Graph databases are crucial for GenAI and ML due to their proven efficiency in managing highly connected data structures. Unlike traditional relational databases, they excel in storing and querying complex relationships, making them essential for AI and machine learning tasks.

The associativity of nodes in a graph enhances feature extraction and accelerates data retrieval, which is vital for training ML models on expensive GPUs. Graph databases also contribute to more precise AI and machine learning application results, surpassing standard datasets.

Their visualisation capabilities are highly valued for data analysis, making them suitable for leveraging generative AI and handling interconnected data.

The increasing prevalence of graph databases in GenAI and ML is attributed to their efficiency, focus on relationships, visualisation capabilities, and seamless integration with AI and machine learning processes.

Here is a list of the top graph databases in 2024.

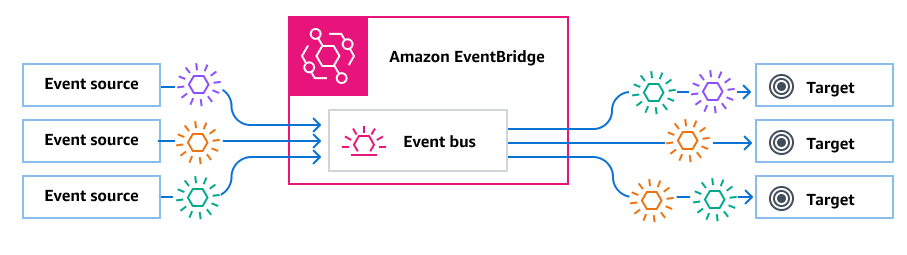

Amazon Neptune

Amazon Neptune stands out as a fully managed graph database service, offering a purpose-built, high-performance engine optimised for storing vast relationships. It supports graph models like Property Graph and W3C’s RDF and their respective query languages.

Recommended for fraud detection and network security applications, Amazon Neptune provides a robust foundation for building and running applications that work with highly connected datasets.

IBM Graph

IBM Graph is an enterprise-grade property graph as a service built on open-source technologies. It allows organisations to store, query, and visualise data points, connections, and properties in a property graph.

With a focus on always-on service, IBM Graph is designed to scale on-demand as data complexity increases. This scalability makes it suitable for enterprises dealing with evolving and expanding datasets.

Azure Cosmos DB

Azure Cosmos DB is a fully managed NoSQL database service by Microsoft that offers automatic scalability and open-source APIs for MongoDB and Cassandra. It enables near real-time analytics and AI on operational data within existing SQL databases.

Ideal for modern application development with varying workloads, Azure Cosmos DB provides users with flexibility and performance backed by SLAs and serverless options for cost-effective scalability.

Neo4j

Neo4j provides a graph database facilitating understanding of data relationships, especially regarding people, processes, and systems. Natively storing interconnected data, Neo4j supports high-performance graph queries on large datasets.

Its property graph model makes it easier for organisations to evolve machine learning and AI models, making Neo4j a valuable asset for those seeking insights from intricate relationships within their data.

Oracle Spatial and Graph

Part of Oracle’s converged database offering, Oracle Spatial and Graph, includes Graph Studio for easy provisioning and integrated tooling. It automates graph data management and simplifies lifecycle modelling, analysis, and visualisation.

Supporting both property and RDF knowledge graphs, Oracle’s solution is integrated into the broader Oracle Autonomous Database, providing users with comprehensive support for diverse graph data use cases.

Redis Enterprise

Redis Enterprise by Redis Labs leverages modern in-memory technologies for deployment over cloud and on-prem data centres. It supports native data structures, offering data modelling techniques for graphs, documents, and machine learning.

Known for strategic partnerships with vendors such as Pivotal and Red Hat, Redis Enterprise caters to organisations seeking real-time capabilities and efficient data handling.

TigerGraph

TigerGraph offers a graph database platform for enterprise applications, supporting real-time deep link analytics. Finding applications in IoT, AI, and machine learning for making sense of large data volumes, TigerGraph provides personalised recommendations, fraud prevention, supply-chain logistics, and company knowledge graph.

Its focus on real-time analytics positions it as a valuable tool for organisations dealing with dynamic and fast-changing data.

AnzoGraph DB

AnzoGraph DB is a massively parallel processing graph database designed to hasten data integration analytics. It includes various functions for line-of-business analytics and graph and data science algorithms.

Enabling in-graph feature engineering and transformations, AnzoGraph DB is tailored for organisations seeking advanced capabilities for analytics within their graph data.

DataStax Enterprise

DataStax offers a distributed hybrid cloud database built on Apache Cassandra. DataStax Enterprise eliminates the complexity of deploying applications across multiple on-prem data centres or public clouds.

Powering mission-critical applications, DataStax Enterprise eliminates data silos and cloud vendor lock-in, providing enterprises with a scalable and robust solution for their diverse data management needs.

As organisations navigate the intricate web of interconnected data, these graph databases emerge as essential tools, each offering unique features and capabilities catering to diverse needs in data management.