Month: August 2023

MMS • RSS

Posted on nosqlgooglealerts. Visit nosqlgooglealerts

The Nosql market research delivers comprehensive research on the present stage of the market, covers market size with respect to assessment as sales volume, and provides a precise forecast of the market scenario over the estimated period. Also focuses on the product, application, manufacturers, suppliers, and regional segments of the market. Nosql market report research highlights market driving factors, an overview of the market growth, industry size, and market share. Subsequently Nosql market report depicts the constantly evolving needs of clients, vendors, and purchasers in different regions, it becomes simple to target specific market and generate large revenues in the global industry.

According to the latest research study, the demand of global Nosql market size & share was valued at approximately USD 85.4 Billion in 2022 and is expected to reach USD 96.2 billion in 2023 and is expected to reach a value of around USD 170 Billion by 2030, at a compound annual growth rate (CAGR) of about 12%during the forecast period 2023 to 2030.”

Some of these key players include: Microsoft SQL Server, MySQL, MongoDB, PostgreSQL, Oracle Database, MongoLab, MarkLogic, Couchbase, CloudDB, DynamoDB, Basho Technologies, Aerospike, IBM, Neo, Hypertable, Cisco, Objectivity

Click here to get a Free Sample Copy of the Report: https://www.mraccuracyreports.com/report-sample/346435

Global Nosql Market by Type:

Key-Value Store, Document Databases, Column Based Stores, Graph Database

Global Nosql Market by Application:

Data Storage, Metadata Store, Cache Memory, Distributed Data Depository, e-Commerce, Mobile Apps, Web Applications, Data Analytics, Social Networking

|

Report Attributes |

Report Details |

|

Report Name |

Nosql Market Size Report |

|

Market Size in 2020 |

USD 96.2 Billion |

|

Market Forecast in 2028 |

USD 170 Billion |

|

Compound Annual Growth Rate |

CAGR of 12% |

|

Number of Pages |

188 |

|

Forecast Units |

Value (USD Billion), and Volume (Units) |

|

Key Companies Covered |

Microsoft SQL Server, MySQL, MongoDB, PostgreSQL, Oracle Database, MongoLab, MarkLogic, Couchbase, CloudDB, DynamoDB, Basho Technologies, Aerospike, IBM, Neo, Hypertable, Cisco, Objectivity |

|

Segments Covered |

By Type,By end-user, And By Region |

|

Regions Covered |

North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

|

Countries Covered |

North America: U.S and Canada |

|

Base Year |

2021 |

|

Historical Year |

2016 to 2020 |

|

Forecast Year |

2022 – 2030 |

|

Customization Scope |

Avail customized purchase options to meet your exact research needs.https://www.mraccuracyreports.com/report-sample/346435 |

Regional Assessment:

Geographically, the global Nosql market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)).

The Research covers the following objectives:

– To study and analyze the Global Nosql consumption by key regions/countries, product type and application, history data from 2016 to 2021, and forecast to 2028.

– To understand the structure of Nosql market by identifying its various sub-segments.

– Focuses on the key global Nosql manufacturers, to define, describe and analyze the sales volume, value, market share, market competition landscape, Porter’s five forces analysis, SWOT analysis and development plans in next few years.

– To analyze the Nosql with respect to individual growth trends, future prospects, and their contribution to the total market.

– To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

– To project the consumption of Nosql submarkets, with respect to key regions (along with their respective key countries).

Please click here today to buy full report @ https://www.mraccuracyreports.com/checkout/346435

Strategic Points Covered in Table of Content of Global Nosql Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Nosql market

Chapter 2: Exclusive Summary and the basic information of the Nosql Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Nosql

Chapter 4: Presenting the Nosql Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2017-2021

Chapter 6: Evaluating the leading industrialists of the Nosql market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Nosql Market is a valuable source of guidance for individuals and companies.

Key Benefits for Industry Participants & Stakeholders:

- Industry drivers, restraints, and opportunities covered in the study

- Neutral perspective on the market performance

- Recent industry trends and developments

- Competitive landscape & strategies of key players

- Potential & niche segments and regions exhibiting promising growth covered

- Historical, current, and projected market size, in terms of value

- In-depth analysis of the Nosql Market

The report on the market presents a critical assessment of frameworks for branding decisions, market fit growth strategies, and approaches for leaders and pioneers. The study analyzes distribution channel, product portfolio, business units of top players, and goal attacking, and market expansion.

Ask Analyst for 30% Free Customized Report @ https://www.mraccuracyreports.com/check-discount/346435

Additional paid Services: –

- Client will get one free update on the purchase of Corporate User License.

- Quarterly Industry Update for 1 Year at 40% of the report cost per update.

- One dedicated research analyst allocated to the client.

- Fast Query resolution within 48 hours.

- Industry Newsletter at USD 100 per month per issue.

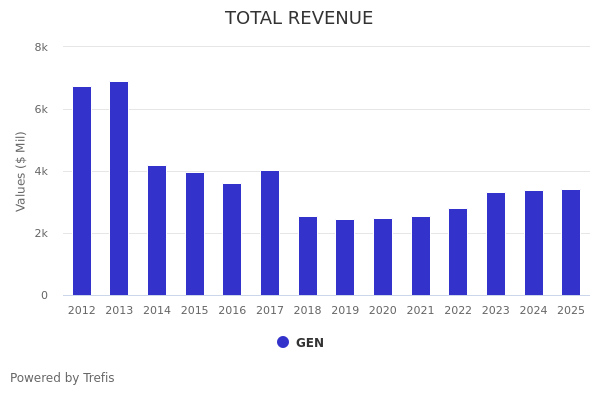

GEN YTD Stock Return Of -8.2% Underperforms PCTY by -24% and Underperforms MDB by -123%

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

©Copyright 2019 Insight Guru Inc. All Rights Reserved.

By using the Site, you agree to be bound by our Terms of

Use. Financial market data powered by Quotemedia.com.

Consensus EPS estimates are from QuoteMedia and are updated every weekday.

All rights reserved.

NYSE/AMEX data delayed 20 minutes. NASDAQ and other

data delayed 15 minutes unless indicated.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • Anthony Alford

Article originally posted on InfoQ. Visit InfoQ

Researchers from Carnegie Mellon University (CMU) have published LLM Attacks, an algorithm for constructing adversarial attacks on a wide range of large language models (LLMs), including ChatGPT, Claude, and Bard. The attacks are generated automatically and are successful 84% of the time on GPT-3.5 and GPT-4, and 66% of the time on PaLM-2.

Unlike most “jailbreak” attacks which are manually constructed using trial and error, the CMU team devised a three-step process to automatically generate prompt suffixes that can bypass the LLM’s safety mechanisms and result in a harmful response. The prompts are also transferrable, meaning that a given suffix will often work on many different LLMs, even closed-source models. To measure the effectiveness of the algorithm, the researchers created a benchmark called AdvBench; when evaluated on this benchmark, LLM Attacks has an 88% success rate against Vicuna, compared to 25% for a baseline adversarial algorithm. According to the CMU team:

Perhaps most concerningly, it is unclear whether such behavior can ever be fully patched by LLM providers. Analogous adversarial attacks have proven to be a very difficult problem to address in computer vision for the past 10 years. It is possible that the very nature of deep learning models makes such threats inevitable. Thus, we believe that these considerations should be taken into account as we increase usage and reliance on such AI models.

With the release of ChatGPT and GPT-4, many techniques for jailbreaking these models emerged, which consisted of prompts which could cause the models to bypass their safeguards and output potentially harmful responses. While these prompts are generally discovered by experimentation, the LLM Attacks algorithm provides an automated way to create them. The first step is to create a target sequence of tokens “Sure, here is (content of query),” where “content of query” is the user’s actual prompt which is asking for a harmful response.

Next, the algorithm generates an adversarial suffix for the prompt by finding a sequence of tokens that is likely to cause the LLM to output the target sequence, using a Greedy Goordinate Gradient-based (GCG). While this does require access to the LLM’s neural network, the team found that by running GCG against many open-source models, the results were transferrable even to closed models.

In a CMU press release discussing their research, co-auth Matt Fredrikson said:

The concern is that these models will play a larger role in autonomous systems that operate without human supervision. As autonomous systems become more of a reality, it will be very important to ensure that we have a reliable way to stop them from being hijacked by attacks like these…Right now, we simply don’t have a convincing way to stop this from happening, so the next step is to figure out how to fix these models…Understanding how to mount these attacks is often the first step in developing a strong defense.

Lead author Andy Zou, a PhD student at CMU, wrote about the work on Twitter. He said:

Despite the risks, we believe it to be proper to disclose in full. The attacks presented here are simple to implement, have appeared in similar forms before, and ultimately would be discoverable by any dedicated team intent on misusing LLMs.

David Krueger, an Assistant Professor at the University of Cambridge, replied to Zou’s thread, saying:

Given that 10 years of research and thousands of publications haven’t found a fix for adversarial examples in image models, we have a strong reason to expect the same outcome with LLMs.

In a discussion of the work on Hacker News, one user pointed out:

Remember that a big point of this research is that these attacks don’t need to be developed using the target system. When the authors talk about the attacks being “universal”, what they mean is that they used a completely local model on their own computers to generate these attacks, and then copied and pasted those attacks into GPT-3.5 and saw meaningful success rates. Rate limiting won’t save you from that because the attack isn’t generated using your servers, it’s generated locally. The first prompt your servers get already has the finished attack string included — and researchers were seeing success rates around 50% success rate in some situations even for GPT-4.

Code for reproducing the LLM Attacks experiments against the AdvBench data is available on GitHub. A demo of several adversarial attacks is available on the project website.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Nisa Investment Advisors LLC decreased its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 89.0% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,140 shares of the company’s stock after selling 9,200 shares during the quarter. Nisa Investment Advisors LLC’s holdings in MongoDB were worth $266,000 at the end of the most recent quarter.

Nisa Investment Advisors LLC decreased its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 89.0% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,140 shares of the company’s stock after selling 9,200 shares during the quarter. Nisa Investment Advisors LLC’s holdings in MongoDB were worth $266,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Cherry Creek Investment Advisors Inc. lifted its holdings in shares of MongoDB by 1.5% during the 4th quarter. Cherry Creek Investment Advisors Inc. now owns 3,283 shares of the company’s stock worth $646,000 after acquiring an additional 50 shares during the period. CWM LLC grew its position in MongoDB by 2.4% in the first quarter. CWM LLC now owns 2,235 shares of the company’s stock valued at $521,000 after acquiring an additional 52 shares in the last quarter. Cetera Advisor Networks LLC grew its position in MongoDB by 7.4% in the second quarter. Cetera Advisor Networks LLC now owns 860 shares of the company’s stock valued at $223,000 after acquiring an additional 59 shares in the last quarter. First Republic Investment Management Inc. grew its position in MongoDB by 1.0% in the fourth quarter. First Republic Investment Management Inc. now owns 6,406 shares of the company’s stock valued at $1,261,000 after acquiring an additional 61 shares in the last quarter. Finally, Janney Montgomery Scott LLC grew its position in MongoDB by 4.5% in the fourth quarter. Janney Montgomery Scott LLC now owns 1,512 shares of the company’s stock valued at $298,000 after acquiring an additional 65 shares in the last quarter. Hedge funds and other institutional investors own 89.22% of the company’s stock.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on MDB. Tigress Financial raised their price target on shares of MongoDB from $365.00 to $490.00 in a research report on Wednesday, June 28th. 58.com reiterated a “maintains” rating on shares of MongoDB in a research note on Monday, June 26th. Needham & Company LLC raised their target price on MongoDB from $250.00 to $430.00 in a research note on Friday, June 2nd. KeyCorp raised their target price on MongoDB from $372.00 to $462.00 and gave the company an “overweight” rating in a research note on Friday, July 21st. Finally, William Blair reiterated an “outperform” rating on shares of MongoDB in a research note on Friday, June 2nd. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and twenty have assigned a buy rating to the company. According to MarketBeat, the stock has an average rating of “Moderate Buy” and an average target price of $378.09.

MongoDB Stock Performance

NASDAQ:MDB opened at $423.40 on Tuesday. The company has a quick ratio of 4.19, a current ratio of 4.19 and a debt-to-equity ratio of 1.44. MongoDB, Inc. has a fifty-two week low of $135.15 and a fifty-two week high of $439.00. The stock’s 50-day moving average is $378.35 and its two-hundred day moving average is $278.11.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings results on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.18 by $0.38. The business had revenue of $368.28 million during the quarter, compared to analyst estimates of $347.77 million. MongoDB had a negative return on equity of 43.25% and a negative net margin of 23.58%. The firm’s revenue was up 29.0% on a year-over-year basis. During the same period in the previous year, the company earned ($1.15) EPS. Sell-side analysts anticipate that MongoDB, Inc. will post -2.8 earnings per share for the current year.

Insider Activity

In related news, CRO Cedric Pech sold 15,534 shares of the business’s stock in a transaction that occurred on Tuesday, May 9th. The stock was sold at an average price of $250.00, for a total value of $3,883,500.00. Following the completion of the sale, the executive now directly owns 37,516 shares in the company, valued at approximately $9,379,000. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. In other MongoDB news, CRO Cedric Pech sold 15,534 shares of MongoDB stock in a transaction that occurred on Tuesday, May 9th. The stock was sold at an average price of $250.00, for a total value of $3,883,500.00. Following the transaction, the executive now directly owns 37,516 shares of the company’s stock, valued at approximately $9,379,000. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, CEO Dev Ittycheria sold 20,000 shares of MongoDB stock in a transaction that occurred on Thursday, June 1st. The stock was sold at an average price of $287.32, for a total value of $5,746,400.00. Following the completion of the transaction, the chief executive officer now directly owns 262,311 shares in the company, valued at $75,367,196.52. The disclosure for this sale can be found here. Insiders sold a total of 116,427 shares of company stock worth $41,304,961 in the last three months. 4.80% of the stock is owned by insiders.

MongoDB Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Nisa Investment Advisors LLC decreased its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 89.0% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,140 shares of the company’s stock after selling 9,200 shares during the quarter. Nisa Investment Advisors LLC’s holdings in MongoDB were worth $266,000 at the end of the most recent quarter.

Nisa Investment Advisors LLC decreased its holdings in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 89.0% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,140 shares of the company’s stock after selling 9,200 shares during the quarter. Nisa Investment Advisors LLC’s holdings in MongoDB were worth $266,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Cherry Creek Investment Advisors Inc. lifted its holdings in shares of MongoDB by 1.5% during the 4th quarter. Cherry Creek Investment Advisors Inc. now owns 3,283 shares of the company’s stock worth $646,000 after acquiring an additional 50 shares during the period. CWM LLC grew its position in MongoDB by 2.4% in the first quarter. CWM LLC now owns 2,235 shares of the company’s stock valued at $521,000 after acquiring an additional 52 shares in the last quarter. Cetera Advisor Networks LLC grew its position in MongoDB by 7.4% in the second quarter. Cetera Advisor Networks LLC now owns 860 shares of the company’s stock valued at $223,000 after acquiring an additional 59 shares in the last quarter. First Republic Investment Management Inc. grew its position in MongoDB by 1.0% in the fourth quarter. First Republic Investment Management Inc. now owns 6,406 shares of the company’s stock valued at $1,261,000 after acquiring an additional 61 shares in the last quarter. Finally, Janney Montgomery Scott LLC grew its position in MongoDB by 4.5% in the fourth quarter. Janney Montgomery Scott LLC now owns 1,512 shares of the company’s stock valued at $298,000 after acquiring an additional 65 shares in the last quarter. Hedge funds and other institutional investors own 89.22% of the company’s stock.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on MDB. Tigress Financial raised their price target on shares of MongoDB from $365.00 to $490.00 in a research report on Wednesday, June 28th. 58.com reiterated a “maintains” rating on shares of MongoDB in a research note on Monday, June 26th. Needham & Company LLC raised their target price on MongoDB from $250.00 to $430.00 in a research note on Friday, June 2nd. KeyCorp raised their target price on MongoDB from $372.00 to $462.00 and gave the company an “overweight” rating in a research note on Friday, July 21st. Finally, William Blair reiterated an “outperform” rating on shares of MongoDB in a research note on Friday, June 2nd. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and twenty have assigned a buy rating to the company. According to MarketBeat, the stock has an average rating of “Moderate Buy” and an average target price of $378.09.

MongoDB Stock Performance

NASDAQ:MDB opened at $423.40 on Tuesday. The company has a quick ratio of 4.19, a current ratio of 4.19 and a debt-to-equity ratio of 1.44. MongoDB, Inc. has a fifty-two week low of $135.15 and a fifty-two week high of $439.00. The stock’s 50-day moving average is $378.35 and its two-hundred day moving average is $278.11.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings results on Thursday, June 1st. The company reported $0.56 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.18 by $0.38. The business had revenue of $368.28 million during the quarter, compared to analyst estimates of $347.77 million. MongoDB had a negative return on equity of 43.25% and a negative net margin of 23.58%. The firm’s revenue was up 29.0% on a year-over-year basis. During the same period in the previous year, the company earned ($1.15) EPS. Sell-side analysts anticipate that MongoDB, Inc. will post -2.8 earnings per share for the current year.

Insider Activity

In related news, CRO Cedric Pech sold 15,534 shares of the business’s stock in a transaction that occurred on Tuesday, May 9th. The stock was sold at an average price of $250.00, for a total value of $3,883,500.00. Following the completion of the sale, the executive now directly owns 37,516 shares in the company, valued at approximately $9,379,000. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. In other MongoDB news, CRO Cedric Pech sold 15,534 shares of MongoDB stock in a transaction that occurred on Tuesday, May 9th. The stock was sold at an average price of $250.00, for a total value of $3,883,500.00. Following the transaction, the executive now directly owns 37,516 shares of the company’s stock, valued at approximately $9,379,000. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, CEO Dev Ittycheria sold 20,000 shares of MongoDB stock in a transaction that occurred on Thursday, June 1st. The stock was sold at an average price of $287.32, for a total value of $5,746,400.00. Following the completion of the transaction, the chief executive officer now directly owns 262,311 shares in the company, valued at $75,367,196.52. The disclosure for this sale can be found here. Insiders sold a total of 116,427 shares of company stock worth $41,304,961 in the last three months. 4.80% of the stock is owned by insiders.

MongoDB Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s list of seven best retirement stocks and why they should be in your portfolio.

Article originally posted on mongodb google news. Visit mongodb google news

Chinas Cabinet Approves Construction of Three New Nuclear Power Stations – Best Stocks

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

China’s cabinet has given the green light for the construction of three brand new nuclear power stations, marking a significant step in the country’s ambitious long-term development plan for nuclear energy. The approved projects encompass the second phase of the Zhangzhou nuclear power plant in Fujian province, the first phase of the Lianjiang nuclear power plant in Guangdong province, and an additional project in an undisclosed location.

With an estimated total cost of approximately 80 billion yuan ($11.5 billion), these ventures demonstrate China‘s commitment to expanding its domestic nuclear power capacity while simultaneously addressing concerns regarding carbon emissions. This move comes as part of the government’s strategic efforts to increase the number of nuclear plants within the country.

It is noteworthy to mention that China had temporarily halted the approval of new reactors for a duration of four years following the Fukushima nuclear plant disaster in Japan back in 2011. However, in 2015, the country resumed approvals, showcasing its resilience and determination to pursue nuclear energy as a vital component of its energy mix.

As of 2022, China was on track to have a remarkable total of 51 nuclear power units, including 17 units currently under construction. The operational nuclear plants are projected to have a generating capacity of 70 million kW by 2025, further solidifying China’s position as a global leader in nuclear power production.

Thus, with the recent approval of these three new nuclear power stations, China continues to forge ahead on its path towards a sustainable and diversified energy future.

MDB Stock Shows Positive Performance and Strong Growth Potential in the Technology Services Sector

On July 31, 2023, the stock of MongoDB Inc. (MDB) had a positive performance, opening at $415.95 and reaching a high of $426.44. The stock closed at $413.44 the previous day, indicating an increase in value. The day’s range for MDB was between $415.01 and $426.44. The trading volume for the day was 45,837 shares, which is significantly lower than the average volume of 1,737,525 shares over the past three months. The market capitalization of MDB stands at $29.1 billion.

MDB has shown impressive earnings growth in recent years. While the company experienced a decline of 5.89% in earnings growth last year, it has rebounded significantly with a growth rate of 92.12% this year. Looking ahead, MDB is expected to maintain a steady earnings growth rate of 8.00% over the next five years.

In terms of revenue growth, MDB has demonstrated strong performance. The company experienced a revenue growth rate of 46.95% last year, indicating its ability to increase its top-line. This growth is a positive sign for investors, as it suggests that MDB is successfully expanding its customer base and increasing its market share.

When analyzing the valuation metrics of MDB, the price-to-earnings (P/E) ratio is not available (NM). However, the price-to-sales ratio stands at 11.45, indicating that investors are willing to pay a premium for each dollar of sales generated by the company. The price-to-book ratio is 39.00, which suggests that the stock is trading at a significant premium compared to its book value.

In comparison to other technology services companies, MDB has performed well. On July 31, 2023, ANSS (ANSYS Inc) experienced a change of +2.81% and HUBS (HubSpot Inc) had a change of +4.05%. VEEV (Veeva Systems Inc) also had a positive performance with a change of +1.54%.

MDB operates in the technology services sector, specifically in the packaged software industry. The company is headquartered in New York, New York.

Looking ahead, MDB’s next reporting date is scheduled for August 31, 2023. Analysts forecast an earnings per share (EPS) of $0.46 for the quarter. In the previous year, MDB generated an annual revenue of $1.3 billion but reported a net loss of -$345.4 million. The net profit margin stood at -26.90%, indicating that the company’s expenses exceeded its revenue.

In conclusion, MDB has shown positive stock performance on July 31, 2023, with an increase in value from the previous day’s close. The company has demonstrated strong earnings and revenue growth, indicating its ability to generate profits and expand its customer base. However, the stock is trading at a premium compared to its book value, which may be a consideration for investors. Overall, MDB’s performance suggests a promising future for the company in the technology services sector.

MDB Stock Shows Positive Performance and Optimistic Outlook for Future Growth

MDB stock, the stock of MongoDB Inc, had a positive performance on July 31, 2023, according to the information provided by CNN Money. The 22 analysts who have offered 12-month price forecasts for MDB stock have a median target of $424.50. The high estimate is $462.00, while the low estimate is $210.00.

The median estimate of $424.50 represents a 0.22% increase from the last price of $423.56. This suggests that analysts are generally optimistic about the future performance of MDB stock.

Furthermore, a consensus among 28 polled investment analysts is to buy stock in MongoDB Inc. This rating has remained unchanged since July, indicating a consistent positive sentiment towards the stock.

In terms of financial performance, MongoDB Inc reported earnings per share of $0.46 and sales of $393.7 million for the current quarter. The company is scheduled to report its earnings on August 31.

Overall, the information suggests that MDB stock had a positive performance on July 31, 2023, and analysts have a generally positive outlook for the stock’s future performance. Investors may consider buying MDB stock based on the consensus recommendation and the potential for future growth indicated by the median price target. However, it is important for investors to conduct their own research and analysis before making any investment decisions.

Article originally posted on mongodb google news. Visit mongodb google news