Month: May 2022

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

To ensure this doesn’t happen in the future, please enable Javascript and cookies in your browser.

If you have an ad-blocker enabled you may be blocked from proceeding. Please disable your ad-blocker and refresh.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

How about a well-researched study on the Non-Native Database Management Systems that includes an in-depth review of different patterns, programmes, and goods that have the potential to cause a paradigm shift in the growth rate? This is a reality. Based on the latest changes in the Non-Native Database Management Systems, Market Reports is the solution to all of your questions! During the forecast era, the study provides a detailed overview of the most profitable opportunities around the different segments in terms of revenues and volumes. With an emphasis on different criteria such as drivers, constraints, barriers, opportunities, and competitive environment evaluation, the study with bull’s eye analysis has the potential to shape the crux of the organization’s performance.

The volatile COVID-19 pandemic has slashed revenues in a variety of industries around the world. It has wreaked havoc on the economy and resulted in unprecedented losses. Policymakers, business players, and participants in the Non-Native Database Management Systems are attempting to combat the lethal pandemic of economic failure as the planet continues to combat the COVID-19 pandemic. The stakeholders in the Non-Native Database Management Systems took commendable measures by implementing effective plans, making fast decisions, and reorganising the whole market framework. They are now able to maintain their companies as a result of this.

Market Reports was used to paint the colours of development on the COVID-19-affected company canvas. Via near-perfect visualisation and deep knowledge retrieval, Market Reports provides a comprehensive and informative analysis on the Non-Native Database Management Systems. When the study is paired with realistic implementation by the Non-Native Database Management Systems’s stakeholders, they will undoubtedly light the lamp of progress.

Access Sample Report – marketreports.info/sample/46314/Non-Native-Database-Management-Systems

The research also examines the effect of numerous government policies around the world on the Non-Native Database Management Systems. The study also includes regulatory approvals and regulations specific to the Non-Native Database Management Systems, allowing key stakeholders to tailor their corporate practises accordingly. Breakthrough developments in the Non-Native Database Management Systems that have the ability to alter the competitive environment are also highlighted in the study. The article becomes a knight in shining armour for the key stakeholders in the Non-Native Database Management Systems by emphasising those aspects.

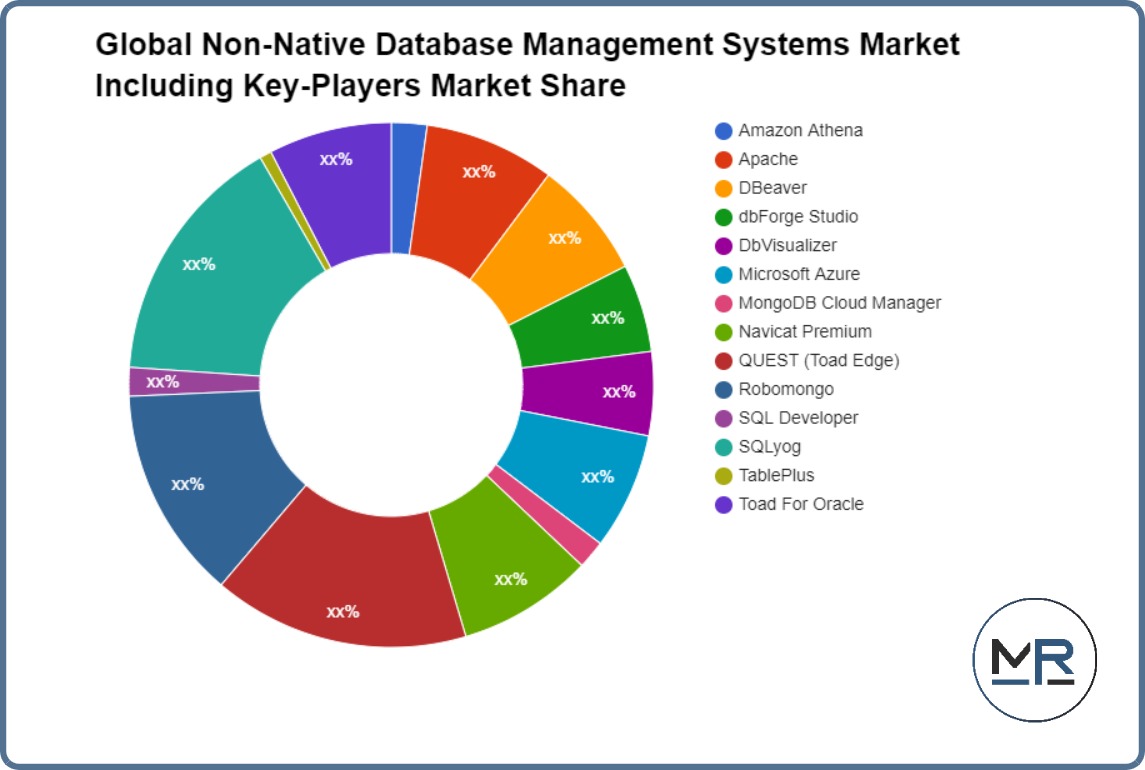

Top Key Players Included In Non-Native Database Management Systems Market Are : Amazon Athena, Apache, DBeaver, dbForge Studio, DbVisualizer, Microsoft Azure, MongoDB Cloud Manager, Navicat Premium, QUEST (Toad Edge), Robomongo, SQL Developer, SQLyog, TablePlus, Toad For Oracle

By Type

– Cloud Based

– Web Based

By Application

– Large Enterprises

– SMEs

What makes Market Reports’ stand out from others?

360 degree research mechanism is used by Market Reports. The study was developed specifically to evaluate the COVID-19’s effect on the Non-Native Database Management Systems. This mechanism reflects on nearly all aspects in a systematic way in order to produce the best research report for business stakeholders.

Check For Instant Discount- marketreports.info/discount/46314/Non-Native-Database-Management-Systems

Assess: This is a reality.

The Market Reports report analyses any little detail that may prove to be a Non-Native Database Management Systems development driver, making it unique and distinct from other studies.

Visualize: Authors participating in the research activities created a visual representation of the post-COVID-19 age to help key stakeholders of the Non-Native Database Management Systems gain a better understanding of the situation and take action to ensure continued development over the forecast period.

Overcome: The study examines points that may prove to be the Non-Native Database Management Systems’s Achilles heel and assists in the development of strategies to overcome the obstacles that may obstruct the Non-Native Database Management Systems’s progress.

Leverage: The Non-Native Database Management Systems will help you leverage those things that can help you maximise your growth rate. This is a reality. All of the points on which the primary stakeholders should depend on are covered by Market Reports.

Verify: Research is carried out in a comprehensive manner to ensure that all parts of the study are accurate. To prevent errors and false facts, all of the points are carefully rechecked and validated.

Last but not least, this feature assists the primary stakeholder in removing all barriers that stand in the way of the growth rate and the Non-Native Database Management Systems.

Regional Outlook:

Regionally, the global Non-Native Database Management Systems market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. Also, the classification of market data and analysis of region into countries is covered in the market research report. Further, the regions are segregated into the country and regional groupings:

– North America (U.S. & Canada)

– Europe (Germany, United Kingdom, France, Italy, Spain, Russia, and Rest of Europe)

– Asia Pacific (China, India, Japan, South Korea, Indonesia, Taiwan, Australia, New Zealand, and Rest of Asia Pacific)

– Latin America (Brazil, Mexico, and Rest of Latin America)

– Middle East & Africa (GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, and Rest of Middle East & Africa)

Purchase Full Report @ marketreports.info/checkout?buynow=46314/Non-Native-Database-Management-Systems

About Us:

Market Reports offers a comprehensive database of syndicated research studies, customized reports, and consulting services. These reports are created to help in making smart, instant, and crucial decisions based on extensive and in-depth quantitative information, supported by extensive analysis and industry insights.

Our dedicated in-house team ensures the reports satisfy the requirement of the client. We aim at providing value service to our clients. Our reports are backed by extensive industry coverage and is made sure to give importance to the specific needs of our clients. The main idea is to enable our clients to make an informed decision, by keeping them and ourselves up to date with the latest trends in the market.

Contact Us:

Carl Allison (Head of Business Development)

Market Reports

phone: +44 141 628 5998

Email: sales@marketreports.info

Website: www.marketreports.info

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Olemedia/E+ via Getty Images

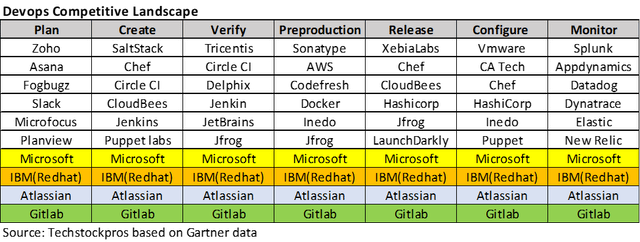

We are bearish on GitLab (NASDAQ:GTLB) shares and urge investors to sell shares here. GitLab still is very expensive despite being 43% below its IPO price of $77. GitLab is facing intense competition from large incumbents, and we expect the growth to slow faster than bulls expect. GitLab operates in a highly contested market niche of software development tools. The market is highly fragmented, with companies having multiple DevOps tools within their organizations. The most critical source code of the company is usually deposited in source code repositories from Microsoft (MSFT) (GitHub), IBM (IBM) (ClearCase), or Atlassian (TEAM) (Bitbucket), and displacing these incumbents is very difficult. Experimental and side projects source code is usually deposited in repositories from smaller vendors such as GitLab. Growth for companies such as GitLab usually slows quickly as the low-hanging fruit eventually is depleted. Therefore, we expect growth to slow, driving the shares much lower from the current levels. Therefore, we recommend investors sell shares to preserve gains or limit their losses.

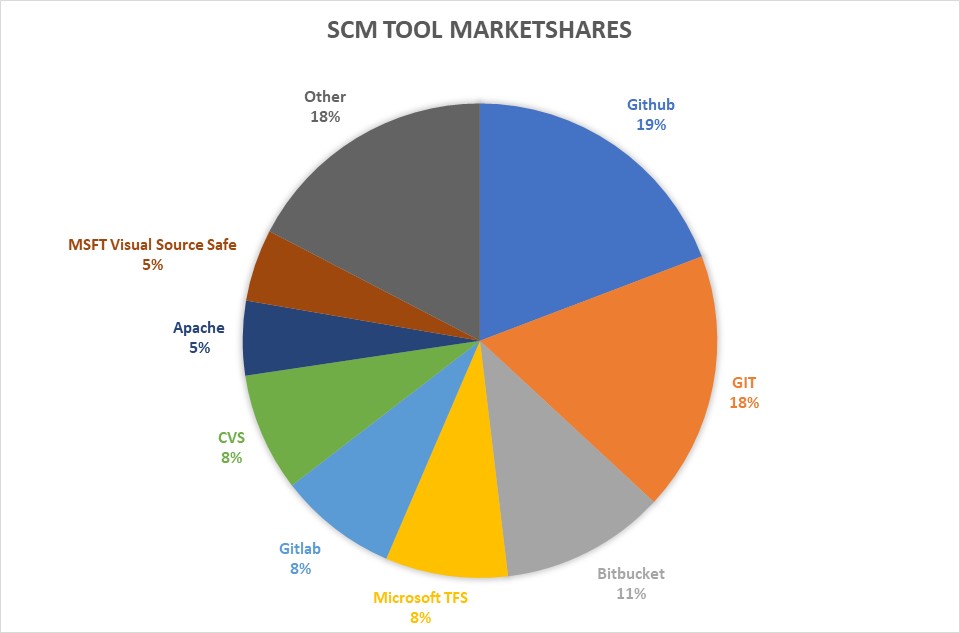

GitLab is a software repository and DevOps platform. GitLab is based on open-source GIT software. GitLab shares the market with open source GIT, GitHub (owned by Microsoft), Bitbucket (owned by Atlassian), IBM, and Azure DevOps. In addition, there are many small companies offering point products that can be integrated to form a holistic offering. CircleCI, Jenkins, and JFrog (FROG) are some smaller and lesser-known players. The competition is heavy, and the market is fragmented with several point products. We believe there is limited differentiation between various players in the market. We expect GitLab to remain a distant fourth in the market share, as it primarily competes against open-source GIT, GitHub, and Bitbucket. Therefore, we expect Microsoft, GIT, and Atlassian to take the lion’s share of the market, leaving GitLab and others to fight over scraps.

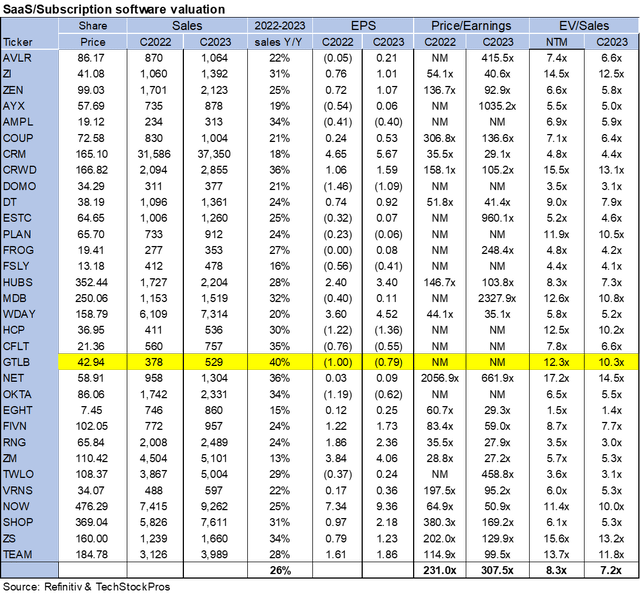

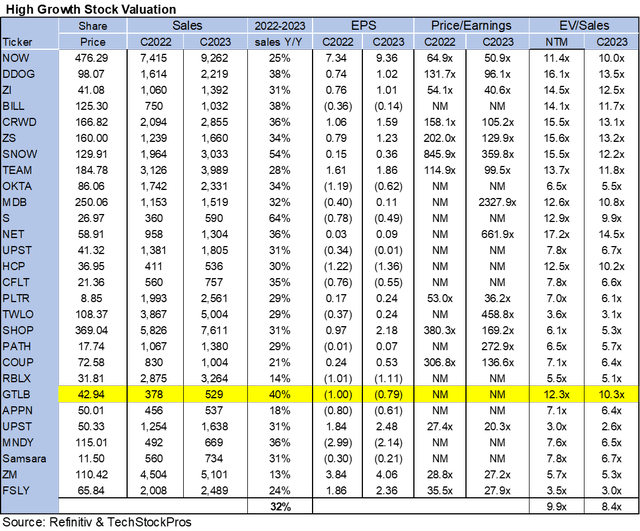

In addition, we expect the large incumbents to buy up smaller and niche technologies to round out their offerings and stay current. GitLab is still very expensive and continues to generate losses. With the stock trading at 12.3x EV/NTM sales versus the high-growth peer group average of 9.9x, we expect the sell-off in the shares to continue. We recommend investors sell their shares and look for a better entry point. The historical valuation of high-growth companies is in the 5x-10x EV/NTM sales, and investors should expect GitLab to trade at that level. A 5x-10x EV/NTM valuation implies a stock price in the range of $22-35.

Competition is real and intense

Microsoft is easily the biggest threat to GitLab and open source GIT and Atlassian. Both Microsoft and Atlassian have large install bases and salespeople to push their products. As a former software developer at a leading silicon valley software behemoth, I attest that organizations have multiple development tools. Different groups sometimes use different toolsets since these groups work on separate projects which do not have common code bases. Hence, it is not uncommon for companies like GitLab to count large and well-known companies as their clients. In addition, many new and side projects can be run on separate toolsets without replacing the “main” or product toolsets. Hence, we believe GitLab will have a challenging time displacing incumbents, which are used to run the “core” software development projects.

Techstockpros & Gartner

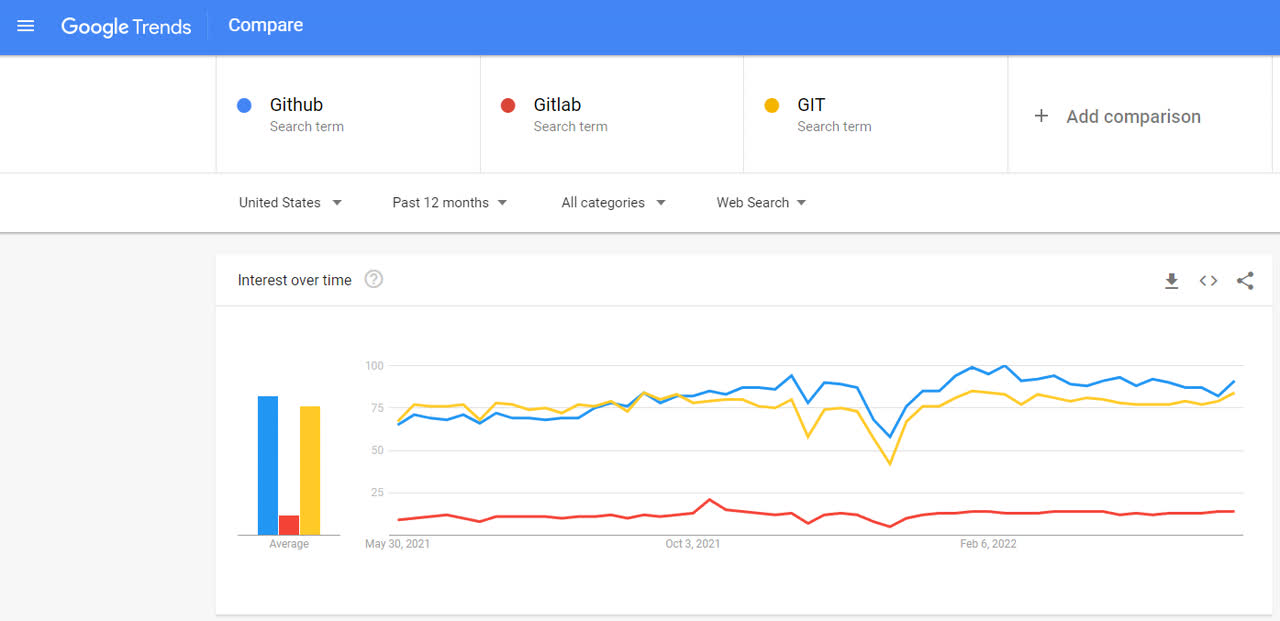

GitHub and GIT remain more popular than GitLab

Based on our conversations with our contacts in the industry, Microsoft looked at JFrog, GitLab, and other companies in the space before settling on GitHub to acquire. GitHub is the most heavily used tool in the industry, and Microsoft is not sitting still. It continues to roll out new tools and features all the time. Displacing incumbent tools is challenging, and we believe acquiring new customers will be slow and arduous. On top of this, developers are an opinionated bunch, with each having his favorite tool, and convincing them to use alternate tools would be challenging. It is not uncommon to see a given organization have multiple tools used by a different group within the enterprise. The following Google Trends chart illustrates that developers search for information on GitHub and GIT more than on GitLab.

Displacing incumbents will be challenging for GitLab

Developers usually drive small projects and frequently try newer technologies in the market, such as GitLab. But eventually, realize that the effort to install newer tools is not worth the effort since the differentiation is limited for an overwhelming number of users within an organization. Hence incumbents and tools with prominent legacy players will be hard to overcome.

Microsoft GitHub tools are cheaper than GitLab. On top of this, Microsoft uses various bundling schemes to undercut the competition. Historically, players such as GitLab find initial success with departmental and small-scale projects but eventually will find landing more significant deals much more challenging, leading to slowing growth. The following chart illustrates SCM/DevOps market shares.

Datanyze

Valuation remains challenging

GitLab IPOed at $77 and closed at around $104 on the first day. The stock peaked at $137 and is now trading 44% below the IPO price. We still believe the stock is expensive at the current levels. The stock is trading at 12.3x EV/NTM sales, versus the SaaS peer group average of 8.3x and the High Growth software peer group average of 9.9x. The historical trading multiple for the best software stocks with no competition is around 5x-10x NTM sales and the middling companies in the 3x-5x. Given the intense competition and fragmented market, we believe the appropriate multiple for GitLab is 3x-5x NTM sales. The following charts highlight SaaS/Subscription and High Growth software company valuations.

Refinitiv

Refinitiv

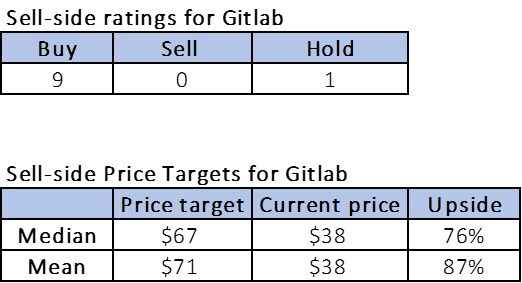

A majority of the sell-side analysts are buy-rated on the stock. Out of the ten analysts covering the stock, nine are buy-rated, and only one analyst is hold rated. The average price target is $71, and the median is $67, well below the $77 IPO price. The following charts indicate Sell-side ratings for GitLab.

Refinitiv

While we expect GitLab to be used for side projects within enterprises, we have a hard time believing it will replace industry-leading products such as GitHub, GIT, and Bitbucket.

What to do with the stock

GitLab is still expensive, and we believe the stock has more downside from the current levels. The infrastructure business is highly fragmented, with several established incumbents rolling out their offerings to match offerings from GitLab. To make money on infrastructure stocks, you need to buy the stock at a much lower valuation, perhaps in the 3x-5x range, and ride the valuation curve, not at the current trading multiple of around 12x. We expect the stock to decline to $25 price levels over the next few months to get into the historical trading range of software stocks of around 5x. The 52-week low for GitLab is around $31. Hence getting the stock below $25 is likely. We urge investors to sell the shares and perhaps get back into the stock at the 3x-5x levels.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB MDB is set to give its latest quarterly earnings report on Wednesday, 2022-06-01. Here’s what investors need to know before the announcement.

Analysts estimate that MongoDB will report an earnings per share (EPS) of $-0.09.

MongoDB bulls will hope to hear the company to announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Past Earnings Performance

Last quarter the company beat EPS by $0.13, which was followed by a 18.58% increase in the share price the next day.

Here’s a look at MongoDB’s past performance and the resulting price change:

| Quarter | Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 |

|---|---|---|---|---|

| EPS Estimate | -0.22 | -0.38 | -0.39 | -0.37 |

| EPS Actual | -0.09 | -0.11 | -0.24 | -0.15 |

| Price Change % | 18.58% | 16.42% | 26.33% | 16.27% |

| Quarter | Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 |

|---|---|---|---|---|

| EPS Estimate | -0.22 | -0.38 | -0.39 | -0.37 |

| EPS Actual | -0.09 | -0.11 | -0.24 | -0.15 |

| Price Change % | 18.58% | 16.42% | 26.33% | 16.27% |

Stock Performance

Shares of MongoDB were trading at $250.06 as of May 30. Over the last 52-week period, shares are down 13.36%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

To track all earnings releases for MongoDB visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

In the last trading session, 1.9 million shares of the MongoDB Inc. (NASDAQ:MDB) were traded, and its beta was 1.05. Most recently the company’s share price was $250.06, and it changed around $17.0 or 7.29% from the last close, which brings the market valuation of the company to $15.86B. MDB currently trades at a discount to its 52-week high of $590.00, offering almost -135.94% off that amount. The share price’s 52-week low was $213.39, which indicates that the current value has risen by an impressive 14.66% since then. We note from MongoDB Inc.’s average daily trading volume that its 3-month average coming to 1.55 million.

Instantly MDB has showed a green trend with a performance of 7.29% at the end of last trading. The performance over the last five days has remained in the green territory. The rise to weekly highs of 253.09 on Friday, 05/27/22 increased the stock’s daily price by 1.2%. The company’s shares are currently down -52.76% year-to-date, but still up 0.79% over the last five days. On the other hand, MongoDB Inc. (NASDAQ:MDB) is -33.79% up in the 30-day period.

3 Tiny Stocks Primed to Explode

The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for big returns.

The consensus price target as assigned by Wall Street analysts is $435.73, which translates to bulls needing to increase their stock price by 42.61% from its current value. Analyst projections state that MDB is forecast to be at a low of $270.00 and a high of $650.00. In order for the stock price to hit the forecast high, the stock would need to plunge -159.94% from its current level, while the stock would need to crash -7.97% from its current level to reach the projected low.

MongoDB Inc. (MDB) estimates and forecasts

MongoDB Inc. share prices are performing particularly well compared to other companies within the same industry. As is evident from the statistics, the company’s shares have fallen -51.78 percent over the past six months and at a 33.90% annual growth rate that is well above the industry average of 4.20%. Moreover, analysts have decided to roll up on their fiscal year 2022 revenue estimates. The rating firms predict that it will gain 40.00% in revenue this quarter, and will report an increase of 41.70% in the next quarter. The year-over-year growth rate is expected to be 35.20%, up from the previous year.

Consensus estimates provided by 14 financial analysts predict the company will bring in an average of $266.45 million in revenue for the current quarter. 14 analysts expect MongoDB Inc. to make $277.85 million in revenue for the quarter ending Jul 2022.

Looking at the company’s year-over-year earnings, the past five years showed a positive earnings growth rate of 3.70%.

MDB Dividends

MongoDB Inc.’s next quarterly earnings report is expected to be released around March 07 and March 11.

MongoDB Inc. (NASDAQ:MDB)’s Major holders

Upon looking at major shareholders, it appears that insiders hold 5.59% of MongoDB Inc. shares, and 89.29% of them are in the hands of institutional investors. The stock currently has a share float of 94.58%. MongoDB Inc. stock is held by 793 institutions, with Price (T.Rowe) Associates Inc being the largest institutional investor. By Dec 30, 2021, it held 10.60% of the shares, which is about 7.16 million shares worth $3.79 billion.

Capital World Investors, with 9.67% or 6.53 million shares worth $3.46 billion as of Dec 30, 2021, holds the second largest percentage of outstanding shares.

Growth Fund Of America Inc and Vanguard Total Stock Market Index Fund were the top two Mutual Funds as of Feb 27, 2022. The former held 4.77 million shares worth $1.82 billion, making up 7.06% of all outstanding shares. On the other hand, Vanguard Total Stock Market Index Fund held roughly 1.79 million shares worth around $945.81 million, which represents about 2.64% of the total shares outstanding.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • Vasco Veloso

Article originally posted on InfoQ. Visit InfoQ

Lyft’s product manager John Kirn published an article recently about the challenges they face when conducting experiments. Existing experimentation techniques did not fully adapt to Lyft’s real-time business nature or mitigate network effects. Lyft’s Experimentation team deployed new ones, such as time and region split testing, and improved internal experimentation norms and techniques.

The well-known technique known as A/B testing consists of a randomised experiment where two variants are compared. For example, a user interface change may be evaluated by rolling out one version to one part of the users and a second version to another. The user’s behaviour is then analysed to determine the most effective alternative.

However, Lyft’s team concluded that the ride-sharing model is subject to strong interference effects. Given its nature, a test may change the user’s behaviour in a way that interferes with the other user’s choices, effectively violating the statistical assumption that two experiments are different from each other.

Lyft’s experimentations are mostly user split tests, but they also use other experimentation techniques to mitigate undesired network effects.

The second most common test type at Lyft is the time split test. In this test, users in the same geographical area receive the same experience during a specific period.

Time split testing is a powerful way to establish causation in the face of network effects, as it reduces interference between users.

Since it can cause inconsistent user experiences, Lyft tries to use this type of test for experiments that affect parts of their system that are not visible to users.

Early versions of time split tests were vulnerable to interference from force majeure events (e.g. storms, outages). Lyft is currently applying new causal inference methodologies to mitigate these interferences and time split variance reduction techniques to accelerate this type of test.

Another test type in use at Lyft is region split testing. As its name implies, region split testing presents the experiment to all users within specific geographic boundaries.

For control [in region split testing], [Lyft] uses trends from before the test begins to develop counterfactual predictions of what would have happened had [Lyft] not launched a treatment.

In addition, Lyft built a set of norms and techniques designed to enhance its experiment’s quality and the validity of its results.

One is a guided hypothesis workflow. This workflow ensures that the hypothesis is registered before the experiment is launched, reducing the phenomena of hypothesising after the results are known (also known as HARKing). The association between the experiment and the hypothesis and its components is also recorded, allowing quick hypothesis verification and discoverability.

The Experimentation team used the Benjamini-Hochberg method to address the multiple comparisons problem by building a “Multiple Hypothesis Testing correction” technique to adjust p-values when multiple metrics are used. It is, however, still under evaluation.

Lyft also built a “results and decision tracking” mechanism to improve alignment regarding decisions made and their trade-offs.

[Lyft] aims to use this results log to generate consensus on proper investment trade-offs (…) and then feed these back into the hypothesis workflow tool to help coordinate teams working in similar areas.

In response to the very dynamic nature of the world where it operates, Lyft wishes to “test widely and move quickly”. It invests in adaptive experimentation platforms and reinforcement learning approaches to achieve this goal.

MMS • RSS

Posted on nosqlgooglealerts. Visit nosqlgooglealerts

New Jersey, USA,- The Global “NoSQL Software Market” Report provides insights into the worldwide trade together with valuable facts and figures. This analysis study explores the worldwide market intimately, like industrial chain structures, stuff suppliers and producing. The NoSQL Software sales market examines the big segments of the market GPS Bike Computers scale. This good study provides historical knowledge likewise as a forecast from 2022 to 2028.

The entire price chain and demanding downstream and upstream components ar examined during this report. This market report Covers technical knowledge, analysis of producing facilities and analysis of stuff provided for the NoSQL Software trade and conjointly explains that product has the very best penetration, its profit margins and market shares.

Click the link to get a Sample Copy of the Report: https://www.marketresearchintellect.com/download-sample/?rid=280810

Key Drivers & Barriers:

High-impact factors and rendering engines are studied within the NoSQL Software market report back to facilitate reader’s perceive the development. additionally, the report contains restrictions and challenges which will fill in the method of players. this can facilitate user’s listen and build knowledgeable business-related choices. The specialists conjointly checked out the following business outlook.

Market Segmentation:

Key Players:

- E-Commerce

- Social Networking

- Data Analytics

- Data Storage

- Others

Segment by Types:

- MongoDB

- OrientDB

- Amazon

- Azure Cosmos DB

- Couchbase

- ArangoDB

- CouchDB

- MarkLogic

- SQL-RD

- RethinkDB

- RavenDB

- Microsoft

- Redis

Segment by Applications:

- Cloud Based

- Web Based

Get | Discount On The Purchase Of This Report @ https://www.marketresearchintellect.com/ask-for-discount/?rid=280810

NoSQL Software Market Report Scope:

| Report Attribute | Details |

|---|---|

| Market size available for years | 2022 – 2029 |

| Base year considered | 2021 |

| Historical data | 2018 – 2021 |

| Forecast Period | 2022 – 2029 |

| Quantitative units | Revenue in USD million and CAGR from 2022 to 2029 |

| Segments Covered | Types, Applications, End-Users, and more. |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchaseoptions |

Regional Analysis of the NoSQL Software Market:

The global NoSQL Software Market research report details the ongoing market trends, development outlines, and several research methodologies. It illustrates the key factors that directly manipulate the Market, for instance, production strategies, development platforms, and product portfolio. According to our researchers, even minor changes within the product profiles could result in huge disruptions to the above-mentioned factors.

➛ North America (United States, Canada, and Mexico)

➛ Europe (Germany, France, UK, Russia, and Italy)

➛ Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

➛ South America (Brazil, Argentina, Colombia, etc.)

➛ Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

Post-covid-19 Outlook:

The readers in the section will understand how the NoSQL Software Market scenario changed across the globe during the pandemic and post-pandemic. The study is done keeping in view the changes in aspects such as production, demand, consumption, and supply chain. The Market experts have also highlighted the key factors that will help create opportunities for players and stabilize the overall market in the years to come.

What insights does the NoSQL Software Market report provide to the readers?

➜ NoSQL Software fragmentation on the basis of product type, end-use, and region

➜ Comprehensive assessment of upstream starting materials, downstream demand, and present market landscape

➜ Collaborations, R&D projects, acquisitions, and product launches of each NoSQL Software player

➜ Various regulations imposed by the governments on the consumption of NoSQL Software in detail

➜ Impact of modern technologies, such as big data & analytics, artificial intelligence, and social media platforms on the global NoSQL Software Market.

Buy Full Report: https://www.marketresearchintellect.com/select-licence/?rid=280810

There are 13 Sections to show the global NoSQL Software market:

Chapter 1: Market Overview, Drivers, Restraints and Opportunities, Segmentation overview

Chapter 2: Market Competition by Manufacturers

Chapter 3: Production by Regions

Chapter 4: Consumption by Regions

Chapter 5: Production, By Types, Revenue, and Market share by Types

Chapter 6: Consumption, By Applications, Market share (%), and Growth Rate by Applications

Chapter 7: Complete profiling and analysis of Manufacturers

Chapter 8: Manufacturing cost analysis, Raw materials analysis, Region-wise manufacturing expenses

Chapter 9: Industrial Chain, Sourcing Strategy, and Downstream Buyers

Chapter 10: Marketing Strategy Analysis, Distributors/Traders

Chapter 11: Market Effect Factors Analysis

Chapter 12: Market Forecast

Chapter 13: NoSQL Software Market Research Findings and Conclusion, Appendix, methodology, and data source

Finally, researchers throw light on the pinpoint analysis of Global NoSQL Software Market dynamics. It also measures the sustainable trends and platforms which are the basic roots behind the market growth. The degree of competition is also measured in the research report. With the help of SWOT and Porter’s five analyses, the market has been deeply analyzed. It also helps to address the risk and challenges in front of the businesses. Furthermore, it offers extensive research on sales approaches.

Note: All the reports that we list have been tracking the impact of COVID-19. Both upstream and downstream of the entire supply chain have been accounted for while doing this. Also, where possible, we will provide an additional COVID-19 update supplement/report to the report in Q3, please check with the sales team.

Top Trending Reports:

Global Rotary Hydraulic Actuator Market

Global Oil Water Separator Market

Global Offshore Inflatable Boats Market

Global Hydraulic Sand Fracturing Equipment Market

Global Cbm Drilling Rig Market

Global Air Freshener Fragrances Market

Global Gantry Waterjet Cutting Machine Market

Global Compact Street Sweeper Market

About Us: Market Research Intellect

Market Research Intellect provides syndicated and customized research reports to clients from various industries and organizations with the aim of delivering functional expertise. We provide reports for all industries including Energy, Technology, Manufacturing and Construction, Chemicals and Materials, Food and Beverage, and more. These reports deliver an in-depth study of the market with industry analysis, the market value for regions and countries, and trends that are pertinent to the industry.

Contact Us:

Mr. Steven Fernandes

Market Research Intellect

New Jersey (USA)

Tel: +1-650-781-4080

Email: sales@marketresearchintellect.com

Website: –https://www.marketresearchintellect.com/

MMS • Steef-Jan Wiggers

Article originally posted on InfoQ. Visit InfoQ

During the recent Build conference, Microsoft announced the Microsoft Dev Box. This new cloud service provides developers with secure, ready-to-code developer workstations for hybrid teams of any size. With the new service, the company aims to make life easier for developers to quickly access a preconfigured environment with all the tools and resources to write code.

With Microsoft Dev Box, development teams can create and maintain Dev Box images themselves with all the developers’ tools and dependencies to build and run their applications. Moreover, development teams can include their application source code and nightly built binaries, enabling developers to immediately start running and understanding the code without waiting for long re-builds.

According to the company, developers control their dev boxes by providing a developer portal where they can create dev boxes for a proof-of-concept or manage already made boxes. In addition, they can keep their projects separate or even parallelize tasks across multiple Dev Boxes to avoid bogging down their primary environment.

Microsoft Dev Box supports any developer Integrated Development Environment (IDE), SDK, or internal tool that runs on Windows. Furthermore, according to the company, the Dev boxes can target any development workload a developer can build from a Windows desktop and are particularly well-suited for desktop, mobile, IoT, and gaming. A developer can also build cross-platform apps using Windows Subsystem for Linux.

A correspondent on a Reddit thread on Microsoft Dev Box also indicated which use cases are suitable for dev boxes:

If you’re building for the Windows desktop, embedded, gaming consoles, and/or mobile, in addition to the developer tools like Visual Studio/VSCode, you may be interacting with additional UI client apps in your development that operate beyond the command line (e.g., mBed pin config tools, Unreal Engine Editor, etc.). For those scenarios, DevBox is a more suitable offering.

In addition, another correspondent stated:

I can see the use cases already for my crew, we use CLion instead of VSCode because VSCode is a terrible clickfest in terms of UX for serious C++ development. Our dependency chain also totals 100GB of binaries, libs, and source. (the final output is much smaller).

Microsoft Dev Box is built on Windows 365, a service that allows IT admins to provide users with preconfigured virtual PCs. Hence, they can create operating system images and choose from hardware configurations with different amounts of CPU power, storage, and RAM for dev boxes. In addition, these Windows 365 virtual machines, including but not limited to Dev Box VMs, can be accessed from other Windows PCs or devices running macOS, iOS, Android, Linux, or ChromeOS.

Since dev boxes are hosted on Azure and integrated with Azure Active Directory, development teams can rapidly onboard new team members by assigning them to Azure Active Directory groups that grant access to the Dev Boxes they need for their projects. In addition, dev boxes can be deployed the developer’s local region and started/stopped at any time to save cost (it’s still a VM that incurs cost when enabled).

Daniel Amini, Head of Microsoft Technology at BJSSLtd, tweeted:

#Microsoft Dev Box, a Windows 365-based dev workstation. This could be very handy for getting devs moving in a managed, controlled, and quick way.

Note that Microsoft is not the first public cloud vendor that deployed a commercial cloud-based IDE. Its competitor AWS has already deployed a cloud-based IDE with AWS Cloud9, available since 2017. It offers a fully-featured IDE for writing, running, and debugging code from a web browser (in much the same fashion as the existing one, Eclipse Che).

Lastly, the service is currently in private preview and will be in public preview in the next few months.

HTAP-Enabling In-Memory Computing Technologies Market Biggest Innovation with Top Key Players

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

The HTAP-Enabling In-Memory Computing Technologies report is an in-depth examination of the global HTAP-Enabling In-Memory Computing Technologies’s general consumption structure, development trends, sales techniques, and top nations’ sales. The research looks at well-known providers in the global HTAP-Enabling In-Memory Computing Technologies industry, as well as market segmentation, competition, and the macroeconomic climate. A complete HTAP-Enabling In-Memory Computing Technologies analysis takes into account a number of aspects, including a country’s population and business cycles, as well as market-specific microeconomic consequences. The global market research also includes a specific competition landscape section to help you better understand the HTAP-Enabling In-Memory Computing Technologies industry. This information can help stakeholders make educated decisions before investing.

Leading players of HTAP-Enabling In-Memory Computing Technologies including:

Microsoft, IBM, MongoDB, SAP, Aerospike, DataStax, GridGain

Free Sample Report + All Related Graphs & Charts @ https://www.mraccuracyreports.com/report-sample/192510

The report is classified into multiple sections which consider the competitive environment, latest market events, technological developments, countries and regional details related to the HTAP-Enabling In-Memory Computing Technologies. The section that details the pandemic impact, the recovery strategies, and the post-pandemic market performance of each actor is also included in the report. The key opportunities that may potentially support the HTAP-Enabling In-Memory Computing Technologies are identified in the report. The report specifically focuses on the near term opportunities and strategies to realize its full potential. The uncertainties that are crucial for the market players to understand are included in the HTAP-Enabling In-Memory Computing Technologies report.

As a result of these issues, the HTAP-Enabling In-Memory Computing Technologies industry has been hampered. Because of the industry’s small number of important enterprises, the HTAP-Enabling In-Memory Computing Technologies area is heavily targeted. Customers would benefit from this research since they would be informed about the current HTAP-Enabling In-Memory Computing Technologies scenario. The most recent innovations, product news, product variants, and in-depth updates from industry specialists who have effectively leveraged HTAP-Enabling In-Memory Computing Technologies position are all included in this research study. Many firms would benefit from HTAP-Enabling In-Memory Computing Technologies research study in identifying and expanding their global demand. Micro and macro trends, important developments, and their usage and penetration across a wide variety of end-users are also included in the HTAP-Enabling In-Memory Computing Technologies segment.

The market analysis done with statistical tools also helps to analyze many aspects that include the demand, supply, storage costs, maintenance, profit, sales, and production details of the market. Furthermore, the global HTAP-Enabling In-Memory Computing Technologies research report provides the details about the HTAP-Enabling In-Memory Computing Technologies share, import volume, export volume, and the gross margin of the companies.

HTAP-Enabling In-Memory Computing Technologies Segmentation by Type:

.

HTAP-Enabling In-Memory Computing Technologies Segmentation by Application:

Large Enterprises(1000+ Users), Medium-Sized Enterprise(499–1000 Users), Small Enterprises(1–499 Users)

HTAP-Enabling In-Memory Computing Technologies report answers some key questions:

- What is the expected growth of global HTAP-Enabling In-Memory Computing Technologies after covid-19 vaccine or treatment is found?

• What are the new business practices that can be implemented post-pandemic to remain competitive, agile, customer-centric, and collaborative in the global HTAP-Enabling In-Memory Computing Technologies?

• Which specific sectors are expected to drive growth in the global HTAP-Enabling In-Memory Computing Technologies?

• What are key government policies and interventions implemented by leading global HTAP-Enabling In-Memory Computing Technologies countries to help further adoption or growth of HTAP-Enabling In-Memory Computing Technologies .

• How have the market players or the leading global HTAP-Enabling In-Memory Computing Technologies firms have addressed the challenges faced during the pandemic?

• What growth opportunities the global HTAP-Enabling In-Memory Computing Technologies offers?

Highlights of the Report:

- The report provides HTAP-Enabling In-Memory Computing Technologies industry demand trends in Q1 and Q2 2021.

• Individual circumstances of the HTAP-Enabling In-Memory Computing Technologies segments are discussed in the report.

• The report contains forward-looking information on risks and uncertainties.

• The report studies the consumer-focused sectors of the HTAP-Enabling In-Memory Computing Technologies.

• The trade scenarios of the products and services in particular segments are detailed in the report along with regulation, taxes, and tariffs.

• The trends that are impacting the HTAP-Enabling In-Memory Computing Technologies for past few years are discussed in the report.

• The report studies the potential impact of the Covid-19 pandemic on the HTAP-Enabling In-Memory Computing Technologies industry economy and performance of the market players in the same context.

Please click here today to buy full report @ https://www.mraccuracyreports.com/checkout/192510

Table of Content:

1 Scope of the Report

1.1 Market Introduction

1.2 Research Objectives

1.3 Years Considered

1.4 Market Research Methodology

1.5 Economic Indicators

1.6 Currency Considered

2 Executive Summary

3 Global HTAP-Enabling In-Memory Computing Technologies by Players

4 HTAP-Enabling In-Memory Computing Technologies by Regions

4.1 HTAP-Enabling In-Memory Computing Technologies Size by Regions

4.2 Americas HTAP-Enabling In-Memory Computing Technologies Size Growth

4.3 APAC HTAP-Enabling In-Memory Computing Technologies Size Growth

4.4 Europe HTAP-Enabling In-Memory Computing Technologies Size Growth

4.5 Middle East & Africa HTAP-Enabling In-Memory Computing Technologies Size Growth

5 Americas

6 APAC

7 Europe

8 Middle East & Africa

9 Market Drivers, Challenges and Trends

9.1 Market Drivers and Impact

9.1.1 Growing Demand from Key Regions

9.1.2 Growing Demand from Key Applications and Potential Industries

9.2 Market Challenges and Impact

9.3 Market Trends

10 Global HTAP-Enabling In-Memory Computing Technologies Forecast

11 Key Players Analysis

12 Research Findings and Conclusion

MR Accuracy Reports is the number one publisher in the world and have published more than 2 million reports across globe. Fortune 500 companies are working with us. Also helping small players to know the market and focusing on consulting.

Article originally posted on mongodb google news. Visit mongodb google news

Brokerages Anticipate MongoDB, Inc. (NASDAQ:MDB) to Announce -$0.10 Earnings Per Share

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Equities research analysts predict that MongoDB, Inc. (NASDAQ:MDB – Get Rating) will announce earnings of ($0.10) per share for the current fiscal quarter, Zacks reports. Five analysts have made estimates for MongoDB’s earnings. The lowest EPS estimate is ($0.12) and the highest is ($0.08). MongoDB posted earnings of ($0.15) per share during the same quarter last year, which indicates a positive year over year growth rate of 33.3%. The business is scheduled to announce its next quarterly earnings results after the market closes on Monday, January 1st.

Equities research analysts predict that MongoDB, Inc. (NASDAQ:MDB – Get Rating) will announce earnings of ($0.10) per share for the current fiscal quarter, Zacks reports. Five analysts have made estimates for MongoDB’s earnings. The lowest EPS estimate is ($0.12) and the highest is ($0.08). MongoDB posted earnings of ($0.15) per share during the same quarter last year, which indicates a positive year over year growth rate of 33.3%. The business is scheduled to announce its next quarterly earnings results after the market closes on Monday, January 1st.

According to Zacks, analysts expect that MongoDB will report full-year earnings of ($0.39) per share for the current fiscal year, with EPS estimates ranging from ($0.43) to ($0.33). For the next year, analysts forecast that the company will report earnings of $0.04 per share, with EPS estimates ranging from ($0.11) to $0.19. Zacks’ EPS averages are a mean average based on a survey of analysts that that provide coverage for MongoDB.

MongoDB (NASDAQ:MDB – Get Rating) last released its earnings results on Tuesday, March 8th. The company reported ($1.20) earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of ($1.25) by $0.05. MongoDB had a negative return on equity of 66.70% and a negative net margin of 35.12%. The business had revenue of $266.50 million during the quarter, compared to the consensus estimate of $243.42 million. During the same period last year, the business posted ($1.01) earnings per share. The business’s revenue for the quarter was up 55.8% on a year-over-year basis.

In crisis there’s opportunity and believe it or not – this is when investors can make the most amount of money.

Download your FREE Market Crash 2022 Profit Playbook and see the sectors most likely to hand you 16,000% or more gains over the next 36 months alone.

Simply click here to claim your report.

MDB has been the subject of a number of recent research reports. Needham & Company LLC decreased their target price on MongoDB from $626.00 to $362.00 and set a “buy” rating for the company in a research report on Wednesday, March 9th. Canaccord Genuity Group reduced their price target on MongoDB from $560.00 to $400.00 in a research report on Wednesday, March 9th. Barclays reduced their price target on MongoDB from $410.00 to $330.00 and set an “overweight” rating for the company in a research report on Friday, May 20th. Morgan Stanley reduced their price target on MongoDB from $475.00 to $378.00 and set an “overweight” rating for the company in a research report on Thursday, May 19th. Finally, Oppenheimer reduced their price target on MongoDB from $510.00 to $410.00 in a research report on Wednesday, March 9th. One investment analyst has rated the stock with a sell rating, one has given a hold rating and sixteen have issued a buy rating to the company’s stock. Based on data from MarketBeat.com, the company currently has a consensus rating of “Buy” and an average price target of $483.83.

NASDAQ:MDB traded up $17.00 during trading hours on Monday, reaching $250.06. The stock had a trading volume of 83,065 shares, compared to its average volume of 1,431,503. The company has a debt-to-equity ratio of 1.70, a quick ratio of 4.02 and a current ratio of 4.02. The stock has a 50 day simple moving average of $349.73 and a 200 day simple moving average of $407.40. MongoDB has a 12-month low of $213.39 and a 12-month high of $590.00. The stock has a market cap of $16.90 billion, a P/E ratio of -52.76 and a beta of 0.98.

In other news, CEO Dev Ittycheria sold 35,000 shares of the business’s stock in a transaction dated Thursday, May 5th. The stock was sold at an average price of $321.10, for a total value of $11,238,500.00. Following the completion of the sale, the chief executive officer now owns 204,744 shares of the company’s stock, valued at approximately $65,743,298.40. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, Director Dwight A. Merriman sold 14,000 shares of the company’s stock in a transaction that occurred on Monday, May 2nd. The shares were sold at an average price of $349.22, for a total value of $4,889,080.00. Following the transaction, the director now directly owns 1,323,384 shares of the company’s stock, valued at approximately $462,152,160.48. The disclosure for this sale can be found here. In the last three months, insiders sold 124,475 shares of company stock valued at $43,717,816. 5.70% of the stock is currently owned by corporate insiders.

A number of institutional investors and hedge funds have recently added to or reduced their stakes in MDB. Allspring Global Investments Holdings LLC purchased a new position in shares of MongoDB during the 4th quarter worth approximately $674,390,000. Norges Bank purchased a new position in shares of MongoDB during the 4th quarter worth approximately $277,934,000. TD Asset Management Inc. grew its holdings in shares of MongoDB by 153.9% during the 4th quarter. TD Asset Management Inc. now owns 525,000 shares of the company’s stock worth $277,909,000 after acquiring an additional 318,259 shares during the period. Jennison Associates LLC purchased a new position in shares of MongoDB during the 1st quarter worth approximately $113,395,000. Finally, 1832 Asset Management L.P. grew its stake in shares of MongoDB by 19.3% in the 1st quarter. 1832 Asset Management L.P. now owns 1,028,400 shares of the company’s stock worth $450,095,000 after buying an additional 166,400 shares during the last quarter. 88.70% of the stock is owned by institutional investors and hedge funds.

MongoDB Company Profile (Get Rating)

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Recommended Stories

Get a free copy of the Zacks research report on MongoDB (MDB)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to [email protected]

Should you invest $1,000 in MongoDB right now?

Before you consider MongoDB, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MongoDB wasn’t on the list.

While MongoDB currently has a “Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Article originally posted on mongodb google news. Visit mongodb google news