Category: Uncategorized

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB – Get Free Report) saw some unusual options trading activity on Wednesday. Stock investors purchased 36,130 call options on the stock. This is an increase of approximately 2,077% compared to the typical daily volume of 1,660 call options.

Insider Activity

In related news, insider Cedric Pech sold 287 shares of the stock in a transaction that occurred on Thursday, January 2nd. The shares were sold at an average price of $234.09, for a total value of $67,183.83. Following the sale, the insider now directly owns 24,390 shares in the company, valued at $5,709,455.10. This trade represents a 1.16 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CEO Dev Ittycheria sold 2,581 shares of the stock in a transaction that occurred on Thursday, January 2nd. The shares were sold at an average price of $234.09, for a total transaction of $604,186.29. Following the completion of the sale, the chief executive officer now owns 217,294 shares in the company, valued at $50,866,352.46. This represents a 1.17 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 43,094 shares of company stock valued at $11,705,293. 3.60% of the stock is currently owned by insiders.

Institutional Investors Weigh In On MongoDB

Hedge funds and other institutional investors have recently modified their holdings of the company. Norges Bank acquired a new position in MongoDB in the fourth quarter valued at about $189,584,000. Jennison Associates LLC raised its stake in MongoDB by 23.6% in the third quarter. Jennison Associates LLC now owns 3,102,024 shares of the company’s stock valued at $838,632,000 after purchasing an additional 592,038 shares in the last quarter. Marshall Wace LLP acquired a new position in MongoDB in the fourth quarter valued at about $110,356,000. Raymond James Financial Inc. acquired a new position in MongoDB in the fourth quarter valued at about $90,478,000. Finally, D1 Capital Partners L.P. acquired a new position in MongoDB in the fourth quarter valued at about $76,129,000. Institutional investors and hedge funds own 89.29% of the company’s stock.

Analyst Upgrades and Downgrades

MDB has been the topic of several research analyst reports. JMP Securities restated a “market outperform” rating and set a $380.00 target price on shares of MongoDB in a report on Wednesday, December 11th. Loop Capital raised their target price on shares of MongoDB from $315.00 to $400.00 and gave the stock a “buy” rating in a report on Monday, December 2nd. Needham & Company LLC raised their target price on shares of MongoDB from $335.00 to $415.00 and gave the stock a “buy” rating in a report on Tuesday, December 10th. Mizuho raised their target price on shares of MongoDB from $275.00 to $320.00 and gave the stock a “neutral” rating in a report on Tuesday, December 10th. Finally, Scotiabank lowered their price objective on shares of MongoDB from $350.00 to $275.00 and set a “sector perform” rating on the stock in a report on Tuesday, January 21st. Two research analysts have rated the stock with a sell rating, four have issued a hold rating, twenty-three have issued a buy rating and two have given a strong buy rating to the company’s stock. Based on data from MarketBeat, the stock currently has a consensus rating of “Moderate Buy” and a consensus price target of $361.00.

Check Out Our Latest Research Report on MongoDB

MongoDB Price Performance

MDB stock opened at $295.00 on Thursday. MongoDB has a one year low of $212.74 and a one year high of $459.78. The stock has a market cap of $21.97 billion, a price-to-earnings ratio of -107.66 and a beta of 1.28. The company has a fifty day moving average price of $261.56 and a two-hundred day moving average price of $273.13.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its earnings results on Monday, December 9th. The company reported $1.16 earnings per share for the quarter, topping analysts’ consensus estimates of $0.68 by $0.48. MongoDB had a negative return on equity of 12.22% and a negative net margin of 10.46%. The company had revenue of $529.40 million during the quarter, compared to the consensus estimate of $497.39 million. During the same quarter last year, the firm earned $0.96 earnings per share. The company’s revenue was up 22.3% on a year-over-year basis. Research analysts anticipate that MongoDB will post -1.78 EPS for the current fiscal year.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you make your next trade, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now…

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB – Get Free Report) was the target of unusually large options trading on Wednesday. Investors acquired 23,831 put options on the company. This represents an increase of 2,157% compared to the typical daily volume of 1,056 put options.

Insiders Place Their Bets

In other news, Director Dwight A. Merriman sold 3,000 shares of the company’s stock in a transaction dated Monday, December 2nd. The stock was sold at an average price of $323.00, for a total value of $969,000.00. Following the completion of the transaction, the director now directly owns 1,121,006 shares in the company, valued at approximately $362,084,938. This represents a 0.27 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Cedric Pech sold 287 shares of the company’s stock in a transaction dated Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total value of $67,183.83. Following the completion of the transaction, the insider now owns 24,390 shares of the company’s stock, valued at $5,709,455.10. The trade was a 1.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 43,094 shares of company stock worth $11,705,293 in the last ninety days. 3.60% of the stock is currently owned by insiders.

Institutional Trading of MongoDB

Several institutional investors have recently added to or reduced their stakes in MDB. Strategic Investment Solutions Inc. IL purchased a new stake in MongoDB during the 4th quarter valued at $29,000. Hilltop National Bank boosted its stake in MongoDB by 47.2% during the 4th quarter. Hilltop National Bank now owns 131 shares of the company’s stock valued at $30,000 after purchasing an additional 42 shares during the last quarter. NCP Inc. purchased a new position in shares of MongoDB in the 4th quarter worth $35,000. Brooklyn Investment Group purchased a new position in shares of MongoDB in the 3rd quarter worth $36,000. Finally, Continuum Advisory LLC boosted its stake in shares of MongoDB by 621.1% in the 3rd quarter. Continuum Advisory LLC now owns 137 shares of the company’s stock worth $40,000 after buying an additional 118 shares during the last quarter. 89.29% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts recently weighed in on MDB shares. Citigroup increased their target price on MongoDB from $400.00 to $430.00 and gave the company a “buy” rating in a report on Monday, December 16th. Oppenheimer increased their target price on MongoDB from $350.00 to $400.00 and gave the company an “outperform” rating in a report on Tuesday, December 10th. JMP Securities restated a “market outperform” rating and set a $380.00 target price on shares of MongoDB in a report on Wednesday, December 11th. Stifel Nicolaus increased their target price on MongoDB from $325.00 to $360.00 and gave the company a “buy” rating in a report on Monday, December 9th. Finally, Mizuho increased their target price on MongoDB from $275.00 to $320.00 and gave the company a “neutral” rating in a report on Tuesday, December 10th. Two investment analysts have rated the stock with a sell rating, four have issued a hold rating, twenty-three have assigned a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of “Moderate Buy” and an average price target of $361.00.

Get Our Latest Report on MongoDB

MongoDB Stock Down 1.2 %

MDB stock opened at $295.00 on Thursday. MongoDB has a twelve month low of $212.74 and a twelve month high of $459.78. The firm has a market cap of $21.97 billion, a PE ratio of -107.66 and a beta of 1.28. The business has a 50 day moving average of $261.56 and a 200 day moving average of $273.13.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings data on Monday, December 9th. The company reported $1.16 earnings per share for the quarter, beating analysts’ consensus estimates of $0.68 by $0.48. MongoDB had a negative return on equity of 12.22% and a negative net margin of 10.46%. The company had revenue of $529.40 million during the quarter, compared to analyst estimates of $497.39 million. During the same quarter last year, the company earned $0.96 EPS. The firm’s revenue for the quarter was up 22.3% on a year-over-year basis. On average, research analysts expect that MongoDB will post -1.78 earnings per share for the current fiscal year.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you make your next trade, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now…

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

MMS • RSS

EDB Postgres AI, the latest PostgreSQL-based database from EnterpriseDB (EDB), outperformed four other databases, including Oracle, SQL Server, MongoDB, and MySQL, on a pair of benchmark tests that span SQL and NoSQL workloads, the vendor announced today.

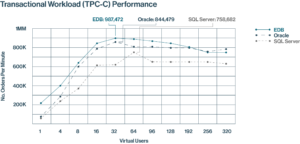

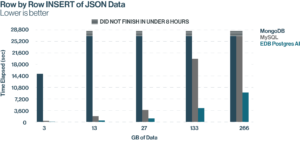

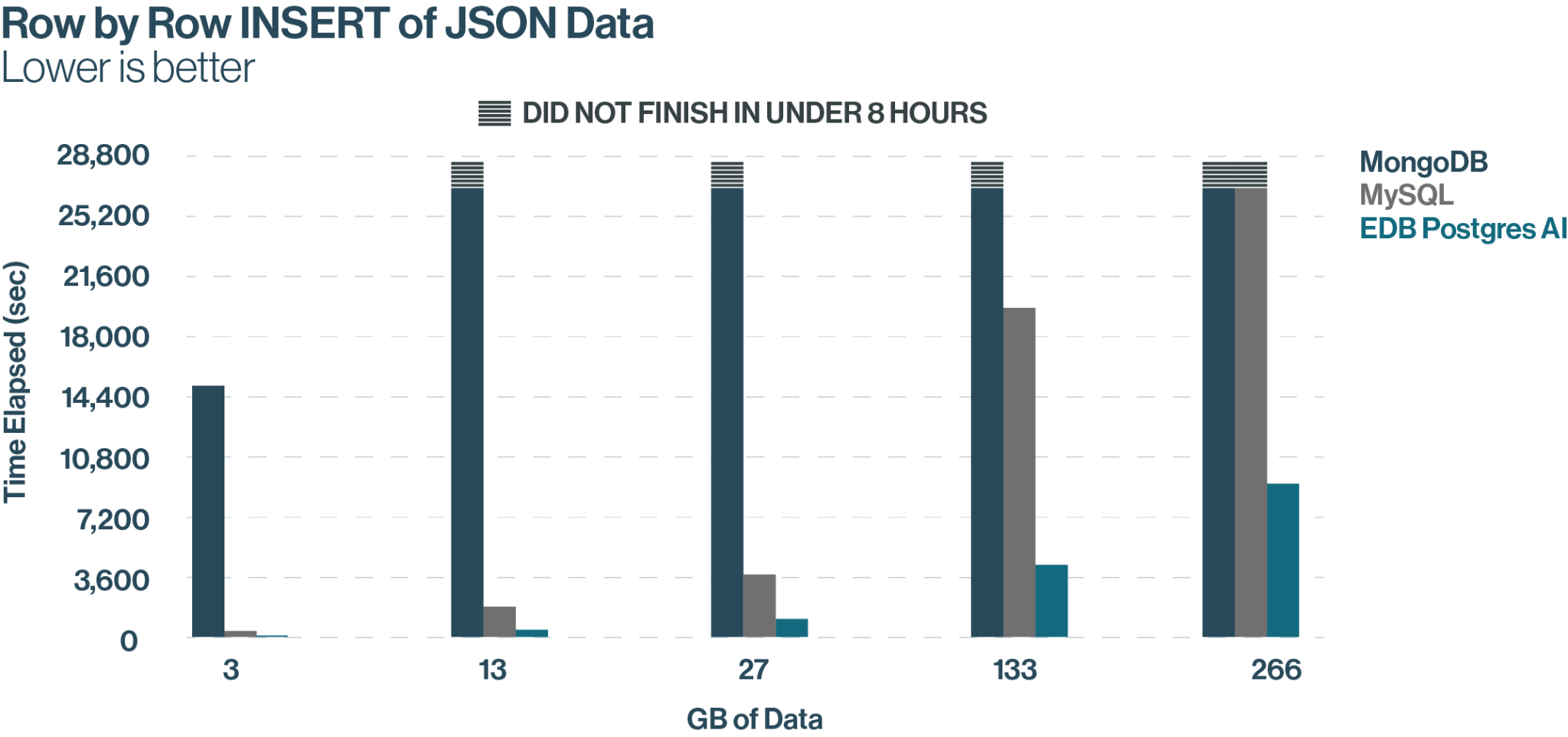

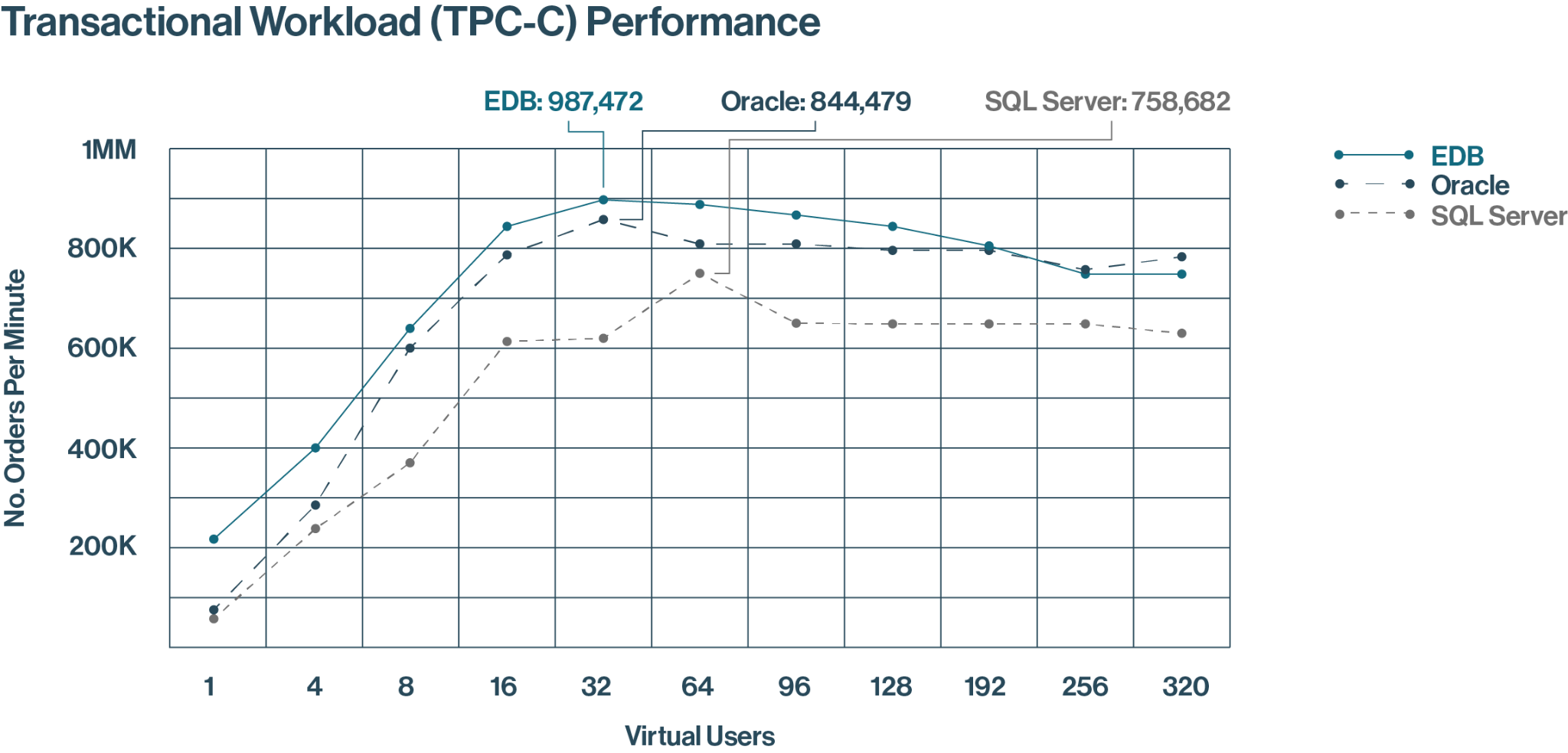

EDB commissioned McKnight Consulting Group to run a pair of benchmark tests to measure the relative performance of EDB Postgres AI against relational and non-relational databases. McKnight set up a TPC-C-like test to compare the transaction processing prowess of EDB Postgres AI against Oracle and Microsoft SQL Server, while it set up a JSON processing test to compare the multi-modal database against MongoDB and MySQL, which is controlled by Oracle and can also process JSON documents.

On the new orders per minute (NOPM) transactional test, McKnight measured EDB Postgres AI hitting a peak throughput of about 987,000 NOPM compared to about 844,000 for Oracle and about 759,000 for SQL Server. The tests were performed on identical AWS environments: ixi8xlarge instances running in US East 1, which cost $24,055 per year to run.

The price-per-performance comparisons were starker. According to McKnight, EDB Postgres AI was able to achieve an NOPM cost of $0.21 per unit compared to Oracle’s $1.58 and SQL Server’s $1.26. The differences are due to the higher cost of the Oracle ($47,500 per unit) and Microsoft ($15,123 per unit) software environments compared to EDB ($2,780 per unit), as well as higher support costs ($10,450 per unit for Oracle and $3,327 per unit for Microsoft versus zero for EDB).

McKnight notes that, while the NOMP benchmark was set up in accordance with TPC-C standards, it was not an official TPC-C benchmark test. To serve as the database driver, McKnight used HammerDB, which is “a widely used and accepted implementation of the TPC-C test,” the company says.

An entirely different test was used for the JSON workload, but the same AWS instances were used. For the JSON test, McKnight used PG NoSQL Benchmark, which is a benchmark tool created by EDB to test PostgreSQL and MongoDB databases. McKnight modified the syntax of the benchmark to include MySQL, which also is capable of processing JSON data.

The test measured how quickly each database could perform batch loads of JSON documents, INSERT the data into the database, and then perform a SELECT query on the data. The batches ranged from 5 million documents (13GB) up to 100 million documents (266GB). The test simulates the type of database work that would be performed as part of a retrieval augmented generation (RAG) pipeline for a generative AI application.

EDB Postgres AI beat the other two databases across all three JSON tests. For bulk loads, EDB was 34% faster than MongoDB and 63% faster than MySQL. For database INSERTS, EDB was 4 times faster than MySQL and 150 times faster than MongoDB. For the SELECT query, EDB was on average almost 3 times faster than MySQL and more than 5 times faster than MongoDB. More details of the test setup and results can be found in McKnights’ report here.

The tests pit the world’s five most popular databases against each other. While Oracle, MySQL, and SQL Server continue to be the most popular relational databases, PostgreSQL has emerged to threaten them for dominance, according to DB-Engines ranking. MongoDB has been the world’s most popular NoSQL database for well over a decade.

Related Items:

Microsoft Open Sources Code Behind PostgreSQL-Based MongoDB Clone

Postgres17 Brings Improvements to JSON, Backup, And More

Postgres Rolls Into 2024 with Massive Momentum. Can It Keep It Up?

MMS • RSS

Long-time channel executive Alan Chhabra departs to take a channel chief post at AI company Cerebras while MongoDB veteran and global cloud VP Olivier Zieleniecki assumes the top channel job at the data platform company.

Next-generation data platform developer MongoDB has undergone a channel management changing-of-the-guard as long-time channel chief Alan Chhabra has left the company after nearly 10 years and nine-year company veteran Olivier Zieleniecki (pictured) takes over the top channel management post.

Chhabra is now executive vice president of worldwide partners at Cerebras Systems, an AI systems developer headquartered in Sunnyvale, Calif. Zieleniecki, meanwhile, is now global vice president, worldwide partners at MongoDB.

In an interview with CRN, Chhabra said he decided back in November to “take some time off and figure out what I wanted to do next” and “create space for potentially something new. Because it’s been 10 years, I kind of had the craving to go build something again.”

While Chhabra had anticipated some downtime before finding his next job, the Cerebras opportunity quickly appeared and the time off turned into a job change.

Cerebras builds high-powered computer systems for complex AI training, deep learning and inference applications. The company just unveiled Sonar, an AI model built on Llama that’s optimized for the Perplexity AI-powered search engine.

At Cerebras Chhabra will lead the company’s global partner ecosystem and “expand and strengthen strategic relationships across industries, and drive adoption of Cerebras’ groundbreaking AI technology,” according to a company announcement of Chhabra’s hire.

“Alan’s track record of scaling partner ecosystems and driving impactful business growth will be invaluable as we further expand our global footprint,” said Andrew Feldman, Cerebras co-founder and CEO, in the announcement that cited Chhabra’s achievements at MongoDB.

Zieleniecki, MongoDB’s new channel chief, has been with the company since April 2016 and worked his way up through several sales management positions before being named vice president of worldwide cloud pursuits in February 2021, according to his LinkedIn profile. (Before joining MongoDB he held sales jobs between 2009 and 2016 at Analog Way, ClickFox and ClearSlide.)

In January 2023 he joined Chhabra’s organization as managing director and global vice president of cloud and then, in January in anticipation of Chhabra’s departure, global vice president of worldwide partners.

In recent years MongoDB has broken away from the pack of next-generation NoSQL databases to become a leading development platform for building cloud and – more recently – AI and generative AI applications. The company’s offerings include its flagship “document” database software and popular Atlas cloud database and developer data platform.

MongoDB is expected to reported revenue for fiscal 2025, which ended Jan. 31, of approximately $2 billion.

MongoDB’s channel operations under Chhabra’s leadership has been a big part of the company’s growth. “The company is in great shape. The partner organization has never been better,” Chhabra said in the interview.

One of Chhabra’s biggest accomplishments during his term has been the establishment of deep strategic alliances with the major hyperscalers Amazon Web Services, Google Cloud and Microsoft Azure, along with Chinese multinational giant Alibaba. That despite the fact some of those companies sell database products that compete with MongoDB’s open-source database software.

Today partners are responsible for sourcing and influencing more than 80 percent of MongoDB’s new business, Chhabra said, and channel partners and the hyperscalers also source a large part of the company’s annual recurring revenue. “So we’ve come a super long way with partnerships.”

Chhabra, Zieleniecki and the channel organization also played a significant role in last year’s launch of the MongoDB AI Applications Program (MAAP) that provides a complete technology stack, services and other resources to help partners and customers develop and deploy at scale applications with advanced generative AI capabilities.

“We’ve got a great ecosystem of partners in the MAAP program,” Chhabra said.

Zieleniecki has played a key role in recent years in building up MongoDB’s cloud operations and establishing the relationships with the cloud hyperscalers. In the interview he said that over the next year he will be particularly focused on two major initiatives.

The first is working with partners to leverage generative AI technology to help businesses and organizations move workloads from legacy relational database systems, such as Oracle or Sybase, to MongoDB’s Atlas cloud platform, “for a fraction of the cost and fraction of the time,” Zieleniecki said. “Customers are responding very well to this.”

Both executives said the millions of lines of application code written for legacy databases has always been a hurdle for organizations looking to move to MongoDB. In the last year the company has been investing in partner training and resources to help consulting and service partners leverage GenAI copilots and code assistant tools to better capitalize on those migration opportunities.

MongoDB is currently involved in just such a migration project for a major European insurance company that also involves AWS and several system integrator partners, Zieleniecki said. “We’re not a service company, so obviously we’re going to need help to scale this. And we want to do more of these,” he said.

Zieleniecki’s second initiative is ramping up production of the MAAP effort, working with partners – including service providers and AI technology partners – to “help our customers get the most ROI out of their new AI applications moving forward,” he said.

“Alan has built a fantastic team and we want to continue to build our partner ecosystem and to increase partners as a key component of where MongoDB is going,” Zieleniecki said. “In 2025 the two objectives that I mentioned are at the center of the MongoDB vision [and] partners will play a critical role.”

Chhabra, when asked what he sees as his biggest achievements at MongoDB, points to the alliances with the cloud hyperscalers as a major win. But perhaps most important was how he has ensured that partners were always a key part of MongoDB’s strategy rather than “an afterthought.”

“I’ve been in every single board meeting MongoDB has had since I’ve joined…so partners have a seat at the table at MongoDB and I believe that is something that other ISVs should learn,” he said.

MMS • RSS

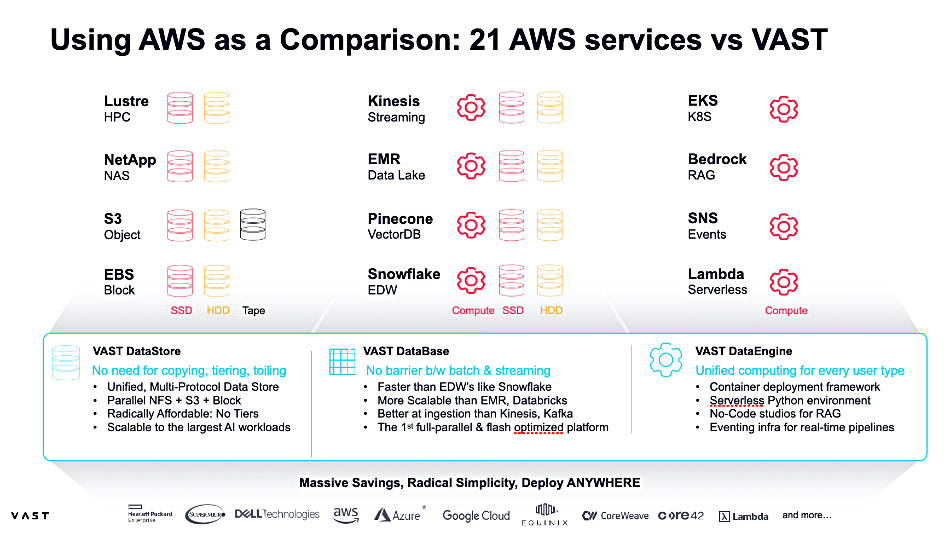

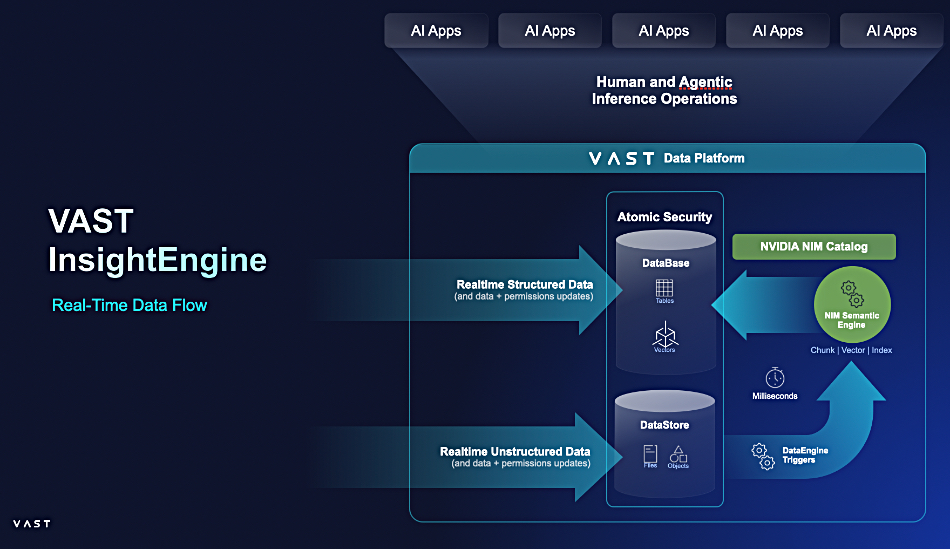

VAST Data has added block access to its existing file and object protocol support along with Kafka event broking to provide real-time data streaming to AI, ML, and analytic workloads.

VAST Data’s storage arrays, with their scale-out, disaggregated shared everything (DASE) architecture, support parallel access to file and object data, and have a software stack featuring a DataCatalog, DataBase, DataSpace, and DataEngine. The system already supports real-time notification of data change events to external Kafka clusters. Now it has its own Kafka event broker, added to the DataEngine, to receive, store, and distribute such events.

In a statement Aaron Chaisson, VP Product and Solutions Marketing at VAST, said: “With today’s announcement, we’re eliminating the data silos that once hindered AI and analytics initiatives, affording customers faster, more accurate decisions and unlocking data-driven growth.”

By providing block-level data access, VAST Data says it can now support classic structured data applications such as relational databases, SQL or NoSQL, ERP, and CRM systems along with virtualization (VMware, Hyper-V, KVM) and containerized workloads. The whole set of legacy structured data workloads is able to run with a VAST Data storage array, giving customers a chance to consolidate their block, file, object, tabular, and streaming storage onto a single storage system. The hope is that channel partners will pitch the migration of such block access-dependent workloads off existing block arrays – Dell PowerMax, Hitachi Vantara VSP One, and IBM DS8000, for example.

VAST is also supporting Boot from SAN, and says “enterprises can streamline server deployment and management by eliminating reliance on local disks.” It claims this approach “enhances disaster recovery, improves redundancy, and enables rapid provisioning of new virtual or bare-metal servers while ensuring consistent performance across IT environments.”

The event broking addition allows, VAST says, “AI agents to instantly act on incoming data for real-time intelligence and automation.”

The company says customers can have all data accessible in its single system, addressing all workloads within one unified architecture. It has “unified transactional, analytical, AI, and real-time streaming workloads” via the event broker. Customers can “stream event logs to systems for processing, publishing and processing telemetry data in real time, giving event-driven updates to users, and streaming data to models for real-time training or inference.”

VAST says Kafka implementations are widely used for data movement but “create isolated event data silos that hinder seamless analytics.” They involve infrastructure sprawl, data replication, and slow batch ETL processes “that delay real-time insights.” It’s new Event Broker can activate computation when new data points enter VAST’s DataBase. It should enable AI agents and applications to respond instantly to events and help automate decision-making. The Event Broker delivers, VAST claims, “a 10x+ performance advantage over Kafka on like-for-like hardware, with unlimited linear scaling, capable of processing over 500 million messages per second across VAST’s largest cluster deployments today.”

VAST Co-founder Jeff Denworth stated: “By merging event streaming, analytics, and AI into a single platform, VAST is removing decades of data pipeline inefficiencies and event streaming complexity, empowering organizations to detect fraud in milliseconds, correlate intelligence signals globally, act on data-driven insights instantly, and deliver AI-enabled customer experiences. This is the future of real-time intelligence, built for the AI era.”

All these methods of data access; block, file, object, tabular and streaming, can use VAST’s snapshot, replication, multi-tenancy, QoS, encryption, and role-based access control services. It claims that in the AWS cloud, customers would need 21 separate services to do what VAST does.

Competing systems that offer unified block, file, and object data access include Red Hat’s Ceph and StorOne. Both Quantum’s Myriad and HPE’s Alletra MP X10000 are based on key-value stores that have files or object access protocols supported and can be extended to add block or other protocols.

VAST’s support for block data will bring it into direct competition with Lenovo’s Infinidat high-end SAN storage business unit for the first time.

NetApp’s ONTAP arrays offer unified file and block access. However, NetApp found some of its all-flash customers preferred buying block-only ASA (SAN) arrays instead of classic ONTAP AFF arrays. They wanted to de-consolidate rather than consolidate, indicating that not all customers want a single, do-it-all unified array.

VAST has promised unified data access for some time, so we can envisage that many of its customers will look positively at moving block-based application data stores to their VAST systems.

Read more about the background to block data access support in a VAST blog. VAST’s Event Broker will be available in March.

MMS • RSS

As the status of an on-premises version of Oracle Database 23ai remains in limbo, the company has tossed a bone to its on-prem Oracle Database 19c customers in the form of an extension of Premier Support to Dec. 31, 2029, and Extended Support to Dec. 31, 2032.

This stretches Extended Support from its previous 2024-2027 timeline, announced in 2022, increasing the product’s lifespan by another five years. This emulates companies such as SAP, which is granting reprieves to its on-prem S/4HANA customers.

However, as with SAP, there are some gotchas. During the period from May 1, 2027, through Dec. 31, 2032, Oracle will exclude support for BSAFE crypto libraries, Java, or any Java-related products, Transport Layer Security (TLS), Native Network Encryption, Transparent Data Encryption, DBMS_CRYPTO programmatic encryption, both C and Java utilities, and FIPS compliance.

EDB Postgres® AI Significantly Outperforms Oracle, SQL Server, MongoDB, and MySQL in New

MMS • RSS

WILMINGTON, Del., Feb. 19, 2025 (GLOBE NEWSWIRE) — EnterpriseDB (“EDB”), the leading Postgres data and AI company, today announced the results of a new benchmark study from McKnight Consulting Group. The study confirms that EDB Postgres AI delivers superior performance over Oracle, SQL Server, MongoDB, and MySQL across transactional, analytical, and AI workloads—offering unmatched speed, cost efficiency, and scalability while giving enterprises full control over their sovereign data.

Enterprises need their IT budgets to go further for AI, but 55% is tied up in sustaining existing business operations, including maintaining legacy systems, instead of building a modern, sovereign data platform ( Deloitte ). Legacy technology also blocks AI adoption, making modernization essential for agility, cost efficiency, and innovation.

MMS • RSS

WILMINGTON, Del., Feb. 19, 2025 (GLOBE NEWSWIRE) — EnterpriseDB (“EDB”), the leading Postgres data and AI company, today announced the results of a new benchmark study from McKnight Consulting Group. The study confirms that EDB Postgres AI delivers superior performance over Oracle, SQL Server, MongoDB, and MySQL across transactional, analytical, and AI workloads—offering unmatched speed, cost efficiency, and scalability while giving enterprises full control over their sovereign data.

Enterprises need their IT budgets to go further for AI, but 55% is tied up in sustaining existing business operations, including maintaining legacy systems, instead of building a modern, sovereign data platform (Deloitte). Legacy technology also blocks AI adoption, making modernization essential for agility, cost efficiency, and innovation.

EDB Postgres AI provides the solution enterprises need to stay ahead—simplifying and modernizing their data infrastructure, eliminating legacy constraints, reducing TCO, and scaling AI in a secure, sovereign environment. The 2024 McKnight Consulting Group benchmark confirms that EDB Postgres AI delivers the superior performance and efficiency to power this transformation.

“Agility with open source is becoming a top priority for our customers as they look to reduce OPEX, free up resources for innovation, and move towards an AI and data-centric future. Our partnership with EDB enables enterprises to confidently work with open-source solutions like EDB Postgres AI, unlocking greater flexibility, scalability, and control over their data infrastructure,” said Ashish Mohindroo, GM s& SVP, Nutanix Database Service.

“This benchmark highlights the critical role of database performance in AI-driven workloads. EDB Postgres AI outperformed MongoDB in JSON processing—delivering significantly better speed and efficiency in a test that mirrors RAG AI use cases,” said William McKnight, President, McKnight Consulting Group. “For enterprises, database choice isn’t just a technical decision—it’s a strategic imperative for maximizing performance, optimizing costs, and ensuring future scalability.”

Benchmark Study Highlights

The 2024 McKnight Consulting Group benchmark compared EDB Postgres AI with Oracle, SQL Server, MongoDB, and MySQL in self-hosted environments. The results show a clear advantage for EDB Postgres AI across performance and total cost of ownership (TCO):

- 150x faster than MongoDB in processing JSON data

- 4x faster than MySQL in handling insert operations

- Outperformed Oracle by 17% and SQL Server by 30% in processing New Orders Per Minute (NOPM)

- 7x better price performance than Oracle and 6x better than SQL Server (measured in cost per transaction)

Neither MongoDB nor MySQL could finish a row-by-row insert of JSON data in the allotted 8 hours. EDB Postgres AI’s average time elapsed for row-by-row insert of JSON data was 150x faster than MongoDB, making it suitable for NoSQL and AI workloads.

This TPC-C test illustrates how EDB Postgres AI consistently outperforms Oracle and SQL Server for transactional workloads, showcasing its suitability for demanding enterprise environments.

“Modernizing application and data infrastructure is no longer optional—it’s essential in a world where data density, complexity, and agility define success. Through our work on complex Oracle migrations, we’ve seen firsthand how critical it is to demonstrate measurable ROI at every stage of the process,” said Satya Bolli, Chairman & Managing Director, Prolifics. “The McKnight research validates what we experience on the ground every day. Partnering with EDB enables us to deliver a seamless, high-value migration path that not only maximizes efficiency but also positions businesses for AI-driven innovation.”

Performance, Data Sovereignty, and AI-Readiness in One Platform

Unlike legacy and proprietary databases that struggle with scalability and cost inefficiencies, EDB Postgres AI is built for enterprise demands of high performance, sovereignty, and AI-readiness. EDB Postgres AI supports complex workloads while giving organizations greater control over their most strategic asset—their data infrastructure and AI.

“We decided to embrace an open source software strategy, because we see it as far more transparent, reliable, and secure. We know we can review the software at any time, which gives us greater confidence in the functionality and its configurability. Postgres gives us greater security than with any closed source database, as well as far greater flexibility to switch vendors and avoid expensive, traditional, perpetual licensing,” said EDB customer Christian Blaesing, Head of IT, telegra.

Many enterprises are also moving away from proprietary NoSQL databases like MongoDB, seeking better query performance, SQL compatibility, and reduced operational complexity.

“We were seeing how much we were paying Oracle, and it was just incredibly high. It seemed to be going up 10% to 15% per year. Moreover, we had a bunch of Oracle engineers who were just sick of dealing with Oracle,” said John Lovato, Database Architect, USDA Forest Service.

“The era of overpriced, proprietary databases is over. This benchmark confirms there’s a better way,” said Nancy Hensley, Chief Product Officer, EDB. “EDB Postgres AI delivers breakthrough performance over Oracle, SQL Server, and MongoDB—delivering a single, sovereign platform for data and AI without the constraints or costs of legacy vendors.”

Benchmark Report Now Available

For more information on the benchmark study and EDB Postgres AI, visit https://www.enterprisedb.com/resources/benchmarks/mcknight

About EDB

EDB provides a data and AI platform that enables organizations to harness the full power of Postgres for transactional, analytical, and AI workloads across any cloud, anywhere. EDB empowers enterprises to control risk, manage costs and scale efficiently for a data and AI led world. Serving more than 1,500 customers globally and as the leading contributor to the vibrant and fast-growing PostgreSQL community, EDB supports major government organizations, financial services, media and information technology companies. EDB’s data-driven solutions enable customers to modernize legacy systems and break data silos while leveraging enterprise-grade open source technologies. EDB delivers the confidence of up to 99.999% high availability with mission critical capabilities built in such as security, compliance controls, and observability. For more information, visit www.enterprisedb.com.

Media Contact:

Scott Lechner

Offleash PR for EDB

edb@offleashpr.com

EnterpriseDB and EDB are registered trademarks of EnterpriseDB Corporation. Postgres and PostgreSQL are registered trademarks of the PostgreSQL Community Association of Canada and used with their permission. All other trademarks are owned by their respective owners.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/31a4e23f-db67-44e8-ad25-bc58e603680e

https://www.globenewswire.com/NewsRoom/AttachmentNg/ce516693-cfa6-400b-826a-1df94531fb96

MMS • RSS

#UAE #dataplatforms – MongoDB plans to more than double its Middle East, Türkiye and Africa (META) workforce in 2025 as Saudi Arabia and the UAE’s appetite for artificial intelligence and ongoing digital transformation, drives more demand for data platforms and services. The New York tech firm is a global leader in cloud database management, providing developers with tools to build AI-powered applications. MongoDB’s regional expansion follows five years of strong growth, and has a focus on hiring across sales, solutions architecture, channel partnerships, and customer success. According to LinkedIn, the company has more than 50 employees working in its META region, while more than 23,000 developers in the UAE list MongoDB as a skill in their LinkedIn profiles.

SO WHAT? – MongoDB’s expansion in META over the past five years, maps the region’s rapid adoption of AI and investment from business, government and academia in the development of AI models and solutions. In comparison with other leading global database vendors, MongoDB is a relative newcomer to the Middle East and the key markets of Saudi Arabia and the UAE, but timing is everything and the vendor’s expansion plans are proof positive that it is matching market needs and delivering effectively.

Here’s some more information about MongoDB in the region:

-

MongoDB plans to more than double its headcount across the Middle East, Türkiye and Africa (META) in 2025, with hiring focused on sales, solutions architecture, and customer success. According to LinkedIn the company currently has more than 50 employees in the region.

-

MongoDB works with major retailers, financial institutions, and public sector organisations to support AI-powered applications. The tech firm has been operating in the Middle East since 2019.

-

There are open-source and commercial versions of MongoDB’s unified database platform, which has been downloaded hundreds of millions of times by end-users and developers globally.

-

Over 23,000 developers in the UAE have listed MongoDB as a skill on LinkedIn, reflecting a 20% year-on-year increase.

-

The company has recently signed a partnership with Moro Hub, the data centre subsidiary of Digital DEWA, to accelerate digital transformation and AI adoption.

-

MongoDB’s technology supports applications such as facial recognition for airport security, cargo tracking at major ports, and traffic monitoring for government entities.

-

The database leader organised its first regional Customer Day Summit at Dubai’s Museum of the Future this week, hosting over 250 customers from the government, aviation, and retail sectors.

-

MongoDB was recognised as a Leader in the 2024 Gartner Magic Quadrant for Cloud Database Management Systems.

ZOOM OUT – Market growth in AI and digital transformation presents an enormous opportunity for technology vendors, in particular those focusing on emerging technologies. According to IDC spending on AI in Middle East, Türkiye, and Africa (META) is soaring at a five-year compound annual growth rate (CAGR) of 37%, with investments set to increase from $4.5 billion last year to $7.2 billion in 2026. Saudi Arabia and the UAE have led in AI-related investments, spending on solutions, platforms and R&D in context of ambitious digital transformation initiatives. IDC predicts that digital transformation investment overall in META will reach $74 billion in 2026 and account for 43.2% of all ICT investments.

MMS • RSS

CIBC Asset Management Inc boosted its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 239.6% in the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 49,973 shares of the company’s stock after purchasing an additional 35,256 shares during the quarter. CIBC Asset Management Inc owned approximately 0.07% of MongoDB worth $11,634,000 as of its most recent filing with the Securities & Exchange Commission.

Several other large investors have also added to or reduced their stakes in the stock. Hilltop National Bank boosted its position in shares of MongoDB by 47.2% during the 4th quarter. Hilltop National Bank now owns 131 shares of the company’s stock valued at $30,000 after acquiring an additional 42 shares during the last quarter. Brooklyn Investment Group bought a new stake in shares of MongoDB during the 3rd quarter valued at about $36,000. Continuum Advisory LLC boosted its position in shares of MongoDB by 621.1% during the 3rd quarter. Continuum Advisory LLC now owns 137 shares of the company’s stock valued at $40,000 after acquiring an additional 118 shares during the last quarter. Wilmington Savings Fund Society FSB bought a new stake in shares of MongoDB during the 3rd quarter valued at about $44,000. Finally, Versant Capital Management Inc boosted its position in shares of MongoDB by 1,100.0% during the 4th quarter. Versant Capital Management Inc now owns 180 shares of the company’s stock valued at $42,000 after acquiring an additional 165 shares during the last quarter. Institutional investors own 89.29% of the company’s stock.

Insiders Place Their Bets

In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction on Monday, February 10th. The stock was sold at an average price of $281.62, for a total value of $281,620.00. Following the sale, the director now directly owns 1,112,006 shares of the company’s stock, valued at approximately $313,163,129.72. The trade was a 0.09 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, insider Cedric Pech sold 287 shares of the business’s stock in a transaction on Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total value of $67,183.83. Following the completion of the sale, the insider now directly owns 24,390 shares in the company, valued at $5,709,455.10. This trade represents a 1.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 43,094 shares of company stock valued at $11,705,293. 3.60% of the stock is currently owned by corporate insiders.

MongoDB Stock Performance

Shares of NASDAQ MDB traded down $3.52 during mid-day trading on Wednesday, hitting $295.00. 1,056,658 shares of the stock traded hands, compared to its average volume of 1,502,277. MongoDB, Inc. has a 52 week low of $212.74 and a 52 week high of $459.78. The company has a market cap of $21.97 billion, a price-to-earnings ratio of -107.66 and a beta of 1.28. The stock has a fifty day moving average price of $261.45 and a 200-day moving average price of $272.51.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings results on Monday, December 9th. The company reported $1.16 earnings per share for the quarter, beating the consensus estimate of $0.68 by $0.48. MongoDB had a negative return on equity of 12.22% and a negative net margin of 10.46%. The company had revenue of $529.40 million for the quarter, compared to analyst estimates of $497.39 million. During the same period in the previous year, the company posted $0.96 earnings per share. The firm’s revenue was up 22.3% on a year-over-year basis. As a group, sell-side analysts predict that MongoDB, Inc. will post -1.78 EPS for the current fiscal year.

Wall Street Analyst Weigh In

MDB has been the subject of a number of research analyst reports. Monness Crespi & Hardt downgraded MongoDB from a “neutral” rating to a “sell” rating and set a $220.00 price target for the company. in a research report on Monday, December 16th. Morgan Stanley lifted their price target on MongoDB from $340.00 to $350.00 and gave the company an “overweight” rating in a research report on Tuesday, December 10th. KeyCorp raised their price objective on MongoDB from $330.00 to $375.00 and gave the company an “overweight” rating in a report on Thursday, December 5th. Loop Capital raised their price objective on MongoDB from $315.00 to $400.00 and gave the company a “buy” rating in a report on Monday, December 2nd. Finally, Cantor Fitzgerald initiated coverage on MongoDB in a report on Friday, January 17th. They set an “overweight” rating and a $344.00 price objective on the stock. Two analysts have rated the stock with a sell rating, four have given a hold rating, twenty-three have assigned a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, MongoDB currently has a consensus rating of “Moderate Buy” and a consensus target price of $361.00.

View Our Latest Stock Analysis on MDB

MongoDB Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Which stocks are likely to thrive in today’s challenging market? Enter your email address and we’ll send you MarketBeat’s list of ten stocks that will drive in any economic environment.