Month: November 2024

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

The software portion of the larger tech industry has recently experienced a sharp upward swing. A benchmark ETF, the iShares Expanded Tech-Software Sector ETF (BATS: IGV), has climbed by nearly 38% in the last year, with more than a quarter of that increase in the month from mid-October to mid-November.

This coincides with the period immediately surrounding the presidential election and may reflection an expectation of a looser regulatory environment going forward, largely seen as a potential boon for software developers.

Amid the broader rally, several niche software companies may warrant further investigation by investors considering a focus on this industry.

MDB: Leading Product in a Competitive Space

MongoDB Inc. (NASDAQ: MDB) provides software platforms for companies to use to store and analyze data more effectively. It offers a database-as-a-service tool, MongoDB Atlas, that allows clients from many different industries to manage databases remotely via the cloud.

For the second quarter of its 2025 fiscal year, MongoDB reported excellent workload acquisition, contributing to 13% year-over-year improvement to overall revenue. Atlas made up more than 70% of the $478 million in revenue the company generated during the year. While net losses widened slightly to $54.5 million, the company ended the quarter with a strong cash position of $2.3 billion.

MongoDB is positioning itself well in a rapidly growing, though niche, NoSQL database industry that is expected to reach more than $82 billion in size by 2031. On the other hand, though, the company will have to contend with significantly larger rivals that are also exploring offerings in the same space. Most notable in this category is Amazon.com Inc.’s (NASDAQ: AMZN) DynamoDB.

MongoDB has a “moderate buy” rating with 20 out of 26 analysts recommending that investors purchase shares. The consensus price target for MDB is $334.25, 14.1% higher than current levels.

CHKP: Cybersecurity Strength, But Recent Dip May Mean Buy Opportunity

Check Point Software Technologies Ltd. (NASDAQ: CHKP) creates cybersecurity software and a range of related products and services. In the latest quarter, the company posted 7% overall revenue growth to $635 million, including 12% year-over-year subscription revenue growth, even as Check Point executives acknowledged that several deals had been pushed to the fourth quarter and would be reflected in a later earnings report.

Despite this setback, Check Point reiterated its guidance of $2.5 billion in revenue for the year and net profit of over $1 billion. The company has also posted gross margin of 89% even as operating expenses have increased. This is all to say that Check Point has solid fundamentals and a popular cybersecurity product lineup.

Nonetheless, shares of CHKP fell following the earnings announcement in late October. This is understandable given that the report did not dramatically exceed expectations and that the company’s stock traded around a 1-year high throughout most of the month in anticipation of new executive leadership.

Now, even though Bank of America has recently downgraded Check Point to “neutral” from “buy” previously, a relatively lower share price means analysts see shares rising by about 12%. This could be an opportune moment for investors to buy in.

TYL: Promising Trends But Mixed Earnings

Tyler Technologies Inc. (NYSE: TYL) provides software and services to public sector organizations to aid in cybersecurity efforts, data analysis, payments solutions, and more. In the latest quarter, Tyler’s revenue climbed by almost 10% year-over-year, driven by increased demand for its software as a service (SaaS) options. Transaction revenues grew by more than 15% thanks to higher volumes from both new and returning customers.

These signs point to Tyler’s successful implementation of its cloud-based strategy, which it intends to continue to develop going forward. And yet, there are reasons to be cautious as well: while the company boosted its guidance range for GAAP diluted EPS for 2024, it reduced its expected free cash margin and slightly lowered the top end of its full-year revenue guidance as well.

Assessing Risk

As each of the firms above contests with larger, more established rivals, there is both the potential for growth and the risk of failure to overcome these obstacles. Each of the companies has analyst votes of confidence, but each also has potential disadvantages for an investor as well.

Source MarketBeat

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Thrivent Financial for Lutherans trimmed its stake in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) by 17.7% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 349,251 shares of the company’s stock after selling 75,151 shares during the quarter. Thrivent Financial for Lutherans owned 0.47% of MongoDB worth $94,420,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors have also made changes to their positions in the company. Intech Investment Management LLC lifted its position in shares of MongoDB by 40.0% during the 1st quarter. Intech Investment Management LLC now owns 5,814 shares of the company’s stock worth $2,085,000 after purchasing an additional 1,661 shares during the last quarter. Vanguard Group Inc. lifted its holdings in MongoDB by 1.0% during the 1st quarter. Vanguard Group Inc. now owns 6,910,761 shares of the company’s stock worth $2,478,475,000 after buying an additional 68,348 shares during the last quarter. Cynosure Group LLC acquired a new position in shares of MongoDB during the 1st quarter worth about $313,000. O Shaughnessy Asset Management LLC increased its holdings in shares of MongoDB by 21.8% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 2,150 shares of the company’s stock valued at $771,000 after acquiring an additional 385 shares during the last quarter. Finally, Clearbridge Investments LLC raised its position in shares of MongoDB by 109.0% during the 1st quarter. Clearbridge Investments LLC now owns 445,084 shares of the company’s stock worth $159,625,000 after acquiring an additional 232,101 shares in the last quarter. Hedge funds and other institutional investors own 89.29% of the company’s stock.

MongoDB Price Performance

Shares of NASDAQ MDB opened at $279.77 on Monday. The company has a debt-to-equity ratio of 0.84, a quick ratio of 5.03 and a current ratio of 5.03. MongoDB, Inc. has a one year low of $212.74 and a one year high of $509.62. The firm has a market capitalization of $20.67 billion, a P/E ratio of -92.64 and a beta of 1.15. The company’s fifty day moving average is $278.10 and its two-hundred day moving average is $274.30.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Thursday, August 29th. The company reported $0.70 EPS for the quarter, topping analysts’ consensus estimates of $0.49 by $0.21. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The firm had revenue of $478.11 million for the quarter, compared to the consensus estimate of $465.03 million. During the same quarter in the previous year, the firm earned ($0.63) earnings per share. The firm’s revenue was up 12.8% on a year-over-year basis. Analysts forecast that MongoDB, Inc. will post -2.39 EPS for the current fiscal year.

Wall Street Analyst Weigh In

MDB has been the topic of several recent analyst reports. Barclays increased their price target on shares of MongoDB from $290.00 to $345.00 and gave the company an “overweight” rating in a research note on Friday. Scotiabank boosted their price target on shares of MongoDB from $250.00 to $295.00 and gave the company a “sector perform” rating in a research report on Friday, August 30th. Stifel Nicolaus raised their price objective on MongoDB from $300.00 to $325.00 and gave the stock a “buy” rating in a report on Friday, August 30th. Oppenheimer boosted their target price on MongoDB from $300.00 to $350.00 and gave the company an “outperform” rating in a report on Friday, August 30th. Finally, Bank of America raised their price target on MongoDB from $300.00 to $350.00 and gave the stock a “buy” rating in a research note on Friday, August 30th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating, nineteen have assigned a buy rating and one has issued a strong buy rating to the company’s stock. Based on data from MarketBeat, the stock currently has an average rating of “Moderate Buy” and a consensus price target of $336.54.

View Our Latest Stock Report on MDB

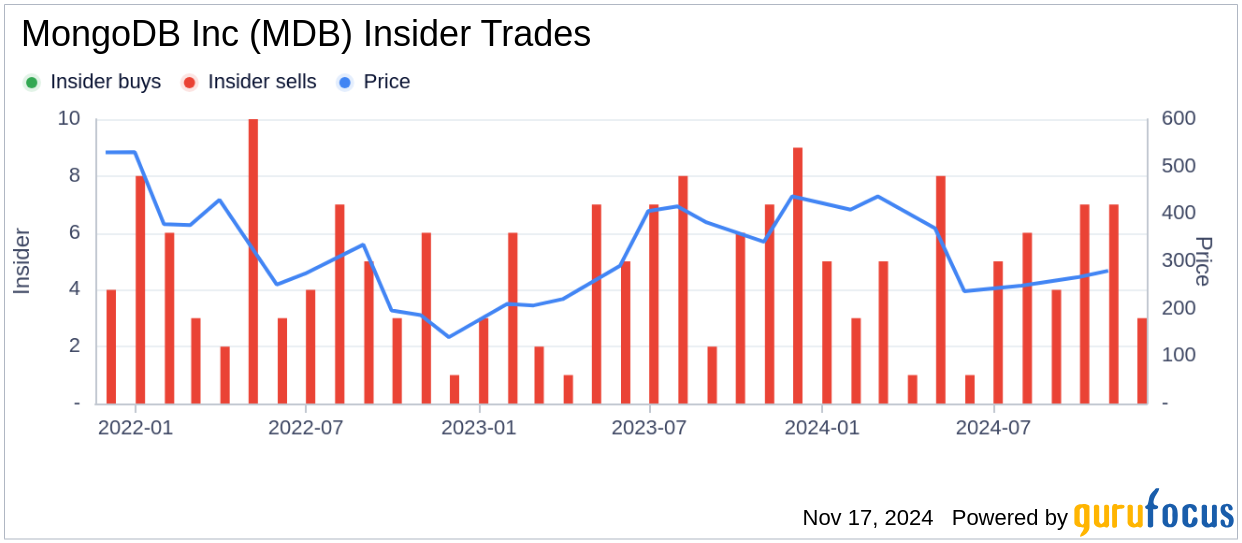

Insider Buying and Selling at MongoDB

In related news, CRO Cedric Pech sold 302 shares of MongoDB stock in a transaction dated Wednesday, October 2nd. The stock was sold at an average price of $256.25, for a total transaction of $77,387.50. Following the completion of the sale, the executive now owns 33,440 shares in the company, valued at approximately $8,569,000. This trade represents a 0.90 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Dev Ittycheria sold 3,556 shares of the company’s stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $256.25, for a total transaction of $911,225.00. Following the completion of the transaction, the chief executive officer now owns 219,875 shares in the company, valued at approximately $56,342,968.75. This trade represents a 1.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 24,281 shares of company stock valued at $6,657,121 over the last quarter. Corporate insiders own 3.60% of the company’s stock.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Which stocks are major institutional investors including hedge funds and endowments buying in today’s market? Click the link below and we’ll send you MarketBeat’s list of thirteen stocks that institutional investors are buying up as quickly as they can.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • Michael Redlich

Article originally posted on InfoQ. Visit InfoQ

This week’s Java roundup for November 11th, 2024 features news highlighting: the release of Spring Framework 6.2.0; four JEPs that have been targeted for JDK 24; two JEPs that have been proposed to target for JDK 24; three new JEP candidates; and the release of Micronaut 4.7.0 and Gradle 8.11.0.

OpenJDK

The following JEPs, having successfully completed their respective reviews, are now Targeted for JDK 24.

The following JEPs have been elevated to Proposed to Target for JDK 24. Their reviews are expected to conclude on November 21st, 2024.

Details on all of these JEPs may be found in this InfoQ news story.

JEP 501, Deprecate the 32-bit x86 Port for Removal, has been promoted from its JEP Draft 8338285 to Candidate status. This JEP proposes to deprecate the Linux 32-bit x86 port with a plan to remove it in JDK 25. This JEP is related to JEP 449, Deprecate the Windows 32-bit x86 Port for Removal, delivered in JDK 21. Once this port is removed, Java applications running in 32-bit x86 processors will be run through the Zero port.

JEP 499, Structured Concurrency (Fourth Preview), has been promoted from its JEP Draft 8344096 to Candidate status. This JEP proposes a fourth preview, without change, in order to gain more feedback from the previous three rounds of preview, namely: JEP 480, Structured Concurrency (Third Preview), delivered in JDK 23; JEP 462, Structured Concurrency (Second Preview), delivered in JDK 22; and JEP 453, Structured Concurrency (Preview), delivered in JDK 21. This feature simplifies concurrent programming by introducing structured concurrency to “treat groups of related tasks running in different threads as a single unit of work, thereby streamlining error handling and cancellation, improving reliability, and enhancing observability.”

JEP 498, Warn upon Use of Memory-Access Methods in sun.misc.Unsafe, has been promoted from its JEP Draft 8342077 to Candidate status. This JEP, a successor to JEP 471, Deprecate the Memory-Access Methods in sun.misc.Unsafe for Removal, delivered in JDK 23, proposes to issue a runtime warning if any of the memory-access methods, defined in the unsupported Unsafe class, are invoked. These methods were deprecated in JDK 23 and have been superseded by APIs, such as: JEP 193, Variable Handles, delivered in JDK 9; and JEP 454, Foreign Function & Memory API, delivered in JDK 22.

JDK 24

Build 24 of the JDK 24 early-access builds was made available this past week featuring updates from Build 23 that include fixes for various issues. Further details on this release may be found in the release notes.

For JDK 24, developers are encouraged to report bugs via the Java Bug Database.

Jakarta EE

In his weekly Hashtag Jakarta EE blog, Ivar Grimstad, Jakarta EE Developer Advocate at the Eclipse Foundation, provided an update on Jakarta EE 11, writing:

As I have mentioned a couple of times already, Jakarta EE 11 Core Profile will be the first of the Platform- and Profile-specifications to reach the release review stage. That will most likely happen this week. All artifacts are ready and two compatible implementations have passed the TCK. Check out the compatibility requests and test results for WildFly and Open Liberty.

The road to Jakarta EE 11 included four milestone releases with the potential for release candidates as necessary before the GA release in 4Q2024.

Spring Framework

After seven milestone releases and three release candidates, Spring Framework 6.2.0 is now available to the Java community featuring: improvements in the core container, Spring Expression Language (SpEL); web and messaging applications; and testing. It is important to note that several deprecated classes, constructors and methods, such as: Base64Utils, JCacheOperationSourcePointcut and AbstractClientHttpResponse classes, have been removed in version 6.2.0. More details on this release may be found in the release notes. InfoQ will follow up with a more detailed news story that will include the upcoming release of Spring Boot 3.4.0, scheduled for November 21st, 2024.

The release of Spring Framework 6.1.15 delivers bug fixes, improvements in documentation, dependency upgrades and new features such as: use of the UriUtils class to process static resource paths for consistency and to ensure proper handling of raw characters; and improved interaction methods in the MultiValueMap interface that better align with its implementations in native mode. Further details on this release may be found in the release notes.

After one milestone release and one release candidate, Spring Data 2024.1.0 is now available to the Java community featuring: full support for value expressions (via the Spring Expression Language) in repository query methods using the @Query annotation; and refinement of SQL and JPQL query parsers for an enhanced QueryRenderer model. More details on this release may be found in the release notes.

Similarly, the release of Spring Data 2024.0.6 and 2023.1.12 ship with bug fixes and respective dependency upgrades to sub-projects such as: Spring Data Commons 3.3.6 and 3.2.12; Spring Data MongoDB 4.3.6 and 4.2.12; Spring Data Elasticsearch 5.3.6 and 5.2.12; and Spring Data Neo4j 7.3.6 and 7.2.12. These versions will be included in the upcoming releases of Spring Boot and 3.3.6 and 3.2.12. It is important to note that Spring Data 2023.1.12 will be the final release as an open-source project as it has reached end-of-life.

The Spring Framework team has disclosed CVE-2024-38828, DoS via Spring MVC Controller Method with byte[] Parameter, a vulnerability affecting Spring Framework versions 5.3.0 – 5.3.41 where controller methods from Spring MVC using a @RequestBody byte[] method parameter are vulnerable to a denial-of-service attack. Developers are encouraged to upgrade to version 5.3.42

Micronaut

The Micronaut Foundation has released version 4.7.0 of the Micronaut Framework featuring Micronaut Core 4.7.5 with many improvements such as: a new FilterBodyParser interface, an API to parse a request body within a server filter; improvements to implementations of the HTTPClient interface; and the ability to display circular dependency errors. This release also introduces the experimental Micronaut LangChain4j module and version 1.0.0 of the Micronaut Graal Languages module, a collection of components for integration of Graal-based dynamic languages with Micronaut Framework. Further details on this release may be found in the release notes.

Helidon

The release of Helidon 4.1.4 ships with notable changes such as: replace the use of the replaceAll() method, defined in the Java String class with the replace() method as it was determined that the regular expression parameter in the former wasn’t being used; and updates in URI validation that moves host validation to the URIValidator class. More details on this release may be found in the changelog.

Quarkus

Quarkus 3.16.3, the second maintenance release (3.16.0 was skipped) provide notable changes such as: replace use of the Jakarta JSON Processing Json class due to inefficiency with a custom JsonProviderHolder class with OpenID Connect; and support for the Jakarta RESTful Web Services RuntimeDelegate class in native mode. Further details on this release may be found in the changelog.

Hibernate

The second beta release of Hibernate ORM 7.0.0 features: a migration to the Jakarta Persistence 3.2 specification, the latest version targeted for Jakarta EE 11; a baseline of JDK 17; improved domain model validations; and a migration from Hibernate Commons Annotations (HCANN) to the new Hibernate Models project for low-level processing of an application domain model. More details on migrating to version 7.0 may be found in the migration guide.

Micrometer

Micrometer Metrics 1.14.0 provides improvements in documentation, dependency upgrades and new features such as: the ability to track the history from an instance of the ObservationValidator class if an InvalidObservationException is thrown; and improved performance when merging instances of the Tags and KeyValues classes. Further details on this release may be found in the release notes.

Similarly, versions 1.13.7 and 1.12.12 of Micrometer Metrics feature dependency upgrades and a resolution to a NoSuchMethodError exception thrown by the HazelcastIMapAdapter class upon attempting to resolve a method name while converting to native image. More details on these releases may be found in the release notes for version 1.13.7 and version 1.12.12.

Micrometer Tracing 1.4.0 provides dependency upgrades and new features such as: the addition of the Micrometer Metrics @Nullable annotation to method and fields under the micrometer-tracing-bridges directory; and support for tags containing values of String, boolean, long and double in the Span and SpanCustomizer interfaces to be stored in an array list. Further details on this release may be found in the release notes.

Project Reactor

After six milestones and one release candidate, Project Reactor 2024.0.0 has been released providing dependency upgrades to reactor-core 3.7.0, reactor-netty 1.2.0, reactor-pool 1.1.0, reactor-addons 3.5.2, reactor-kotlin-extensions 1.2.3 and reactor-kafka 1.3.23. More details on this release may be found in the changelog.

Next, Project Reactor 2023.0.12, the twelfth maintenance release, provides dependency upgrades to reactor-core 3.6.12 and reactor-netty 1.1.24. There was also a realignment to version 2023.0.12 with the reactor-pool 1.0.8, reactor-addons 3.5.2, reactor-kotlin-extensions 1.2.3 and reactor-kafka 1.3.23 artifacts that remain unchanged. Further details on this release may be found in the changelog.

Piranha Cloud

The release of Piranha 24.11.0 delivers many dependency upgrades and notable changes such as: a removal of the Jakarta Expression Language specification from the Piranha Core Profile; a downgrade of Eclipse Epicyro, the compatible implementation of the Jakarta Authentication specification, from version 3.1.0 to 3.0.0 due to issues with the newer version of Epicyro. More details on this release may be found in the release notes, documentation and issue tracker.

JBang

Versions 0.121.0 and 0.120.4 of JBang provide new features such as: the ability to honor transitive dependencies managed dependencies (similar to Maven 4) and, conversely, the ability to ignore transitive dependencies as needed; and support for running posts in BlueSky. Further details on these releases may be found in the release notes for version 0.121.0 and version 0.120.4.

JHipster

The release of JHipster Lite 1.22.0 ships with dependency upgrades and new features/enhancements such as: support for LangChain4j; the addition of a missing test for the RestManagementRepository class; and removal of deprecated code. More details on this release may be found in the release notes.

LangChain4j

Version 0.36.0 of LangChain for Java (LangChain4j) features new integrations: an embedding store from Oracle Coherence; a streaming chat model from Google AI Gemini; and a moderation model from Mistral AI. Other notable changes include: introduce the use of the Testcontainers for Java MongoDBAtlasLocalContainer class to locally cache a new image that may be executed offline; and a JDK 17 minimal baseline. Further details on this release may be found in the release notes.

Gradle

The release of Gradle 8.11.0 delivers new features such as: improved performance in the configuration cache with an opt-in parallel loading and storing of cache entries; the C++ and Swift plugins now compatible with the configuration cache; and improved error and warning reporting in which Java compilation errors are now displayed at the end of the build output. More details on this release may be found in the release notes.

MMS • Mostafa Radwan

Article originally posted on InfoQ. Visit InfoQ

Last week, the cloud-native community gathered in Salt Lake City, Utah for KubeCon + CloudNativeCon North America 2024. Practitioners, tech leaders, and vendors explored the latest innovations and technologies defining cloud-native computing.

This year’s theme “scaling new heights” focused on enhancing scalability, efficiency, and security to enable teams and organizations in the AI era as the Kubernetes project turned 10 this year.

Jim Zemlin, the executive director of the Linux Foundation, and Chris Aniszczyk, CTO of the CNCF kicked off the event by underscoring the community efforts to combat patent trolls and announcing the cloud native heroes challenge, a community-driven program for practitioners to help protect the ecosystem from patent trolls, and a partnership with unified patents.

In addition, the CNCF announced the release of the return of the technology radar landscape, a detailed report that looks deep into the maturity of key tools and technologies in the ecosystem, and a set of cloud-native reference architectures. Both are intended to provide guidance and promote the adoption of cloud-native technologies in organizations.

Some of the key announcements include:

- The graduation of project Cert-manager, a project that helps with the issuing and renewal of TLS and mTLS certificates. The project has wide adoption across the cloud-native ecosystem as it simplifies the lifecycle management of X.509 certificates in Kubernetes platforms.

- The graduation of project Dapr, a distributed portable runtime that makes it easy for developers to build resilient distributed systems that run across the cloud and edge. The project provides APIs for communication, state, and workflow to simplify the process of building production-ready distributed applications.

- Release of KubeVirt v1.4. The tool provides a unified platform that enables developers to build and deploy applications regardless of the underlying infrastructure including application containers and virtual machines. The new release includes generally available features such as GPU assignment, support for Non-uniform Memory Access (NUMA), and common instance types.

- The premiere of Inside Argo: Automating the Future. The documentary film goes into the making of the open-source project and how it grew from a single engine to a set of tools to simplify and automate Kubernetes deployments.

- New Certifications were announced during the event including the Certified Backstage Associate (CBA). OpenTelemetry Certified Associate (OTCA), Kyverno Certified Associate (KCA), and Certified Cloud Native Platform Engineer (CNPE).

The certifications are designed to focus on the skills that are increasingly essential to organizations adopting cloud-native technologies and go beyond Kubernetes as they provide a way to demonstrate competence in hands-on experience building, maintaining, and observing cloud-native applications and platforms.

Recordings of the conference sessions and keynotes are available on the CNCF YouTube channel.

The last KubeCon + CloudNativeCon in 2024 will occur next month in New Delhi. This is the first time such an event will be held in India. It will be from December 11-12.

Next year, KubeCon + CloudNativeCon Europe will take place in London, England from April 1-4, North America in Atlanta, Georgia from November 10-13, China in Hong Kong from June 10-11, and for the very first time Japan from June 16-17.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB (NASDAQ:MDB – Get Free Report) had its target price lifted by analysts at Barclays from $290.00 to $345.00 in a research report issued to clients and investors on Friday,Benzinga reports. The brokerage currently has an “overweight” rating on the stock. Barclays‘s price objective would suggest a potential upside of 23.32% from the company’s current price.

MongoDB (NASDAQ:MDB – Get Free Report) had its target price lifted by analysts at Barclays from $290.00 to $345.00 in a research report issued to clients and investors on Friday,Benzinga reports. The brokerage currently has an “overweight” rating on the stock. Barclays‘s price objective would suggest a potential upside of 23.32% from the company’s current price.

A number of other equities analysts have also recently weighed in on MDB. Wells Fargo & Company increased their price objective on shares of MongoDB from $300.00 to $350.00 and gave the stock an “overweight” rating in a research report on Friday, August 30th. Wedbush raised shares of MongoDB to a “strong-buy” rating in a research report on Thursday, October 17th. Piper Sandler raised their price target on shares of MongoDB from $300.00 to $335.00 and gave the company an “overweight” rating in a research report on Friday, August 30th. Morgan Stanley raised their price target on shares of MongoDB from $320.00 to $340.00 and gave the company an “overweight” rating in a research report on Friday, August 30th. Finally, Citigroup raised their price objective on shares of MongoDB from $350.00 to $400.00 and gave the company a “buy” rating in a report on Tuesday, September 3rd. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating, nineteen have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, MongoDB presently has an average rating of “Moderate Buy” and an average price target of $336.54.

Check Out Our Latest Report on MDB

MongoDB Stock Down 4.1 %

MDB opened at $279.77 on Friday. MongoDB has a fifty-two week low of $212.74 and a fifty-two week high of $509.62. The company has a debt-to-equity ratio of 0.84, a quick ratio of 5.03 and a current ratio of 5.03. The company has a fifty day moving average of $278.10 and a two-hundred day moving average of $274.93. The stock has a market capitalization of $20.67 billion, a price-to-earnings ratio of -92.64 and a beta of 1.15.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings data on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, beating analysts’ consensus estimates of $0.49 by $0.21. The company had revenue of $478.11 million during the quarter, compared to analysts’ expectations of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The firm’s revenue for the quarter was up 12.8% on a year-over-year basis. During the same quarter in the previous year, the company earned ($0.63) earnings per share. On average, research analysts expect that MongoDB will post -2.39 earnings per share for the current year.

Insider Buying and Selling at MongoDB

In other MongoDB news, CAO Thomas Bull sold 154 shares of the firm’s stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $256.25, for a total transaction of $39,462.50. Following the completion of the sale, the chief accounting officer now owns 16,068 shares of the company’s stock, valued at $4,117,425. This trade represents a 0.95 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Dwight A. Merriman sold 3,000 shares of the firm’s stock in a transaction on Monday, November 4th. The shares were sold at an average price of $269.57, for a total value of $808,710.00. Following the sale, the director now directly owns 1,127,006 shares of the company’s stock, valued at $303,807,007.42. This represents a 0.27 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 24,281 shares of company stock worth $6,657,121. Corporate insiders own 3.60% of the company’s stock.

Institutional Inflows and Outflows

A number of hedge funds have recently modified their holdings of MDB. Jennison Associates LLC boosted its stake in shares of MongoDB by 23.6% during the third quarter. Jennison Associates LLC now owns 3,102,024 shares of the company’s stock valued at $838,632,000 after purchasing an additional 592,038 shares in the last quarter. Swedbank AB boosted its stake in shares of MongoDB by 156.3% during the second quarter. Swedbank AB now owns 656,993 shares of the company’s stock valued at $164,222,000 after purchasing an additional 400,705 shares in the last quarter. Thrivent Financial for Lutherans boosted its stake in shares of MongoDB by 1,098.1% during the second quarter. Thrivent Financial for Lutherans now owns 424,402 shares of the company’s stock valued at $106,084,000 after purchasing an additional 388,979 shares in the last quarter. Clearbridge Investments LLC boosted its stake in shares of MongoDB by 109.0% during the first quarter. Clearbridge Investments LLC now owns 445,084 shares of the company’s stock valued at $159,625,000 after purchasing an additional 232,101 shares in the last quarter. Finally, Point72 Asset Management L.P. acquired a new stake in shares of MongoDB during the second quarter valued at about $52,131,000. Institutional investors own 89.29% of the company’s stock.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Janney Montgomery Scott LLC purchased a new stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 3,183 shares of the company’s stock, valued at approximately $861,000.

Janney Montgomery Scott LLC purchased a new stake in MongoDB, Inc. (NASDAQ:MDB – Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 3,183 shares of the company’s stock, valued at approximately $861,000.

Other hedge funds have also bought and sold shares of the company. Vanguard Group Inc. raised its holdings in shares of MongoDB by 1.0% during the first quarter. Vanguard Group Inc. now owns 6,910,761 shares of the company’s stock valued at $2,478,475,000 after acquiring an additional 68,348 shares during the last quarter. Swedbank AB grew its holdings in shares of MongoDB by 156.3% during the 2nd quarter. Swedbank AB now owns 656,993 shares of the company’s stock worth $164,222,000 after purchasing an additional 400,705 shares during the period. Champlain Investment Partners LLC increased its position in shares of MongoDB by 22.4% during the first quarter. Champlain Investment Partners LLC now owns 550,684 shares of the company’s stock valued at $197,497,000 after acquiring an additional 100,725 shares during the last quarter. Clearbridge Investments LLC lifted its holdings in shares of MongoDB by 109.0% in the 1st quarter. Clearbridge Investments LLC now owns 445,084 shares of the company’s stock worth $159,625,000 after acquiring an additional 232,101 shares during the last quarter. Finally, Thrivent Financial for Lutherans raised its position in MongoDB by 1,098.1% in the second quarter. Thrivent Financial for Lutherans now owns 424,402 shares of the company’s stock valued at $106,084,000 after purchasing an additional 388,979 shares during the period. Hedge funds and other institutional investors own 89.29% of the company’s stock.

Analyst Upgrades and Downgrades

Several analysts have recently issued reports on MDB shares. UBS Group increased their price target on shares of MongoDB from $250.00 to $275.00 and gave the stock a “neutral” rating in a research report on Friday, August 30th. Scotiabank increased their price target on shares of MongoDB from $250.00 to $295.00 and gave the stock a “sector perform” rating in a research note on Friday, August 30th. Stifel Nicolaus increased their price target on MongoDB from $300.00 to $325.00 and gave the stock a “buy” rating in a report on Friday, August 30th. JMP Securities reiterated a “market outperform” rating and issued a $380.00 price objective on shares of MongoDB in a research report on Friday, August 30th. Finally, Truist Financial upped their price objective on MongoDB from $300.00 to $320.00 and gave the company a “buy” rating in a research report on Friday, August 30th. One analyst has rated the stock with a sell rating, five have issued a hold rating, nineteen have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of “Moderate Buy” and an average target price of $336.54.

Read Our Latest Stock Report on MDB

MongoDB Trading Down 4.1 %

Shares of MongoDB stock opened at $279.77 on Friday. The business has a fifty day simple moving average of $278.10 and a 200-day simple moving average of $274.93. MongoDB, Inc. has a fifty-two week low of $212.74 and a fifty-two week high of $509.62. The firm has a market cap of $20.67 billion, a price-to-earnings ratio of -92.64 and a beta of 1.15. The company has a quick ratio of 5.03, a current ratio of 5.03 and a debt-to-equity ratio of 0.84.

MongoDB (NASDAQ:MDB – Get Free Report) last issued its quarterly earnings results on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, beating analysts’ consensus estimates of $0.49 by $0.21. The company had revenue of $478.11 million during the quarter, compared to the consensus estimate of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. MongoDB’s revenue was up 12.8% on a year-over-year basis. During the same period in the prior year, the company earned ($0.63) EPS. On average, equities analysts forecast that MongoDB, Inc. will post -2.39 EPS for the current fiscal year.

Insider Buying and Selling at MongoDB

In related news, CRO Cedric Pech sold 302 shares of the firm’s stock in a transaction that occurred on Wednesday, October 2nd. The shares were sold at an average price of $256.25, for a total value of $77,387.50. Following the completion of the transaction, the executive now owns 33,440 shares of the company’s stock, valued at approximately $8,569,000. This trade represents a 0.90 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Dwight A. Merriman sold 3,000 shares of MongoDB stock in a transaction that occurred on Monday, November 4th. The stock was sold at an average price of $269.57, for a total transaction of $808,710.00. Following the transaction, the director now owns 1,127,006 shares in the company, valued at approximately $303,807,007.42. The trade was a 0.27 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 24,281 shares of company stock valued at $6,657,121. Corporate insiders own 3.60% of the company’s stock.

MongoDB Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Free Report).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • Steef-Jan Wiggers

Article originally posted on InfoQ. Visit InfoQ

GitHub has introduced significant updates at GitHub Universe 2024, showcasing a shift towards enhanced developer autonomy and AI-native experiences. The event centered on accessibility, innovation, and multi-model flexibility, offering tools designed to simplify workflows and enable developers of all skill levels to harness the power of artificial intelligence.

The platform’s Copilot now supports multiple AI models, including OpenAI, Anthropic, and Google Gemini, offering developers greater flexibility. Moreover, developers can select an AI model that aligns with their project requirements. The company explains in a press release:

Developers can toggle between models during a conversation with Copilot Chat to choose the right model for the right use case, or continue to let Copilot use its powerful default. With this multi-model approach, GitHub is enabling developers to build with an array of leading models in the workflows they’re accustomed to.

Another update was the launch of GitHub Spark, an AI-driven tool that allows users to create complete applications using natural language prompts. This innovation significantly lowers the barrier to entry for individuals new to coding, with GitHub estimating that Spark has the potential to reach over one billion users worldwide. By translating everyday language into functional code, Spark simplifies app creation, making it accessible to seasoned developers and beginners. On X, Kitze, a Web developer and Educator, tweeted:

GitHub Spark is the future of coding.

Just let the user generate what they want; no one will care about the underlying code.

(except the 4 diehard vim nerds who’ll still yell at a cloud about the good ole days of manual programming)

In addition, GitHub has also integrated enhanced AI functionalities within popular development environments like Visual Studio Code. These updates include more intuitive code suggestions, personalized assistance, and the ability to debug and test applications with minimal manual intervention. Additionally, Copilot Extensions allows developers to customize their AI tools, further streamlining their workflows and improving efficiency across multiple stages of development.

Other updates on the GitHub platform include security as a focal point of the company’s offerings, with the introduction of Copilot Autofix. This feature leverages AI to detect and resolve vulnerabilities in real time, reducing the need for exhaustive manual reviews. By addressing security risks proactively, GitHub reaffirms its commitment to fostering safer development practices and protecting critical projects.

Earlier, in a Reddit thread, a correspondent commented on the Autofix feature:

It feels like AI was just slapped on to this to make it more marketable

I don’t see how AI is more effective at this than static analysis. A tool like Sonar can already do this very effectively, and it does it without needing AI.

Furthermore, over 55,000 developers have used Copilot Workspace to plan, build, test, and run code, resulting in over 10,000 merged pull requests. Based on developer feedback, GitHub has implemented over 100 updates, including a build and repair agent, error correction commands, brainstorming mode, VS Code integrations, iterative feedback, and enhanced AI assistance for improved context and personalization.

Lastly, the company expanded features with GitHub Models in public preview. The company stated that over 70,000 developers have used the interactive model playground to experiment with various AI models, including OpenAI, Meta Llama 3, Microsoft Phi, and Cohere Command R. New capabilities include side-by-side model comparison, support for multi-modal models, and the ability to save and share prompts and parameters, along with new cookbooks and SDK support in GitHub Codespaces.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Janney Montgomery Scott LLC purchased a new position in shares of MongoDB, Inc. (NASDAQ:MDB – Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 3,183 shares of the company’s stock, valued at approximately $861,000.

A number of other large investors have also added to or reduced their stakes in MDB. Vanguard Group Inc. lifted its stake in shares of MongoDB by 1.0% in the 1st quarter. Vanguard Group Inc. now owns 6,910,761 shares of the company’s stock valued at $2,478,475,000 after acquiring an additional 68,348 shares during the last quarter. Swedbank AB boosted its stake in shares of MongoDB by 156.3% in the 2nd quarter. Swedbank AB now owns 656,993 shares of the company’s stock worth $164,222,000 after buying an additional 400,705 shares during the last quarter. Champlain Investment Partners LLC lifted its stake in MongoDB by 22.4% in the first quarter. Champlain Investment Partners LLC now owns 550,684 shares of the company’s stock valued at $197,497,000 after purchasing an additional 100,725 shares during the last quarter. Clearbridge Investments LLC lifted its stake in MongoDB by 109.0% in the first quarter. Clearbridge Investments LLC now owns 445,084 shares of the company’s stock valued at $159,625,000 after purchasing an additional 232,101 shares during the last quarter. Finally, Thrivent Financial for Lutherans lifted its stake in MongoDB by 1,098.1% in the second quarter. Thrivent Financial for Lutherans now owns 424,402 shares of the company’s stock valued at $106,084,000 after purchasing an additional 388,979 shares during the last quarter. Institutional investors and hedge funds own 89.29% of the company’s stock.

Analyst Ratings Changes

Several equities research analysts have issued reports on MDB shares. Needham & Company LLC increased their target price on MongoDB from $290.00 to $335.00 and gave the stock a “buy” rating in a research report on Friday, August 30th. Wells Fargo & Company increased their target price on MongoDB from $300.00 to $350.00 and gave the company an “overweight” rating in a research note on Friday, August 30th. Morgan Stanley raised their price objective on MongoDB from $320.00 to $340.00 and gave the company an “overweight” rating in a research note on Friday, August 30th. Stifel Nicolaus raised their price objective on MongoDB from $300.00 to $325.00 and gave the company a “buy” rating in a research note on Friday, August 30th. Finally, Bank of America increased their target price on shares of MongoDB from $300.00 to $350.00 and gave the stock a “buy” rating in a report on Friday, August 30th. One analyst has rated the stock with a sell rating, five have assigned a hold rating, nineteen have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of “Moderate Buy” and an average target price of $336.54.

View Our Latest Analysis on MongoDB

Insiders Place Their Bets

In other news, CFO Michael Lawrence Gordon sold 5,000 shares of MongoDB stock in a transaction on Monday, October 14th. The shares were sold at an average price of $290.31, for a total transaction of $1,451,550.00. Following the transaction, the chief financial officer now owns 80,307 shares in the company, valued at $23,313,925.17. This trade represents a 5.86 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, Director Dwight A. Merriman sold 3,000 shares of MongoDB stock in a transaction on Monday, November 4th. The stock was sold at an average price of $269.57, for a total transaction of $808,710.00. Following the transaction, the director now owns 1,127,006 shares in the company, valued at $303,807,007.42. This represents a 0.27 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 24,281 shares of company stock valued at $6,657,121. Company insiders own 3.60% of the company’s stock.

MongoDB Trading Down 4.1 %

NASDAQ:MDB opened at $279.77 on Friday. The company has a current ratio of 5.03, a quick ratio of 5.03 and a debt-to-equity ratio of 0.84. MongoDB, Inc. has a 12 month low of $212.74 and a 12 month high of $509.62. The company has a market cap of $20.67 billion, a PE ratio of -92.64 and a beta of 1.15. The company has a 50 day simple moving average of $278.10 and a two-hundred day simple moving average of $274.30.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its earnings results on Thursday, August 29th. The company reported $0.70 EPS for the quarter, topping analysts’ consensus estimates of $0.49 by $0.21. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The business had revenue of $478.11 million during the quarter, compared to the consensus estimate of $465.03 million. During the same quarter in the previous year, the firm posted ($0.63) EPS. The firm’s revenue was up 12.8% on a year-over-year basis. Research analysts forecast that MongoDB, Inc. will post -2.39 earnings per share for the current year.

About MongoDB

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB Inc (MDB, Financial) Chief Revenue Officer Cedric Pech sold 965 shares of the company on November 13, 2024, according to a recent SEC Filing. Following this transaction, the insider now owns 31,482 shares of MongoDB Inc.

MongoDB Inc is a general-purpose database platform that enables developers to build applications. The company’s technology, known as MongoDB, allows developers to work with both structured and unstructured data, including JSON-like documents. This flexibility makes it particularly useful for applications that require a scalable, agile, and performance-oriented database solution.

Over the past year, Cedric Pech has sold a total of 16,640 shares and has not purchased any shares. This recent transaction is part of a broader trend seen within the company, where there have been 58 insider sells and no insider buys over the past year.

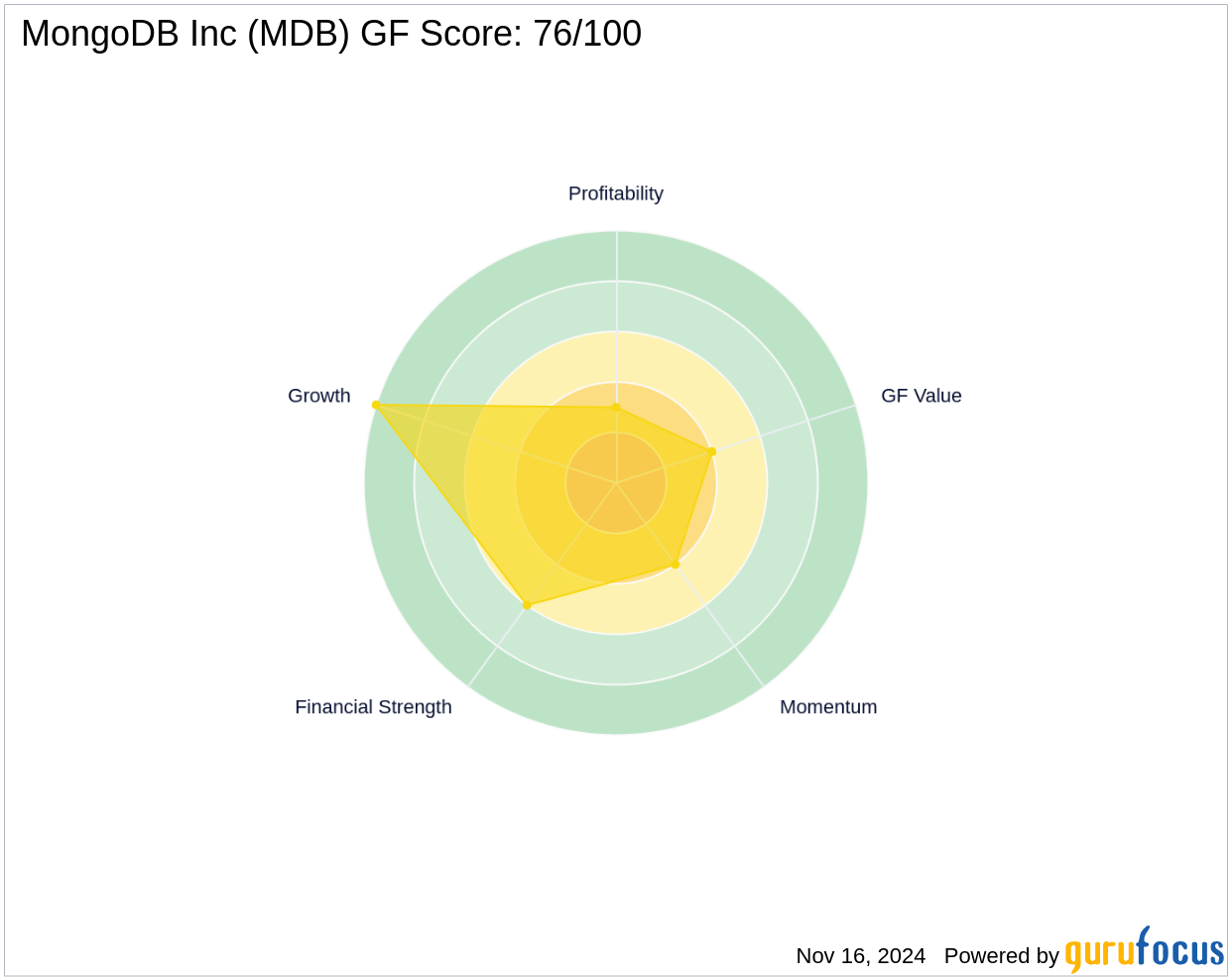

Shares of MongoDB Inc were trading at $300 on the day of the transaction, giving the company a market cap of approximately $20.67 billion. The stock is currently considered significantly undervalued with a price-to-GF Value ratio of 0.66, based on a GF Value of $456.20.

The GF Value is a proprietary measure used to determine the fair value of a stock, taking into account historical trading multiples, an adjustment factor based on the company’s past performance, and expected future business outcomes.

This insider sale comes at a time when MongoDB Inc’s stock is deemed significantly undervalued according to the GF Value, suggesting a potential discrepancy between the insider’s actions and the estimated intrinsic value of the stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

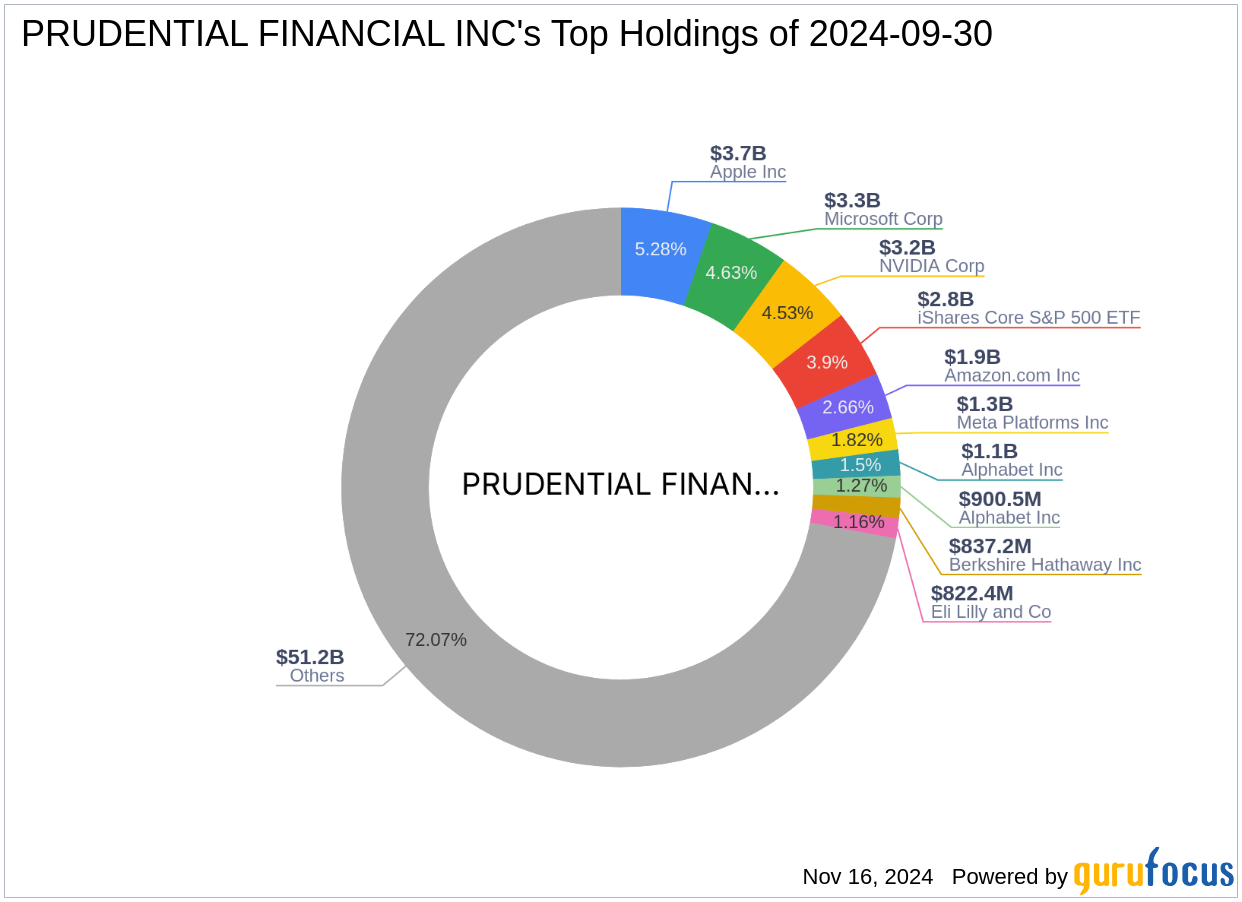

Overview of the Recent Transaction

On November 15, 2024, Prudential Financial Inc made a significant addition to its investment portfolio by acquiring 3,180,953 shares of MongoDB Inc (MDB, Financial) at a price of $291.59 per share. This transaction not only reflects a substantial investment in the tech sector but also marks a notable expansion of Prudential’s holdings in MongoDB, bringing the total shares owned to 3,183,210. This move has a calculated impact of 1.29% on the firm’s portfolio, indicating a strategic positioning by Prudential in the technology landscape.

Prudential Financial Inc: A Firm’s Profile

Prudential Financial Inc, headquartered at 751 Broad Street, Newark, NJ, operates as a diversified financial services firm. With a robust portfolio of over 2,706 stocks, Prudential is known for its strategic investments across various sectors, with a significant emphasis on technology and financial services. The firm’s top holdings include major entities such as iShares Core S&P 500 ETF (IVV, Financial), Apple Inc (AAPL, Financial), and Microsoft Corp (MSFT, Financial), showcasing its inclination towards high-performing tech giants.

Introduction to MongoDB Inc

Founded in 2007, MongoDB Inc has emerged as a leader in the software industry, specializing in a document-oriented database platform. It serves approximately 33,000 paying customers and boasts over 1.5 million free users. MongoDB’s business model revolves around licensing and subscription services, catering to a diverse range of programming languages and deployment needs. The company’s primary revenue streams include MongoDB Atlas-related services, other subscriptions, and professional services.

Financial and Market Analysis of MongoDB Inc

MongoDB Inc is currently valued at a market capitalization of $20.67 billion, with a recent stock price of $279.77, reflecting a 4.05% decrease since the transaction date. Despite this dip, MongoDB remains significantly undervalued according to GF Value, with a current intrinsic value of $456.20. The company’s financial health shows mixed signals; it boasts a strong Growth Rank of 10/10 but struggles with profitability, holding a Profitability Rank of 3/10.

Impact of the Trade on Prudential Financial Inc’s Portfolio

The acquisition of MongoDB shares significantly enhances Prudential’s exposure to the technology sector, aligning with its strategy to invest in high-growth potential areas. This new position in MongoDB now represents 1.29% of Prudential’s total portfolio, underscoring the strategic importance of this investment amidst their top holdings in the tech-dominated landscape.

Broader Market Context and Investor Interest

MongoDB has also attracted attention from other notable investors like Ron Baron (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio), indicating a broader market interest in its business model and growth potential. Within the context of current market trends, MongoDB’s innovative solutions in database management continue to draw significant investor interest, despite recent market volatilities.

Conclusion

Prudential Financial Inc’s recent acquisition of MongoDB shares is a strategic move that aligns with its investment philosophy and commitment to technology and innovation. This transaction not only diversifies Prudential’s portfolio but also positions the firm to capitalize on the growth trajectory of MongoDB Inc. As the market continues to evolve, this investment may play a pivotal role in shaping Prudential’s financial landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Article originally posted on mongodb google news. Visit mongodb google news