Month: June 2023

MMS • Anthony Alford

Article originally posted on InfoQ. Visit InfoQ

Google DeepMind recently announced PaLM 2, a large language model (LLM) powering Bard and over 25 other product features. PaLM 2 significantly outperforms the previous version of PaLM on a wide range of benchmarks, while being smaller and cheaper to run.

Google CEO Sundar Pichai announced the model at Google I/O ’23. PaLM 2 performs well on a variety of tasks including code generation, reasoning, and multilingual processing, and it is available in four different model sizes, including a lightweight version called Gecko that is intended for use on mobile devices. When evaluated on NLP benchmarks, PaLM 2 showed performance improvements over PaLM, and achieved new state-of-the-art levels in many tasks, especially on the BIG-bench benchmark. Besides powering Bard, the new model is also a foundation for many other products, including Med-PaLM 2, a LLM fine-tuned for the medical domain, and Sec-PaLM, a model for cybersecurity. According to Google,

PaLM 2 shows us the impact of highly capable models of various sizes and speeds—and that versatile AI models reap real benefits for everyone. Yet just as we’re committed to releasing the most helpful and responsible AI tools today, we’re also working to create the best foundation models yet for Google.

In 2022, InfoQ covered the original release of Pathways Language Model (PaLM), a 540-billion-parameter large language model (LLM). PaLM achieved state-of-the-art performance on several reasoning benchmarks and also exhibited capabilities on two novel reasoning tasks: logical inference and explaining a joke.

For PaLM 2, Google implemented several changes to improve model performance. First, they studied model scaling laws to determine the optimal combination of training compute, model size, and data size. They found that, for a given compute budget, data and model size should be scaled “roughly 1:1,” whereas previous researchers had scaled model size 3x the data size.

The team improved PaLM 2’s multilingual capabilities by including more languages in the training dataset and updating the model training objective. The original dataset was “dominated” by English; the new dataset pulls from a more diverse set of languages and domains. Instead of using only a language modeling objective, PaLM 2 was trained using a “tuned mixture” of several objectives.

Google evaluated PaLM 2 on six broad classes of NLP benchmark, including: reasoning, coding, translation, question answering, classification, and natural language generation. The focus of the evaluation was to compare its performance to the original PaLM. On BIG-bench, PaLM 2 showed “large improvements,” and on classification and question answering even the smallest PaLM 2 model achieved performance “competitive” with much the larger PaLM model. On reasoning tasks, PaLM 2 was also “competitive” with GPT-4; it outperformed GPT-4 on the GSM8K mathematical reasoning benchmark.

In a Reddit discussion about the model, several users commented that although its output wasn’t as good as that from GPT-4, PaLM 2 was noticeably better. One user said:

They probably want it to be scalable so they can implement it for free/low cost with their products. Also so it can accompany search results without taking forever (I use GPT 4 all the time and love it, but it is pretty slow.)…I just used the new Bard (which is based on PaLM 2) and it’s a good amount faster than even GPT 3.5 turbo.

The PaLM 2 tech report page on Papers with Code lists the model’s performance on several NLP benchmarks.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

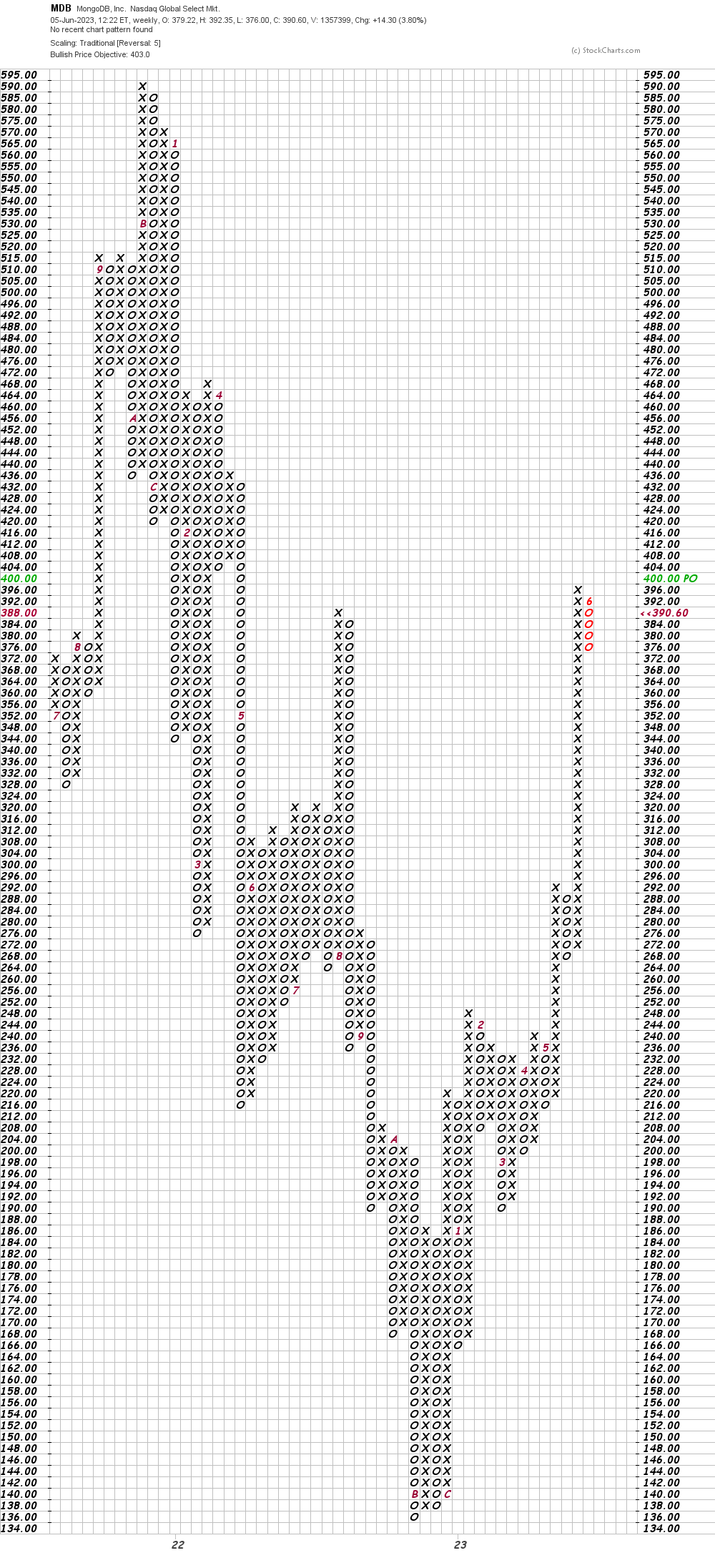

As of June 6, 2023, Canaccord Genuity analyst David Hynes has given MongoDB (NASDAQ:MDB) a Buy rating and increased the price target from $250 to $410. This new price target is significantly higher than the average of $256.26 set by 20 Wall Street analysts who have offered 12-month price targets for MongoDB in the last 3 months. In the past, Canaccord Genuity analyst Richard Davis also raised the price target on MongoDB stock from $125 to $160 while maintaining a buy rating.

MDB (MongoDB Inc.) Stock Performance and Financial Analysis – June 6, 2023

On June 6, 2023, MDB (MongoDB Inc.) opened at $379.22 and fluctuated between $376.00 and $392.35 throughout the day. The volume for the day was 2,820,650, and the market cap for MDB is $26.5 billion.

MDB is a technology services company that specializes in packaged software. The company’s revenue growth for the last year was 46.95%, and its earnings growth for this year is expected to be 78.94%. The company’s earnings growth for the next five years is projected to be 8.00%.

MDB’s price-to-earnings (P/E) ratio is not available (NM), but its price-to-sales ratio is 11.45, and its price-to-book ratio is 35.53. The net profit margin for the company is -26.90%.

In comparison to other technology services companies, ANSS (ANSYS Inc.) experienced a slight increase of 0.31% in its stock price, while HUBS (HubSpot Inc.) experienced a minimal increase of 0.01%. VEEV (Veeva Systems Inc.) had a decrease of 0.79% in its stock price.

MDB’s next reporting date is on August 31, 2023, and the EPS forecast for this quarter is $0.43. The company had an annual revenue of $1.3 billion last year, but a net profit of -$345.4 million.

Overall, MDB’s stock performance on June 6, 2023, was mixed, with a high volume and a wide range of prices throughout the day. While the company’s revenue growth is strong, its negative net profit margin and negative earnings growth from last year may be concerning to some investors.

MongoDB Inc. Stock Price Sees Slight Increase and Investment Analysts Maintain Buy Rating

On June 6, 2023, MongoDB Inc. (MDB) saw a slight increase in its stock price, according to data from CNN Money. The median target for the company’s stock price was $390.00, with a high estimate of $430.00 and a low estimate of $210.00. The median estimate represented a 0.32% increase from the last price of $388.77. Investment analysts have consistently recommended buying MDB stock, with 26 polled analysts maintaining a buy rating since June. The company’s strong financial performance, with earnings per share of $0.43 and sales of $392.4 million in the current quarter, is likely the reason for this positive outlook. Investors will be eagerly anticipating MDB’s reporting date on August 31, when the company will release its latest financial results. If the company continues to perform well, it is likely that its stock price will continue to rise. Overall, MDB’s strong financial performance and positive outlook from investment analysts suggest that the company is a solid investment option for those looking to invest in the technology sector.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB, Inc. (NASDAQ:MDB – Get Rating) CEO Dev Ittycheria sold 20,000 shares of the firm’s stock in a transaction that occurred on Thursday, June 1st. The shares were sold at an average price of $287.32, for a total value of $5,746,400.00. Following the completion of the transaction, the chief executive officer now owns 262,311 shares in the company, valued at approximately $75,367,196.52. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link.

MongoDB, Inc. (NASDAQ:MDB – Get Rating) CEO Dev Ittycheria sold 20,000 shares of the firm’s stock in a transaction that occurred on Thursday, June 1st. The shares were sold at an average price of $287.32, for a total value of $5,746,400.00. Following the completion of the transaction, the chief executive officer now owns 262,311 shares in the company, valued at approximately $75,367,196.52. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link.

Dev Ittycheria also recently made the following trade(s):

- On Monday, April 3rd, Dev Ittycheria sold 49,249 shares of MongoDB stock. The stock was sold at an average price of $227.55, for a total transaction of $11,206,609.95.

MongoDB Trading Up 3.3 %

MongoDB stock opened at $388.57 on Tuesday. The company has a debt-to-equity ratio of 1.54, a quick ratio of 3.80 and a current ratio of 3.80. MongoDB, Inc. has a fifty-two week low of $135.15 and a fifty-two week high of $397.98. The stock has a market cap of $27.22 billion, a P/E ratio of -83.21 and a beta of 1.04. The firm’s fifty day moving average price is $250.84 and its 200-day moving average price is $216.79.

MongoDB (NASDAQ:MDB – Get Rating) last released its quarterly earnings results on Thursday, June 1st. The company reported $0.56 earnings per share for the quarter, beating the consensus estimate of $0.18 by $0.38. MongoDB had a negative return on equity of 44.73% and a negative net margin of 23.58%. The firm had revenue of $368.28 million for the quarter, compared to analysts’ expectations of $347.77 million. During the same quarter last year, the firm posted ($1.15) EPS. The company’s revenue was up 29.0% compared to the same quarter last year. Equities research analysts forecast that MongoDB, Inc. will post -4.04 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

MDB has been the topic of several analyst reports. Stifel Nicolaus boosted their price target on shares of MongoDB from $240.00 to $375.00 in a report on Friday. Mizuho upped their price objective on MongoDB from $180.00 to $220.00 in a research note on Friday. Royal Bank of Canada raised their target price on MongoDB from $235.00 to $400.00 in a research report on Friday. Barclays increased their price target on shares of MongoDB from $280.00 to $374.00 in a research report on Friday. Finally, Citigroup lifted their price objective on shares of MongoDB from $363.00 to $430.00 in a research report on Friday. One analyst has rated the stock with a sell rating, two have assigned a hold rating and twenty-one have given a buy rating to the company. Based on data from MarketBeat.com, MongoDB has an average rating of “Moderate Buy” and an average target price of $328.35.

Institutional Investors Weigh In On MongoDB

Several hedge funds have recently bought and sold shares of the stock. Global Retirement Partners LLC lifted its holdings in shares of MongoDB by 346.7% during the 1st quarter. Global Retirement Partners LLC now owns 134 shares of the company’s stock worth $30,000 after acquiring an additional 104 shares during the last quarter. Bessemer Group Inc. bought a new stake in MongoDB during the fourth quarter worth about $29,000. BI Asset Management Fondsmaeglerselskab A S purchased a new position in shares of MongoDB in the 4th quarter worth about $30,000. Manchester Capital Management LLC bought a new position in shares of MongoDB during the 1st quarter valued at about $36,000. Finally, Clearstead Advisors LLC purchased a new position in shares of MongoDB during the 1st quarter valued at about $36,000. 84.86% of the stock is currently owned by institutional investors.

MongoDB Company Profile

MongoDB, Inc engages in the development and provision of a general-purpose database platform. The firm’s products include MongoDB Enterprise Advanced, MongoDB Atlas and Community Server. It also offers professional services including consulting and training. The company was founded by Eliot Horowitz, Dwight A.

Recommended Stories

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

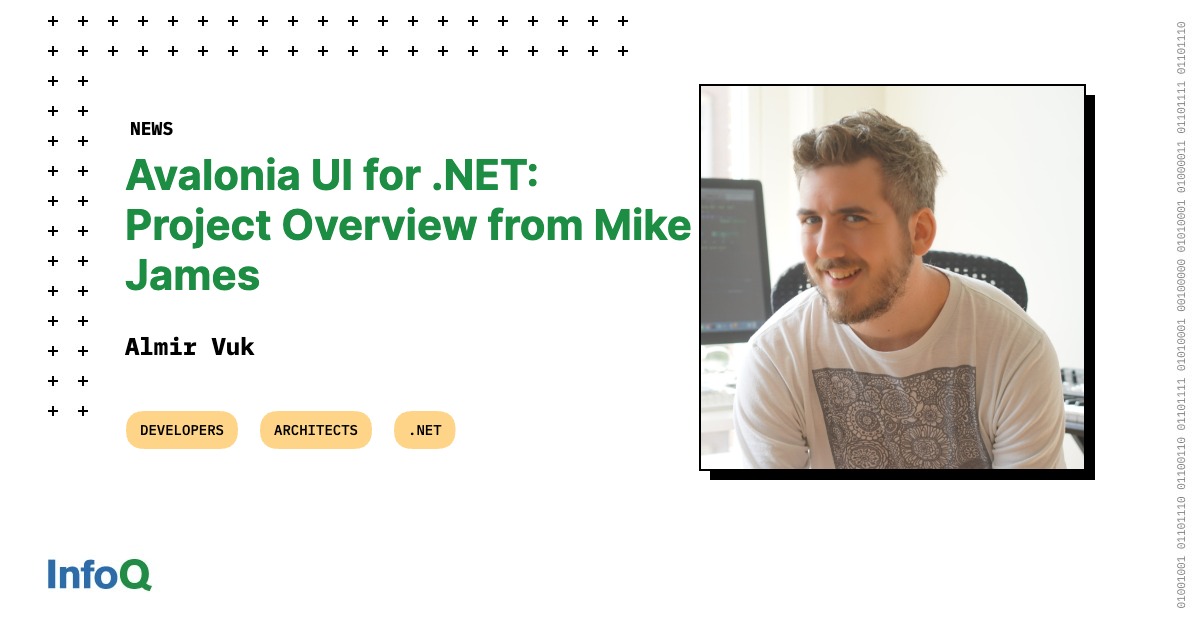

MMS • Almir Vuk

Article originally posted on InfoQ. Visit InfoQ

Avalonia UI is an open-source and cross-platform UI framework for .NET developers, designed to facilitate the development of desktop applications that can run on Windows, macOS, Linux, iOS, Android, and WebAssembly. InfoQ interviewed Mike James, CEO of Avalonia UI, in order to understand more about this UI framework and its features.

InfoQ: How did Avalonia UI emerge within the ecosystem?

Mike James: The project has its roots in OSS, being community-led from its inception rather than being built by an established business and later shared. The core contributors established a company a few years back to provide support and development services to enterprises.

We recently announced our first foray into products with Avalonia XPF, our cross-platform WPF, which enables WPF apps to run on macOS and Linux with little to no code changes.

InfoQ: What are the key features and benefits of using Avalonia UI for developing desktop applications?

Mike: Using Skia, we enable “pixel-perfect” applications that look the same across every platform. You don’t need to learn or dig into platform-specific APIs to tweak your app’s UI or create custom controls! We’ve found that this level of customisation is essential to many of our users.

The other key benefit of Avalonia UI is that we have the broadest range of supported platforms while not compromising performance. You can develop apps for powerful desktops, low-powered embedded devices, phones, tablets, and WebAssembly.

Our API is designed to be cross-platform, and we take time to ensure that added features make sense in the context of cross-platform UI app development. While WPF and WinUI influence our APIs, we don’t simply copy them; we change things where we can improve. We’ve always regarded blindly copying Windows APIs as a flawed strategy.

InfoQ: What is the current state of Avalonia UI in the .NET User Interface landscape?

Mike: When I started exploring cross-platform UIs for .NET in 2012, the only option was Xamarin. Today the landscape is very different; we have many more options, all with their strengths and weaknesses. Our strength is our ability to provide a high-performance, consistent user experience across platforms while providing developers with a familiar, stable and proven SDK.

We’re often compared to MAUI, which interests me as we don’t view MAUI as a competitor. When I worked at Xamarin, the significant benefit was that Xamarin apps were native apps; that is, they used the native UI toolkits. In 2013, this was extremely important, but it’s no longer such a crucial component when picking a UI technology. If we look at Flutter or the growing popularity of web technologies, we see that it’s possible to deliver high-quality experiences without using native UI toolkits.

We have a ton of respect for MAUI, but we see Flutter and Qt as the main competitors going forward. That’s not to disrespect them, but we believe that technologies outside the .NET ecosystem are doing some exciting things.

In terms of our current state, we provide the most performant cross-platform UI toolkit for .NET developers. If developers prioritise performance, then it makes sense for them to use Avalonia UI. We achieve this by managing every pixel displayed within the application. We have very minimal dependencies, on Windows only using Win32 for the Window.

We previously had a version of Avalonia UI that depended on MonoMac, the precursor to Xamarin.Mac, but found its performance wasn’t acceptable, and thus created our own binding approach called MicroCOM.

On Linux, we only need X11, and iOS and Android just require NET.iOS and NET.Android. Once we have a native Window, we’re good to start pushing pixels and receiving user input events.

InfoQ: How is Avalonia UI positioned in comparison with Microsoft’s recent efforts?

Mike: We tend not to compare ourselves to MAUI, which provides respectable support for mobile but falters on other platforms. From a technical perspective, Avalonia’s approach is drastically different from that of MAUI. MAUI is less a UI toolkit and more a UI abstraction. It relies on the underlying native UI toolkit to work, while we draw the entire UI using ourselves. Most of our users are using SkiaSharp to achieve this, but our architecture makes the renderer pluggable and we’re looking at alternatives as SkiaSharp risks becoming a liability with its lack of maintenance from Microsoft.

The drawn approach yields considerable benefits, especially regarding performance, ease of development and platform support. What really illustrates this is our ability to easily support any platform. Our only requirement is the ability to push pixels and receive interaction events. To give a concrete example, you only need to look at our VNC support, which works with only ~200 LOC. It’d be impossible for MAUI to add new platforms at the speed that we can, simply due to their architecture and dependency on abstracting native UI toolkits.

Our ultimate aim is to become the first choice for every new project that requires a client app, regardless of the target platform. We deliver the best experience for desktop apps already, but we must continue improving our mobile offering to compete with Flutter. We’re going to achieve this by continuing to make investments in growing the team developing Avalonia UI.

InfoQ: What is the roadmap for future development of Avalonia UI, and what new features can we expect to see in upcoming releases?

Mike: In the short term, our roadmap focuses on releasing v11 and overhauling the documentation portal.

v11 provides vast improvements, including a new compositional renderer, accessibility, additional platform support and much more.

Past the release of v11, we’ve some plans that will help us continue to drive adoption and improve the developer experience. We’re going to improve our Visual Studio extension and investigate other renderers to remove our dependency on SkiaSharp.

Interested readers can learn more about Avalonia UI and get started using the documentation and Avalonia GitHub repository.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

© Reuters. Meta Platforms To Rally Around 30%? Here Are 10 Other Analyst Forecasts For Monday

Benzinga –

- BMO Capital boosted the price target for Equity Residential (NYSE: EQR) from $60 to $64. BMO Capital analyst John Kim upgraded the stock from Underperform to Market Perform. Equity Residential shares rose 0.7% to $63.56 in pre-market trading.

- SVB Leerink cut the price target for Blueprint Medicines Corporation (NASDAQ: BPMC) from $48 to $43. SVB Leerink analyst Andrew Berens downgraded the stock from Market Perform to Underperform. Blueprint Medicines shares fell 2.5% to $56.75 in pre-market trading.

- Morgan Stanley cut the price target for The Walt Disney Company (NYSE: DIS) from $120 to $110. Morgan Stanley analyst Benjamin Swinburne maintained an Overweight rating. Disney shares rose 0.4% to $91.14 in pre-market trading.

- BTIG increased Intuitive Surgical, Inc. (NASDAQ: ISRG) price target from $313 to $326. BTIG analyst Ryan Zimmerman maintained a Buy rating. Intuitive Surgical shares fell 0.1% to $311.90 in pre-market trading.

- B of A Securities raised Citigroup Inc. (NYSE: C) price target from $58 to $60. B of A Securities analyst Ebrahim Poonawala maintained a Buy rating on the stock. Citigroup shares fell 0.3% to $46.18 in pre-market trading.

- Baird boosted Spotify Technology S.A. (NYSE: SPOT) price target from $160 to $175. Baird analyst Vikram Kesavabhotla maintained an Outperform rating. Spotify shares fell 0.2% to $151.40 in pre-market trading.

- Susquehanna cut Global Payments Inc. (NYSE: GPN) price target from $190 to $180. Susquehanna analyst James Friedman maintained a Positive rating. Global Payments shares rose 1.6% to close at $100.39 on Friday.

- Evercore ISI Group increased the price target for Apple Inc. (NASDAQ: AAPL) from $190 to $210. Evercore ISI Group analyst Amit Daryanani maintained an Outperform rating. Apple shares rose 1% to $182.66 in pre-market trading.

- Oppenheimer raised Meta Platforms, Inc. (NASDAQ: META) price target from $285 to $350. Oppenheimer analyst Jason Helfstein maintained an Outperform rating. Meta shares fell 0.9% to $270.17 in pre-market trading.

- Wells Fargo increased Broadcom Inc. (NASDAQ: AVGO) price target from $600 to $800. Wells Fargo analyst Aaron Rakers maintained an Equal-Weight rating. Broadcom shares fell 0.3% to $809.29 in pre-market trading.

- Bernstein raised MongoDB, Inc. (NASDAQ: MDB) price target from $257 to $424. Bernstein analyst Firoz Valliji maintained an Outperform rating. MongoDB shares fell 0.1% to $376.21 in pre-market trading.

Check This Out: Top 5 Tech And Telecom Stocks That May Rocket Higher This Month

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga

Article originally posted on mongodb google news. Visit mongodb google news

PostgreSQL, Oracle Database, Objectivity, Neo, MySQL, MongoLab, MongoDB, Microsoft SQL Server

MMS • RSS

Posted on nosqlgooglealerts. Visit nosqlgooglealerts

The NoSQL market research delivers comprehensive research on the present stage of the market, covers market size with respect to assessment as sales volume, and provides a precise forecast of the market scenario over the estimated period. Also focuses on the product, application, manufacturers, suppliers, and regional segments of the market. NoSQL market report research highlights market driving factors, an overview of the market growth, industry size, and market share. Subsequently NoSQL market report depicts the constantly evolving needs of clients, vendors, and purchasers in different regions, it becomes simple to target specific market and generate large revenues in the global industry.

According to the latest research study, the demand of global NoSQL market size & share was valued at approximately USD 85.4 Billion in 2022 and is expected to reach USD 96.2 billion in 2023 and is expected to reach a value of around USD 170 Billion by 2030, at a compound annual growth rate (CAGR) of about 12%during the forecast period 2023 to 2030.”

Some of these key players include: PostgreSQL, Oracle Database, Objectivity, Neo, MySQL, MongoLab, MongoDB, Microsoft SQL Server, MarkLogic, IBM, Hypertable, DynamoDB, Couchbase, CloudDB, Cisco, Basho Technologies, Aerospike

Click here to get a Free Sample Copy of the Report: https://www.mraccuracyreports.com/report-sample/516883

Global NoSQL Market by Type:

Key-Value Store, Document Databases, Column Based Stores, Graph Database

Global NoSQL Market by Application:

Data Storage, Metadata Store, Cache Memory, Distributed Data Depository, e-Commerce, Mobile Apps, Web Applications, Data Analytics, Social Networking

|

Report Attributes |

Report Details |

|

Report Name |

NoSQL Market Size Report |

|

Market Size in 2020 |

USD 96.2 Billion |

|

Market Forecast in 2028 |

USD 170 Billion |

|

Compound Annual Growth Rate |

CAGR of 12% |

|

Number of Pages |

188 |

|

Forecast Units |

Value (USD Billion), and Volume (Units) |

|

Key Companies Covered |

PostgreSQL, Oracle Database, Objectivity, Neo, MySQL, MongoLab, MongoDB, Microsoft SQL Server, MarkLogic, IBM, Hypertable, DynamoDB, Couchbase, CloudDB, Cisco, Basho Technologies, Aerospike |

|

Segments Covered |

By Type,By end-user, And By Region |

|

Regions Covered |

North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

|

Countries Covered |

North America: U.S and Canada |

|

Base Year |

2021 |

|

Historical Year |

2016 to 2020 |

|

Forecast Year |

2022 – 2030 |

|

Customization Scope |

Avail customized purchase options to meet your exact research needs.https://www.mraccuracyreports.com/report-sample/516883 |

Regional Assessment:

Geographically, the global NoSQL market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)).

The Research covers the following objectives:

– To study and analyze the Global NoSQL consumption by key regions/countries, product type and application, history data from 2016 to 2021, and forecast to 2028.

– To understand the structure of NoSQL market by identifying its various sub-segments.

– Focuses on the key global NoSQL manufacturers, to define, describe and analyze the sales volume, value, market share, market competition landscape, Porter’s five forces analysis, SWOT analysis and development plans in next few years.

– To analyze the NoSQL with respect to individual growth trends, future prospects, and their contribution to the total market.

– To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

– To project the consumption of NoSQL submarkets, with respect to key regions (along with their respective key countries).

Please click here today to buy full report @ https://www.mraccuracyreports.com/checkout/516883

Strategic Points Covered in Table of Content of Global NoSQL Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the NoSQL market

Chapter 2: Exclusive Summary and the basic information of the NoSQL Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the NoSQL

Chapter 4: Presenting the NoSQL Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2017-2021

Chapter 6: Evaluating the leading industrialists of the NoSQL market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, NoSQL Market is a valuable source of guidance for individuals and companies.

Key Benefits for Industry Participants & Stakeholders:

- Industry drivers, restraints, and opportunities covered in the study

- Neutral perspective on the market performance

- Recent industry trends and developments

- Competitive landscape & strategies of key players

- Potential & niche segments and regions exhibiting promising growth covered

- Historical, current, and projected market size, in terms of value

- In-depth analysis of the NoSQL Market

The report on the market presents a critical assessment of frameworks for branding decisions, market fit growth strategies, and approaches for leaders and pioneers. The study analyzes distribution channel, product portfolio, business units of top players, and goal attacking, and market expansion.

Ask Analyst for 30% Free Customized Report @ https://www.mraccuracyreports.com/check-discount/516883

Additional paid Services: –

- Client will get one free update on the purchase of Corporate User License.

- Quarterly Industry Update for 1 Year at 40% of the report cost per update.

- One dedicated research analyst allocated to the client.

- Fast Query resolution within 48 hours.

- Industry Newsletter at USD 100 per month per issue.

Wedbush Raises MongoDB’s Price Target to $410 From $230 After ‘Good’ Q1 Results With …

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

06/05/2023 | 10:46am EDT

© MT Newswires 2023

|

|

|

|

Financials (USD)

|

|

Technical analysis trends MONGODB, INC.

| Short Term | Mid-Term | Long Term | |

| Trends | Bullish | Bullish | Bullish |

Income Statement Evolution

|

Sell Buy |

|

| Mean consensus | BUY |

| Number of Analysts | 28 |

| Last Close Price | 388,57 $ |

| Average target price | 362,41 $ |

| Spread / Average Target | -6,73% |

EPS Revisions

Managers and Directors

Sector and Competitors

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

On June 5, 2023, Kash Rangan, an analyst at Goldman Sachs, reiterated his Buy rating on MongoDB (NASDAQ:MDB) and boosted the price target from $280 to $420. This upward adjustment marks a significant increase of $140 from the previous target price. With the new price target, the stock has a potential upside of about 11% from its current price of $377. MongoDB is a cutting-edge, versatile database platform that is specifically engineered to cater to modern data management needs.

MDB Stock Update: June 5, 2023

On June 5, 2023, MDB stock opened at 378.63, up 2.33 points from the previous day’s close of 376.30. The stock had a day’s range of 376.02 to 392.35 and traded at a volume of 110,577, significantly lower than its average volume of 1,810,243 over the past three months. The market cap of MDB stood at $26.5B.

MDB, or MongoDB Inc., is a technology services company that specializes in packaged software. The company had an earnings growth of -5.89% last year, but this year it has seen a significant increase in earnings growth, with a +78.94% growth rate. The company is projected to have an earnings growth rate of +8.00% over the next five years.

The P/E ratio for MDB is not available (NM), but the price/sales ratio is 11.45, and the price/book ratio is 35.53.

MDB’s next reporting date is August 31, 2023, and the EPS forecast for this quarter is $0.42.

Overall, MDB’s stock performance on June 5, 2023 was mixed. While the stock opened higher than the previous day’s close, it did not see significant gains throughout the day. The company’s earnings growth and revenue growth rates are positive, but its net profit margin is negative. Investors will be closely watching the company’s next earnings report to see if it can turn its net loss into a profit.

MongoDB Incs Stock Value Drops Slightly on June 5, 2023, but Investment Analysts Recommend Buying

On June 5, 2023, MongoDB Inc’s stock (MDB) experienced a slight decrease in value. The median target for the company’s stock price was $375.00, with a high estimate of $430.00 and a low estimate of $210.00. The current consensus among 26 polled investment analysts is to buy stock in MongoDB Inc. The company reported earnings per share of $0.42 and sales of $391.1 million for the current quarter. The upcoming earnings report on August 31, 2023, will provide further insight into the company’s financial performance and may impact its stock price in the future.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB, Inc. (NASDAQ: MDB) was one of the worst-affected tech firms when the market selloff battered stock indexes recently. The company’s stock jumped last week after it reported stronger-than-expected results for the first quarter and raised the full-year guidance. The impressive numbers mainly reflect increased spending on research & development and marketing activities.

Stock Rallies

The first-quarter outcome triggered a rally and the New York-headquartered database software provider’s stock rose sharply soon after the announcement a few days ago, marking the biggest single-day gain in recent times. After slipping to a two-year low in the final weeks of 2022, the stock has been gaining. While MDB moved past the 52-week average, it remains well below the all-time highs of 2021.

The valuation is favorable considering the innovation-focused business model and the company’s ability to create long-term shareholder value, though the stock is expected to trade sideways in the near future. The positive top-line performance in recent quarters indicates that revenues are stabilizing after a period of volatility, which adds to the stock’s prospects as a safe investment.

Net income, excluding one-off items, jumped to $0.56 per share in the most recent quarter from $0.20 per share a year earlier, far exceeding Wall Street’s projection. Earnings beat estimates for the fourth consecutive quarter and were broadly on line with the record high of last quarter.

Solid Results

On a reported basis, including special items, it was a net loss of $54.2 million or $0.77 per share, compared to a loss of $77.3 million or $1.14 per share last year. The bottom line benefitted from a 29% year-over-year increase in revenues to $368.3 million. The latest number also topped expectations. The company attributed the surge in revenues to some major customer wins, including China Mobile which migrated a key service from Oracle to MongoDB.

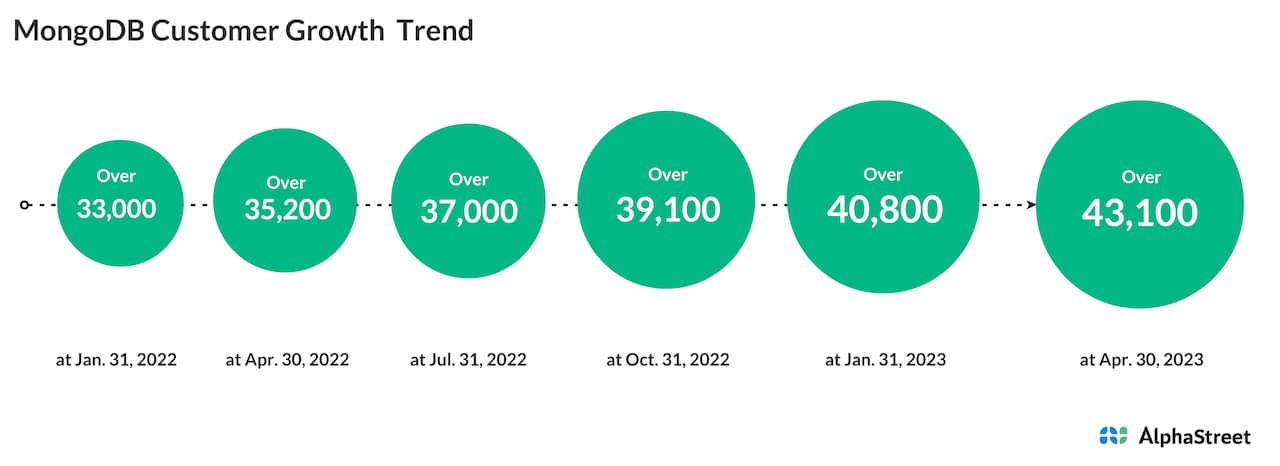

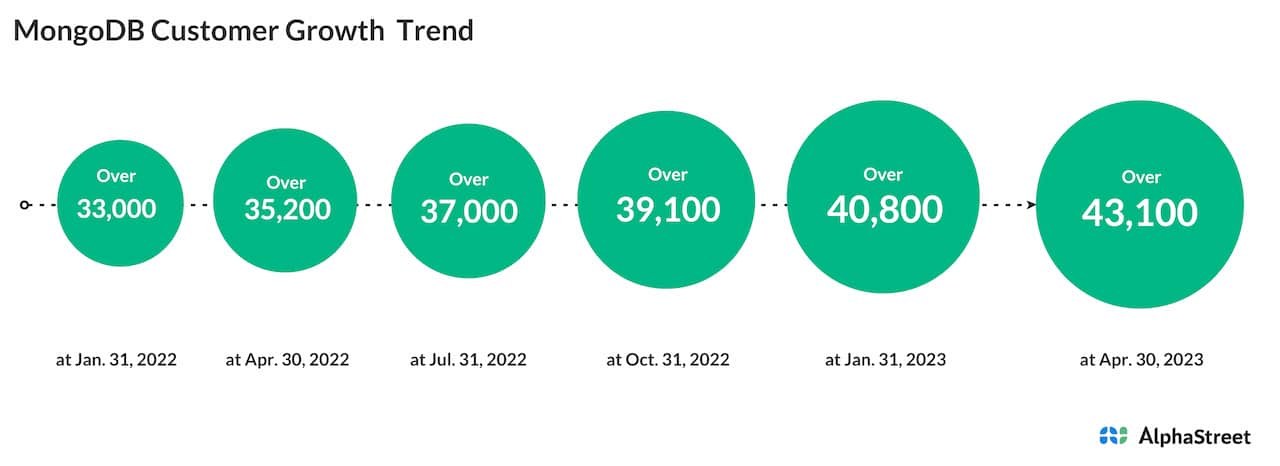

MongoDB added 2,300 new customers in the April quarter, taking the total number to more than 43,100 which also came in above the consensus estimates. Free cash flow, at the end of the quarter, was $53.73 million, which represents a three-fold increase from the prior-year period.

From MongoDB’s Q1 2023 earnings conference call:

“Our customers ranging from the largest companies in the world to cutting-edge startups use our developer data platform to develop and run mission-critical applications. As these applications become successful, customers spend more with MongoDB. In other words, their spend on our platform is directly aligned with the usage of their underlying application, therefore, the value they derive from it. While the growth rate of existing applications can vary based on a number of factors including macro conditions, the relationship between application usage and growth – application usage growth and MongoDB spend has remained consistent.”

Outlook

In a move that could drive long-term revenue growth, the company extended its strategic partnership with Alibaba through 2027, to further integrate its cloud services to serve customers better. Buoyed by the positive developments, the management raised its full-year 2024 revenue guidance to $1.522 billion to $1.542 billion and increased the forecast for adjusted earnings to $1.42-1.56 per share. For the second quarter, the company expects revenue to be in the range of $388 million to $392 million, and earnings per share between $0.43 and $0.46.

MDB opened Monday’s session at $376.30 and made steady gains in the early hours. Currently, the stock is at its highest level in more than a year.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB (MDB) is a “document database used to build highly available and scalable internet applications.” The stock price of the company made a huge upside price gap last Friday on a strong first-quarter earnings and revenue beat along with strong second-quarter guidance.

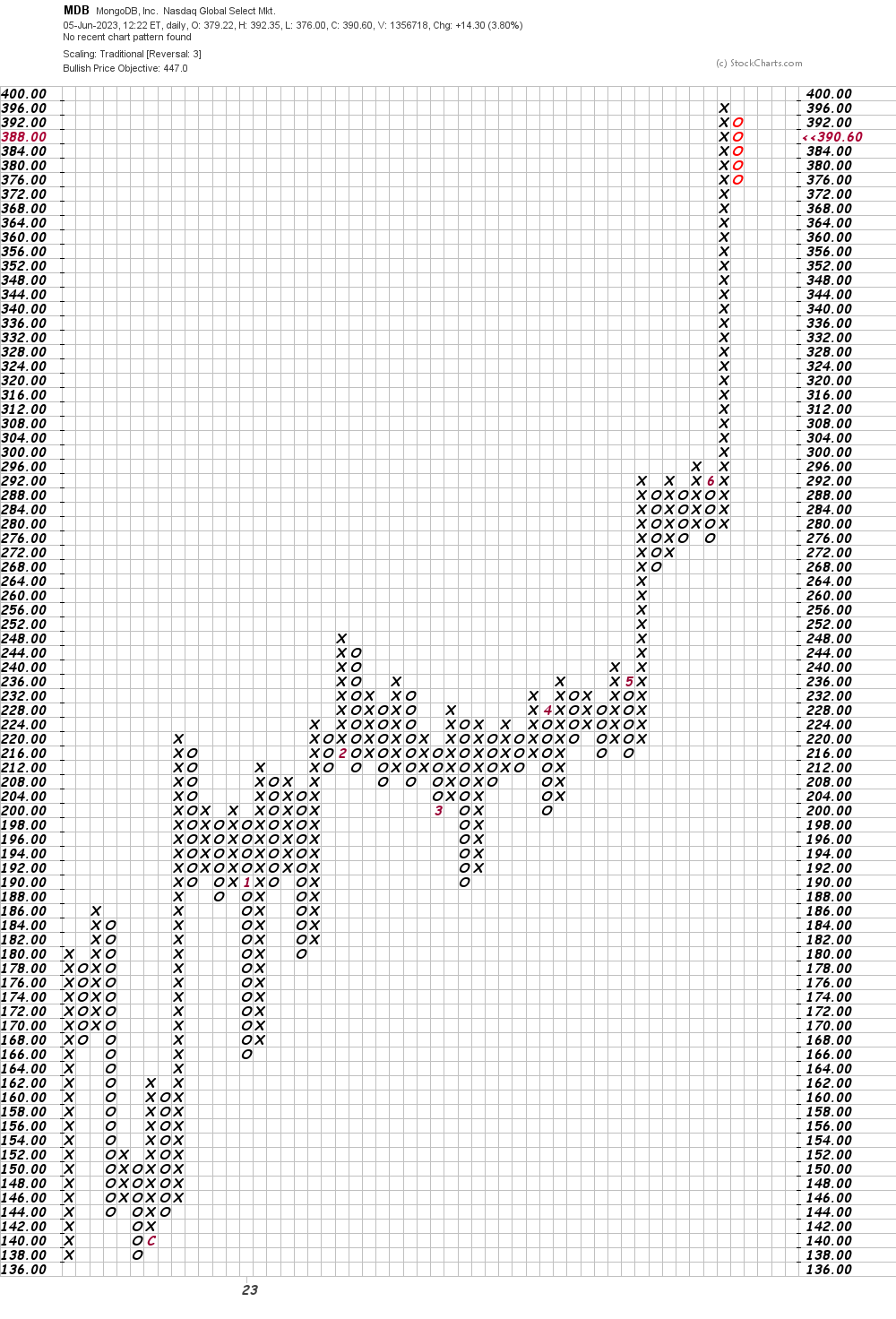

Let’s check out the charts and indicators for clues to its next move.

In this daily bar chart of MDB, below, I can see that the shares made lows in the November/December time frame and then turned higher. Prices began to rise in January and then rallied strongly in May ahead of their earnings report. MDB trades above the rising 50-day moving average line and above the still declining 200-day line.

The On-Balance-Volume (OBV) line shows a smooth rise from December and tells me that buyers of MDB are more aggressive than sellers. The Moving Average Convergence Divergence (MACD) oscillator is in a bullish alignment above the zero line.

Article originally posted on mongodb google news. Visit mongodb google news