Month: June 2023

MMS • RSS

Posted on nosqlgooglealerts. Visit nosqlgooglealerts

Couchbase has introduced a slew of new features that analysts say could help make life easier for developers when using its NoSQL database.

The document-oriented database, which uses the JSON format and is open source, licensed under Apache 2.0, counts airline ticketing system Amadeus, European supermarket giant Carrefour, and Cisco among its user base.

In a effort to get closer to developers in their native habitat, the vendor has integrated its Capella database-as-a-service within the popular Netlify developer platform, and offered a new Visual Studio Code (VS Code) extension.

The aim is to make it easier for developers and development teams to build so-called modern applications — read internet scale or web-native — on Capella.

Rachel Stephens, a senior analyst at RedMonk, told us developers didn’t want to spend time operating and integrating separate elements of the application stack. “Capella’s new developer platform integrations aims to address this widespread issue, minimizing the developer experience gap and allowing teams to focus on what they do best — writing code and solving problems,” she said.

The combination of an IDE extension (VS Code) together with the Netlify app platform and Capella database service had the “potential to streamline how applications are written, delivered and run,” she said.

Couchbase has also introduced a new time series array function in its support for JSON designed to address a broader set of use cases, including IoT and finance applications.

The vendor said that to use Capella in Netlify, developers would need to create a netlify.toml file and .env file, an approach familiar to developers already using Netlify. Another optional tool that can help developers using Netlify is Ottoman.js (ottomanjs.com), a JavaScript ODM that can let developers define document structure, build more maintainable code and map documents to application objects, Couchbase said.

In doing so, developers could potentially reduce complicated mappings from a relational database to objects in code. It would also allow developers to work SQL++, a similar language to the ubiquitous SQL in relational databases.

Lara Greden, IDC research director, said it was a positive move in terms of enhancing the developer experience.

“Developer adoption is fundamentally about reducing the friction for a developer to make use of DBaaS’s capabilities. Direct integration with application platforms and IDEs takes away the friction. Direct, native integrations are increasingly a critical part of any cloud service vendor’s strategy to be a strong contender in the cloud ecosystem,” she said.

In 2021, Couchbase 7.0 introduced schema-like features in the NoSQL database, in a move the vendor said would provide the flexibility and scale of NoSQL database with the semantics and structure of relational systems.

The move liberated the developer from the DBA, but it meant running queries on a pure document database that has no indexes, which was “very inefficient,” according to one analyst.

Couchbase’s latest update came on the back of a string of other database news over the last week which included:

- Distributed relational database Cockroach has introduced its database-as-a-service on Azure as well as multi-region capabilities for its consumption-based, auto-scaling offering, CockroachDB serverless.

- Yugabyte, which offers a PostgreSQL compatible front-end with a distributed relational database underneath, has introduced its 2.18 iteration, promising to ease the deployment of multi-region Kubernetes environments “at scale”, as well as simplify the management of the DBaaS.

- DataStax, the company which offers commercial products built around the open-source wide-column Cassandra database, has formed a partnership with AI startup ThirdAI in a bid to help users build large language models and other forms of generative AI technologies. ®

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

As of June 5, 2023, there has been a surge of unusual options activity in MongoDB (MDB), leading some to believe that a large investor has taken a bearish stance on the company. According to Benzinga’s options scanner, there have been 21 uncommon options trades for MongoDB, with 38% of big-money traders being bullish and 61% bearish. Out of these trades, 6 are puts totaling $455,715, and 15 are calls totaling $1,069,765.

Based on the volume and open interest of these contracts, the price target for MongoDB is estimated to be between $130.0 to $490.0. It is unclear whether this activity is from an institution or a wealthy individual, but typically when such a significant move occurs with a company, it suggests that someone may have insider knowledge of an impending event or change within the company.

MDB Stock Performance and Analysis on June 5, 2023

On June 5, 2023, shares of MongoDB Inc. (MDB) opened at 378.63, up 2.33 points or 0.62% from the previous day’s close of 376.30. The day’s range was between 376.02 and 392.35, with a volume of 56,834 shares traded.

MDB’s market capitalization was $26.5 billion, making it a large-cap stock in the technology services sector. The company’s earnings growth for the past year was -5.89%, but it had a significant increase of 78.94% in earnings growth this year. Furthermore, the company’s earnings growth for the next five years is expected to be 8.00%. The revenue growth for the past year was 46.95%.

MDB’s price-to-earnings (P/E) ratio was not available (NM), but the price-to-sales ratio was 11.45, and the price-to-book ratio was 35.53.

MDB’s next reporting date was set for August 31, 2023, with an earnings per share (EPS) forecast of $0.42 for the quarter. The company’s annual revenue for the past year was $1.3 billion, but it had a net loss of $345.4 million, resulting in a negative net profit margin of -26.90%.

In conclusion, MDB had a positive performance on June 5, 2023, with an increase in stock price and lower-than-average trading volume. The company’s strong revenue growth and earnings growth this year are promising signs for investors. However, the stock’s high price-to-sales and price-to-book ratios may indicate that it is overvalued. Investors should carefully consider all factors before making any investment decisions.

MongoDB Inc Expected to Experience a Slight Decrease in Stock Price, But Analysts Remain Positive

On June 5, 2023, MongoDB Inc (MDB) had a median target price of $375.00, according to the 21 analysts offering 12-month price forecasts. The high estimate was $430.00, while the low estimate was $210.00. This suggests that the stock was expected to experience a -3.47% decrease from its last price of $388.49.

Despite this decrease, the current consensus among 26 polled investment analysts was to buy stock in MongoDB Inc. This rating had held steady since June, when it was unchanged from a buy rating.

Looking at the current quarter’s earnings per share, MongoDB Inc had $0.42, with sales of $391.1M. The reporting date for this quarter was set for August 31, 2023.

The performance of MDB stock on June 5, 2023, was likely influenced by a number of factors. These could include the overall state of the market, news related to MongoDB Inc, and changes in investor sentiment.

It is worth noting that the stock market is inherently unpredictable, and even the most well-informed analysts and investors cannot always accurately predict how a stock will perform. As such, it is important for investors to carefully consider their investment goals and risk tolerance before making any decisions.

Overall, while the median target price for MDB suggested a slight decrease, the consensus among analysts remained positive. As the reporting date for the current quarter approached, investors would likely be closely monitoring MongoDB Inc’s performance and looking for any signs of growth or potential risks.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Software company MongoDB, Inc. (NASDAQ: MDB) has announced financial results for the first quarter of 2024, posting an increase in revenues and adjusted profit.

The company reported a 29% increase in total revenues to $368.3 million for the first three months of fiscal 2024. Both subscription revenues and services revenues rose in double digits, driving strong top-line growth.

On an adjusted basis, MongoDB reported earnings of $0.56 per share, which is more than double the profit it achieved in the comparable period of 2023. On an unadjusted basis, meanwhile, it was a net loss of $54.25 million or $0.77 per share, compared to a loss of $77.3 million or $1.14 per share a year earlier.

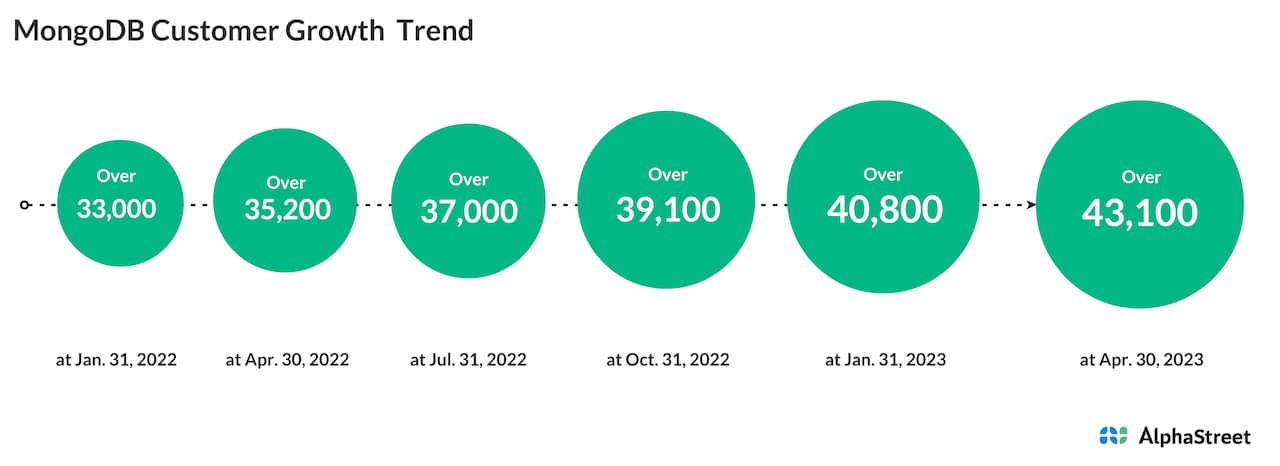

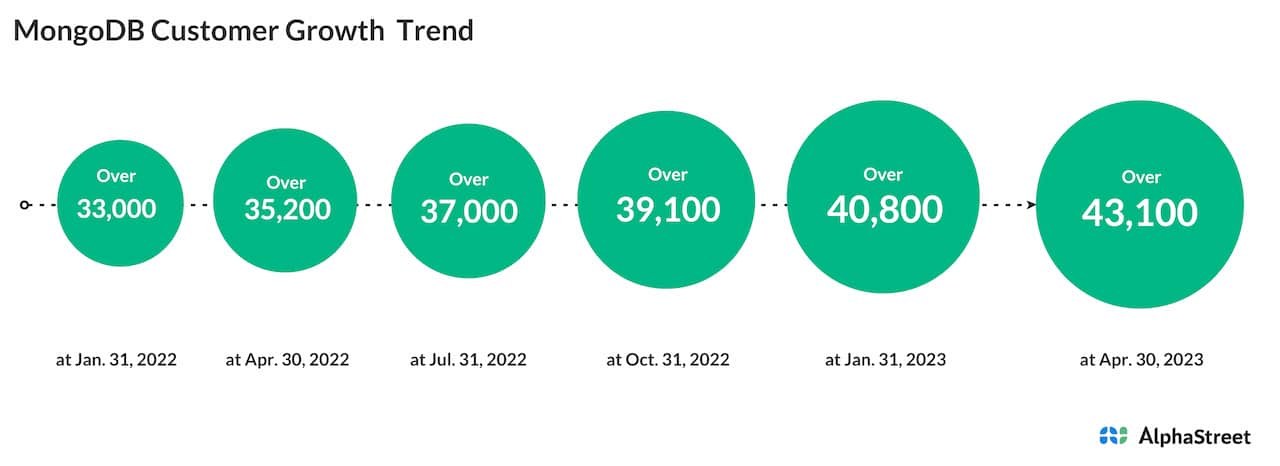

The company continued to expand its customer base, and the number came in at 43,100 as of April 30, 2023. At the end of the quarter, MongoDB had $1.9 billion in cash, cash equivalents, short-term investments, and

restricted cash. During the three-month period, it generated $53.7 million of cash from operations,

compared to $11.6 million in the year-ago period.

Commenting on the results, the company’s CEO Dev Ittycheria said, “MongoDB began fiscal 2024 with strong first quarter results, highlighted by 40% Atlas revenue growth and the most net new customer additions in over two years. The continued strength in new business activity indicates the mission criticality of the MongoDB developer data platform and underscores that investments in innovation remain a top priority for customers.”

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

-

Lululemon Athletica Inc.’s (LULU) shares jumped 11.3% after reporting first quarter fiscal 2023 adjusted earnings er share of $2.28, surpassing the Zacks Consensus Estimate of $1.97.

-

Broadcom Inc.’s (AVGO) shares surged 2.8% after the company reported second quarter fiscal 2023 adjusted earnings per share of $10.32, beating the Zacks Consensus Estimate of $10.13.

-

Shares of Five Below Inc. (FIVE) climbed 7.8% after the company posted first quarter fiscal 2023 adjusted earnings per share of $0.67, outpacing the Zacks Consensus Estimate of $0.62.

-

Shares of MongoDB, Inc. (MDB) soared 28% after posting first quarter fiscal 2024 adjusted earnings per share of $0.56, exceeding the Zacks Consensus Estimate of $0.19.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

© Provided by CNBC

Traders on the floor of the NYSE, June 1, 2023.

Check out the companies making headlines in premarket trading.

Apple — The tech giant’s shares rose about 1% ahead of Apple’s Worldwide Developers Conference, which kicks off Monday at in Cupertino, California. Apple is widely expected to announce a “Reality Pro” headset that incorporates virtual reality.

Palo Alto Networks — The stock jumped nearly 5% after S&P Dow Jones Indices announced Friday evening that the cybersecurity company will replace Dish Network in the S&P 500, effective June 20. Dish Network’s stock fell 4% in premarket.

Valley National Bancorp — The regional bank climbed more than 4% after JPMorgan upgraded the stock to overweight from neutral. The Wall Street firm said the concern around Valley National’s commercial real estate appears “overblown” as Manhattan offices represents less than 1% of its loans.

Target — KeyBanc downgraded the retailer to sector weight from overweight, warning that the resumption of student loan repayments could squeeze Target’s margins. Shares of Target were down less than 1% in premarket trading.

Dollar General — Shares fell 0.8%. Morgan Stanley downgraded the discount retailer’s stock to equal weight from overweight on Sunday, citing its “thesis-shifting quarter.” When reporting quarterly financials last week, the company said a challenging economic environment prompted on a miss on earnings and a cut to full-year guidance.

Estee Lauder — The luxury cosmetic maker dipped about 1% after Oppenheimer downgraded the stock to perform from outperform and removed its $250 price target. The firm said Estee Lauder will struggle to meet these “aggressive” Street expectations.

— CNBC’s Alex Harring and Jesse Pound contributed reporting.

Article originally posted on mongodb google news. Visit mongodb google news

Wedbush Raises MongoDB’s Price Target to $410 From $230 After ‘Good’ Q1 Results With …

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

06/05/2023 | 07:04am EDT

© MT Newswires 2023

|

|

|

|

Financials (USD)

|

|

Technical analysis trends MONGODB, INC.

| Short Term | Mid-Term | Long Term | |

| Trends | Bullish | Bullish | Neutral |

Income Statement Evolution

|

Sell Buy |

|

| Mean consensus | BUY |

| Number of Analysts | 28 |

| Last Close Price | 376,30 $ |

| Average target price | 350,79 $ |

| Spread / Average Target | -6,78% |

EPS Revisions

Managers and Directors

Sector and Competitors

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB’s bright quarter and upped guidance defied the wobbly trend across database-software companies.

- MongoDB, an enterprise software provider, surged on Friday, following its first-quarter earnings data. MongoDB stock (ticker: MDB) popped 28% on a comfortable earnings beat of 56 cents a share, vs analyst consensus for 18 cents. Revenue for the firm landed at $368mn, topping the $348mn projected.

- Pumped by the robust performance, MongoDB lifted not only its second-quarter guidance but also threw in a lofty figure for the full year. In the current quarter, the cloud-based database software provider expects to rake in revenue of at least $388mn. Full-year sales are projected to hit $1.52bn.

- A big factor at play here is the firm’s outstanding performance in the context of slow-walking software companies. Difficult macro environment prompted Salesforce (ticker: CRM) to take a conservative approach to guidance, while PagerDuty (ticker: PD) expects customer activity to drop.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

© Reuters. This Analyst With 85% Accuracy Rate Sees Over 52% Upside In Capri Holdings – Here Are 5 Stock Picks For Last Week From Wall Street’s Most Accurate Analysts

Benzinga – U.S. stocks closed sharply higher on Friday following the release of jobs data, with the S&P 500 adding 1.82% last week.

Wall Street analysts make new stock picks on a daily basis. Unfortunately for investors, not all analysts have particularly impressive track records at predicting market movements. Even when it comes to one single stock, analyst ratings and price targets can vary widely, leaving investors confused about which analyst’s opinion to trust.

Benzinga’s Analyst Ratings API is a collection of the highest-quality stock ratings curated by the Benzinga news desk via direct partnerships with major sell-side banks. Benzinga displays overnight ratings changes on a daily basis three hours prior to the U.S. equity market opening. Data specialists at investment dashboard provider Toggle.ai recently uncovered that the analyst insights Benzinga Pro subscribers and Benzinga readers regularly receive can successfully be used as trading indicators to outperform the stock market.

Top Analyst Picks: Fortunately, any Benzinga reader can access the latest analyst ratings on the Analyst Stock Ratings page. One of the ways traders can sort through Benzinga’s extensive database of analyst ratings is by analyst accuracy. Here’s a look at the most recent stock picks from each of the five most accurate Wall Street analysts, according to Benzinga Analyst Stock Ratings.

Analyst: William Power

- Analyst Firm: Baird

- Ratings Accuracy: 86%

- Latest Rating: Maintained an Outperform rating on MongoDB, Inc. (NASDAQ: MDB) and raised the price target from $290 to $390 on June 2, 2023. Fadem sees around 4% upside in the company’s stock.

- Recent News: MongoDB reported better-than-expected first-quarter results and issued strong guidance.

Analyst: Mark Shmulik

- Analyst Firm: Bernstein

- Ratings Accuracy: 85%

- Latest Rating: Maintained an Outperform rating and increased the price target from $125 to $140 on Amazon.com, Inc. (NASDAQ: AMZN) on May 31, 2023. This analyst sees around 13% upside in the stock.

- Recent News: Amazon.com agreed to pay $30.8 million in settlements with the Federal Trade Commission over allegations of spying on customers through Ring doorbell cameras and violating children’s privacy rights with Alexa recordings.

Analyst: Rick Patel

- Analyst Firm: Raymond James

- Ratings Accuracy: 85%

- Latest Rating: Maintained a Strong Buy rating on Capri Holdings Limited (NYSE: CPRI) and cut the price target from $60 to $55 on June 1, 2023. This analyst expects over 52% gain in the company’s stock.

- Recent News: Capri Holdings reported a fourth-quarter FY23 sales decline of 10.5% year-on-year to $1.33 billion, beating the analyst consensus estimate of $1.28 billion.

Analyst: Eric Wold

- Analyst Firm: B. Riley Securities

- Ratings Accuracy: 85%

- Latest Rating: Initiated coverage on Bowlero Corp. (NYSE: BOWL) with a Buy rating and a price target of $18 on June 2, 2023. Power sees the stock surging around 55%.

- Recent News: Bowlero entered into a definitive agreement to acquire substantially all of the assets of Lucky Strike Entertainment LLC, an upscale bowling company with 14 locations across nine states.

Analyst: Aaron Rakers

- Analyst Firm: Wells Fargo

- Ratings Accuracy: 83%

- Latest Rating: Maintained an Equal-Weight rating on Broadcom Inc. (NASDAQ: AVGO) and raised the price target from $600 to $800 on June 2, 2023. This analyst sees around 1% decline in the stock.

- Recent News: Broadcom reported better-than-expected second-quarter financial results and issued third-quarter revenue guidance above estimates.

Read More: Top 3 Real Estate Stocks That Could Blast Off In June

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga

Article originally posted on mongodb google news. Visit mongodb google news

Windows Dev Drive – Storage Volume Customized for Developers with Improved Performance

MMS • Giorgi Dalakishvili

Article originally posted on InfoQ. Visit InfoQ

Microsoft released Dev Drive at the Build 2023 developer conference, a custom storage volume geared for developers. Built on top of Microsoft’s proprietary ReFS (Resilient File System), Dev Drive is optimized for heavy I/O operations and has improved performance and security capabilities.

Dev Drive includes file-system optimizations and Microsoft claims up to 30% improvement in build times as well as improved security using the new performance mode in Microsoft Defender for Antivirus. In Microsoft Defender performance mode, real-time protection runs asynchronously, balancing security and performance. The balance is reached by delaying security scans until after the file operation has been completed instead of running security scans synchronously while the file operation is being executed. This performance mode is more secure than a folder or process exclusion that disables security scans altogether.

Dev Drive also speeds up other disc-bound operations such as cloning Git repositories, restoring packages, and copying files. Dev Drive is designed for storing source code, package caches and build artifacts but it is not intended for developer tools or installing apps.

Another optimization that Dev Drive implements is copy-on-write (CoW) linking, also known as block cloning. The article on Engineering@Microsoft describes how it works:

Copy-on-write (CoW) linking, also known as block cloning in the Windows API documentation, avoids fully copying a file by creating a metadata reference to the original data on-disk. CoW links are like hardlinks but are safe to write to, as the filesystem lazily copies the original data into the link as needed when opened for append or random-access write. With a CoW link you save disk space and time since the link consists of a small amount of metadata and they write fast.

Dev Drive is currently in public preview and is available to Windows Insiders running the Dev Channel of Windows 11. It requires at least 50GB in free space and a minimum of 8GB of RAM though Microsoft recommends 16GB. Users can create a Dev Drive volume as a new virtual hard disk, or it can use unallocated space.

Those developers who already tried the Dev Drive report getting faster builds, with one user seeing about 40% off npm build and about 20% speedier .NET build. Another user got 25% speed up even though Dev Drive was running on a three-times slower disk.

Dev Drive should appear in the main Windows release channel later this year. It will also be available in Azure Pipelines and GitHub Actions for faster CI builds in the cloud. In addition to the original release blog post, Microsoft has published a detailed page that describes how to set up Dev Drive, what limitations it has as well as frequently asked questions.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

New Jersey, United States,- The latest report published by MR Accuracy Reports indicates that the NoSQL Databases Software Market is likely to accelerate strongly in the coming years. Analysts have studied market drivers, restraints, risks, and opportunities in the global market. The NoSQL Databases Software Market report shows the likely direction of the market in the coming years along with its estimates. An accurate study aims to understand the market price. By analyzing the competitive landscape, the authors of the report have made excellent efforts to help readers understand the key business tactics that major companies are using to maintain market sustainability.

Key Players Mentioned in the NoSQL Databases Software Market Research Report: MongoDB, Amazon, ArangoDB, Azure Cosmos DB, Couchbase, MarkLogic, RethinkDB, CouchDB, SQL-RD, OrientDB, RavenDB, Redis

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.mraccuracyreports.com/report-sample/204170

The report includes company profiles of almost all major players in the NoSQL Databases Software market. The Company Profiles section provides valuable analysis of strengths and weaknesses, business trends, recent advances, mergers and acquisitions, expansion plans, global presence, market presence, and portfolios of products from major market players. This information can be used by players and other market participants to maximize their profitability and streamline their business strategies. Our competitive analysis also provides vital information that will help new entrants identify barriers to entry and gauge the level of competitiveness in the NoSQL Databases Software market.

NoSQL Databases Software Market

.

Application as below

Large Enterprises, SMEs

The global market for NoSQL Databases Software is segmented on the basis of product, type. All of these segments have been studied individually. The detailed investigation allows assessment of the factors influencing the NoSQL Databases Software Market. Experts have analyzed the nature of development, investments in research and development, changing consumption patterns, and growing number of applications. In addition, analysts have also evaluated the changing economics around the NoSQL Databases Software Market that are likely affect its course.

The regional analysis section of the report allows players to concentrate on high-growth regions and countries that could help them to expand their presence in the NoSQL Databases Software market. Apart from extending their footprint in the NoSQL Databases Software market, the regional analysis helps players to increase their sales while having a better understanding of customer behavior in specific regions and countries. The report provides CAGR, revenue, production, consumption, and other important statistics and figures related to the global as well as regional markets. It shows how different type, application, and regional segments are progressing in the NoSQL Databases Software market in terms of growth.

NoSQL Databases Software Market Report Scope

ESTIMATED YEAR 2022

BASE YEAR 2021

FORECAST YEAR 2029

HISTORICAL YEAR 2020

UNIT Value (USD Million/Billion)

The NoSQL Databases Software report provides information about the market area, which is further subdivided into sub-regions and countries/regions. In addition to the market share in each country and sub-region, this chapter of this report also contains information on profit opportunities. This chapter of the report mentions the market share and growth rate of each region, country and sub-region during the estimated period.

- North America (USA and Canada)

- Europe (UK, Germany, France and the rest of Europe)

- Asia Pacific (China, Japan, India, and the rest of the Asia Pacific region)

- Latin America (Brazil, Mexico, and the rest of Latin America)

- Middle East and Africa (GCC and rest of the Middle East and Africa)

Please click here today to buy full report @ https://www.mraccuracyreports.com/checkout/204170

Key questions answered in the report:

- Which are the five top players of the NoSQL Databases Software market?

- How will the NoSQL Databases Software market change in the next five years?

- Which product and application will take a lion’s share of the NoSQL Databases Software market?

- What are the drivers and restraints of the NoSQL Databases Software market?

- Which regional market will show the highest growth?

- What will be the CAGR and size of the NoSQL Databases Software market throughout the forecast period?

Note – To provide a more accurate market forecast, all our reports will be updated prior to delivery considering the impact of COVID-19.

Article originally posted on mongodb google news. Visit mongodb google news