Month: March 2025

MMS • Steef-Jan Wiggers

Article originally posted on InfoQ. Visit InfoQ

Microsoft has recently launched Azure AI Foundry Labs, a hub designed to bring the latest AI research and experiments to developers, startups, and enterprises. The company started this to bridge the gap between groundbreaking research and real-world applications, enabling developers to explore new possibilities.

Azure AI Foundry Labs offers a range of new assets and experimental research projects that empower developers to create prototypes for new technologies. Among the notable projects are Aurora, a large-scale atmospheric model providing high-resolution weather forecasts and air pollution predictions; MatterSim, a deep learning model for atomistic simulations; and TamGen, a generative AI model for drug design using a GPT-like chemical language model for target-aware molecule generation and refinement.

The Labs also feature ExACT, an open-source project that enables agents to learn from past interactions and dynamically improve search efficiency. Magentic-One is a multi-agent system built on the AutoGen framework that solves complex problems by orchestrating multiple agents. Additionally, OmniParser v2, a vision-based module, converts UI into structured elements, enhancing agents’ action generation.

The company writes in an AI and Machine Learning blog post:

Developers can create prototypes using experimental research in Azure AI Foundry Labs, collaborate with researchers and engineering teams by sharing feedback, and help speed up the time to market for some of the most promising technologies.

Lastly, one of the most recent additions to Azure AI Foundry Labs is BioEmu-1, introduced by Microsoft Research. This deep-learning model is designed to predict the range of structural conformations that proteins can adopt. Another one is Magma, a multimodal foundation model designed to understand and act in digital and physical environments.

In a LinkedIn post of Satya Nadella, John C. Hockinson, an AI & Automation Leader, commented:

AI innovation is moving fast, and Azure AI Foundry Labs is putting cutting-edge research directly into the hands of developers. Access to experimental models and breakthroughs means faster iteration, real-world testing, and accelerated AI adoption.

And similar responses on X where Microsoft MVP John Cook tweeted:

Massive move! Giving devs direct access to cutting-edge AI research is how real innovation happens.

Microsoft is not alone in the hyperscale cloud market with AI exploration for developers through Azure AI Foundry Labs. Competing companies like Google and AWS have also launched similar services.

Google, for instance, has Google Labs, which gives developers access to the latest AI innovations, including Project Astra, Project Mariner, and NotebookLM. Project Astra is a research prototype that explores the potential capabilities of a universal AI assistant, while Project Mariner investigates the future of human-agent interaction, specifically through web browsers. On the other hand, AWS offers PartyRock, a mostly free, low-code tool designed for building generative AI applications. This tool features a new app search function and allows document processing integration into applications.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Monness Crespi & Hardt upgraded shares of MongoDB (NASDAQ:MDB – Free Report) from a sell rating to a neutral rating in a research note released on Monday morning, MarketBeat Ratings reports.

Monness Crespi & Hardt upgraded shares of MongoDB (NASDAQ:MDB – Free Report) from a sell rating to a neutral rating in a research note released on Monday morning, MarketBeat Ratings reports.

A number of other analysts have also issued reports on MDB. KeyCorp raised their target price on shares of MongoDB from $330.00 to $375.00 and gave the stock an “overweight” rating in a research report on Thursday, December 5th. Guggenheim upgraded shares of MongoDB from a “neutral” rating to a “buy” rating and set a $300.00 target price on the stock in a research report on Monday, January 6th. Oppenheimer raised their target price on shares of MongoDB from $350.00 to $400.00 and gave the stock an “outperform” rating in a research report on Tuesday, December 10th. JMP Securities restated a “market outperform” rating and set a $380.00 target price on shares of MongoDB in a research report on Wednesday, December 11th. Finally, Needham & Company LLC raised their target price on shares of MongoDB from $335.00 to $415.00 and gave the stock a “buy” rating in a research report on Tuesday, December 10th. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating, twenty-three have assigned a buy rating and two have issued a strong buy rating to the company’s stock. According to data from MarketBeat.com, the company has an average rating of “Moderate Buy” and an average price target of $359.33.

View Our Latest Analysis on MongoDB

MongoDB Price Performance

MDB stock opened at $259.02 on Monday. The company’s 50 day simple moving average is $263.05 and its 200-day simple moving average is $275.34. The firm has a market capitalization of $19.29 billion, a PE ratio of -94.53 and a beta of 1.28. MongoDB has a 12 month low of $212.74 and a 12 month high of $443.09.

MongoDB (NASDAQ:MDB – Get Free Report) last released its quarterly earnings results on Monday, December 9th. The company reported $1.16 EPS for the quarter, beating the consensus estimate of $0.68 by $0.48. The business had revenue of $529.40 million for the quarter, compared to analyst estimates of $497.39 million. MongoDB had a negative net margin of 10.46% and a negative return on equity of 12.22%. The company’s quarterly revenue was up 22.3% on a year-over-year basis. During the same period in the prior year, the business earned $0.96 earnings per share. As a group, sell-side analysts anticipate that MongoDB will post -1.78 earnings per share for the current year.

Insider Activity at MongoDB

In related news, CAO Thomas Bull sold 1,000 shares of the firm’s stock in a transaction on Monday, December 9th. The shares were sold at an average price of $355.92, for a total transaction of $355,920.00. Following the completion of the sale, the chief accounting officer now directly owns 15,068 shares of the company’s stock, valued at approximately $5,363,002.56. This trade represents a 6.22 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Cedric Pech sold 287 shares of the firm’s stock in a transaction on Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total transaction of $67,183.83. Following the transaction, the insider now directly owns 24,390 shares of the company’s stock, valued at approximately $5,709,455.10. This represents a 1.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 47,314 shares of company stock valued at $12,525,863. Corporate insiders own 3.60% of the company’s stock.

Institutional Inflows and Outflows

Several hedge funds have recently added to or reduced their stakes in the stock. Universal Beteiligungs und Servicegesellschaft mbH acquired a new position in MongoDB during the 4th quarter worth $13,270,000. Azzad Asset Management Inc. ADV grew its holdings in MongoDB by 17.7% during the 4th quarter. Azzad Asset Management Inc. ADV now owns 7,519 shares of the company’s stock worth $1,750,000 after acquiring an additional 1,132 shares in the last quarter. Infinitum Asset Management LLC acquired a new position in shares of MongoDB in the 4th quarter valued at about $8,148,000. Polar Asset Management Partners Inc. acquired a new position in shares of MongoDB in the 4th quarter valued at about $14,458,000. Finally, Mackenzie Financial Corp boosted its holdings in shares of MongoDB by 47.8% in the 4th quarter. Mackenzie Financial Corp now owns 5,731 shares of the company’s stock valued at $1,334,000 after buying an additional 1,854 shares during the period. 89.29% of the stock is owned by institutional investors and hedge funds.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Further Reading

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB (NASDAQ:MDB – Free Report) had its price objective cut by Loop Capital from $400.00 to $350.00 in a research note issued to investors on Monday,Benzinga reports. They currently have a buy rating on the stock.

MongoDB (NASDAQ:MDB – Free Report) had its price objective cut by Loop Capital from $400.00 to $350.00 in a research note issued to investors on Monday,Benzinga reports. They currently have a buy rating on the stock.

MDB has been the topic of several other research reports. Monness Crespi & Hardt raised shares of MongoDB from a “sell” rating to a “neutral” rating in a research report on Monday. Stifel Nicolaus lifted their target price on MongoDB from $325.00 to $360.00 and gave the company a “buy” rating in a research report on Monday, December 9th. Wells Fargo & Company upped their price target on MongoDB from $350.00 to $425.00 and gave the stock an “overweight” rating in a report on Tuesday, December 10th. Tigress Financial raised their price objective on MongoDB from $400.00 to $430.00 and gave the company a “buy” rating in a research note on Wednesday, December 18th. Finally, Morgan Stanley increased their target price on shares of MongoDB from $340.00 to $350.00 and gave the company an “overweight” rating in a report on Tuesday, December 10th. One investment analyst has rated the stock with a sell rating, five have issued a hold rating, twenty-three have given a buy rating and two have assigned a strong buy rating to the company’s stock. Based on data from MarketBeat.com, MongoDB presently has an average rating of “Moderate Buy” and an average price target of $359.33.

Check Out Our Latest Stock Analysis on MDB

MongoDB Stock Performance

Shares of MongoDB stock opened at $259.02 on Monday. The stock has a market capitalization of $19.29 billion, a PE ratio of -94.53 and a beta of 1.28. MongoDB has a 52 week low of $212.74 and a 52 week high of $443.09. The stock has a 50 day moving average price of $263.05 and a two-hundred day moving average price of $275.34.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings results on Monday, December 9th. The company reported $1.16 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.68 by $0.48. MongoDB had a negative net margin of 10.46% and a negative return on equity of 12.22%. The business had revenue of $529.40 million during the quarter, compared to the consensus estimate of $497.39 million. During the same quarter last year, the firm posted $0.96 EPS. MongoDB’s revenue was up 22.3% compared to the same quarter last year. Research analysts forecast that MongoDB will post -1.78 EPS for the current year.

Insider Activity at MongoDB

In other news, CAO Thomas Bull sold 1,000 shares of the business’s stock in a transaction on Monday, December 9th. The shares were sold at an average price of $355.92, for a total transaction of $355,920.00. Following the completion of the transaction, the chief accounting officer now directly owns 15,068 shares in the company, valued at $5,363,002.56. The trade was a 6.22 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Dev Ittycheria sold 8,335 shares of the stock in a transaction on Friday, January 17th. The stock was sold at an average price of $254.86, for a total value of $2,124,258.10. Following the completion of the sale, the chief executive officer now owns 217,294 shares in the company, valued at $55,379,548.84. This trade represents a 3.69 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 47,314 shares of company stock worth $12,525,863. 3.60% of the stock is owned by company insiders.

Hedge Funds Weigh In On MongoDB

A number of institutional investors have recently added to or reduced their stakes in the business. Norges Bank purchased a new position in shares of MongoDB during the fourth quarter worth about $189,584,000. Jennison Associates LLC grew its stake in MongoDB by 23.6% in the 3rd quarter. Jennison Associates LLC now owns 3,102,024 shares of the company’s stock worth $838,632,000 after buying an additional 592,038 shares in the last quarter. Marshall Wace LLP bought a new position in shares of MongoDB in the 4th quarter worth $110,356,000. Raymond James Financial Inc. purchased a new stake in shares of MongoDB during the 4th quarter valued at $90,478,000. Finally, D1 Capital Partners L.P. bought a new stake in shares of MongoDB during the 4th quarter worth $76,129,000. 89.29% of the stock is currently owned by institutional investors.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

INP Last Week #38: IBM Acquired Cassandra Provider DataStax, MongoDB Acquired … – Substack

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

🎉 Israeli-based Quantum Machines, a provider of quantum control solutions, raises $170M in a Series C funding round, led by PSG Equity with participation from Intel Capital and Red Dot Capital Partners.(Read More)

🎉 San Francisco-based cybersecurity startup Archipelo secures $12M in seed funding to develop its Developer Security Posture Management platform, led by Dell Technologies Capital.(Read More)

🎉 New York City-based human-driven security platform Anagram raises $10M in Series A funding, led by Madrona, with participation from General Catalyst, Bloomberg Beta, Operator Partners, and Secure Octane.(Read More)

🎉 Munich-based IT infrastructure monitoring vendor Checkmk receives an undisclosed strategic investment from PSG Equity to enhance its R&D and expand internationally.(Read More)

🎉 Khobar-based Operational Technology cybersecurity company CQR raises $3M in funding, led by Shorooq, to scale and expand its AI capabilities.(Read More)

🎉 Seattle-based workload isolation technology company Edera raises $15M in Series A funding, led by M12, with participation from Mantis VC and In-Q-Tel.(Read More)

🎉 San Francisco-based usage-based billing platform Metronome raises $50M in Series C funding, led by NEA with participation from a16z, Greyhound Capital, General Catalyst, Workday Ventures, Truebridge Capital Partners, Activant Capital, SineWave Ventures, and Megalith Ventures.(Read More)

🎉 Palo Alto, CA-based enterprise ransomware defense company Mimic raises $50M in Series A funding, led by GV and Menlo Ventures.(Read More)

🎉 London-based cybersecurity company Nothreat, specializing in AI-driven security and IoT protection, raised an undisclosed amount in Seed funding, confirming its valuation at £40M, and was led by Algara Group.(Read More)

🎉 Mountain View, CA-based Skylo Technologies, a provider of direct-to-device satellite connectivity, raised $30M in funding in a round led by NGP Capital.(Read More)

🎉 Tokyo-based GPU server business Ubitus receives an undisclosed investment from UTokyo IPC to expand its GPU data center operations in Japan.(Read More)

🎉 NinjaOne LLC, an Austin, Texas-based IT management platform provider, has raised $500M in a Series C extension led by Alphabet Inc.’s CapitalG and ICONIQ Growth, bringing its valuation to $5 billion. (Read More)

🎉 MongoDB Inc., headquartered in New York City, has acquired Voyage AI Inc., a Palo Alto, California-based startup specializing in artificial intelligence models for generating embeddings,MongoDB Inc. (Read More)

🎉 MongoDB Inc, based in Armonk, New York, has announced its intent to acquire DataStax Inc., a Santa Clara-based database company, to enhance its watsonx AI platform. The financial terms of the deal were not disclosed.(Read More)

🎉 RAD Security Inc., a San Francisco-based cloud-native threat detection and response startup, has raised $14M in Series A funding, led by Cheyenne Ventures, to enhance its platform, expand go-to-market efforts, forge partnerships, and advance artificial intelligence security initiatives.(Read More)

🔔 Perplexity Launches $50M Seed and Pre-seed VC Fund, Backed by Limited Partners (Read More)

🔔 Snowflake: Snowflake Expands Startup Accelerator with $200M Backing from Leading VCs (Read More)

🔔 IBM completes $6.4B HashiCorp acquisition following regulatory approvals(Read More)

🔔 Anthropic’s latest flagship AI might not have been incredibly costly to train(Read More)

🔔 DeepSeek reopens access to its API after three-week pause(Read More)

🔔 Microsoft cancels some of its AI data center leases(Read More)

🔔 Microsoft finalizes its EU sovereign cloud project(Read More)

🔔 Nvidia CEO Jensen Huang shrugs off DeepSeek as sales soar(Read More)

🔔 Thousands of exposed GitHub repositories, now private, can still be accessed through Copilot(Read More)

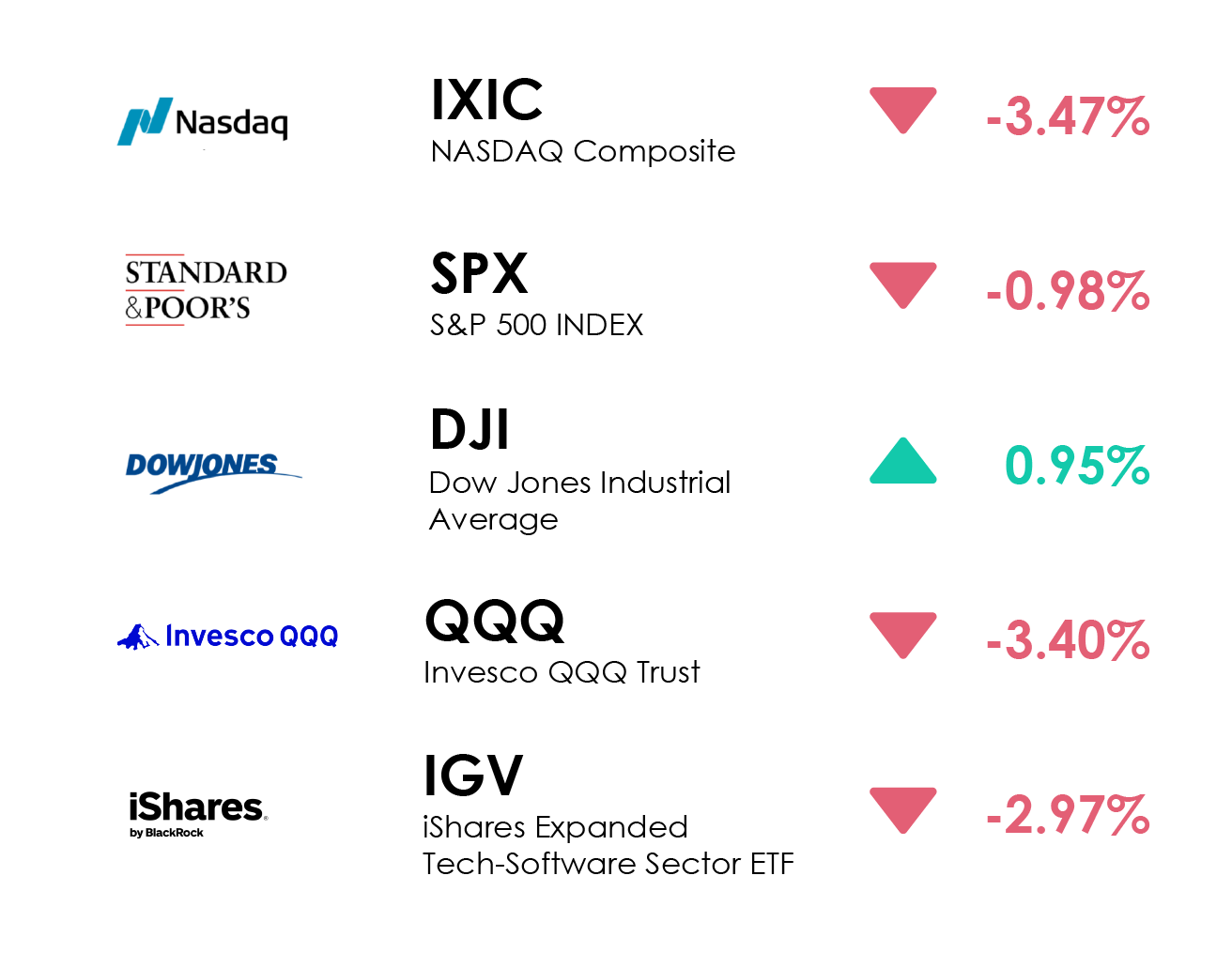

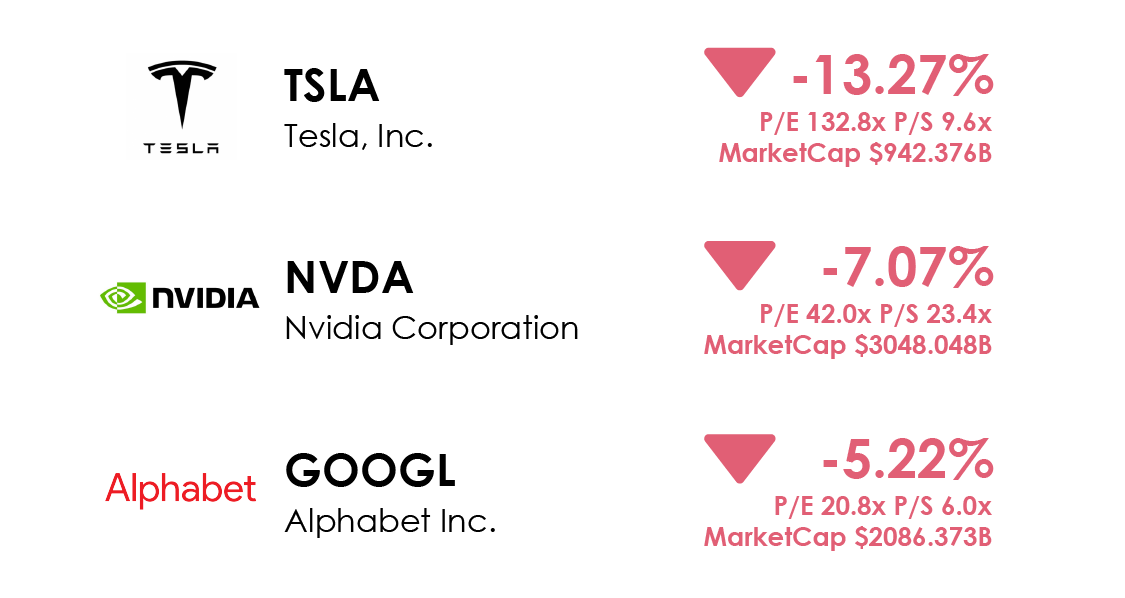

The Major Indices showed mixed performanced

Magnificent 7 Index closed lower: -4.87%

Magnificent 7 Index closed lower (weighted using MarketCap): -4.03%

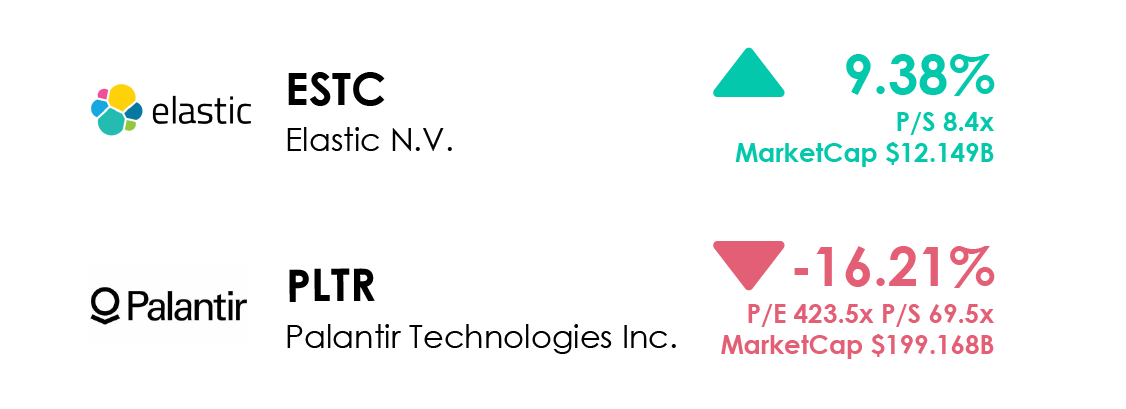

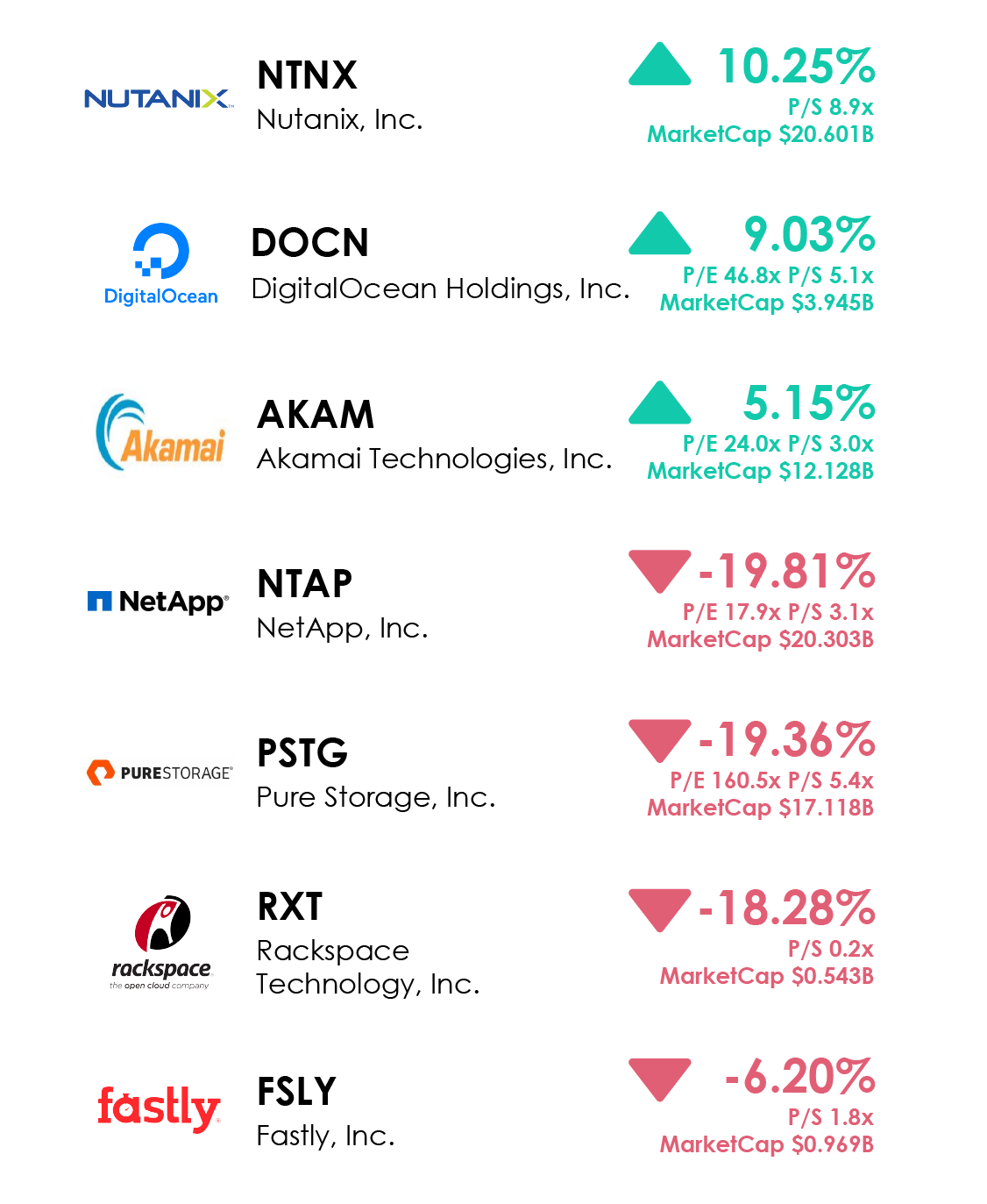

Data Infra Index closed lower: -0.88%

Data Infra Index closed higher (weighted using MarketCap): -4.7%

Cloud Infra Index closed lower: -4.08%

Cloud Infra Index closed lower (weighted using MarketCap): -2.02%

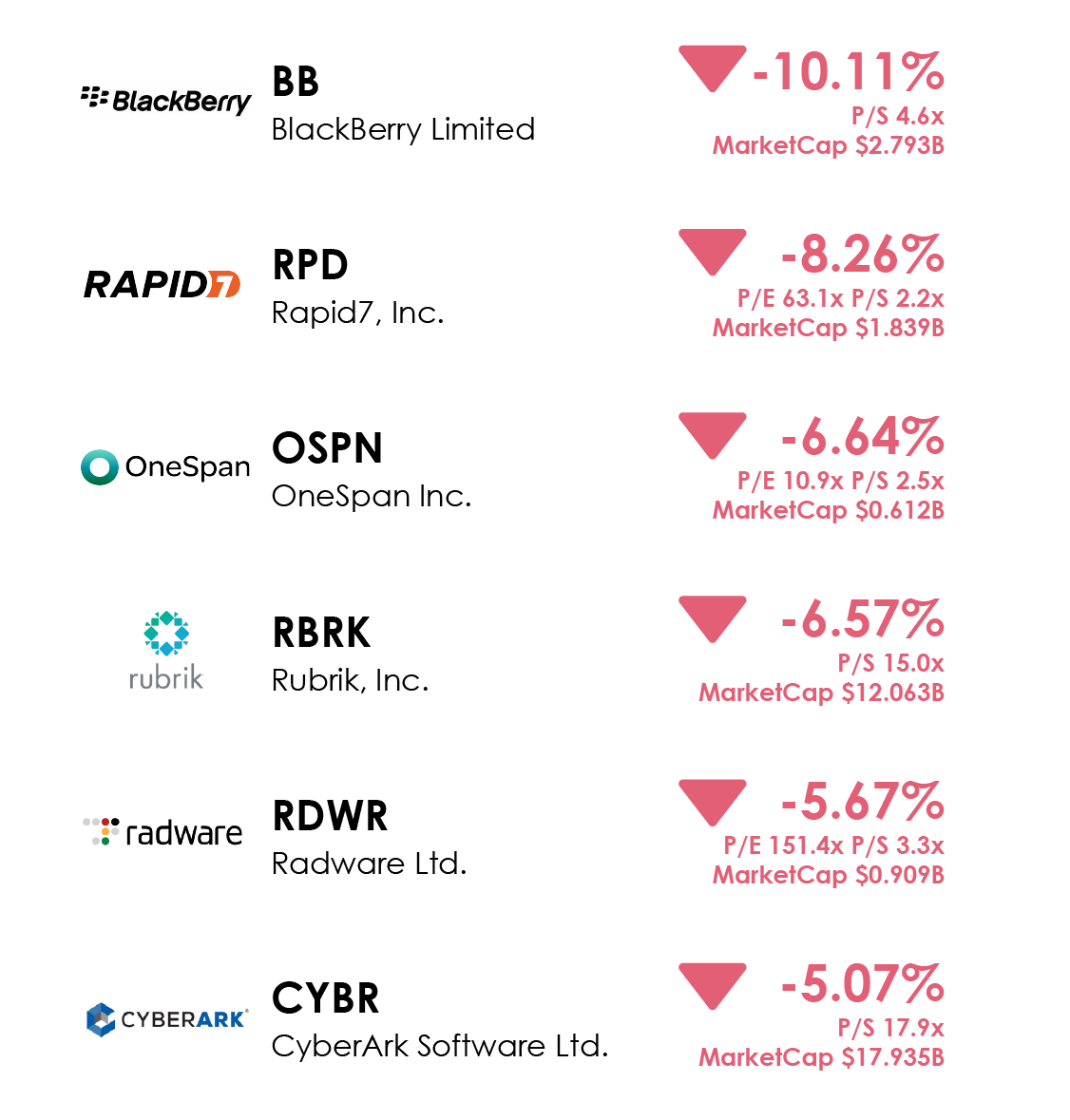

Security Index closed lower: -2.83%

Security Index closed lower (weighted using MarketCap): -2.26%

Dev Tool Index closed lower: -2.63%

Dev Tool Index closed lower(weighted using MarketCap): -1.23%

SaaS Index closed lower: -3.82%

SaaS Index closed lower (weighted using MarketCap): -0.99%

💰 Elastic delights investors with earnings and revenue beats(Read More)

💰 VMware defections propel Nutanix to another strong earnings and revenue beat(Read More)

💰 Snowflake’s stock surges on earnings crush and revenue beat(Read More)

💰 Workday’s stock pops as it reports strong earnings beat and targets federal customer wins(Read More)

💰 Zoom Reports Earnings Beat but First-Quarter Guidance Disappoints Investors(Read More)

💰 Synopsys shares gain on stronger-than-expected earnings forecast(Read More)

💰 Couchbase shares rise despite mixed quarterly results and lower outlook(Read More)

💰 Pure Storage tops earnings expectations but guidance tanks shares(Read More)

💰 Nvidia’s sales leap 78% as it starts producing more next-generation Blackwell GPUs(Read More)

💰 Salesforce delivers strong AI growth but disappoints on fiscal 2026 forecast(Read More)

🆕 Tencent releases new AI model it says is faster than DeepSeek-R1(Read More)

🆕 Amazon debuts its first quantum chip ‘Ocelot’ prototype with novel architecture(Read More)

🆕 Red Hat broadens virtualization options in latest OpenShift release(Read More)

🆕 Anthropic’s Claude 3.7 Sonnet reasoning model can think for as long as you want(Read More)

🆕 Zscaler launches Asset Exposure Management for enhanced cyber asset tracking(Read More)

🆕 F5 expands application security with new platform and AI-powered automation tools(Read More)

🆕 Arm Introduces Armv9 Edge AI Platform to Enhance Edge AI Application Intelligence(Read More)

🆕 IBM Debuts New Granite 3.2 Family of Models That Include Reasoning When You Want It(Read More)

📕 Observability Can Get Expensive, Here’s How to Trim Costs(Read More)

📙 Curl’s Daniel Stenberg on Securing 180,000 Lines of C Code(Read More)

📒 Breaking the cloud silos with HPE: The future of hybrid cloud and IT observability(Read More)

📗 Grammarly’s data-driven approach to maximizing AI ROI(Read More)

📘 CrowdStrike report finds surge in malware-free cyberattacks and AI-driven threats in 2024(Read More)

📕 Secretly Swapping Clouds While Everybody Is Watching(Read More)

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

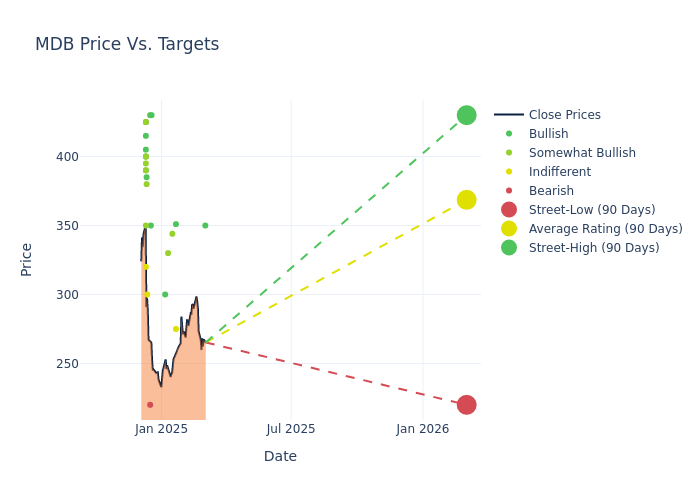

MongoDB MDB underwent analysis by 31 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

In the table below, you’ll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 13 | 13 | 4 | 0 | 1 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 2 | 1 | 0 | 0 |

| 3M Ago | 10 | 11 | 3 | 0 | 1 |

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $369.35, along with a high estimate of $430.00 and a low estimate of $220.00. Observing a 5.24% increase, the current average has risen from the previous average price target of $350.96.

Breaking Down Analyst Ratings: A Detailed Examination

The analysis of recent analyst actions sheds light on the perception of MongoDB by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Yun Kim | Loop Capital | Lowers | Buy | $350.00 | $400.00 |

| Patrick Colville | Scotiabank | Lowers | Sector Perform | $275.00 | $350.00 |

| Colin Liu | China Renaissance | Announces | Buy | $351.00 | – |

| Thomas Blakey | Cantor Fitzgerald | Announces | Overweight | $344.00 | – |

| Raimo Lenschow | Barclays | Lowers | Overweight | $330.00 | $400.00 |

| Howard Ma | Guggenheim | Maintains | Buy | $300.00 | $300.00 |

| Ivan Feinseth | Tigress Financial | Raises | Buy | $430.00 | $400.00 |

| Blair Abernethy | Rosenblatt | Announces | Buy | $350.00 | – |

| Tyler Radke | Citigroup | Raises | Buy | $430.00 | $400.00 |

| Brian White | Monness, Crespi, Hardt | Announces | Sell | $220.00 | – |

| Steve Koenig | Macquarie | Announces | Neutral | $300.00 | – |

| David Hynes | Canaccord Genuity | Raises | Buy | $385.00 | $325.00 |

| Patrick Walravens | JMP Securities | Maintains | Market Outperform | $380.00 | $380.00 |

| Andrew Nowinski | Wells Fargo | Raises | Overweight | $425.00 | $350.00 |

| Miller Jump | Truist Securities | Raises | Buy | $400.00 | $320.00 |

| Eric Heath | Keybanc | Raises | Overweight | $395.00 | $375.00 |

| Brad Reback | Stifel | Raises | Buy | $425.00 | $360.00 |

| Ittai Kidron | Oppenheimer | Raises | Outperform | $400.00 | $350.00 |

| Rudy Kessinger | DA Davidson | Raises | Buy | $405.00 | $340.00 |

| Rishi Jaluria | RBC Capital | Raises | Outperform | $400.00 | $350.00 |

| Kash Rangan | Goldman Sachs | Raises | Buy | $390.00 | $340.00 |

| Patrick Colville | Scotiabank | Raises | Sector Perform | $350.00 | $295.00 |

| William Power | Baird | Raises | Outperform | $390.00 | $380.00 |

| Matthew Broome | Mizuho | Raises | Neutral | $320.00 | $275.00 |

| Sanjit Singh | Morgan Stanley | Raises | Overweight | $350.00 | $340.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $400.00 | $375.00 |

| Mike Cikos | Needham | Raises | Buy | $415.00 | $335.00 |

| Brent Bracelin | Piper Sandler | Maintains | Overweight | $425.00 | $425.00 |

| Brad Reback | Stifel | Raises | Buy | $360.00 | $325.00 |

| Eric Heath | Keybanc | Raises | Overweight | $375.00 | $330.00 |

| William Power | Baird | Raises | Outperform | $380.00 | $305.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they ‘Maintain’, ‘Raise’, or ‘Lower’ their stance, it signifies their response to recent developments related to MongoDB. This offers insight into analysts’ perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from ‘Outperform’ to ‘Underperform’. These ratings offer insights into expectations for the relative performance of MongoDB compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for MongoDB’s future value. Examining the current and prior targets offers insights into analysts’ evolving expectations.

Capture valuable insights into MongoDB’s market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on MongoDB analyst ratings.

Get to Know MongoDB Better

Founded in 2007, MongoDB is a document-oriented database. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB’s database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Breaking Down MongoDB’s Financial Performance

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: MongoDB’s revenue growth over a period of 3 months has been noteworthy. As of 31 October, 2024, the company achieved a revenue growth rate of approximately 22.27%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: MongoDB’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive -1.85% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of -0.68%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): MongoDB’s ROA stands out, surpassing industry averages. With an impressive ROA of -0.31%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: MongoDB’s debt-to-equity ratio is below the industry average at 0.77, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street’s Next Big Mover

Benzinga’s #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Article originally posted on mongodb google news. Visit mongodb google news

Flux v2.5 Release: Expanding GitOps Capabilities with CEL Integration and GitHub App Auth

MMS • Claudio Masolo

Article originally posted on InfoQ. Visit InfoQ

Flux, the popular GitOps tool for Kubernetes, has released version 2.5, bringing a host of powerful new capabilities that significantly enhance its functionality and flexibility. This release represents a substantial evolution in Flux’s capabilities, with features that the community has been eagerly awaiting. Let’s explore what’s new and how these changes can improve your GitOps workflows.

Perhaps the most transformative addition in Flux v2.5 is the integration of Common Expression Language (CEL). This integration has enabled several long-requested features that give users more control and flexibility in their deployments.

Flux now supports custom health checks using CEL expressions, allowing you to define precisely how Flux should determine the health of your custom resources. While Flux has always performed health checks for core Kubernetes resources, this new capability lets you teach Flux how to verify the readiness of custom resources that don’t follow standard Kubernetes conventions.

For example, when managing a fleet of Kubernetes clusters with Cluster API, you can now define health checks to ensure clusters are ready before deploying addons:

apiVersion: kustomize.toolkit.fluxcd.io/v1

kind: Kustomization

metadata:

name: prod-clusters

namespace: infra

spec:

interval: 30m

retryInterval: 5m

prune: true

sourceRef:

kind: GitRepository

name: fleet

path: "./production"

timeout: 15m

wait: true

healthCheckExprs:

- apiVersion: cluster.x-k8s.io/v1beta1

kind: Cluster

failed: "status.conditions.filter(e, e.type == 'Ready').all(e, e.status == 'False')"

current: "status.conditions.filter(e, e.type == 'Ready').all(e, e.status == 'True')"

In this example, Flux will wait for all Cluster objects to reach the Ready state before proceeding with dependent Kustomizations. The community is also maintaining a health check library with CEL expressions for popular custom resources, making it easy to implement common patterns.

The Receiver API now supports filtering resources based on CEL expressions, giving you finer-grained control over which events trigger reconciliations. This allows for more sophisticated automation workflows and reduces unnecessary reconciliation operations.

Another significant improvement is the addition of GitHub App authentication support. This addresses a common pain point in GitOps workflows: the reliance on personal access tokens or SSH keys that require manual rotation.

With GitHub App authentication, you can configure Flux to interact with GitHub repositories using an identity not tied to a specific user account. This approach provides better security posture and simpler credential management.

Setting up GitHub App authentication is straightforward using the new Flux CLI command:

flux create secret githubapp github-auth

--app-id=1

--app-installation-id=2

--app-private-key=~/private-key.pem

The resulting Kubernetes Secret can be referenced in GitRepository and ImageUpdateAutomation resources, providing a more robust authentication mechanism for your GitOps pipelines.

Flux v2.5 introduces also, the ability to enrich event metadata by adding annotations to Flux resources. This feature significantly improves the context provided in notifications sent to platforms like Slack or Microsoft Teams. One particularly useful application is including image tags in notifications when Flux’s image automation updates container images.

The Flux ecosystem continues to grow with Flux Operator v0.14, which introduces one of the most requested features: ephemeral environments for testing and validating changes in pull requests.

This powerful capability allows you to automatically deploy application code or configuration changes from GitHub Pull Requests or GitLab Merge Requests to temporary environments. The Flux Operator can create, update, and delete application instances on-demand based on ResourceSet definitions and the state of the PR/MR.

This feature streamlines the development workflow by providing isolated testing environments that accurately reflect how changes will behave in production, without affecting existing environments.

Flux v2.5 adds several CLI improvements designed to make troubleshooting easier:

flux debug kustomization --show-vars: Inspect the final variable values by merging inline variables with those from ConfigMaps/Secretsflux debug helmrelease --show-values: Examine the final Helm values by merging inline values with those from ConfigMaps/Secretsflux create secret githubapp: Generate Kubernetes Secrets for GitHub App authentication

These tools provide greater visibility into Flux’s internal state, making it easier to diagnose and fix issues in your GitOps pipelines.

The release includes several other enhancements:

- Fine-grained control of garbage collection with

.spec.deletionPolicy - SOPS support for decryption of Kubernetes secrets generated by Kustomize components

- Ability to update Git commit statuses from events about Kustomizations that consume OCIRepositories

To take advantage of these new features, you’ll need to upgrade your Flux installation to v2.5. For detailed instructions on using these new capabilities, refer to the official Flux documentation, which provides comprehensive guides for implementing each feature.

FluxCD has gained traction as a powerful GitOps tool for Kubernetes, enabling teams to manage cluster state declaratively through Git repositories. However, depending on your needs, several alternatives offer unique features that might better suit your infrastructure.

One of the most popular alternatives is Argo CD, which provides a Kubernetes-native continuous delivery solution with an intuitive UI, multi-cluster support, and advanced progressive delivery capabilities. If you’re looking for a GitOps solution designed for large-scale multi-cluster environments, Fleet (from Rancher) is a lightweight yet scalable option. Meanwhile, Jenkins X integrates GitOps principles into a CI/CD workflow, bridging the gap between traditional automation and Kubernetes-native deployments. For teams already using Spinnaker, its support for GitOps workflows makes it a viable option for multi-cloud continuous delivery.

Choosing the right tool depends on your requirements—whether you prioritize UI-driven workflows, scalability, or deep Kubernetes integration. As GitOps continues to evolve, these alternatives to FluxCD are helping organizations simplify and streamline their Kubernetes deployment strategies.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB (NASDAQ:MDB – Get Free Report) had its price objective reduced by equities researchers at Loop Capital from $400.00 to $350.00 in a research note issued on Monday,Benzinga reports. The firm currently has a “buy” rating on the stock. Loop Capital’s target price suggests a potential upside of 30.78% from the company’s current price.

A number of other equities research analysts also recently weighed in on the company. Barclays cut their price target on MongoDB from $400.00 to $330.00 and set an “overweight” rating for the company in a research note on Friday, January 10th. The Goldman Sachs Group raised their price objective on shares of MongoDB from $340.00 to $390.00 and gave the company a “buy” rating in a research report on Tuesday, December 10th. Truist Financial reissued a “buy” rating and issued a $400.00 target price (up from $320.00) on shares of MongoDB in a research report on Tuesday, December 10th. Monness Crespi & Hardt upgraded shares of MongoDB from a “sell” rating to a “neutral” rating in a report on Monday. Finally, Mizuho upped their price objective on shares of MongoDB from $275.00 to $320.00 and gave the stock a “neutral” rating in a report on Tuesday, December 10th. One analyst has rated the stock with a sell rating, five have given a hold rating, twenty-three have assigned a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, MongoDB presently has a consensus rating of “Moderate Buy” and an average target price of $359.33.

Get Our Latest Analysis on MDB

MongoDB Price Performance

MDB traded up $0.19 on Monday, reaching $267.62. 305,191 shares of the company traded hands, compared to its average volume of 1,456,005. The stock’s 50 day moving average price is $262.73 and its 200-day moving average price is $275.27. MongoDB has a 52-week low of $212.74 and a 52-week high of $443.09. The company has a market cap of $19.93 billion, a price-to-earnings ratio of -97.45 and a beta of 1.28.

MongoDB (NASDAQ:MDB – Get Free Report) last posted its quarterly earnings results on Monday, December 9th. The company reported $1.16 EPS for the quarter, beating the consensus estimate of $0.68 by $0.48. MongoDB had a negative net margin of 10.46% and a negative return on equity of 12.22%. The business had revenue of $529.40 million for the quarter, compared to analysts’ expectations of $497.39 million. During the same period in the previous year, the company posted $0.96 EPS. MongoDB’s revenue was up 22.3% on a year-over-year basis. As a group, equities research analysts forecast that MongoDB will post -1.78 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, CFO Michael Lawrence Gordon sold 1,245 shares of the business’s stock in a transaction on Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total value of $291,442.05. Following the sale, the chief financial officer now owns 79,062 shares of the company’s stock, valued at $18,507,623.58. The trade was a 1.55 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Cedric Pech sold 287 shares of the company’s stock in a transaction dated Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total transaction of $67,183.83. Following the completion of the sale, the insider now directly owns 24,390 shares in the company, valued at approximately $5,709,455.10. The trade was a 1.16 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 47,314 shares of company stock valued at $12,525,863 over the last ninety days. 3.60% of the stock is owned by company insiders.

Institutional Trading of MongoDB

A number of hedge funds and other institutional investors have recently made changes to their positions in the business. Nisa Investment Advisors LLC increased its position in MongoDB by 3.8% in the 3rd quarter. Nisa Investment Advisors LLC now owns 1,090 shares of the company’s stock valued at $295,000 after acquiring an additional 40 shares in the last quarter. US Bancorp DE boosted its holdings in MongoDB by 9.1% in the third quarter. US Bancorp DE now owns 3,869 shares of the company’s stock valued at $1,046,000 after acquiring an additional 324 shares during the last quarter. Janney Montgomery Scott LLC acquired a new stake in shares of MongoDB during the 3rd quarter worth approximately $861,000. Principal Financial Group Inc. raised its stake in shares of MongoDB by 2.7% during the third quarter. Principal Financial Group Inc. now owns 6,095 shares of the company’s stock worth $1,648,000 after buying an additional 160 shares during the last quarter. Finally, Atria Investments Inc lifted its holdings in MongoDB by 6.6% in the third quarter. Atria Investments Inc now owns 2,175 shares of the company’s stock valued at $588,000 after buying an additional 135 shares during the period. 89.29% of the stock is currently owned by institutional investors and hedge funds.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

Nuclear energy stocks are roaring. It’s the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Investing.com — Monness, Crespi, Hardt upgraded Oracle Corporation (NYSE:ORCL) and MongoDB (NASDAQ:MDB), both to “Neutral” from “Sell” given the growth opportunities in cloud and generative AI despite ongoing challenges.

For Oracle, the brokerage expects the company to meet its third-quarter fiscal 2025 revenue estimate of $14.56 billion, up 10% year-over-year, and non-GAAP EPS of $1.54. While Oracle has potential in AI and cloud, the note flagged concerns over valuation, capital expenditures, and competition.

Monness, Crespi, Hardt said Oracle represents a high-quality company with the opportunity to participate in a cloud transformation and benefit from the gen AI trend, but flagged a stretched valuation, an unsustainable capex spending, fierce competition, transition in software, and a fragile macro environment.

MongoDB, which is set to report fourth-quarter results on March 5, is projected to post $547 million in revenue, up 19% year-over-year, and EPS of $1.06.

Brokerage noted continued pressure on MongoDB’s cloud database service, Atlas (NYSE:ATCO), which has seen growth slow for 11 consecutive quarters. “No other cloud product unit within our software universe, and Big Tech coverage, has undergone a losing streak as protracted as MongoDB Atlas during this cycle,” analyst said.

Despite macroeconomic uncertainty and competition, the firm acknowledged both companies’ positioning within long-term industry trends.

Related Articles

MCH upgrades Oracle, MongoDB ahead of earnings on cloud, AI growth

Ex-Barclays CEO Staley should be banned over Epstein statements, UK’s FCA says

Kroger ousts long-time CEO after probe into personal conduct

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB (NASDAQ:MDB – Get Free Report) was upgraded by analysts at Monness Crespi & Hardt from a “sell” rating to a “neutral” rating in a report issued on Monday,Finviz reports.

Several other analysts also recently issued reports on the company. Citigroup increased their price target on MongoDB from $400.00 to $430.00 and gave the company a “buy” rating in a report on Monday, December 16th. The Goldman Sachs Group increased their target price on MongoDB from $340.00 to $390.00 and gave the company a “buy” rating in a research note on Tuesday, December 10th. Piper Sandler reissued an “overweight” rating and set a $425.00 price target on shares of MongoDB in a research report on Tuesday, December 10th. Rosenblatt Securities began coverage on shares of MongoDB in a research report on Tuesday, December 17th. They issued a “buy” rating and a $350.00 price objective for the company. Finally, Canaccord Genuity Group lifted their price objective on shares of MongoDB from $325.00 to $385.00 and gave the company a “buy” rating in a research note on Wednesday, December 11th. One research analyst has rated the stock with a sell rating, five have issued a hold rating, twenty-three have assigned a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of “Moderate Buy” and an average price target of $361.00.

View Our Latest Stock Report on MDB

MongoDB Stock Up 1.9 %

Shares of NASDAQ MDB opened at $267.43 on Monday. The stock has a market capitalization of $19.92 billion, a PE ratio of -97.60 and a beta of 1.28. The firm has a fifty day moving average of $262.73 and a 200-day moving average of $275.27. MongoDB has a 52-week low of $212.74 and a 52-week high of $449.12.

MongoDB (NASDAQ:MDB – Get Free Report) last announced its quarterly earnings results on Monday, December 9th. The company reported $1.16 EPS for the quarter, topping the consensus estimate of $0.68 by $0.48. MongoDB had a negative return on equity of 12.22% and a negative net margin of 10.46%. The company had revenue of $529.40 million during the quarter, compared to analyst estimates of $497.39 million. During the same period in the prior year, the firm posted $0.96 earnings per share. The firm’s revenue was up 22.3% on a year-over-year basis. Equities research analysts expect that MongoDB will post -1.78 EPS for the current fiscal year.

Insider Buying and Selling

In other news, CAO Thomas Bull sold 1,000 shares of the company’s stock in a transaction dated Monday, December 9th. The shares were sold at an average price of $355.92, for a total transaction of $355,920.00. Following the completion of the transaction, the chief accounting officer now owns 15,068 shares in the company, valued at approximately $5,363,002.56. This represents a 6.22 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Dev Ittycheria sold 8,335 shares of the stock in a transaction dated Friday, January 17th. The stock was sold at an average price of $254.86, for a total transaction of $2,124,258.10. Following the completion of the sale, the chief executive officer now directly owns 217,294 shares in the company, valued at approximately $55,379,548.84. This trade represents a 3.69 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 47,314 shares of company stock worth $12,525,863 over the last quarter. 3.60% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the company. Norges Bank bought a new stake in shares of MongoDB during the fourth quarter valued at approximately $189,584,000. Jennison Associates LLC raised its position in shares of MongoDB by 23.6% during the 3rd quarter. Jennison Associates LLC now owns 3,102,024 shares of the company’s stock worth $838,632,000 after buying an additional 592,038 shares in the last quarter. Marshall Wace LLP bought a new position in shares of MongoDB in the fourth quarter valued at approximately $110,356,000. Raymond James Financial Inc. acquired a new position in shares of MongoDB during the fourth quarter valued at approximately $90,478,000. Finally, D1 Capital Partners L.P. bought a new stake in MongoDB during the fourth quarter worth approximately $76,129,000. Institutional investors own 89.29% of the company’s stock.

MongoDB Company Profile

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat’s analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Article originally posted on mongodb google news. Visit mongodb google news

MongoDB cofounder Eliot Horowitz raises $30 million Series C for hardware automation … – Fortune

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

© 2025 Fortune Media IP Limited. All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice | Do Not Sell/Share My Personal Information

FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. FORTUNE may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.

Article originally posted on mongodb google news. Visit mongodb google news