just fed up, or unimpressed by the benefits that everyone says the new system will bring, and don’t feel like learning it for that reason. Or we’ve tied our identity to a particular programming language or operating system, and feel like switching to a new one would mean saying we were wrong.

If we can set that aside and focus on the purpose of our work more than the tools we use, picking up a new tool is not beyond any of us.

InfoQ: What’s your advice for a long and happy old age?

Gregory: Embrace exercising, both in the form of active hobbies and active commutes and such, but also in deliberate “twenty minutes of stretching” kind of exercise.

Save money starting young, so that you will be relaxed and comfortable when you reach retirement age. Build up other resources too — surround yourself with nice people, for example, and learn skills like how to talk to people when the stakes are very high, such as during a family medical emergency, so that you get the information and help you need.

Eat well, sleep well, and care for your body. It’s not your enemy, it’s you. Plan for your retirement and work towards that plan now — if you want to paint or sail or golf a lot, learn how to do it now so you can evaluate it and get at least some of that enjoyment without waiting decades.

MMS • RSS

Commonwealth Equity Services LLC reduced its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.2% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 11,515 shares of the company’s stock after selling 138 shares during the quarter. Commonwealth Equity Services LLC’s holdings in MongoDB were worth $2,681,000 as of its most recent SEC filing.

Commonwealth Equity Services LLC reduced its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.2% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 11,515 shares of the company’s stock after selling 138 shares during the quarter. Commonwealth Equity Services LLC’s holdings in MongoDB were worth $2,681,000 as of its most recent SEC filing.

A number of other hedge funds also recently added to or reduced their stakes in the business. Raymond James Financial Inc. purchased a new position in MongoDB during the 4th quarter valued at about $90,478,000. Amundi increased its holdings in MongoDB by 86.2% during the fourth quarter. Amundi now owns 693,740 shares of the company’s stock valued at $172,519,000 after buying an additional 321,186 shares during the period. Assenagon Asset Management S.A. raised its stake in MongoDB by 11,057.0% in the fourth quarter. Assenagon Asset Management S.A. now owns 296,889 shares of the company’s stock worth $69,119,000 after buying an additional 294,228 shares in the last quarter. Avala Global LP purchased a new stake in MongoDB during the third quarter worth $47,960,000. Finally, Healthcare of Ontario Pension Plan Trust Fund bought a new stake in MongoDB during the 3rd quarter valued at $25,636,000. 89.29% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

MDB has been the subject of a number of analyst reports. Robert W. Baird decreased their price objective on MongoDB from $390.00 to $300.00 and set an “outperform” rating for the company in a research note on Thursday, March 6th. DA Davidson raised their price target on shares of MongoDB from $340.00 to $405.00 and gave the company a “buy” rating in a report on Tuesday, December 10th. Piper Sandler reduced their price objective on shares of MongoDB from $425.00 to $280.00 and set an “overweight” rating for the company in a research note on Thursday, March 6th. Oppenheimer cut their price target on shares of MongoDB from $400.00 to $330.00 and set an “outperform” rating on the stock in a report on Thursday, March 6th. Finally, Mizuho increased their price objective on MongoDB from $275.00 to $320.00 and gave the company a “neutral” rating in a report on Tuesday, December 10th. Seven research analysts have rated the stock with a hold rating and twenty-three have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of “Moderate Buy” and a consensus target price of $320.70.

Check Out Our Latest Stock Analysis on MongoDB

Insider Buying and Selling

In other MongoDB news, CAO Thomas Bull sold 169 shares of the firm’s stock in a transaction on Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total value of $39,561.21. Following the transaction, the chief accounting officer now owns 14,899 shares in the company, valued at approximately $3,487,706.91. This trade represents a 1.12 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Director Dwight A. Merriman sold 3,000 shares of the company’s stock in a transaction on Monday, March 3rd. The stock was sold at an average price of $270.63, for a total transaction of $811,890.00. Following the sale, the director now directly owns 1,109,006 shares of the company’s stock, valued at $300,130,293.78. The trade was a 0.27 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 43,139 shares of company stock worth $11,328,869 in the last 90 days. Insiders own 3.60% of the company’s stock.

MongoDB Trading Down 2.5 %

Shares of MDB stock opened at $193.66 on Thursday. MongoDB, Inc. has a 12-month low of $173.13 and a 12-month high of $387.19. The business’s 50 day moving average is $248.25 and its two-hundred day moving average is $267.64. The company has a market capitalization of $14.42 billion, a P/E ratio of -70.68 and a beta of 1.30.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its earnings results on Wednesday, March 5th. The company reported $0.19 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $0.64 by ($0.45). The business had revenue of $548.40 million for the quarter, compared to analysts’ expectations of $519.65 million. MongoDB had a negative net margin of 10.46% and a negative return on equity of 12.22%. During the same quarter last year, the business earned $0.86 EPS. On average, research analysts predict that MongoDB, Inc. will post -1.78 earnings per share for the current fiscal year.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • InfoQ

The Act One: From Chatbots to AI Agents eMag marks a pivotal moment in the evolution of artificial intelligence, a shift from the familiar realm of chatbots to the more dynamic and autonomous world of AI agents. We’ve curated a collection of articles that explore this exciting transition, offering both practical insights and forward-looking perspectives on the challenges and opportunities that lie ahead. This paradigm shift has the potential to revolutionize industries, but also demands a new set of tools, techniques, and ethical considerations.

This edition offers a glimpse into the transformative potential of AI agents. We believe this is just the beginning of a much longer story. We invite you to join us on this journey as we continue to explore the exciting world of AI and its profound impact on our future.

Free download

MMS • Daniel Dominguez

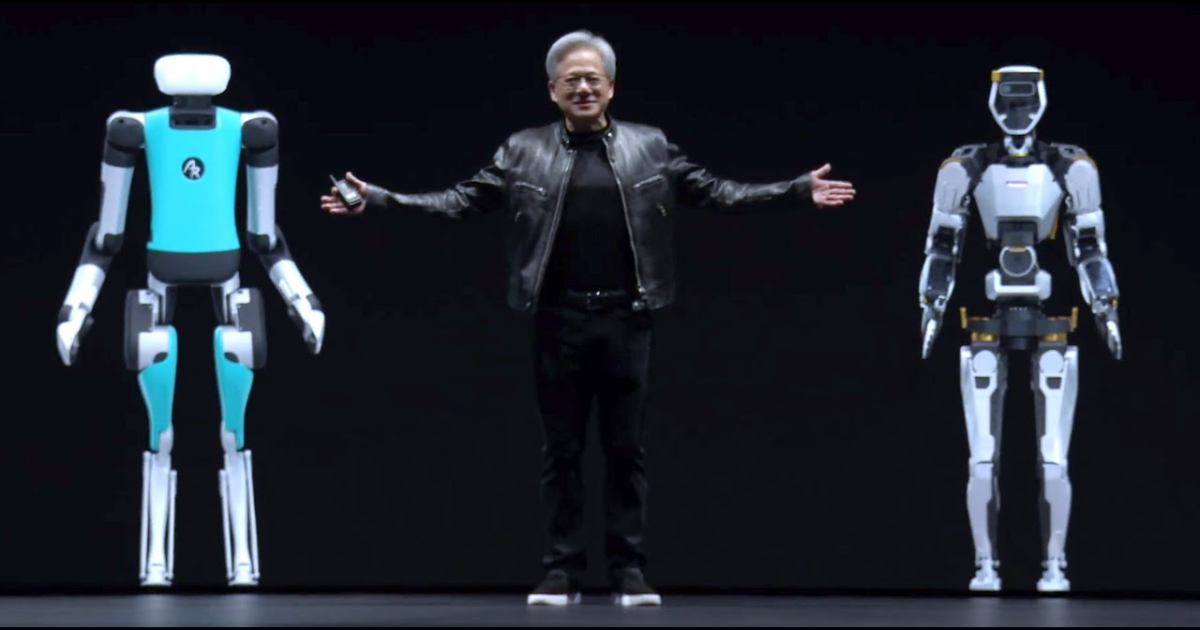

Nvidia presented a range of new technologies at its GTC 2025 event, focusing on advancements in GPUs, AI infrastructure, robotics, and quantum computing. The company introduced the GeForce RTX 5090, a graphics card built on the Blackwell architecture, featuring improvements in energy efficiency, size reduction, and AI-assisted rendering capabilities. Nvidia highlighted the increasing role of AI in real-time, path-traced rendering and GPU performance optimization.

In the data center sector, Nvidia announced the Blackwell Ultra GB300 family of GPUs, designed to enhance AI inference efficiency with 1.5 times the memory capacity of previous models. The company also introduced MVLink, a high-speed interconnect technology that enables faster GPU communication, and Nvidia Dynamo, an AI data center operating system aimed at improving management and efficiency. The DGX Station, a computing platform for AI workloads, was also unveiled to support enterprise AI development.

Nvidia’s automotive division revealed a partnership with General Motors to develop AI-powered self-driving vehicles. The company stated that all software components involved in the project have undergone rigorous safety assessments. Additionally, Nvidia introduced Halos, an AI-powered safety system for autonomous vehicles, integrating hardware, software, and AI-based decision-making.

In robotics, Nvidia introduced the Isaac GR00T N1, an open-source humanoid reasoning model developed in collaboration with Google DeepMind and Disney Research. The Newton physics engine, also open-source, was announced to enhance robotics training by simulating real-world physics for AI-driven robots. Nvidia also expanded its Omniverse platform for physical AI applications with the launch of Cosmos, a generative model aimed at improving AI-driven world simulation and interaction.

The company announced new AI models under the Llama Nemotron family, designed for reasoning-based AI agents. These models are optimized for enterprises looking to deploy AI agents that can work autonomously or collaboratively. Nvidia stated that members of the Nvidia Developer Program could access Llama Nemotron for development, testing, and research.

Nvidia revealed its latest advancements in quantum computing, including the launch of the Nvidia Accelerated Quantum Research Center in Boston. The company is collaborating with Harvard and MIT on quantum computing initiatives. During the conference, Nvidia hosted Quantum Day, where CEO Jensen Huang discussed the evolving role of quantum computing and acknowledged previous underestimations of its development timeline.

The company introduced a roadmap for future GPUs, including the Vera Rubin GPU, set for release in 2026, followed by Rubin Ultra NVL576 in 2027, which is projected to deliver 15 exaflops of computing power. Nvidia also announced the Feynman GPU, scheduled for 2028, designed to advance AI workloads with enhanced memory and performance capabilities.

Following the conference, online discussions reflected various perspectives on Nvidia’s announcements. Many users expressed interest in the concept of physical AI and its potential applications.

AI expert Armughan Ahmad shared:

AI is shifting from simple chat assistants to autonomous agents that execute work on our behalf.

While AI strategist Vivi Linsi commented:

With the arrival of agentic and physical AI, AI has developed from talking to Doing – are you ready?

Nvidia’s announcements at GTC 2025 highlight the company’s continued investment in AI, data centers, robotics, and quantum computing, positioning itself at the forefront of next-generation computing infrastructure.

MMS • RSS

Quantbot Technologies LP acquired a new stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor acquired 3,016 shares of the company’s stock, valued at approximately $702,000.

Several other hedge funds and other institutional investors have also modified their holdings of MDB. Hilltop National Bank raised its stake in MongoDB by 47.2% during the 4th quarter. Hilltop National Bank now owns 131 shares of the company’s stock valued at $30,000 after purchasing an additional 42 shares during the last quarter. Brooklyn Investment Group acquired a new position in shares of MongoDB during the third quarter valued at about $36,000. Continuum Advisory LLC lifted its stake in shares of MongoDB by 621.1% in the third quarter. Continuum Advisory LLC now owns 137 shares of the company’s stock valued at $40,000 after buying an additional 118 shares during the period. NCP Inc. acquired a new stake in MongoDB during the fourth quarter worth about $35,000. Finally, Wilmington Savings Fund Society FSB bought a new position in MongoDB during the third quarter valued at about $44,000. Institutional investors and hedge funds own 89.29% of the company’s stock.

Analyst Upgrades and Downgrades

MDB has been the topic of a number of research reports. Guggenheim upgraded MongoDB from a “neutral” rating to a “buy” rating and set a $300.00 price objective on the stock in a research report on Monday, January 6th. DA Davidson boosted their price target on shares of MongoDB from $340.00 to $405.00 and gave the company a “buy” rating in a report on Tuesday, December 10th. JMP Securities reaffirmed a “market outperform” rating and set a $380.00 price objective on shares of MongoDB in a report on Wednesday, December 11th. KeyCorp cut shares of MongoDB from a “strong-buy” rating to a “hold” rating in a research note on Wednesday, March 5th. Finally, Rosenblatt Securities restated a “buy” rating and set a $350.00 price target on shares of MongoDB in a research note on Tuesday, March 4th. Seven equities research analysts have rated the stock with a hold rating and twenty-three have given a buy rating to the company. According to MarketBeat.com, MongoDB has an average rating of “Moderate Buy” and a consensus target price of $320.70.

Insider Activity at MongoDB

In other news, CEO Dev Ittycheria sold 2,581 shares of the company’s stock in a transaction dated Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total value of $604,186.29. Following the completion of the sale, the chief executive officer now directly owns 217,294 shares of the company’s stock, valued at $50,866,352.46. This represents a 1.17 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CAO Thomas Bull sold 169 shares of MongoDB stock in a transaction that occurred on Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total transaction of $39,561.21. Following the transaction, the chief accounting officer now directly owns 14,899 shares in the company, valued at $3,487,706.91. The trade was a 1.12 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 43,139 shares of company stock worth $11,328,869 over the last ninety days. Company insiders own 3.60% of the company’s stock.

MongoDB Stock Down 2.5 %

MDB stock opened at $193.66 on Thursday. MongoDB, Inc. has a twelve month low of $173.13 and a twelve month high of $387.19. The company has a market cap of $14.42 billion, a P/E ratio of -70.68 and a beta of 1.30. The business has a fifty day moving average of $248.25 and a 200-day moving average of $267.64.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings data on Wednesday, March 5th. The company reported $0.19 earnings per share for the quarter, missing the consensus estimate of $0.64 by ($0.45). The firm had revenue of $548.40 million for the quarter, compared to the consensus estimate of $519.65 million. MongoDB had a negative return on equity of 12.22% and a negative net margin of 10.46%. During the same period in the prior year, the firm posted $0.86 earnings per share. As a group, equities research analysts anticipate that MongoDB, Inc. will post -1.78 earnings per share for the current fiscal year.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

Nuclear energy stocks are roaring. It’s the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

MMS • RSS

Sei Investments Co. lessened its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 56.9% during the 4th quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 108,209 shares of the company’s stock after selling 142,830 shares during the quarter. Sei Investments Co. owned approximately 0.15% of MongoDB worth $25,193,000 at the end of the most recent reporting period.

A number of other institutional investors have also recently added to or reduced their stakes in MDB. Intech Investment Management LLC raised its holdings in MongoDB by 10.7% in the 3rd quarter. Intech Investment Management LLC now owns 5,205 shares of the company’s stock worth $1,407,000 after acquiring an additional 502 shares during the period. Charles Schwab Investment Management Inc. increased its stake in shares of MongoDB by 2.8% in the third quarter. Charles Schwab Investment Management Inc. now owns 278,419 shares of the company’s stock worth $75,271,000 after purchasing an additional 7,575 shares during the period. Cerity Partners LLC lifted its position in shares of MongoDB by 8.3% during the 3rd quarter. Cerity Partners LLC now owns 9,094 shares of the company’s stock worth $2,459,000 after purchasing an additional 695 shares during the last quarter. Daiwa Securities Group Inc. boosted its stake in MongoDB by 12.3% during the 3rd quarter. Daiwa Securities Group Inc. now owns 10,323 shares of the company’s stock valued at $2,791,000 after purchasing an additional 1,132 shares during the period. Finally, Independent Advisor Alliance grew its holdings in MongoDB by 5.3% in the 3rd quarter. Independent Advisor Alliance now owns 1,516 shares of the company’s stock valued at $410,000 after buying an additional 76 shares during the last quarter. 89.29% of the stock is currently owned by institutional investors and hedge funds.

MongoDB Stock Performance

Shares of MDB stock opened at $193.66 on Thursday. The stock’s fifty day moving average is $248.25 and its 200-day moving average is $267.64. MongoDB, Inc. has a 52 week low of $173.13 and a 52 week high of $387.19. The stock has a market capitalization of $14.42 billion, a PE ratio of -70.68 and a beta of 1.30.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings data on Wednesday, March 5th. The company reported $0.19 earnings per share for the quarter, missing the consensus estimate of $0.64 by ($0.45). MongoDB had a negative net margin of 10.46% and a negative return on equity of 12.22%. The company had revenue of $548.40 million during the quarter, compared to analyst estimates of $519.65 million. During the same quarter in the previous year, the business posted $0.86 EPS. As a group, analysts forecast that MongoDB, Inc. will post -1.78 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, insider Cedric Pech sold 287 shares of MongoDB stock in a transaction dated Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total value of $67,183.83. Following the completion of the sale, the insider now directly owns 24,390 shares in the company, valued at $5,709,455.10. This trade represents a 1.16 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CAO Thomas Bull sold 169 shares of the company’s stock in a transaction dated Thursday, January 2nd. The shares were sold at an average price of $234.09, for a total transaction of $39,561.21. Following the transaction, the chief accounting officer now owns 14,899 shares in the company, valued at approximately $3,487,706.91. The trade was a 1.12 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 43,139 shares of company stock worth $11,328,869 in the last quarter. Insiders own 3.60% of the company’s stock.

Wall Street Analysts Forecast Growth

A number of equities analysts recently issued reports on MDB shares. Truist Financial dropped their target price on shares of MongoDB from $400.00 to $300.00 and set a “buy” rating on the stock in a research report on Thursday, March 6th. UBS Group set a $350.00 price objective on shares of MongoDB in a research report on Tuesday, March 4th. Guggenheim raised MongoDB from a “neutral” rating to a “buy” rating and set a $300.00 target price on the stock in a research report on Monday, January 6th. Wells Fargo & Company cut MongoDB from an “overweight” rating to an “equal weight” rating and cut their price target for the company from $365.00 to $225.00 in a report on Thursday, March 6th. Finally, Tigress Financial lifted their price objective on MongoDB from $400.00 to $430.00 and gave the stock a “buy” rating in a report on Wednesday, December 18th. Seven research analysts have rated the stock with a hold rating and twenty-three have assigned a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of “Moderate Buy” and a consensus target price of $320.70.

Read Our Latest Analysis on MDB

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

MMS • RSS

According to Morgan Stanley, the overall performance of the U.S. software sector has deteriorated in the fourth quarter. However, infrastructure software companies like Palantir (PLTR, Financial) and MongoDB (MDB) have bucked the trend, achieving strong revenue growth for the second consecutive quarter.

Analysts led by Keith Weiss at Morgan Stanley reported a decline in revenue, operating margins, and earnings per share across the software industry. The percentage of companies exceeding market expectations by 1% dropped, and the median extent of exceeding expectations turned negative after two quarters of improvement, falling below historical averages. For instance, 64% of companies exceeded revenue expectations by more than 1%, down from 71% in the previous quarter. Regarding earnings per share, 69% surpassed market expectations by $0.02 or more, compared to 71% previously.

In contrast, infrastructure software companies have managed to avoid this downward trend, showing robust revenue performance for the second quarter in a row. SolarWinds (SWI) exceeded market expectations by 7.2%, Palantir by 6.6%, MongoDB by 5.6%, and Elastic (ESTC) by 4.5%. Notably, 80% of infrastructure software companies exceeded revenue expectations by more than 1%, and 85% surpassed earnings per share expectations by more than $0.02.

Weiss highlighted Palantir as the second-best performing stock in the infrastructure software sector, despite high expectations. The company has seen accelerated revenue growth for six consecutive quarters, indicating its potential for sustained growth. Palantir’s stock has risen by 22% this year, while the Nasdaq has declined by over 7% during the same period.