Month: April 2023

MMS • RSS

Posted on nosqlgooglealerts. Visit nosqlgooglealerts

Sundry Photography

How long until usage trends start to move the other way?

Have you ever seen one of those rope bridges strung across a river in a jungle or high across a canyon. Scary as heck, at least for this writer. Investing in high growth IT shares these days reminds me of that as much as anything else. It is possible to see the objective on the other side, but the bridge, often made of plant material and a few slats of wood and rope, sways and seems terribly unsteady. And the bridge seems to sway in every breeze, and one can see storm clouds all around. Perhaps not the most comfortable of metaphors but in some regards a realistic description of the environment.

The storm clouds of April 25th seemed a bit more ominous than some. Consumer confidence down, UPS (UPS) forecasting weak results as consumer behavior changes for the worse and First Republic (FRC) continuing to unravel and needs another rescue. Within the tech space, Tenable (TENB) indicated that some of its expected deals didn’t close at the end of the quarter due to uncertainties created by the turmoil in the banking sector created by the failure of Silicon Valley. And then came earnings reports from Google (GOOG) (GOOGL) and Microsoft (MSFT) that suggested that the reports of the demise of the IT space have been exaggerated.

This is an article about MongoDB (NASDAQ:MDB), and not an article about macro conditions. But I want to acknowledge again, if it necessary to do so, that investing in Mongo, as well as any other high growth IT name is unlikely to work until investors are willing to look across the chasm and consider the very substantial opportunities for Mongo that are outlined in the balance of this article.

It ought to be obvious after the last 18 months that high growth IT stocks simply won’t work as investments in a risk off environment. And it also ought to be evident that in an environment with macro headwinds, the percentage growth of IT companies is likely to compress. Further, the level of growth expected from software companies whose model is based on usage is sensitive to macro headwinds. At this point, none of this is new or unknown, and yet when macro data is seen as disappointing, investors sell high growth IT shares, even when the companies have already acknowledged the changed environment and altered their forecasts accordingly.

I think that this is a good time to consider the shares of MongoDB – not because I doubt that the macro environment is deteriorating; the signs of that are too pervasive and substantial to ignore – but because the shares and the company’s forecast reflects that deterioration. Mongo dominates a high growth space, i.e. that of the NoSQL database. It has technology advantages and its strategy of appealing to developers as the platform of choice has resonated. I am not trying to forecast when the Fed Board will finally acknowledge that their demand destruction has gone far enough. I think it is a matter of months, if not less, but I surely do not know. Obviously fixed income traders who are bidding down yields substantially at the moment feel they have a good insight on the Fed pivot.

I surely don’t know when sentiment toward high growth IT shares is going to finally pivot. Perhaps when the Fed actually articulates a victory over inflation, or when it actually pivots on rates. It is easy to see just how toxic current sentiment is – there have been numerous surveys of investor sentiment, including those of both institutional and retail components, that make that point – which is why valuations in the space have continued to compress even when results are better for companies such as Mongo and turn out to be better than feared. It can be difficult and lonely to recommend the shares of a company such as Mongo that will be battling macro headwinds. But to me, the logical time to enter a position is when everyone is already negative and is suggesting that earnings reports should be black bordered and positioned next to the obituary page.

Mongo shares may not seem cheap now, and on some measures they aren’t. But if one looks across the proverbial chasm and dares to cross that flimsy bridge, I think a case can be made as to why the shares are far cheaper than might be surmised by some commentators. The aphorism popularized by the sage of Omaha, Warren Buffett, about being greedy when others are fearful ought to be in play here. I will discuss the valuation at the end of this article, but while currently, based on the company’s recent guidance, the shares have an EV/S ratio of about 9.5X, and the company has a modest free cash flow margin, in a recovery scenario the components of that EV/S ratio will change substantially, and the company’s free cash flow margin will grow several times.

In the last several years many IT companies have developed business models based on consumption, rather than seats. It is, I believe, a win/win situation. The users actually pay for the value they receive, and are not stuck buying seats that are often under-utilized and which represent a fixed cost that hurts in times of economic stress. And most of the time, a usage paradigm is going to reward vendors with higher revenue in return for some variability and uncertainty. Over the course of years, the vendors will most likely wind up with more revenue, and conceptually, at least, new users are easier to sell, knowing that their software bills will be part of opex and not capex and will relate to the actual value they are receiving from an application.

But for at least the last 9 months the paradigm has been troublesome for the vendors, although perhaps comforting for the users. There is a great debate amongst software analysts and investors as to when “cloud optimization” will abate and usage growth will start to resume traditional patterns.

Much as I might wish for it, I certainly don’t have some crystal ball that provides me with specific insights on the subject. Recently the analyst team at Morgan Stanley released the findings generated from its AlphaWise IT survey. I didn’t think the findings were earth shaking; the survey indicated, about 75% of the respondents said that 2023 would be a year of cloud optimization/digestion which is consistent with what vendors have been reporting for some quarters at this point. The MS analyst team said they were surprised that this cohort of respondents said they would reaccelerate their cloud spending next year, and were planning on having an increasing percentage of applications reside in the public cloud post optimization.

IT spending optimization initiatives are a consistent theme for users. And once they happen, usage growth returns simply because usage is like data, there is inevitably more of it. As applications get deployed, and become part of the operating fabric of an enterprise, and as users find new insights to be had from applications, usage rises. It is not as though there is some well of new optimizations – they are based almost entirely on remediating workflows that have become inefficient, and that is not something that is done as a consistent process.

Before diving in to some of the relevant details around MDB’s current and future outlook, I think the following quote from the CEO on the latest conference call is worth parsing.

Our principal focus is acquiring — or said another way new applications, which is the biggest driver of our long-term growth. In our market, it’s important to understand that the unit of competition is the workload, getting both new and existing customers to deploy new workflows in our data platform is our overarching goal. Once the world has been onboarded its consumption growth is not something we can meaningfully influence. Some workloads will grow faster than others depending on the underlying business drivers for their specific application, the macro environment, seasonality and other factors.

While we cannot control the rate of growth of existing workloads, we do know workloads typically grow over time. So as long as we keep acquiring new workloads at a healthy rate, we are well-positioned for the long run.

In a broad sense, it is not possible for vendors to greatly influence consumption. Over time, the usage of most apps/workloads is going to grow. It is my opinion that long term investors should try not to focus too much on consumption which has a cyclical component that is beyond the control of Mongo and other vendors with usage based models. It can be easier to simply focus on reported revenue growth and look at statistics relating to the percentage change in the various metrics related to sales performance on a quarterly basis. But to some extent those metrics are backward rather than forward looking.

In my opinion, the aspect of the business on which to focus is the growth of new applications. Some of those will create major revenue streams, others will have less of an impact. With that as a backdrop, which companies make best sense as investments looking ahead to next year in an improving environment for IT spending growth? There are, to be sure, many IT companies these days with usage models which will benefit from a return to usage growth and will also benefit as applications migrate to the public cloud. And there are a number of IT vendors who have been able to acquire new customers and sell additional functionality to existing customers even though the revenue growth from that success is less now than it was 2-3 quarters ago. There isn’t lots of history about how consumption tracks either during a recession, or in a recovery. The last real recession in the economy was more than a decade ago, and none of these companies existed at that time in meaningful form. What is available is the data that was recorded during the initial stages of the Covid-19 lockdown, and then the recovery from that impact, as work from home paradigms were created. The companies themselves were surprised at the rapid increase in usage at that time.

At this point, I am looking for companies not so much from the point of view of their specific usage trends in these quarters of macro headwinds, but at companies that continue to acquire new workloads and are selling their user base on using their services for new applications. In my opinion, one of the best such companies is MongoDB and that is the subject of the rest of this article.

Aren’t MongoDB shares expensive?

Valuation is always a fraught question in looking at high growth IT companies. A year or so ago, critiques centering on profitability were easy to write when looking at Mongo. Initially profitability was not a concern of most investors, and Mongo certainly wasn’t reporting any. I first wrote about MongoDB on the pages of SA way back in 2018. It has come a long way since that time. Back then, it had a non-GAAP operating loss margin of about 33% and its free cash flow margin was negative 16%. When I next wrote about the company last April, the shares had already fallen by about 35%, but more was to come. At that point, the non-GAAP operating loss margin was about 6%, and the company’ 12 month operating cash flow margin had recently reached break even. The shares most recently made a low in mid-November, falling by another 60%+. Since that time the shares have seen a bit of a rally, albeit from a very compressed level, and are now up more than 50%, although far below the level they were when I last wrote about the company.

Is that compression enough? Valuation compression by itself is not a reason to buy stocks. Mongo is a fairly controversial stock on SA with a neutral rating, but brokerage analysts have a much more positive evaluation with most ratings at buy, although the average price target of $253 is just 10% above the current price. The company was profitable in the latest fiscal year, and generated a modest level of free cash flow, and it is projecting about 5% non-GAAP operating margins in the current year.

The company has projected revenues of $1.51 billion for the current fiscal year which is growth of 17%. The consensus analyst projection as depicted by 1st call for the following fiscal year, at least as published, is for revenue growth of 19%. I doubt that anyone owning the shares or contemplating making an investment in MongoDB believes that 19% number although it accounts for the modest price objective of many covering analysts. Revenue growth for Mongo, at least in the short-term, is significantly correlated with usage. Usage growth has been pressured for Mongo since the summer of 2022. Has usage growth reached its nadir?

The company during its latest conference call held in early March indicated that usage growth had actually returned to “normal” in February, after falling short of expectations in December and February. Normal, however is not at the rates of early 2022, but the rates the company had seen in last fiscal year’s Q2-3.

Obviously reported revenue growth in the 2nd half of this year and in fiscal ’25 is going to depend on usage trends, and they are not really knowable in advance. My guess is that usage growth will start to return toward its long-term trend in 2024, although whether it can actually reach such a level and when is more or less imponderable. That said I will devote some space in this article as to why I think Mongo’s usage growth, and thus its revenue growth is probably underestimated by the consensus. In fact, my 3 year CAGR estimate for the company is in the mid-high 30% range, with a steady ramp in terms of non-GAAP margins and free cash flow generation.

If one looks at Mongo shares solely based on historical data, or even the company’s projection for this current year, the shares still look expensive-although the forecast, like many other forecasts by high growth IT companies, appears to be de-risked. The current EV/S was 9.5X on April 25, and relative to average valuations these days, that isn’t a particular bargain. (Mongo shares are highly volatile and I picked the point at which I had finished writing this article as the date on which to compute the EV/S ratio). And 6% free cash flow margin is not a standout either. If one, however, looks at the growth opportunities, and the improving margin, an opposite conclusion is reached, and that is the one I think is most likely.

Why is Mongo still growing rapidly?

First of all, it isn’t AI. Or at least not directly AI. The company’s conference call last month was one of the few held by an IT vendor that didn’t include a mention of growth headwinds from AI. I am a firm believer in the AI revolution. I have written about it on SA, with an article on MSFT somewhat recently. But the reality is that the proliferation of AI applications have been going on for years now. What is new, is the emergence of generative AI, and the attention this has garnered for the technology. AI itself has been inside many applications for some time now – Salesforce (CRM) has offered Einstein and IBM (IBM) has offered Watson for more than 5 years. All of the modern cyber security companies have used AI for years to identify anomalies and potential breaches. There is, perhaps, some thought that the popularization of AI will lead to more workloads for Mongo – but that is a weak correlation. Mongo is not, and is not likely to be an “AI stock” and much as AI is revolutionary at some level, this is not the stock for readers looking to invest in that technology.

But that said, there are a few answers to the question as to why MongoDB is likely to remain in hyper growth mode, once the current economic environment changes, and will be in that mode for years to come. At the most basic level, Mongo offers a non-SQL database, which has tremendous advantages compared to the relational database model that has been in use for about 50 years. Relational databases simply can’t provide the performance necessary to ensure end users have a reasonable experience. Mongo has been, is, and will continue to be a company focused on developers. Developers find relational data base technology difficult to work with. The technology doesn’t really cope with unstructured data and it was never meant for use with internet workloads that require massive scaling over a brief time period. And, the dominant vendor in the space, Oracle (ORCL), is well known for aggressive and intrusive sales practices and contract terms. The database space was ripe for disruption when Mongo emerged offering its non-SQL technology.

That said the relational database market is enormous. While Oracle no longer reports relational database revenue explicitly, the relational market alone is apparently worth $70 billion in annual revenues. The market for non-SQL databases is still smaller than the market for legacy technology but growing several times faster – the linked analysis suggests a CAGR of 30% for the next several years. And Mongo is the dominant company in that space with a market share of 45%. Oracle does, of course, have an offering, MySQL, which it acquired when it acquired Sun in 2010. It exists, but is not an effective competitor in the space for users outside the Sun/Oracle ecosystem.

As management has stated many times, the real measure of growth for Mongo is that of workload acquisition. Not all workloads will have similar usage. New workloads are being continuously envisaged and constructed. Mongo’s percentage revenue growth has obviously declined. A year ago, before macro headwinds impacted usage trends substantially, the company was growing revenues by 57%. At that time, it noted that a small part of its business was being impacted by macro headwinds that had trimmed 1 percentage point from the sequential growth of Atlas, these days its dominant product offering. Last quarter revenue growth was 36%. Its forecast for revenue growth this fiscal year is 17%. The 17% forecast reflects a continuation, but not a further deterioration of the usage trends the company has experienced the last couple of quarters. The company’s forecast for its fiscal Q1 reflects the heightened slowdown from consumption over the holiday period. It also reflects the fact that Q1 has 3 fewer days than Q4, and that will obviously impact consumption revenue. In addition, the full year 17% growth forecast reflects a significantly smaller contribution from growth of what is called Enterprise Advanced, the company’s initial product. EA has had several quarters of growth that has been above trend; the company is forecasting that EA comparisons will be constrained because of these elevated year earlier period. Because Enterprise Advanced has a subscription/seat based pricing model, the current accounting conventions call for a substantial component of upfront revenue recognition, so changes in EA deployments have more substantial revenue impacts in the short-term than the growth in the company’s Atlas, cloud product.

I think everyone interested in, or invested in Mongo shares is well aware of this reported growth deceleration. What may not be as well appreciated is that through this time, new customer acquisition has remained at strong levels, and has not deteriorated as might be expected if there were existential demand issues. Specifically, the company’s direct sales customers, who are those with the highest level of contract value, have been increasing at 500/quarter over the past year. The smaller customers, which are best represented by the growth of Atlas users have been rising by about 1700/quarter, just slightly below trends earlier in 2022.

New customers are being sold as part of a paradigm of workload acquisition. There has been no real slowdown in workload acquisition, but workload acquisition impacts revenue over time as applications get written, deployed and go into production. So, not all of the new workload acquisition activity is reflected in usage/revenue thus far in 2023.

Another major source of growth relates to migration of users from their legacy relational database model to Atlas. That is something that has been going on consistently for some time now, but it is more of a focus for MDB in an environment in which concerns abound that it will be more difficult to secure required approvals for projects to launch new workloads. Last year, Mongo introduced what it calls its Relational Migrator which includes an enhanced user interface and what is described as a data synch engine. The version of Migrator that customers can directly use is scheduled for availability later this year.

Last quarter the CEO indicated that a growth focus for MDB has been its search capability. Like most other IT vendors, one of the ingredients to sustained high growth is to offer users solutions in adjacencies. In the case of Mongo, one of the adjacencies of choice currently is search. There are, of course, other adjacencies one of which is called Time Series which is a specialized variant of the standard data base solution offered by the company. Time series supports additional use cases, as well.

It is hard as an analyst to know precisely what percentage growth expectations investors have for Mongo these days. Certainly far greater than what is in the published consensus. Mongo growth will probably exceed trends when the current climate of macro headwinds abates.

I am not about to hazard a guess as to exactly when that will be. Anecdotally, I have heard of some suggestions that the deceleration in usage growth has seemingly abated – not reversed, but abated. That said, most observers will be laser-focused on exactly what the cloud hyper-scalers have to say on the subject – although by now, it should be obvious that the exact correlation between hyper-scaler cloud usage and usage for Mongo’s Atlas is nothing like one for one.

What will Mongo’s revenue growth look like in a recovery scenario? Anything I say here has to be considered a guess. I don’t imagine that Mongo can return to 57% growth, either next year, or in the foreseeable future. On the other hand, I would be surprised if Mongo didn’t grow faster than the forecast of industry analysts for market growth of 30%. It is enjoying some success pushing into adjacencies that are not considered in market growth, and the company has been, and is likely to continue to take share in its market. I do think in recovery quarters its percentage revenue growth rate will scrape the 40% level. As long as the company continues its focus on acquiring workloads/use cases, it prospects to remain a hyper growth vendor remain strong.

When commentators write that Mongo shares are overvalued – and there are of course many such commentators – they overlook the likely growth upswing during a recovery and choose instead to focus on the current state of the IT space and its effect on Mongo’s growth. It is simply a backward, as opposed to a forward looking methodology in evaluating high growth shares, and not one that I choose to follow.

Competition

While Mongo may have been a pioneer in developing and popularizing a non-SQL database, there are of course many competitors. All of the hyperscalers are in the market and have been for years now. I have linked here to a 3rd party analysis of competitors; I didn’t find anything in this analysis or others publicly available that was particularly useful in evaluating how product features were impacting competition.

I am not going to try to address all of the functional advantages offered by Mongo. For as long as I have followed the database market it has been characterized by an avalanche of claims with regards to features and functions, and that remains the case. In most cases, trying to evaluate all of the claims will not result in a better investment conclusion. I certainly do not purport to be some kind of expert on the technology of the database market; I know just enough to conclude that Mongo has a desirable set of offerings that allow it to win over the key developer community.

The reason Mongo has been increasing its market share is the same one that has been in evidence for years; developers prefer to use Mongo and they continue to be the major proponents of Mongo in its largest accounts. Over time, and in many cases, the influence of developers often leads to Mongo becoming a standard, but this is a lengthy and involved process. It would appear that despite macro headwinds this paradigm is still in evidence.

Mongo also competes with some very specialized point products such as companies who offer a database exclusively for a particular workload such as that of time series referenced above. In the current environment, there is some vendor consolidation occurring, and Mongo has been a beneficiary of that trend. The company maintains that something similar has been occurring with regards to the company’s search functionality, where developers use the Mongo platform to enable an application built on the company’s database and search functionality. It is not something that the company has quantified, and I am not altogether sure that it can be quantified, but it is another factor that leads me to conclude that Mongo will be able to grow at rates above the market in a less hostile macro environment.

Mongo has an offering in the space known as serverless data bases. This is just now becoming a mainstream technology, but will almost inevitably become a greater proportion of total database installations because of its advantages in terms of cost and architectural factors. Mongo is likely to enjoy competitive success here, and it is part of the company’s evolution to address the many corners of the database market.

It has been said by some that Mongo shares are primarily held by its community of developers. While that is probably apocryphal – 93% of Mongo shares are held by institutions and another 3.5% of the shares are held by insiders leaving very little to be held by individual investors. On the other hand, Mongo’s developers are an enthusiastic and vocal community and the company caters to them, and this paradigm has become a virtuous circle, and is likely to remain so, given management’s priorities.

Mongo’s Profitability Pivot – Is it fast enough?

What was sound corporate strategy a year ago simply will not satisfy investors in the current environment. Mongo is profitable… barely, and it is generating a bit of cash. The question relates to the planned cadence of profitability improvement. The company is forecasting a 100 bps improvement in non-GAAP operating margins this year. That rate of improvement is, no doubt, a sticking point for some investors, and is certainly less than the profitability improvements being forecast by most other high growth IT vendors.

Overall, while Mongo has been able to avoid layoffs, it is reducing its hiring and the overall growth of its opex. Part of the issue that is embedded in the conservative cadence of opex margin improvement that has been forecast were a couple of factors that helped results in the last fiscal year, and which are unlikely to recur this year. These are most notably the stronger growth in Enterprise Advanced, which has a front-loaded revenue recognition model, and the revenue recognized in Q4 from unused contractual commitments. In turn, this has led to the company forecasting high teens revenue growth, which constrains the cadence of operating margin improvement. Overall, Mongo is forecasting opex expense growth in the low-mid teens range which includes merit increases and some selective hiring.

Many IT vendors are facing the vexing question how to size their business during this time of macro headwinds, while ensuring their choices to not hobble growth in a recovery. I am not sure that there is a single right answer to that kind of Hobson’s choice. Writing about Mongo and its shares at the end of April, I imagine that most stakeholders and potential shareholders are aware of the company’s decisions, and this less than average increase in non-GAAP operating margins is already baked into the valuation.

Mongo uses stock based compensation. Last quarter, stock based compensation was 27% of revenues compared to 26% of revenues the prior year. I look at dilution as the actual cost of stock based comp as opposed to the results of using the Black Scholes formula. Dilution last quarter was 0.87%. I have used slightly more than 3.5% dilution for the current year in calculating valuation. Given the expected decrease in hiring rates this year, I expect that SBC expense ratios will decline, although it takes longer for that to feed through into weighted average shares.

Gross margins were 73% of revenue last quarter compared to 69% of revenues the prior year. Mongo’s non-GAAP gross margins have improved, but are still being constrained by the rapid growth of Atlas which has an entirely ratable revenue recognition model. Last quarter, as mentioned, gross margins were above trend, because of the recognition of previously unutilized contractual usage commitments.

Last quarter did see some opex ratio improvements, but this business model has a long way to go before it reaches levels that most would find reasonable. Sales and marketing costs were about 42% of revenue last quarter on a non-GAAP basis compared to 44% of revenue in the prior year period. Research and development expense was 19% of revenue last quarter, compared to 19.5% of revenue a year ago, and general and administrative expense was about 8.4% of revenue compared to 9% of revenue the prior year. Overall, non-GAAP opex was 70% of revenue in this latest quarter, significantly less than the 76% of revenue reported in the year earlier period. About half of the improvement in the ratios was apparently a result of the revenue recognition of the previously unbilled commitments.

The company’s free cash flow can be influenced by the level deferred revenue generated by its Enterprise Advanced non-cloud offering. Over time, as Atlas becomes even more the dominant revenue source, changes in deferred revenue will diminish as a driver of free cash flow. The increase in deferred revenues fell last quarter from the year earlier level which was something of a record for Enterprise Advanced bookings/renewals. Last quarter, free cash flow rose about 15% year on year; free cash flow growth was constrained because of a substantial rise in receivables. The company’s full year free cash flow margin was negative I expect free cash flow margins to be in the range of 5%-6% this year as it should track the improvement in non-GAAP operating margins and, in addition, is not likely to see a continued increase in receivables.

Wrapping Up – Mongo’s valuation and the case to own the shares

I started this article by saying it isn’t about macro trends. That said, it is worth noting that the usage issue, and cloud optimization has been somewhat resolved with Microsoft’s earnings release and guidance, and to a lesser extent by the release of Google’s numbers showing sustained growth of GCP revenues. I wrote earlier in the article about anecdotal data points that suggested that the most aggressive cloud optimization effects were beginning to abate – not reverse – but abate. And so it now seems to be confirmed by 2 of the 3 large public cloud vendors.

At this point, Mongo’s EV/S ratio of just greater than 9.4X (based on the closing price of 4/25) is above average for its growth cohort. But that is essentially a measure of macro headwinds, and a couple of factors unique to MDB’s revenue. If cloud optimization is now at a peak, then growth estimates for Mongo are far too low for its FY ’25 year. It is going to be one of the single most significant beneficiaries of a return to less painful conditions in the enterprise IT space as its usage model will drive substantial upside to what the current published consensus suggests. While the company’s current profitability forecast and free cash flow generation are certainly not at a level that investors find acceptable, trends in profitability and cash flow generation are highly correlated with the trajectory of revenue growth.

In the article I focused on why the company is winning, and why it ought to continue to grow more rapidly than its core market, that of NoSQL databases. I think understanding the company’s workload acquisition strategy is a key tenet in supporting my buy recommendation for the shares. While Mongo has competition, it has continued to increase its market share in its core market, and to grow even more rapidly by starting to sell solutions in adjacencies such as search. And I reiterated my belief that Mongo’s focus on the developer community was resonating in the market.

I have made the point several times that Mongo shares are unlikely to perform well consistently until investor sentiment pivots to a more risk-on mode. And I make no forecast as to when that pivot really happens; while I would like to believe that the results of Microsoft, and to an extent Google might ultimately impact investor sentiment, I suspect that there is still lots of fear, uncertainty and doubt to overcome.

Mongo should be on a short list for investors willing to look across the chasm and to invest in an IT recovery. It is not for the risk adverse, or for those focused on stock based compensation as reported. While investing in something seemingly as mundane as data base technology doesn’t have the pizzazz of investing in the generative AI space, there is likely some correlation between Mongo workloads, and applications built using generative AI. But not enough to make that a pillar of the investment case.

I am willing to look across the chasm, knowing that despite the quarterly reports of two hyper-scalers there are still macro headwinds. It is on that basis that I believe that Mongo will generate positive alpha over the next year, and that the current valuation provides investors with an attractive entry point.

Nisa Investment Advisors LLC Increases Holdings in Tech Champion MongoDB by … – Best Stocks

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

In an age where technology is king, it’s no surprise that a company like MongoDB, Inc. (NASDAQ:MDB) is making waves. With its development and provision of a general-purpose database platform, the company has captured the attention of investors everywhere. And now, Nisa Investment Advisors LLC has announced that it grew its holdings in MongoDB during the fourth quarter of last year by a whopping 1,746.4%!

According to the most recent disclosure with the Securities & Exchange Commission, Nisa’s holdings in MongoDB were worth $2,035,000 as of their most recent filing. This news is sure to turn some heads and trigger murmurs among those interested in investing in this rapidly growing company.

MongoDB has built an esteemed reputation for itself through its products such as MongoDB Enterprise Advanced, MongoDB Atlas and Community Server. The company also offers professional services including consulting and training. Its founder Eliot Horowitz and co-founder Dwight A have been instrumental in developing platforms that have made it easier for companies to store data more efficiently.

However, this announcement from Nisa comes on the heels of several equities analysts commenting on shares of MongoDB. While Piper Sandler reiterated an “overweight” rating and set a $270.00 price objective on shares of MongoDB earlier this year, The Goldman Sachs Group reduced their price objective from $325 to $280.

Royal Bank of Canada restated an “outperform” rating and issued a $235 target price on shares while Barclays reduced their ratings from $264 to $257 with an “overweight” rating.

Despite these fluctuations in opinion from various firms across Wall Street- Tigress Financial reissued a “buy” rating and issued a $365 price objective on shares signalling good news for existing shareholders or investors looking to dip their toes into the market.

With twenty-one analysts giving MDB stock a buy rating out of twenty-four total ratings according to data from Bloomberg; there’s plenty of confidence that MongoDB will continue to blaze trails in the years ahead.

In conclusion, the world is developing more complex data sets and complex insights. For a company like MongoDB, Inc., who provides top-notch database solutions, it seems like sunny days are ahead as data continues to become the lifeblood of progress for businesses worldwide.

Changes in Institutional Investors & Insiders Sell-off Raises Concerns for MongoDB Inc.

MongoDB, Inc. has seen changes in the positions of several institutional investors and hedge funds, a trend that has been on the rise. As per legal filings with Securities & Exchange Commission (SEC), Sentry Investment Management LLC purchased a new stake worth $33,000 in MongoDB shares during Q3 2020; Lindbrook Capital LLC grew its position by 350% valuing at $34,000 during Q4 2020; Alta Advisers Ltd purchased a new position in MongoDB valued at $40,000 during Q3 2020; Huntington National Bank raised its holdings by 1,468.8% to $50,000 from an additional acquisition of 235 shares in the last quarter of 2020; Quent Capital LLC managed to lift its position by nearly four times in Q4 2020 resulting in owning about $79,000 worth of shared from MongoDB.

Shockingly however on Monday April 3rd this year Dev Ittycheria who is the CEO of the company sold a total of 49,249 shares valuing at $11,206,609.95 through SEC filings indicating there could an underlying problem within the internal functioning of the company which could potentially spook shareholders as corporate insiders own around 5.7% of the company’s stock.

MongoDB operates primarily as a developer and provider of general-purpose database platforms such as MongoDB Enterprise Advanced and Community Server among others whilst also providing professional services including consulting and training with Eliot Horowitz and Dwight A being some of its founders.

The firm’s prices currently trade within NASDAQ under ticker MDB at a value slightly higher than at opening on Thursday May 6th coming up to $238.22 per share with a quick ratio and current ratio both totaling to approximately to about roughly 3.80 showing evidence that they are financially stable despite negative net margins recorded consistently over recent quarters.

Since reporting earnings results on Wednesday March 8th an EPS value of $-0.98 that beat consensus estimates by around 20 cents was recorded with it’s revenue close to the consensus estimate. Research analysts seem unphased and anticipate a $-4.04 EPS for investors to expect for the current year.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

/*! elementor – v3.11.3 – 07-03-2023 */

.elementor-heading-title{padding:0;margin:0;line-height:1}.elementor-widget-heading .elementor-heading-title[class*=elementor-size-]>a{color:inherit;font-size:inherit;line-height:inherit}.elementor-widget-heading .elementor-heading-title.elementor-size-small{font-size:15px}.elementor-widget-heading .elementor-heading-title.elementor-size-medium{font-size:19px}.elementor-widget-heading .elementor-heading-title.elementor-size-large{font-size:29px}.elementor-widget-heading .elementor-heading-title.elementor-size-xl{font-size:39px}.elementor-widget-heading .elementor-heading-title.elementor-size-xxl{font-size:59px}

Article originally posted on mongodb google news. Visit mongodb google news

MMS • Ben Linders

Article originally posted on InfoQ. Visit InfoQ

Many approaches to software architecture assume that the architecture is planned at the beginning. Unfortunately, architecture planned in this way is hard to change later. Functional programming can help achieve loose coupling to the point that advance planning can be kept to a minimum, and architectural decisions can be changed later.

Michael Sperber spoke about software architecture and functional programming at OOP 2023 Digital.

Sperber gave the example of dividing up the system’s code among its building blocks. This is a particularly important kind of architectural decision to work on different building blocks separately, possibly with different teams. One way to do this is to use Domain-Driven Design (DDD) for the coarse-grain building blocks – bounded contexts:

DDD says you should identify bounded contexts via context mapping – at the beginning. However, if you get the boundaries between the contexts wrong, you lose a lot of the benefits. And you will get them wrong, at least slightly – and then it’s hard to move them later.

According to Sperber, functional programming enables late architecture and reduces coupling compared to OOP. In order to defer macroarchitecture decisions, we must always decouple, Sperber argued. Components in functional programming are essentially just data types and functions, and these functions work without mutable state, he said. This makes dependencies explicit and coupling significantly looser than with typical OO components. This in turn enables us to build functionality that is independent of the macroarchitecture, Sperber said.

Sperber made clear that functional programming isn’t “just like OOP only without mutable state”. It comes with its own methods and culture for domain modelling, abstraction, and software construction. You can get some of the benefits just by adopting immutability in your OO project. To get all of them, you need to dive deeper, and use a proper functional language, as Sperber explained:

Functional architecture makes extensive use of advanced abstraction, to implement reusable components, and, more importantly, supple domain models that anticipate the future. In exploring and developing these domain models, functional programmers frequently make use of the rich vocabulary provided by mathematics. The resulting abstractions are fundamentally enabled by the advanced abstraction facilities offered by functional languages.

InfoQ interviewed Michael Sperber about how our current toolbox of architectural techniques predisposes us to bad decisions that are hard to undo later, and what to do about this problem.

InfoQ: What are the challenges of defining the macroarchitecture at the start of a project?

Michael Sperber: A popular definition of software architecture is that it’s the decisions that are hard to change later. Doing this at the beginning means doing it when you have the least information. Consequently, there’s a good chance the decisions are wrong.

InfoQ: What makes it so hard to move boundaries between contexts?

Sperber: It seems in the architecture community we have forgotten how to achieve modularity within a bounded context or a monolith, which is why there’s this new term “modulith”, implying that a regular monolith is non-modular by default and that its internals are tightly coupled.

InfoQ: So you’re saying we don’t know how to achieve loose coupling within a monolith?

Sperber: Yes. This is because the foundation of OO architecture is programming with mutable state i.e. changing your objects in place. These state changes make for invisible dependencies that are hard to see and that tangle up your building blocks. This does not just affect the functional aspects of a project, but also other quality goals.

InfoQ: Can you give an example?

Sperber: Let’s say you choose parallelism as a tactic to achieve high performance: You need to choose aggregate roots, and protect access to those roots with mutual exclusion. This is tedious work, error-prone, hard to make fast, and increases coupling dramatically.

InfoQ: What’s your advice to architects and developers if they want to improve the way that they take architectural decisions?

Sperber: Even if you can’t use a functional language in your project, play with the basics of functional programming to get a feel for the differences and opportunities there. If you’re new to FP, I recommend the How to Design Programs approach to get you started – or DeinProgramm for German speakers.

There are also two books on software construction with functional programming:

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Nisa Investment Advisors LLC grew its holdings in MongoDB, Inc. (NASDAQ:MDB – Get Rating) by 1,746.4% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 10,340 shares of the company’s stock after purchasing an additional 9,780 shares during the period. Nisa Investment Advisors LLC’s holdings in MongoDB were worth $2,035,000 as of its most recent filing with the Securities & Exchange Commission.

Nisa Investment Advisors LLC grew its holdings in MongoDB, Inc. (NASDAQ:MDB – Get Rating) by 1,746.4% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 10,340 shares of the company’s stock after purchasing an additional 9,780 shares during the period. Nisa Investment Advisors LLC’s holdings in MongoDB were worth $2,035,000 as of its most recent filing with the Securities & Exchange Commission.

Several other institutional investors and hedge funds have also made changes to their positions in MDB. Sentry Investment Management LLC purchased a new stake in shares of MongoDB in the third quarter valued at approximately $33,000. Lindbrook Capital LLC grew its position in shares of MongoDB by 350.0% during the 4th quarter. Lindbrook Capital LLC now owns 171 shares of the company’s stock worth $34,000 after buying an additional 133 shares in the last quarter. Alta Advisers Ltd purchased a new position in shares of MongoDB during the third quarter valued at $40,000. Huntington National Bank raised its holdings in shares of MongoDB by 1,468.8% in the third quarter. Huntington National Bank now owns 251 shares of the company’s stock valued at $50,000 after acquiring an additional 235 shares in the last quarter. Finally, Quent Capital LLC lifted its position in shares of MongoDB by 372.9% in the 4th quarter. Quent Capital LLC now owns 402 shares of the company’s stock worth $79,000 after purchasing an additional 317 shares during the period. 84.86% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, CEO Dev Ittycheria sold 49,249 shares of MongoDB stock in a transaction that occurred on Monday, April 3rd. The shares were sold at an average price of $227.55, for a total transaction of $11,206,609.95. Following the completion of the transaction, the chief executive officer now directly owns 222,311 shares of the company’s stock, valued at approximately $50,586,868.05. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. In other MongoDB news, Director Dwight A. Merriman sold 14,095 shares of the stock in a transaction that occurred on Wednesday, March 1st. The stock was sold at an average price of $206.95, for a total transaction of $2,916,960.25. Following the transaction, the director now owns 1,227,954 shares in the company, valued at $254,125,080.30. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Dev Ittycheria sold 49,249 shares of the firm’s stock in a transaction that occurred on Monday, April 3rd. The shares were sold at an average price of $227.55, for a total value of $11,206,609.95. Following the completion of the sale, the chief executive officer now directly owns 222,311 shares in the company, valued at $50,586,868.05. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 112,901 shares of company stock worth $24,616,177. Corporate insiders own 5.70% of the company’s stock.

Analyst Upgrades and Downgrades

A number of equities analysts recently commented on the stock. The Goldman Sachs Group reduced their price objective on shares of MongoDB from $325.00 to $280.00 and set a “buy” rating for the company in a research note on Thursday, March 9th. Piper Sandler reiterated an “overweight” rating and set a $270.00 price objective on shares of MongoDB in a research note on Thursday, March 9th. Royal Bank of Canada restated an “outperform” rating and issued a $235.00 target price on shares of MongoDB in a research note on Thursday, March 9th. Barclays reduced their price target on MongoDB from $264.00 to $257.00 and set an “overweight” rating on the stock in a research report on Thursday, March 9th. Finally, Tigress Financial reissued a “buy” rating and issued a $365.00 price objective on shares of MongoDB in a research report on Thursday, April 20th. Three equities research analysts have rated the stock with a hold rating and twenty-one have assigned a buy rating to the company’s stock. According to data from MarketBeat, the stock currently has an average rating of “Moderate Buy” and an average price target of $256.00.

MongoDB Price Performance

NASDAQ:MDB opened at $238.22 on Thursday. The firm’s fifty day moving average is $217.27 and its two-hundred day moving average is $197.28. The firm has a market cap of $16.68 billion, a price-to-earnings ratio of -47.27 and a beta of 1.07. The company has a debt-to-equity ratio of 1.54, a quick ratio of 3.80 and a current ratio of 3.80. MongoDB, Inc. has a one year low of $135.15 and a one year high of $390.84.

MongoDB (NASDAQ:MDB – Get Rating) last issued its earnings results on Wednesday, March 8th. The company reported ($0.98) EPS for the quarter, topping analysts’ consensus estimates of ($1.18) by $0.20. The firm had revenue of $361.31 million for the quarter, compared to the consensus estimate of $335.84 million. MongoDB had a negative return on equity of 48.38% and a negative net margin of 26.90%. Research analysts expect that MongoDB, Inc. will post -4.04 EPS for the current year.

MongoDB Profile

MongoDB, Inc engages in the development and provision of a general-purpose database platform. The firm’s products include MongoDB Enterprise Advanced, MongoDB Atlas and Community Server. It also offers professional services including consulting and training. The company was founded by Eliot Horowitz, Dwight A.

Featured Articles

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB – Get Rating).

Receive News & Ratings for MongoDB Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for MongoDB and related companies with MarketBeat.com’s FREE daily email newsletter.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

What happened

For good or for bad, the state of the economy has dominated the headlines in recent months and has been the primary market driver thus far in 2023. Market watchers and the Federal Reserve alike have been watching closely for signs of an impending recession, and while talk of a mild downturn has increased in recent weeks, investors have been hopeful for a so-called “soft landing,” with the economy sidestepping a recession. However, the quarterly results of a couple of prominent cloud providers gave the clearest indication yet that the expected downturn may yet be avoided.

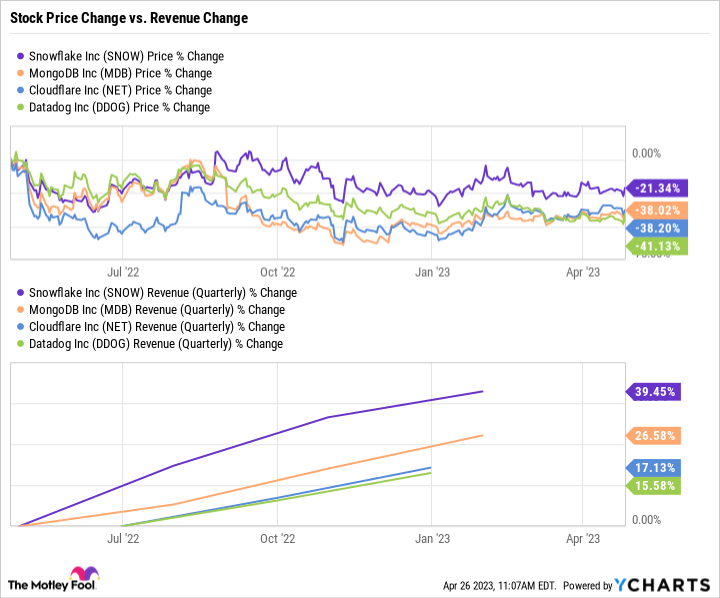

With that as a backdrop, Cloudflare (NET 3.87%) rose 5.2%, Snowflake (SNOW 9.29%) climbed 8.1%, MongoDB (MDB 13.38%) jumped 11.2%, and Datadog (DDOG 12.07%) rallied 14% as of 11:10 a.m. ET on Wednesday.

A check of all the usual sources — regulatory filings, earnings results, and changes to analysts’ targets — turned up nothing in the way of company-specific news driving these cloud stocks higher today. This seems to support the conclusion that investors are reacting to the possibility that the economy might actually be headed for better days and the worst of the bear market could be in the rearview mirror.

Image source: Getty Images.

So what

Minutes from the April meeting of the central bank’s Federal Open Market Committee, released earlier this month, revealed that Fed officials believe the economy will likely experience a brief recession later this year. The potential for a recession, however brief, led to fears that businesses would further rein in spending, which would weigh on growth in cloud computing.

However, quarterly results released by cloud infrastructure leaders Microsoft and Alphabet were more robust than expected, which seemed to dispel those concerns — at least for now — giving investors a much-needed dose of confidence, and sending a number of stocks in the cloud sector higher.

After the market close on Tuesday, Microsoft reported the results for its fiscal 2023 third quarter (which ended March 31). The tech giant delivered revenue of $52.9 billion, up 7% year over year. The growth was even better when excluding the impact of foreign currency exchange rates, growing 10% in constant currency. That strength continued to the bottom line: Earnings per share (EPS) of $2.45 rose 10%, or 14% in constant currency. For context, analysts’ consensus estimates were calling for revenue of $51 billion and EPS of $2.24, so Microsoft surpassed expectations with ease.

Alphabet’s results were also better than anticipated. For the first quarter, the Google parent generated revenue of $69.8 billion, up 3% year over year, or 6% in constant currency. Alphabet’s EPS of $1.17 slipped 5%, but the company cited a one-time charge of $2.6 billion related to job cuts as the culprit. Market watchers were expecting revenue of $68.9 billion and EPS of $1.31, so it was a mixed bag.

Still, the results were better than many expected, helping to buoy many companies in the cloud sector and helping push the tech-centric Nasdaq Composite into positive territory on Wednesday morning.

Data by YCharts

Now what

It’s important to note that while investor sentiment is rosy today, the market is only one negative report away from further declines, as the final chapter on this economic story has yet to be written and stocks will likely remain volatile for the foreseeable future.

Veteran investors know full well that calling a bottom is hard, if not impossible. There’s good news, however. As illustrated in the above chart, each of these companies has continued to grow revenue over the past year, even as their stock prices have trended lower. Once the economy stabilizes, which it no doubt will, Wall Street will reward companies that have proven their mettle during uncertain times — and this quartet of stocks clearly meets that criteria.

There is, of course, the matter of valuation to consider. While none of these stocks is necessarily cheap, they are trading at a significant discount to their recent highs. Snowflake, Cloudflare, MongoDB, and Datadog are currently selling for 12 times, 11 times, 9 times, and 9 times next year’s sales, respectively, when a reasonable price-to-sales ratio is generally between 1 and 2. That said, valuation shouldn’t be viewed in a vacuum and investors frequently award a higher valuation to companies with continued strong revenue growth — particularly in the face of economic headwinds.

For investors expecting to hold their shares for at least three to five years, these stocks represent an intriguing opportunity, and could generate impressive gains over time.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Cloudflare, Datadog, Microsoft, MongoDB, and Snowflake. The Motley Fool has positions in and recommends Alphabet, Cloudflare, Datadog, Microsoft, MongoDB, and Snowflake. The Motley Fool has a disclosure policy.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Investing is like trying to make the perfect batch of cookies: Start with a good recipe, try to keep the right ingredients ready, and be ready to spend some time on it. Stick to the recipe, dodge any unexpected challenges, and let the whole process run its course, and you’ll end up with something sweet.

And if you don’t have a good time in the kitchen, you can always pick up some macaroons or shortbread masterpieces from the bake sale at the park with the extra cash you earned from these great tech stocks — I won’t tell.

On that note, let’s grab some annual statements and a stick of lightly salted butter. I know you’re just here for the dough, but it’s time to bake up some tech stock snickerdoodles.

The Trade Desk: Advertising in the age of algorithms

First, I’ll give you a taste of The Trade Desk (TTD -3.40%), an adtech company that helps advertisers place their ads across various media channels. When this company does a good job, its clients get more business results from a lower marketing budget. Unsurprisingly, this idea is popular during a tough economy, like the inflation-based downturn we’re living through right now.

What sets The Trade Desk apart is its self-service platform that uses algorithms to select the best location for an ad. Companies are expected to spend a whopping $348 billion on advertising in the U.S. alone in 2023, giving The Trade Desk a tremendous opportunity to benefit from this growing market. Its long-term growth strategy includes expanding its global presence, continuing to grow its connected-TV opportunity, and innovating and improving its technology offering.

Over 1,000 clients have spent more than $20,000 on this company’s services. More than 95% of these customers renewed their arrangements in 2020, 2021, and 2022. That’s some impressive customer loyalty — is The Trade Desk handing out free cookies to committed clients?

Of course, I jest, but loyal customers’ business value is real. While The Trade Desk’s valuation might make some investors hesitate, with a lofty valuation of 58 times forward earnings, its impressive cash reserves and industry-defining market position make it a strong contender for investors with a long-term time horizon.

And as if The Trade Desk’s self-service ad platform isn’t enough to entice investors, the company’s multifaceted growth strategy is exciting for the long haul.

The Trade Desk is expanding its global presence in some of the world’s biggest economies, like China, India, and Indonesia. Plus, the company is a trailblazer in addressing the sector-wide technical challenges of online user tracking by developing a tool called Unified ID 2.0, already approved in the U.S. and currently going through approval processes in the European Union. This system lets The Trade Desk continue to sell privacy-respecting but targeted advertising without relying on third-party tracking cookies, which are slowly but surely being phased out by all major web browsers over the next year or so.

With these forward-looking strategies, The Trade Desk is set to keep dominating the adtech market for years to come.

The connected TV market is still in its early innings, and the full-on transition from billboards and untargeted cable TV ads to digital advertising has a long way to go. However, while the overall digital advertising market has slumped, The Trade Desk continues to bake up a storm, and its stock price has skyrocketed as a result.

With its innovative platform, impressive customer retention rates, and long-term growth strategy, The Trade Desk is a top software stock worth considering for the long haul.

MongoDB: This isn’t your grandpa’s database system

Next up is MongoDB (MDB -4.93%), a company that offers a multicloud database platform for developers. It’s a leader among next-generation NoSQL databases.

Let me nerd out on NoSQL databases, just for a second. Unlike traditional SQL databases, where data is stored in precisely defined tables, NoSQL databases like MongoDB use a more flexible, document-based approach. This makes them better suited for managing modern, unstructured data types like social media posts, images, and sensor readings.

Many databases can be hosted in the cloud, but MongoDB’s Atlas lets users choose exactly where the cloud database lives. It supports the leading cloud computing services, direct installation on the hardware in your data center, and any mix-and-match combination. It’s like mixing chocolate chips and peanut butter — it just works! This flexibility sets MongoDB apart from its competitors and gives it a real edge in the market.

MongoDB’s next-generation database design is also a perfect fit for modern businesses dealing with lots of messy data inputs.

Thanks to its flexible technology and firmly established leadership in the $45 billion market for operational database systems, MongoDB has many opportunities to gain share in many key markets in the years to come.

The company has a large developer base and a uniquely flexible range of deployment options. Its long-term growth strategy includes expanding its Atlas platform, growing its partnership network, and expanding its offerings to support a wider range of data workloads. Like The Trade Desk, this company is doing strong business in spite of a weak economy.

A lofty valuation might worry some investors — shares are changing hands at 147 times forward earnings and 12 times trailing sales. Even so, MongoDB’s ongoing pivot to sustained profits, on top of a more-than-solid market position, make it an intriguing pick for long-term investors.

You can’t go wrong with The Trade Desk and MongoDB

Investing is all about sticking to the recipe. You’ll be rewarded with a sweet treat if you’re patient and ready to improvise when the eggs are too cold or the butter’s too soft. In this case, you’re baking up a couple of tasty software stocks that can stand the test of time.

So whether you’re interested in The Trade Desk’s self-service marketing platform or MongoDB’s multicloud database solutions, both of these software stocks should stay sweet for decades to come.

Article originally posted on mongodb google news. Visit mongodb google news

MMS • RSS

Posted on mongodb google news. Visit mongodb google news

Apps & Software

This year certainly started off better than last year, but over the past 16 months the Dow Jones industrials are down almost 8%, the S&P 500 over 12% and the Nasdaq a stunning 13%. Despite a solid rally to start the year, we are still just treading water, and we could be poised for a big sell-off after what has been a classic bear market rally.

While conservative growth and income investors can buy stocks with big dividends or guaranteed money markets, which could be at 5% soon, what are aggressive growth investors to do at what seems like a difficult impasse? One good idea now is cloud software stocks that have been battered and could be poised to shoot higher in the second half of this year.

A new Goldman Sachs research report focuses on three cloud software companies that, despite nasty headwinds over the past year, look poised to take off over the balance of calendar 2023. All three have been pounded and are offering outstanding entry points. Goldman Sachs noted this in its extensive report on the three consumption software stocks:

Based on our conversations, investors have generally been more cautious on consumption names in the last 12 months due to the less-predictable nature of revenue relative to recurring models such as ServiceNow or Workday, particularly against a worsening macro-backdrop. While we have maintained the position that software is a growth-cyclical industry and consumption names are most likely to lead us on the way down due to real-time revenue recognition and higher susceptibility to customers’ end-market performance, the opposite also holds true if we see stabilization or incremental improvement to the macro-environment.

While still cautious, the analysts are looking ahead and also noted this:

From our perspective, we believe that the consumption peers may be among those furthest along in setting achievable fiscal year guidance targets relative to our broader coverage given pronounced revenue deceleration (30-40 pp.), still healthy backlogs and new logo wins, and management teams factoring for no incremental improvement to operating conditions through the remainder of the year. Better alignment between management guidance and buy-side expectations at the start of 2023 could set the stage for better stock performance for the consumption models.

Note that economic worries and tightening budgets are accelerating a move to consumption pricing, which charges software customers based on how much they use a product rather than a recurring annual or multiyear subscription fee.

While these three stocks are Buy rated at Goldman Sachs, it is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Article originally posted on mongodb google news. Visit mongodb google news

Article: Respect. Support. Connect. The Manager’s Role in Building a Great Remote Team

MMS • Kinga Witko

Article originally posted on InfoQ. Visit InfoQ

Key Takeaways

- Mindfulness at work is not just about individual benefits, it is also about creating a more mindful society and working environment. When we practice mindfulness, we are better equipped to solve the challenges that face us as an industry.

- Remote working comes with a unique set of challenges that can make it difficult for some people to adjust – one of the best daily routines is a virtual coffee – a short daily meeting open for everybody – but not mandatory. You can come, bring coffee or food and just hang around with other people. In such a friendly setup it’s easier to find out that we like similar things, read good books and are fun to work with.

- It’s important to make a virtual office accessible for everybody- from the right tech gear, like laptops or tablets with good internet connections, to ground rules on how to interact efficiently within a team.

- In the workplace, it is important to understand and respect the different personality types of our colleagues. We may not always understand or agree with their approach, but it is important to recognize that everyone has their preferences, strengths, and weaknesses.

- The times when a boss dictates what to do and how to do it are gone. Modern companies require working together with a team and guiding people on their development paths.

The industry is changing, and our perception is changing. We have people working in different time zones; we build diverse teams.

As managers, we also face challenges in terms of needs, accessibility, gender, nationalities, and other conditions that influence our teams and working environments. We cannot build projects based on Excel sheets only, not considering peoples’ preferences and options for personal growth. We need to see real people – even if we meet them in a virtual working environment only.

Remote working challenges

The past three years have brought us to a different reality, in which we can easily choose the most productive place, suitable working hours, and remote employers. Most of us no longer have to stay 8 – 9 hours at the office, but can provide the service from our own homes.

Remote working comes with a unique set of challenges that can make it difficult for some people to adjust.

It doesn’t have to be “work from home” per se, but also connecting from different offices, time zones, or countries, living the life as a digital nomad, or being able to work from anywhere when life circumstances force you to do so.

Unfortunately, it comes with a set of challenges that employees face daily in their professional environment. The most common are:

- Isolation – remote workers may feel isolated and disconnected from their colleagues, which can affect their motivation and job satisfaction.

- Communication – different time zones, languages, tools, and habits.

- Distractors – such as family members needing attention, construction work around, loud noises, etc. – I don’t claim that it is easy to focus in the office open space – but it is easier to separate the private from the professional while working.

When the pandemic started, my colleagues from different countries around the world began to work from their homes, and we found it really attractive to compare our background noises. I heard some exotic animals, music that was new to me, the sound of never-ending traffic horns, and crying babies. On the other side, my “listeners” started to recognize my cat’s noises, as he usually would start to meow incredibly loud just after I would launch a meeting.

Online meeting challenges

My team and I, all spread around the globe, wanted to be connected with the team in real-time. On a daily basis, some of the teammates just exchanged asynchronous messages on chat. They knew one another from their picture in Teams and have never had the opportunity to talk.

Have you ever tried to do a retrospective meeting with people located in four different time zones? I had this crazy idea of waking some of them up at 3 AM my time and not letting some of them fall asleep at 10 PM their time. We had one common session with food and fun and it helped us to shape a real team, not just co-workers.

One of my favourite daily routines is a virtual coffee – a short daily meeting open for everybody – but not mandatory. You can come, bring coffee or food and just hang around with other people. In such a friendly setup it’s easier to find out that we like similar things, read good books and are fun to work with.

It is a completely different situation when you meet somebody in person and then you cooperate with her/him remotely. If you only know somebody from Teams or Zoom, it is extremely hard to create a bond and trust.

What is most fun about this? Did you notice that people in Teams are the same height? When you then meet somebody in person, it might be quite a shocking experience. I had a chance to meet my leader after a couple of months of working together online only. In Teams we were talking face-to-face and eye-to-eye, when in real life it turned out that he was almost 50 cm taller than I am, and he needed to sit to have a normal conversation with me. Funny, isn’t it?

When you lead a team, it is not enough to get information from the team – it is also your role to connect them with one another. I must say, this required stepping out of our comfort zones (and sometimes bed early in the morning) from the entire group, but in the end, they didn’t mind.

Making the virtual office accessible to every team member

It is important to set ground rules for communication and make everybody aware of them.

- Set a time for the everyday meetings (daily or synchro) that suits everyone. If it’s not possible, give people at least a chance to meet online from time-to-time. Be mindful when it comes to time zones.

- If you go for lunch or you are not available – mark it in your calendar or communicator – be transparent and require the same from other people in the project.

- Use separate communication channels to separate daily business from chatting. It’s important to have space for both, but not to mix them.

- Make it clear how the team communicates – whether it’s just Teams/Zoom/Slack, or you use emails as well – what is the preferred response time? And check if everybody is okay with that.

To make the virtual office accessible to every team member, there are a few things you can do:

Make sure everyone’s got the right tech gear, like laptops or tablets with good internet connections, so they can connect to the virtual office from wherever they are. Next, make sure everyone knows how to use the virtual office software, like Zoom or Slack or whatever you’re using. Maybe run some training sessions or create some tutorials.

Moreover, be open to different communication styles – some folks might prefer video calls, while others might prefer messaging.

In one of my projects, I had a developer who never showed his face in the meetings with the group. He used an avatar and was quite a mysterious person to the rest of the team. On the other hand, in one-on-one sessions, I was able to see him live. Some people might think it’s weird, but he probably had reasons behind it, so we respected it.

Lastly, make sure everyone knows they can reach out for help if they’re having any issues connecting to or using the virtual office. Accessibility is all about making sure everyone’s included, so do what you can to make sure everyone feels like they’re part of the team, whether they’re in the same room or on the other side of the world! My favourite tip: when at least one person is not in the same room, everybody connects from their desktops – not from the conference room. It improves sound quality and allows participation in the discussion on the same terms as everyone else.

Mindfulness at work

Mindfulness is often described as the practice of purposely bringing one’s attention to the present-moment experience without evaluation. This simple definition, however, belies the profound impact that mindfulness can have on our lives.

Research has shown that being mindful can bring a wide range of benefits, from reducing stress and anxiety to improving focus and memory. It can also help us to build better relationships, as it enables us to be more attuned to the needs and perspectives of people around us.

On the other hand, mindfulness is not just about individual benefits, it is also about creating a more mindful society and working environment. When we practice mindfulness, we become more compassionate and understanding, and we are better equipped to solve the challenges that face us as an industry.

To practice mindfulness, you can start small, as we did in my team. For example, we exchange some yoga practices that help us be in better connection with our bodies. We also stay close to one another, we check on others’ feelings and moods and don’t cross our boundaries. It all makes us a team – not a group of co-workers.

Personality types help to better understand and respect people

We all come from different backgrounds, have different experiences, and possess unique personalities, and it is these differences that make us who we are.

In the workplace, it is important to understand and respect the different personality types of our colleagues. We may not always understand or agree with their approach, but it is important to recognize that everyone has their preferences, strengths, and weaknesses. By respecting these differences, we can work together more effectively, and create a more harmonious work environment.

Thomas Erikson’s book “Surrounded by Idiots” is a total game-changer when it comes to understanding personality types! The book argues that there are four main personality types – red, blue, yellow, and green – and that knowing someone’s type can help us understand how they think, feel, and behave.

For example, if you know someone’s blue, you might understand that they’re detail-oriented and like to plan things out in advance, while a Yellow might be more spontaneous and enjoy taking risks. This knowledge can help us communicate with others in a way that’s more effective and respectful.

By understanding someone’s personality type, we can also learn to appreciate their strengths and weaknesses. Maybe you’re a red who’s great at taking charge, but not so great at listening to other people’s ideas – but you can respect a yellow’s ability to come up with creative solutions.

I’m almost 100% red and I have the entire package. I ALWAYS do my tasks on time (or even before the deadline), but barely do small talk – just go straight to the business. There are people, who understand my pace and we fantastically get along, there are also some who find my way of working rude. And I respect both. I know how hard it is for me to wait for a detailed analysis from a blue 🙂

How managers build relationships with their teams

Building strong relationships with your team is crucial for any manager, but it’s especially important when you’re working in software testing. As testers usually have the overall view on the project, they need to be in touch with everybody else in the project, not just their own group. This can be stressful both for you and your team members. Here are a few tips for building good relationships:

- Communication is key. Make sure you’re clear and transparent with your team about goals, expectations, and deadlines. Encourage open and honest communication, and be willing to listen to feedback and concerns. It is even more important if you work remotely and know each other only via Teams or Zoom.

- Show appreciation. Let your team know when they’re doing a great job, and celebrate their successes. Take the time to thank them for their hard work, and recognize their contributions.

- Invest in your team’s development. Support your team’s growth and learning, whether that’s through training, conferences, or mentorship. Show that you care about their careers, and want to help them achieve their goals.

- Have fun! Work can be stressful, so make sure you take the time to enjoy each other’s company. Plan team-building activities, celebrate birthdays and milestones, and find ways to inject a bit of fun and laughter into the workday.

From time-to-time I have the opportunity to work with my team in one office. On those days we eat cake, drink coffee together and have lunch. Our space in the office is also decorated with hand-made posters, funny sentences from our chat and made-up certificates. I think people like to work from there and enjoy the good mood that we have created together.

Become an approachable person