Month: July 2022

Russell 2000 Index, Dropbox Inc, MongoDB Inc, Akamai Technologies and more | Smartkarma

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

💡 Before it’s here, it’s on Smartkarma

Sign Up for Free

The Smartkarma Preview Pass is your entry to the Independent Investment Research Network

- ✓ Unlimited Research Summaries

- ✓ Personalised Alerts

- ✓ Custom Watchlists

- ✓ Company Data and News

- ✓ Events & Webinars

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

(VIANEWS) – The NASDAQ ended the session with MongoDB (MDB) jumping 5.19% to $312.42 on Friday while NASDAQ rose 1.88% to $12,390.69.

Volume

Today’s last reported volume for MongoDB is 1572130, 14.99% below its average volume of 1849500.

MongoDB’s last close was $297.01, 49.66% below its 52-week high of $590.00.

The company’s growth estimates for the current quarter and the next is 40% and 41.7%, respectively.

MongoDB’s Revenue

Year-on-year quarterly revenue growth grew by 55.8%, now sitting on 873.78M for the twelve trailing months.

Stock Price Classification

According to the stochastic oscillator, a useful indicator of overbought and oversold conditions,

MongoDB’s stock is considered to be oversold (<=20).

MongoDB’s Stock Yearly Top and Bottom Value

MongoDB’s stock is valued at $312.42 at 18:56 EST, way below its 52-week high of $590.00 and way above its 52-week low of $213.39.

MongoDB’s Moving Average

MongoDB’s worth is way above its 50-day moving average of $271.24 and way under its 200-day moving average of $397.38.

More news about MongoDB (MDB).

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Presented by MongoDB

“Identity is the new security perimeter,” says Shiv Ramji, chief product officer at Auth0. “Think about how many applications you logged into just this morning. All of those need a seamless, highly secure login experience.”

Ramji spoke about how mission-critical user identity and authentication has become during his fireside chat at at VB Transform 2022, “How to re-engineer global platforms for our multi-cloud reality.”

This issue today is that too many companies rely on custom integrations to implement secure login, single sign-on (SSO) and other identity needs across each of their touchpoints. From there, issues like inconsistencies in the user experience, which can create friction or even barriers for access, can creep in. And as customer identity (CIAM) technology has evolved, many also have struggled to easily add multi-factor authentication and passwordless or social login. And all those challenges together mean everything from lower conversion rates to security issues and increased developer costs.

Auth0, which was recently acquired by Okta, was built to meet these challenges for its customers. The platform currently powers login experiences for consumer and SaaS applications that are built from the start on the MongoDB developer data platform. Okta now serves more than 15,800 customers globally.

“As the company started scaling, we had to make sure that our login service can scale to billions of logins per month — we have customers with millions of consumers who are constantly logging in to access services,” Ramji says. “We have to be able to support that level of scale.”

The database is obviously not the only part of the stack. But it is the foundation, making it possible to more easily build the application and the database that powers it behind the scenes, end to end, with security best practices built in. Here’s a look at Auth0’s database journey.

Choosing a database layer

Choosing the right database provider has been key to the company’s success from the start. The database layer sits in a critical part of the Auth0 stack, as a piece of the platform’s authentication and authorization pipeline. Customers can be deployed in either a shared or multi-tenant environment, or in dedicated environments, depending on their needs and what makes sense for their architecture. The service was initially on AWS primarily, but they have also embraced Azure, and Ramji expects they will continue to expand.

“When we thought about the database technology that we were using or picking, we wanted to make sure we could use the same technology regardless of the cloud provider,” he says. “In the future, as customers demand support for other clouds, we should be able to support that with technology that works.”

The other areas in which their choice of database was critical were availability and geo-failover capabilities — especially given the SLA commitments they’ve made to their customers. And the last piece is scale.

“We wanted the database technology to be able to scale as our customers scale or as we scale. It was critical for us to work with a database technology that’s going to be able to scale,” he says. “And like any other SaaS platform, we’re always looking to have operational efficiencies, removing any undifferentiated heavy lifting that we’re doing, and working with vendors who can take that on for us.”

From self-managed to automation

Auth0 began with a self-managed solution, with MongoDB instances — and that became a bottleneck. Initially, when scaling with different geographies and customers, a big need was the ability to launch new environments. But the time for environment creation kept creeping up, until it was taking three or four months in some instances.

When Ramji joined Auth0, part of his goal was to methodically bring that down from three months to three weeks. He’s surpassed that goal. Recently, between replatforming their private cloud offering onto Kubernetes and adopting MongoDB Atlas, a fully managed database service, that time is now down to two hours.

“Just think about the orders of magnitude impact that we can have in terms of the ability to spin up new environments and meet our customers’ needs,” he said.

The operational burden on the engineering teams has lifted significantly, and now they’re able to meet their commitments to an RPO target of less than one minute, and an RTO target of less than 15 minutes. Atlas has also helped Auth0 embrace migrations as a core capability for its customers, which are constantly right-sizing their environments, launching in new geos or markets, and needing to spin up new environments and migrate customers over quickly.

“Some of our customers in the dedicated environment could have 30,000 tenants,” he said, “We want to be able to seamlessly move them over into a new environment. That was why we went down this route of moving to a managed service, so that we could serve our customers the way we want to.”

Meeting the challenges of migrations at scale

In large-scale migrations, with thousands of customers, who then have thousands of tenants, and then millions of consumers who are logging in, production scenarios are always a very delicate balance, Ramji said.

The first challenge was to right-size its large collections in its self-managed and self-hosted environments, because some of those services were storing far too much unnecessary data. From there, they ironed out the kinks in a staging environment before moving to the production environment. It took a tremendous amount of testing, and initially launching in smaller or lower traffic regions to lower the impact of any quirks. Eventually that progressive rollout strategy helped them grow skilled enough to make rollouts invisible to customers.

The MongoDB team helped Auth0 manage the process of replatforming and rolling out seamlessly, Ramji said, from developing a strategy and testing support to feedback on challenges and offering internal or external resources.

Best practices and lessons learned

Whether you’re beginning database migrations, or taking on a big platform re-architecture or modernization, there are some key things to keep in mind before you ever start. Lesson number one for Ramji was reframing the objective of the project to ensure executive buy-in. Rather than positioning it as a way to pay down the tech debt, which was slowing the company down, they looked at it as a way to unlock future value.

“We really made sure that the positioning of this was focused on customer value, as opposed to internal hurdles,” he explained. “In our case, future value means we can deploy to a new cloud, Azure. We can deploy features faster because we have parity across both deployment types.”

And secondly, when you’re taking on a big database migration, cut the problem down into smaller bites. For instance, Auth0 reduced the size of their collections before starting the migration, and made sure they had tested it in different environments before starting the production migration.

“And where we didn’t have the answers, we partnered with teams like MongoDB to ensure that if there were things we didn’t know, we were able to get the right contextual help that was required to do that,” Ramji said.

Learn more here about MongoDB Atlas, our multi-cloud developer data platform and try it free forever here.

Sponsored articles are content produced by a company that is either paying for the post or has a business relationship with VentureBeat, and they’re always clearly marked. Content produced by our editorial team is never influenced by advertisers or sponsors in any way. For more information, contact sales@venturebeat.com.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB Inc. (NASDAQ:MDB)’s traded shares stood at 1.15 million during the last session, with the company’s beta value hitting 0.95. At the close of trading, the stock’s price was $297.01, to imply an increase of 2.45% or $7.09 in intraday trading. The MDB share’s 52-week high remains $590.00, putting it -98.65% down since that peak but still an impressive 28.15% since price per share fell to its 52-week low of $213.39. The company has a valuation of $21.33B, with an average of 1.39 million shares in intraday trading volume over the past 10 days and average of 1.83 million shares over the past 3 months.

Analysts have given a consensus recommendation of an Overweight for MongoDB Inc. (MDB), translating to a mean rating of 2.00. Of 23 analyst(s) looking at the stock, 2 analyst(s) give MDB a Sell rating. 3 of those analysts rate the stock as Overweight while 3 advise Hold as 15 recommend it as a Buy. 0 analyst(s) have given it an Underweight rating. Estimates put the company’s current-quarter earnings per share at -$0.09.

3 Tiny Stocks Primed to Explode

The world’s greatest investor — Warren Buffett — has a simple formula for making big money in the markets. He buys up valuable assets when they are very cheap. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential.

We’ve set up an alert service to help smart investors take full advantage of the small cap stocks primed for big returns.

Click here for full details and to join for free.

Sponsored

After registering a 2.45% upside in the last session, MongoDB Inc. (MDB) has traded red over the past five days. The stock hit a weekly high of 323.00 this Thursday, 07/28/22, jumping 2.45% in its intraday price action. The 5-day price performance for the stock is -6.58%, and 6.70% over 30 days. With these gigs, the year-to-date price performance is -43.89%. Short interest in MongoDB Inc. (NASDAQ:MDB) saw shorts transact 4.12 million shares and set a 4.04 days time to cover.

Analysts on Wall Street suggest a consensus price target of $365.50, implying an increase of 18.74% to the stock’s current value. The extremes give us $270.00 and $500.00 for target low and target high price respectively. As such, MDB has been trading -68.34% off suggested target high and 9.09% from its likely low.

MongoDB Inc. (MDB) estimates and forecasts

Looking at statistics comparing MongoDB Inc. share performance against respective industry, we note that the company has outperformed competitors. MongoDB Inc. (MDB) shares are -15.52% down over the last 6 months, with its year-to-date growth rate higher than industry average at 54.24% against 3.20%. Revenue is forecast to grow 40.00% this quarter before jumping 41.70% for the next one. The rating firms project that company’s revenue will grow 35.20% compared to the previous financial year.

Revenue forecast for the current quarter as set by 14 analysts is $266.45 million. Meanwhile, for the quarter ending Jul 2022, a total of 14 analyst(s) estimate revenue growth to $277.85 million.

MDB Dividends

MongoDB Inc. has its next earnings report out between March 07 and March 11. However, it is important to take into account that this dividend yield ratio is just an indicator to only serve the purpose of guidance. Investors interested to invest in the stock should ponder company’s other fundamental and operations related aspects too. MongoDB Inc. has a forward dividend ratio of 0, with the share yield ticking at 0.00% to continue the rising pattern observed over the past year. The company’s average dividend yield trailing the past 5-year period is 0.00%.

MongoDB Inc. (NASDAQ:MDB)’s Major holders

MongoDB Inc. insiders hold 5.59% of total outstanding shares, with institutional holders owning 89.29% of the shares at 94.58% float percentage. In total, 89.29% institutions holds shares in the company, led by Price (T.Rowe) Associates Inc. As of Dec 30, 2021, the company held over 7.16 million shares (or 10.60% of shares), all amounting to roughly $3.79 billion.

The next major institution holding the largest number of shares is Capital World Investors with 6.53 million shares, or about 9.67% of shares outstanding. As of the market price on Dec 30, 2021, these shares were worth $3.46 billion.

We also have Growth Fund Of America Inc and Vanguard Total Stock Market Index Fund as the top two Mutual Funds with the largest holdings of the MongoDB Inc. (MDB) shares. Going by data provided on Feb 27, 2022, Growth Fund Of America Inc holds roughly 4.77 million shares. This is just over 7.06% of the total shares, with a market valuation of $1.82 billion. Data from the same date shows that the other fund manager holds a little less at 1.79 million, or 2.64% of the shares, all valued at about 945.81 million.

Article originally posted on mongodb google news. Visit mongodb google news

Database Maintenance Software Market to Register Exponential Growth During 2022 â?? 2028

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

The report highlights the current impact of COVID-19 on the Database Maintenance Software market along with the latest economic scenario and changing market dynamics. The Database Maintenance Software market Report is a comprehensive document containing key information on key players, market trends, price analysis and market overview for the forecast period. It consists of valuable information and an in-depth analysis of the major and minor factors, market share, major segments and regional analysis. The report also provides details of key competitors and their strategies such as mergers, acquisitions, recent technological developments and the business landscape.

The new research report on Database Maintenance Software market intends to offer a competitive edge to companies operating in this business sphere. It elaborates on the historical data of the overall market alongside major development trends impacting the industry remuneration.

The document evaluates the growth factors as well as opportunities defining the profitability graph of the market over the study duration. It also lists out the limitations & restraints inhibiting the business expansion.

Request Sample Copy of this Report @ https://www.altcoinbeacon.com/request-sample/83323

The study delivers a comparative assessment of the past and the prevailing market scenario in order to predict the growth rate during the forecast period. Apart from this, it also offers significant information regarding the impact of COVID-19 outbreak on the regional as well as the overall market in order to derive required methodologies amidst the pandemic.

Key information from the Table of Contents:

Product landscape

- Product range: On-Premise and Cloud Based

- Market share and revenues generated by each product type

- Predicted growth rate of every product variety listed over the analysis timeframe.

Application scope

- Application spectrum: Large Enterprises , SMEs ,By Company , Couchbase , SolarWinds , Oracle , IBM , Altibase , Microsoft , SAP , Teradata , Software AG , Amazon , Quickbase , Zoho , Airtable , Google , MongoDB ,By Region , North America , United States and Ca

- Data regarding the product demand as well as the market share held by every application type.

- Growth rate estimations for each application fragment during the estimated timeframe.

Regional landscape

- Regional segmentation: North America, Europe, Asia Pacific, Latin America, Middle East and Africa.

- Statistical information regarding revenues and total sales generated by all the regions mentioned.

- Growth rate each region is expected to record during the projected timespan.

Competitive arena

- Industry Sellers: Couchbase SolarWinds Oracle IBM Altibase Microsoft SAP Teradata Software AG Amazon Quickbase Zoho Airtable Google MongoDB By Region North America United States Canada Europe Germany France UK Italy Russia Nordic Countries Rest of Europe Asia-Pacific China Japan South Korea Southeast Asia India Australia Rest of Asia Latin America Mexico Brazil Rest of Latin America Middle East & Africa Turkey Saudi Arabia UAE Rest of MEA

- Analysis of market concentration ratio.

- Company and product portfolio coupled with the specifications and the respective applications of the listed products.

- Manufacturing capabilities of the key participants in their individual operational regions.

- Market share, sales graph and pricing patterns of each firm mentioned.

In a nutshell, the research report on Database Maintenance Software market provides granular assessment of the various segmentations while highlighting the supply chain and sales channels implemented by the major companies. Speaking of which, the research document also contains information regarding the raw materials and equipment used, distributors, suppliers and downstream users of this industry vertical.

Questions Answered in the Global Database Maintenance Software market Report:

Which are the five top players of the Global Database Maintenance Software market?

How will the Global Database Maintenance Software market changes during the forecast period?

Which product and application will take a share of the Global Database Maintenance Software market?

What are the drivers and restraints of the Global Database Maintenance Software market?

Which regional market will show the highest Global Database Maintenance Software market growth?

Table of Contents:

- Study Coverage

- Executive Summary

- Database Maintenance Software market Size by Manufacturers

- Database Maintenance Software market Production by Regions

- Database Maintenance Software market Consumption by Region

- Database Maintenance Software market Size by Type (2015-2025)

- Database Maintenance Software market Size by Application (2015-2025)

- Corporate Profiles

- Database Maintenance Software market Production Forecast by Regions

- Database Maintenance Software market Consumption Forecast by Region

- Value Chain and Sales Channels Analysis

- Market Opportunities & Challenges, Risks and Influences Factors Analysis

Request Customization on This Report @ https://www.altcoinbeacon.com/request-for-customization/83323

Article originally posted on mongodb google news. Visit mongodb google news

MMS • Matt Saunders

Article originally posted on InfoQ. Visit InfoQ

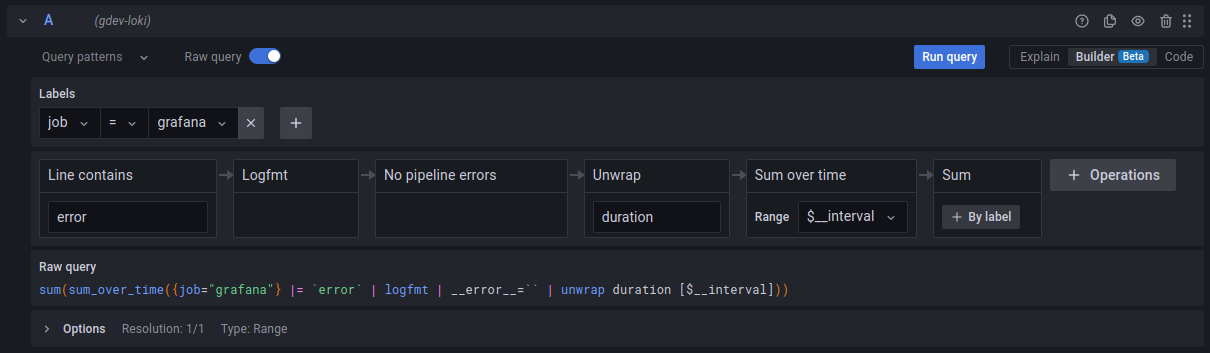

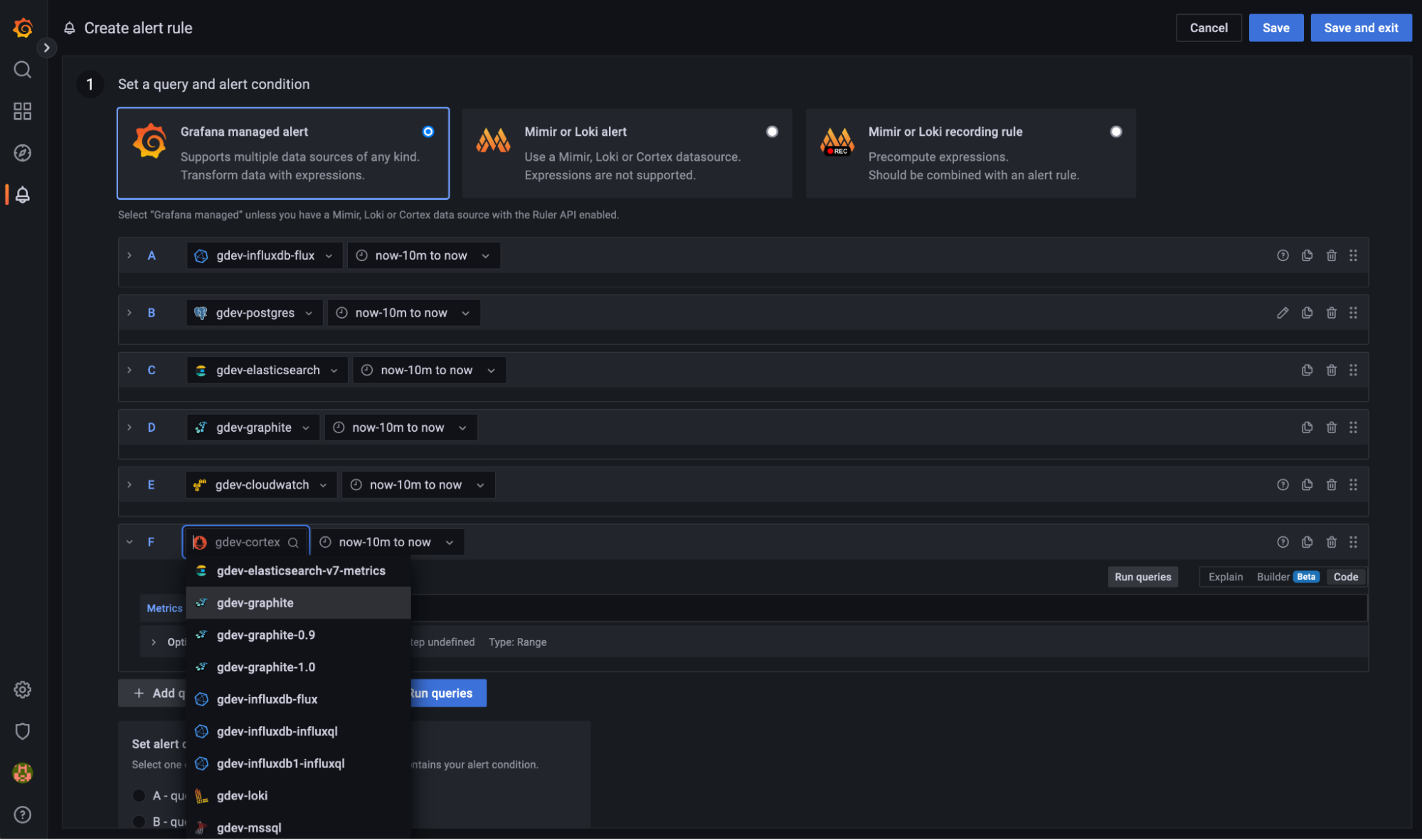

Grafana, an open-source graphing tool, has reached its version 9 release. The key goals behind version 9 are improving the user experience, making observability and data visualization easy and accessible, and improving alerting.

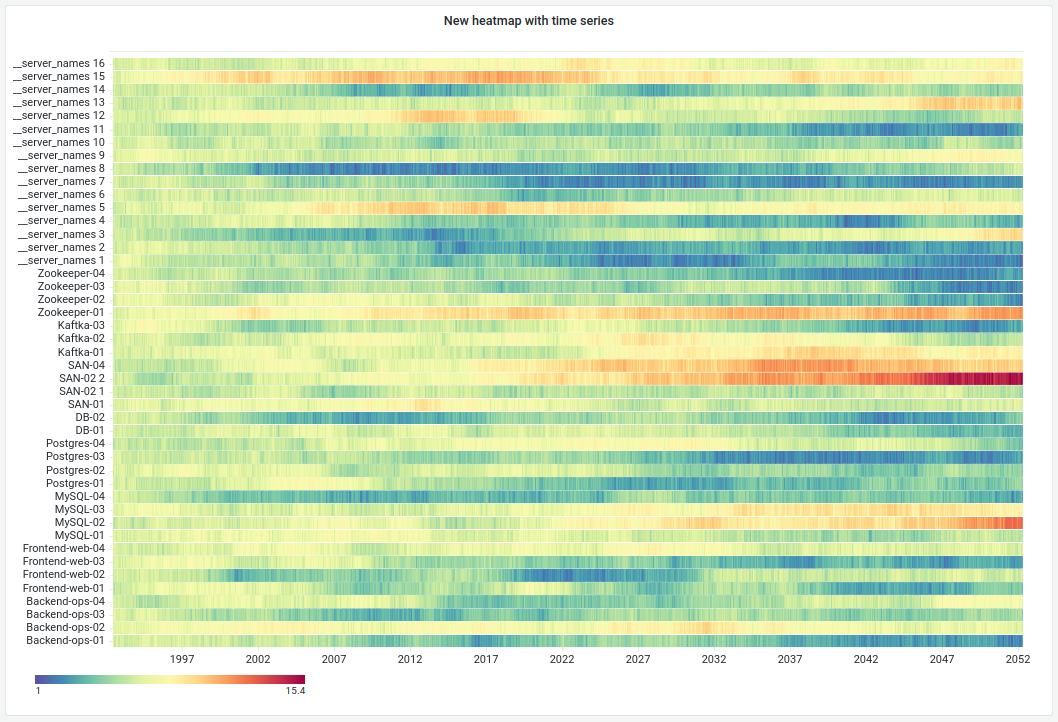

Visual query builders make their debut in Grafana 9, providing easier and more intuitive ways to discover and investigate data. These are for Prometheus, widely-adopted alerting and monitoring tool, and for Grafana Loki, Grafana’s own answer for log aggregation. A new dashboard panel also provides high-resolution histogram visualizations.

Previously, the only option for building queries in Grafana was through writing PromQL, which comes with a steep learning curve to write and understand, and this can be a daunting task for new users. The new visual query builder allows anyone to build queries with a visual interface, by choosing metrics through a searchable dropdown menu. This acts on both metrics and labels for maximum ease of use. The interface also allows a developer to switch between the builder and code modes without losing their changes.

Furthermore, an explore-to-dashboard workflow allows users to create dashboards directly from the “Explore” mode. This means that it’s now possible to create a desired view and save it as a dashboard without copy-and-pasting the query into the dashboard creation mode – removing much scope for errors.

Heatmap panel performance has been improved, and granular control over color palettes has been added to improve visualisation of data.

A command palette has been added – boosting productivity for those who prefer to work with the keyboard through easier key-based navigation and search.

Changes to the alerting experience, trialed as an option in earlier versions of Grafana, have now been made the default, leading to several improvements:

- Alerts are now streamlined and simplified across multiple data sources and Grafana deployments.

- Alerts are now available based on a single rule, regardless of whether they are tied to a specific panel or dashboard. This removes a limitation that was previously in place.

- Alerts can now be multi-dimensional – so a single alert can be triggered by more than one item triggering the rule.

- Grouping and routing of alerts are also improved, with notification policies allowing admins to bundle alerts together – preventing a potential storm of notifications when multiple alerts fire.

- Granular alert muting and silencing are also now possible, allowing admins to prevent notifications at certain times (such as weekends), and to turn off notifications for an already existent alert temporarily.

Finally, the Enterprise versions of Grafana come with further improvements. Reporting is improved with it now possible to add multiple dashboards to a single report and embed a static image from a dashboard in a report. Enterprise version 9.0 also contains enhancements to envelope encryption and to RBAC (role-based access control).

Grafana 9.0 is now available.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB, Inc. (NASDAQ:MDB – Get Rating) traded up 6.4% during mid-day trading on Wednesday . The company traded as high as $285.48 and last traded at $283.88. 9,476 shares were traded during trading, a decline of 99% from the average session volume of 1,499,249 shares. The stock had previously closed at $266.70.

Analyst Upgrades and Downgrades

A number of analysts recently issued reports on the stock. Needham & Company LLC raised their target price on shares of MongoDB from $310.00 to $350.00 and gave the stock a “buy” rating in a research report on Friday, June 10th. Piper Sandler decreased their target price on shares of MongoDB from $430.00 to $375.00 and set an “overweight” rating on the stock in a research report on Monday, July 18th. Mizuho decreased their target price on shares of MongoDB from $325.00 to $270.00 and set a “neutral” rating on the stock in a research report on Wednesday, May 18th. Morgan Stanley decreased their price target on shares of MongoDB from $378.00 to $368.00 and set an “overweight” rating on the stock in a report on Thursday, June 2nd. Finally, Oppenheimer decreased their price target on shares of MongoDB from $490.00 to $400.00 and set an “outperform” rating on the stock in a report on Thursday, June 2nd. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and sixteen have given a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of “Moderate Buy” and a consensus target price of $401.17.

MongoDB Stock Performance

The stock’s 50 day moving average price is $274.51 and its 200 day moving average price is $339.69. The company has a current ratio of 4.16, a quick ratio of 4.16 and a debt-to-equity ratio of 1.69. The firm has a market cap of $20.23 billion, a PE ratio of -61.37 and a beta of 0.91.

MongoDB (NASDAQ:MDB – Get Rating) last issued its earnings results on Wednesday, June 1st. The company reported ($1.15) EPS for the quarter, beating analysts’ consensus estimates of ($1.34) by $0.19. MongoDB had a negative net margin of 32.75% and a negative return on equity of 45.56%. The business had revenue of $285.45 million for the quarter, compared to the consensus estimate of $267.10 million. During the same quarter last year, the firm posted ($0.98) EPS. The business’s revenue for the quarter was up 57.1% compared to the same quarter last year. As a group, equities analysts forecast that MongoDB, Inc. will post -5.08 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, insider Thomas Bull sold 489 shares of MongoDB stock in a transaction on Tuesday, July 5th. The shares were sold at an average price of $264.45, for a total transaction of $129,316.05. Following the sale, the insider now owns 17,104 shares of the company’s stock, valued at approximately $4,523,152.80. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. In related news, Director Dwight A. Merriman sold 14,000 shares of MongoDB stock in a transaction on Monday, May 2nd. The shares were sold at an average price of $349.22, for a total transaction of $4,889,080.00. Following the sale, the director now owns 1,323,384 shares of the company’s stock, valued at approximately $462,152,160.48. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. Also, insider Thomas Bull sold 489 shares of MongoDB stock in a transaction on Tuesday, July 5th. The stock was sold at an average price of $264.45, for a total transaction of $129,316.05. Following the sale, the insider now directly owns 17,104 shares in the company, valued at approximately $4,523,152.80. The disclosure for this sale can be found here. Insiders have sold 77,185 shares of company stock valued at $23,594,636 in the last quarter. Company insiders own 5.70% of the company’s stock.

Institutional Investors Weigh In On MongoDB

Several hedge funds and other institutional investors have recently modified their holdings of the stock. Commerce Bank increased its position in shares of MongoDB by 1.7% in the 4th quarter. Commerce Bank now owns 1,413 shares of the company’s stock worth $747,000 after purchasing an additional 24 shares during the last quarter. Total Clarity Wealth Management Inc. boosted its holdings in shares of MongoDB by 6.9% in the 1st quarter. Total Clarity Wealth Management Inc. now owns 465 shares of the company’s stock valued at $206,000 after buying an additional 30 shares during the period. Profund Advisors LLC boosted its holdings in shares of MongoDB by 5.2% in the 4th quarter. Profund Advisors LLC now owns 647 shares of the company’s stock valued at $342,000 after buying an additional 32 shares during the period. Ieq Capital LLC boosted its holdings in shares of MongoDB by 2.3% in the 1st quarter. Ieq Capital LLC now owns 1,485 shares of the company’s stock valued at $659,000 after buying an additional 34 shares during the period. Finally, Wedbush Securities Inc. boosted its holdings in shares of MongoDB by 1.8% in the 1st quarter. Wedbush Securities Inc. now owns 2,253 shares of the company’s stock valued at $999,000 after buying an additional 40 shares during the period. Institutional investors own 88.70% of the company’s stock.

About MongoDB

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • Dylan Schiemann

Article originally posted on InfoQ. Visit InfoQ

The TypeScript team announced the release of TypeScript 4.8 beta and TypeScript 4.7, which introduces ES Module (ESM) support for Node.js, improved type inference and control flow analysis, and significant performance improvements.

Since ES6 introduced modules in 2015, work has been underway to move the JavaScript and TypeScript ecosystems to the native module format. Early usage was primarily limited to authoring, with build tools such as Webpack and transpilers such as TypeScript converting code to modules that would run in various environments.

As the module format has improved over the past few years, browsers natively support ESM loading and Node.js 16 now does as well. The TypeScript 4.7 release helps get us closer to a world where all JavaScript is authored and used as ESM.

Daniel Rosenwasser, TypeScript Program Manager, explains:

For the last few years, Node.js has been working to support ECMAScript modules (ESM). This has been a very difficult feature, since the Node.js ecosystem is built on a different module system called CommonJS (CJS). Interoperating between the two brings large challenges, with many new features to juggle.

TypeScript 4.7 adds two new module settings: node16 and nodenext. Through the use of package.json’s "type": "module", Node.js determines whether .js files are interpreted as ESM or CommonJS modules. ESM supports key features include import/export statements and top-level async/await.

Relative import paths with ESM need full file extensions in the path, and various techniques used by CommonJS modules are not supported such as top-level require and module.

Node.js supports two new file extensions for modules always of ESM or CJS, .mjs and .cjs, so TypeScript has added analogs, .mts and .cts.

These releases add more than just Node.js ESM support. Control-Flow Analysis for bracketed element access helps narrow the types of element accesses when the indexed keys are literal types and unique symbols. The --strictPropertyInitialization flag now checks that computed properties get initialized before the end of a constructor body.

TypeScript 4.7 also supports more granular type inference from functions within objects and arrays. New support for instantiation expressions allow for the narrowing of generics during instantiation.

TypeScript 4.8 adds many correctness and consistency improvements to the --strictNullChecks mode. Improvements to intersection and union types help TypeScript narrow its type definitions.

Also in TypeScript 4.8, the TypeScript tranpsiler can better infer types within template string types.

TypeScript transpiler improvements with --build, --watch, and --incremental reduce typical transpilation times by 10-25%.

These two releases added dozens of other improvements and bug fixes. Read the full release notes to learn more about each release.

The official release of TypeScript 4.8 is expected in mid-late August, in time for TypeScript turning 10 years old in October!

TypeScript is open-source software available under the Apache 2 license. Contributions and feedback are encouraged via the TypeScript GitHub project and should follow the TypeScript contribution guidelines and Microsoft open-source code of conduct.

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB, Inc. (NASDAQ:MDB – Get Rating) saw unusually large options trading activity on Wednesday. Investors purchased 36,130 call options on the stock. This is an increase of approximately 2,077% compared to the typical daily volume of 1,660 call options.

Insiders Place Their Bets

In other MongoDB news, Director Dwight A. Merriman sold 14,000 shares of MongoDB stock in a transaction on Monday, May 2nd. The shares were sold at an average price of $349.22, for a total transaction of $4,889,080.00. Following the sale, the director now owns 1,323,384 shares of the company’s stock, valued at approximately $462,152,160.48. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In other news, Director Dwight A. Merriman sold 14,000 shares of the stock in a transaction on Monday, May 2nd. The stock was sold at an average price of $349.22, for a total transaction of $4,889,080.00. Following the completion of the transaction, the director now directly owns 1,323,384 shares in the company, valued at approximately $462,152,160.48. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CEO Dev Ittycheria sold 35,000 shares of the stock in a transaction on Thursday, May 5th. The stock was sold at an average price of $321.10, for a total value of $11,238,500.00. Following the transaction, the chief executive officer now owns 204,744 shares of the company’s stock, valued at $65,743,298.40. The disclosure for this sale can be found here. Insiders have sold a total of 77,185 shares of company stock valued at $23,594,636 in the last 90 days. 5.70% of the stock is owned by insiders.

Hedge Funds Weigh In On MongoDB

Several hedge funds and other institutional investors have recently made changes to their positions in MDB. Confluence Wealth Services Inc. purchased a new stake in shares of MongoDB during the fourth quarter valued at $25,000. Bank of New Hampshire acquired a new position in shares of MongoDB in the first quarter worth about $25,000. Covestor Ltd purchased a new position in shares of MongoDB in the fourth quarter worth approximately $43,000. Cullen Frost Bankers Inc. acquired a new stake in shares of MongoDB during the first quarter valued at approximately $44,000. Finally, John W. Brooker & Co. CPAs acquired a new position in MongoDB in the 2nd quarter worth approximately $26,000. 88.70% of the stock is currently owned by institutional investors and hedge funds.

MongoDB Trading Up 2.4 %

NASDAQ:MDB opened at $297.01 on Friday. The firm has a market capitalization of $20.23 billion, a PE ratio of -61.37 and a beta of 0.91. The company has a debt-to-equity ratio of 1.69, a current ratio of 4.16 and a quick ratio of 4.16. MongoDB has a 12 month low of $213.39 and a 12 month high of $590.00. The business’s 50-day moving average is $274.51 and its two-hundred day moving average is $339.69.

MongoDB (NASDAQ:MDB – Get Rating) last issued its quarterly earnings data on Wednesday, June 1st. The company reported ($1.15) EPS for the quarter, topping analysts’ consensus estimates of ($1.34) by $0.19. MongoDB had a negative net margin of 32.75% and a negative return on equity of 45.56%. The firm had revenue of $285.45 million for the quarter, compared to analyst estimates of $267.10 million. During the same quarter in the previous year, the business posted ($0.98) EPS. The firm’s revenue was up 57.1% compared to the same quarter last year. Research analysts predict that MongoDB will post -5.08 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several analysts recently weighed in on the stock. Oppenheimer reduced their target price on shares of MongoDB from $490.00 to $400.00 and set an “outperform” rating on the stock in a report on Thursday, June 2nd. William Blair reissued an “outperform” rating on shares of MongoDB in a report on Tuesday, May 24th. UBS Group increased their price target on shares of MongoDB from $315.00 to $345.00 and gave the company a “buy” rating in a research note on Wednesday, June 8th. Mizuho decreased their price target on shares of MongoDB from $325.00 to $270.00 and set a “neutral” rating for the company in a research note on Wednesday, May 18th. Finally, Piper Sandler lowered their price target on MongoDB from $430.00 to $375.00 and set an “overweight” rating on the stock in a report on Monday, July 18th. One analyst has rated the stock with a sell rating, one has assigned a hold rating and sixteen have issued a buy rating to the stock. According to data from MarketBeat, the company has an average rating of “Moderate Buy” and an average target price of $401.17.

About MongoDB

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

MongoDB, Inc. (NASDAQ:MDB – Get Rating) was the target of some unusual options trading on Wednesday. Traders bought 36,130 call options on the company. This is an increase of approximately 2,077% compared to the average volume of 1,660 call options.

Insider Activity at MongoDB

In other news, CEO Dev Ittycheria sold 35,000 shares of MongoDB stock in a transaction dated Thursday, May 5th. The shares were sold at an average price of $321.10, for a total transaction of $11,238,500.00. Following the completion of the sale, the chief executive officer now directly owns 204,744 shares in the company, valued at $65,743,298.40. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. In other news, CEO Dev Ittycheria sold 35,000 shares of the company’s stock in a transaction dated Thursday, May 5th. The shares were sold at an average price of $321.10, for a total transaction of $11,238,500.00. Following the completion of the transaction, the chief executive officer now owns 204,744 shares of the company’s stock, valued at approximately $65,743,298.40. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, Director Dwight A. Merriman sold 588 shares of the firm’s stock in a transaction that occurred on Monday, July 11th. The stock was sold at an average price of $309.62, for a total transaction of $182,056.56. Following the completion of the sale, the director now directly owns 1,322,954 shares in the company, valued at $409,613,017.48. The disclosure for this sale can be found here. Insiders have sold a total of 77,185 shares of company stock valued at $23,594,636 over the last quarter. Insiders own 5.70% of the company’s stock.

Hedge Funds Weigh In On MongoDB

A number of hedge funds and other institutional investors have recently bought and sold shares of MDB. Confluence Wealth Services Inc. bought a new position in MongoDB during the fourth quarter worth about $25,000. Bank of New Hampshire bought a new stake in MongoDB in the 1st quarter valued at about $25,000. John W. Brooker & Co. CPAs bought a new stake in shares of MongoDB during the 2nd quarter valued at approximately $26,000. Prentice Wealth Management LLC bought a new stake in shares of MongoDB during the 2nd quarter valued at approximately $26,000. Finally, Venture Visionary Partners LLC bought a new position in MongoDB in the 2nd quarter valued at approximately $28,000. Institutional investors own 88.70% of the company’s stock.

Wall Street Analysts Forecast Growth

Several equities research analysts have commented on the company. Redburn Partners began coverage on MongoDB in a research note on Wednesday, June 29th. They set a “sell” rating and a $190.00 price target for the company. Robert W. Baird began coverage on shares of MongoDB in a research report on Tuesday, July 12th. They issued an “outperform” rating and a $360.00 price objective for the company. Morgan Stanley lowered their price objective on MongoDB from $378.00 to $368.00 and set an “overweight” rating for the company in a report on Thursday, June 2nd. Credit Suisse Group lowered their price objective on shares of MongoDB from $650.00 to $500.00 and set an “outperform” rating for the company in a research report on Thursday, June 2nd. Finally, Stifel Nicolaus lowered their price target on shares of MongoDB from $425.00 to $340.00 in a research report on Thursday, June 2nd. One equities research analyst has rated the stock with a sell rating, one has assigned a hold rating and sixteen have given a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of “Moderate Buy” and a consensus target price of $401.17.

MongoDB Price Performance

Shares of MDB stock opened at $297.01 on Friday. The firm has a market capitalization of $20.23 billion, a price-to-earnings ratio of -61.37 and a beta of 0.91. MongoDB has a 1 year low of $213.39 and a 1 year high of $590.00. The company has a current ratio of 4.16, a quick ratio of 4.16 and a debt-to-equity ratio of 1.69. The firm’s 50 day moving average is $274.51 and its 200-day moving average is $339.69.

MongoDB (NASDAQ:MDB – Get Rating) last announced its quarterly earnings data on Wednesday, June 1st. The company reported ($1.15) EPS for the quarter, topping analysts’ consensus estimates of ($1.34) by $0.19. The business had revenue of $285.45 million during the quarter, compared to analysts’ expectations of $267.10 million. MongoDB had a negative return on equity of 45.56% and a negative net margin of 32.75%. The firm’s quarterly revenue was up 57.1% compared to the same quarter last year. During the same period in the previous year, the firm earned ($0.98) earnings per share. Sell-side analysts forecast that MongoDB will post -5.08 EPS for the current fiscal year.

MongoDB Company Profile

MongoDB, Inc provides general purpose database platform worldwide. The company offers MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment; MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Stories

- Get a free copy of the StockNews.com research report on MongoDB (MDB)

- Can International Business Machines Recover After Its Sell-Off?

- Wingstop And Hershey Are Two Food Stocks Overcoming Inflation

- Ford Stock Rallies As EV Strategy Takes Center Stage

- Should High Yield Altria Be In Your Portfolio?

- Is Keurig-Dr. Pepper A Value Worth Buying?

Want More Great Investing Ideas?

- Bear Market Game Plan!

- The 10 Best Stocks to Own in 2022

- 7 Stocks to Buy and Hold Forever

- 3 Stocks to DOUBLE This Year

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news