Month: July 2023

Raymond James Financial Services Advisors Inc. Increases Stake in MongoDB, Inc. (NASDAQ:MDB)

MMS • RSS

Raymond James Financial Services Advisors Inc. boosted its stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 10.5% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,863 shares of the company’s stock after acquiring an additional 177 shares during the quarter. Raymond James Financial Services Advisors Inc.’s holdings in MongoDB were worth $434,000 at the end of the most recent reporting period.

Raymond James Financial Services Advisors Inc. boosted its stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 10.5% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,863 shares of the company’s stock after acquiring an additional 177 shares during the quarter. Raymond James Financial Services Advisors Inc.’s holdings in MongoDB were worth $434,000 at the end of the most recent reporting period.

Several other institutional investors also recently bought and sold shares of the stock. Bessemer Group Inc. purchased a new stake in shares of MongoDB in the fourth quarter valued at approximately $29,000. BI Asset Management Fondsmaeglerselskab A S purchased a new stake in shares of MongoDB in the fourth quarter valued at approximately $30,000. Lindbrook Capital LLC increased its position in shares of MongoDB by 350.0% in the fourth quarter. Lindbrook Capital LLC now owns 171 shares of the company’s stock valued at $34,000 after buying an additional 133 shares in the last quarter. Y.D. More Investments Ltd purchased a new stake in shares of MongoDB in the fourth quarter valued at approximately $36,000. Finally, CI Investments Inc. increased its position in shares of MongoDB by 126.8% during the fourth quarter. CI Investments Inc. now owns 186 shares of the company’s stock worth $37,000 after purchasing an additional 104 shares in the last quarter. 89.22% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at MongoDB

In related news, Director Dwight A. Merriman sold 1,000 shares of MongoDB stock in a transaction on Tuesday, July 18th. The stock was sold at an average price of $420.00, for a total value of $420,000.00. Following the completion of the transaction, the director now directly owns 1,213,159 shares in the company, valued at $509,526,780. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the firm’s stock in a transaction on Tuesday, July 18th. The stock was sold at an average price of $420.00, for a total value of $420,000.00. Following the sale, the director now directly owns 1,213,159 shares in the company, valued at $509,526,780. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Dwight A. Merriman sold 2,000 shares of the firm’s stock in a transaction on Wednesday, April 26th. The shares were sold at an average price of $240.00, for a total value of $480,000.00. Following the completion of the sale, the director now owns 1,225,954 shares in the company, valued at $294,228,960. The disclosure for this sale can be found here. Insiders sold a total of 118,427 shares of company stock worth $41,784,961 over the last ninety days. Company insiders own 4.80% of the company’s stock.

MongoDB Trading Down 4.3 %

MDB opened at $412.64 on Friday. MongoDB, Inc. has a 52 week low of $135.15 and a 52 week high of $439.00. The business has a fifty day simple moving average of $359.61 and a 200-day simple moving average of $265.73. The firm has a market cap of $29.12 billion, a P/E ratio of -88.36 and a beta of 1.13. The company has a quick ratio of 4.19, a current ratio of 4.19 and a debt-to-equity ratio of 1.44.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings results on Thursday, June 1st. The company reported $0.56 EPS for the quarter, topping the consensus estimate of $0.18 by $0.38. MongoDB had a negative return on equity of 43.25% and a negative net margin of 23.58%. The business had revenue of $368.28 million during the quarter, compared to analyst estimates of $347.77 million. During the same period last year, the business posted ($1.15) earnings per share. The company’s quarterly revenue was up 29.0% on a year-over-year basis. On average, equities analysts expect that MongoDB, Inc. will post -2.8 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on MDB. Barclays boosted their price target on MongoDB from $374.00 to $421.00 in a research report on Monday, June 26th. Morgan Stanley boosted their price target on MongoDB from $270.00 to $440.00 in a research report on Friday, June 23rd. VNET Group reiterated a “maintains” rating on shares of MongoDB in a research report on Monday, June 26th. Stifel Nicolaus boosted their price target on MongoDB from $375.00 to $420.00 in a research report on Friday, June 23rd. Finally, Piper Sandler boosted their price target on MongoDB from $270.00 to $400.00 in a research report on Friday, June 2nd. One analyst has rated the stock with a sell rating, three have given a hold rating and twenty have given a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of “Moderate Buy” and a consensus price target of $366.59.

About MongoDB

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

MongoDB, Inc. is a developer data platform company. Its developer data platform is an integrated set of databases and related services that allow development teams to address the growing variety of modern application requirements. Its core offerings are MongoDB Atlas and MongoDB Enterprise Advanced. MongoDB Atlas is its managed multi-cloud database-as-a-service offering that includes an integrated set of database and related services. MongoDB Atlas provides customers with a managed offering that includes automated provisioning and healing, comprehensive system monitoring, managed backup and restore, default security and other features. MongoDB Enterprise Advanced is its self-managed commercial offering for enterprise customers that can run in the cloud, on-premises or in a hybrid environment. It provides professional services to its customers, including consulting and training. It has over 40,800 customers spanning a range of industries in more than 100 countries around the world.

MongoDB, Inc. (MDB) is Attracting Investor Attention: Here is What You Should Know – Zacks

MMS • RSS

MongoDB (MDB – Free Report) has been one of the most searched-for stocks on Zacks.com lately. So, you might want to look at some of the facts that could shape the stock’s performance in the near term.

Over the past month, shares of this database platform have returned +15.6%, compared to the Zacks S&P 500 composite’s +3.6% change. During this period, the Zacks Internet – Software industry, which MongoDB falls in, has gained 8.5%. The key question now is: What could be the stock’s future direction?

While media releases or rumors about a substantial change in a company’s business prospects usually make its stock ‘trending’ and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Here at Zacks, we prioritize appraising the change in the projection of a company’s future earnings over anything else. That’s because we believe the present value of its future stream of earnings is what determines the fair value for its stock.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock’s fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

For the current quarter, MongoDB is expected to post earnings of $0.45 per share, indicating a change of +295.7% from the year-ago quarter. The Zacks Consensus Estimate has changed +4.6% over the last 30 days.

For the current fiscal year, the consensus earnings estimate of $1.51 points to a change of +86.4% from the prior year. Over the last 30 days, this estimate has changed +1.6%.

For the next fiscal year, the consensus earnings estimate of $2.04 indicates a change of +35.1% from what MongoDB is expected to report a year ago. Over the past month, the estimate has changed +3.6%.

Having a strong externally audited track record, our proprietary stock rating tool, the Zacks Rank, offers a more conclusive picture of a stock’s price direction in the near term, since it effectively harnesses the power of earnings estimate revisions. Due to the size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, MongoDB is rated Zacks Rank #2 (Buy).

The chart below shows the evolution of the company’s forward 12-month consensus EPS estimate:

12 Month EPS

Revenue Growth Forecast

While earnings growth is arguably the most superior indicator of a company’s financial health, nothing happens as such if a business isn’t able to grow its revenues. After all, it’s nearly impossible for a company to increase its earnings for an extended period without increasing its revenues. So, it’s important to know a company’s potential revenue growth.

For MongoDB, the consensus sales estimate for the current quarter of $389.93 million indicates a year-over-year change of +28.4%. For the current and next fiscal years, $1.54 billion and $1.87 billion estimates indicate +19.8% and +21.7% changes, respectively.

Last Reported Results and Surprise History

MongoDB reported revenues of $368.28 million in the last reported quarter, representing a year-over-year change of +29%. EPS of $0.56 for the same period compares with $0.20 a year ago.

Compared to the Zacks Consensus Estimate of $346.3 million, the reported revenues represent a surprise of +6.35%. The EPS surprise was +194.74%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates each time over this period.

Valuation

Without considering a stock’s valuation, no investment decision can be efficient. In predicting a stock’s future price performance, it’s crucial to determine whether its current price correctly reflects the intrinsic value of the underlying business and the company’s growth prospects.

Comparing the current value of a company’s valuation multiples, such as its price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), to its own historical values helps ascertain whether its stock is fairly valued, overvalued, or undervalued, whereas comparing the company relative to its peers on these parameters gives a good sense of how reasonable its stock price is.

The Zacks Value Style Score (part of the Zacks Style Scores system), which pays close attention to both traditional and unconventional valuation metrics to grade stocks from A to F (an An is better than a B; a B is better than a C; and so on), is pretty helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

MongoDB is graded F on this front, indicating that it is trading at a premium to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

Bottom Line

The facts discussed here and much other information on Zacks.com might help determine whether or not it’s worthwhile paying attention to the market buzz about MongoDB. However, its Zacks Rank #2 does suggest that it may outperform the broader market in the near term.

MMS • Almir Vuk

Microsoft has recently released the sixth preview of the .NET Multi-platform App UI (MAUI) framework in .NET 8 roadmap. As reported, this latest preview release resolves a number of high-impact issues, including Visual Studio for Mac 17.6.1 support, Native AOT for iOS and the new Visual Studio Code extension for .NET MAUI development.

Regarding the improvements, the latest update for .NET MAUI addresses and resolves several critical issues affecting the desktop experience and font-related problems have been tackled, ensuring a smoother user experience when dealing with text and typography for the desktop apps.

Also, this version includes changes and fixes for navigation, associated with crashes, modals, and Shell. Additionally, tabs have been fine-tuned for better functionality including fixes for colours and redraw issues, and the file picker issue on MacOS has been resolved, making it more reliable control.

Furthermore, the development team has made strides in improving memory management and addressing potential leaks. This step forward ensures more stable and reliable performance for .NET MAUI applications.

In another exciting development, the .NET 8 preview 6 brings Native AOT (ahead-of-time compilation) support for iOS. This feature offers developers the option to opt-in for a preview of Native AOT, resulting in a reported 30-40% reduction in app sizes when compared to the Mono. This optimization promises faster loading times and more performance for iOS apps.

The big news about this version is the preview release of Visual Studio Code extension .NET MAUI. The extension is an integrated toolset aimed at enhancing the development experience for .NET MAUI applications. Its primary focus lies in providing developers with improved code editing, debugging, and deployment capabilities.

In the original announcement post about Visual Studio Code Extension, Maddy Montaquila, Senior Product Manager, states the following:

The .NET MAUI extension lets you develop and debug your app on devices, emulators, and simulators from VS Code. .NET MAUI and C# Dev Kit borrow some familiar features from Visual Studio to enhance your productivity, making your mobile and desktop development delightful with C# in VS Code.

Based on the source, the extension is powered by the Roslyn compiler platform, and it offers advanced C# code editing functionalities. The newly updated open-source C# Extension supports IntelliSense code completion, providing developers with context-aware suggestions while writing C# code. Additionally, AI-assisted features, such as whole-line completions and starred suggestions as developers type, are made available through the integration of the IntelliCode for C# Dev Kit extension.

As reported, when working with XAML, the extension facilitates a more user-friendly editing process. It offers lightweight syntax highlighting and autocomplete features that adapt to developers coding habits, leading to increased editing efficiency. Regarding debugging and deployment, the .NET MAUI extension simplifies the process of targeting various devices, including Android, iOS, macOS, and Windows.

In the current preview version, the extension supports specific device targets for different operating systems. On Windows, debugging is available for local Windows machines, Android emulators, and Android devices. On macOS, debugging can be performed locally on Mac machines, as well as on iOS simulators or devices and Android emulators or devices. For Linux users, debugging is supported on Android emulators and devices.

The comment section of the original release blog posts has generated significant activity, with users engaging in numerous questions and discussions with the development team. Developers are encouraged to explore the comment section for further information and insights about community feedback and development team answers to those suggestions.

Lastly, in addition to an original release blog post, and as part of the development process, the development team calls on developers to test the new release and share feedback through the GitHub issue tracker.

The community members are also invited to visit the official GitHub project repository and learn more about this project and its future roadmap.

MMS • Daniel Dominguez

Meta AI has introduced CM3leon, a novel multimodal model combining text and image production. This model is the first of its type, using a modified formula from text-only language models to deliver remarkable outcomes with unequaled computational efficiency.

This new model generates text-to-images at a state-of-the-art rate while utilizing five times less computing power than earlier transformer-based techniques. It maintains low training costs and high inference efficiency while combining the adaptability and efficiency of autoregressive models. As a causal masked mixed-modal (CM3) model, CM3leon enhances the capabilities of prior models by being able to produce text and image sequences dependent on arbitrary sequences of other text and image content.

CM3leon possesses both the power and adaptability characteristic of autoregressive models, along with the remarkable efficiency and cost-effectiveness during both training and inference stages. This significant advancement overcomes the limitations of previous models, which were restricted to performing either text or image generation tasks exclusively.

CM3Leon’s architecture uses a decoder-only transformer akin to well-established text-based models. However, what sets CM3Leon apart is its ability to input and generate both text and images. This empowers CM3Leon to successfully handle a variety of tasks like prompt questions and model generations.

According to Meta’s research on Autoregressive Multi-Modal Models, diffusion models have recently taken over picture production efforts because of their superior performance and low computing cost. Token-based autoregressive models, on the other hand, are well known to likewise yield great results, with superior global picture coherence in particular, but they are significantly more expensive to train and employ for inference.

Generative models are getting more and more complex trained on millions of sample photos to learn the relationship between visuals and text, but they may also reflect any biases found in the training data. While AI-generated images have become increasingly familiar through popular tools like Stable Diffusion, DALL·E, and Midjourney, Meta AI’s approach in constructing CM3leon and the performance it promises to deliver represent a significant leap forward.

MMS • Ben Linders

The circular economy is a framework that aims to keep products and materials in use for as long as possible, reducing waste and pollution, and regenerating natural systems. As practitioners or change enablers, we can support sustainable product development using concepts from the circular economy in our daily work.

Ines Garcia spoke about the circular economy and agile product development at XP 2023.

The IT industry can reduce waste and pollution by embracing circular economy principles, Garcia mentioned. This includes designing products for reuse and refurbishment, promoting the sharing economy, implementing closed-loop supply chains, and responsibly managing electronic waste. The principles can guide the products we create and how we create them, Garcia said.

Garcia explained why the circular economy matters to her:

It provides a pathway to decouple economic growth from environmental degradation and create a more resilient and thriving future for all, not just humans as species.

PESTEL analysis is a strategic tool often applied in the circular economy world, that just suits any product organisation and therefore worth equipping as agile practitioners on our toolboxes, Garcia said. PESTEL stands for Political, Economic, Social, Technological, Environmental, and Legal factors. This tool evaluates external macro-environmental factors impacting an organization:

For example, suggestions for using it include analyzing how these factors can impact product development, project funding, team dynamics, regulatory compliance, and market demand. To its core, PESTEL analysis helps inform decision-making, identify opportunities, and address risks related to sustainability and circularity.

We often think of software and services as ephemeral, non physical. Yet the crossroads with the circular economy are rather wide, Garcia said.

As practitioners and change enablers, we can support sustainable software development by promoting practices such as green software engineering, optimizing energy consumption, and reducing waste in the software development life cycle, Garcia said. This is a simple starting point.

Garcia mentioned that a good next step is to advocate for the use of renewable energy sources, implement eco-friendly infrastructure, and raise awareness about the environmental impact of software development:

Don’t forget about the physical items we use such as hardware, remember to keep products and materials in use for as long as possible. Extend and maximise items use, repair, upcycle, etc.

InfoQ interviewed Ines Garcia about the circular economy and sustainable product development.

InfoQ: What can be done by the IT industry to reduce waste and pollution?

Ines Garcia: The industry can prioritize energy efficiency, adopt sustainable sourcing practices, and minimize the use of hazardous materials in production. Just to name a few.

Needless to say, tech is everywhere. I see it not as an industry, but as a fabric layer in our 21st century. If you think about it, tech is touching almost every aspect of society and the economy.

It has become an integral part of our daily routines, communication, entertainment, transportation, healthcare, and more. When I refer to tech as a fabric layer in our 21st century, I mean that it permeates and interconnects everything, much like a fabric weaves together different threads. It has a profound impact on how we live, work, and interact.

Whilst it has potential to support the reduction of planetary boundaries overshoot and the social shortfall, it’s essential to recognize that technology also has its own environmental footprint. The production, use, and disposal of tech devices and infrastructure contribute to resource consumption, waste generation, and carbon emissions; and the huge amounts of energy consumption.

InfoQ: What do you hope that the future will bring?

Garcia: When considering the topic at hand, often the concept of “the future” is brought up. In the question posed here, for instance, we are prompted to contemplate what lies ahead. In our limited time, we must recognize the urgency to take action. Today is the focal point for change, as we cannot afford to delay further.

My hope is that TODAY will bring a widespread adoption of circular economy principles, where sustainability becomes seamlessly integrated into every aspect of our lives and business practices.

In envisioning TOMORROW–rather than future–I see a world where organizations prioritize the well-being of the planet and its inhabitants (not just humans). This entails using resources efficiently, regenerating in the process, and leveraging technology and innovation to create a thriving and resilient environment.

And doing so not just for future generations, but to dramatically slow down the detrimental effects we impose–us humans– as one species into our biosphere, which is not ours alone.

The future is not to be predicted nor forecasted, but to be imagined so that it can be created. It’s up to us.

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB – Get Free Report)’s stock price hit a new 52-week high during mid-day trading on Tuesday . The company traded as high as $426.97 and last traded at $411.98, with a volume of 561238 shares trading hands. The stock had previously closed at $409.17.

MongoDB, Inc. (NASDAQ:MDB – Get Free Report)’s stock price hit a new 52-week high during mid-day trading on Tuesday . The company traded as high as $426.97 and last traded at $411.98, with a volume of 561238 shares trading hands. The stock had previously closed at $409.17.

Wall Street Analysts Forecast Growth

A number of research analysts have recently commented on MDB shares. Barclays upped their price target on MongoDB from $374.00 to $421.00 in a research report on Monday, June 26th. Citigroup upped their price target on MongoDB from $363.00 to $430.00 in a research report on Friday, June 2nd. Capital One Financial assumed coverage on MongoDB in a report on Monday, June 26th. They set an “equal weight” rating and a $396.00 price objective on the stock. 58.com reissued a “maintains” rating on shares of MongoDB in a report on Monday, June 26th. Finally, Royal Bank of Canada increased their price objective on MongoDB from $400.00 to $445.00 in a report on Friday, June 23rd. One research analyst has rated the stock with a sell rating, three have given a hold rating and twenty have issued a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of “Moderate Buy” and an average target price of $366.59.

MongoDB Price Performance

The company has a debt-to-equity ratio of 1.44, a quick ratio of 4.19 and a current ratio of 4.19. The stock has a market capitalization of $30.44 billion, a P/E ratio of -92.34 and a beta of 1.13. The firm has a 50-day moving average price of $356.64 and a 200 day moving average price of $264.70.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings data on Thursday, June 1st. The company reported $0.56 EPS for the quarter, beating the consensus estimate of $0.18 by $0.38. MongoDB had a negative return on equity of 43.25% and a negative net margin of 23.58%. The firm had revenue of $368.28 million for the quarter, compared to analyst estimates of $347.77 million. During the same period in the prior year, the company earned ($1.15) EPS. The company’s revenue was up 29.0% on a year-over-year basis. On average, analysts expect that MongoDB, Inc. will post -2.8 EPS for the current year.

Insider Buying and Selling

In related news, Director Dwight A. Merriman sold 606 shares of the firm’s stock in a transaction that occurred on Monday, July 10th. The stock was sold at an average price of $382.41, for a total transaction of $231,740.46. Following the transaction, the director now directly owns 1,214,159 shares in the company, valued at approximately $464,306,543.19. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. In other news, Director Dwight A. Merriman sold 606 shares of MongoDB stock in a transaction that occurred on Monday, July 10th. The stock was sold at an average price of $382.41, for a total value of $231,740.46. Following the sale, the director now directly owns 1,214,159 shares in the company, valued at approximately $464,306,543.19. The sale was disclosed in a filing with the SEC, which is available through this link. Also, Director Dwight A. Merriman sold 2,000 shares of MongoDB stock in a transaction that occurred on Wednesday, April 26th. The stock was sold at an average price of $240.00, for a total value of $480,000.00. Following the completion of the sale, the director now owns 1,225,954 shares in the company, valued at $294,228,960. The disclosure for this sale can be found here. Insiders have sold a total of 117,427 shares of company stock worth $41,364,961 in the last ninety days. 4.80% of the stock is owned by insiders.

Institutional Investors Weigh In On MongoDB

A number of large investors have recently made changes to their positions in the business. Northside Capital Management LLC bought a new stake in shares of MongoDB in the 2nd quarter worth approximately $210,000. CHICAGO TRUST Co NA purchased a new position in shares of MongoDB in the 2nd quarter valued at approximately $306,000. D.B. Root & Company LLC purchased a new position in shares of MongoDB in the 2nd quarter valued at approximately $380,000. Diversified Trust Co lifted its stake in shares of MongoDB by 16.0% in the 2nd quarter. Diversified Trust Co now owns 3,321 shares of the company’s stock valued at $1,365,000 after purchasing an additional 458 shares during the period. Finally, Connective Portfolio Management LLC purchased a new position in shares of MongoDB in the 2nd quarter valued at approximately $494,000. 89.22% of the stock is currently owned by institutional investors.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • Steef-Jan Wiggers

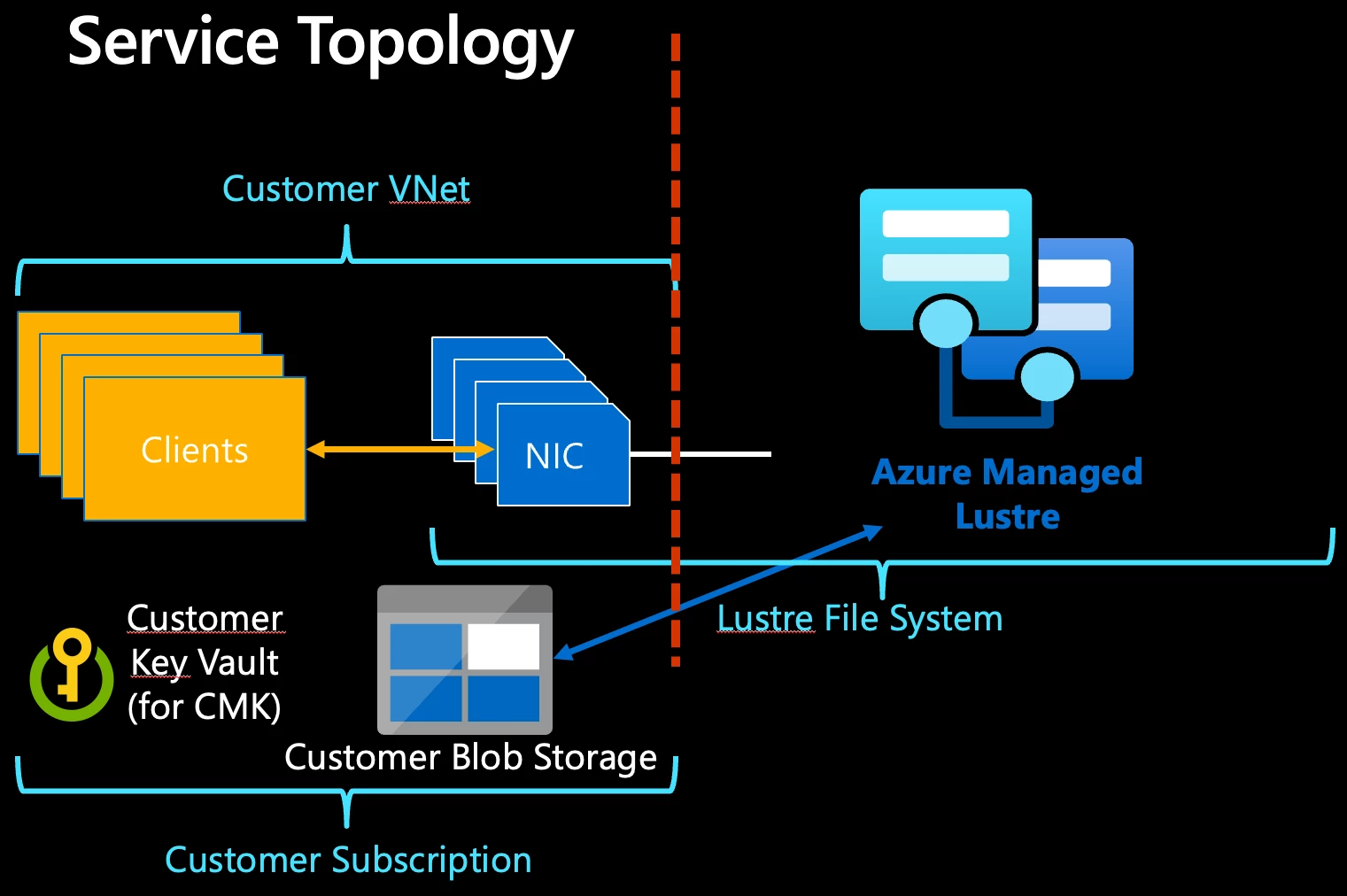

Microsoft recently announced the general availability (GA) of Azure Managed Lustre, a managed file system for high-performance computing (HPC) and AI workloads.

Earlier, the company released a preview of the service as a managed offering for its customers to allow them to focus more on their business goals, such as predicting weather patterns, researching genomic sequences for diseases, and drug discovery. With the GA release, customers have a managed platform service allowing them to consume the Lustre file system, an open-source parallel filesystem born for high-performance computing as a research project in 1999. It provides a high-performance distributed parallel file system with hundreds of GBps storage bandwidth and solid-state disk latency. In addition, it integrates with Azure services like Azure HPC Compute, Azure Kubernetes Service, and Azure Machine Learning.

Wolfgang De Salvador, an EMEA GBB HPC, and AI Senior Specialist at Microsoft, explains in an Azure High-Performance Computing (HPC) blog post:

Azure Managed Lustre delivers all the performance and scalability benefits of Lustre, without the burden of managing the underlying infrastructure. Moreover, it features an integration through Lustre HSM with Azure Blob Storage for data retrieval and archival. This allows HPC/AI workloads to have access on the hot tier to the working datasets, keeping the remaining data in Azure Blob to minimize operational costs.

Azure Managed Lustre is provided in a hosted-on-behalf-of subscription, accessed through a straightforward interface within the customer’s virtual network, eliminating the need for customers to worry about the complexities of deploying, managing, and operating the Lustre file system, including metadata servers/targets (MDS/MDT), management servers/targets (MGS/MGT), and object storage servers/targets (OSS/OSTs).

Service Topology of the Azure Managed Lustre Service (Source: Microsoft Compute Blog Post)

Jurgen Willis, Vice President of Product Management, Azure Storage, explained in the announcement blog post the need for a managed service in Azure allowing customers to leverage Lustre:

Lustre, one of the most popular distributed parallel filesystems in the HPC world, has long been deployed on-premises serving scalable and high throughput storage needs of HPC workloads. As an open-source solution, it has enjoyed a thriving ecosystem of users and developers. With the recent explosive growth seen in generative AI and the need for a high throughput storage that keeps the expensive GPU cores from waiting on data, Lustre has found a renewed growth in its adoption.

The service offers two persistent, durable instances based on solid state drives (SSDs), which are differentiated by their performance option delivered for provisioned Tebibyte of capacity:

- Azure Managed Lustre File System (AMLFS) Standard – 125 MB/s

- AMLFS Premium – 250 MB/s

Users of Azure Managed Lustre can download the Lustre client packages from packages.microsoft.com for their desired Linux distribution and kernel version. Additionally, Microsoft offers support for HPC images prebuilt with Lustre client packages for Ubuntu – 18.04, 20.04, 22.04, and Alma 8.7.

Lastly, more details on the service are available through the documentation landing page. Furthermore, the pricing and availability details are on the pricing page.

MMS • RSS

D.A. Davidson & CO. reduced its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 51.4% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 945 shares of the company’s stock after selling 1,000 shares during the quarter. D.A. Davidson & CO.’s holdings in MongoDB were worth $220,000 as of its most recent SEC filing.

D.A. Davidson & CO. reduced its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 51.4% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 945 shares of the company’s stock after selling 1,000 shares during the quarter. D.A. Davidson & CO.’s holdings in MongoDB were worth $220,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also recently modified their holdings of MDB. Asset Management One Co. Ltd. increased its holdings in MongoDB by 7.1% in the 1st quarter. Asset Management One Co. Ltd. now owns 64,283 shares of the company’s stock worth $14,782,000 after acquiring an additional 4,268 shares in the last quarter. Mackenzie Financial Corp raised its position in shares of MongoDB by 96.3% during the 1st quarter. Mackenzie Financial Corp now owns 5,773 shares of the company’s stock worth $1,346,000 after purchasing an additional 2,832 shares during the last quarter. DekaBank Deutsche Girozentrale lifted its stake in MongoDB by 23.4% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 13,654 shares of the company’s stock valued at $2,964,000 after buying an additional 2,591 shares in the last quarter. Whittier Trust Co. of Nevada Inc. boosted its holdings in MongoDB by 60.4% in the 1st quarter. Whittier Trust Co. of Nevada Inc. now owns 15,075 shares of the company’s stock worth $3,514,000 after buying an additional 5,679 shares during the last quarter. Finally, Whittier Trust Co. increased its stake in MongoDB by 21.0% during the 1st quarter. Whittier Trust Co. now owns 29,391 shares of the company’s stock worth $6,851,000 after buying an additional 5,094 shares in the last quarter. Hedge funds and other institutional investors own 89.22% of the company’s stock.

Insider Activity

In related news, CRO Cedric Pech sold 360 shares of the stock in a transaction on Monday, July 3rd. The stock was sold at an average price of $406.79, for a total value of $146,444.40. Following the transaction, the executive now owns 37,156 shares of the company’s stock, valued at $15,114,689.24. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. In other news, CEO Dev Ittycheria sold 50,000 shares of the firm’s stock in a transaction that occurred on Wednesday, July 5th. The shares were sold at an average price of $407.07, for a total transaction of $20,353,500.00. Following the transaction, the chief executive officer now directly owns 218,085 shares in the company, valued at $88,775,860.95. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, CRO Cedric Pech sold 360 shares of the company’s stock in a transaction on Monday, July 3rd. The shares were sold at an average price of $406.79, for a total transaction of $146,444.40. Following the completion of the sale, the executive now owns 37,156 shares of the company’s stock, valued at approximately $15,114,689.24. The disclosure for this sale can be found here. In the last three months, insiders have sold 117,427 shares of company stock worth $41,364,961. 4.80% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

A number of analysts have recently issued reports on MDB shares. Piper Sandler lifted their price target on MongoDB from $270.00 to $400.00 in a research note on Friday, June 2nd. Royal Bank of Canada increased their target price on shares of MongoDB from $400.00 to $445.00 in a research report on Friday, June 23rd. Oppenheimer boosted their price target on shares of MongoDB from $270.00 to $430.00 in a research report on Friday, June 2nd. Capital One Financial started coverage on shares of MongoDB in a report on Monday, June 26th. They issued an “equal weight” rating and a $396.00 price objective for the company. Finally, VNET Group restated a “maintains” rating on shares of MongoDB in a research report on Monday, June 26th. One investment analyst has rated the stock with a sell rating, three have given a hold rating and twenty have issued a buy rating to the company. According to MarketBeat.com, MongoDB has an average rating of “Moderate Buy” and a consensus price target of $366.59.

MongoDB Trading Up 1.2 %

NASDAQ:MDB opened at $431.21 on Thursday. The stock has a fifty day moving average price of $356.64 and a 200 day moving average price of $264.70. The company has a current ratio of 4.19, a quick ratio of 4.19 and a debt-to-equity ratio of 1.44. MongoDB, Inc. has a 12-month low of $135.15 and a 12-month high of $439.00. The firm has a market cap of $30.44 billion, a PE ratio of -92.34 and a beta of 1.13.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings data on Thursday, June 1st. The company reported $0.56 EPS for the quarter, topping analysts’ consensus estimates of $0.18 by $0.38. MongoDB had a negative return on equity of 43.25% and a negative net margin of 23.58%. The business had revenue of $368.28 million during the quarter, compared to the consensus estimate of $347.77 million. During the same period in the previous year, the company posted ($1.15) earnings per share. The business’s revenue for the quarter was up 29.0% on a year-over-year basis. Sell-side analysts anticipate that MongoDB, Inc. will post -2.8 earnings per share for the current fiscal year.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Headlines haven’t changed, and we continue coasting higher on recent employment and inflation data. At this point, the reality is coming in far closer to the best-case scenario than anyone thought was possible earlier this year.

But for as good as this rally looks, 200 points in two weeks means we need to start watching our backside. The smart time to buy was back near 4,400, not now, as we are approaching 4,600. In fact, this is a far better place to be taking profits than adding new money.

Everything looks great, and that’s exactly why smart money is already peeling off some of its profits. As easy as it is to buy back in, we can always buy the next move above 4,600. But until that happens, we need to protect the profits we have now.

Once we acknowledge we can’t pick tops, the next decision becomes selling too early or holding too long. As a nimble trader, my preference is to sell too early because that means when other people are getting nervous watching their profits disappear, I’m in the perfect situation to take advantage of the next trade.

No doubt I’m peeling off profits too early, but as easy as it is to jump back in, my bigger fear is letting these profits escape. We don’t need to sell everything, but it is amazing how much better we feel after locking in some worthwhile profits and reducing our risk.

Remember, we only make money when we sell our favorite positions…