Month: April 2025

MMS • Sergio De Simone

Conducted between December 2024 and January 2025, the State of React Native 2024 Survey collected insights from around 3,500 React Native developers to capture the current state of key tools and technologies in the React Native ecosystem and help developers make better decisions, explains Software Mansion software engineer Bartłomiej Bukowski, who curated the survey.

The State of React native 2024 Survey covers over 15 distinct areas, including used APIs, libraries, state management, navigation, debugging, build and publish, and others.

In terms of demographics, around 30% of respondents have been working as developers for over 10 years, and 96% identified as male, across more than 20 countries.

Over 80% of respondents worked in teams of up to five developers, mostly targeting the iOS and Android platforms across a wide range of industry sectors, including finance, education, entertainment, communication, productivity, and many more. Nearly 50% of respondents reported that their top-performing React Native app has fewer than 1,000 users, while 37% of developers have apps with over 10,000 users. 50% of the respondents have released five apps or more.

According to Amazon developer advocate Anisha Malde, these responses highlight the diversity of the React Native ecosystem and its versatility, as reflected in the range of app scale and industry sectors.

Among the most used platform APIs, respondents listed the Camera API, Notifications, Permissions, Deep Linking, and others. Quite interestingly, three of them also rank among the top five pain points, namely Notifications, Deep Linking, and Permissions.`

React dev & OSS maintainer Vojtech Novak offered an explanation, noting that push notifications “are not trivial to set up, have an extremely large surface area, notable cross-platform differences, and quirks such as behavior dependent on the application”. This also applies to background processing, although it is not one of the most commonly used APIs.

State management is a major topic in the React ecosystem, with tools like Redux, Redux Toolkit, and others taking the spotlight. Redux received the most negative feedback, with around 18% of respondents expressing dissatisfaction. In contrast, React’s built-in state management was positively regarded by 31% of respondents, while Zustand followed closely with 21% of positive remarks.

According to Galaxies.dev founder Simon Grimm:

Zustand continues its rise as the go-to modern state management library, offering a refreshingly simple developer experience. Besides the React built-ins, no other libraries leaves developers with such a positive experience after using it. Which also shows that using the Context API is still extremely popular, and actually an acceptable solution for the needs of most small apps.

As a final note, the survey highlights a growing trend toward the adoption of automated solutions, such as Expo’s EAS Build, which 71% of respondents reported using. While manual methods like Xcode and Android Studio are becoming less prevalent, they remain widely used by 59.7% and 54.5% of respondents, respectively.

There is much more to the React Native 2024 Survey than what can be covered here, so be sure to check out the official report for all the details.

MMS • Steef-Jan Wiggers

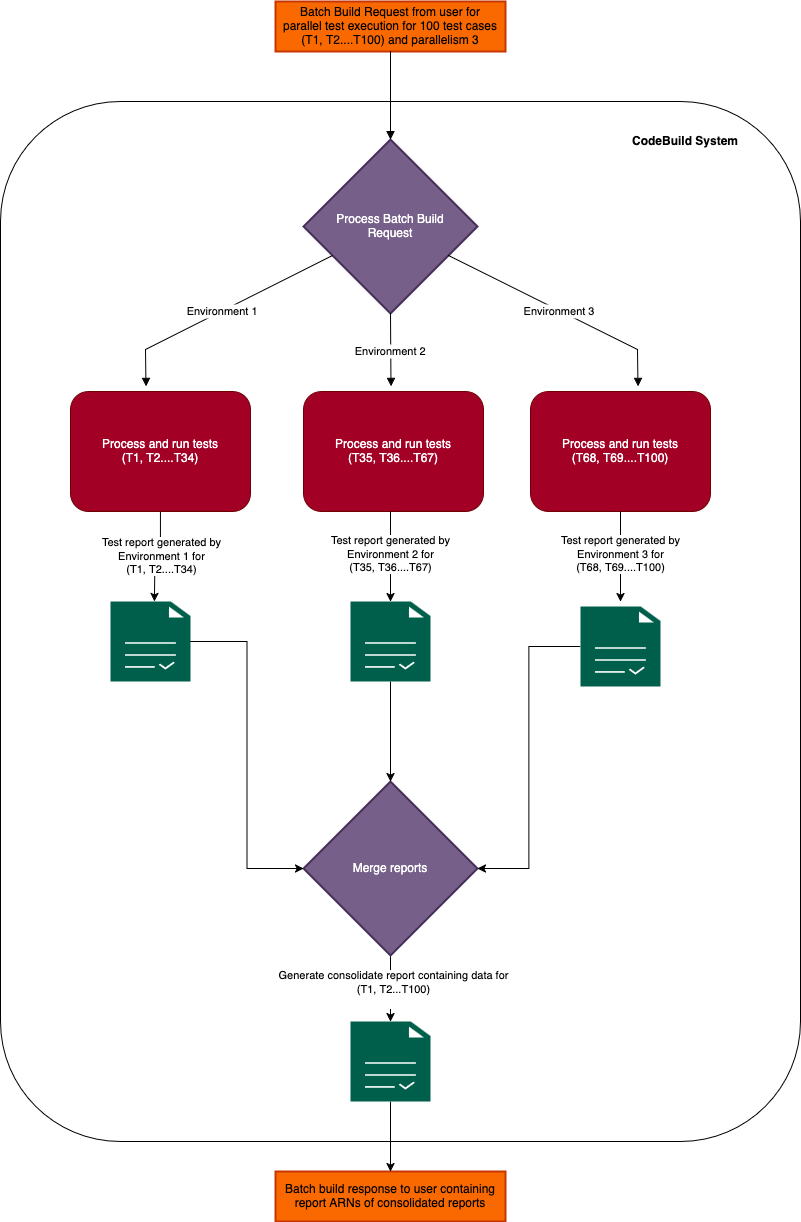

AWS has announced the availability of parallel test execution in AWS CodeBuild, a fully-managed continuous integration service. According to the company, this new feature significantly reduces build times by allowing test suites to run concurrently across multiple build compute environments.

The announcement highlights the growing challenge of lengthy test execution times in continuous integration (CI) pipelines as projects become increasingly complex. These long cycles can delay feature delivery, hinder developer productivity, and increase costs.

Thomas Fernandez wrote in a Semaphore blog post on parallel testing:

Parallel testing lets us do more while waiting less. It’s an essential tool to keep sharp and ready so we can always establish a fast feedback loop.

With parallel test execution in CodeBuild, developers can now configure their build process to split test suites and run them in parallel across multiple independent build nodes. CodeBuild provides environment variables to identify the current node and the total number of nodes, enabling intelligent test distribution. The feature supports a sharding approach with two main strategies:

- Equal distribution: Sorts test files alphabetically and distributes them evenly across parallel environments.

- Stability: Uses a consistent hashing algorithm to maintain file-to-shard assignments even when test files are added or removed.

To enable parallel testing, developers configure the batch fanout section in their buildspec.xml file, specifying the desired level of parallelism. The pre-installed codebuild-tests-run utility is used in the build step to manage test execution and sharding based on the chosen strategy. A sample of a buildspec.yml that shows parallel test execution with Cucumber on a Linux platform looks like:

version: 0.2

batch:

fast-fail: false

build-fanout:

parallelism: 5

ignore-failure: false

phases:

install:

commands:

- echo 'Installing Ruby dependencies'

- gem install bundler

- bundle install

pre_build:

commands:

- echo 'prebuild'

build:

commands:

- echo 'Running Cucumber Tests'

- cucumber --init

- |

codebuild-tests-run

--test-command "cucumber"

--files-search "codebuild-glob-search '**/*.feature'"

post_build:

commands:

- echo "Test execution completed"

CodeBuild also offers automatic merging of test reports from the parallel executions into a single, consolidated test summary. This simplifies result analysis by providing aggregated pass/fail statuses, test durations, and failure details in the CodeBuild console, via the AWS CLI, or through integration with other reporting tools.

(Source: AWS Documentation)

A demonstration highlighted in an AWS blog post on the feature showed a reduction in total test time from 35 minutes to 6 minutes (including environment provisioning) for a Python project with 1,800 tests when running on ten parallel compute environments.

Sébastien Stormacq, a principal developer advocate at AWS, wrote:

The 1,800 tests of the demo project take one second each to complete. When I run this test suite sequentially, it took 35 minutes to complete. When I run the test suite in parallel on ten compute environments, it took 6 minutes to complete, including the time to provision the environments. The parallel run took 17.9 percent of the time of the sequential run.

This new capability is compatible with all testing frameworks, and the AWS documentation provides examples for popular languages and frameworks like Django, Elixir, Go, Java (Maven), Javascript (Jest), Kotlin, PHPUnit, Pytest, Ruby (Cucumber), and Ruby (RSpec). For frameworks with specific requirements for test file lists, CodeBuild provides the CODEBUILD_CURRENT_SHARD_FILES environment variable, which contains a newline-separated list of test files for the current shard.

Parallel test execution in AWS CodeBuild is available today in all AWS regions where CodeBuild is offered, across all three compute modes: on-demand, reserved capacity, and AWS Lambda compute, with no additional cost beyond the standard CodeBuild pricing for the resources used.