Month: July 2023

MMS • Ben Linders

At QCon New York 2023 Sarah Aslanifar presented Building a Culture of Continuous Experimentation. She showed how fostering a culture of continuous experimentation and leveraging the principle of continuous learning can drive efficiency, eliminate waste, and improve product outcomes.

Aslanifar started her talk by stating that learning is change. It needs time and practice to do it, she argued.

Agility is not limited to a specific methodology or framework, Aslanifar said. She presented an approach called IDEA which stands for Imagine, Decide, Execute, and Assess.

Imagine starts by questioning what problem you want to solve, exploring profit opportunities or cost benefits, and deciding if you can afford to explore a new idea. Open-mindedness and creativity are important elements in this phase, Aslanifar mentioned.

Next, you Decide on the scope, Aslanifar said, where the team agrees the idea is worth exploring and unifies around it. This includes defining an MVP or MLP.

Journey maps can help you to make sense of a problem, Aslanifar said. They describe the typical use of your product by the users, including pains, rewards, and further context to better understand and emphasize with users.

During Execute, the team builds the product. While the focus changes to development, it’s important to keep communicating with the stakeholders and expect adjustments, Aslanifar said. You have to ensure learning by balancing exploration and exploitation, she added.

Value stream mapping is a visualization tool to help identify process inefficiencies from start to finish. It can show you where is the waste, using data that you have, Aslanifar mentioned.

In Asses, the team collects feedback from stakeholders, users, and the system. The feedback informs decisions on how to continue, Aslanifar said.

A Minimum Lovable Product (MLP) goes beyond building a functional prototype. It’s a product that users not only find functional but also love, there’s measurable user engagement, Aslanifar mentioned. This includes a combination of attractive design, intuitive user experience, meaningful branding, and unique features that delight.

When you are in doubt about what to do, Aslanifar suggested flipping a coin to decide, or do both solutions in parallel to learn, experiment and make it easier to decide.

With a premortem you anticipate and prepare for potential problems. It helps you to plan ahead on what to do if your plan fails. Aslanifar suggested to don’t wait for the postmortem.

Aslanifar summarized their path to agility. They adhered to the agile software development values, but skipped some of the activities like story writing sessions, grooming sessions, and estimations. What they kept were things like standups, feedback, and demos.

MMS • RSS

MongoDB stock has more than doubled in price since December

Subscribers to Chart of the Week received this commentary on Sunday, July 9.

Back in December, our very own Senior Market Strategist Matthew Timpane CMT, participated in MoneyShow’s Top Picks special report for 2023. Six months into the year, two of his best investment ideas cracked MoneyShow’s “Top 10” list. Below is a postmortem on MongoDB Inc (NASDAQ:MDB), which etched in its place at #1. We’ll also be taking a look at what could be next for the software giant, as well as how bulls can mitigate risk while continuing to take home more gains on MDB.

A MongoDB Masterpiece

MongoDB’s Atlas database saw a revenue increase of 61% year-over-year. The fully managed platform has been a sought-after cloud database model that ensures customers don’t have to worry about upgrading or setting up new storage, as it will automatically scale. However, consumption remained well below historical levels at the time of Timpane’s bull pick, and looked poised for a rebound.

A slew of key partnerships were also boosting the cloud concern, specifically with big names Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These partnerships looked to be a great benefit for growth in database and cloud integrations for MongoDB. Chart support was also coming into play for the shares, specifically the 2019 and 2020 $150 horizontal level of resistance. The stock was trying to approach and hold the $10 billion market cap level, while also finding a floor near $144 — six times its initial public offering (IPO) price.

Revenue for the company was expected to grow +28% in 2023, with a price/sales ratio of 9.03, which had not been seen since 2018. An increase in revenue growth was also expected. In terms of technical analysis, brokerage firms were split, with a handful still sporting tepid “hold” or worse ratings. This left the tech name open to bull notes and tailwinds.

Short interest, was on the rise and there also looked to be significant put open interest at the 185- and 200-strikes, which left room for more support after the stock’s late-2022 post-earnings bull run. Lastly, MDB carried an Schaeffer’s Volatility Scorecard (SVS) of 94 (out of 100), indicating the stock tends to outperform said expectations – a boon for options buyers.

From the end of December when Timpane suggested the 2023 bull pick, to the beginning of July, MongoDB stock has more than doubled in price. While the equity was already enjoying a steady climb up the charts, an early June fiscal first-quarter beat-and-raise sent the shares into a 28% post-earnings bull gap, which preceded a June 30 one-year peak of $418.69.

Where Do We Go Next?

While there still looks to be further room for improvement, Timpane suggests taking at least some risk off the table. Leaving a partial position will give potential for more profits, but the market may see a rotation away from tech for the next few months — though once through October expiration, the sector historically comes back to rally.

Of the current market climate for MDB, there have only been a few upgrades this year, despite its impressive run. Short interest is down from January, but is basing, and a short covering rally began in the first half of 2023.

Total Estimated Revenue Growth expanded to 47.1% for 2023, after the company enjoyed its aforementioned Q1 beat. We can also expect a boost in revenue from generative artificial intelligence (AI) due to accelerating application development for new functionality, as big data enters a new paradigm shift.

The stock is still sporting an elevated SVS of 74 out of 100. Even further, at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), MDB sports a 50-day put/call open interest ratio of 1.36, which ranks in the 98th annual percentile. In simpler terms, should this bearish sentiment begin to unwind, it could trigger further tailwinds for the software giant.

However, like we mentioned earlier, risk remains, with potential for macro headwinds. To alleviate unnecessary risk, it’s suggested to cut any remaining position if the stock breaks below the 200-day moving average.

MMS • Julien Danjou

Subscribe on:

Transcript

Shane Hastie: Good day, folks. This is Shane Hastie for the InfoQ Engineering Culture Podcast. Today, I’m sitting down across many miles with Julien Danjou. Julien is the chief executor and founder of Mergify. Julien, I’ll let you tell us a bit about yourself.

Introductions [00:23]

Julien Danjou: Sure. Thank you. So I’m Julien, I’m 39 now. I’m getting older. I’m a software engineer. I started doing software engineering stuff 20 or 25 years ago now, and I started doing open-source work. Basically, that was my first task to doing a lot of toying with computers. I started this way. I think, for the last 20 years, I contributed to a lot of open-source project and worked in companies interested into open source. My last experience were working at Red Hat, Datadog and the Mergify that I founded a few years ago.

Advantages and challenges of working remotely in both remote first and hybrid environments [00:57]

Shane Hastie: We were chatting, before we started recording, about your experience working remotely in both remote first and hybrid environments. Do you want to tell us a little bit about that? Some of the good points and the challenges.

Julien Danjou: That’s a very, very wide topic. The way I started, it started for me when I started my career as a Debian developer like 20 years ago. I was still a student by then. And I joined the project as an engineer to help building Debian, all of that. And that’s the first time I started to work with people that were around the globe, basically. I was based in France and I was working with people in the US, in Australia and wherever you want, basically. Which, I don’t know, in my mind it was a game changer. You were able to start building stuff, software, with people not in the same office or classroom back then for me.

But it was very weird feeling. And I started to discover working remotely with people this way, chatting over IRC, all of that. And then, it drew to me when I started to work. And the first company I joined was Red Hat where … I mean, Red Hat has this culture of … coming right straight from open source. Everybody is used to work asynchronously, which is a very funny way of working. It’s way different than general people are used to work. And you also work with people … Same thing, Red Hat is global. So I was in France, there are people in the US, people all over Europe. So, it was really growing on me this way of working.

When we started Mergify a few years ago, my co-founder was also at the other side of France to me. So, we used to work together at Red Hat remotely, asynchronously and we started the company this way. In that case of Mergify, we started that as a full remote company. But I used to work, for example, at Datadog which is more hybrids, same for Red Hat. And all this working method and environment are very challenging in different ways. For example, I’ll start with the hybrid approach where people are in the office or not in the office. How do you organize people so you do not end up with, what I call, second class citizen.

Basically, it’s very easy for people not being in the office to miss a lot of the water cooler chat. And we all know that a lot of things happen during those chats, basically. Maybe the coffee helps. But people talk and information is transmitted between people. Very important information that you might miss. I think people are just lazy to type everything on a keyboard, which makes sense. We’re all like that. So, you really communicate the minimum amount of information over Slack, over Teams, whatever you use. Whereas, if you have to make conversation with somebody, you’re just talking about topics and information to transmit, which is very important. And you don’t do that when we are not in the office, basically.

And if people are in the office, do that maybe every day because we like to go to the office every day but not into the … Just go remote for a few days a week. And you have people on the other side of the spectrum which are never on the office because they can’t go because, whatever, they’re very far. Then, you have this kind of second-class citizen of people not getting the information that everyone knows.

I have this anecdote. When I started to work 15 years ago, I used to work in an office and I had to move very far for a few months. So, I said to my boss, “I’m just going to move out.” And it was very small company, we were like 12 people in the company.

And I moved very far and I work remotely. I’m the only one being remote, and I live in this other city, a few miles from Paris. And one other guy from the other company, which was a neighbour of our office, comes near my place and say, “Do you want to have lunch?” So, we have lunch. And he say to me, “Do you know, by the way, why you hire this person?” And I was like, “My company hired this person? No, I don’t know.” “He’s been there for like a month.” And nobody ever told me, nobody sent an email saying, “We hired this guy. There’s one new people in the office.”

And for a month I didn’t know because I was not in the office. It was obvious for everyone, so nobody thought about sending an email because the guy was in the office. And that culture was not doing remote, all of that. So I mean, I don’t blame them. But that’s the kind of thing that you still find in hybrid places. That’s all I can see.

How to overcome some of the challenges of hybrid work [05:15]

Shane Hastie: Hybrid is a challenge. What do we need to do to overcome some of those challenges? If we’re stuck with hybrid, what do you think?

Julien Danjou: I think it’s very hard for hybrid to work because of that. So, there are people doing hybrid differently. For example, I know teams doing everybody goes to the office on Friday. Or the opposite, nobody goes on the office. So, you actually have the same schedule so you know people won’t have the chance to miss all the recording information being transmitted, and there’s a chance for one to be in the same place. So, that might work. There are the other aspects because you can also fix that, I think, with more process and being more … Always think about people not in the office.

And then, the percentage of people not being in the office matters. If you have only 5% of the people not being in the office, you have this problem where people are just ignored if they’re not in the office. If you have only, I don’t know, 10, 20% of the people going into an office every day, then the culture can shift to being, “Okay. We’re actually remote. But from time to time, we have a place where we can go and hang out together.” So, the culture shifts a bit in the sense that you are more thinking about people not being there because you know that it’s not the norm to be in the office.

So, that’s where you have to draw the line. And people doing hybrid you can go, from time to time in remote work, being in your home or whatever. And I think it makes very hard to go really into shifting the culture. It’s also true if you start from that, we’re just going to say, “There’s a place where you can go work if you want from time to time.” And people can sync up and say, “Okay, I’m going on the office on Monday.” And then, your culture can be asynchronous, can be remote.

Whereas, if you spend … Which happened with the COVID thing where people were used to work in the office, then suddenly were like, “Okay. We’re just being full remote, and then we go hybrid.” And that’s not your culture so you’re just mixing everything. And it’s very hard to turn a company culture from everybody is in the office, I don’t need to send emails to transmit information, I don’t have to think about people being there. Or maybe I’ll leave a note if I know somebody on sick leave or whatever.

But then, it’s hard to transition to like, “No, I don’t expect people to be right on same time zone as me. I’m going to expect people not to be there also.” And you all changed the way you worked, basically, entirely. And when you have a lot of history because your company is not a startup, I think it makes it harder to switch to that mode.

The challenges in working remote first and how to overcome them [07:38]

Shane Hastie: So when you founded Mergify, you did this with a very deliberate remote first. What are the challenges in working remote first and how do you overcome them?

Julien Danjou: So when you are full remote, the challenges are a bit different. So, you don’t have this second class citizen problem because everyone is on the same page. And I think it’s very important, whatever your mode of working is, or actually that’s my view, but everybody’s on the same level of privilege. There’s no people getting perks because they’re going in the office and they got parties and free snacks and the others don’t have anything. So you don’t have this problem, nobody got free snacks.

But then, the real issue for that, which you can also find in a hybrid approach, is how you connect people. So we are, I think, social animals. I’m a software engineer. Like many people in that area, I’m more introvert so I’m happy being alone for the whole day in my place. That’s cool. But after a while, it drains you out. You feel disconnected from your work, from people, you don’t talk to. Zoom and calls are a solution to that, but it’s not having a barbecue with people. So it’s very hard, when you build a remote company, to have this kind of connection with everyone.

And you feel that worse when you go hybrid because you have connection with everyone who you see every day or every couple of days in the office, and not with the other people. So, it’s a very weird dynamic in your teams if you are that. When you’re full remote, everybody feels weird because everybody don’t meet other people. So although we solved that at Mergify, I don’t think there is a silver bullet. It really depends on the culture you want to build. It took us time. I think we started to build the team two years ago. So, it took us time to find the right pace and the right thing.

We are a team of 11 people right now. The way we solved that is that we basically hired only people in France. Which was not deliberate choice at the beginning, but we were based in France, it was more natural for us to find people in France on network, all of that. So we realized that having everyone remote but in France was a chance because obviously it makes it easier to hire people when you don’t have to look for people in a certain place. So, we were able to find a lot of talents everywhere. And then, we decided to every quarter meet in the same place.

So what we do is that every quarter, so every three months, we find a place in France, anywhere, it could be a remote place in the country or near a mountain or whatever. We rent to house, a mansion, whatever we find. We rent that for week. So on Monday, everyone travels. Take the train, planes, car, whatever, go to that place. On one evening we do a small party, barbecue, whatever, to just meet and drink beers. And sometimes, we have people that just joined the team and they work for a month or two months and they never met anyone face-to-face, which is very weird to work in a place where you never shake the hand of anyone. So, we can do that on Monday.

Then we work, chat, whatever, for the next three days. And on Friday, everybody gets back to their place. So we just take a train, car, whatever and go back. Which means we don’t impact people on weekend or whatever to travel, which we don’t want to do. We don’t force people to come either. I have kids, people have kids, have a life. So if they can’t come for a week, it’s fine. So far, everybody, I mean, do the effort at least once or twice a year, most of the time, four times a year to come to that. Which is very great because it allows everyone to feel connected to each other.

And it gives you this kind of creativeness you need for a startup where everyone really is fueled with that energy. And the next few weeks there’s this high energy of people being connected together. And I think it’s really nice to work together to boost that. And then, it just dries out after a few weeks. So, you have to restart this process and that’s why we do that every three months. So it’s a trade-off, because like I was saying, I have two kids, it makes it very hard for me to travel every weekend and for some people in the team.

But I think good trade-off. For three months, you don’t have to commute to any place. You can stay home, save a lot of time and all the perks that you get with remote work. On the other side, a week every three months you have to, I mean, move your ass somewhere.

Bringing people together: deliberate social interaction [11:52]

Shane Hastie: That intense period of bringing people together. You mentioned in that quite a lot of social interaction and deliberate social interaction. How much of that time is focused on work versus general social?

Julien Danjou: I think it changed over the last edition that we had. The last time we spent a whole afternoon… For example, we were near Bordeaux, so we spent a whole afternoon going to a winery and seeing grape of wine and tasting wine, all of that for a whole afternoon just to have fun. We got to drink wine, obviously. So, we tend to focus more and more on less work. At the beginning, we were working too much for three days straight, just having conversation and working because we were very young and very, “Have to do that to survive. We’re still a startup.” So, we had to work a lot on different things.

Now, we are still in that area but we’re a larger team and it feels more important. I think we are growing and learning from that. So, we understand that it’s very, very more important to spend that time with people having fun together and building connections and trusting each other for the next … It’s short term versus long term, basically. Short term you want to work, you want to spend time building stuff and have this technical conversation or product conversation or marketing conversation, which we do have, but it’s fine to not have…

You can have conversation at over time during the rest of the days of the time. I mean, Zoom is still there. So what you can’t do the rest of the time, you need to do that. And I mean, visiting a winery, you can’t do that over Zoom for sure, which would be not very fun. So, let’s just do that. So, we do know focus more on that. We’re not going to spend the three days not working et cetera, but we do spend time just chatting together. It’s very hard to chat with 10 people over Zoom. I mean, the more you are… It’s easier to do that face to face. So having this large conversation, transmitting the ideas, the vision of the company, the product, doing brainstorms it’s easier face-to-face with a glass of wine or anything to chat to all of that. So we really emphasis, I would say, that part now during our week meeting.

The challenges of being managed remotely [13:57]

Shane Hastie: Thank you. Some interesting ideas there. Managing remote teams. You are a leader and, as you mentioned, you have been in the other side of that as well. You have been managed remotely. What are the challenges there?

Julien Danjou: I’ve been managed remotely for a few years before running Mergify. I think really the pain point as being managed remotely is what I was saying, do you feel connected to your teammates? Or do you trust them? Or do you understand them, who they are? When I was young, I was thinking about my work, my job was to write software and the more I grew, the more I understand that we’re just a team trying to solve a problem. And the way we solve the problem is by writing software. It’s a by-product of who we are and what we do, but it’s not necessarily the goal, the end goal. And to understand that and to do all of that, you have to feel connected to your teammates and to understand them.

I’m not saying you have to be friends with anyone, that’s not the goal. But there’s a certain level of connection. You can’t just ignore people and work alone. That’s not what a team is. You can go very fast alone, but not very far. So, you have to work with other people. So when you are managed, I think there are expectations from your management teams in term, for example, meetings. I spent a period of my time at Red Hat where there was no budget for travel, for example. So, we were not able to meet. I spent two years without any budget for travel so I was not able to meet the other teammates.

The culture was pre-COVID, so the culture was not a lot of Zoom and calls. So, mostly IRC. It’s very hard to work with people just talking with text for years, for months and years over IRC and feel connected to your work, et cetera. So being managed like that, it makes very hard. You can be depressed and that’s one other real problem, and I could feel depressed in that position and management not being able to see that or to acknowledge that because you don’t see people with a sad face coming to the office. You just be on their desk and maybe don’t talk to them for a week because you have this one-to-one meeting every week.

So, it’s very hard in that sense to be managed. I think if you are remote and you are very young and junior, it’s very hard to be managed in remote because you have to be very mature and mature enough to say, “By the way, I have this problem.” But nobody’s going to see that because you are alone behind your desk. And that’s true also for management. In Mergify, most of our engineers are senior – five, eight years of experience. So, they’re easy to manage in the sense that they’re grown up. They don’t expect us to come after us and see if everything’s fine. They’re going to raise their hand and say, “By the way, I have a problem.” And say something over a meeting, over Slack, whatever. Which is not true for junior engineers.

And for example, at Red Hat we saw that where basically it’s very hard to hire junior engineers because most of the team I used to work in were full remotes. And it’s very hard to mentor new engineers when you are remote because talking every day to them over IRC, Slack, or whatever makes it very hard to see if everything is fine. And they can… A junior feel ashamed of being stuck and just be stuck for two days behind their desk with a problem and just being blocked and waiting for something to happen. And you don’t have the contact that you can have in an office and just go to lunch and say, “By the way, this morning I have this problem. Do you have an idea on-” “Yeah sure. You should meet this guy.” Or, “You should look at this.”

You don’t have this conversation. It just don’t happen. So if you have junior engineers, they’re not going to have this conversation on their own because they don’t know where the bar is, where is it okay to reach people and distract them like, “Hey, by the way, can I knock on your door and ask for help? Or I’m disturbing you and question is stupid.” It’s hard to assess that remotely. Whereas, you can just say a word or two in a real life conversation and see how the other person reacts by looking at their face. So, all these kinds of social cues you don’t have. So, managing people or being managed is very hard and really depends on the level of seniorness that you have, basically.

Shane Hastie: And advice for new managers.

Julien Danjou: I think if you are a new manager managing a remote team, you really need to look… If you have junior people, really look very hard at how things are going. Because like I was saying, they’re not going to necessarily raise their hand and say, “I have a problem.” Et cetera. So, mentoring them is very important. One way of doing that might be, for example, having a buddy system where you find more senior engineer in the team and say, “Okay. You can just harass this person and ask them anything at any time by the rules. So you will never disturb them, you will never be a problem. So just ask anything.”

We do that, for example, for new people joining the team. They have a buddy that they can ask anything about the company itself, engineering problem, whatever. It’s free. So there’s no social problem being like, “Maybe I should not ask, maybe I will be bothering them.” Or whatever. So, do something like that. Not with somebody that is the manager because you have this hierarchy which can block people from asking. That may be a good way of solving these kinds of problem.

If you have more senior engineers or people to manage, I think that problem disappear a bit. People know what’s acceptable, what’s unacceptable. They’re more autonomous, basically. Then, the problem is you have more senior people work with the other people in the team, and how do you connect everyone? Especially if you have people that are a bit introvert, all of that, which can stay two days without talking to anyone over on Slack. I mean, I’ve seen that. Just people… Working, actually. But just not talking to anyone for two days or three days, which is very weird. Imagine going to an office and there’s a guy working and it doesn’t talk, it’s just like working. It’s doing its job.

But it’s weird. So, you have to feel that and organize anything. So, we do things on site. If you can’t do that… I think the goal as a manager is to animate the team, do things to… So, do party with them, do events, whatever you can to build this sense of team. Always trying to build the team. And it takes a lot more effort than being in an office where you can just go, “Let’s go grab a beer.” And that’s it. For example, I think what we tried last year was we played a bit with gather.town, which is a 2D world where we can move things around. Very fun. Didn’t work for the long term for us because people were not using it.. They built-in escape game on that. And so, we did that with the whole team, solve the escape game for an hour, which was very fun. It was solving problems which are not the ones we solve in our day-to-day activities.

So it was very cool cause you discover people on new angles, basically. And we discovered that the marketing guy could actually do math. Or I don’t know, these kinds of fun stuff where you can… For the whole team, we’re a small team so it’s easy to do that with a cross team from everyone. But even if you have a team of engineers, you can just do things like that. Or even we do board games. There are board games online now, for a couple of hours at the end of the day, and just grab a drink and do that. It should be really part of your job to do that, to find an excuse for people to be together in the same… Either the same room, but least the same Zoom meeting and do something else than working just so they’re able to connect and to know each other and trust each other beyond than just coding, for example.

Shane Hastie: Some really useful, actionable advice there. And some good food for thought. If people would like to continue the conversation, where do they find you?

Julien Danjou: To find me, just type my name on LinkedIn. I’m happy to connect and to have a chat. I’m also on Twitter. Well, I’m less active, but I’m also there. So if you want to ask me any questions, reach me out. Happy to answer.

Shane Hastie: Wonderful. Thanks very much. Julien, thank you very much for taking the time to talk to us today.

Julien Danjou: Thank you, Shane.

Mentioned:

.

From this page you also have access to our recorded show notes. They all have clickable links that will take you directly to that part of the audio.

MMS • RSS

MongoDB (MDB) is firing on all cylinders to move up in the massive and fast-growing database market, which is getting a huge boost from artificial intelligence. MDB stock has doubled this year on the back of stellar earnings and new product releases.

X

Based in New York, Mongo DB’s open-source platform helps developers build databases and apps designed to be fast, flexible and scalable. Further, the ability to integrate powerful AI features increases their competitiveness.

“You can’t have off-the-shelf shrink-wrap software, you have to be able to customize it,” Ivan Feinseth, director of research at Tigress Financial Partners, told Investor’s Business Daily. “MongoDB enables the customization of your AI tools and software to create your competitive advantage.”

By using generative AI, companies can identify patterns and reactions from customers to uncover marketing and sales opportunities, he added.

“Every company is going to be an AI company,” Feinseth said. “They’re going to have to adopt AI in some form to pull value of whatever data they have.”

Huge Market Opportunity For MDB Stock

The market potential for MongoDB is huge, analysts say. Market research firm IDC estimates the database market will grow to $136 billion in 2027 from $81 billion in 2023. That doesn’t even include the effects of generative AI.

“Highlighting the early nature of this opportunity, less than 40% of the Fortune 500 and less than 25% of the Global 2000 are MongoDB customers today,” MDB stock analysts Jason Ader and Sebastien Naji of William Blair said in a recent note to clients. “Even within these customers, MongoDB’s footprint remains small.”

Michael Gordon, MongoDB’s chief operating officer and chief financial officer, says the company is “only getting started.”

“Our market share is just approaching 2%,” Gordon told IBD in a written statement. “We are in the midst of a massive technological shift, particularly with generative AI, which is accelerating the development of more applications and driving a greater demand for operational data stores.”

He added: “Companies know they need to innovate quickly to keep up with the demand of their customers, and MongoDB Atlas is the ideal platform to reach that goal.”

MongoDB’s main platform, Atlas, uses what is known as NoSQL. It’s a document-based data model that creates unstructured, non-relational data documents. This provides features such as real-time, high-volume data processing and AI integration.

Rival Databases From Tech Giants

By comparison, the legacy relational databases use Structured Query Language, or SQL, to build tabular databases. Examples include Microsoft‘s (MSFT) SQL Server, Oracle‘s (ORCL) Database, IBM‘s (IBM) DB2, and the independent MySQL.

MongoDB’s platform integrates with the three major cloud providers: Amazon‘s (AMZN) Amazon Web Services, Microsoft’s Azure and Alphabet‘s (GOOGL) Google Cloud.

“We also provide the only true multicloud developer data platform that provides high performance and availability in over 110 cloud regions globally so customers have a broad choice of their cloud provider and can more easily meet data sovereignty requirements,” the company’s Gordon said.

“We also provide the only true multicloud developer data platform that provides high performance and availability in over 110 cloud regions globally so customers have a broad choice of their cloud provider and can more easily meet data sovereignty requirements,” the company’s Gordon said.

In early June, MongoDB reported strong fiscal 2024 first-quarter earnings for the period ended April 30. Revenue rose 29% over the prior-year quarter to $386 million as Atlas saw increased usage. Atlas revenue grew 40%, adding 2,300 net new customers during the quarter — the highest addition in more than two years. It now represents 65% of total revenue.

MongoDB also raised its revenue and operating income outlook for fiscal 2024. It now expects more than $1.5 billion in revenue and in excess of $110 million in operating income. MDB stock jumped 33% on the news and has been consolidating since.

This came after a disappointing fiscal 2023 fourth quarter. At that point, management lowered its future outlook due to macro and customer demand slowdown. But the trend seems to have reversed for MongoDB. Its “mission-critical” functionality underscores the nondiscretionary nature of its platform.

MDB Stock: Half Of Fortune 100 Are Clients

MongoDB has more than 43,000 customers. Those range in size from hot new AI startups to legacy enterprise customers. They’re also spread across industries, with the financial sector representing the largest share. Other industries include health care, retail and manufacturing.

More than half of the Fortune 100 are MongoDB customers. Further, in the U.S., 19 of the top 20 banks use MongoDB. In Europe, it’s eight of the top 10 banks, while worldwide six out 10 use its platform.

More than half of the Fortune 100 are MongoDB customers. Further, in the U.S., 19 of the top 20 banks use MongoDB. In Europe, it’s eight of the top 10 banks, while worldwide six out 10 use its platform.

During fiscal 2023, three-quarters of the company’s annual recurring revenue came from enterprise-level customers. The rest was split between midmarket and self-serve clients.

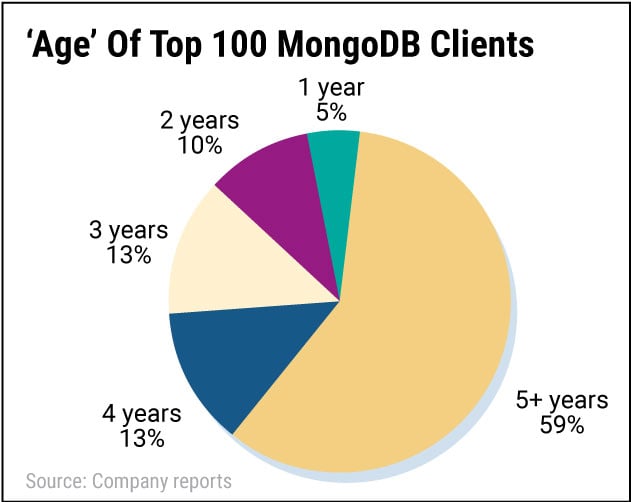

The top 100 customers generated 36% of annual recurring revenue. And 59% of those top 100 firms had used MongoDB’s products for five years or more.

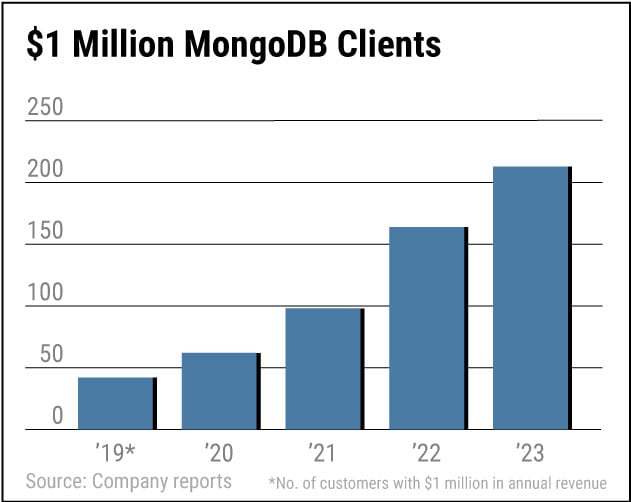

Further, MongoDB’s large customers grew significantly in the past few years. Those bringing in more than $1 million in recurring revenue grew from 42 in fiscal 2019 to 213 in fiscal 2023.

More Business From Existing Customers

What sets MongoDB apart is that its competitive unit is based on gaining additional workflows, such as a database project, with existing customers. It doesn’t just add new customers.

“The number of $1 million customers is growing a lot, but that group of customers is coming from the smaller entrees to the platform,” said MDB stock analyst Feinseth from Tigress. “So, they’re getting companies that start off with, let’s say a $50,000 (spend) a year and they keep growing. Because they’re not necessarily small, they’re big companies with smaller migrating workflow business; and also smaller companies that are growing.”

“The number of $1 million customers is growing a lot, but that group of customers is coming from the smaller entrees to the platform,” said MDB stock analyst Feinseth from Tigress. “So, they’re getting companies that start off with, let’s say a $50,000 (spend) a year and they keep growing. Because they’re not necessarily small, they’re big companies with smaller migrating workflow business; and also smaller companies that are growing.”

At its June developer conference in New York, MongoDB announced a slew of new products and features. Many are designed to help streamline AI integration.

Relational Migrator simplifies the process to switch from legacy relational databases to MongoDB’s document-based platform. The process automates and speeds the conversion, which lowers switching costs for companies.

Atlas Vector Search applies context and meaning to data in searches vs. the traditional indexing that uses exact keywords. Atlas Stream Processing will allow companies to process streaming data. That includes data coming from browsing the internet, real-time inventory management or credit card fraud prevention.

Other Partnerships And New Releases

The company also expanded its partnership with Google Cloud. It plans to accelerate the use of generative AI and create new classes of applications by developers.

Other releases included Dedicated Search Notes, Queryable Encryption, Time Series, as well as Online Archive and Data Federation. The new AI Innovators Program will help startups and more established firms build with generative artificial intelligence.

“We believe that recent advancements in generative AI technology, like large language models, will create significant opportunities for MongoDB over time,” MongoDB’s Gordon said. “With more applications being created, the demand for operational data stores like MongoDB will increase.”

He added: “Moreover, we expect most applications to add AI capabilities over time — this means that developers are even more likely to choose a modern platform for software development, favoring MongoDB vs. legacy alternatives.”

MDB stock holds a best-possible IBD Composite Rating of 99, which offers an overall assessment of shares. Further, it has a Relative Strength Rating of 97, meaning it has performed among the top 3% of all stocks over the last 12 months.

MDB stock also is on IBD’s Tech Leaders list, IBD Leaderboard and the IBD 50 list.

YOU MAY ALSO LIKE:

InMode, A Top 1% Profit Machine, Breaks Out On Solid Preannouncement — But There’s A Caveat

Recursion Catapults 78% On Nvidia Investment For AI In Drug Development

See Stocks On The List Of Leaders Near A Buy Point

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

Watch IBD’s Investing Strategies Show For Actionable Market Insights

MongoDB, Inc.: A Promising Growth Opportunity with Strong Investor Interest – Best Stocks

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB), a leading database software provider, experienced an interesting surge in options trading activity on July 12, 2023. Investors eagerly purchased 36,130 call options on the stock, marking a staggering increase of 2,077% compared to the typical daily volume of 1,660 call options.

The following day, MongoDB’s stock opened at $391.08. The company’s 50-day simple moving average stood at $339.94, while its 200-day simple moving average was recorded at $257.00. With a market capitalization of $27.60 billion and a beta of 1.13, MDB has solidified its position as a significant player in the technology industry. Additionally, the company boasts a current ratio and quick ratio of 4.19 each and carries a debt-to-equity ratio of 1.44.

Given these figures, it is no surprise that MongoDB’s stock has seen impressive growth over the past year. The company’s shares reached a high of $418.70 and held steady above their low point of $135.15 throughout this period.

Numerous research analyst reports have shed light on MongoDB’s performance and future prospects for investors’ consideration. Barclays, for instance, recently increased their target price on MDB from $374.00 to $421.00 in one such report released on June 26th. Similarly, Tigress Financial raised their price target from $365 to an impressive $490 in another research report published merely two days later.

Moreover, VNET Group reiterated their “maintains” rating on MongoDB shares alongside positive comments from KeyCorp which lifted their price objective to $264 with an “overweight” rating for the company back in April.

Although one research analyst provided a sell rating for MDB shares, three others maintained hold ratings while an overwhelmingly positive twenty analysts assigned buy ratings to MongoDB.

To further solidify MongoDB’s potential, data from Bloomberg reveals that the company holds an average rating of “Moderate Buy” and boasts an impressive average target price of $366.59.

Continuing to turn heads in the investment community, several institutional investors have recently made modifications to their holdings of MongoDB stock. Notably, 1832 Asset Management L.P. boosted its stake by a jaw-dropping 3,283,771%, resulting in ownership of 1,018,000 shares worth approximately $200.4 million.

Price T Rowe Associates Inc. MD followed suit with a 13.4% increase in their position during the first quarter, now holding 7,593,996 shares valued at $1.8 billion.

Renaissance Technologies LLC also sought to capitalize on MongoDB’s success by raising their stake by a remarkable 493.2%. The firm currently owns 918,200 shares valued at $180.7 million.

Norges Bank made a significant entry into MDB for the first time during the fourth quarter with a position amounting to $147.7 million.

Lastly, Champlain Investment Partners LLC purchased fresh MongoDB stock in the first quarter worth $89.2 million.

Taken together, these institutional investors now hold considerable influence over the future growth potential of MDB with approximately 89.22% of outstanding shares being owned by hedge funds and other institutional investors.

When considering MongoDB’s financial performance in recent months, it becomes evident that the company has made significant strides towards profitability. On June 1st, MongoDB announced its quarterly earnings report which revealed earnings per share (EPS) of $0.56 for the quarter – exceeding analysts’ consensus estimates ($0.18) by an impressive margin of $0.38.

Furthermore, the firm reported revenue of $368.28 million during this period as opposed to analyst estimates of $347.77 million – showcasing a solid growth rate of 29.0% compared to the same quarter in the previous year.

Despite these encouraging figures, it should be noted that MongoDB retains a negative return on equity of 43.25% and a negative net margin of 23.58%. However, the company’s ability to surpass expectations in recent quarters suggests positive momentum and potential for future growth.

Overall, with a unique surge in options trading activity, favorable analyst reports, and significant institutional investments, MongoDB has garnered attention as an attractive investment prospect. As financial analysts forecast earnings per share of -2.8 for the current fiscal year, investors eagerly await further updates from this dynamic technology company.

Insider Trading Activities Spark Interest in MongoDB’s Future Direction

Key Insider Trading Activities Suggest Interesting Developments at MongoDB

Date: July 13, 2023

In recent news concerning MongoDB, a leading modern database platform provider, significant insider trading activities involving the Chief Accounting Officer (CAO), Thomas Bull, and Director Dwight A. Merriman have come to light. The transactions have raised both eyebrows and questions within the investment community regarding the potential implications for the company’s future trajectory.

Thomas Bull’s Stock Transaction:

On Monday, July 3rd, CAO Thomas Bull sold 516 shares of MongoDB’s stock at an average price of $406.78 per share. The total value of this transaction was approximately $209,898.48. After this sale, Bull now possesses 17,190 shares directly in the company, with an estimated value of $6,992,548.20 as of the same date.

The disclosure of this transaction was made via a legal filing with the Securities and Exchange Commission (SEC), which can be accessed through their website.

Dwight A. Merriman’s Stock Transaction:

On Wednesday, April 26th earlier this year, Director Dwight A. Merriman sold 2,000 shares of MongoDB’s stock at an average price of $240 per share. The total value of this particular transaction amounted to $480,000. Following this sale’s completion, Merriman now owns approximately 1,225,954 shares directly in the company with an estimated value of around $294,228,960.

It is important to note that information on this sale is available through a disclosure document filed with the SEC accessible through a provided link.

Insiders Sales Trend:

During the last three months alone leading up to July 13th today itself saw insiders’ sales activity reach 117,427 shares valued at a staggering $41,364,961. Based on these figures presented during this period alone insiders held ownership of approximately 4.80% of the company’s stock.

Implications and Analysis:

Such notable levels of insider trading activities within a relatively short span have piqued the curiosity of investors and analysts, prompting speculation about what may lie ahead for MongoDB. While it is not uncommon for insiders to periodically sell their shares, the volume and value associated with these transactions raise notable questions.

One interpretation could be that Bull and Merriman are taking advantage of the current strong market position of MongoDB to monetize some of their holdings given the stock’s upward trajectory in recent times. However, this hypothesis alone does not fully elucidate why multiple insiders have chosen to sell significant quantities simultaneously.

Another plausible explanation may center around capitalizing on personal financial needs or diversification strategies among both Bull and Merriman. It is common for executives or directors to engage in such financial decisions when their portfolios become concentrated in one particular company’s stock.

Conclusion:

These recent insider trading activities involving Thomas Bull and Dwight A. Merriman at MongoDB present an intriguing situation that has caught the attention of market observers. The motivations behind these sales remain uncertain, leaving room for conjecture regarding future business developments within the company. Investors will eagerly await further disclosures from MongoDB to provide more clarity on these sales and monitor how they may impact the overall stability and outlook of the organization moving forward.

MMS • RSS

MongoDB, Inc. (NASDAQ:MDB – Get Free Report) Director Dwight A. Merriman sold 606 shares of the company’s stock in a transaction that occurred on Monday, July 10th. The stock was sold at an average price of $382.41, for a total transaction of $231,740.46. Following the completion of the transaction, the director now owns 1,214,159 shares of the company’s stock, valued at $464,306,543.19. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website.

MongoDB, Inc. (NASDAQ:MDB – Get Free Report) Director Dwight A. Merriman sold 606 shares of the company’s stock in a transaction that occurred on Monday, July 10th. The stock was sold at an average price of $382.41, for a total transaction of $231,740.46. Following the completion of the transaction, the director now owns 1,214,159 shares of the company’s stock, valued at $464,306,543.19. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website.

MongoDB Trading Up 4.1 %

Shares of MDB opened at $407.21 on Friday. MongoDB, Inc. has a twelve month low of $135.15 and a twelve month high of $418.70. The company has a market cap of $28.74 billion, a P/E ratio of -87.20 and a beta of 1.13. The company has a current ratio of 4.19, a quick ratio of 4.19 and a debt-to-equity ratio of 1.44. The company’s fifty day simple moving average is $343.34 and its 200-day simple moving average is $258.04.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings results on Thursday, June 1st. The company reported $0.56 EPS for the quarter, topping the consensus estimate of $0.18 by $0.38. The company had revenue of $368.28 million for the quarter, compared to the consensus estimate of $347.77 million. MongoDB had a negative net margin of 23.58% and a negative return on equity of 43.25%. The firm’s revenue was up 29.0% compared to the same quarter last year. During the same quarter last year, the firm posted ($1.15) EPS. As a group, analysts expect that MongoDB, Inc. will post -2.8 EPS for the current year.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in the stock. Price T Rowe Associates Inc. MD increased its stake in MongoDB by 13.4% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 7,593,996 shares of the company’s stock worth $1,770,313,000 after buying an additional 897,911 shares during the period. Vanguard Group Inc. grew its holdings in MongoDB by 2.1% during the 1st quarter. Vanguard Group Inc. now owns 5,970,224 shares of the company’s stock worth $2,648,332,000 after acquiring an additional 121,201 shares in the last quarter. Franklin Resources Inc. grew its holdings in MongoDB by 6.4% during the 4th quarter. Franklin Resources Inc. now owns 1,962,574 shares of the company’s stock worth $386,313,000 after acquiring an additional 118,055 shares in the last quarter. State Street Corp grew its holdings in MongoDB by 1.8% during the 1st quarter. State Street Corp now owns 1,386,773 shares of the company’s stock worth $323,280,000 after acquiring an additional 24,595 shares in the last quarter. Finally, 1832 Asset Management L.P. grew its holdings in MongoDB by 3,283,771.0% during the 4th quarter. 1832 Asset Management L.P. now owns 1,018,000 shares of the company’s stock worth $200,383,000 after acquiring an additional 1,017,969 shares in the last quarter. Hedge funds and other institutional investors own 89.22% of the company’s stock.

Analyst Upgrades and Downgrades

MDB has been the subject of a number of research reports. Barclays upped their target price on shares of MongoDB from $374.00 to $421.00 in a research report on Monday, June 26th. Tigress Financial upped their target price on shares of MongoDB from $365.00 to $490.00 in a research report on Wednesday, June 28th. JMP Securities upped their target price on shares of MongoDB from $245.00 to $370.00 in a research report on Friday, June 2nd. Citigroup upped their target price on shares of MongoDB from $363.00 to $430.00 in a research report on Friday, June 2nd. Finally, VNET Group restated a “maintains” rating on shares of MongoDB in a research report on Monday, June 26th. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and twenty have assigned a buy rating to the company’s stock. Based on data from MarketBeat, the stock has a consensus rating of “Moderate Buy” and a consensus price target of $366.59.

About MongoDB

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

IFP Advisors Inc reduced its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 33.5% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,232 shares of the company’s stock after selling 622 shares during the period. IFP Advisors Inc’s holdings in MongoDB were worth $57,000 as of its most recent SEC filing.

IFP Advisors Inc reduced its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 33.5% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,232 shares of the company’s stock after selling 622 shares during the period. IFP Advisors Inc’s holdings in MongoDB were worth $57,000 as of its most recent SEC filing.

Other institutional investors also recently added to or reduced their stakes in the company. Vanguard Group Inc. grew its holdings in shares of MongoDB by 2.1% during the 1st quarter. Vanguard Group Inc. now owns 5,970,224 shares of the company’s stock worth $2,648,332,000 after purchasing an additional 121,201 shares in the last quarter. Franklin Resources Inc. grew its holdings in shares of MongoDB by 6.4% during the 4th quarter. Franklin Resources Inc. now owns 1,962,574 shares of the company’s stock worth $386,313,000 after purchasing an additional 118,055 shares in the last quarter. State Street Corp grew its holdings in shares of MongoDB by 1.8% during the 3rd quarter. State Street Corp now owns 1,349,260 shares of the company’s stock worth $267,909,000 after purchasing an additional 23,846 shares in the last quarter. 1832 Asset Management L.P. grew its holdings in shares of MongoDB by 3,283,771.0% during the 4th quarter. 1832 Asset Management L.P. now owns 1,018,000 shares of the company’s stock worth $200,383,000 after purchasing an additional 1,017,969 shares in the last quarter. Finally, Geode Capital Management LLC grew its holdings in shares of MongoDB by 4.5% during the 4th quarter. Geode Capital Management LLC now owns 931,748 shares of the company’s stock worth $183,193,000 after purchasing an additional 39,741 shares in the last quarter. 89.22% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other MongoDB news, Director Dwight A. Merriman sold 2,000 shares of the firm’s stock in a transaction on Thursday, May 4th. The stock was sold at an average price of $240.00, for a total transaction of $480,000.00. Following the transaction, the director now owns 1,223,954 shares in the company, valued at approximately $293,748,960. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. In related news, Director Dwight A. Merriman sold 2,000 shares of the firm’s stock in a transaction on Thursday, May 4th. The stock was sold at an average price of $240.00, for a total transaction of $480,000.00. Following the sale, the director now owns 1,223,954 shares of the company’s stock, valued at approximately $293,748,960. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CTO Mark Porter sold 2,734 shares of the firm’s stock in a transaction on Monday, July 3rd. The stock was sold at an average price of $412.33, for a total value of $1,127,310.22. Following the transaction, the chief technology officer now directly owns 35,056 shares of the company’s stock, valued at $14,454,640.48. The disclosure for this sale can be found here. Insiders have sold a total of 117,427 shares of company stock worth $41,364,961 in the last 90 days. Company insiders own 4.80% of the company’s stock.

Analysts Set New Price Targets

Several analysts have recently weighed in on the company. 22nd Century Group reissued a “maintains” rating on shares of MongoDB in a report on Monday, June 26th. Stifel Nicolaus boosted their price target on MongoDB from $375.00 to $420.00 in a research note on Friday, June 23rd. Sanford C. Bernstein boosted their price target on MongoDB from $257.00 to $424.00 in a research note on Monday, June 5th. Morgan Stanley boosted their price target on MongoDB from $270.00 to $440.00 in a research note on Friday, June 23rd. Finally, JMP Securities boosted their price target on MongoDB from $245.00 to $370.00 in a research note on Friday, June 2nd. One equities research analyst has rated the stock with a sell rating, three have given a hold rating and twenty have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of “Moderate Buy” and a consensus target price of $366.59.

MongoDB Trading Up 4.1 %

NASDAQ MDB opened at $407.21 on Friday. The stock has a 50-day simple moving average of $343.34 and a 200 day simple moving average of $258.04. MongoDB, Inc. has a 12 month low of $135.15 and a 12 month high of $418.70. The company has a current ratio of 4.19, a quick ratio of 4.19 and a debt-to-equity ratio of 1.44. The company has a market capitalization of $28.74 billion, a PE ratio of -87.20 and a beta of 1.13.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.18 by $0.38. The firm had revenue of $368.28 million for the quarter, compared to analyst estimates of $347.77 million. MongoDB had a negative return on equity of 43.25% and a negative net margin of 23.58%. The business’s revenue for the quarter was up 29.0% compared to the same quarter last year. During the same quarter in the prior year, the company earned ($1.15) earnings per share. Research analysts forecast that MongoDB, Inc. will post -2.8 EPS for the current year.

About MongoDB

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Global Relational Database Management System Market 2023 to Flourish with an … – Digital Journal

MMS • RSS

PRESS RELEASE

Published July 13, 2023

Relational Database Management System Market Premium Research Report during the forecast years 2029 | No Pages 119 | Number of Tables and Figures | Global Relational Database Management System Industry production, Potential Application, demand, Global key Players (, MariaDB, Webyog, MarkLogic, Exasol, Microsoft Corporation, Aerospike, Teradata Corporation, SAP SE, Amazon.com, Oracle Corporation, PostgreSQL, Couchbase, Informix Corporation, International Business Machines Corporation, MongoDB, Actian Corporation, DataStax, Connx Solutions,), and current industry status.

Relational Database Management System Market {360 Market Updates with 119 Pages Research Report} Industry Report helps identify potential markets for new product launches and best distribution strategies for certain products. A planning and management system has been developed to do the same to achieve all the aspects mentioned above. The report also examines the trends of buyers and suppliers that help shape the production strategy for the Relational Database Management System market. The Relational Database Management System market research report is one of the best comprehensive market research reports that highlights the challenges, market trends, opportunities, driving forces, emerging trends, product types (, On Premise, Cloud Based, ,), applications (, BFSI, IT and Telecom, Retail and E Commerce, Health, Manufacturing, Others,) and competition in the Relational Database Management System industry.

Browse the detailed TOC, Tables and Charts scattered across the 119 pages that provide exclusive data, information, key statistics, trends and competitive landscape information in this niche industry.

Who are the Top Key players operating the global Relational Database Management System market:

- MariaDB

- Webyog

- MarkLogic

- Exasol

- Microsoft Corporation

- Aerospike

- Teradata Corporation

- SAP SE

- Amazon.com

- Oracle Corporation

- PostgreSQL

- Couchbase

- Informix Corporation

- International Business Machines Corporation

- MongoDB

- Actian Corporation

- DataStax

- Connx Solutions

Get a Sample PDF of the Report @https://www.360marketupdates.com/enquiry/request-sample/20664613

360 Market Updates provides an analysis of the key trends in each segment and sub-segment of the Relational Database Management System market, along with forecasts at the country and regional level from 2022-2029. Our report has categorized the market based on product type and Applications.

On the basis of Types, the Relational Database Management System market can primarily split into:

- On Premise

- Cloud Based

On the basis of Applications, the Relational Database Management System market covers:

- BFSI

- IT and Telecom

- Retail and E Commerce

- Health

- Manufacturing

- Others

For More Information or Query or Customization before buying, Visit at https://www.360marketupdates.com/enquiry/request-customization/20664613

Relational Database Management System Marketsize, segment (mainly coveringMajorType (, On Premise, Cloud Based, ,),End Users (, BFSI, IT and Telecom, Retail and E Commerce, Health, Manufacturing, Others,), and regions), recent status, development trendsa and competitor landscape. Furthermore, the 119 pages report provides detailed cost analysis, supply chain.

Technological innovation and advancement will further optimize the performance of the product, making it more widely used in downstream end users. Also, Consumer behaviour analysis and market dynamics (drivers, restraints, opportunities) provides crucial information for knowing the Relational Database Management System market.

With Relational Database Management System market documents, businesses can get details about market drivers and market restraints which help them to take presumption about reducing or growing the production of particular product. When globalization is growing day by day, many businesses call for global market research consisting of actionable market insights that support decision making. This global Relational Database Management System industry report analyses chief factors of the market which provides precise data and information for the business growth. To implement Relational Database Management System market research study, competent and advanced tools and techniques viz SWOT analysis and Porter’s Five Forces Analysis have been employed.

The report is useful in providing answers to several critical questions that are important for the industry stakeholders such as manufacturers and partners, end users, etc., besides allowing them in strategizing investments and capitalizing on market opportunities. Key target audience are:

– Manufacturers of disproportionate Relational Database Management System

– Raw material suppliers

– Market research and consulting firms

– Government bodies such as regulating authorities and policy makers

– Organizations, forums and alliances related to disproportionate Relational Database Management System

Inquire more and share questions if any before the purchase on thishttps://www.360marketupdates.com/enquiry/pre-order-enquiry/20664613

Main Points from Table of Contents:

1 Study Coverage

1.1 Relational Database Management System Product Introduction

1.2 Market by Type

1.3 Market by Application

1.4 Study Objectives

1.5 Years Considered

2 Global Relational Database Management System Production

2.1 Global Relational Database Management System Production Capacity (2017-2029)

2.2 Global Relational Database Management System Production by Region: 2022 VS 2029

2.3 Global Relational Database Management System Production by Region

3 Global Relational Database Management System Sales in Volume and Value Estimates and Forecasts

3.1 Global Relational Database Management System Sales Estimates and Forecasts 2017-2029

3.2 Global Relational Database Management System Revenue Estimates and Forecasts 2017-2029

3.3 Global Relational Database Management System Revenue by Region: 2017 VS 2022 VS 2029

3.4 Global Relational Database Management System Sales by Region

3.5 Global Relational Database Management System Revenue by Region

4 Competition by Manufactures

4.1 Global Relational Database Management System Production Capacity by Manufacturers

4.2 Global Sales by Manufacturers

4.3 Global Relational Database Management System Revenue by Manufacturers

4.4 Global Relational Database Management System Sales Price by Manufacturers

4.5 Analysis of Competitive Landscape

4.6 Mergers and Acquisitions, Expansion Plans

5 Market Size by Type

5.1 Global Relational Database Management System Sales by Type

5.2 Global Relational Database Management System Revenue by Type

5.3 Global Relational Database Management System Price by Type

6 Market Size by Application

6.1 Global Relational Database Management System Sales by Application

6.2 Global Revenue by Application

6.3 Global Relational Database Management System Price by Application

7 North America

8 Europe

9 Asia Pacific

10 Latin America

11 Middle East and Africa

12 Corporate Profiles

12.1 Company

12.1.1 Corporation Information

12.1.2 Overview

12.1.3 Sales, Price, Revenue and Gross Margin (2017-2022)

12.1.4 Product Model Numbers, Pictures, Descriptions and Specifications

12.1.5 Recent Developments

13 Industry Chain and Sales Channels Analysis

13.1 Relational Database Management System Industry Chain Analysis

13.2 Key Raw Materials

13.3 Production Mode and Process

13.4 Sales and Marketing

13.5 Relational Database Management System Customers

14 Market Drivers, Opportunities, Challenges and Risks Factors Analysis

14.1 Relational Database Management System Industry Trends

14.2 Market Drivers

14.3 Market Challenges

14.4 Market Restraints

15 Key Findings in the Global Relational Database Management System Study

Purchase this report (Price 2980 USD for a single-user license) @https://www.360marketupdates.com/purchase/20664613

Contact Us:

360 market updates

Phone:USA: +1 424 253 0807

UK: +44 203 239 8187

Email:[email protected]

Web: https://www.360marketupdates.com/

Press Release Distributed by The Express Wire

To view the original version on The Express Wire visit Global Relational Database Management System Market 2023 to Flourish with an Impressive CAGR of in the year 2030, Growth With upcoming Industry

TheExpressWire

AWS Introduces New Clickstream Analytics on AWS Solution for Mobile and Web Applications

MMS • Steef-Jan Wiggers

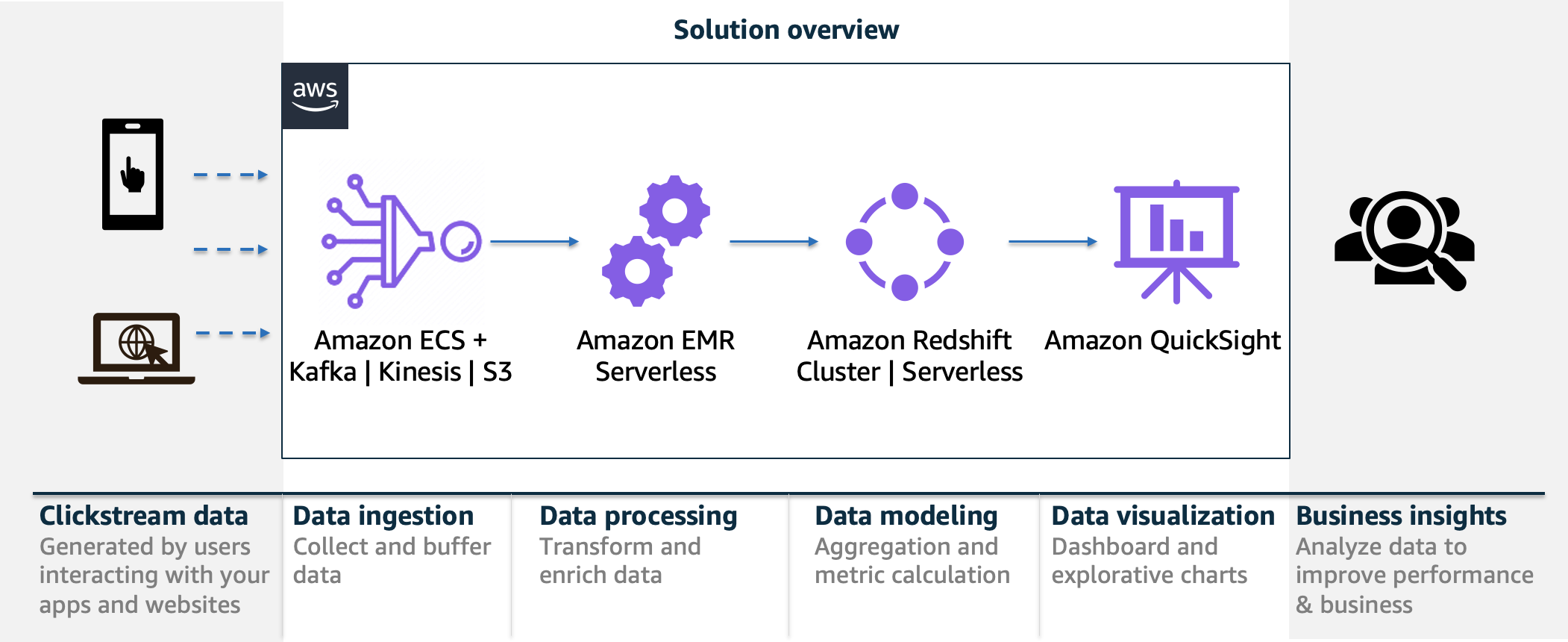

AWS recently announced a new service called Clickstream Analytics on AWS, an end-to-end solution to collect, ingest, analyze, and visualize clickstream data inside organizations’ web and mobile applications.

With this new solution, organizations can keep their data in their AWS account’s security and compliance perimeter and customize the processing and analytics to their requirements. Sébastien Stormacq, a principal developer advocate at AWS, explains in an AWS news blog the value of the solution:

For example, many business line owners want to combine clickstream analytics data with business system data to gain more comprehensive insights. Storing clickstream analysis data in your AWS account allows you to cross-reference the data with your existing business system, which is complex to implement when you use a third-party analytics solution that creates an artificial data silo.

The solution offers a backend system for capturing, processing, and visualizing clickstream data. It can be quickly deployed using an AWS CloudFormation template. Furthermore, it includes Java and Swift SDKs specifically designed for mobile applications, simplifying data collection and providing developers with a user-friendly API to gather application-specific data, handling tasks such as local buffering, communication retries, and more.

Source: https://docs.aws.amazon.com/solutions/latest/clickstream-analytics-on-aws/solution-overview.html

The solution offers an intuitive console for easy configuration, allowing users to select from three AWS services (Amazon Managed Streaming for Apache Kafka, Amazon Kinesis Data Streams, or Amazon S3) to ingest application clickstream data. It supports multiple data pipelines for different applications or teams, providing flexibility to tailor the backend to the user base and requirements.

In addition, the solution includes preinstalled plugins for data transformation, such as User-Agent and IP address enrichment. Furthermore, it provides an Amazon Redshift Serverless cluster by default to minimize the costs; however, users can select a provisioned Amazon Redshift configuration to meet their performance and budget requirements.

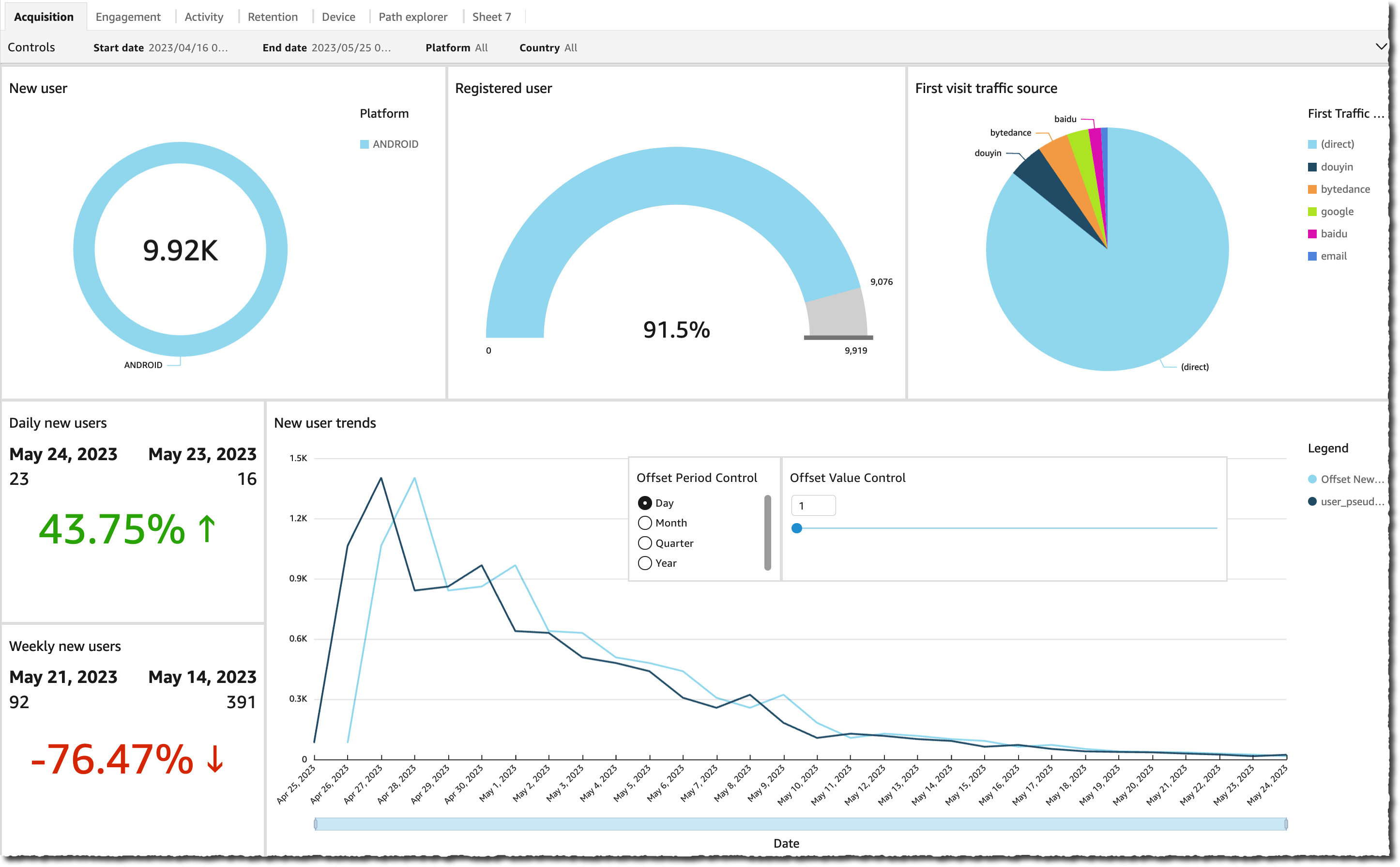

Additionally, Clickstream Analytics on AWS provides pre-built visualization dashboards for user acquisition, activity, and engagement using Amazon Redshift, with the option to develop custom analytics and dashboards using preferred tools and services.

The Clickstream Analytics solution is free; however, users are responsible for paying for the AWS services they choose to use, such as Kinesis or Amazon Redshift. The expenses incurred will vary based on the specific configuration users opt for.

Goran Opacic, an AWS Data Hero, tweeted regarding the cost:

I’m a bit worried about the costs. You can’t easily predict the cost due to many services involved.

With Stormacq, responding:

It really depends on the quantity of data to ingest, store, and analyse. The recurring fixed cost is minimal.

Lastly, more details and guidance is available through the Clickstream Analytics on AWS Workshop and documentation.

MMS • RSS

Recently AWS announced the preview release of the AWS .NET Distributed Cache Provider for DynamoDB. This library enables Amazon DynamoDB to be used as the storage for ASP.NET Core’s distributed cache framework.

The AWS .NET Distributed Cache Provider for DynamoDB is the successor to the AWS DynamoDB Session State Provider, offering compatibility with both .NET Framework and ASP.NET Core applications. While the session state provider library, released in 2012, is limited to .NET Framework applications, the new distributed cache provider also extends its functionality to support ASP.NET Core.

Alex Shovlin, software development engineer at AWS, explains in an AWS Developer Tools blog post the benefit of caching:

A cache can improve the performance of an application; an external cache allows the data to be shared across application servers and helps to avoid cache misses when the application is restarted or redeployed.

To use the library, developers can install the AWS.AspNetCore.DistributedCacheProvider package from NuGet.org. For instance, when they are building an application that requires sessions in a distributed webapp, .NET’s session state middleware looks for an implementation of IDistributedCache to store the session data. They can accomplish that by directing the session service to use the DynamoDB distributed cache implementation through dependency injection.

The company recommends configuring the cache provider with the following options for production applications:

- A Tablename, the name of the DynamoDB table that will store the cache data

- A PartitionKeyName, the name of the DynamoDB table’s partition key

- A TTLAttributeName, a DynamoDB’s Time To Live (TTL) feature, which removes cache items from the table

var builder = WebApplication.CreateBuilder(args);

builder.Services.AddAWSDynamoDBDistributedCache(options =>

{

options.TableName = "session_cache_table";

options.PartitionKeyName = "id";

options.TTLAttributeName = "cache_ttl";

});

builder.Services.AddSession(options =>

{

options.IdleTimeout = TimeSpan.FromSeconds(90);

options.Cookie.IsEssential = true;

});

var app = builder.Build();

...

In addition, Shovlin points out in the blog post that:

- The partition key must be of a type string without a sort key required for the table to prevent exceptions during cache operations

- Enable DynamoDB’s Time to Live feature for the table to ensure expired cached entries are automatically deleted

- Prefix the partition keys of cached items with a configurable value (default prefix is “dc:”) to avoid collisions and enable fine-grained access control using IAM policy conditions

- Additionally, consider using CreateTableIfNotExists for development or testing purposes, as it allows automatic table creation but may add latency to the first cache operation

Azure Cosmos DB, a comparable managed service like DynamoDB on Azure, can also serve as a cache for the session state. A Microsoft Caching Extension using Azure Cosmos DB package contains an implementation of IDistributedCache. This package can be leveraged in ASP.NET Core as a Session State Provider.

Alternatively, developers can use Amazon Relational Database Service (Amazon RDS) for SQL Server and Amazon ElastiCache for Redis for caching regarding ASP.NET Core applications. Both have an implementation of IDistributedCache: Microsoft.Extensions.Caching.SqlServer and Microsoft.Extensions.Caching.StackExchangeRedis.

The authors of a Microsoft Workloads on AWS blog post last year concluded:

AWS provides several managed services that can serve as a managed cache for your ASP.NET Core web applications. We examined how Amazon RDS for SQL Server and Amazon ElastiCache for Redis can be used as a distributed cache layer for your applications. They are managed services that are simple to set up and scale, with low operational overhead.

With AWS .NET Distributed Cache Provider for DynamoDB library, there is an additional now with Amazon DynamoDB.

The Microsoft documentation shows more details on using an IDistributedCache implementation to save session state data. In addition, the .NET on AWS page provides information on learning about building, deploying, and developing .NET applications on AWS.