Month: August 2023

MMS • RSS

Long-term investors are always told to “turn down the noise” in order to not be distracted by short-term developments and share price volatility.

But among the information overload, which metrics are the best indicators of long-term bullishness, and which numbers are to be ignored?

US buy-and-hold expert Brian Feroldi had a suggestion in a recent newsletter to his subscribers.

When ‘noise’ causes a 15% plummet in share price

Feroldi took the example of US software stock MongoDB Inc (NASDAQ: MDB), which reported its financial results on 8 March earlier this year.

“The company — which provides a next-generation database for software developers — saw its stock fall 15% in response to the results,” he said.

“The culprit: MongoDB has a usage-based model. The more its customers use the database, the more it gets paid. And because MongoDB’s biggest customer base — tech companies — were cutting back on spending, MongoDB’s growth fell sharply over a short time frame.”

But, at the time, Feroldi and his team uploaded a YouTube video to explain why they weren’t worried about MongoDB shares.

It was because they sat back and asked two questions about the company:

- Would demand for MongoDB’s product go up or down over the next decade?

- Does MongoDB have a moat?

Ignoring ‘noise’ can make you a long-term winner

Boiling down the business to just those two simple questions allowed Feroldi to mute “the noise”.

Firstly, his team deduced that demand for MongoDB products would increase in the next 10 years.

“The proliferation of data means organising unstructured bits of information will only become more critical in the years ahead.”

Secondly, Feroldi’s team certainly thinks MongoDB has a competitive advantage.

“The switching costs become onerous once a software developer starts using MongoDB’s platform.”

So, despite the massive short-term plunge, they held onto MongoDB shares.

Now, Feroldi and his team have huge smiles on their faces with the stock rising more than 118% since 10 March.

“Holding through the short-term pain has — so far — proven to be the right move.”

Feroldi admitted the above two questions are not the only way to measure long-term worthiness.

But they do much of the heavy lifting.

“Many other factors — valuation, execution, competition — all impact whether an investment pays off in the long term,” he said.

“But we’d argue those two questions carry at least 80% of the freight.”

MMS • RSS

August 10, 2023 – Unusual Options Trading Activity Boosts MongoDB (NASDAQ:MDB)

MongoDB, Inc. (NASDAQ:MDB), a leading technology company specializing in database management systems, experienced an extraordinary surge in options trading on Wednesday. Investors seized the opportunity by purchasing a staggering 36,130 call options on the company. This figure represents an astounding increase of approximately 2,077% compared to the average volume of 1,660 call options.

The significant rise in call options trading reflects a growing interest and confidence among investors in MongoDB’s future prospects. The surge also indicates that market participants are looking to capitalize on potential upward movements in the stock price.

Over the past few months, several research reports have provided positive outlooks for MongoDB. VNET Group maintained their rating on shares of MongoDB, highlighting their confidence in the company’s performance. Likewise, Morgan Stanley raised their price target from $270.00 to $440.00, emphasizing the substantial growth potential of the company’s stock.

KeyCorp analysts also revised their price objective for MongoDB from $372.00 to $462.00 and gave it an “overweight” rating, further solidifying the positive sentiment surrounding the stock.

However, Guggenheim adopted a different perspective on MongoDB and downgraded its rating from “neutral” to “sell.” Despite this downgrade, Guggenheim still raised its price target from $205.00 to $210.00 based solely on valuation concerns.

In contrast to Guggenheim’s sell rating, JMP Securities upgraded MongoDB and increased its price target from $400.00 to $425.00 while assigning it an “outperform” rating.

With one analyst issuing a sell rating, three providing hold ratings, and twenty attributing buy ratings to MongoDB’s stock, Bloomberg data indicates that there is a consensus view of a “Moderate Buy” regarding the company’s future expectations. Currently, the consensus price target stands at $378.09.

On Thursday, August 10, 2023, NASDAQ MDB opened at $360.00. The company boasts a robust quick ratio and current ratio of 4.19, demonstrating its solid financial position. Moreover, with a debt-to-equity ratio of 1.44, MongoDB exhibits responsible management of debt.

Despite recent fluctuations in the market, MDB maintains a market capitalization of $25.41 billion, implying stability within the industry. Additionally, the stock has shown a previous range between its 12-month low of $135.15 and its 12-month high of $439.00.

MongoDB last released its earnings results on June 1st, 2023 – an event that surpassed analysts’ expectations. The company reported earnings per share (EPS) of $0.56 for the quarter, beating consensus estimates by an impressive $0.38.

Furthermore, MongoDB achieved revenue of $368.28 million during the quarter – higher than analyst predictions of $347.77 million.

Additionally noteworthy is MongoDB’s strong year-over-year growth rate of 29%. These robust financials illustrate MongoDB’s ability to deliver consistent performance and capitalize on market opportunities.

In terms of insider trading activity surrounding MongoDB’s stock, Director Dwight A. Merriman sold a total of 9,000 shares in two separate transactions – one on June 1st and another on August 4th – with the average sale price around $350 per share.

After these transactions were completed, Merriman still retains a significant stake in the company – approximately 1,207,159 shares valued at approximately $501 million – emphasizing his faith in MongoDB’s future prospects.

Overall, this surge in options trading activity demonstrates investors’ increased interest in MongoDB’s potential growth trajectory and their confidence in the company’s management team to drive success.

As we move forward into a rapidly evolving market, it will be fascinating to observe how MongoDB navigates the shifting landscape and capitalizes on emerging opportunities in the database management systems industry.

MongoDB’s Impressive Q2 Stock Report Reveals Strong Performance and Growth Potential

August 10, 2023 – MongoDB (NASDAQ:MDB) has released its latest stock report, revealing impressive earnings per share (EPS) for the quarter. The figures have exceeded analysts’ consensus estimates by a significant margin, indicating strong performance and growth potential for the company.

In the second quarter of the fiscal year, MongoDB reported EPS of $0.56, surpassing expectations by an astonishing $0.38. This remarkable achievement showcases the company’s ability to generate profits and deliver value to its stakeholders. Furthermore, MongoDB achieved a revenue of $368.28 million during this period, demonstrating a substantial increase of 29% compared to the same quarter last year.

One key aspect highlighted in the stock report is MongoDB’s negative net margin of 23.58% and negative return on equity of 43.25%. Despite these figures, investors remain optimistic about the company’s future prospects due to its stellar performance in terms of revenue growth. As such, analysts predict that MongoDB will post -2.8 earnings per share for the current fiscal year.

The confidence in MongoDB is further bolstered by a number of institutional investors who have recently modified their holdings within the company. For example, Dimensional Fund Advisors LP raised its position in shares of MongoDB by 7.6% during the second quarter, resulting in ownership of 87,520 shares valued at an estimated $35.967 million.

Similarly, Veritable L.P., another institutional investor, increased its position in shares by 1.4%, holding a total of 2,321 shares valued at roughly $954 thousand during the same period under review. Additionally, Kingswood Wealth Advisors LLC entered into a new position acquiring shares valued at around $257 thousand during this time frame.

Canada Pension Plan Investment Board raised its stake in shares by an astonishing 83.4% during Q2-2023 when it added an extra 16,690 shares to its portfolio, bringing the total to 36,700 shares valued at $15.083 million. Highland Capital Management LLC also placed a new bet on MongoDB by acquiring shares worth approximately $2.824 million during the second quarter.

It is worth noting these moves made by institutional investors demonstrate not only their confidence in the company’s current performance but also their belief in its long-term growth potential. Such trust from experienced investors serves as validation for other market participants considering investing in MongoDB.

Institutional investors currently own a significant portion, 89.22%, of MongoDB’s stock. Their actions suggest a genuine conviction in the company’s direction and its ability to thrive in the market.

As for individual investors, these latest findings may offer an opportunity to assess their portfolios and consider the potential benefits of investing in MongoDB. With strong financial results, robust revenue growth, and endorsement from institutional players, MongoDB appears to be an appealing option for those seeking solid returns on investment.

In conclusion, MongoDB has released an impressive stock report showcasing better-than-expected earnings per share for the second quarter of this year. The company’s financial performance demonstrates its ability to generate profits and presents promising prospects for future growth. Additionally, institutional investors have shown confidence in MongoDB’s potential by increasing their holdings within the company. As such, both individual and institutional investors may find it worthwhile to closely monitor MongoDB when making investment decisions moving forward.

Disclaimer: This article should not be considered as financial advice or guidance regarding personal investments. Individual readers are advised to conduct thorough research and consult with a certified financial advisor before making any investment decisions based on this information.

MMS • RSS

In a blog post, Arman Dadgar, who cofounded the San Francisco-based company in 2021 with Mitchell Hashimoto, said the company is moving to “the Business Source Licence to ensure continued investment in its community and to continue providing open, freely available products.”

Dadgar said the company was founded on a belief in the open source model for its ability to build ecosystems and communities around products, for users to be able to modify the code for their purposes, and for reasons of transparency.

However, he went on, there are vendors that “take advantage of pure OSS models, and the community work on OSS projects, for their own commercial goals, without providing material contributions back.”

As a result, he added, “we believe commercial open source models need to evolve for the ecosystem to continue providing open, freely available software.”

As of 10th August, HashiCorp source code licencing has changed from the Mozilla Public Licence v2.0 (MPL 2.0) to the Business Source Licence (BSL, also known as BUSL) v1.1 for all future releases of HashiCorp products. However, HashiCorp APIs, SDKs and “almost all other libraries” will remain under MPL 2.0.

HashiCorp’s move mirrors those of other formerly open source companies including MongoDB, Redis Labs and Elastic, which also complained that their work was being exploited, particularly by the cloud giants who they accused of creating their own versions of the software and favouring it in their marketplaces while contributing little in return.

Like those companies, Hashicorp says it wants more control over how the software is commercialised, while keeping it free to use for most end users.

“BSL 1.1 is a source-available licence that allows copying, modification, redistribution, non-commercial use, and commercial use under specific conditions. With this change we are following a path similar to other companies in recent years,” Dadgar wrote.

BSL 1.1 is also used by the likes of Couchbase and Cockroach labs to control the commercialisation of their code, but HashiCorp will add some tweaks to “include additional usage grants that allow for broadly permissive use of our source code,” said Dadgar.

End-users will still be able to copy, modify and redistribute the code “except where providing a competitive offering to HashiCorp”, and Hashicoprp partners will be able to build integrations as before. However, vendors who provide competitive services will no longer be able to incorporate releases, bug fixes or security updates contributed to the community products.

As might be expected, the response to the announcement has been mixed.

Many on social media saw it as hypocritical and out of line with HashiCorp’s claims of continued commitment to open source.

Some were angered that, as they see it, HashiCorp has benefited over the years from the work of community contributors and is now pulling up the drawbridge, with none of that ownership accruing to the contributors.

And there were accusations of ‘open washing’ and bait-and-switch from open source.

Others wondered why the company had not adopted the existing BSL v1.1 licence as-is, instead adding its own tweaks, with the risk of fragmenting the landscape further, to the possible detriment of customers.

However, Avi Press, CEO at open source analytics tools company Scarf was sympathetic:

“HashiCorp has set a good bar for how to do a BSL switch smoothly. No misnaming anything, no attacks, just a difficult business decision carefully communicated. They are a well-meaning group of people who have shown they do care about OSS, whether or not you like their decision,” he said on Twitter/X.

HashiCorp has set a good bar for how to do a BSL switch smoothly. No misnaming anything, no attacks, just a difficult business decision carefully communicated. They are a well-meaning group of people who have shown they do care about OSS, whether or not you like their decision.

— Avi Press (@avi_press) August 11, 2023

Nevertheless, he did express some concern about the Balkanisation of the licencing landscape.

“I think an important problem for us to solve is how to best standardise the ‘You can do anything except compete directly with us’ kind of licence. Different BSL flavours are all basically trying to achieve this but there are still a myriad of ways that big co’s choose to do this.”

Open washing

Amanda Brock, CEO of not-for-profit open technology advocacy group OpenUK was more critical, wondering whether a recent leadership change, which saw co-founder Mitchell Hashimoto step aside from the leadership in 2021 as the company went public, might have something to do with the decision.

“Taking it to an IPO and seeing Mitchell have the apparent wisdom to step aside and allow a more experienced individual to run HashiCorp all made sense, but has that also led to its downfall as an open source company? The statements about BUSL are sadly open washing,” she said.

See also: Open source: supporting a different form of capitalism

“It would be wrong to suggest these two ever intended a ‘bait and switch’ but they have indeed switched away from open source. The pressure of enabling their competitors with their innovations – an inevitability of open source – did not align with the need to generate shareholder value.

“There’s almost a bigger question here – how much money is enough? Is a lot of money with others generating a lot of money too a reason to stop? We’re left wondering whether had Mitchell remained CEO, would this have occurred?”

In its latest quarterly figures from June, HashiCorp reported total revenues of $138 million, representing an increase of 37% year-over-year. 830 out of a total of 4,392 paying customers provided annual recurring revenues of $100,000 or more.

MMS • Sergio De Simone

Key pinning, a technique used to prevent an attacker from tricking a vulnerable certificate authority (CA) into issuing an apparently valid certificate for a server, is now used in Chrome for Android, version 106. This helps preventing man-in-the-middle attacks against Google services.

As Chrome security engineers David Adrian, Joe DeBlasio, and Carlos Joan Rafael Ibarra Lopez explain, key pinning was devised at Google as a response to real attacks seen in the wild, specifically an attack that targeted Google services in 2011.

Key pinning was born as an extension to the HTTP protocol, later deprecated, that enabled sending an HTTP header that tells user agents to “pin” cryptographic identities over a period of time.

During that time, user agents (UAs) will require that the host presents a certificate chain including at least one Subject Public Key Info structure whose fingerprint matches one of the pinned fingerprints for that host.

This effectively reduces the number of CAs that can authenticate the domain while the identity is pinned. While effective, key pinning has its own drawbacks. For example, if pins get out of date, there’s a risk of locking users out of a service, which leads to a number of good practices:

Whenever pinning, it’s important to have safety-valves such as not enforcing pinning (i.e. failing open) when the pins haven’t been updated recently, including a “backup” key pin, and having fallback mechanisms for bootstrapping.

These mechanisms are hard for individual sites to manage, say Google engineers, which, as mentioned, led to the RFC being deprecated. As a matter of fact, Google removed public key pinning from Chrome in 2017. But key pinning may still have its own use cases, including web browsers, automatic software updates, and package managers, where client and server are operated by the same entity.

Specifically, in Google’s case, thanks to the control that the company has on its browser, Chrome embeds pinned certificates (pins) for all Google properties. This means every HTTPS access is only authenticated through a key belonging to the embedded set of pins.

To fully understand what role key pinning plays into Chrome security, Adrian, DeBlasio, and Ibarra Lopez hint at Chrome’s “rule of two”, which states that you cannot write code using an unsafe language to process untrustworthy inputs outside of a sandbox. From this viewpoint, key pinning in Chrome ensures all data coming from Google Services can be trusted.

Originally, Google used to compile the pin set into Chrome’s binaries, which required updating it whenever the pin set changed. More recently, Google started to also distribute the pin set through Chrome’s component updater, which makes it possible to update it even in older Chrome versions.

As a related note, after the demise of the Public Key Pinning RFC, Certificate Transparency (CT) was suggested and enforced as a way to address the possibility CA vulnerabilities may lead to certificate tampering. CT is an Internet security standard for monitoring and auditing the issuance of digital certificates.

MMS • RSS

Assetmark Inc. increased its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 17.8% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 4,786 shares of the company’s stock after buying an additional 724 shares during the quarter. Assetmark Inc.’s holdings in MongoDB were worth $1,116,000 as of its most recent filing with the Securities & Exchange Commission.

Assetmark Inc. increased its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 17.8% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 4,786 shares of the company’s stock after buying an additional 724 shares during the quarter. Assetmark Inc.’s holdings in MongoDB were worth $1,116,000 as of its most recent filing with the Securities & Exchange Commission.

Several other hedge funds also recently made changes to their positions in MDB. Raymond James & Associates increased its stake in shares of MongoDB by 32.0% in the first quarter. Raymond James & Associates now owns 4,922 shares of the company’s stock worth $2,183,000 after buying an additional 1,192 shares during the period. PNC Financial Services Group Inc. increased its position in MongoDB by 19.1% during the 1st quarter. PNC Financial Services Group Inc. now owns 1,282 shares of the company’s stock valued at $569,000 after purchasing an additional 206 shares during the period. MetLife Investment Management LLC purchased a new position in MongoDB during the 1st quarter valued at $1,823,000. Panagora Asset Management Inc. increased its position in MongoDB by 9.8% during the 1st quarter. Panagora Asset Management Inc. now owns 1,977 shares of the company’s stock valued at $877,000 after purchasing an additional 176 shares during the period. Finally, Vontobel Holding Ltd. increased its position in MongoDB by 100.3% during the 1st quarter. Vontobel Holding Ltd. now owns 2,873 shares of the company’s stock valued at $1,236,000 after purchasing an additional 1,439 shares during the period. 89.22% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at MongoDB

In other news, Director Dwight A. Merriman sold 6,000 shares of the firm’s stock in a transaction on Friday, August 4th. The stock was sold at an average price of $415.06, for a total transaction of $2,490,360.00. Following the transaction, the director now owns 1,207,159 shares in the company, valued at $501,043,414.54. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. In other news, CRO Cedric Pech sold 360 shares of the firm’s stock in a transaction on Monday, July 3rd. The stock was sold at an average price of $406.79, for a total transaction of $146,444.40. Following the transaction, the executive now owns 37,156 shares in the company, valued at $15,114,689.24. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Dwight A. Merriman sold 6,000 shares of the firm’s stock in a transaction on Friday, August 4th. The shares were sold at an average price of $415.06, for a total value of $2,490,360.00. Following the transaction, the director now owns 1,207,159 shares in the company, valued at approximately $501,043,414.54. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 102,220 shares of company stock worth $38,763,571. 4.80% of the stock is currently owned by insiders.

MongoDB Stock Down 0.1 %

Shares of MDB opened at $359.66 on Friday. The company has a market cap of $25.38 billion, a PE ratio of -77.01 and a beta of 1.13. The business has a fifty day moving average of $393.69 and a 200 day moving average of $287.14. MongoDB, Inc. has a 52-week low of $135.15 and a 52-week high of $439.00. The company has a quick ratio of 4.19, a current ratio of 4.19 and a debt-to-equity ratio of 1.44.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings results on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $0.18 by $0.38. The company had revenue of $368.28 million during the quarter, compared to the consensus estimate of $347.77 million. MongoDB had a negative return on equity of 43.25% and a negative net margin of 23.58%. MongoDB’s revenue was up 29.0% on a year-over-year basis. During the same period last year, the company earned ($1.15) earnings per share. On average, sell-side analysts expect that MongoDB, Inc. will post -2.8 EPS for the current year.

Analyst Ratings Changes

MDB has been the topic of a number of research analyst reports. Morgan Stanley boosted their price objective on shares of MongoDB from $270.00 to $440.00 in a research report on Friday, June 23rd. Truist Financial boosted their price objective on shares of MongoDB from $365.00 to $420.00 in a research report on Friday, June 23rd. Barclays upped their target price on shares of MongoDB from $374.00 to $421.00 in a research report on Monday, June 26th. VNET Group reaffirmed a “maintains” rating on shares of MongoDB in a research report on Monday, June 26th. Finally, 58.com reaffirmed a “maintains” rating on shares of MongoDB in a research report on Monday, June 26th. One analyst has rated the stock with a sell rating, three have given a hold rating and twenty have assigned a buy rating to the company. According to MarketBeat.com, the company has an average rating of “Moderate Buy” and an average target price of $378.09.

Read Our Latest Stock Report on MongoDB

MongoDB Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

Commerce Bank purchased a new stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 1,201 shares of the company’s stock, valued at approximately $280,000.

Commerce Bank purchased a new stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 1,201 shares of the company’s stock, valued at approximately $280,000.

Other institutional investors have also added to or reduced their stakes in the company. Vanguard Group Inc. raised its stake in shares of MongoDB by 2.1% during the first quarter. Vanguard Group Inc. now owns 5,970,224 shares of the company’s stock valued at $2,648,332,000 after acquiring an additional 121,201 shares during the last quarter. Franklin Resources Inc. raised its stake in shares of MongoDB by 6.4% during the fourth quarter. Franklin Resources Inc. now owns 1,962,574 shares of the company’s stock valued at $386,313,000 after acquiring an additional 118,055 shares during the last quarter. State Street Corp raised its stake in shares of MongoDB by 1.8% during the third quarter. State Street Corp now owns 1,349,260 shares of the company’s stock valued at $267,909,000 after acquiring an additional 23,846 shares during the last quarter. 1832 Asset Management L.P. raised its stake in shares of MongoDB by 3,283,771.0% during the fourth quarter. 1832 Asset Management L.P. now owns 1,018,000 shares of the company’s stock valued at $200,383,000 after acquiring an additional 1,017,969 shares during the last quarter. Finally, Geode Capital Management LLC raised its stake in shares of MongoDB by 4.5% during the fourth quarter. Geode Capital Management LLC now owns 931,748 shares of the company’s stock valued at $183,193,000 after acquiring an additional 39,741 shares during the last quarter. 89.22% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In other MongoDB news, CRO Cedric Pech sold 360 shares of MongoDB stock in a transaction on Monday, July 3rd. The shares were sold at an average price of $406.79, for a total value of $146,444.40. Following the sale, the executive now directly owns 37,156 shares in the company, valued at approximately $15,114,689.24. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. In other MongoDB news, Director Dwight A. Merriman sold 3,000 shares of the company’s stock in a transaction that occurred on Thursday, June 1st. The stock was sold at an average price of $285.34, for a total transaction of $856,020.00. Following the sale, the director now directly owns 1,219,954 shares in the company, valued at $348,101,674.36. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, CRO Cedric Pech sold 360 shares of the firm’s stock in a transaction that occurred on Monday, July 3rd. The shares were sold at an average price of $406.79, for a total value of $146,444.40. Following the completion of the sale, the executive now directly owns 37,156 shares of the company’s stock, valued at $15,114,689.24. The disclosure for this sale can be found here. Insiders have sold 102,220 shares of company stock worth $38,763,571 in the last three months. Company insiders own 4.80% of the company’s stock.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on the stock. Stifel Nicolaus upped their price objective on shares of MongoDB from $375.00 to $420.00 in a research note on Friday, June 23rd. Truist Financial increased their price target on shares of MongoDB from $365.00 to $420.00 in a research note on Friday, June 23rd. Oppenheimer increased their price target on shares of MongoDB from $270.00 to $430.00 in a research note on Friday, June 2nd. KeyCorp increased their price target on shares of MongoDB from $372.00 to $462.00 and gave the stock an “overweight” rating in a research note on Friday, July 21st. Finally, Barclays increased their price target on shares of MongoDB from $374.00 to $421.00 in a research note on Monday, June 26th. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and twenty have issued a buy rating to the company’s stock. According to data from MarketBeat, the stock presently has an average rating of “Moderate Buy” and an average target price of $378.09.

View Our Latest Stock Report on MDB

MongoDB Trading Down 0.1 %

NASDAQ:MDB opened at $359.66 on Friday. MongoDB, Inc. has a 52 week low of $135.15 and a 52 week high of $439.00. The company has a quick ratio of 4.19, a current ratio of 4.19 and a debt-to-equity ratio of 1.44. The company’s 50 day moving average price is $393.69 and its 200-day moving average price is $287.14. The stock has a market cap of $25.38 billion, a price-to-earnings ratio of -77.09 and a beta of 1.13.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its earnings results on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.18 by $0.38. The company had revenue of $368.28 million for the quarter, compared to analysts’ expectations of $347.77 million. MongoDB had a negative net margin of 23.58% and a negative return on equity of 43.25%. The firm’s quarterly revenue was up 29.0% on a year-over-year basis. During the same quarter last year, the company posted ($1.15) earnings per share. On average, equities research analysts forecast that MongoDB, Inc. will post -2.8 earnings per share for the current fiscal year.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

MMS • RSS

By harnessing the right open source database solutions for IoT, organisations can drive innovation, enhance data management, and get actionable insights that propel them ahead in the IoT landscape. Unlock the full potential of IoT by selecting the right set of open source databases.

The technology ecosystem of Internet of Things (IoT) is complex, and includes hardware, connectivity, platforms, middleware, analytics, operating systems, applications, and services.

As per IDC, there will be 41.6 billion connected IoT devices or ‘things’, generating 79.4 zettabytes (ZB) of data in 2025. Sixty-four per cent of those surveyed think open source is significant in deploying IoT, as per the IDC Global IoT Decision-Maker Survey. According to a survey by W3.Org, 91% of IoT developers use open source software, open hardware, or open data in at least one part of their development stack.

According to Statista, the total installed base of Internet of Things (IoT) connected devices is projected to amount to 75.44 billion worldwide by 2025. By 2030, IoT could enable US$ 5.5 trillion to $12.6 trillion in value globally, including the value captured by consumers and customers of IoT products and services, as per McKinsey.

With billions of devices generating trillions of bytes of data, it is very crucial for enterprises to organise, store and work with all the data that is generated.

In general, IoT applications leverage both relational and non-relational (NoSQL) databases. The selection of the type of the database depends on the application type. In most of the cases, a combination of both the databases can be utilised.

Most IoT applications are heterogeneous and domain-centric. Choosing the most efficient database for these applications can be challenging. The important parameters for choosing the right database for IoT applications are scalability, availability, ability to handle huge amounts of data, high processing speed, schema flexibility, integration with varied analytical tools, security and costs.

Open source adoption for IoT

The following are the major drivers that prompt enterprises to adopt open source technologies for IoT.

Cost: Adoption of open source IoT frameworks involves no money, as they are free for use.

Efficiency: Adoption of open source helps developers reduce development times, thereby reducing the development cost.

Scalability: Where billions of devices are supported using open source technology, it helps in affordable scaling.

Innovation: Open source adoption in building newer applications is permissionless and low risk, which leads to better innovation and agility.

Open source API: Open source APIs are a standard gateway for IoT framework-based applications. They help to improve the communication between various software components, hardware devices, and systems.

Libraries: An open source IoT framework offers a wide range of libraries, SDKs, and open source hardware. Raspberry Pi and Arduino are open source tools for customising IoT platforms.

Security: Open source software can protect individuals’ data by implementing powerful encryption (SSH, SSL, PGP, etc).

Interoperability: The adoption of open source helps in collaboration and interoperability.

Drivers for adopting open source databases for IoT

Most IoT solutions are distributed across various geographical locations. This necessitates solutions that adopt fog computing at the edge and cloud computing at the enterprise level. However, no single database product in the market can fulfil the IoT database requirements across the organisation. There is need for a collection of databases, potentially from a variety of vendors, used in one or more stages of the IoT life cycle.

The key business drivers for open source database adoption are:

- Flexibility to process the data at the edge

- Synchronising data between edge servers and the cloud

- Real-time data streaming and analytics

- Data filtering and aggregation

- Increasing cost of ownership for the database landscape

- Increased complexity integration and managing the databases to achieve IoT solutions

- Multiple databases with duplicate functionality and products that are under-utilised

- Need for a wide range of skills to support the IoT landscape

Selection of open source databases for IoT implementation depends on the following requirements:

- Nature and type of data to be collected

- Business criticality of the data

- Importance of the collected data

- High availability and disaster recovery considerations for database processing

- A database that addresses single points of failure

- Intensity of the data communication

- Integration with various sources of data for analytics

Characteristics of open source databases

An open source database for IoT should be fault-tolerant and highly available. It should have the following characteristics:

- No vendor lock-in and should ensure seamless integration of enterprise-wide tools, applications, products and systems developed or deployed by different organisations and vendors.

- These databases should increase productivity, speed up time-to-market, reduce risks and increase quality.

- No vendor monopoly allows use of free and open source databases. With data transferability and open data formats, there are greater opportunities to share data across interoperable platforms.

- Adoption of open source databases enhances the interoperability with other enterprise applications because of reuse of software stacks, libraries, and components.

Layers of IoT architecture and the database they need

The architecture of an IoT database analytics system has the following significant requirements.

- Context: Capturing the context 24 hours a day, 365 days a year

- Standards: Leveraging standard protocols of communication between IoT devices and enterprise systems

- Scalability: Responding to increased load by declining performance, not failure; increasing capacity proportionally as resources are added

- Data management: Efficiently managing enormous volumes of data

- Connectivity: Providing high network connectivity for large data payloads and continuous streaming

- Security: Moving and encrypting information securely even as IoT introduces new risks and vulnerabilities

- Interoperability: Networking all systems together and ensuring interoperability of all data

- Device management: The ability to connect to devices remotely at scale to manage devices such as updating security credentials and firmware.

- AI-driven analytics: Enriching and exploring prescriptive and predictive analytics data to deliver actionable insights

In an enterprise IoT solution, thousands of sensors and actuators are connected to the edge server, continuously collecting data. The database must efficiently perform data transformation operations. The IoT data stream normalises the data to a standard format and sends it to a central repository.

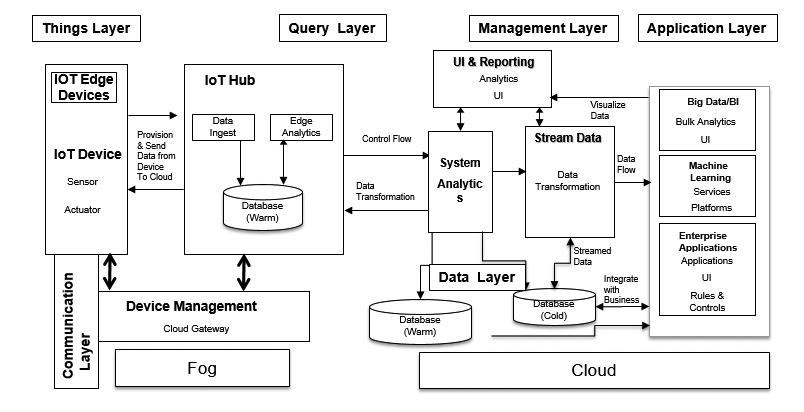

The various layers of IoT architecture are data layer, things layer, communication layer, query layer, management layer, and application layer.

Things layer: This layer consists of entities that produce data for the IoT application and its modules. It covers IoT sensors, actuators, and devices that act like data production objects. Data collection, processing, and real-time data aggregation are performed at this layer.

‘Data ingest’ collects and stores logs and messages from the devices. The database needs to support high-speed write operations and ensure that the data captured is not lost under any circumstances. MQTT, Kafka and REST service components are used to ingest the data from the devices to the database.

‘Edge analytics’ performs the data translation, aggregation and filtering on the incoming data, enabling real-time decision-making at the edge. The database needs to support high-speed reads and writes with sub-millisecond latency and perform complex analytical computations on the data.

Communication layer: The communication layer supports the transmission of requests, queries, data, and results (collection and delivery). This layer acts as a bridge between distributed data sources and data storage processing units. Inter-objects and objects-to-infrastructure communication technologies are used, and interoperation guarantees are provided at upper layers.

The device manager communicates messages to the devices. The database needs to access and deliver messages to the devices with minimum latency. It consists of an IoT/cloud gateway that provides endpoints for device connectivity, facilitating bi-directional communication with the platform and enterprise systems. It also implements edge intelligence with different processing capabilities, enabling connectivity between devices, routing, filtering, and protocol and identity translation.

Query layer: The query layer handles the details of query processing and optimisation in cooperation with the federation layer and the complementary transactions layer (processing, delivery). This layer handles the components for generating, optimising, and executing queries on the IoT database level. It can be deployed at both the central and local levels.

Data layer: The data layer is the core element in the data architecture. It performs the discovery of the data sources across the system. The catalogue of data sources, storage of data, and indexing of collected data are performed at this layer. In addition, filtering of data, pre-processing, and processing of data steps are handled at the data layer. It gathers local and autonomous data repositories to perform these activities.

A warm database is a high-speed in-memory database that reads and writes with the least latency. It provides real-time querying capabilities. This database is highly available and addresses disaster recovery.

Historical data of the IoT systems is stored in a cold database. Typical databases can be relational databases to a data lake.

Management layer: The management layer provides access and security to the various data stores in the data layer of the IoT framework. This layer consists of transaction, recovery, and security managers.

System analytics collects the data from the edge server and performs data transformation and analytics operation. The database provides the commands to perform analytical computations on the data, and stores the data as long as is required by the analytics engine.

Application layer: This layer is an important layer for IoT applications as it acts as an interface to interact with applications for end users. Devices like smartphones, computers and tablets are used as a medium to make IoT applications interactive. This layer handles the orchestration of device data collected into business processes and enterprise applications. It provides interfaces to end users, including operations.

It also implements domain-specific enterprise applications, enterprise data (includes a system of records, reference data, historical data, data warehouses, and transactional data), enterprise’s active directory (stores user profile data), and rules or decision support systems.

Enterprise BI (business intelligence) runs reports, queries, and interfaces from historical data. The database needs to store data cost-effectively for an extended period.

Key open source databases for IoT adoption

The following are some of the top open source databases available for IoT based applications.

MongoDB: This is a powerful, flexible, open source, document-oriented and scalable NoSQL database. It supports features like indexes, range queries, sorting, aggregations, and geospatial indexes. It supports JSON to store and transmit information. JSON, being standard protocol, is a great advantage for both the web and the database. MongoDB supports a rich query language to support read and write operations (CRUD) as well as data aggregation, text search and geospatial queries.

As an example, Bosch has built its IoT suite on MongoDB.

InfluxDB: This time series database is designed to handle high write and query loads. It provides an SQL-like query language called InfluxQL for interacting with data. InfluxDB has no external dependencies and SQL-like queries are used for querying a data structure comprising measurements, series, and points. Each point consists of varied key-value pairs called field set and timestamp. Values can be 64-bit integers, 64-bit floating points, strings, and Booleans. Points are indexed by their time and tagset. InfluxDB stores data via HTTP, TCP and UDP. It has plugin support for other data ingestion protocols like Graphite and Open TSDB.

BigchainDB: This is an embedded database for IoT devices. The assets created are stored as JSON documents in BigchainDB. It helps to convert physical objects into blockchain services by building blockchain-specific hardware compatible with any IoT device. It helps to define permission for reading and writing rights into the IoT device. BigchainDB can be integrated with every IoT scenario where there is a need for immutability and tamper-proof storage of data assets, along with search and query capability with high throughput.

MySQL: This open source relational database management system brings data consistency, scalability, high performance, availability, and flexibility to IoT solutions by efficient collection of data from IoT devices. It helps in data transformation through annotation and aggregation making it easier to understand data better.

Based on the IoT solution requirement, if the data format is fixed then MySQL is the preferred database.

GridDB: This is a container data model extending the NoSQL key-value store, and representing data in the form of a collection referenced by keys. It provides high scalability, reliability, and availability.

The two types of containers in GridDB are:

- Collection container: General-purpose container

- TimeSeries container: Data associated with timestamp providing functions like data compression and data aggregation

- Redis: This is an in-memory open source database. It is a popular choice for IoT solutions as a hot database. It is widely used by IoT solutions for data ingest real-time analytics, messaging, caching, and many other use cases. It helps in edge computing involving deep learning, image recognition and other innovative computing requirements.

- CrateDB: CrateDB is an open source distributed SQL database management system that fully integrates a searchable document-oriented data store. The CrateDB platform provides the distributed SQL query engine for faster joins, aggregations, and ad-hoc queries. This highly scalable and available database supports various types of data.

- Cassandra: This is a highly scalable and distributed open source database for managing voluminous amounts of structured data across many commodity servers. It provides availability, linear scale performance, simplicity and easy distribution of data across multiple database servers. It supports strong data consistency across distributed architecture.

- Hadoop: This open source software platform for distributed storage and distributed processing of very large data sets on computer clusters is built from commodity hardware. It helps in driving analytics from all IoT data. It easily ingests data from multiple data sources and supports both batch as well as real-time data ingest from sensors using tools such as Apache Kafka and Apache Flume. It handles multiple IoT data types, structures, and schemas. It supports real-time processing and applications on streaming data. Hadoop is a flexible, scalable and secure database.

A number of leading organisations, including leading automotive manufacturers, utilities, industrial automation companies, insurers, healthcare organisations, and telecom and technology leaders are adopting Hadoop.

Benefits of using open source databases in IoT

Open source databases in IoT have the following advantages over proprietary databases:

- Easy upgrade to new technologies with open source DB

- Ability to connect with upcoming device protocols and backend applications.

- Lower overall software cost, ease of change in technology, and open source APIs for integration

- Flexibility and easy change in architecture of solutions that are centred on microservices

Flexibility to change with a change in the cloud service provider

IoT is one of the most significant sources of Big Data. This data is rendered useless without analytics power. It is very important to choose the right set of open source databases for an IoT solution, as there are so many available in the market.

We need to first analyse the business problem, arrive at a solution, break this solution into services, and understand the database needs of these services. This will help to narrow down the database choices.

Most IoT solutions can depend on a hot database for real-time data collection, processing, messaging and analytics. Cold databases are better suited to store historical data and gather business intelligence. This will make the architecture simple, lean and robust.

Disclaimer: The views expressed in this article are that of the author and HCL does not subscribe to the substance, veracity, or truthfulness of the said opinion.

MMS • RSS

NEW YORK, Aug. 10, 2023 /PRNewswire/ — MongoDB, Inc. (NASDAQ: MDB) today announced it will report its second quarter fiscal year 2024 financial results for the three months ended July 31, 2023, after the U.S. financial markets close on Thursday, August 31, 2023.

In conjunction with this announcement, MongoDB will host a conference call on Thursday, August 31, 2023, at 5:00 p.m. (Eastern Time) to discuss the Company’s financial results and business outlook. A live webcast of the call will be available on the “Investor Relations” page of the Company’s website at http://investors.mongodb.com. To access the call by phone, please go to this link ( registration link ), and you will be provided with dial in details. To avoid delays, we encourage participants to dial into the conference call fifteen minutes ahead of the scheduled start time. A replay of the webcast will also be available for a limited time at http://investors.mongodb.com.

NoSQL Databases Software Market 2023 Dynamics, Startegic Initiative and … – theyyscene.ca

MMS • RSS

Press Release, August, 2023 (Orbis Research) – The study includes a complete analysis and prognosis for the global NoSQL Databases Software market size on a global and regional scale from 2021 to 2031. The study gives revenue numbers (USD Million) from 2016 to 2020, as well as an estimate from 2021 to 2031.The report includes an in-depth analysis of the market, including an investigation of market drivers, limitations, and opportunities. It also predicts the impact of these drivers and restraints on the NoSQL Databases Software market from 2021 to 2031.

Request a sample report : https://www.orbisresearch.com/contacts/request-sample/6694484

The assessments allow readers of the report to analyse the NoSQL Databases Software market based on a variety of parameters such as brand loyalty, switching costs, capital expenditures, economies of scale, legal regulations, existing sales relationships, proprietary technology and patents, consumer preferences, and advertising impacts. This secret information is expected to help industry players make judgements. Furthermore, the study recommends techniques for new competitors to enter the business. The NoSQL Databases Software analysis also includes an in-depth examination of the major manufacturers and distributors in a number of critical areas. It is hoped that enterprises would be able to increase their market penetration networks and expand their international reach by utilising this research and data.

The majority of the research piece focuses on qualitative qualities that serve as the foundation for growth estimations. It is crucial to analyse the most important driving forces and their influence on development scales and patterns in order to adequately assess future possibilities. A thorough evaluation of the principal limitations, on the other hand, indicates the crucial industrial aspects restricting the global NoSQL Databases Software market’s rate of expansion. Furthermore, the study evaluates current business trends and internationally recognised megatrends across many industries to estimate their impact on the demand and revenue expansion of the worldwide NoSQL Databases Software market.

Do Inquiry before Accessing Report at: https://www.orbisresearch.com/contacts/enquiry-before-buying/6694484

NoSQL Databases Software Market Segmentation

NoSQL Databases Software Market by Types:

Cloud Based

Web BasedNoSQL Databases Software Market by Applications:

Large Enterprises

SMEs

This study includes an in-depth examination of current trends, as well as new projections and market dynamics. This also explains why market-influencing and restricting issues were thoroughly examined. Furthermore, significant industry research based on product category and intended usage aids in determining the most desired products worldwide. A thorough market study is conducted by accentuating critical product positioning and carefully monitoring the market’s major competitors. Financial evaluations, market-winning strategies, new breakthroughs, and the range of items offered by key competitors globally are also included in the research.

The analysis begins with a market overview before moving on to advanced industry suggestions. Worldwide Industry 2023 is a comprehensive, professional study that gives industry research data to both new and established enterprises. It also includes research on the impact of industrial businesses on strategic planning. It also includes SWOT assessments, income breakdowns, and company descriptions for the top international market participants.

Leading Players in the NoSQL Databases Software market report:

MongoDB

Amazon

ArangoDB

Azure Cosmos DB

Couchbase

MarkLogic

RethinkDB

CouchDB

SQL-RD

OrientDB

RavenDB

Redis

Furthermore, the global NoSQL Databases Software market study provides definitive information through a thorough examination of the industry’s competitive environment. It rapidly gathers extremely useful industry data, forecasting the substantial contributions of the leading market players in developing the commercial presence of the global NoSQL Databases Software market. The study assesses each competitor’s capacity in terms of demand to supply ratio, from highest to lowest. The study investigates individual growth objectives and corporate development strategies, as well as the infrastructure capabilities that will allow the international NoSQL Databases Software market to scale up its growth potential.

Buy the report at https://www.orbisresearch.com/contact/purchase-single-user/6694484

We provide significant clarifications in this study.

• What effect will the release of a covid-19 vaccine or drug have on the global NoSQL Databases Software market?

• What new business practises might emerge in the aftermath of the pandemic to maintain agility, collaboration, and competitiveness in the global NoSQL Databases Software market?

• Which industries are most likely to fuel the growth of the global NoSQL Databases Software market?

• What important government programmes and policies have the world’s top NoSQL Databases Software market nations implemented to encourage the term’s growth or expansion?

• How have the world’s top NoSQL Databases Software market participants or corporations coped with the pandemic’s issues?

About Us:

Orbis Research (orbisresearch.com) is a single point aid for all your market research requirements. We have a vast database of reports from leading publishers and authors across the globe. We specialize in delivering customized reports as per the requirements of our clients. We have complete information about our publishers and hence are sure about the accuracy of the industries and verticals of their specialization. This helps our clients to map their needs and we produce the perfect required market research study for our clients.

Contact Us:

Hector Costello

Senior Manager – Client Engagements

4144N Central Expressway,

Suite 600, Dallas,

Texas – 75204, U.S.A.

Phone No.: USA: +1 (972)-591-8191 | IND: +91 895 659 5155

Email ID: sales@orbisresearch.com

Mitsubishi UFJ Kokusai Asset Management Co. Ltd. Has $10.01 Million Position in … – MarketBeat

MMS • RSS

Mitsubishi UFJ Kokusai Asset Management Co. Ltd. lifted its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 4.4% in the first quarter, according to its most recent filing with the SEC. The firm owned 42,917 shares of the company’s stock after acquiring an additional 1,809 shares during the period. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. owned approximately 0.06% of MongoDB worth $10,005,000 as of its most recent filing with the SEC.

Mitsubishi UFJ Kokusai Asset Management Co. Ltd. lifted its holdings in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 4.4% in the first quarter, according to its most recent filing with the SEC. The firm owned 42,917 shares of the company’s stock after acquiring an additional 1,809 shares during the period. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. owned approximately 0.06% of MongoDB worth $10,005,000 as of its most recent filing with the SEC.

Several other institutional investors have also made changes to their positions in the business. Raymond James & Associates grew its position in MongoDB by 32.0% in the first quarter. Raymond James & Associates now owns 4,922 shares of the company’s stock valued at $2,183,000 after acquiring an additional 1,192 shares during the period. PNC Financial Services Group Inc. increased its position in shares of MongoDB by 19.1% during the 1st quarter. PNC Financial Services Group Inc. now owns 1,282 shares of the company’s stock worth $569,000 after purchasing an additional 206 shares in the last quarter. MetLife Investment Management LLC bought a new position in MongoDB during the 1st quarter valued at about $1,823,000. Panagora Asset Management Inc. boosted its position in MongoDB by 9.8% in the first quarter. Panagora Asset Management Inc. now owns 1,977 shares of the company’s stock valued at $877,000 after buying an additional 176 shares in the last quarter. Finally, Vontobel Holding Ltd. grew its stake in MongoDB by 100.3% during the first quarter. Vontobel Holding Ltd. now owns 2,873 shares of the company’s stock worth $1,236,000 after buying an additional 1,439 shares during the last quarter. 89.22% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on the company. The Goldman Sachs Group boosted their target price on MongoDB from $420.00 to $440.00 in a report on Friday, June 23rd. Robert W. Baird boosted their price objective on MongoDB from $390.00 to $430.00 in a research note on Friday, June 23rd. Needham & Company LLC raised their target price on MongoDB from $250.00 to $430.00 in a research note on Friday, June 2nd. KeyCorp upped their price target on shares of MongoDB from $372.00 to $462.00 and gave the stock an “overweight” rating in a research report on Friday, July 21st. Finally, Piper Sandler raised their price objective on shares of MongoDB from $270.00 to $400.00 in a research report on Friday, June 2nd. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating and twenty have assigned a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of “Moderate Buy” and an average price target of $378.09.

Check Out Our Latest Research Report on MongoDB

Insiders Place Their Bets

In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the stock in a transaction dated Tuesday, July 18th. The stock was sold at an average price of $420.00, for a total value of $420,000.00. Following the completion of the sale, the director now directly owns 1,213,159 shares in the company, valued at $509,526,780. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other news, Director Dwight A. Merriman sold 1,000 shares of the company’s stock in a transaction that occurred on Tuesday, July 18th. The shares were sold at an average price of $420.00, for a total value of $420,000.00. Following the completion of the transaction, the director now owns 1,213,159 shares in the company, valued at $509,526,780. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CAO Thomas Bull sold 516 shares of the firm’s stock in a transaction on Monday, July 3rd. The stock was sold at an average price of $406.78, for a total transaction of $209,898.48. Following the sale, the chief accounting officer now owns 17,190 shares in the company, valued at $6,992,548.20. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 102,220 shares of company stock worth $38,763,571. Corporate insiders own 4.80% of the company’s stock.

MongoDB Price Performance

Shares of MDB opened at $359.66 on Friday. The company has a current ratio of 4.19, a quick ratio of 4.19 and a debt-to-equity ratio of 1.44. The stock has a market cap of $25.38 billion, a P/E ratio of -77.01 and a beta of 1.13. The stock’s 50-day moving average price is $393.69 and its two-hundred day moving average price is $287.14. MongoDB, Inc. has a 1 year low of $135.15 and a 1 year high of $439.00.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings data on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.18 by $0.38. MongoDB had a negative net margin of 23.58% and a negative return on equity of 43.25%. The firm had revenue of $368.28 million during the quarter, compared to analysts’ expectations of $347.77 million. During the same quarter in the previous year, the company earned ($1.15) earnings per share. The business’s revenue for the quarter was up 29.0% on a year-over-year basis. On average, equities analysts predict that MongoDB, Inc. will post -2.8 earnings per share for the current year.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Which stocks are likely to thrive in today’s challenging market? Click the link below and we’ll send you MarketBeat’s list of ten stocks that will drive in any economic environment.