Month: January 2024

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Principal Financial Group Inc. grew its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 46.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 67,075 shares of the company’s stock after purchasing an additional 21,171 shares during the period. Principal Financial Group Inc. owned approximately 0.09% of MongoDB worth $23,199,000 at the end of the most recent reporting period.

Principal Financial Group Inc. grew its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 46.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 67,075 shares of the company’s stock after purchasing an additional 21,171 shares during the period. Principal Financial Group Inc. owned approximately 0.09% of MongoDB worth $23,199,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in MDB. Duality Advisers LP grew its holdings in shares of MongoDB by 3.2% in the third quarter. Duality Advisers LP now owns 5,373 shares of the company’s stock valued at $1,858,000 after purchasing an additional 166 shares in the last quarter. Cullen Frost Bankers Inc. bought a new position in MongoDB during the third quarter valued at $35,000. Olympiad Research LP grew its stake in shares of MongoDB by 58.0% in the 3rd quarter. Olympiad Research LP now owns 1,940 shares of the company’s stock worth $671,000 after buying an additional 712 shares in the last quarter. FDx Advisors Inc. increased its holdings in shares of MongoDB by 14.0% in the 3rd quarter. FDx Advisors Inc. now owns 792 shares of the company’s stock worth $274,000 after buying an additional 97 shares during the last quarter. Finally, CloudAlpha Capital Management Limited Hong Kong raised its position in shares of MongoDB by 410.0% during the 3rd quarter. CloudAlpha Capital Management Limited Hong Kong now owns 5,100 shares of the company’s stock valued at $1,764,000 after buying an additional 4,100 shares in the last quarter. 88.89% of the stock is owned by institutional investors.

Insider Activity

In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction dated Wednesday, November 1st. The shares were sold at an average price of $345.21, for a total value of $345,210.00. Following the completion of the transaction, the director now directly owns 533,896 shares in the company, valued at $184,306,238.16. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other news, CAO Thomas Bull sold 359 shares of the firm’s stock in a transaction on Tuesday, January 2nd. The stock was sold at an average price of $404.38, for a total value of $145,172.42. Following the completion of the sale, the chief accounting officer now owns 16,313 shares of the company’s stock, valued at approximately $6,596,650.94. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction on Wednesday, November 1st. The stock was sold at an average price of $345.21, for a total value of $345,210.00. Following the transaction, the director now owns 533,896 shares in the company, valued at $184,306,238.16. The disclosure for this sale can be found here. In the last three months, insiders have sold 149,277 shares of company stock worth $57,223,711. 4.80% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

Several brokerages have weighed in on MDB. DA Davidson reissued a “neutral” rating and set a $405.00 price objective on shares of MongoDB in a research note on Friday. Stifel Nicolaus reiterated a “buy” rating and issued a $450.00 target price on shares of MongoDB in a report on Monday, December 4th. JMP Securities restated a “market outperform” rating and set a $440.00 price target on shares of MongoDB in a report on Monday, January 22nd. Piper Sandler raised their price target on MongoDB from $425.00 to $500.00 and gave the stock an “overweight” rating in a research report on Wednesday, December 6th. Finally, Needham & Company LLC reiterated a “buy” rating and set a $495.00 price objective on shares of MongoDB in a research report on Wednesday, January 17th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and twenty-one have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of “Moderate Buy” and a consensus price target of $429.50.

Get Our Latest Research Report on MongoDB

MongoDB Stock Down 1.3 %

Shares of MongoDB stock opened at $395.29 on Friday. MongoDB, Inc. has a 1 year low of $189.59 and a 1 year high of $442.84. The company has a debt-to-equity ratio of 1.18, a current ratio of 4.74 and a quick ratio of 4.74. The stock has a market cap of $28.53 billion, a price-to-earnings ratio of -149.73 and a beta of 1.23. The firm’s 50-day moving average is $402.37 and its two-hundred day moving average is $380.93.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Tuesday, December 5th. The company reported $0.96 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.51 by $0.45. The firm had revenue of $432.94 million for the quarter, compared to the consensus estimate of $406.33 million. MongoDB had a negative net margin of 11.70% and a negative return on equity of 20.64%. The company’s quarterly revenue was up 29.8% on a year-over-year basis. During the same period last year, the firm earned ($1.23) earnings per share. As a group, research analysts expect that MongoDB, Inc. will post -1.64 earnings per share for the current fiscal year.

MongoDB Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MGO One Seven LLC purchased a new position in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 915 shares of the company’s stock, valued at approximately $316,000.

MGO One Seven LLC purchased a new position in MongoDB, Inc. (NASDAQ:MDB – Free Report) in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 915 shares of the company’s stock, valued at approximately $316,000.

Other institutional investors also recently bought and sold shares of the company. Simplicity Solutions LLC lifted its position in shares of MongoDB by 2.2% during the second quarter. Simplicity Solutions LLC now owns 1,169 shares of the company’s stock worth $480,000 after purchasing an additional 25 shares during the last quarter. AJ Wealth Strategies LLC lifted its position in shares of MongoDB by 1.2% during the second quarter. AJ Wealth Strategies LLC now owns 2,390 shares of the company’s stock worth $982,000 after purchasing an additional 28 shares during the last quarter. Assenagon Asset Management S.A. lifted its position in shares of MongoDB by 1.4% during the second quarter. Assenagon Asset Management S.A. now owns 2,239 shares of the company’s stock worth $920,000 after purchasing an additional 32 shares during the last quarter. Veritable L.P. lifted its position in shares of MongoDB by 1.4% during the second quarter. Veritable L.P. now owns 2,321 shares of the company’s stock worth $954,000 after purchasing an additional 33 shares during the last quarter. Finally, Choreo LLC lifted its position in shares of MongoDB by 3.5% during the second quarter. Choreo LLC now owns 1,040 shares of the company’s stock worth $427,000 after purchasing an additional 35 shares during the last quarter. 88.89% of the stock is currently owned by institutional investors.

MongoDB Price Performance

Shares of MDB opened at $395.29 on Friday. MongoDB, Inc. has a 52-week low of $189.59 and a 52-week high of $442.84. The stock has a fifty day simple moving average of $402.37 and a two-hundred day simple moving average of $380.93. The company has a quick ratio of 4.74, a current ratio of 4.74 and a debt-to-equity ratio of 1.18.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings results on Tuesday, December 5th. The company reported $0.96 earnings per share for the quarter, topping analysts’ consensus estimates of $0.51 by $0.45. The business had revenue of $432.94 million during the quarter, compared to analysts’ expectations of $406.33 million. MongoDB had a negative return on equity of 20.64% and a negative net margin of 11.70%. The company’s revenue was up 29.8% compared to the same quarter last year. During the same period in the prior year, the business posted ($1.23) EPS. Analysts predict that MongoDB, Inc. will post -1.63 EPS for the current year.

Wall Street Analyst Weigh In

Several analysts have recently weighed in on MDB shares. Needham & Company LLC reiterated a “buy” rating and set a $495.00 target price on shares of MongoDB in a research report on Wednesday, January 17th. Scotiabank began coverage on MongoDB in a research report on Tuesday, October 10th. They set a “sector perform” rating and a $335.00 target price for the company. Stifel Nicolaus restated a “buy” rating and set a $450.00 price target on shares of MongoDB in a research note on Monday, December 4th. UBS Group restated a “neutral” rating and set a $410.00 price target (down previously from $475.00) on shares of MongoDB in a research note on Thursday, January 4th. Finally, Royal Bank of Canada raised their price target on MongoDB from $445.00 to $475.00 and gave the company an “outperform” rating in a research note on Wednesday, December 6th. One research analyst has rated the stock with a sell rating, four have given a hold rating and twenty-one have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of “Moderate Buy” and an average target price of $429.50.

Read Our Latest Research Report on MDB

Insider Transactions at MongoDB

In related news, Director Dwight A. Merriman sold 1,000 shares of the firm’s stock in a transaction dated Monday, January 22nd. The stock was sold at an average price of $420.00, for a total transaction of $420,000.00. Following the completion of the transaction, the director now directly owns 528,896 shares in the company, valued at approximately $222,136,320. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. In other news, CEO Dev Ittycheria sold 100,500 shares of MongoDB stock in a transaction dated Tuesday, November 7th. The stock was sold at an average price of $375.00, for a total value of $37,687,500.00. Following the completion of the transaction, the chief executive officer now owns 214,177 shares in the company, valued at approximately $80,316,375. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Dwight A. Merriman sold 1,000 shares of MongoDB stock in a transaction dated Monday, January 22nd. The shares were sold at an average price of $420.00, for a total value of $420,000.00. Following the completion of the transaction, the director now owns 528,896 shares of the company’s stock, valued at approximately $222,136,320. The disclosure for this sale can be found here. In the last ninety days, insiders sold 149,277 shares of company stock worth $57,223,711. 4.80% of the stock is currently owned by company insiders.

MongoDB Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Nomura Asset Management Co. Ltd. raised its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.8% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 18,285 shares of the company’s stock after buying an additional 320 shares during the period. Nomura Asset Management Co. Ltd.’s holdings in MongoDB were worth $6,324,000 at the end of the most recent quarter.

Nomura Asset Management Co. Ltd. raised its stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 1.8% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 18,285 shares of the company’s stock after buying an additional 320 shares during the period. Nomura Asset Management Co. Ltd.’s holdings in MongoDB were worth $6,324,000 at the end of the most recent quarter.

A number of other institutional investors have also recently made changes to their positions in MDB. KB Financial Partners LLC bought a new position in shares of MongoDB in the 2nd quarter worth $27,000. Capital Advisors Ltd. LLC boosted its stake in shares of MongoDB by 131.0% in the 2nd quarter. Capital Advisors Ltd. LLC now owns 67 shares of the company’s stock valued at $28,000 after purchasing an additional 38 shares in the last quarter. Bessemer Group Inc. purchased a new stake in shares of MongoDB in the 4th quarter valued at $29,000. BluePath Capital Management LLC purchased a new stake in shares of MongoDB in the 3rd quarter valued at $30,000. Finally, Cullen Frost Bankers Inc. purchased a new stake in shares of MongoDB in the 3rd quarter valued at $35,000. Institutional investors own 88.89% of the company’s stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently issued reports on MDB shares. Tigress Financial upped their price objective on shares of MongoDB from $490.00 to $495.00 and gave the company a “buy” rating in a research note on Friday, October 6th. Capital One Financial raised shares of MongoDB from an “equal weight” rating to an “overweight” rating and set a $427.00 price objective for the company in a research note on Wednesday, November 8th. Royal Bank of Canada upped their price objective on shares of MongoDB from $445.00 to $475.00 and gave the company an “outperform” rating in a research note on Wednesday, December 6th. DA Davidson reaffirmed a “neutral” rating and issued a $405.00 price objective on shares of MongoDB in a research note on Friday. Finally, Stifel Nicolaus reissued a “buy” rating and set a $450.00 price target on shares of MongoDB in a research report on Monday, December 4th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and twenty-one have assigned a buy rating to the company’s stock. According to MarketBeat, the company currently has an average rating of “Moderate Buy” and a consensus target price of $429.50.

Get Our Latest Stock Report on MDB

MongoDB Price Performance

Shares of MongoDB stock opened at $395.29 on Friday. The company has a current ratio of 4.74, a quick ratio of 4.74 and a debt-to-equity ratio of 1.18. The company has a 50-day moving average of $402.37 and a 200 day moving average of $380.93. MongoDB, Inc. has a 1 year low of $189.59 and a 1 year high of $442.84.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings results on Tuesday, December 5th. The company reported $0.96 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.51 by $0.45. The company had revenue of $432.94 million during the quarter, compared to analyst estimates of $406.33 million. MongoDB had a negative net margin of 11.70% and a negative return on equity of 20.64%. MongoDB’s quarterly revenue was up 29.8% compared to the same quarter last year. During the same period last year, the business earned ($1.23) EPS. As a group, analysts anticipate that MongoDB, Inc. will post -1.63 EPS for the current fiscal year.

Insider Buying and Selling

In related news, Director Dwight A. Merriman sold 1,000 shares of the stock in a transaction dated Wednesday, November 1st. The shares were sold at an average price of $345.21, for a total value of $345,210.00. Following the completion of the transaction, the director now directly owns 533,896 shares in the company, valued at approximately $184,306,238.16. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In other MongoDB news, CRO Cedric Pech sold 1,248 shares of the firm’s stock in a transaction dated Tuesday, January 16th. The shares were sold at an average price of $400.00, for a total transaction of $499,200.00. Following the completion of the sale, the executive now directly owns 25,425 shares in the company, valued at approximately $10,170,000. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, Director Dwight A. Merriman sold 1,000 shares of the firm’s stock in a transaction dated Wednesday, November 1st. The shares were sold at an average price of $345.21, for a total transaction of $345,210.00. Following the sale, the director now owns 533,896 shares of the company’s stock, valued at $184,306,238.16. The disclosure for this sale can be found here. Insiders sold a total of 149,277 shares of company stock worth $57,223,711 in the last three months. 4.80% of the stock is owned by corporate insiders.

About MongoDB

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Principal Financial Group Inc. grew its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 46.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 67,075 shares of the company’s stock after purchasing an additional 21,171 shares during the period. Principal Financial Group Inc. owned approximately 0.09% of MongoDB worth $23,199,000 at the end of the most recent reporting period.

Principal Financial Group Inc. grew its position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 46.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 67,075 shares of the company’s stock after purchasing an additional 21,171 shares during the period. Principal Financial Group Inc. owned approximately 0.09% of MongoDB worth $23,199,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in MDB. Duality Advisers LP grew its holdings in shares of MongoDB by 3.2% in the third quarter. Duality Advisers LP now owns 5,373 shares of the company’s stock valued at $1,858,000 after purchasing an additional 166 shares in the last quarter. Cullen Frost Bankers Inc. bought a new position in MongoDB during the third quarter valued at $35,000. Olympiad Research LP grew its stake in shares of MongoDB by 58.0% in the 3rd quarter. Olympiad Research LP now owns 1,940 shares of the company’s stock worth $671,000 after buying an additional 712 shares in the last quarter. FDx Advisors Inc. increased its holdings in shares of MongoDB by 14.0% in the 3rd quarter. FDx Advisors Inc. now owns 792 shares of the company’s stock worth $274,000 after buying an additional 97 shares during the last quarter. Finally, CloudAlpha Capital Management Limited Hong Kong raised its position in shares of MongoDB by 410.0% during the 3rd quarter. CloudAlpha Capital Management Limited Hong Kong now owns 5,100 shares of the company’s stock valued at $1,764,000 after buying an additional 4,100 shares in the last quarter. 88.89% of the stock is owned by institutional investors.

Insider Activity

In other MongoDB news, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction dated Wednesday, November 1st. The shares were sold at an average price of $345.21, for a total value of $345,210.00. Following the completion of the transaction, the director now directly owns 533,896 shares in the company, valued at $184,306,238.16. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other news, CAO Thomas Bull sold 359 shares of the firm’s stock in a transaction on Tuesday, January 2nd. The stock was sold at an average price of $404.38, for a total value of $145,172.42. Following the completion of the sale, the chief accounting officer now owns 16,313 shares of the company’s stock, valued at approximately $6,596,650.94. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Dwight A. Merriman sold 1,000 shares of the business’s stock in a transaction on Wednesday, November 1st. The stock was sold at an average price of $345.21, for a total value of $345,210.00. Following the transaction, the director now owns 533,896 shares in the company, valued at $184,306,238.16. The disclosure for this sale can be found here. In the last three months, insiders have sold 149,277 shares of company stock worth $57,223,711. 4.80% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

Several brokerages have weighed in on MDB. DA Davidson reissued a “neutral” rating and set a $405.00 price objective on shares of MongoDB in a research note on Friday. Stifel Nicolaus reiterated a “buy” rating and issued a $450.00 target price on shares of MongoDB in a report on Monday, December 4th. JMP Securities restated a “market outperform” rating and set a $440.00 price target on shares of MongoDB in a report on Monday, January 22nd. Piper Sandler raised their price target on MongoDB from $425.00 to $500.00 and gave the stock an “overweight” rating in a research report on Wednesday, December 6th. Finally, Needham & Company LLC reiterated a “buy” rating and set a $495.00 price objective on shares of MongoDB in a research report on Wednesday, January 17th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and twenty-one have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of “Moderate Buy” and a consensus price target of $429.50.

Get Our Latest Research Report on MongoDB

MongoDB Stock Down 1.3 %

Shares of MongoDB stock opened at $395.29 on Friday. MongoDB, Inc. has a 1 year low of $189.59 and a 1 year high of $442.84. The company has a debt-to-equity ratio of 1.18, a current ratio of 4.74 and a quick ratio of 4.74. The stock has a market cap of $28.53 billion, a price-to-earnings ratio of -149.73 and a beta of 1.23. The firm’s 50-day moving average is $402.37 and its two-hundred day moving average is $380.93.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Tuesday, December 5th. The company reported $0.96 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.51 by $0.45. The firm had revenue of $432.94 million for the quarter, compared to the consensus estimate of $406.33 million. MongoDB had a negative net margin of 11.70% and a negative return on equity of 20.64%. The company’s quarterly revenue was up 29.8% on a year-over-year basis. During the same period last year, the firm earned ($1.23) earnings per share. As a group, research analysts expect that MongoDB, Inc. will post -1.64 earnings per share for the current fiscal year.

MongoDB Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Los Angeles Capital Management LLC trimmed its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 37.7% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 33,545 shares of the company’s stock after selling 20,319 shares during the quarter. Los Angeles Capital Management LLC’s holdings in MongoDB were worth $11,602,000 at the end of the most recent quarter.

Los Angeles Capital Management LLC trimmed its position in MongoDB, Inc. (NASDAQ:MDB – Free Report) by 37.7% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 33,545 shares of the company’s stock after selling 20,319 shares during the quarter. Los Angeles Capital Management LLC’s holdings in MongoDB were worth $11,602,000 at the end of the most recent quarter.

Other large investors also recently modified their holdings of the company. KB Financial Partners LLC acquired a new stake in shares of MongoDB in the second quarter valued at about $27,000. Capital Advisors Ltd. LLC grew its stake in shares of MongoDB by 131.0% in the second quarter. Capital Advisors Ltd. LLC now owns 67 shares of the company’s stock valued at $28,000 after buying an additional 38 shares in the last quarter. Bessemer Group Inc. acquired a new stake in shares of MongoDB in the fourth quarter valued at about $29,000. BluePath Capital Management LLC acquired a new stake in shares of MongoDB in the third quarter valued at about $30,000. Finally, Cullen Frost Bankers Inc. acquired a new stake in shares of MongoDB in the third quarter valued at about $35,000. 88.89% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities research analysts have recently issued reports on the company. JMP Securities reiterated a “market outperform” rating and issued a $440.00 target price on shares of MongoDB in a research note on Monday, January 22nd. Tigress Financial lifted their price objective on MongoDB from $490.00 to $495.00 and gave the stock a “buy” rating in a report on Friday, October 6th. Mizuho lifted their price objective on MongoDB from $330.00 to $420.00 and gave the stock a “neutral” rating in a report on Wednesday, December 6th. Truist Financial restated a “buy” rating and set a $430.00 price objective on shares of MongoDB in a report on Monday, November 13th. Finally, Needham & Company LLC restated a “buy” rating and set a $495.00 price objective on shares of MongoDB in a report on Wednesday, January 17th. One analyst has rated the stock with a sell rating, four have assigned a hold rating and twenty-one have issued a buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of “Moderate Buy” and a consensus target price of $429.50.

Get Our Latest Stock Report on MongoDB

MongoDB Stock Performance

MDB stock traded down $5.01 during trading on Friday, reaching $395.29. 973,617 shares of the company’s stock were exchanged, compared to its average volume of 1,191,025. The company has a quick ratio of 4.74, a current ratio of 4.74 and a debt-to-equity ratio of 1.18. MongoDB, Inc. has a 1-year low of $189.59 and a 1-year high of $442.84. The company’s fifty day moving average price is $402.37 and its 200-day moving average price is $380.93. The firm has a market cap of $28.53 billion, a PE ratio of -149.73 and a beta of 1.23.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings results on Tuesday, December 5th. The company reported $0.96 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $0.51 by $0.45. MongoDB had a negative return on equity of 20.64% and a negative net margin of 11.70%. The company had revenue of $432.94 million during the quarter, compared to analyst estimates of $406.33 million. During the same quarter in the previous year, the firm posted ($1.23) EPS. The firm’s quarterly revenue was up 29.8% on a year-over-year basis. On average, research analysts expect that MongoDB, Inc. will post -1.64 EPS for the current fiscal year.

Insiders Place Their Bets

In other news, Director Dwight A. Merriman sold 1,000 shares of the company’s stock in a transaction on Wednesday, November 1st. The stock was sold at an average price of $345.21, for a total value of $345,210.00. Following the completion of the sale, the director now owns 533,896 shares in the company, valued at $184,306,238.16. The sale was disclosed in a legal filing with the SEC, which is available at this link. In other news, Director Dwight A. Merriman sold 1,000 shares of the company’s stock in a transaction on Wednesday, November 1st. The stock was sold at an average price of $345.21, for a total value of $345,210.00. Following the completion of the sale, the director now owns 533,896 shares in the company, valued at $184,306,238.16. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CRO Cedric Pech sold 1,248 shares of the company’s stock in a transaction on Tuesday, January 16th. The shares were sold at an average price of $400.00, for a total value of $499,200.00. Following the completion of the sale, the executive now owns 25,425 shares of the company’s stock, valued at approximately $10,170,000. The disclosure for this sale can be found here. In the last quarter, insiders sold 149,277 shares of company stock worth $57,223,711. 4.80% of the stock is owned by company insiders.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s list of seven best retirement stocks and why they should be in your portfolio.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • Steef-Jan Wiggers

Article originally posted on InfoQ. Visit InfoQ

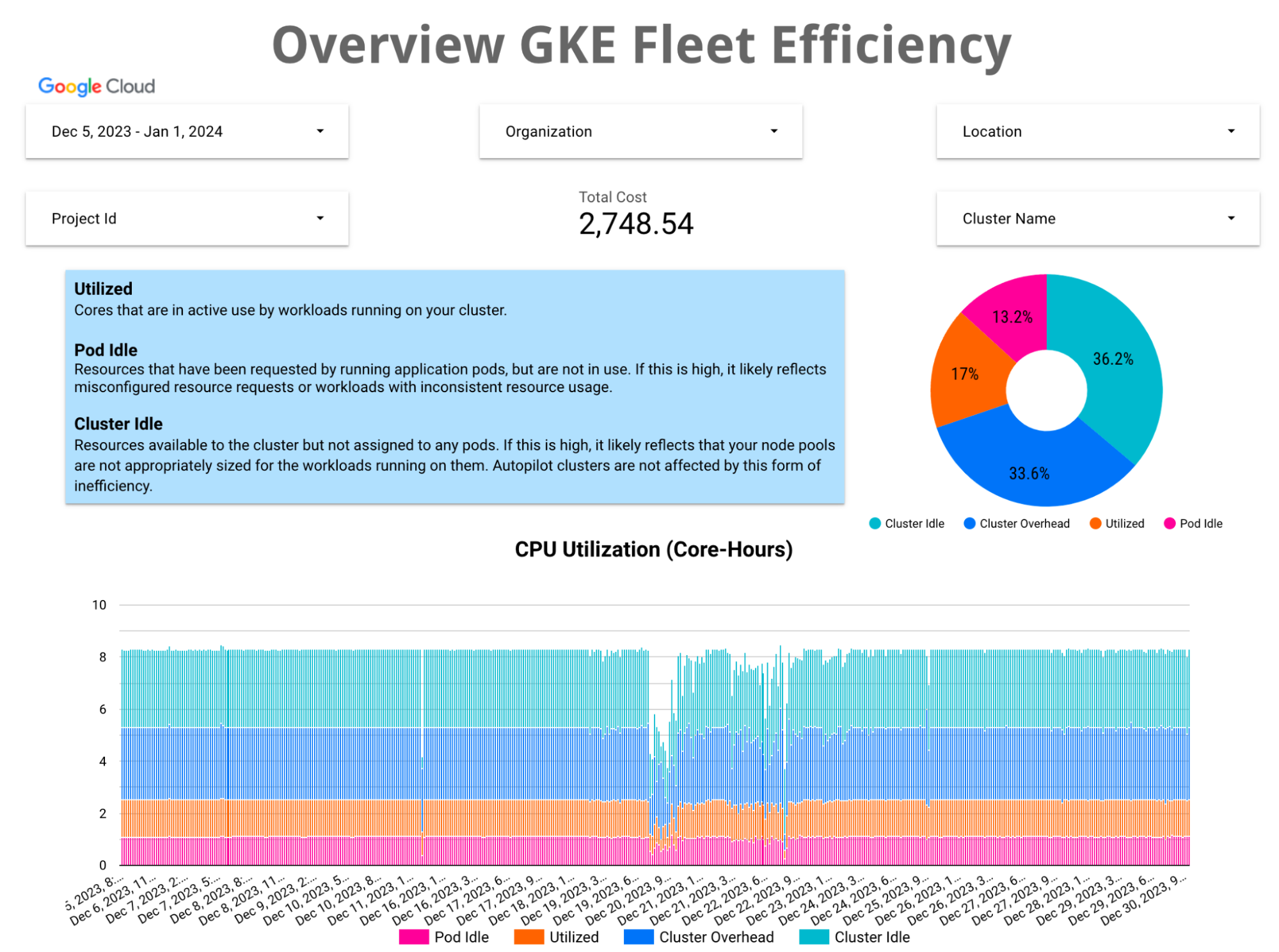

Google brings Cloud Monitoring metrics in BigQuery as a new capability in preview to combine billing data with resource utilization metrics. The combination allows users to perform detailed cost analyses in BigQuery. In addition, the company provides an out-of-the-box Looker Studio template that combines Cloud Monitoring and detailed billing metrics for Google Kubernetes Engine (GKE).

According to the company, Cloud Monitoring metrics in BigQuery offer Google Cloud users advantages such as identifying and optimizing resource allocation, enabling cost-driven decision-making for workload scaling and infrastructure optimization, and providing enhanced cost visibility by uncovering hidden costs and eliminating unnecessary expenses. Furthermore, it improves chargeback visibility by accurately allocating costs to individual teams or projects, promoting fair and transparent chargeback practices.

Integrating resource metric data and billing data gives customers better visibility of costs. The authors of a Google blog post write:

By joining billing data with GKE resource usage metrics, you can now attribute specific costs to individual workloads, namespaces, or even pods within their clusters. This granular level of detail empowers you to pinpoint the sources of your cloud expenditures and make data-driven decisions to optimize resource allocation and minimize costs.

Richard Seroter, chief evangelist at Google Cloud, states in his daily reading list blog post:

Combining billing data with utilization data for Kubernetes clusters? That’s a big deal, and should change the game for those figuring out cluster costs.

Overview GKE Spend (Source: Google Cloud blog post)

The preview capability allows users to generate granular cost insight for GKE by joining Google Cloud Observability Analytics data and billing data.

In a LinkedIn post by Joy Wang, a Google product manager, and Vipul M., a SRE leader and Equifax Fellow, commented:

Why just GKE? How about all GCP products resource metering combined with billing and query using labels enriched with meta data to drive insights that give deeper context insights?

With Wang responding:

Great suggestion! More will come!

Cloud providers like Microsoft natively offer several services allowing users to consolidate billing data and resource utilization metrics, yet they do not have Google’s current preview capability. In Azure, to combine billing data and resource utilization for the GKE counterpart Azure Kubernetes Service (AKS), users must get billing data from the Azure Cost Management and Billing tool and Azure Monitor and Azure Log Analytics for metrics.

Lastly, the capability is in preview; customers must sign up for access.

MMS • Robert Krzaczynski

Article originally posted on InfoQ. Visit InfoQ

Microsoft has released Copilot Pro and Copilot for Microsoft 365, and is providing free access to those tools for smaller organizations and educational faculty. They also created the Copilot mobile application. Moreover, Copilot is also available in the Microsoft 365 mobile application.

Copilot Pro provides access to Microsoft 365 applications for Microsoft 365 Personal and Family subscribers. Moreover, access is provided to GPT-4 Turbo and the ability to build a Copilot GPT.

Copilot for Microsoft 365 uses data from emails, chats, documents and the Internet to execute complex tasks via a natural language prompt. For example, generating a status update based on the meetings, emails and chat threads.

Furthermore, Microsoft launched Copilot mobile application for Android and iOS. This brings Copilot capabilities to both phone and PC, enabling smooth transitions of queries and chats between the two devices. The mobile version replicates Copilot’s abilities from the computer, providing entry to GPT-4 for crafting images, and the choice to integrate photos from the phone in Copilot interactions.

Microsoft also announced the addition of Copilot to the Microsoft 365 mobile application for individuals with a Microsoft account. This new feature is going to be ready in approximately one month. This application will give access to Copilot inside Microsoft 365 and allow easy export of the created content. The applications can be downloaded from the Google Play Store or the Apple App Store.

This announcement is generating significant interest in the IT world, especially among users of Microsoft tools and programmers. Many of them share their insights after their initial experiences of usage. Overall, the community expresses positive opinions about the tool. However, there are also doubts and questions. Among others, about the high subscription price. Vincent Lauria added his thoughts on this topic:

I feel like Copilot Pro ought to be included with a Microsoft 365 subscription, or at least the other way around. Having to subscribe to it on top of 365 feels like a double-dip, especially since Copilot Pro is already twice as much as 365 on its own.

When it comes to the first user experiences, Ethan Mollick, an associate professor at The Wharton School of the University of Pennsylvania, summarised his own with the following words:

All-in-all, it is a pretty impressive set of tools, especially if you are not a GPT-4 power user. It is also clear that the easy UXs built into everyone’s most used office tools will make AI-generated content ubiquitous, for better or worse.

Copilot for Microsoft 365 became generally available for enterprises in November. From 15th January, Copilot for Microsoft 365 is also available for small businesses with Microsoft 365 Business Premium. Business Standard Customers can purchase between one and 299 seats for $30 per person per month.

Additionally, Copilot for Microsoft 365 has free access for education faculty and staff, offering AI chat on the web, and featuring models like GPT-4 and DALL-E 3 without additional charges. Starting in early 2024, commercial data protection will be activated for authorized users logging into school accounts. This ensures the safety of user and organizational data, with chat prompts and responses in Copilot not being stored, and Microsoft having no direct access to them. This data is not utilized to train fundamental large language models.

MMS • Renato Losio

Article originally posted on InfoQ. Visit InfoQ

AWS recently introduced Console-to-Code, offering a new capability to transform actions executed in the console into reusable code for AWS CDK and CloudFormation. This generative AI feature is currently in preview, supporting only Amazon EC2, and provides a guided path for creating resources and testing prototypes.

Designed to get started with automation code, Console-to-Code records all the actions and generates code in different infrastructure-as-code (IaC) formats: the service currently supports outputs for the CDK (in Java, Python, or TypeScript) and CloudFormation, both JSON and YAML. The documentation warns:

You then use the code as a starting point for your automation scripts. You’ll need to validate that the code meets your intent and that the parameters will configure your resources as expected. You’ll need to customize the code to make it production-ready for your use case. Once you’re satisfied with the code, you can use it in your automation scripts.

The cloud provider released an animation to showcase how to generate code using Console-to-Code in the EC2 console. David Jennings, Python developer and DevOps engineer, comments:

Oh God, this is going to make my life so much easier. It’s been a long time since I’ve genuinely been excited about a new AWS thing.

Matt Lloyd, technical lead at Thoughtworks, adds:

This is exactly what I was hoping AWS would create. Console to code, so your console actions can be converted to CDK. So many teams struggle with infra as code, so revert to the console. Now you can have the best of both worlds. Excited to play with this!

In the “Console-to-Code Preview: Test Drive, Bright Future” article, Jon Holman, solutions architect at Groundswell, considers different use cases for the new product:

Using this tool, newcomers can more easily adopt the best practice of using Infrastructure as Code (IaC). This tool can even help seasoned IaC professionals create new templates while adding rarely used resource types.

The ability to generate code for console actions gained positive reactions in the community, but the limited scope of the preview raised some doubts. Holman writes:

I thought creating an EC2 instance with all default settings except my key pair would be a simple test of this new feature. However, after needing to fix the provided template over six iterations to deploy successfully, I conclude that this feature is unfortunately not ready to be used. It is fun to play with, though. I understand this feature is still in preview, but what can this current version successfully do? The current version is limited in scope to the EC2 console. In the EC2 console, what is more fundamental than creating an EC2 instance?

Based on generative AI, Console-to-Code is still in preview and supports a maximum of 5 actions for a single transformation. The feature is limited to the Amazon EC2 console and only available in the Northern Virginia region. There are no additional costs for using it.

Millions of corporate messages leaked by Miracle Software’s unsecured MongoDB instance

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Copyright © 2024 CyberRisk Alliance, LLC All Rights Reserved.

This material may not be published, broadcast, rewritten or redistributed

in any form without prior authorization.

Your use of this website constitutes acceptance of CyberRisk Alliance Privacy Policy and Terms & Conditions.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

© Reuters $1000 Invested In NVIDIA 10 Years Ago Would Be Worth This Much Today

Benzinga – by Benzinga Insights, Benzinga Staff Writer.

NVIDIA (NASDAQ:NVDA) has outperformed the market over the past 10 years by 55.04% on an annualized basis producing an average annual return of 65.57%. Currently, NVIDIA has a market capitalization of $1.50 trillion.

Buying $1000 In NVDA: If an investor had bought $1000 of NVDA stock 10 years ago, it would be worth $157,401.03 today based on a price of $608.34 for NVDA at the time of writing.

NVIDIA’s Performance Over Last 10 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga

Article originally posted on mongodb google news. Visit mongodb google news