Month: March 2025

MMS • RSS

USA, New Jersey- According to Market Research Intellect, the global NoSQL Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The NoSQL software market is experiencing robust growth as organizations increasingly adopt non-relational databases to handle the complexities of big data and real-time applications. Traditional relational databases often struggle with scalability, flexibility, and the need for high-performance processing, which has led to the growing popularity of NoSQL solutions. These databases are particularly favored for their ability to store and manage vast amounts of unstructured data across distributed systems, making them ideal for cloud environments and modern applications. As businesses continue to embrace digital transformation, the demand for scalable, high-performance databases that can handle a variety of data types is expected to drive the growth of the NoSQL software market. Innovations in AI and machine learning, along with the expanding adoption of IoT devices, are further fueling the demand for NoSQL solutions.

The growth of the NoSQL software market is driven by several key factors. The explosion of big data and the increasing volume of unstructured data is one of the primary catalysts, as traditional relational databases struggle to effectively store, manage, and process such data. NoSQL databases offer the scalability, flexibility, and high-performance capabilities needed to handle these challenges, making them ideal for businesses dealing with large, diverse datasets. Additionally, the rise of cloud computing has further accelerated the adoption of NoSQL solutions, as they are better suited for cloud environments due to their ability to scale horizontally across distributed networks. The demand for real-time applications in areas like IoT, social media, and e-commerce is another significant driver, as NoSQL databases can provide faster data processing and support real-time analytics. Furthermore, the growing interest in machine learning and artificial intelligence, which require large datasets for training models, is fueling the market’s expansion.

Request PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.marketresearchintellect.com/download-sample/?rid=1065792&utm_source=OpenPr&utm_medium=042

Market Growth Drivers-NoSQL Software Market:

The growth of the NoSQL Software market is driven by several key factors, including technological advancements, increasing consumer demand, and supportive regulatory policies. Innovations in product development and manufacturing processes are enhancing efficiency, improving performance, and reducing costs, making NoSQL Software more accessible to a wider range of industries. Rising awareness about the benefits of NoSQL Software, coupled with expanding applications across sectors such as healthcare, automotive, and electronics, is further accelerating market expansion. Additionally, the integration of digital technologies, such as AI and IoT, is optimizing operational workflows and enhancing product capabilities. Government initiatives promoting sustainable solutions and industry-standard regulations are also playing a crucial role in market growth. The increasing investment in research and development by key market players is fostering new product innovations and expanding market opportunities. Overall, these factors collectively contribute to the steady rise of the NoSQL Software market, making it a lucrative industry for future investments.

Challenges and Restraints-NoSQL Software Market:

The NoSQL Software market faces several challenges and restraints that could impact its growth trajectory. High initial investment costs pose a significant barrier, particularly for small and medium-sized enterprises looking to enter the industry. Regulatory complexities and stringent compliance requirements add another layer of difficulty, as companies must navigate evolving policies and standards. Additionally, supply chain disruptions, including raw material shortages and logistical constraints, can hinder market expansion and lead to increased operational costs.

Market saturation in developed regions also presents a challenge, forcing businesses to explore emerging markets where infrastructure and consumer awareness may be lacking. Intense competition among key players further pressures profit margins, making it crucial for companies to differentiate through innovation and strategic partnerships. Economic fluctuations, geopolitical instability, and changing consumer preferences add to the uncertainty, requiring businesses to adopt agile strategies to sustain long-term growth in the evolving NoSQL Software market.

Emerging Trends-NoSQL Software Market:

The NoSQL Software market is evolving rapidly, driven by emerging trends that are reshaping industry dynamics. One key trend is the integration of advanced digital technologies such as artificial intelligence, automation, and IoT, which enhance efficiency, performance, and user experience. Sustainability is another major focus, with companies shifting toward eco-friendly materials and processes to meet growing environmental regulations and consumer demand for greener solutions. Additionally, the rise of personalized and customized offerings is gaining momentum, as businesses strive to cater to specific consumer preferences and industry requirements. Investments in research and development are accelerating, leading to continuous innovation and the introduction of high-performance products. The market is also witnessing a surge in strategic collaborations, partnerships, and acquisitions, as companies aim to expand their geographical footprint and technological capabilities. As these trends continue to evolve, they are expected to drive the market’s long-term growth and competitiveness in a dynamic global landscape.

Competitive Landscape-NoSQL Software Market:

The competitive landscape of the NoSQL Software market is characterized by intense rivalry among key players striving for market dominance. Leading companies focus on product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. Continuous research and development investments are driving technological advancements, allowing businesses to enhance their offerings and gain a competitive edge.

Regional expansion strategies are also prominent, with companies targeting emerging markets to capitalize on growing demand. Additionally, sustainability and regulatory compliance have become crucial factors influencing competition, as businesses aim to align with evolving industry standards.

Startups and new entrants are introducing disruptive solutions, intensifying competition and prompting established players to adopt agile strategies. Digital transformation, AI-driven analytics, and automation are further reshaping the competitive dynamics, enabling companies to streamline operations and improve efficiency. As the market continues to evolve, businesses must adapt to changing consumer demands and technological advancements to maintain their market position.

Get a Discount On The Purchase Of This Report @ https://www.marketresearchintellect.com/ask-for-discount/?rid=1065792&utm_source=OpenPr&utm_medium=042

The following Key Segments Are Covered in Our Report

Global NoSQL Software Market by Type

Cloud Based

Web Based

Global NoSQL Software Market by Application

E-Commerce

Social Networking

Data Analytics

Data Storage

Others

Major companies in NoSQL Software Market are:

MongoDB, Amazon, ArangoDB, Azure Cosmos DB, Couchbase, MarkLogic, RethinkDB, CouchDB, SQL-RD, OrientDB, RavenDB, Redis, Microsoft

NoSQL Software Market -Regional Analysis

The NoSQL Software market exhibits significant regional variations, driven by economic conditions, technological advancements, and industry-specific demand. North America remains a dominant force, supported by strong investments in research and development, a well-established industrial base, and increasing adoption of advanced solutions. The presence of key market players further enhances regional growth.

Europe follows closely, benefiting from stringent regulations, sustainability initiatives, and a focus on innovation. Countries such as Germany, France, and the UK are major contributors due to their robust industrial frameworks and technological expertise.

Asia-Pacific is witnessing the fastest growth, fueled by rapid industrialization, urbanization, and increasing consumer demand. China, Japan, and India play a crucial role in market expansion, with government initiatives and foreign investments accelerating development.

Latin America and the Middle East and Africa are emerging markets with growing potential, driven by infrastructure development and expanding industrial sectors. However, challenges such as economic instability and regulatory barriers may impact growth trajectories.

Frequently Asked Questions (FAQ) – NoSQL Software Market (2025-2032)

1. What is the projected growth rate of the NoSQL Software market from 2025 to 2032?

The NoSQL Software market is expected to experience steady growth from 2025 to 2032, driven by technological advancements, increasing consumer demand, and expanding industry applications. The market is projected to witness a robust compound annual growth rate (CAGR), supported by rising investments in research and development. Additionally, factors such as digital transformation, automation, and regulatory support will further boost market expansion across various regions.

2. What are the key drivers fueling the growth of the NoSQL Software market?

Several factors are contributing to the growth of the NoSQL Software market. The increasing adoption of advanced technologies, a rise in industry-specific applications, and growing consumer awareness are some of the primary drivers. Additionally, government initiatives and favorable regulations are encouraging market expansion. Sustainability trends, digitalization, and the integration of artificial intelligence (AI) and Internet of Things (IoT) solutions are also playing a vital role in accelerating market development.

3. Which region is expected to dominate the NoSQL Software market by 2032?

The NoSQL Software market is witnessing regional variations in growth, with North America and Asia-Pacific emerging as dominant regions. North America benefits from a well-established industrial infrastructure, extensive research and development activities, and the presence of leading market players. Meanwhile, Asia-Pacific, particularly China, Japan, and India, is experiencing rapid industrialization and urbanization, driving increased adoption of NoSQL Software solutions. Europe also holds a significant market share, particularly in sectors focused on sustainability and regulatory compliance. Emerging markets in Latin America and the Middle East & Africa are showing potential but may face challenges such as economic instability and regulatory constraints.

4. What challenges are currently impacting the NoSQL Software market?

Despite promising growth, the NoSQL Software market faces several challenges. High initial investments, regulatory hurdles, and supply chain disruptions are some of the primary obstacles. Additionally, market saturation in certain regions and intense competition among key players may lead to pricing pressures. Companies must focus on innovation, cost efficiency, and strategic partnerships to navigate these challenges successfully. Geopolitical factors, economic fluctuations, and trade restrictions can also impact market stability and growth prospects.

5. Who are the key players in the NoSQL Software market?

The NoSQL Software market is highly competitive, with several leading global and regional players striving for market dominance. Major companies are investing in research and development to introduce innovative solutions and expand their market presence. Key players are also engaging in mergers, acquisitions, and strategic collaborations to strengthen their positions. Emerging startups are bringing disruptive innovations, further intensifying market competition. Companies that prioritize sustainability, digital transformation, and customer-centric solutions are expected to gain a competitive edge in the industry.

6. How is technology shaping the future of the NoSQL Software market?

Technology plays a pivotal role in the evolution of the NoSQL Software market. The adoption of artificial intelligence (AI), big data analytics, automation, and IoT is transforming industry operations, improving efficiency, and enhancing product offerings. Digitalization is streamlining supply chains, optimizing resource utilization, and enabling predictive maintenance strategies. Companies investing in cutting-edge technologies are likely to gain a competitive advantage, improve customer experience, and drive market expansion.

7. What impact does sustainability have on the NoSQL Software market?

Sustainability is becoming a key focus area for companies operating in the NoSQL Software market. With increasing environmental concerns and stringent regulatory policies, businesses are prioritizing eco-friendly solutions, energy efficiency, and sustainable manufacturing processes. The shift toward circular economy models, renewable energy sources, and waste reduction strategies is influencing market trends. Companies that adopt sustainable practices are likely to enhance their brand reputation, attract environmentally conscious consumers, and comply with global regulatory standards.

8. What are the emerging trends in the NoSQL Software market from 2025 to 2032?

Several emerging trends are expected to shape the NoSQL Software market during the forecast period. The rise of personalization, customization, and user-centric innovations is driving product development. Additionally, advancements in 5G technology, cloud computing, and blockchain are influencing market dynamics. The growing emphasis on remote operations, automation, and smart solutions is reshaping industry landscapes. Furthermore, increased investments in biotechnology, nanotechnology, and advanced materials are opening new opportunities for market growth.

9. How will economic conditions affect the NoSQL Software market?

Economic fluctuations, inflation rates, and geopolitical tensions can impact the NoSQL Software market’s growth trajectory. The availability of raw materials, supply chain stability, and changes in consumer spending patterns may influence market demand. However, industries that prioritize innovation, agility, and strategic planning are better positioned to withstand economic uncertainties. Diversification of revenue streams, expansion into emerging markets, and adaptation to changing economic conditions will be key strategies for market sustainability.

10. Why should businesses invest in the NoSQL Software market from 2025 to 2032?

Investing in the NoSQL Software market presents numerous opportunities for businesses. The industry is poised for substantial growth, with advancements in technology, evolving consumer preferences, and increasing regulatory support driving demand. Companies that embrace innovation, digital transformation, and sustainability can gain a competitive advantage. Additionally, expanding into emerging markets, forming strategic alliances, and focusing on customer-centric solutions will be crucial for long-term success. As the market evolves, businesses that stay ahead of industry trends and invest in R&D will benefit from sustained growth and profitability.

For More Information or Query, Visit @ https://www.marketresearchintellect.com/product/nosql-software-market/?utm_source=OpenPR&utm_medium=042

Our Top Trending Reports

Data Loss Prevention DLP Solutions Market Size By Type: https://www.marketresearchintellect.com/ko/product/data-loss-prevention-dlp-solutions-market/

Financial Data Warehouse Solution Market Size By Applications: https://www.marketresearchintellect.com/zh/product/financial-data-warehouse-solution-market/

Digital Turbidity Meter Market Size By Type: https://www.marketresearchintellect.com/de/product/global-digital-turbidity-meter-market-size-and-forecast-2/

Intelligent Excavator Market Size By Applications: https://www.marketresearchintellect.com/es/product/global-intelligent-excavator-market-size-and-forecast/

Cloud Automation Market Size By Type: https://www.marketresearchintellect.com/ja/product/global-cloud-automation-market-size-and-forecast/

Spectroscopy Reagent Sp Market Size By Type: https://www.marketresearchintellect.com/pt/product/spectroscopy-reagent-sp-market-size-and-forecast/

Flexible Foam Sales Market Size By Applications: https://www.marketresearchintellect.com/it/product/global-flexible-foam-sales-market/

Network Traffic Analysis Tool Market Size By Type: https://www.marketresearchintellect.com/nl/product/network-traffic-analysis-tool-market/

Push To Talk Telemedicine And M-Health Convergence Market Size By Applications: https://www.marketresearchintellect.com/ko/product/global-push-to-talk-telemedicine-and-m-health-convergence-market/

Payroll And Bookkeeping Services Market Size By Type: https://www.marketresearchintellect.com/zh/product/payroll-and-bookkeeping-services-market/

As Interface Market Size By Applications: https://www.marketresearchintellect.com/de/product/as-interface-market-size-and-forecast/

About Us: Market Research Intellect

Market Research Intellect is a leading Global Research and Consulting firm servicing over 5000+ global clients. We provide advanced analytical research solutions while offering information-enriched research studies. We also offer insights into strategic and growth analyses and data necessary to achieve corporate goals and critical revenue decisions.

Our 250 Analysts and SMEs offer a high level of expertise in data collection and governance using industrial techniques to collect and analyze data on more than 25,000 high-impact and niche markets. Our analysts are trained to combine modern data collection techniques, superior research methodology, expertise, and years of collective experience to produce informative and accurate research.

Our research spans a multitude of industries including Energy, Technology, Manufacturing and Construction, Chemicals and Materials, Food and Beverages, etc. Having serviced many Fortune 2000 organizations, we bring a rich and reliable experience that covers all kinds of research needs.

For inquiries, Contact Us at:

Mr. Edwyne Fernandes

Market Research Intellect

APAC: +61 485 860 968

EU: +44 788 886 6344

US: +1 743 222 5439

This release was published on openPR.

MMS • RSS

LEESBURG, Va., March 19, 2025 (Newswire.com)

–

Vertosoft is thrilled to announce that they have been named as MongoDB’s newest public sector distributor. With this partnership, MongoDB and their intelligent data platform will be available to Vertosoft’s channel partners as well as government agencies through Vertosoft’s trusted and secure supply chain. This addition significantly enhances Vertosoft’s Big Data & Analytics technology portfolio, showcasing their commitment to providing innovative software solutions that drive operational efficiency and improve decision-making within the public sector.

MongoDB is the world’s leading modern document database provider, and the MongoDB for Public Sector program offers flexible, highly-secure data infrastructure that is optimized for the public sector, enabling federal, state, and local governments to accelerate and streamline their digital transformation efforts. MongoDB for Public Sector is specifically designed to help public sector organizations balance the unique set of compliance requirements they face with the need to innovate in order to keep up with technological progress in the private sector.

MongoDB Atlas for Government is the FedRAMP Moderate Authorized environment of MongoDB’s cloud-native data platform, Atlas. Atlas for Government facilitates the modernization of legacy applications to the cloud while meeting the unique requirements and missions of the U.S. government in a secure, fully managed environment. With real-time data visibility and robust security features, it ensures easy adoption within the public sector community. Additionally, MongoDB Enterprise Advanced provides similar capabilities in an on-premises operational model, making it the only NoSQL database with a STIG reviewed and approved by DISA.

“Public sector organizations must balance some of the strictest compliance requirements with the need to keep up with the breakneck pace of private sector technological innovation,” said Joe Perrino, Vice President of Public Sector at MongoDB. “MongoDB gives them the flexibility and intuitive developer experience they need to move fast, while its exceptional levels of security, durability, availability, and performance enable them to build and deploy cutting-edge applications with confidence. More than 1,000 public sector customers in the U.S. rely on MongoDB to power mission-critical workloads, and now, it’s even easier for them to do so.”

“We are excited to partner with MongoDB and add the world’s most versatile data platform to our Big Data & Analytics portfolio. This collaboration emphasizes our commitment to supporting public sector missions by delivering cutting-edge solutions to the Government,” said Jay Colavita, President of Vertosoft.

About Vertosoft

At Vertosoft, we are a trusted, value-driven distributor of innovative technology solutions. Our experienced team and tailored services equip our channel partners and suppliers with the tools, contracts, and secure systems needed to succeed in the public sector market.

Source: Vertosoft

MMS • Sergio De Simone

Born as an enterprise-focused AI-based code generation tool, Gemini Code Assist now provides a free tier to individual developers with a limit of 6,000 code completions and 240 chat requests daily.

Google emphasizes that Gemini Code Assist offers the highest free usage limits. It is indeed true that one of the strongest competitors to Code Assist, GitHub Copilot, only gives up to 2,000 code completions free per month. AWS CodeWhisperer also provides a free tier for individuals, apparently with no limits on code completions, but it does not include a chat.

Another feature in Code Assist that Google underlines is its 128,000 token context size. This is significantly less than the 2 million tokens provided in the Standard and Enterprise editions but is still a compelling offer for a free-tier. Among the advantages of a larger token context are the capability to handle larger codebases, better code completions, and improved multi-file understanding.

However, it is important to understand that Gemini Code Assist’s free tier has several limitations compared to its Standard and Enterprise tiers. For example, the Enterprise tier includes customized code suggestions based on an organization’s private repositories, support for BigQuery, Apigee, and more. The free tier also does not include any form of IP indemnification, which aims to protect Code Assist from certain IP-related challenges.

Another important factor to keep in mind is that while Google is explicitly saying that Code Assist Standard and Enterprise do not use prompts or responses for training, this is not the case with its free tier, where Google will collect prompts, related code, generated responses according to its privacy policy.

Powered by Gemini 2.0, Code Assist uses a specific version of the model customized using a large number of real-world coding samples within the public domain, Google says. While this makes it capable of understanding and generating code in many programming languages, Google defined a subset of languages that it ensures work at best with the model, including C/C++, C#, Go, JavaScript, Python, Kotlin, Swift, and many more.

Code Assist is integrated by default in Google’s Cloud-based IDEs, including the Cloud Shell Editor and Cloud Workstations, and is supported through extensions in Visual Studio Code and JetBrains IDEs.

NoSQL Database Market: Rapid Growth Driven by Big Data, Cloud Adoption, and Real-Time …

MMS • RSS

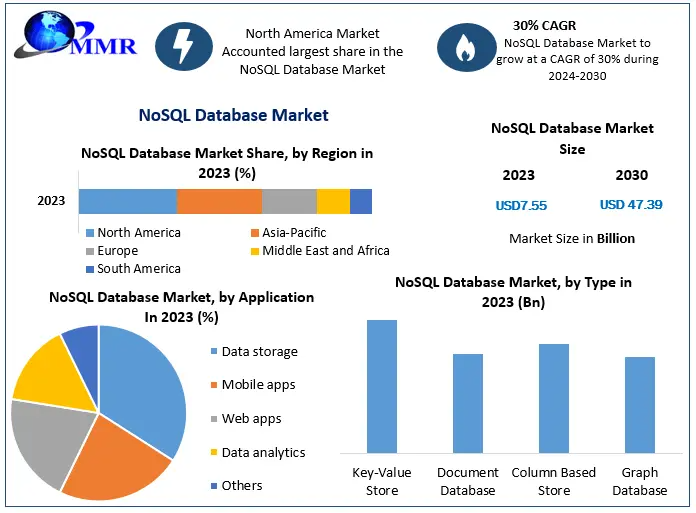

The NoSQL database market is set to hit $47.39B by 2030, driven by big data, AI, and cloud adoption, with MongoDB, AWS, and Redis Labs leading the industry.

NoSQL Database Market Poised for Remarkable Growth Driven by Big Data and Flexible Solutions

The NoSQL Database Market is projected to reach USD 47.39 billion by 2030, growing at a compound annual growth rate (CAGR) of 30% between 2024 and 2030. This surge is primarily fueled by the escalating demand for scalable, flexible, and high-performance database solutions capable of managing vast amounts of unstructured data.

Market Growth Drivers & Opportunities

The proliferation of big data across various industries necessitates robust data management solutions. NoSQL databases, with their schema-less architecture, offer the flexibility required to handle diverse data types, making them ideal for applications involving large-scale data analytics and real-time processing. The rise of social media platforms, e-commerce, and IoT devices has contributed significantly to the generation of unstructured data, further propelling the adoption of NoSQL databases.

Moreover, the increasing need for scalable and high-performance database solutions that can efficiently manage vast amounts of data is one of the major factors bolstering the NoSQL market share. In line with this, the growing adoption of NoSQL databases, owing to their ability to distribute data across multiple servers, is favoring the market growth.

Unlock your special edition of this report:

https://www.maximizemarketresearch.com/request-sample/97851/

Segmentation Analysis

The NoSQL database market is segmented based on type, application, and region.

By Type:

- Document-Based Databases: These databases store data in document formats, typically using JSON or XML. They are favored for their flexibility and ease of use, making them suitable for content management systems and e-commerce applications.

- Key-Value Stores: Utilizing a simple key-value pair mechanism, these databases are ideal for caching and session management, offering high performance and scalability.

- Column-Based Stores: Designed for analytical applications, column-based stores excel in handling large volumes of data and are commonly used in data warehousing solutions.

- Graph Databases: Specializing in representing and navigating relationships between data points, graph databases are crucial for applications involving complex interconnectivity, such as social networks, fraud detection, and recommendation engines.

By Application:

- Data Storage: NoSQL databases are extensively used for storing unstructured and semi-structured data, providing scalable solutions for enterprises dealing with massive datasets.

- Metadata Store: They serve as efficient repositories for metadata management, aiding in the organization and retrieval of data assets.

- Cache Memory: NoSQL databases function as high-speed caches, enhancing application performance by reducing data retrieval times.

- Distributed Data Depository: They facilitate distributed data storage across multiple servers, ensuring data availability and fault tolerance.

- e-Commerce, Mobile Apps, Web Applications: NoSQL databases power various applications, offering flexibility and scalability to meet dynamic user demands.

- Data Analytics: They play a pivotal role in big data analytics, enabling real-time data processing and insights generation.

- Social Networking: NoSQL databases efficiently manage the vast amounts of user-generated content and interactions on social media platforms.

Unlock your special edition of this report:

https://www.maximizemarketresearch.com/request-sample/97851/

Regional Analysis

United States:

The United States leads in the adoption of NoSQL databases, driven by a robust technology sector and the presence of major cloud service providers. The demand for scalable data solutions in industries such as finance, healthcare, and retail has accelerated the integration of NoSQL technologies.

Germany:

Germany’s emphasis on Industry 4.0 and the digitization of manufacturing processes has led to increased adoption of NoSQL databases. The need for real-time data processing and analytics in automotive and engineering sectors has been a significant growth driver.

China:

China’s rapid digital transformation, coupled with the expansion of e-commerce and social media platforms, has resulted in a substantial increase in unstructured data. NoSQL databases have become essential in managing this data deluge, supporting applications ranging from online retail to smart city initiatives.

India:

India’s burgeoning IT industry and the proliferation of mobile applications have spurred the adoption of NoSQL databases. The country’s focus on digitalization and initiatives like Digital India have further accelerated market growth.

United Kingdom:

The UK’s financial services sector, with its emphasis on real-time analytics and customer personalization, has been a significant adopter of NoSQL technologies. Additionally, the media and entertainment industry’s shift towards digital platforms has contributed to market expansion.

Access an exclusive preview of this report:

https://www.maximizemarketresearch.com/checkout/?method=PayPal&reportId=97851&type=Single%20User

Competitor Analysis

The NoSQL database market is characterized by the presence of several key players, each contributing to the market’s dynamic landscape.

Top 5 Players by Market Share:

1. MongoDB, Inc.: A leading provider of document-based NoSQL databases, MongoDB offers a flexible and scalable platform that has been widely adopted across various industries.

2. Amazon Web Services (AWS): Through its DynamoDB service, AWS provides a fully managed key-value and document database, ensuring low latency and scalability for internet-scale applications.

3. Couchbase, Inc.: Couchbase offers a multi-model NoSQL database that combines the capabilities of document and key-value stores, catering to enterprise-level applications.

4. DataStax, Inc.: Built on Apache Cassandra, DataStax delivers a distributed NoSQL database designed for hybrid and multi-cloud environments, emphasizing high availability and scalability.

5. Redis Labs: Known for Redis, an in-memory data structure store, Redis Labs provides solutions that support various data structures, offering high performance for caching and real-time analytics.

Recent Developments:

- ScyllaDB: In July 2022, ScyllaDB introduced ScyllaDB V, the latest iteration of their high-performance NoSQL database designed for data-intensive applications requiring low latency. In December 2022, ScyllaDB announced achieving remarkable NoSQL performance results on the new AWS I4i instances

Discover What’s Trending:

Europe Blockchain Market:

https://www.maximizemarketresearch.com/market-report/europe-blockchain-market/2951/

Retail Media Networks Market:

https://www.maximizemarketresearch.com/market-report/retail-media-networks-market/147754/

Data Historian Market:

https://www.maximizemarketresearch.com/market-report/global-data-historian-market/63023/

About Us:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

MMS • Santosh Yadav

Transcript

Yadav: When I was asked to come here and give a talk, I was thinking about how not to give a talk which we have been through, because at Celonis, we went through a lot of troubles to where we are right now, so it’s like a journey, and the tools which we used in the process to make us deliver faster. Nx is one of the most important tools which we use in our ecosystem. That’s why I just mentioned it in the talk title as well. We’ll talk about Nx as well. Let’s see what we are going to talk about.

First, I want to show you how our application looks like. This is our application. If you see the nav bar, actually each nav bar is actually an application. It’s a separate application which we load inside our shell. Even inside the shell, there can be multiple components which we can combine together and create a new dashboard for our end users. It means there are different teams which are building these applications. This is where we are right now.

Problem Statement

How did we start? I just want to show you what the problem statement was. What was the problem or the issue which we were trying to resolve? Then we ended up here. This was our old approach. I was speaking to some of my friends, and we were talking about the same issue where we have multiple repositories, but we are still thinking about, of course, moving all the code to a single monorepo stuff, but we are not able to do it. Or we are struggling, like we know that there might be challenges. This is where we were three years ago. We had separate apps with separate repositories. We used to load each app using URL routing. It’s not like SPA or module federation or microcontent, which we know today. Because in the past few years, tools have added more capabilities.

For example, webpack came with the support of module federation, which was not there earlier. Everyone was solving module federation in some different ways, just not in the right way. This is another issue which we had. Of course, we had close to 40 different repositories, and then we used to build those code. We are using GitHub Actions. Of course, we used to build that code, push it in the artifact or database, because that was the one way to load the application. We used to push the entire build into the database and then load it on frontend. The only problem is we were doing it X times. The same process, same thing, just 30 times. Of course, it costs a lot of money. The other issue which we had was, of course, we have a design system.

Which company doesn’t have a design system? The first thing which a company decides to do is, let’s have a design system. We don’t have a product, but we should have a design system. This was another issue which we had. Now this became a problem. Of course, we had a design system, but now different applications started using different versions of design system, because sometimes they had time. Some teams started pushing back, we don’t have frontend developers or we don’t have time to upgrade it right now. This was, of course, a big pain. How should we do it? This caused another issue.

Some of our customers are actually seeing the same app, but as soon as they move to a different application or part of the application, they see a different design system. There’s probably a dark theme and light theme, just as an example. Think about a different text box. Someone is seeing a different text box and someone is seeing different.

What were the issues we went through? Page reloads, for example, of course, now with HTML5, everyone knows of course, the experience should be smooth. As soon as I click on the URL, there should not be page refresh. That’s the expectation of today’s users. This is not early ’90s or 2000 where we can just click on a URL and wait for one hour to download my page. This is the thing of the past. Our users were facing this issue. Every page, every app, it reloads the entire thing. Bundle size, of course, we could not actually tree shake anything, or there was no lazy loading. Of course, there was a huge bundle size which we used to download.

Of course, when we have to upgrade Angular or any other framework, this can be any other framework which you are using in your enterprise. We are using Angular, of course. We had too much effort upgrading Angular because we have to do it 30 times. Plus, our reusables and design system. Maintaining multiple versions of shared libraries and design system became a pain because we cannot move ahead and adopt the new things which are available in Angular or any other ecosystem because it’s always about backward compatibility.

Everyone knows, backward compatibility is not a thing. It’s just a compromise. It’s a compromise we do that, ok, we have to support this. That’s why we are just still here. Now, as we said, we had 30-plus apps and then we used to deploy them separately. We had to sync our design system, which we saw in the previous slide. Which was, again, very difficult because for a few seconds or a few minutes, if your releases are not synchronized, you will see different UIs.

What Is Nx?

Then came Nx. Of course, we started adopting Nx almost three years back. Let’s see what is Nx. It’s a build tool. It’s an open-source build tool, which is available for everyone. You can just start using it for free. There’s no cost needed. It also supports monorepo. Monorepo is just an extra thing which you get. The main thing is it’s a build tool. It’s a build tool you can use. Let’s see. It actually provides build cache for tasks like build and test. As of today, one thing which we all are doing is we are building the same code again and again. Nx takes another approach. The founders actually are from Google. Everyone knows Google has different tools.

If you have a colleague from Google, you keep hearing about, we had this tool and we had that tool, and how crazy it was. Of course, these people, they used to work in the Angular team. They took this idea of Bazel. Bazel was, of course, the idea, because Google uses it a lot. They built the entire Nx based on it. Eventually, they launched it for Angular first, and then now it’s platform technology independent. As I said, it’s framework and technology agnostic. You can use it for anything. It’s plugin based, so you can bring your own framework. If there is no support for any existing technology, you can just add it. Or if you have any homegrown framework, you build it on your own. You can also bring it as a plugin, as part of Nx, and you can start getting all the features which Nx offers.

For example, build cache. It supports all the major frameworks out of the box. For example, Angular, React, Vue. On top of it, it supports micro-frontend. If you want to do micro-frontend with React or Angular, it’s just easy. I’ll show you the commands. It also supports backend technologies. They have support for .NET, Java, Spring. They have support for Python. They also added support for Gradle recently. As I said, it’s wide.

Celonis Codebase

This is our codebase as of today. We have 2 million lines of code. We have close to 40-plus applications. We have 200 projects. Why are applications not projects? Because we also have libraries. We try to split our code into smaller chunks using libraries, so that’s why we have close to 200 projects. Then, more than 40-plus teams which are contributing to this codebase. We get close to 100 PRs per day. That’s average. There are some times where we get more. With module federation, this is what we do today. We are not loading those applications via URL routing. It’s just the Angular application loads natively. We have multiple applications here. Shell app is something which just renders your nav bar.

Then you can access any apps. It just feels like you’re a single page application. There is no reload. We can do tree shaking. We can actually do code splitting. We can also share or reduce the need to share our design system across the application, because now we have to do it only once. These are some tasks which we run for each and every PR. Of course, we do build. Once you write your code, the first thing which you do is you build your project. Then we write unit tests. We use Jest. We also have Cypress component test to write our test. Then we, of course, run it on the CI as well. Before we merge our PR, we also run end-to-end test. We are using Playwright for writing our end-to-end test or user journey.

Then, let’s see how to start using module federation with Angular. You can just use this command. You can generate nx generate. For any framework, you will find nx generate. Then you will say nx, and the framework name. You can just here, for example, replace Angular with React, and you get your module federated app or micro-frontend app for your React application. These remotes are actually applications which will be loaded when you route through your URLs. For example, home, about, blogs, this can be different URLs which we have. They are actually different applications. It means your three teams can work on three different applications but, at the end, they will be loaded together.

Feature Flags

We use feature flags a lot because when we started migrating all of the codebase, it became a mess. Of course, a lot of teams started pushing their code in a single codebase. We were coming from different teams. A different team had their different ways to write code. We had feature flags for backend. Of course, that was something which was taken care of. At the frontend, we were seeing a lot of errors. We thought of creating a feature flag framework for our frontend application. This is how it feels like without feature flag. I’ve seen this meme many times. This always says, this is fine. We believe this is not fine. If your organization is always on fire, this is not fine. This is not fine for everyone. You should not do 24 by 7 just monitoring your systems because you just did a release. This is where we started. Of course, we had a lot of fires.

Then we decided, of course, we will have our own feature flag framework for frontend applications. This is what we used to think before we had a feature flag. We’re used to, ok, backend, frontend, we will merge it. Then everything goes fine. We’ll do a release, and everyone is happy. This is not the reality. This looks good on paper but, in reality, this is what happens once you merge your code. Everything just collapses. We started with this. We started creating our frontend feature flag to do this. We now have the ability to ship a feature based on a user, based on a cluster. We can also define how many percentages of users or customers we want to ship this feature to. Or we can also ship a specific build. We generally try to avoid this. This is something which we use for our POCs.

Let’s say if you want to do a POC for a particular customer, we can say, just use this build. That customer will do its POC, and if they’re fine or they’re happy with this, we can go ahead and write for the code. For example, of course, we have to still write tests. We have to write user journey test. This is just for POC. We can also combine all of the above. We ended up with this. We started seeing, now there are less bugs, because now the bugs are isolated, because they are behind a feature flag. We also have the ability to roll back a feature flag if anything goes wrong. We don’t have to roll back the entire release, which was the case earlier. Now we are shipping features with more confidence, which we need.

Before you ask me which feature flag solution we are using, I’m not here to sell anything. We built our own. We decided to build our own. How? Again, Nx comes into the picture. Because Nx, as I said, is plugin based. You can build anything and just create it as a plugin. You get everything out of the box. It feels native. It feels like you are still working with Nx. This is the command. You can just say, nx add and a new plugin. You can define where you want to put that plugin into. For our feature flag solution, we use a lot of YAML files. We added all the code to read those YAML files as part of our plugin. It’s available for everyone.

One thing which you have to focus more on, in case you are creating a custom solution, is developer experience. Otherwise, no one will use it. We also added the ability to enable/disable flags. Developers can just raise a PR and enable and disable a feature flag. We also added some checks that no one should disable a flag in case it’s already being used, and no one knows about it. There are some checks. Like, for example, your release manager or your team lead has to approve it.

Otherwise, someone just does it by mistake. Then we also have a dashboard where you can see which features are enabled and in which environment. Our developers can also see that. We also have a weekly alert, just in case there is a feature flag which is GA now, and it’s available for everyone. We also send a weekly alert so developers can go ahead and remove those feature flags. This is fine, because we know where the fire is, and we can just roll it back.

Proof of Concepts

Of course, when you have a monorepo, the other problem which we have seen is that a lot of teams are actually not fans of monorepos, because they think they’re being restricted to do anything. This is where we came up with the idea like, what if teams want to do a proof of concept? Recently, there were a few teams which said, we want to come into the monorepo, but the problem is our code is something which is a POC. We don’t want to write tests, because we also have checks. I think most of you might have checked for your test coverage. You should have 80%, or 90%, or whatever. I don’t know why we keep it, but it’s useful, just to see the numbers.

Then we said, let’s give you a way so you can start creating POCs, and we will not be a blocker for you anymore. In Angular, you can just say, I’ll define a new remote, and that’s it. A new application is created. They can just do it. Another issue is, most of the enterprises, they have their own way of creating applications. They may need some customization. That, I want to create an application, but I need some extra files to be created when I create this application. Nx offers you that. Nx offers you the way to customize how your projects will be created. For example, in our use case, what we do is whenever we create an Angular application, we also add the ability to write component test. What we did is we just took the functionality from Nx, added all this into a single bundle or a single plugin, and we gave it to our developers.

That whenever you create a new application, you will also get component test out of the box. Or let’s say it can be your Cypress, or it can be your Playwright, or it can be anything which you like. For example, you want to create some extra files, for example, maybe Dockerfile, or maybe something related to your deployment, which is mandatory for each and every app. You can customize the way your applications are created by using the generators. This is called Nx Generator. As I said, you can also create files. You can define the files wherever you want to. Generally, we use files as a folder. You can put all the files.

For example, as I said, Dockerfile, or any other files which you need for configuration. You can pass them as a parameter. It uses a format called EJS. I’m not sure how many people are aware of EJS. It uses a syntax called EJS to replace any variables into the actual file. Here, I’m talking about the actual file. This is not any temporary files. I’m talking about the actual files which will be written on the drive. You can all do this with the help of Nx Generator. This is what we do whenever someone creates a new application. We just add some things out of the box.

Maintaining a Large Codebase

When it comes to maintaining a large codebase, because now we are here, we have 2 million lines of code in a single repository, there are a few things which we have to take care of. For example, refactoring. We do a lot of refactoring because we got the legacy code. I’m sure everyone loves legacy code, because you love to hate it. Then, we keep doing deprecations. This is one thing I think we are doing better, that we are doing deprecations. As soon as we see some old code, we start deprecating that code if it’s not used. Then, migration. Of course, over the period of time, we have migrated multiple apps into our monorepo.

We still support, just in case anyone wants to migrate their code to our monorepo. It took us time. It took us close to two years. Now we are at the stage where I think we have only one app, which is outside our monorepo. This is not going to happen in a day, but you have to start someday. Then, adding linters and tools. Of course, this is very important for any project. You need to have linters today. You may need to add tools tomorrow. Especially with the JavaScript ecosystem, there is a tool every one hour, I think. Then, helping team members. This is very important in case you are responsible for managing your monorepo. I’m sure if you end up doing this, initially you will end up actually doing this a lot.

Most of the time, you’ll be helping your new developers onboard into a monorepo. This is very important, again. Documentation, this is critical, because if you don’t do this, then more developers will rely on you, which you don’t want to. It will take your time away. Then the ability to upgrade Angular framework for everyone. Whatever framework you use, we use Angular, but in case you use React or Vue. This is what we wanted. This is what comes under the maintaining our monorepo. How do we do this? For example, Nx offers something called nx graph. If I run nx graph, I get this view, where I can see all the applications, all the projects.

I can figure out which library is dependent on which app. If I want to refactor something, I can just check if this is being used or not by using the nx graph. Or if there is something refactored which is required, I can just look at this graph and say, probably this UI should not be used in home, it should be used in blogs. Then you can just refactor your code. It helps a lot during refactoring and during deprecations as well.

Now, talking about the migrations. As I said, you may have to migrate a lot of code to your monorepo once you start, because all the code is available in different repositories. Nx offers you a command called nx import, where you can define your source repository and your destination repository, and it will migrate your code with your Git history. This command just came in the last release. From past years, we have been doing it manually. We did it for more than 30 repositories, but we did it manually. The same thing is now available as part of Nx. You can just run this command and do everything automatically. We deploy our documentation on Backstage.

This is what we do, so everyone is aware of where the documentation is. We use Slack for all the communications or any new initiatives or deprecations which we are announcing. We have a dedicated Slack channel, so just in case developers have any questions, they can ask on this channel. It actually improves the knowledge sharing as well, because if someone already knows something, we don’t have to jump in and say, this is how you should do it. It reduced a lot of dependency from us, the core team. Education is important.

We started doing a lot of workshops initially when we moved to a monorepo, just to give the confidence to the developers that we are not taking anything from you. We are actually giving you more control over your codebase, and we are just here to support. We started educating. We did multiple workshops. Whenever we add a new tool, we do a workshop. That’s very important.

Tools

As I said, every other hour, you are getting a tool. What should you use? Which tool should you add? This is true that, of course, introducing a tool in a new codebase is very time consuming. You may actually end up doing probably two, three days just to figure out how to make this tool work. At the same time, sometimes adding a tool is easy, but maintaining it is hard. Because as soon as you add it, there is a new tool, which is available the next hour, which is much more powerful than this. Now you are maintaining this tool, because there is no upgrades. Most of your code is already using this tool, so you cannot actually move away from this now.

At the end of the day, you have to just maintain this code or maintain this tool. Nx makes it easy. It also makes it easy to introduce a new tool and maintain a new tool. Let’s see how. Nx offers you support out of the box for the popular tools, for example, Cypress and Playwright. This is now a go-to tool for writing end-to-end tests. I’m not sure about the others, but it’s widely used in the JavaScript ecosystem. Anyone who starts a new project probably now goes for Playwright, but there was a time that many people were going with Cypress. Nx, just a command, and then you can just start adding or start using this tool. You don’t have to even invest time configuring this. You just start using it. That’s what I’m talking about.

For unit tests, it gives you Jest and Vitest out of the box. You can just add this and then start using it. No time needed to configure this tool. What about the upgrades? Nx offers you something called Migrate. With the migrate command, you can just migrate everything to the latest version. For example, if you’re using React and you want to move to the new React version, you can just say nx migrate latest, and it will migrate your React version. Same for Angular. This is what we do now. We don’t invest a lot of time doing manual upgrades or something. We just use this nx migrate, and our code gets migrated to the new version. It works for all the frameworks, all the technologies which is supported by Nx, but you can also do it for your plugins.

For example, let’s say if you end up writing something for your own company, a new plugin, and you want to push some new updates, you can just write a migration, where this migration tool will just automate the migration for your codebase, and your developers don’t have to even worry about what’s happening. Of course, you have to make sure that you test it properly before shipping.

Demo

I’ll show you a small demo, because everything we saw was a picture. Always believe when you see something running, otherwise, don’t. This is how your nx graph looks like, whenever you run nx graph, and you can click on Show all projects. Then you can hover on any project and see how it is connected, like how it’s being used, which application is dependent on which application. For example, shell, you see dotted lines. Dotted lines is lazy loading. It means they are not directly related, but they are related.

For example, Home and UI, it says that there is a direct dependency. You can figure out all this from nx graph. It also gives you the ability to see tasks, tasks like build or lint. Let’s say if you make a code change, you can figure out what tasks will be run after my code change. Which builds will be running? Which applications will be affected? Everything you can figure out from this nx graph. This is free, so you don’t have to pay. I’m just saying this is one of the best features which I have seen, which is available for free. Let me show you the build. I talked about caching. Let’s run a build, nx run home:build. I’ll just do production build. It’s running the build. This line is important. It says, 1 read from cache. Let’s say if you make some changes, like right now, one thing about monorepo, people think I have 40 projects.

Whenever I make changes, my 40 projects will be built. Monorepos have actually a bad name for this. I have done .NET, so I know. We used to have so many projects, and then rerun the same code or build the same code again and again, but not with Nx. Nx knows your dependency graph, so it can figure out what needs to be built again and what needs to be read from the cache. They do it really well. Here we can see one read from cache, because I already built it before. It just retrieved the same build from the cache. Now let’s say, 40 teams working on 40 different apps, but one team makes changes to its own app, then 39 apps are not built again, because Nx knows from dependency graph that this application is not affected, so I don’t have to build anything.

If I try to build it again, so next time it will just retrieve everything from cache. Now it’s faster than before. It says now it took 3 seconds, which earlier was 10 seconds. This is what Nx offers you out of the box. Nx is available for your builds, your test, your component test, or your end-to-end test, anything. All the tasks can be cached. This is caching.

CI/CD

Of course, CI/CD, there is always one guy in your team who is asking for faster builds. I was one of them. We use GitHub Actions with Nx, which gives us superpower. How do we do it? We use actually larger runners on GitHub Actions. We use our own machines. We used to use GitHub-provided machines, but it was too expensive for us. We moved on to using our own machines now. We use Merge Queue to run end-to-end tests. I’ll talk about Merge Queue, because this is an amazing feature given by GitHub. This is only available for enterprises. We can cache build for faster build and test, which we saw on the local. What we saw was on the local. I’ll show you how we do it on CI. Let’s talk about Merge Queue and user journey test first.

One thing about user journey test is they are an excellent way to avoid bugs. Everyone knows. Because you are testing in a real-time simulation, because you are actually going to log in and click on a button to process something. We all know that if you try running user journey on every PR, it will be very expensive, because we are interacting with the real database. It may take a lot of time to complete your build. We also know that when you are running multiple branches, this is another issue. Because the next branch will soon go out of sync with the main branch because you already have latest changes in main branch.

Then running the user journey test again on an old branch is pointless because now you don’t have latest changes. It means there is chances that you may introduce errors. This is where actually Merge Queue was introduced by GitHub. Let’s see how it works. Let’s say these are four PRs in your pipeline, PR is pull request, and PR 4 fails, so it’s removed from your queue. These three PRs, PR 1, PR 2, PR 3, will be sent to your Merge Queue. Merge Queue is actually a feature provided by GitHub, which you can enable from your settings. You can define how many PRs you need to consider for Merge Queue. We do 10. Ten PRs will be pushed to Merge Queue at once. You can change. Because we have 100 PRs per day, we found that this is our average. We can do 10.

In your case, if you get more PRs, you can just increase the number of PRs which you want to push into Merge Queue. Then once it goes to Merge Queue, this is how it works. GitHub will create a new branch from your PR, the first PR, and the base branch will be main. Then it will rebase your changes from PR 1 to this new branch, which is created, but it will not do anything else. The branch is created. That’s it. Then it creates another branch called PR 1, PR 2. Now the PR 1 branch is your base. Then it will merge PR 2 changes into this branch. Now it’s latest code. Same with PR 3. Now it will create PR 1, PR 2, PR 3, take PR 1, PR 2 as base, and PR 3 changes will be merged to this branch.

After this, it will run all the tasks which are actually available on your CI/CD. For example, you run build, you run test, you run your component test, plus user journey test. Whenever you are running user journey test, you are running it on latest code. It’s not the old code which is out of sync. Yes, it reduces the number of errors you have.

Before I go with affected, I want to give some stats, like how we are doing today. With 2 million lines of code, 200 projects, as of today, our average time for each PR is 12 minutes. For entire rebuild, it’s 30 minutes. It’s all possible because we take usage of affected builds. Because Nx knows what has been affected, so this is what it does internally. For example, Lib1, Lib2, it affects five different applications. Your change is this. You push a new code, which affects your library 1, in turn affects App1 and App3. What we will do is we will just run affected tasks. We will say, run affected and do build, lint, test. That’s it. We retrieve the cache from S3 bucket.

As of today, we are using S3 bucket to push our cache and then retrieve it back whenever there is a change. We just retrieve it back from the S3 bucket. You can do it if you have money. There is a paid solution by Nx, it’s called Nx Cloud. You can just remove this. You don’t have to do it on your own. Nx Cloud can take care of everything for you. It can actually even do cache hit distribution. I’m talking about cache hit distribution on your CI pipeline as well as on your developer’s machine. Your developers can get the latest build, which is available on the cache, and they don’t have to build even a single thing. It’s very powerful, especially if you are onboarding new developers. They can just join your team on day one, within one hour, they are running your code without doing anything, because everything is already built.

As soon as they make changes, they are just building their own code and not everything. If you want to explore Nx Cloud, just go to nx.dev, and then you will find a link for Nx Cloud. As of today, we are not using Nx Cloud because it was probably too expensive for us and not a good fit, but if you have a big organization? As I said, Nx Cloud works for everyone. It’s not only for frontend or backend: any technology, any framework. This is an example from our live code. We have our design system. For example, when I tried to run it for the first time, it took 48 seconds. The next run took us 0.72 seconds, not even a second. This is a crazy level of time which we save on every time we build something. Our developers are saving a lot of time. They are drinking less coffee.

Release Strategy

The last thing is about the release strategy. One thing at Celonis, is we love our weekends. I’m sure everyone loves their weekend, but we really care about it. Our release strategy is actually built around the same, that we don’t have to work on weekends. This is what we do. Of course, we have 40-plus apps, so we know that this is risky, so we don’t do Friday releases. Because it’s not fun, going home and working on Saturdays and Sundays to fix some bugs. What we do today, we create a new release candidate every Monday morning. Then we ask teams to run their test. It’s a journey. There are teams who have automated tests. There are teams who don’t have automated tests. They do manual or whatever way they are doing, or they just say, ok, it’s fast. You should not do that, but, yes, that might be a possibility. They execute their tests, automated or manual.

If everything goes fine, we deploy by Wednesday or Thursday. Wednesday is our timeline that we ask every team to finish their test by Wednesday, or worst case, Thursday. If something goes wrong, we say, no release this week. Because we are already on Thursday, if we do a release, it means our weekends are destroyed. We don’t like that. We really care about our weekends, so we cancel our release, and then we say, we’ll come back on Monday and then see if it goes ahead and we can do a deployment. If everything goes green, we just deploy and then go home and monitor it for Monday, either Thursday or Friday, based on when we release. Everything is happy. Then we do this again next week.

Of course, there are some manual interventions which are required here. This is where we want to be. Of course, every company has a vision. Every person has a vision. We also have a vision. This is what we want to do. We want to create a release candidate every day. If CI/CD is green, we want to deploy to production. That’s it. If there’s something which goes wrong, we want to cancel our deployment and do it next day. Renato accidentally mentioned 40 releases per week. We at least want to do five releases a week. That’s our goal. Probably we will be there one day. We are probably very close to that, but it will take us some time.

Questions and Answers

Participant 1: I have a question about end-to-end test. As I understand you call it user journey test. How do you debug that in this huge setup of 40 teams? Let’s say if test is red, how do I understand root causes? It can be a problematic red.

Yadav: Playwright actually has a very good way to debug the test. We use Playwright. Then it comes with a debug command. You can just pass, –debug, and whichever application is giving us an error, you can just debug that particular application. You don’t have to debug 40 applications. We also have insights. Whenever we run tests, we push the data of success and failure on Datadog. We display it on our GitHub summary. Even the developer knows which test is failing. They don’t have to look into the void and see, what’s going wrong? They know, this is the application, and this is what I have to debug.

Participant 2: I was wondering if you also integrate backend systems into this monorepo, or if it was a conscious decision not to do so.

Yadav: It does support. As I said, you can actually use your backend, like .NET Core. I think it supports Spring, as well as Maven. Now they added support for Gradle as well. You can bring whatever framework or whatever technology you want to. We are not using it because I think that’s not a good use case for us. I think more teams will be happy with having the current setup where they own the backend, and the frontend is owned by a single team.

Participant 3: How do you handle major framework updates or, for example, design system updates? Because I think in the diagram you showed that you try to do it like every day release. I can imagine that with many breaking changes, this is not how it can work. You need more time to test and make sure it’s still working.

Yadav: We actually recommend every developer write their own test. It’s not like another team who is writing the test. That’s one thing. Of course, about the upgrades, this is what we do. We have the ability to push a specific build. For example, Angular 14 upgrade, which was a really big upgrade for us, because after Angular 13, we were doing it for the first time, and there were some breaking changes. We realized very early that there are some breaking changes. We wanted to play safe. What we did is with feature flag, we started loading only Angular 14 build for some customers and see how it goes. We rolled it out initially for our internal customers, like our users.

Then we ran it for a week. We saw, ok, everything is fine. Everything is good. Then we rolled it out for 20% of the users. Then we monitored it again for a week. Then 50%, and now we will go 100%. This is very safe. We don’t have any unexpected issues. With design system, we do it weekly. It’s like design system is owned by another team, so they make all the changes. They also do it on Monday. They get enough time, like four or five days, to test their changes, and then make it stable before the next release goes.

Participant 4: You explained about the weekly release. How do you handle hotfix with so many teams?

Yadav: Of course, there will be hotfixes, we cannot avoid this. There will be some code which goes by mistake on release. We try to capture hotfixes or any issues on release before they go on to production. Just in case there is anything which needs to be hotfixed, they generally create a PR with the last release, which is there. Then we create a new hotfix. It’s all automated. You just need to create a new release candidate from the last build, which we had, and just push a new build again. Good thing is, with the setup, it’s not like we have to roll back the entire release.

See more presentations with transcripts

MMS • Steef-Jan Wiggers

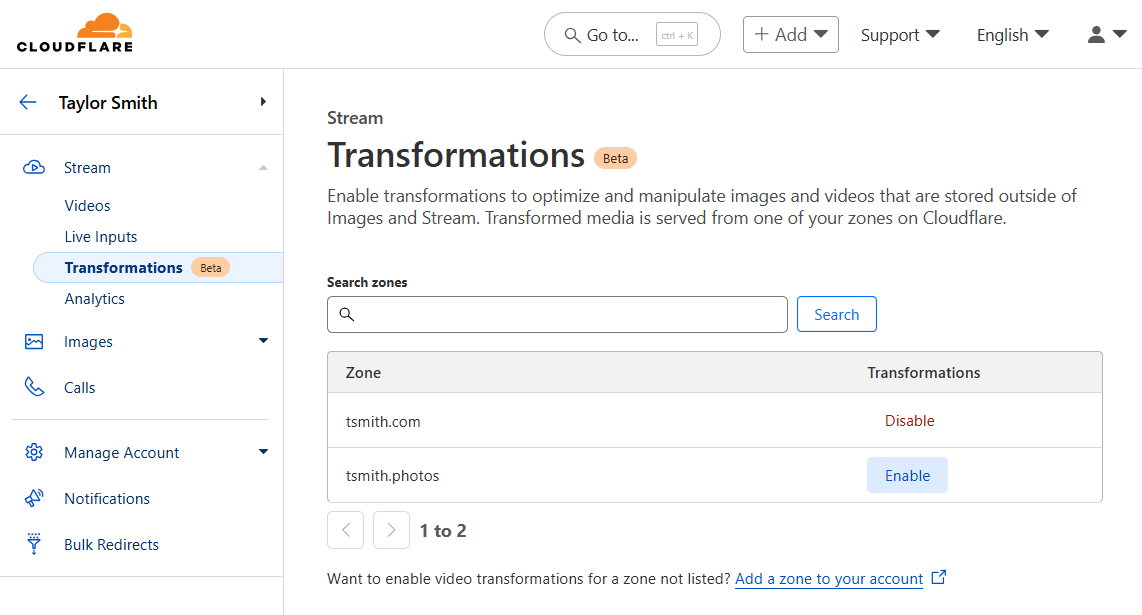

To streamline video optimization for the explosion of short-form content, Cloudflare has launched Media Transformations, a new service that extends its Image Transformations capabilities to short-form video files, regardless of their storage location, eliminating the need for complex video pipelines.

With the service, the company aims to simplify video optimization for users with large volumes of short video content, such as AI-generated videos, e-commerce product videos, and social media clips.

Traditionally, Cloudflare Stream offered a managed video pipeline, but Media Transformations addresses the challenge of migrating existing video files. By allowing users to optimize videos directly from their existing storage, like Cloudflare R2 or S3, Cloudflare aims to reduce friction and streamline workflows.

(Source: Cloudflare blog post)

Media Transformations enables users to apply various optimizations through URL-based parameters. Using URL parameters, Media Transformations enables automation and integration, allowing dynamic video adjustments without complex code changes – simplifying workflows and ensuring optimized video delivery across various platforms and devices.

The key features of the service include:

- Format Conversion: Outputting videos as optimized MP4 files.

- Frame Extraction: Generating still images from video frames.

- Video Clipping: Trimming videos with specified start times and durations.

- Resizing and Cropping: Adjusting video dimensions with “fit,” “height,” and “width” parameters.

- Audio Removal: Stripping audio from video outputs.

- Spritesheet Generation: creating images with multiple frames.

The service is accessible to any website already using Image Transformations and new zones can be enabled through the Cloudflare dashboard. The URL structure for Media Transformations mirrors Image Transformations, using the /cdn-cgi/media/ endpoint.

Initial limitations include a 40MB file size cap and support for MP4 files with h.264 encoding. Users like Philipp Tsipman, founder of CamcorderAI, quickly pointed out the initial limitations, tweeting:

I really wish the media transforms were much more generous. The example you gave would actually fail right now because QuickTime records .mov files. And they are BIG!

Cloudflare plans to adjust input limits based on user feedback and introduce origin caching (Cloudflare stores frequently accessed original videos closer to its servers, reducing the need to fetch them repeatedly from the source).

Internally, Media Transformations leverages the same On-the-Fly Encoder (OTFE) platform Stream Live uses, ensuring efficient video processing. Cloudflare aims to unify Images and Media Transformations to simplify the developer experience further.

In addition to the Cloudflare offering, alternatives are available regarding video optimization, such as Cloudinary, ImageKit, and Gumlet, which have comprehensive features for format conversion, resizing, and compression. Other cloud providers, such as Google Cloud Platform, offer various cloud services, including video processing and delivery solutions. While not solely focused on video transformation, it provides the building blocks for creating custom solutions.

Lastly, Cloudflare highlights use cases such as optimizing product videos for e-commerce, creating social media snippets, and generating thumbnails. The service is currently in beta and free for all users until Q3 2025, after which it will adopt a pricing model similar to Image Transformations.

MongoDB Inc.: Will Its Diversification & Expansion of Atlas Platform Help Achieve the Set Goal?

MMS • RSS

Begin exploring Smartkarma’s AI-augmented investing intelligence platform with a complimentary Preview Pass to:

- Unlock research summaries

- Follow top, independent analysts

- Receive personalised alerts

- Access Analytics, Events and more

Join 55,000+ investors, including top global asset managers overseeing $13+ trillion.

Upgrade later to our paid plans for full-access.

MMS • Nehme Bilal

Key Takeaways

- Message brokers can be broadly categorized as either stream-based or queue-based, each offering unique strengths and trade-offs.

- Messages in a stream are managed using offsets, allowing consumers to efficiently commit large batches in a single network call and replay messages by rewinding the offset. In contrast, queues have limited batching support and typically do not allow message replay, as messages are removed once consumed.

- Streams rely on rigid physical partitions for scaling, which creates challenges in handling poison pills and limits their ability to dynamically auto-scale consumers with fluctuating traffic. Queues, such as Amazon SQS and FIFO SQS, use low-cardinality logical partitions (that are ordered), enabling seamless auto-scaling and effective isolation of poison pills.

- Streams are ideal for data replication scenarios because they enable efficient batching and are generally less susceptible to poison pills.

- When batch replication is not required, queues like Amazon SQS or FIFO SQS are often the better choice, as they support auto-scaling, isolate poison pills, and provide FIFO ordering when needed.

- Combining streams and queues allows organizations to standardize on a single stream solution for producing messages while giving consumers the flexibility to either consume directly from the stream or route messages to a queue based on the messaging pattern.

Messaging solutions play a vital role in modern distributed systems. They enable reliable communication, support asynchronous processing, and provide loose coupling between components. Additionally, they improve application availability and help protect systems from traffic spikes. The available options range from stream-based to queue-based services, each offering unique strengths and trade-offs.

In my experience working with various engineering teams, selecting a message broker is not generally approached with a clear methodology. Decisions are often influenced by trends, personal preference, or the ease of access to a particular technology; rather than the specific needs of an application. However, selecting the right broker should focus on aligning its key characteristics with the application’s requirements – this is the central focus of this article.

We will examine two of the most popular messaging solutions: Apache Kafka (stream-based) and Amazon SQS (queue-based), which are also the main message brokers we use at EarnIn. By discussing how their characteristics align (or don’t) with common messaging patterns, this article aims to provide insights that will help you make more informed decisions. With this understanding, you’ll be better equipped to evaluate other messaging scenarios and brokers, ultimately choosing the one that best suits your application’s needs.

Message Brokers

In this section, we will examine popular message brokers and compare their key characteristics. By understanding these differences, we can evaluate which brokers are best suited for common messaging patterns in modern applications. While this article does not provide an in-depth description of each broker, readers unfamiliar with these technologies are encouraged to refer to their official documentation for more detailed information.

Amazon SQS (Simple Queue Service)

Amazon SQS is a fully managed message queue service that simplifies communication between decoupled components in distributed systems. It ensures reliable message delivery while abstracting complexities such as infrastructure management, scalability, and error handling. Below are some of the key properties of Amazon SQS.

Message Lifecycle Management: In SQS, the message lifecycle is managed either individually or in small batches of up to 10 messages. Each message can be received, processed, deleted, or even delayed based on the application’s needs. Typically, an application receives a message, processes it, and then deletes it from the queue, which ensures that messages are reliably processed.

Best-effort Ordering: Standard SQS queues deliver messages in the order they were sent but do not guarantee strict ordering, particularly during retries or parallel consumption. This allows for higher throughput when strict message order isn’t necessary. For use cases that require strict ordering, FIFO SQS (First-In-First-Out) can be used to ensure that messages are processed in a certain order (more on FIFO SQS below).

Built-in Dead Letter Queue (DLQ): SQS includes built-in support for Dead Letter Queues (DLQs), which help isolate unprocessable messages.

Write and Read Throughput: SQS supports effectively unlimited read and write throughput, which makes it well-suited for high-volume applications where the ability to handle large message traffic efficiently is essential.

Autoscaling Consumers: SQS supports auto-scaling compute resources (such as AWS Lambda, EC2, or ECS services) based on the number of messages in the queue (see official documentation). Consumers can dynamically scale to handle increased traffic and scale back down when the load decreases. This auto-scaling capability ensures that applications can process varying workloads without manual intervention, which is invaluable for managing unpredictable traffic patterns.

Pub-Sub Support: SQS does not natively support pub-sub, as it is designed for point-to-point messaging where each message is consumed by a single receiver. However, you can achieve a pub-sub architecture by integrating SQS with Amazon Simple Notification Service (SNS). SNS allows messages to be published to a topic, which can then fan out to multiple SQS queues subscribed to that topic. This enables multiple consumers to receive and process the same message independently, effectively implementing a pub-sub system using AWS services.

Amazon FIFO SQS